PALMERSTON NORTH CITY

COUNCIL

Memorandum

TO: Finance and Performance Committee

MEETING DATE: 19 April 2017

TITLE: Ashhurst Domain Riverbank Erosion

DATE: 10 April 2017

AUTHOR/S: Ray

Swadel, General Manager - City Networks, City Networks

|

RECOMMENDATION(S) TO Council

1. That

the Committee note any bank protection works fronting the Ashhurst Domain

fall outside of the Lower Manawatu River Management Scheme and therefore

require majority funding from either the Palmerston North City Council and/or

the New Zealand Transport Agency.

2. That

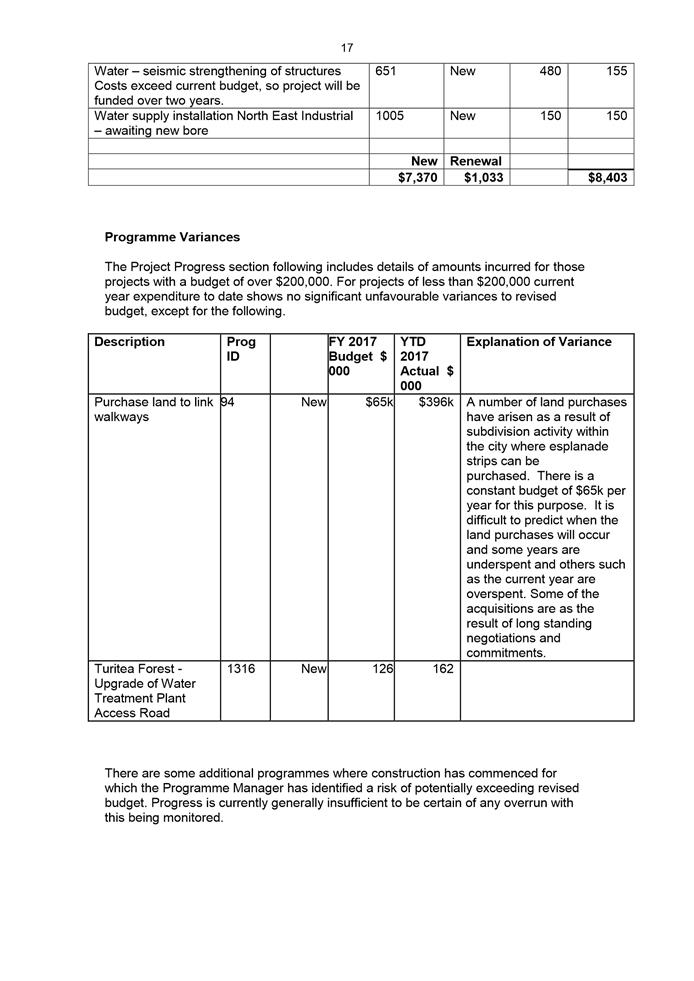

the Committee note river bank protection design options and costings fronting

the Ashhurst Doman and interfacing with the State Highway bridge are being

reviewed, in order to prepare a proposed tri-party agreement between Horizons

Regional Council, Palmerston North City Council and the New Zealand Transport

Agency as to responsibilities and obligations for these protection works, for

consideration at the Committee’s June 2017 meeting.

|

1. ISSUE

1.1 The

right bank of the Manawatu River, fronting the Ashhurst Domain, has been

subjected to erosion following the major June 2015 flood event. Erosion continues

even during modest river flows and there clearly is a need to establish bank

protection works as soon as possible.

1.2 While one of Horizons Regional Council’s core functions is

river management, their funding policy is largely centred around targeted rate

funding. The reach of the Manawatu River adjacent to Ashhurst Domain

falls outside their river management scheme boundaries and that therefore,

under that policy, limits their mandate for involvement in this issue.

1.3 Accordingly there is an expectation that those benefitting from the

bank protection works will primarily fund the construction costs. In this case,

Palmerston North City Council who owns the land being eroded namely the

Ashhurst Domain and the New Zealand Transport Agency (NZTA) given that their

State Highway bridge immediately downstream is vulnerable to losing its western

approach if the bank erosion continues unhindered.

2. BACKGROUND

2.1 Horizons’ River

Engineering Staff have investigated a number of bank protection options ranging

from a series of willow tree groynes anchored with railway irons and wire rope

ties estimated to cost $260,000, through to rip rap rock lining of the exposed

bank estimated to cost $800,000.

2.2 They recommend proceeding

with the rock lining option, as this represents the most robust solution, but

understand the difficulties this may pose regarding funding.

2.3 In regard to the lower cost

groynes option, Horizons note this will require more regular monitoring and

inspection and is likely to require a greater level of maintenance /

modification in the future given that projects of this type have inherent risks

primarily relating to river characteristics and flow conditions, particularly

during the 12 month period following construction.

2.4 In this regard,

Horizons’ advise that while they will continue to provide technical

advice and support they cannot guarantee funding or service commitment to

maintenance/modification works because bank protection works in this location

are outside of their river protection schemes and will not be a Horizons

infrastructural asset. Any future requests for physical

maintenance/modification works assistance would be considered on a case-by-case

basis.

2.5 That said, Horizons at the

last meeting of the triennium resolved to increase funding of its Regional-wide

Environmental Grants Budget relating to river works, primarily to enable it to

make a contribution to the cost of bank protection works for the Ashhurst

Domain. Arising from those deliberations Horizons resolved that in addition to

meeting the costs to design the bank protection works and supervise their

construction they will also fund 30% of the capital costs, capped at $80,000.

2.6 Acceptance of that Horizons

contribution still leaves Palmerston North City Council and/or NZTA with

funding the 70% balance of the capital works. Based on the earlier estimates

this represents a PNCC/NZTA contribution of $182,000 for the lower cost groynes

option or $720,000 for the rock lining option. Plus either PNCC or NZTA needs

to accept ownership of the new asset, with an associated commitment to its

ongoing maintenance and renewal.

2.7 The capital costings may be

summarised as follows:

|

Option

|

Estimated

Total Cost

|

Horizons Contribution

|

PNCC / NZTA Contribution

|

|

Groynes

|

$260k

|

$78k

|

$182k

|

|

Rock Lining

|

$800k

|

$80k

|

$720k

|

2.8 Discussions were held with

all three parties (Horizons, PNCC & NZTA) late last year to consider a

partnership approach to attending to bank protection works at this location

along with the associated funding contributions.

2.9 Horizons provided an initial

risk assessment of the State Highway bridge approaches if the eroded bank was

to be left unattended. Having received that assessment NZTA were of a view that

there was no immediate threat to the bridge and its approaches that would

warrant them having to contribute to bank protection works at this time.

3. DISCUSSION

3.1 While Horizons have made

their position clear on issues concerning erosion of the river bank fronting

the Ashhurst Domain, such as engineering protection options, ownership and

funding contributions, however there are still broader implications for PNCC

and possibly NZTA.

3.2 There remains the issue of

river management and how the active river channel has deposited material

mid-stream, forcing the river flow into the bank and in turn eroding it. This

impacts on the extent of future maintenance / modification works to parties

other than Horizons.

3.3 There are still questions as

to why the 700m section of the Manawatu River from its confluence with the

Pohangina River downstream to the State Highway bridge is excluded from the

Lower Manawatu River Management Scheme.

3.4 Notwithstanding these

considerations, the local Community is expecting action regardless of which

authority has jurisdiction over this matter. Their voice has been strong on

this matter since the 2015 flooding and was heightened by the heavy rain event

during the first week of April 2017, which resulted in further substantial

erosion to this section of the bank.

3.5 This further erosion has

extended much closer to the western abutment of the State Highway bridge, to

the extent that NZTA have acknowledged a need to review their previous decision

not to financially contribute to bank protection works.

3.6 Unfortunately the continued

erosion since Horizons Staff undertook their investigation of protection

options, means there is a need to review those designs and costings. Horizons

have agreed to update this information, in order for an agreement to be reached

between the three parties as to permanent works that will be constructed to

protect this section of the Manawatu River bank.

3.7 Furthermore Horizons have

advised that even if an agreement is reached and funding commitments made, the

opportunity to work on the site has now been lost until the lower river flows

in spring of 2017 (anticipated to be September 2017 at the earliest).

3.8 Time required to undertake

the work is estimated to be around four weeks for the groyne option and up to

six weeks for the rock lining option, subject to availability of material from

the quarry.

3.9 Horizons do not believe

there are any interim works that can be undertaken to arrest the current

erosion.

4. NEXT STEPS

4.1 Following

a review of the bank protection design options and costings by Horizons River

Engineering Staff, efforts will be directed to preparing a proposed tri-party

agreement between Horizons, PNCC and NZTA as to responsibilities and

obligations for these works along the right bank of the Manawatu River fronting

the Ashhurst Domain and interfacing with the State Highway bridge.

