AGENDA

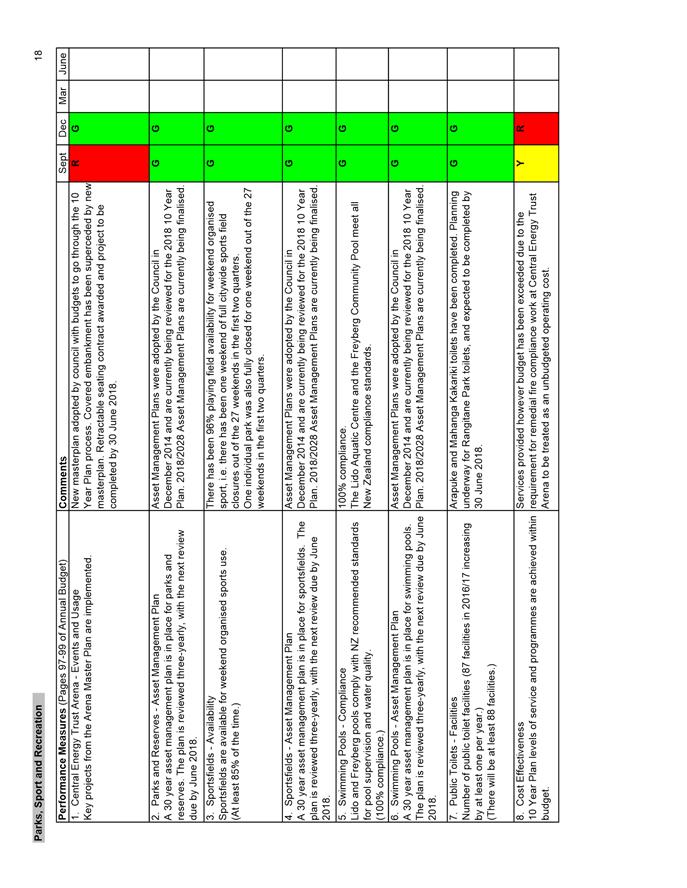

Finance and Performance Committee

|

Susan Baty

(Chairperson)

|

|

Jim Jefferies

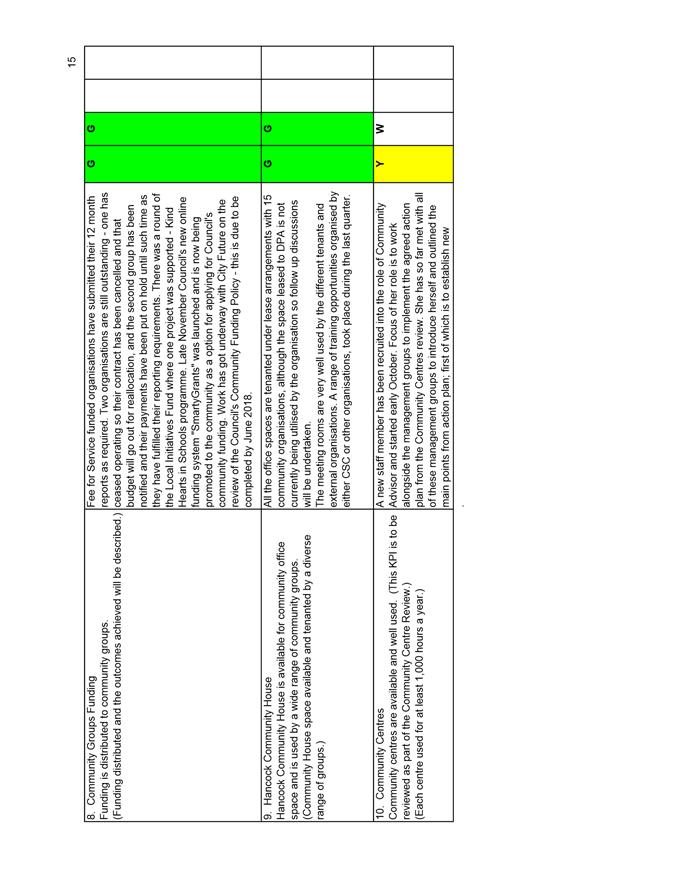

(Deputy Chairperson)

|

|

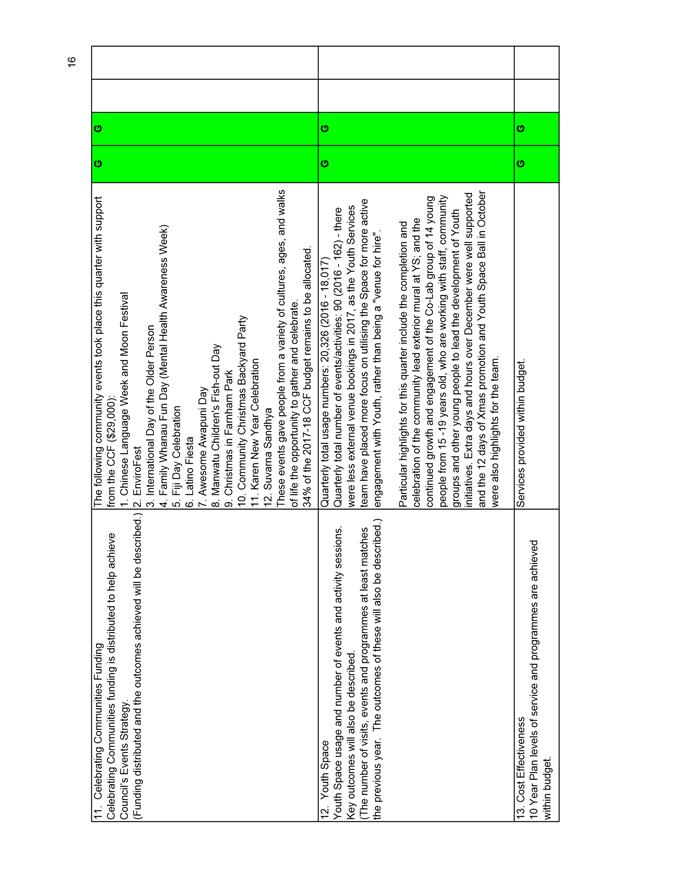

Grant Smith

(The Mayor)

|

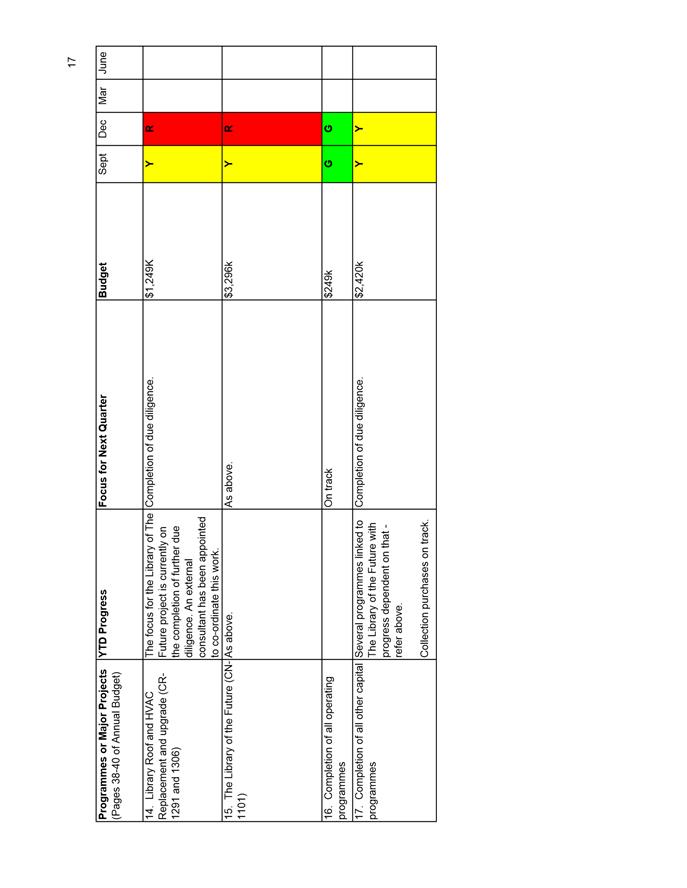

|

Adrian Broad

|

Leonie Hapeta

|

|

Gabrielle

Bundy-Cooke

|

Lorna Johnson

|

|

Vaughan

Dennison

|

Karen Naylor

|

|

Lew Findlay

QSM

|

Bruno Petrenas

|

PALMERSTON NORTH CITY

COUNCIL

Finance and Performance Committee MEETING

19 February 2018

Order of Business

NOTE: The Finance and Performance Committee meeting

coincides with the ordinary meeting of the Audit and Risk Committee

meeting. The format for the meeting will be as follows:

- Audit and Risk Committee will open and

adjourn immediately to Finance and Performance Committee

- Finance and Performance Committee will

open, conduct its business and then close.