4.2 Once

a proposed tri-party agreement has been drafted, this will then be presented to

the respective “governance arms” of each party for consideration

and approval.

4.3 Council

may wish to consider support for the more expensive rock lining option, with a

view to negotiating its subsequent inclusion into the Lower Manawatu River

Management Scheme. Such an arrangement has not been discussed with Horizons

Staff at this stage.

4.4 It

is expected that this matter will be reported back to the Committee at its June

2017 meeting.

Attachments

Nil

|

Ray Swadel

General Manager - City Networks

|

|

|

PALMERSTON NORTH CITY

COUNCIL

Memorandum

TO: Finance and Performance Committee

MEETING DATE: 19 April 2017

TITLE: Treasury Report for 9 months ended 31 March 2017

DATE: 4 April 2017

AUTHOR/S: Steve

Paterson, Strategy Manager Finance, City Corporate

|

RECOMMENDATION(S) TO Finance and Performance Committee

1. That the performance of the treasury activity for the 9 months

ending 31 March 2017 be noted.

2. That it be noted that as at 31 March 2017 the treasury policy

targets were complied with, except for the three to five year fixed rate

maturity profile band target of 15% to 60% and that it is intended that full

policy compliance will be achieved by 30 June 2017.

|

1. ISSUE

To

provide an update on the performance of the Investment Fund (“the

Fund”) and the Council’s Term Debt portfolio for the 9 months ended

31 March 2017.

2. BACKGROUND

2.1 Investment

Fund

In November 2008 Council endorsed an orderly exit strategy for the

Long Term Investment Fund which embraced holding the investments in bonds to

maturity or when they could be sold without realising a loss (ie if the yields

fall below the purchase price).

This strategy has

been encapsulated in subsequent 10 Year and Annual Plans and the realisation

process is nearing an end.

The bond portfolio

is managed directly by the Council with the assistance of MCA Ltd as investment

advisors.

2.2 Term

Debt

The Council’s

Annual Plan for 2016/17 forecast additional debt of $13.5m would need to be

raised during the year to fund the $28.9m of new capital expenditure programmes

(including assumed carry forwards from 2015/16). In June 2016 the Council

resolved to specifically authorise the raising of up to $14m of additional

debt.

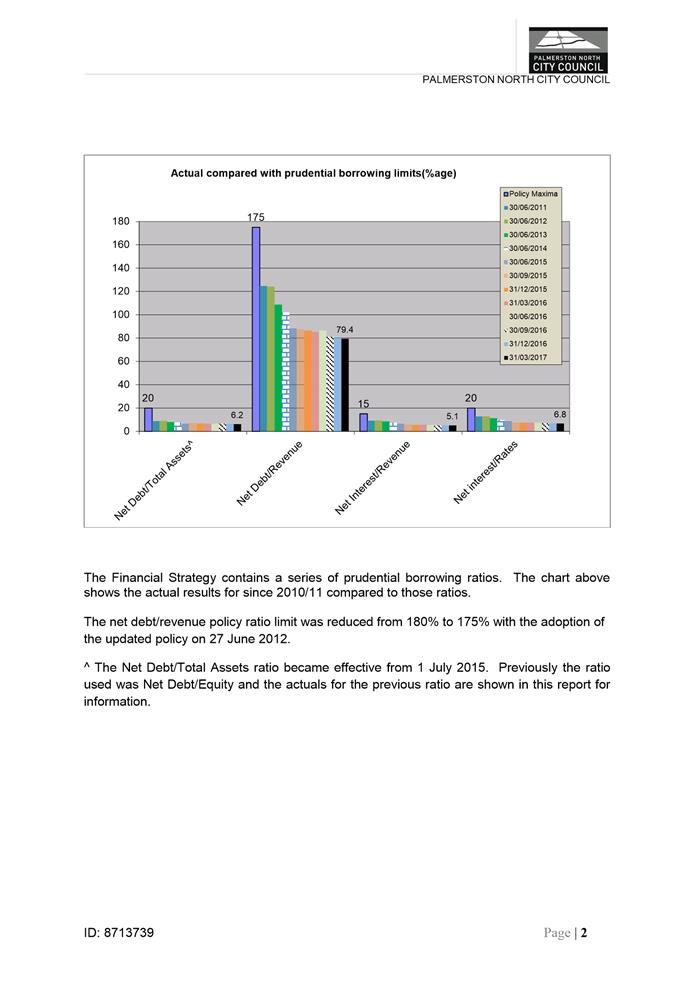

Council’s

Financial Strategy (updated version adopted 24 June 2015) contains the

following ratios which the Council has determined to be prudent maxima:

• Net

debt as a percentage of total assets not exceeding 20%

• Net

debt as a percentage of total revenue not exceeding 175%

• Net

interest as a percentage of total revenue not exceeding 15%

• Net

interest as a percentage of annual rates income not exceeding 20%

The Treasury Policy

(embracing the Liability Management and Investment Policy) also contains a

number of other criteria regarding debt management.

3. Performance

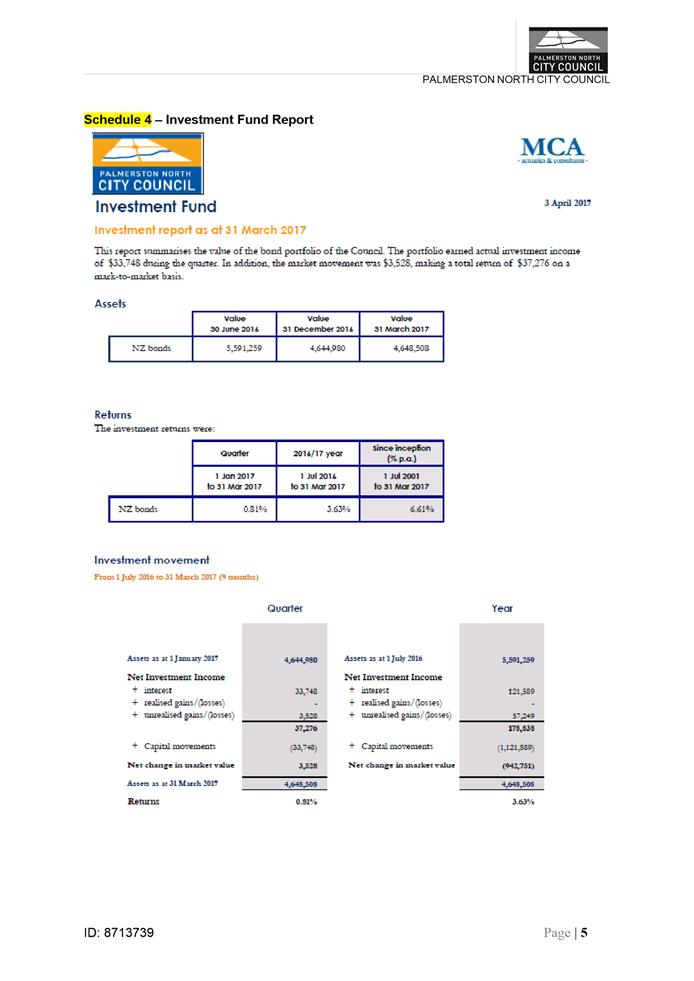

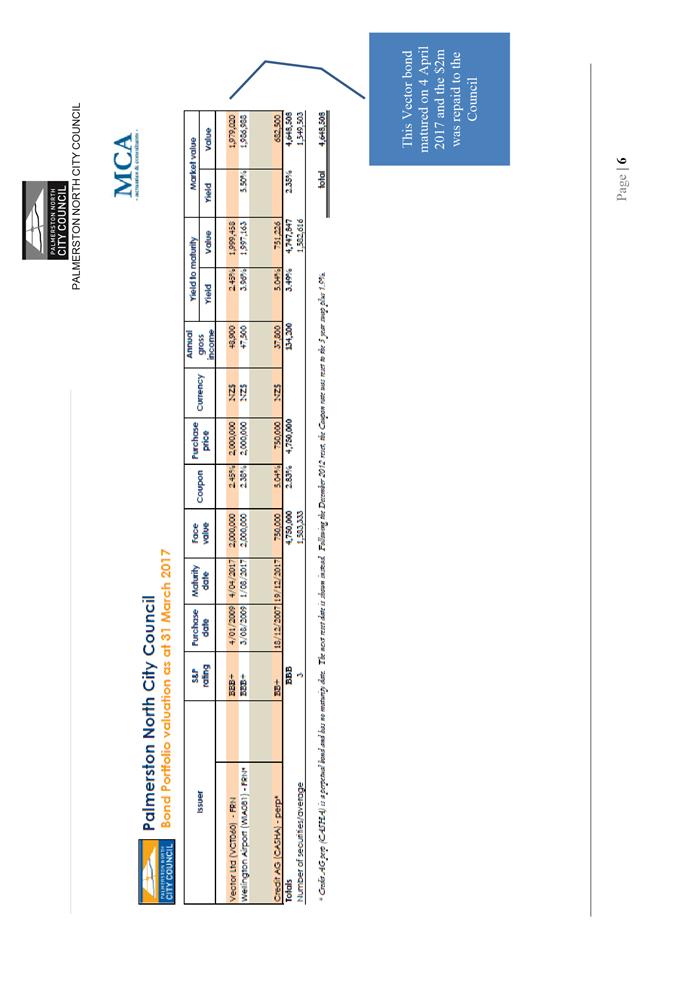

3.1 Investment

Fund

Fund performance is monitored and reviewed

by Council’s investment advisor and Council’s own staff. Attached

as schedule 4 is a consolidated report prepared by Council’s

investment advisor covering the period 1 July 2016 – 31 March 2017.