1. Apologies

2. Notification of Additional Items

Pursuant to Sections 46A(7) and

46A(7A) of the Local Government Official Information and Meetings Act 1987, to

receive the Chairperson’s explanation that specified item(s), which do

not appear on the Agenda of this meeting and/or the meeting to be held with the

public excluded, will be discussed.

Any additions in accordance with

Section 46A(7) must be approved by resolution with an explanation as to why

they cannot be delayed until a future meeting.

Any additions in accordance with

Section 46A(7A) may be received or referred to a subsequent meeting for further

discussion. No resolution, decision or recommendation can be made in

respect of a minor item.

3. Public Comment

To receive comments from members of

the public on matters specified on this Agenda or, if time permits, on other

Committee matters.

(NOTE: If the

Committee wishes to consider or discuss any issue raised that is not specified

on the Agenda, other than to receive the comment made or refer it to the Chief

Executive, then a resolution will need to be made in accordance with clause 2

above.)

4. Confirmation

of Minutes Page 7

“That the

minutes of the Finance and Performance Committee meeting of 18 December 2017

Part I Public be confirmed as a true and correct record.”

5. Gordon

Kear Forest Page 13

Memorandum,

dated 2 February 2018 from the Business Development Executive, Fiona Dredge.

6. Quarterly

Performance and Financial Report - Quarter Ending 31 December 2017 Page 45

Memorandum,

dated 2 February 2018 from the Financial Accountant, Keith Allan and the Head

of Community Planning, Andrew Boyle.

7. Treasury

Report for 6 months ended 31 December 2017 Page 127

Memorandum,

dated 8 February 2018 from the Strategy Manager Finance, Steve Paterson.

8. Committee

Work Schedule - February 2018 Page 139

9. Exclusion of Public

|

|

To be moved:

“That the

public be excluded from the following parts of the proceedings of this

meeting listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under Section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General

subject of each matter to be considered

|

Reason for

passing this resolution in relation to each matter

|

Ground(s)

under Section 48(1) for passing this resolution

|

|

10.

|

Minutes of the Finance and Performance Committee

meeting - Part II Confidential - 18 December 2017

|

For the reasons setout in the Finance and

Performance Committee minutes of 18 December 2017, held in public present.

|

|

|

|

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

Also that the

persons listed below be permitted to remain after the public has been

excluded for the reasons stated.

Chief Executive

(Heather Shotter), Chief Financial Officer (Grant Elliott), General Manager,

City Enterprises (Ray McIndoe), General Manager, City Future (Sheryl Bryant),

General Manager, City Networks (Ray Swadel), General Manager, Customer

Services (Peter Eathorne), General Manager, Libraries and Community Services

(Debbie Duncan), Human Resources Manager (Wayne Wilson) and Communications

and Marketing Manager (or their representative (name)) because of their

knowledge and ability to provide the meeting with advice on matters both from

an organisation-wide context (being members of the Council’s Management

Team) and also from their specific role within the Council.

Legal Counsel

(John Annabell), because of his knowledge and ability to provide the meeting

with legal and procedural advice.

Governance and

Support Team Leader (Kyle Whitfield) and Committee Administrators (Penny

Odell, Carly Chang and Rachel Corser), because of their knowledge and ability

to provide the meeting with procedural advice and record the proceedings of

the meeting.

[Add Council

Officers], because

of their knowledge and ability to assist the meeting in speaking to their

report and answering questions, noting that such officer will be present at

the meeting only for the item that relate to their respective report.

[Add Third

Parties], because of their knowledge and ability

to assist the meeting in speaking to their report/s [or other matters as

specified] and answering questions, noting that such person/s will be present

at the meeting only for the items that relate to their respective report/s

[or matters as specified].

|

PALMERSTON NORTH CITY

COUNCIL

Palmerston North City Council

Minutes of

the Finance and Performance Committee Meeting Part I Public, held in the Council

Chamber, First Floor, Civic Administration Building, 32 The Square, Palmerston

North on 18 December 2017, commencing at 9.00am

|

Members

Present:

|

Councillor Susan Baty (in the Chair), The

Mayor (Grant Smith) and Councillors Jim Jefferies, Brent Barrett, Rachel

Bowen, Adrian Broad, Gabrielle Bundy-Cooke, Lew Findlay QSM, Lorna Johnson,

Duncan McCann, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi

Utikere.

|

|

Apologies:

|

The Mayor (Grant Smith) (Early Departure)

and Councillors Vaughan Dennison, Leonie Hapeta and Duncan McCann (Early

Departure).

|

Councillor Duncan McCann left the meeting at 9.24am during consideration of clause 104. He was not present for clauses 104 to 108 inclusive.

The Mayor (Grant

Smith) left the meeting at 9.29am during consideration of clause 104. He was not present for clauses 104 to 108 inclusive.

|

101-17

|

Apologies

|

|

|

Moved Susan Baty, seconded Jim Jefferies.

The COMMITTEE RESOLVED

1. That the Committee receive the apologies.

|

|

|

Clause 101-17 above was carried 14 votes to 0, the

voting being as follows:

For:

The Mayor (Grant

Smith) and Councillors Brent Barrett, Susan Baty, Rachel Bowen, Adrian Broad,

Gabrielle Bundy-Cooke, Lew Findlay QSM, Jim Jefferies,, Lorna Johnson, Duncan

McCann, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

102-17

|

Confirmation of Minutes

|

|

|

Moved Lorna Johnson, seconded Tangi

Utikere.

The COMMITTEE RESOLVED

1. That the minutes of the Finance and Performance Committee

meeting of 20 November 2017 Part I Public be confirmed as a true and correct

record.

|

|

|

Clause 102-17 above was carried 11 votes to 0, with

3 abstentions, the voting being as follows:

For:

Councillors Brent Barrett, Susan Baty, Adrian Broad,

Gabrielle Bundy-Cooke, Lew Findlay QSM, Jim Jefferies, Lorna Johnson, Duncan

McCann, Karen Naylor, Bruno Petrenas and Tangi Utikere.

Abstained:

The Mayor (Grant Smith) and Councillors Rachel Bowen

and Aleisha Rutherford.

|

|

103-17

|

Planning Fees & Charges -

Confirmation Following Public Consultation

Memorandum,

dated 4 December 2017 from the Strategy Manager Finance, Steve Paterson.

|

|

|

Moved Tangi Utikere, seconded Lorna Johnson.

The COMMITTEE

RECOMMENDS

1. That

the following charges for Planning Services be

approved effective from 1 January 2018:

· Boundary activities (under section 87BA of the Resource Management

Act 1991) – a fixed fee and deposit of $270.

· Marginal/temporary breaches (under section 87BB of the Resource

Management Act 1991) – a fixed fee and deposit of $270.

· Hearing commissioners appointed at the

request of applicants (under section 357AB of the Resource Management Act

1991) – charge at cost plus disbursements of the independent

commissioner.

|

|

|

Clause 103-17

above was carried 14 votes to 0, the voting being as follows:

For:

The Mayor (Grant

Smith) and Councillors Brent Barrett, Susan Baty, Rachel Bowen, Adrian Broad,

Gabrielle Bundy-Cooke, Lew Findlay QSM, Jim Jefferies, Lorna Johnson, Duncan

McCann, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

104-17

|

Update of Treasury Policy (incorporating

Liability Management & Investment Policy)

Memorandum,

dated 4 December 2017 from the Strategy Manager Finance, Steve Paterson.

Councillor Duncan McCann left the meeting

at 9:24am

The Mayor (Grant Smith) left the meeting

at 9:29am

|

|

|

Moved Karen Naylor, seconded Lorna Johnson.

The COMMITTEE

RECOMMENDS

1. That

the updated Treasury

Policy (incorporating the Liability Management and Investment Policy pursuant

to section 102 of the Local Government Act 2002) as attached to this report

be adopted.