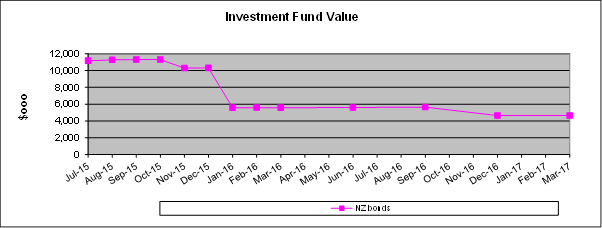

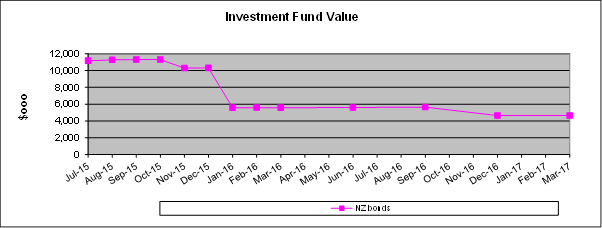

The overall market value of the Fund is summarised in the following table:

|

|

Market Value at

1 Jul 16

$m

|

Market Value at

30 Sep 16

$m

|

Market Value at

31 Dec 16

$m

|

Market Value at

31 Mar 17

$m

|

|

NZ Bonds

|

$5.59

|

$5.64

|

$4.64 #

|

$4.65 #

|

# - a $1 million bond investment matured in

October 2016 and was repaid to the Council

Realised Fund

earnings from interest and dividends for the 9 months totalled $122k and there

were also unrealised gains of $57k. $1.122m was distributed back to the

Council during the period including $1m of maturing investments.

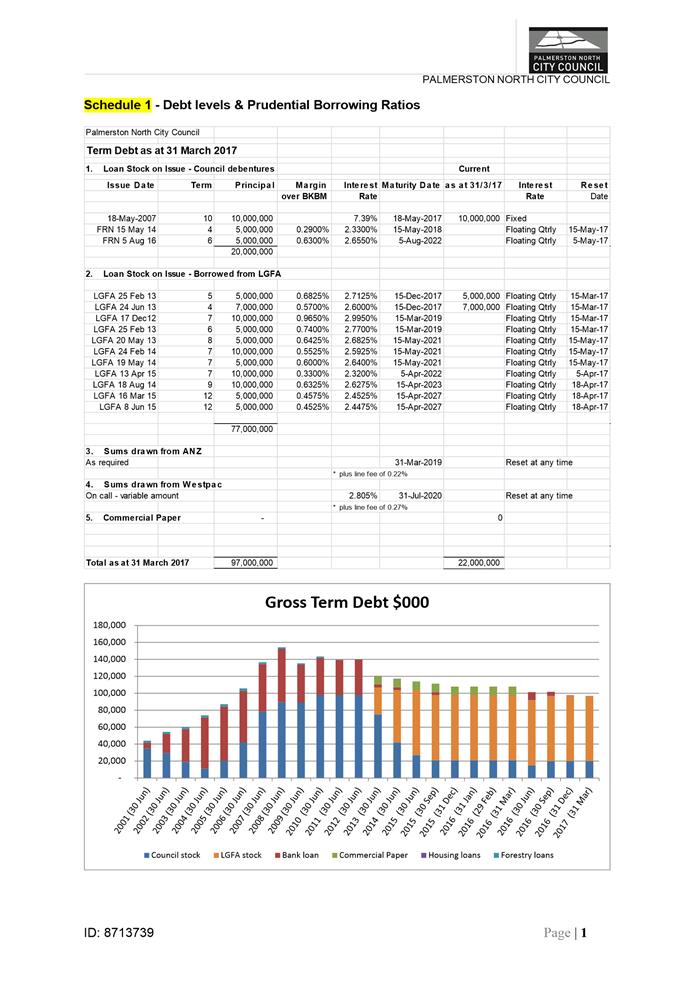

3.2 Term

Debt

Schedule 1 attached shows the details of Council’s debt as at 31

March 2017. Debt levels were within the policy parameters outlined

in clause 2.2. of this report.

The summarised gross

term debt movements are shown in the following table:

|

|

Annual Plan for year (2016/17)

$000

|

Actual – 3 months (2016/17)

$000

|

Actual – 6 months (2016/17)

$000

|

Actual – 9 months (2016/17)

$000

|

|

Opening Debt Balance at 1 July 2016

New Debt #

Debt repayments #

|

101,530

13,516

|

101,275

5,000

(4,495)

|

101,275

5,000

(8,635)

|

101,275

5,000

(9,275)

|

|

Closing Balance

Comprising:

Bank advance (on call)

Commercial paper

LGFA & Council stock

|

115,046

|

101,780

4,780

0

97,000

|

97,640

640

0

97,000

|

97,000

0

0

97,000

|

# A portion of the Council’s debt is drawn on a

daily basis – daily drawdowns & repayments are not included in these

figures but the net draw or repayment for the year to date is shown as part of

new debt or debt repayment as appropriate.