2. That

it be noted the Council will be reviewing the specific borrowing limits

contained in clause 3.6.1 of the Policy as part of the process of developing

its Financial Strategy for the 2018-28 10 Year Plan and that if the outcome

of this is there are changes to these limits the Policy will be updated to

include them.

|

|

|

Clauses 104.1 and

104.2 above were carried 12 votes to 0, the voting being as follows:

For:

Councillors

Brent Barrett, Susan Baty, Rachel Bowen, Adrian Broad, Gabrielle Bundy-Cooke,

Lew Findlay QSM, Jim Jefferies,, Lorna Johnson, Karen Naylor, Bruno Petrenas,

Aleisha Rutherford and Tangi Utikere.

|

|

|

Moved Brent Barrett, seconded Lorna

Johnson.

The COMMITTEE RECOMMENDS

3. Clause

4.1.4 to be the following:

The Council seeks to invest in an ethical manner, which it defines

as meaning

that it will invest in entities that engage in activities that demonstrate

a positive approach to the environment, society and governance.

The Council will

not invest where there are significant legal

or ethical concerns, and will specifically exclude investment in the

following areas:

• the manufacturing or development of controversial weapons

• the manufacturing of tobacco

• the production of fossil fuels

• generating revenue from the operation of casino gambling.

|

|

|

Clause 104.3 above was carried 11 votes to 1, the

voting being as follows:

For:

Councillors Brent Barrett, Susan Baty, Rachel Bowen,

Gabrielle Bundy-Cooke, Lew Findlay QSM, Jim Jefferies, Lorna Johnson, Karen

Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

Against:

Councillor Adrian Broad.

|

|

105-17

|

Central Energy Trust Wildbase Recovery

Naming Rights Memorandum of Understanding and Update

Report,

dated 27 November 2017 from the Senior Property & Parks Planner, Aaron

Phillips.

|

|

|

Moved Aleisha Rutherford, seconded Lew Findlay QSM.

The COMMITTEE

RECOMMENDS

1. That

the Central Energy Trust Wildbase Recovery Naming

Rights Memorandum of Understanding as appended to the report dated 27

November 2017 be approved for signing.

2. That

Council note progress on the construction of Central Energy Trust Wildbase

Recovery facility in the Victoria Esplanade.

|

|

|

Clause 105-17

above was carried 12 votes to 0, the voting being as follows:

For:

Councillors

Brent Barrett, Susan Baty, Rachel Bowen, Adrian Broad, Gabrielle Bundy-Cooke,

Lew Findlay QSM, Jim Jefferies, Lorna Johnson, Karen Naylor, Bruno Petrenas,

Aleisha Rutherford and Tangi Utikere.

|

|

106-17

|

Conference Opportunity - Digital Nations

2030

Memorandum,

dated 4 December 2017 from the Governance & Support Team Leader, Kyle

Whitfield.

|

|

|

Moved Susan Baty, seconded Aleisha Rutherford.

The COMMITTEE

RESOLVED

1. That

the Committee approve the attendance of up to 2 elected member(s) to attend,

with expenses paid, the Digital Nations 2030 conference being held in

Auckland on 19-20 February 2018.

2. That registrations of

interest be invited from elected members wishing to attend, with expenses

paid, and advise the Governance and Support Team Leader, Kyle Whitfield, by

12 noon Friday 22 December 2017.

|

|

|

Clause 106-17

above was carried 12 votes to 0, the voting being as follows:

For:

Councillors

Brent Barrett, Susan Baty, Rachel Bowen, Adrian Broad, Gabrielle Bundy-Cooke,

Lew Findlay QSM, Jim Jefferies, Lorna Johnson, Karen Naylor, Bruno Petrenas,

Aleisha Rutherford and Tangi Utikere.

|

|

107-17

|

Committee Work Schedule

|

|

|

Moved Karen Naylor, seconded Rachel Bowen.

The COMMITTEE

RESOLVED

1. That

the Finance and Performance Committee receive its Work Schedule dated

December 2017.

|

|

|

Clause 107-17

above was carried 12 votes to 0, the voting being as follows:

For:

Councillors

Brent Barrett, Susan Baty, Rachel Bowen, Adrian Broad, Gabrielle Bundy-Cooke,

Lew Findlay QSM, Jim Jefferies, Lorna Johnson, Karen Naylor, Bruno Petrenas,

Aleisha Rutherford and Tangi Utikere.

|

Exclusion of Public

|

108-17

|

Recommendation

to Exclude Public

|

|

|

Moved Brent Barrett, seconded Rachel

Bowen.