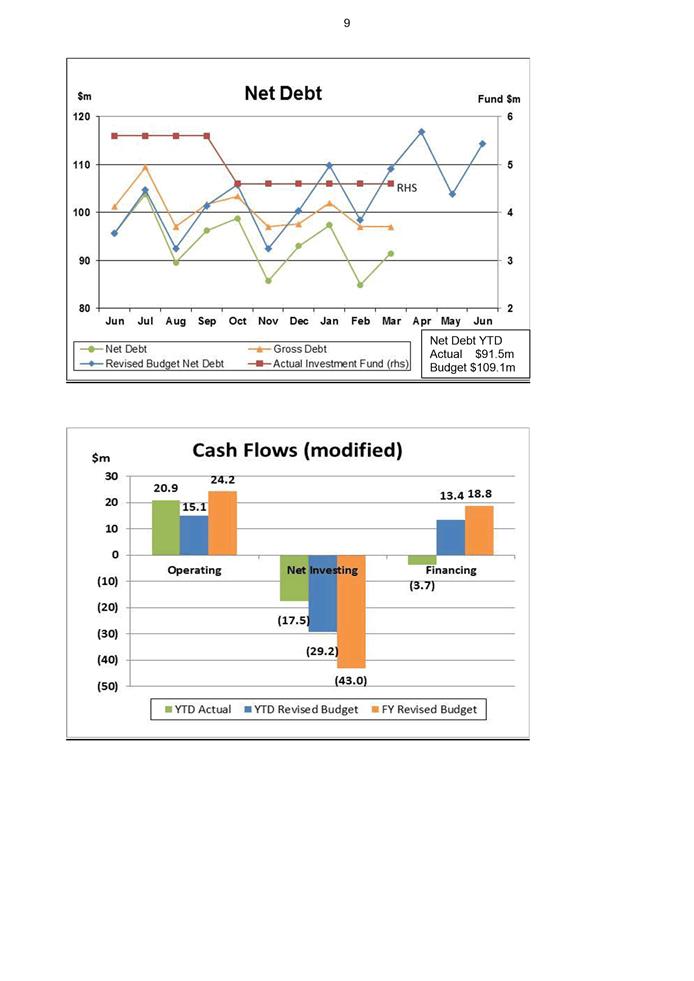

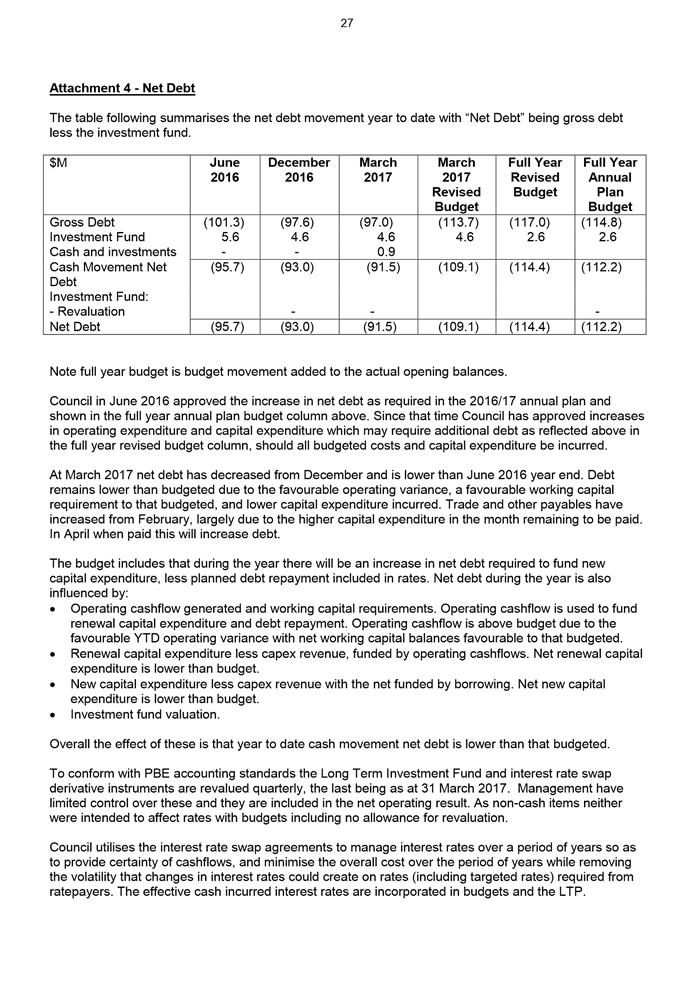

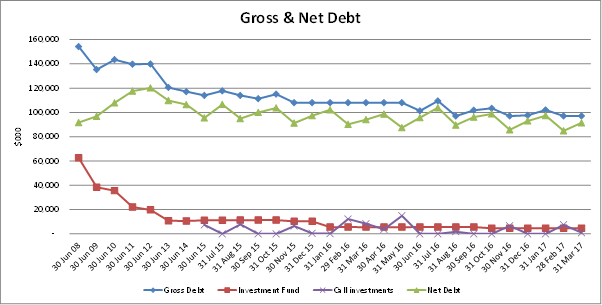

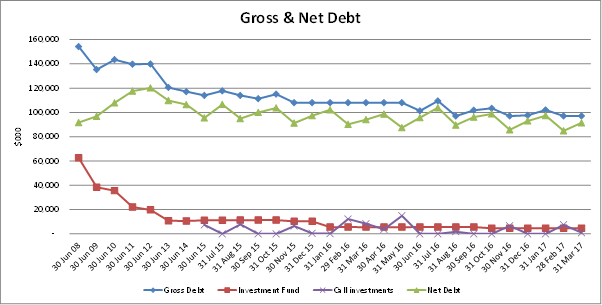

Net debt at 31

March 2017 was $91.451m (ie gross $97m less investment fund of $4.649m less

call investment of $0.9m) compared with $95.684m at 1 July 2016 (ie. gross

$101.275m less investment fund of $5.591m). Movements in recent years are shown

in the following graph:

Actual finance costs incurred

during the 9 months (including interest, line fees & the effects of swaps)

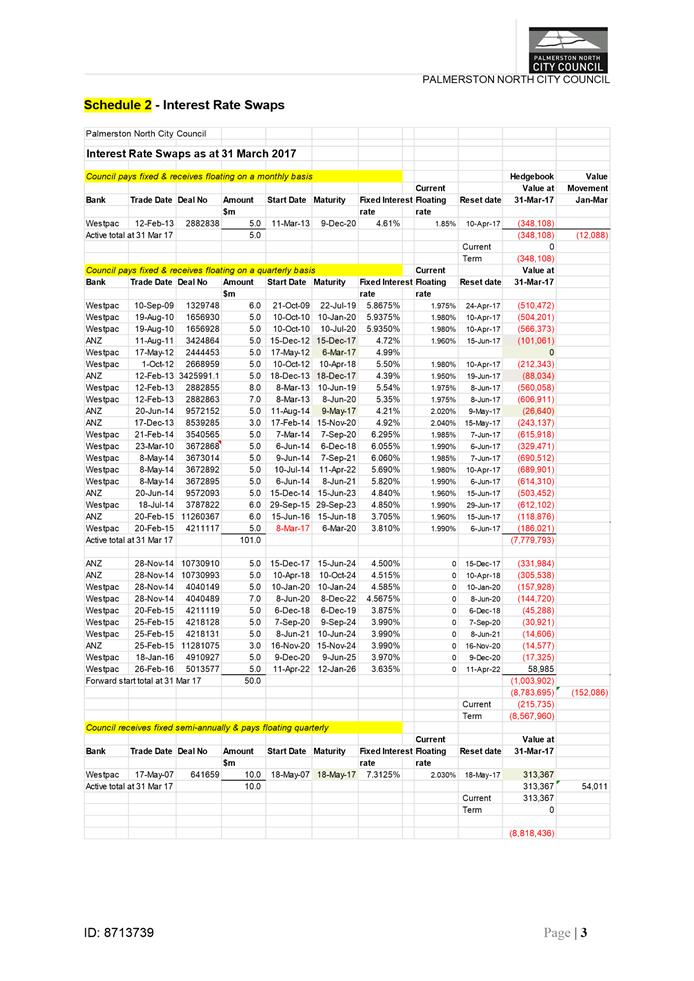

amounted to $4.617m compared with the annual plan budget for the year of

$6.288m.

The Council has entered a number of

financial instruments related to its debt portfolio utilising swap trading

lines established with Westpac and ANZ. The details of these are shown in

Schedule 2 attached.

The value of these instruments is

measured in terms of its “mark-to-market” ie the difference between

the value at which the interest rate was fixed and the current market value of

the transaction. Each of these transactions was valued at the date they

were fixed and again at balance date. Financial reporting standards

require the movement in values to be recorded through the Council’s

Statement of Comprehensive Income (Profit & Loss Account). They have

been revalued as at 31 March 2017 and show a decrease in book value of $110k

for the quarter and an increase of $4.45m for the 9 months.

The

Council’s Treasury Policy contains guidelines regarding the measurement

of treasury risk as follows:

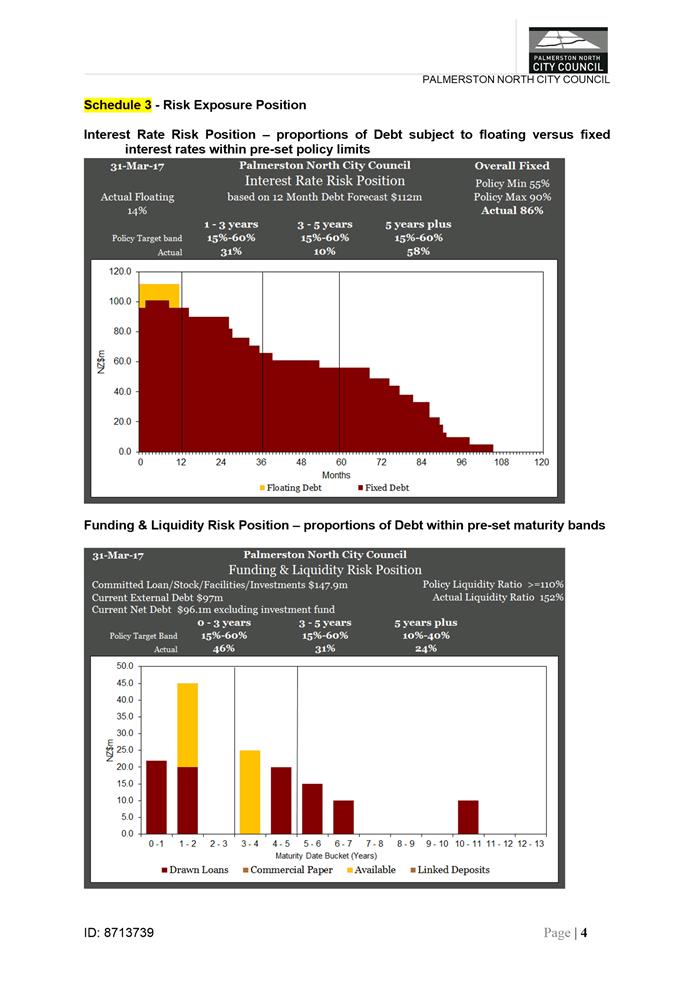

a. Interest rate risk is managed by the Council

maintaining the ratio of debt that is subject to floating versus fixed interest

rates within pre-set limits.

b. Funding and liquidity risk is managed by the

Council maintaining a pre-set portion of its debt in a range of maturity

periods eg < 1 year, 1 – 3 years, 5 years +.