The COMMITTEE RESOLVED

“That the

public be excluded from the following parts of the proceedings of this

meeting listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the reason

for passing this resolution in relation to each matter, and the specific

grounds under Section 48(1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution are as follows:

|

General

subject of each matter to be considered

|

Reason for

passing this resolution in relation to each matter

|

Ground(s)

under Section 48(1) for passing this resolution

|

|

11.

|

Minutes of the Finance and Performance Committee

meeting - Part II Confidential - 20 November 2017

|

For the reasons set out in the Finance and

Performance Committee minutes of 20 November 2017, held in public present.

|

|

12.

|

Library Redevelopment Project - Update

|

Commercial Activities

|

s7(2)(h)

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

Also that the

persons listed below be permitted to remain after the public has been

excluded for the reasons stated.

Chief Executive

(Heather Shotter), Chief Financial Officer (Grant Elliott), General Manager,

City Enterprises (Ray McIndoe), General Manager, City Future (Sheryl Bryant),

General Manager, City Networks (Ray Swadel), General Manager, Customer

Services (Peter Eathorne), General Manager, Libraries and Community Services

(Debbie Duncan), Human Resources Manager (Wayne Wilson) and Communications

and Marketing Manager (or their representative (Sandra Crosbie)) because of

their knowledge and ability to provide the meeting with advice on matters

both from an organisation-wide context (being members of the Council’s

Management Team) and also from their specific role within the Council.

Legal Counsel

(John Annabell), because of his knowledge and ability to provide the meeting

with legal and procedural advice.

Governance and

Support Team Leader (Kyle Whitfield) and Committee Administrators (Penny

Odell, Carly Chang and Rachel Corser), because of their knowledge and ability

to provide the meeting with procedural advice and record the proceedings of

the meeting.

Manager,

Service Delivery (Linda Moore), because of their knowledge and ability to assist the meeting in

speaking to their report and answering questions, noting that such officer

will be present at the meeting only for the item that relate to their

respective report.

WT Partnership

(Warren Wilkes) and Athfield Architects (Jon Rennie), because of their knowledge and ability to assist the meeting in

speaking to their report/s [or other matters as specified] and answering

questions, noting that such person/s will be present at the meeting only for

the items that relate to their respective report/s [or matters as specified].

|

|

|

Clause 108-17 above was carried 12 votes to 0, the

voting being as follows:

For:

Councillors Brent Barrett, Susan Baty, Rachel

Bowen, Adrian Broad, Gabrielle Bundy-Cooke, Lew Findlay QSM, Jim Jefferies,

Lorna Johnson, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi

Utikere.