The position

compared to the policy is illustrated in the graphs in Schedule 3.

The overall ratio of fixed v floating interest rate debt is based on the

assessed level of total debt in 12 months’ time. For most of this

year we have assumed a forecast overall debt, for the purposes of this policy,

of $112m. In this report that forecast is retained. However, given

the outcomes of the latest financial review as at 31 March we are proposing,

for the purpose of this policy assessment, to reduce the forecast position to

$105m. If this forecast was used at 31 March then 91% of the forecast

debt would be fixed compared with 86% using the $112m forecast. 91% is

marginally above the policy maximum of 90%.

As at 31 March

2017 all of the other policy targets except one had been met. The policy

requires 15% to 60% of debt within the three to five year maturity band to be

fixed. Only 10% within this band was fixed.

The policy bands

are considered still to be appropriate so options are being considered to ensure

that all of the policy parameters are met by 30 June 2017.

Council’s credit lines with

the banks include a $25m four year credit facility with Westpac Bank (maturing

31 July 2020) and a revolving $25m three year facility with ANZ Bank (maturing

31 March 2019).

4. CONCLUSION

& NEXT STEPS

Realised interest

and dividends returns for the 9 months from the Investment Fund of $122k was

close to budget. There were also unbudgeted unrealised gains of $57k.

Finance

costs for the 9 month period (including interest, line

fees & the effect of swaps) was $4.617m compared with Annual Plan budget

for the year of $6.288m.

In conjunction with

Council’s treasury advisors hedging instruments are regularly reviewed in

an effort to ensure the instruments are being utilised to best advantage as

market conditions change. The level of hedging cover is also reviewed as the

forecasts of future debt levels are revised. It is proposed to reduce the

12 month forecast debt level and to then take action to ensure the resulting

treasury policy targets are met by 30 June 2017.

Council’s

S&P Global Rating’s credit rating remains unchanged at AA /

A-1+. It is anticipated the outcome of their latest annual review will be

known before the Committee meeting. No change is expected.

Council’s

borrowing strategy is continually reviewed, in conjunction with Council’s

treasury advisors, to ensure best advantage is taken of this quality credit

rating.

A further

performance report will be provided after the end of the June 2017 quarter.

Attachments

|

1.

|

Investment Fund & Borrowing Appendices ⇩

|

|

|

Steve Paterson

Strategy Manager Finance

|

|

|

PALMERSTON NORTH CITY

COUNCIL

Memorandum

TO: Finance and Performance Committee

MEETING DATE: 19 April 2017

TITLE: Illegal Dumping and Charity Shops

DATE: 31 March 2017

AUTHOR/S: Natasha

Hickmott, Rubbish and Recycling Engineer, City Networks

Robert van Bentum,

Water & Waste Services Manager, City Networks

|

RECOMMENDATION(S) TO Finance and Performance Committee

1. That

the Committee receive the Illegal Dumping and Charity Shops Memorandum.

|

1. ISSUE

1.1 Following a deputation from

Lyall Brenton (Methodist Goodwill) to the Community Development Committee on

Monday 13th March 2017, the Committee requested a report from

Officers to outline:

· the extent of illegal dumping in the City

· the impact of illegal dumping on the charity shops

· options to address or mitigate the effects

1.2 This memo attempts to

provide some background to the issues using the limited firm data to hand as

well as outlining some possible mitigation measures.

2. BACKGROUND

to illegal dumping

2.1 The issue of illegal dumping

or ‘fly tipping’ as it variously termed is a growing one locally,

nationally and internationally. Key reasons for the trend include the

increasing cost of waste collection and disposal as well as the increasing

private ownership of waste collection and disposal facilities.

2.2 In Palmerston North, prior

to July 2016, collection of illegal dumping (fly tipping) was carried out by

several different areas of Council with costs incurred against a range of cost

centres depending on the location of the dumping. This tended to obscure the

true cost of the issue to Council.

2.3 From July 2016, the Water

and Waste Division of Council has assumed responsibility for the management and

expenditure associated with illegal dumping through a single Service Level

Agreement (SLA) with City Enterprises. This has allowed the full extent of the

issue to be documented and costs to be tracked more accurately.

2.4 City Enterprises staff are

engaged to attend to all reported incidences of illegal dumping in the City at

Council facilities or Council owned land. Incidences are reported to

Council through the RFS system by members of the public or other Council staff

during the course of their normal duties.

2.5 Incidents are logged through

‘workforce’ from the RFS system and assigned to a collections team

member, who receives the work request via tablet. As part of responding

to a dumping incident, collection staff undertake the following and record

information on a mobile tablet device. The dumping locations are mapped and can

be viewed on PNCC’s intranet.

· Date and time of collection.

· Location logged by coordinate.

· Type of waste collected.

· Estimated volumes and weight.

· Photographs of the waste

2.6 As part of responding to illegal

dumping, staff search through the material and retrieve any items which might

identify the potential source of the material.

2.7 Table 1 summarises the extent of

illegal dumping as measured by way of incidents, tonnages and referrals to

Regulatory during the 8 month period July 2016 – February 2017.

Table 1: Illegal Dumping Statistics

|

|

Jul

2016

|

Aug 2016

|

Sep 2016

|

Oct 2016

|

Nov 2016

|

Dec 2016

|

Jan 2017

|

Feb 2017

|

Total to Date

|

Estimated Total for Year

|

|

Number of Incidents attended

|

97

|

104

|

71

|

107

|

124

|

110

|

63

|

64

|

740

|

1,100

|

|

Tonnes

|

4.4

|

7.1

|

3.2

|

3.5

|

10.2

|

4.5

|

2.5

|

4.6

|

40

|

60

|

|

Evidence Referred to regulatory

|

0

|

0

|

8

|

1

|

1

|

1

|

3

|

1

|

15

|

20

|

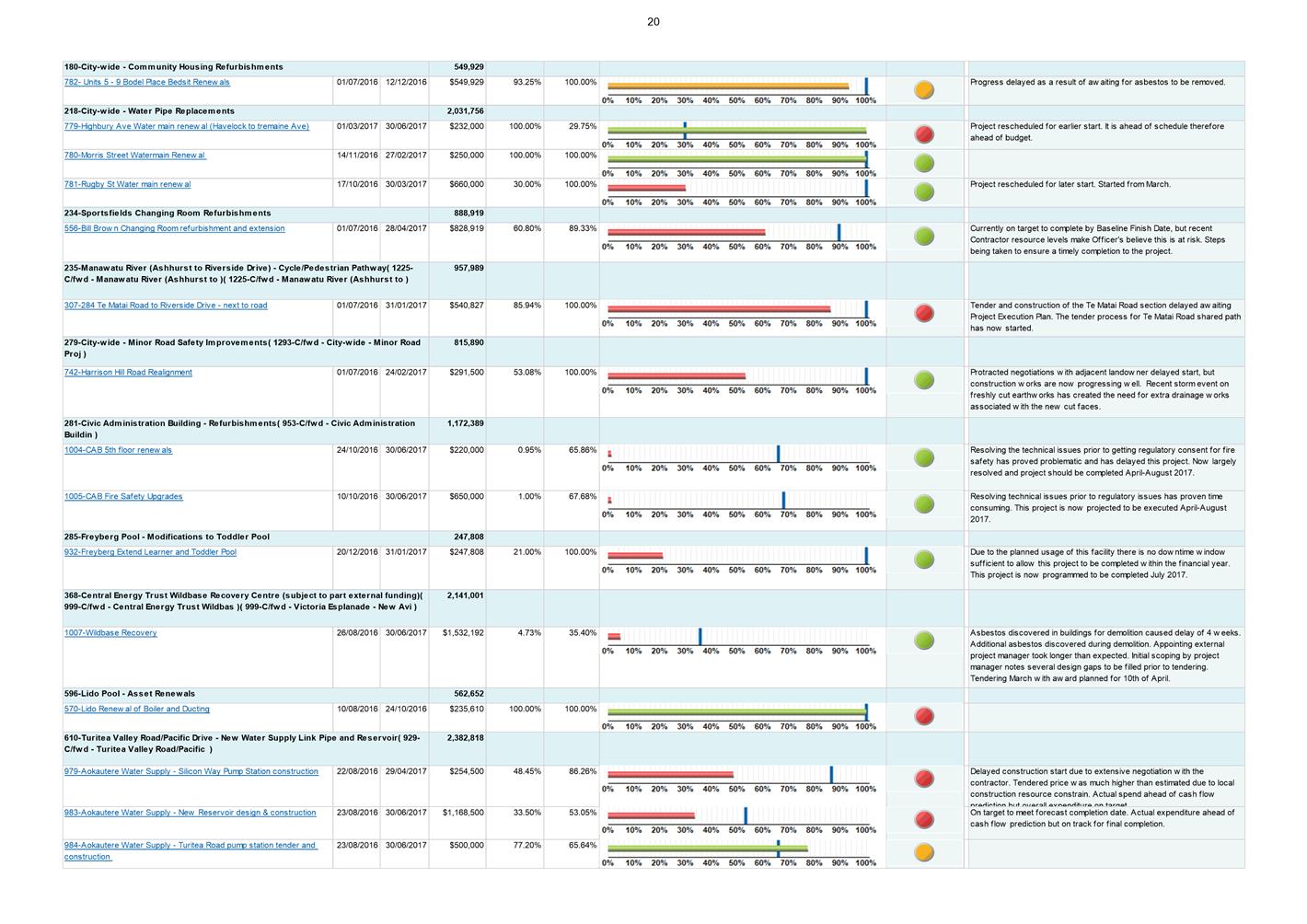

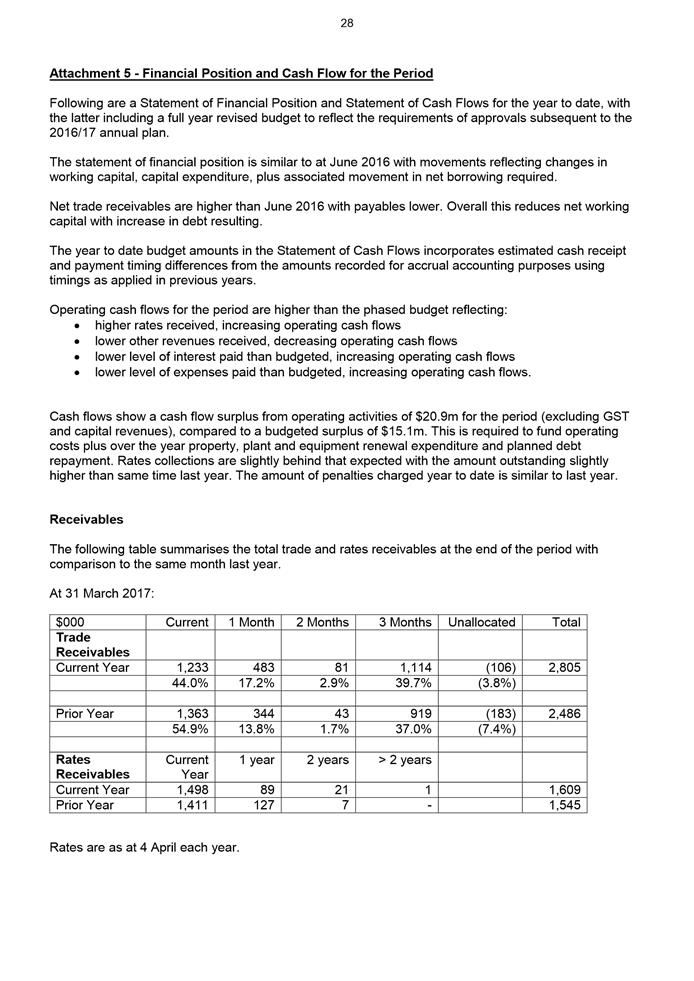

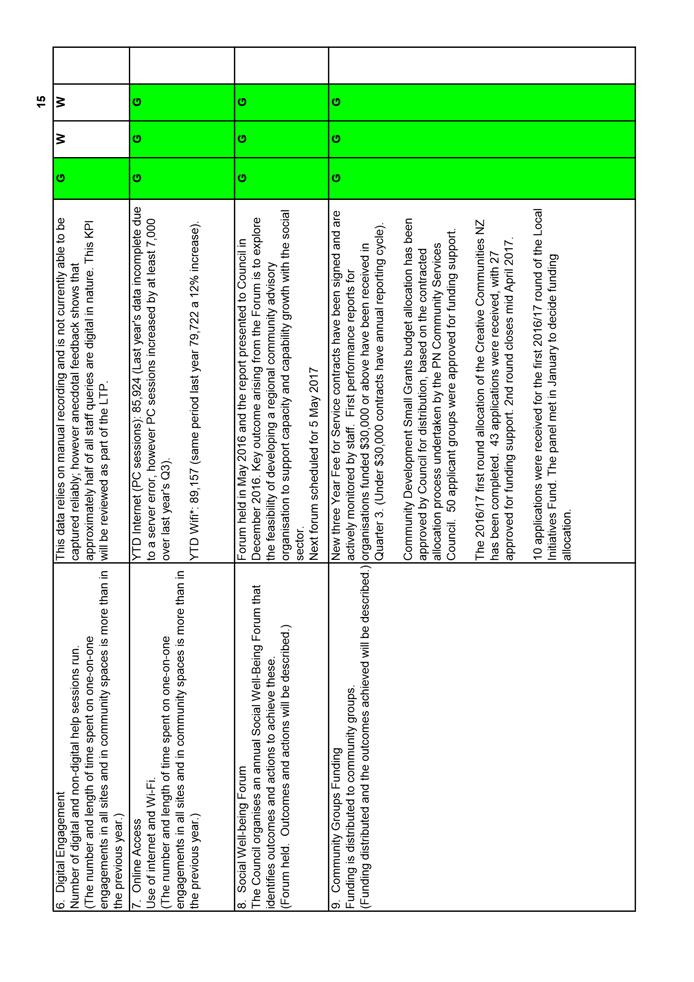

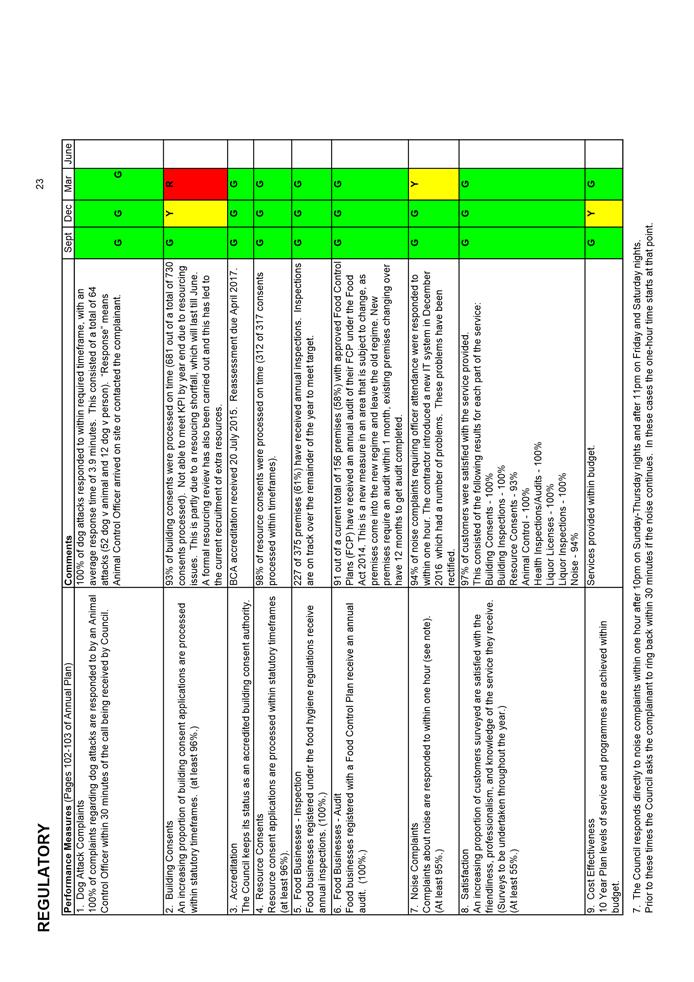

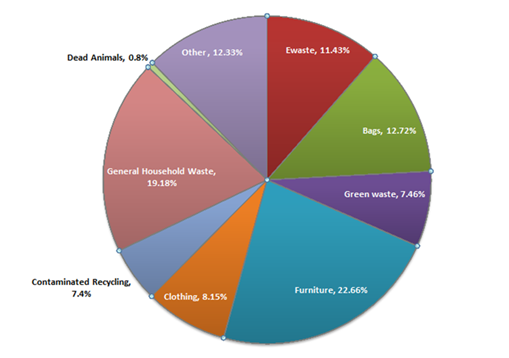

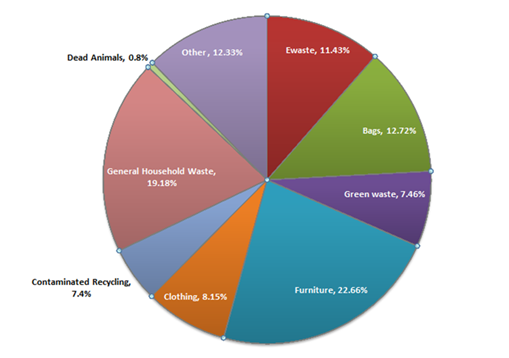

2.8 Figure 1 provides a

breakdown of the illegal dumping incidents by material type over the 8 month

period July 2016 – February 2017.