|

The public part of the meeting finished at 9.50am

Confirmed 19 February

2018

Chairperson

PALMERSTON NORTH CITY

COUNCIL

Memorandum

TO: Finance and Performance Committee

MEETING DATE: 19 February 2018

TITLE: Gordon Kear Forest

DATE: 2 February 2018

AUTHOR/S: Fiona Dredge, Business Development Executive, City Corporate

|

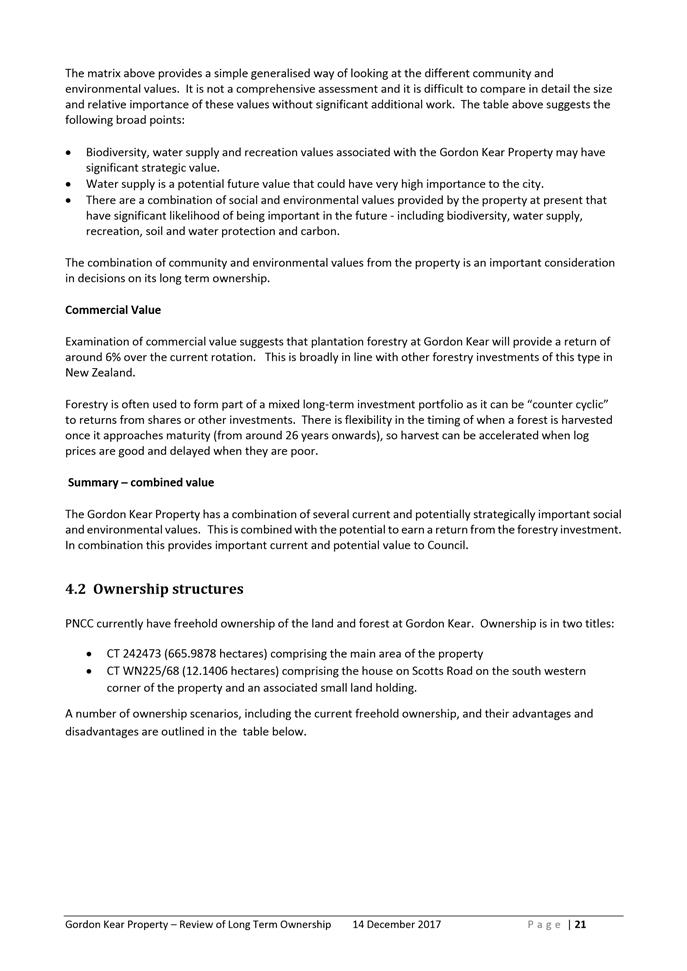

RECOMMENDATION(S) TO Council

1. That

Council retains ownership of the Gordon Kear

property, including the pine plantation, as it has a number of current and

potentially strategically important social and environmental values combined

with providing a commercial return from the forestry investment.

2. That

Council considers ways to enhance the community environmental values of the

property including biodiversity, recreation and water supply in order to

maximise value to the city.

3. That

Council continues to carefully manage the commercial forest estate to

maximise overall return at low risk.

4. That

Council maintains a watching brief on opportunity and benefits from the sale

of the house and small holding.

|

1. ISSUE

In 2008,

Council considered a report that discussed the future use of the Gordon Kear

Forest land following harvest. Council resolved to replant the forest

every winter immediately following the harvest of each area and to review its

long term ownership once the harvest was complete. The resolution

required any such review “to consider the community value of Gordon Kear

Forest in terms of recreational opportunities and environmental

services.”