Figure 1: Illegal Dumping Incidents by Material Type for July 2016

– February 2017.

2.9 Costs for the collection and

disposal of illegal dumping under the SLA for the period July 2016 –

February 2017 total $75,000, with full year costs expected to be in the range

of $120,000 - $130,000.

2.10 The illegal dumping SLA with City

Enterprises accounts for the majority of the larger and significant illegal

incidents, however illegal dumping also occurs in association with other

Council services, e.g.:

· Ferguson Street Recycling Centre – contamination and illegal

dumping

· Recycling Drop Off Points – illegal dumping

· Street Litter Bins – household rubbish

· Parks Litter Bins – household rubbish

· Parks and Reserve Management – dumped household rubbish and

furniture

· Littering on the road network

· Stormwater drains, streams and reserves

2.11 Typically small quantities of household

waste are placed into the public litter bins and this is generally collected as

part of normal day to day operations. The quantities of waste are difficult to

estimate and attribute to illegal dumping. However Officers have noted the

volumes of household waste steady increasing and this is reflected in the

increasing costs for providing these services. The annual costs have risen by

around $10,000 in the last 2 years.

2.12 There are also specific areas and times

of the year when illegal dumping is more of an issue. Each year during November

and December in a number of inner city streets, with large student tenant

populations (Ada, Morris, Oxford and Rolleston Streets) illegal dumping

incidents spike. Typically residents dump anything from general

household rubbish to furniture, e-waste and clothing on the kerbside. The

costs incurred by Council in clearing this in late 2016 were around $8,000.

This dumping occurred despite proactive attempts by Council (with the Massey

Students Association) to place several skip bins in key areas for a designated

period during November, and arranging with Methodist Goodwill to take away any

reusable items from these bins.

2.13 Council had previously trialled in

December 2013 a ‘one off’ free day for the disposal of unwanted

items during this period. The cost of this one free drop off day

was in excess of $11,000. Key lessons and issues from this exercise included

that:

· Items were dumped outside the advertised period (both before and

after).

· Several additional staff were required to handle the waste on the

day.

· Some of the items could have been repurposed or on sold.

· It took several days to completely clear the site.

· There was evidence that residents from outside the City boundary

took advantage of the opportunity to dispose of waste.

3. Council

Support for Charity Shops

3.1 Following a number of

submissions to Councillors and Council staff, in early 2014, Council Officers

met with charity shop managers in September 2014, to discuss the issues they

were facing in relation to illegal dumping. Officers were made aware of

the extent and increasing problem of residents using Charity shop drop-offs to

dispose of unwanted and frequently unusable items.

3.2 As a result of the meeting

Council agreed to pay a subsidy (by reimbursement) towards the waste disposal

costs incurred by these organisations. It should be noted that the business

model for Charity shops is based on receiving goods at no cost and so there is

an expectation that a proportion of items received cannot be sold and must be

disposed of. The main items of issue are bulky furniture items and electrical

and e-waste items.

3.3 Officers proposed a fund of

up to $10,000 be made available to subsidise waste disposal costs. To

ensure some equity, officers requested evidence of the organisations total

annual spend on waste disposal. The total amount spent by these

organisations was used to determine a maximum annual allocation based on a

percentage of each organisation’s previous years expenditure on

waste. Based on a total waste spend of around $50,000 in 2014, a subsidy

of 20% of each organisation’s allocated waste was agreed. Table 2 below

depicts the reimbursements paid to each organisation in the last 2 calendar

years. The extent to which individual organisations have claimed their

allocation has varied.

Table

Two: Charity Reimbursements 2015 - 2016

|

Charity

|

Max.

Limit

|

Total

Reimbursement

|

|

January

– December 2015

|

|

Arohanui

Hospice

|

$1,245

|

$561.63

|

|

Methodist

Goodwill

|

$1,192

|

$1558.71

|

|

NZ Red

Cross

|

$640

|

$300.74

|

|

Salvation

Army – Church Street

|

$3,260

|

$3,258

|

|

Salvation

Army – Main Street

|

$615

|

$364.01

|

|

Arts

Recycling Centre

|

$210

|

$52.50

|

|

St.

Vincent de Paul

|

$320

|

$320

|

|

2015

Totals

|

$7,482

|

$6,415.59

|

|

January

– December 2016

|

|

Arohanui

Hospice

|

$1,325

|

$1,325

|

|

Methodist

Goodwill

|

$1,565

|

$2,012.25

|

|

NZ Red

Cross

|

$690

|

$0

|

|

Salvation

Army – Church Street

|

$4,270

|

$4,270

|

|

Salvation

Army – Main Street

|

$815

|

$815

|

|

St.

Vincent de Paul

|

$325

|

$292.58

|

|

2016

Totals

|

$8,990

|

$8,714.83

|

3.4 Officers are currently

working with NZ Red Cross to assist them to make claims for costs incurred in

2016 so that reimbursement can be made. The Arts Recycling Centre has advised

they no longer require the reimbursement contribution. Once the 2016 claims are

completed, Officers will advise the 2017 reimbursement available to each

organisation. This will be calculated to ensure disbursement of the $10,000

allocated.

3.5 Council also allows Charity

shops to locate clothing donations bins at the Ferguson Street Recycling

Centre. The bins are however a location for illegal dumping and the Charity

Shops are expected to be responsible for removing any non-clothing items.

Recycling Centre employees assist by:

· Collecting any excess clothing on the ground outside the clothing

bins, placing in the building prior to lock up to keep the items dry and useful

for the agencies.

· Removing small items of illegal dumping for disposal.

· Advising agencies when their bins are full and ready for collection

· Providing for CCTV coverage of the area where the clothing bins are

located

3.6 Unfortunately dumping is a

random event, and resources are not always available to monitor the cameras on

a regular basis. However, where and when possible the footage is

reviewed. There has been some limited success in the past in capturing

and following up on dumping incidents, however without sufficient evidence

Regulatory staff has been unable to issue infringement notices or pursue a

prosecution.

3.7 Signage and surveillance

cameras were installed at the Methodist Social Services site at Council’s

expense earlier in 2017. Officers have agreed with Methodist Social

Services that the monitoring and ongoing maintenance of the cameras will be

undertaken by Methodist Social Services. The success or otherwise of the

camera installation has yet to be determined.

4. current

strategies under consideration

4.1 Behaviour Change Approach:

City Networks have recognised that the issue of illegal dumping is a complex

one that requires a multi-pronged approach across waste minimisation,

education, reuse, recycling and prosecution. Officers are working on a number

of fronts to encourage and facilitate behaviour change within the community.

4.2 It is clear that the cost of

waste disposal and in particular large bulky end of use items is costly for

many in the community. However Officers are also clear that waste minimisation,

reuse and recycling offer the best options for reducing waste costs for the

community while still focussed on waste reduction and minimisation. Simply

providing a low cost option for disposal of waste would undo the significant

progress made by Council in the waste minimisation space.

4.3 Public Education: As well

as highlighting the issues of illegal dumping, Officers have been working with

Regulatory to establish and include further information on Council’s

website, including a page dedicated to illegal dumping. A form

which enables the public to report incidents can be downloaded from the website

and Officers are looking to make an online form available soon. It is intended

in this way to enlist the help of the community to identify both illegal

dumping areas but also potentially enable consideration of pursuing prosecution

if the evidence threshold is met.

4.4 Prosecution: While the

new single SLA is providing excellent data on the quantity, number and location

of illegal dumping events it is not yielding information sufficient to meet the

evidence standard required for successful prosecution.

4.5 Council’s Regulatory

Manager has advised that the practice of issuing infringements on the basis of

retrieved documentary evidence does not meet the requirements of the Litter Act

such that any infringement notice could be challenged legally. In addition

Council does not have employees who understand the evidence requirements and

can document any incident adequately for a successful prosecution.

4.6 Council Officers have been

in discussion with Manawatu District Council (MDC) around their enforcement

unit, comprising ex-police and security personnel, established to prosecute

breaches of Council rules and regulations. MDC has agreed to meet with PNCC

staff to discuss assisting with a trial to demonstrate what could be achieved.

It is proposed to begin with the issue of illegal dumping in the first

instance.

5. Other

Support options

5.1 As has been reported to Council in previous reports and workshop

briefings addressing the issue of illegal dumping can only be achieved as part

of a holistic approach to provision of waste and recycling services. The

perception within the community that rubbish disposal is expensive particularly

for those with low or fixed incomes and those who are renting accommodation,

contributes to illegal dumping of household waste. The absence of low cost

re-use and recycling options for large and bulky consumer goods at the end of

their life is also a key driver.

5.2 Council’s strategy has been to increase the range and

accessibility of low cost recycling and reuse services as well as ensuring that

there is a cost effective alternative to commercial rubbish services. Gaps in

the range of services remain. Officers have recommended that Council consider

rating the cost of collecting household rubbish rather than providing any

subsidy for rubbish disposal costs in general. Subsidising the cost of

disposing of general waste has the potential to undermine progress made in

waste reduction and minimisation.

5.3 In the remainder of this report, Officers set out a range of other

options for mitigating the issue of illegal waste, incentivising and

encouraging sustainable disposal of household waste.

5.4 A number of specific suggestions to mitigate illegal dumping issues

in the Charity Shop sector have been proposed which include:

· A

dedicated Council provided weekly waste collection service for Charity Shops

· Provision

of free e-waste drop off

· Provision

of a city wide inorganic waste collection service.

5.5 Charity

Shop Waste Pick-up: The suggestion of a regular

(weekly) Council funded collection from charity shop premises will of course

provide relief to Charity shops. However Officers consider it will make

acceptable the practice of ‘illegal dumping’ and lead to a

significant increase in the level of items placed in front of charity shops. In

effect Council will be legitimising up to 10 mini-dump sites within the City.

By picking up the full cost of waste disposal from the Charity Shops, Council

would be removing the incentive for Charity Shops to manage and control the

practice on their own terms. Currently there is only one Charity Shop openly

advocating for a change to the current level of Council support.

5.6 Free

E-waste Collection Service: Current Council E-waste

services are cost recovery with charges based on the cost of recycling,

transport and disposal. In the absence of any central government or product

stewardship support, the costs are high and clearly a disincentive for users.

Currently around 2,000 to 3,000 items are recycled through this service with

total charges of $10,000 per annum.

5.7 Current industry sources suggest that the average person will

generate around 28kg of e-waste during their lifetime and that this volume is

likely to be increasing. For a population of 80,000 people this gives a total

E-waste waste volume of 2,240 T. Allowing for some items to be re-sold or

reused, the net quantity for disposal is likely to be around 2,000 Tonnes. If

this is disposed of over 25 years, the annual volume going to landfill is

estimated to be around 80 Tonnes. Disposal costs are based on volume rather

than weight, however assuming an E-waste density of 1,600 kg/T, gives a

disposal cost of $1.6/kg. The cost of disposing of 80T of E-waste would be

around $130,000 per annum.

5.8 In addition to disposal costs, additional staff time and materials,

e.g. plastic wrap, will be required. If a low level of charge continues

to be levied, the best estimate for an enhanced E-waste service will be some

$180,000 to $200,000 per annum, or $7 / household per year.

5.9 There is a significant risk that a subsidised E-waste service will

attract commercial and out of town users. Council Officers consider that target

E-waste drop off days or subsidies targeting the more problematic items might

be provide an option for a lower cost intervention.

5.10 Rated

Inorganic Collection Service. Officers have

investigated inorganic collection services options provided by other Councils.

Where previously Councils have provided an annual kerbside collection service,

this approach has largely been abandoned due to the risks, logistics and high

cost. Instead the typical inorganic collection service now offered uses a

booking system by means of an online tool or telephone call centre to Council

(Auckland Council).

5.11 Key features of the service include dividing the City into

collection areas, with each area allocated a single scheduled collection to

occur in a designated week during the year. If residents miss their scheduled

collection then there is no return service. The service has some strict

parameters including:

· limited

to inorganics only with no general household rubbish, green waste/organics or

hazardous material

· quantities

are limited to around 1 – 2m3 per household

· items

must be presented on the property and not on the kerbside

5.12 The service is funded by way of a targeted rate on each property.

Officers estimated that a service of this type would cost in the vicinity of

$40 per rateable property based on the following assumptions:

· 20%

of properties make use of the service

· 2

trucks/4 staff will be able to collect from 16 houses per day

· Average

weight per property is 300kg

· Full

time administrator required for the scheme

· One

off capital cost to develop an on-line booking system

· Waste

is delivered to an off-site warehouse where the items which can be re-used or

sold are recovered, with the balance being disposed to landfill (lease and

maintenance costs)

· E-waste

is packaged and sent to an accredited e-waste

· Metal

rich appliance and waste is accepted by a local metal recycler at no cost to

Council

5.13 While such a service may be attractive, there are also significant

risks, including diversion of waste from the commercial sector and current

private transfer station to the Council service. It is also likely that Council

will attract out of region waste. Costs would need to be monitored closely and

the rated cost may need to be adjusted if higher participation rates than

assumed occur.

6. Option

1. Enhanced Current Services

6.1 Council Officers have reviewed the current range of services and

identified a range of enhancements to the current services which may help to

mitigate illegal dumping and Charity Shop costs. Some of the potential

enhancements are outlined below along with one off capital and annual operational

costs. It is estimated that these enhancements will result in a $5 to $7

increase in the public rubbish and recycling targeted rate.

|

Initiative

|

Capital Cost

|

Operating Cost /

annum

|

|

Further investment in the Behaviour

Change and Education area to support targeted community engagement

initiatives

|

|

$25,000

|

|

Install additional cameras and reposition

existing cameras along with implementing a surveillance and reporting regime

for the Fergusson Street and Awapuni drop-off areas

|

$15,000

|

$20,000

|

|

Invest further in investigating key

problems areas with significant illegal dumping and identify capital and

operational improvements in signage, lighting and access restrictions.

|

TBC

|

$20,000

|

|

Funding of specialist resources to

improve evidence gathering with a view to pursuing prosecutions

|

|

$10,000

|

|

Increase the level of subsidy to Charity

Shop waste disposal costs

|

|

$10,000

|

|

Reduce charges for E-waste recycling

particularly TVs and computer monitors to encourage greater service use

|

|

$30,000

|

|

|

$15,000

|

$115,000

|

7. Option

2 targeted inorganic waste services

7.1 If Council is of a mind to improve access to services which mitigate

the cost of inorganic rubbish disposal then Officers have identified a range of

other targeted inorganic waste services which could be provided. The specific

services and rough order costs for these are summarised below. The total cost

to provide the full package of enhancements is likely to be a $15 to $18

increase in the public rubbish and recycling rate.

7.2 It is envisaged that a similar range of enhanced services as

outlined in Option 1 would be considered with the following additional

services.

7.3 A nationwide mattress recycling scheme is proposed to be rolled out

in 2018/2019. The funding of this scheme is still being determined. In

the interim Council could participate in a trial as mattresses appear to be a

particular problem for Charity Shops. The options for the delivery of

this service still need to be determined as well as the likely cost, however

typical costs for disposal of around $20 - $30 per mattress are expected. Based

on disposal of say 500 mattresses per annum costs to Council could be of the

order of $15,000 per annum. Officers would need to investigate detailed options

for providing the service.

7.4 Provision of a subsidised E-waste collection service is also

suggested, with the largest subsidies offered for items which present the

greatest benefit in terms of removal from the waste stream i.e. TV’s and

Computer Monitors. The specific level of subsidy proposed has not been

determined but if only nominal charges of a few dollars were levied per item,

annual costs of up to $200,000 could be expected or $7 per rateable property.

7.5 Officers recommend that any subsidised E-waste service be introduced

in a staged manner, with fees reduced over time in response to the level of

uptake and the net cost to Council. This would assist Council staff to manage

the service. Alternatively Council could offer specific low cost E-waste

drop-off days. It is expected that with the large volume of legacy items in

storage these drop-off days may attract large volumes of material and be

problematic for Council staff to manage.

8. Option

3 rated inorganic waste service

8.1 Option 3 provides for a significantly enhanced level of service for

inorganic waste receipt and collection. Specific services which might be

provided are listed below. The key additional service is a

‘book-in’ inorganic collection. Auckland Council is the only

Council, Officers have identified that are offering this type of service. For

this service to be cost effective Council will need to secure support from

local Charity shops and recycling businesses to enable diversion of at least

50% of what is collected so that waste disposal costs can be effectively

managed. This will require a sorting and handling facility with additional

staffing and asset costs. It is estimated that costs to Council for this Option

3 level of service will require an increase of around $55 to the public rubbish

and recycling rate to cover the following:

· A range of

enhancements to the existing services as outlined in Option 1.

· Provision of a

subsidised E-waste collection scheme as outlined in paragraphs 7.4 and 7.5

· A rated inorganic

waste service as outlined in sections 5.6 to 5.9.

Attachments

Nil

|

Natasha Hickmott

Rubbish and Recycling Engineer

|

Robert van Bentum

Water & Waste Services Manager

|

|

![]()

![]()