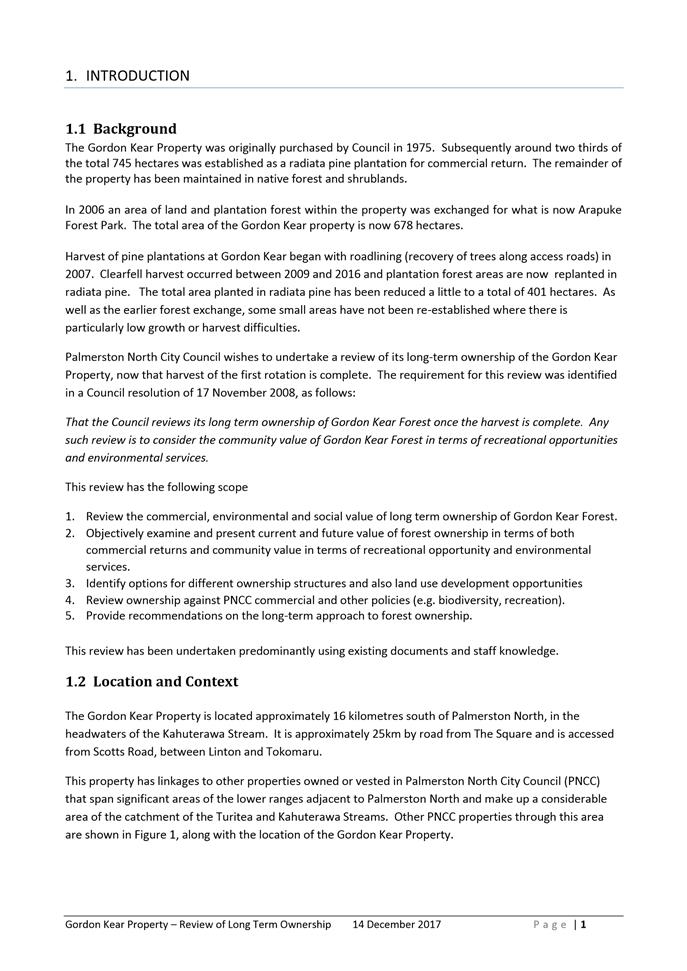

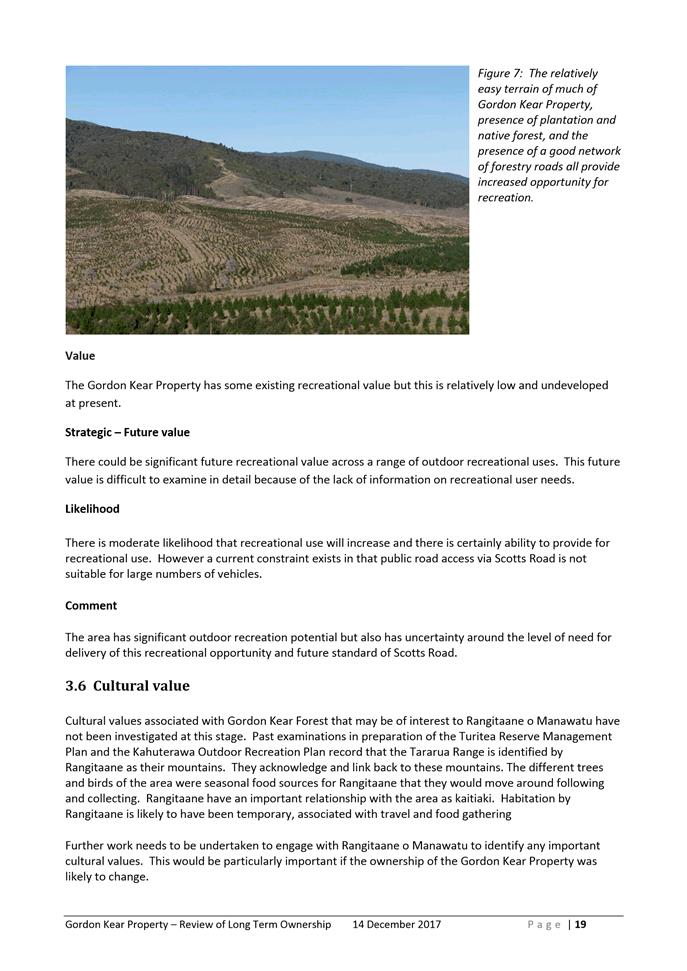

2. BACKGROUND

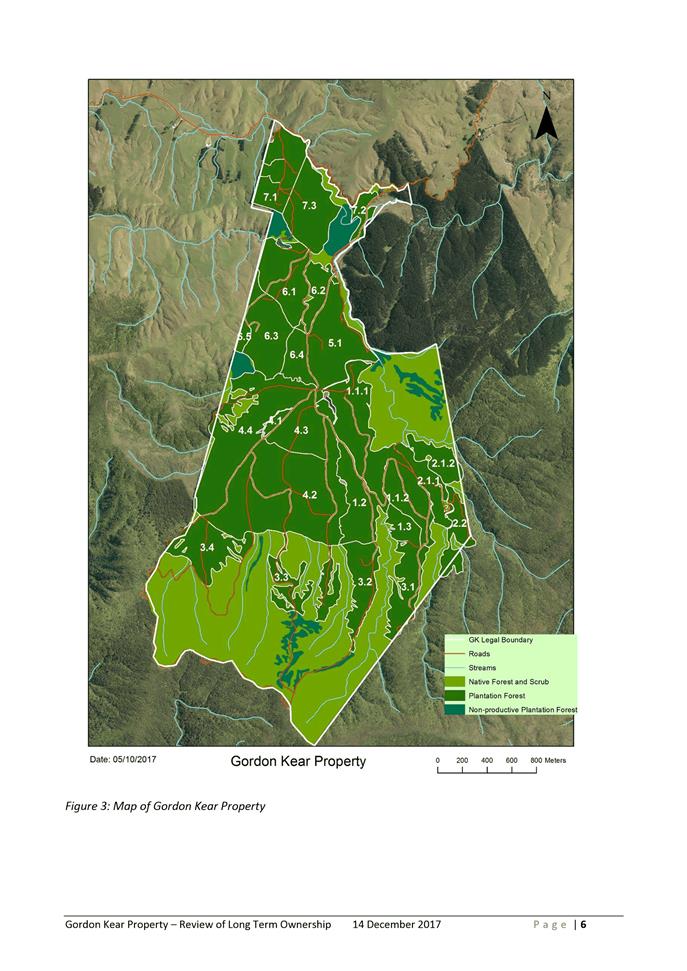

The Gordon

Kear property was purchased by Council in 1975 and a commercial pine plantation

established on approximately two thirds of the land. The remaining area

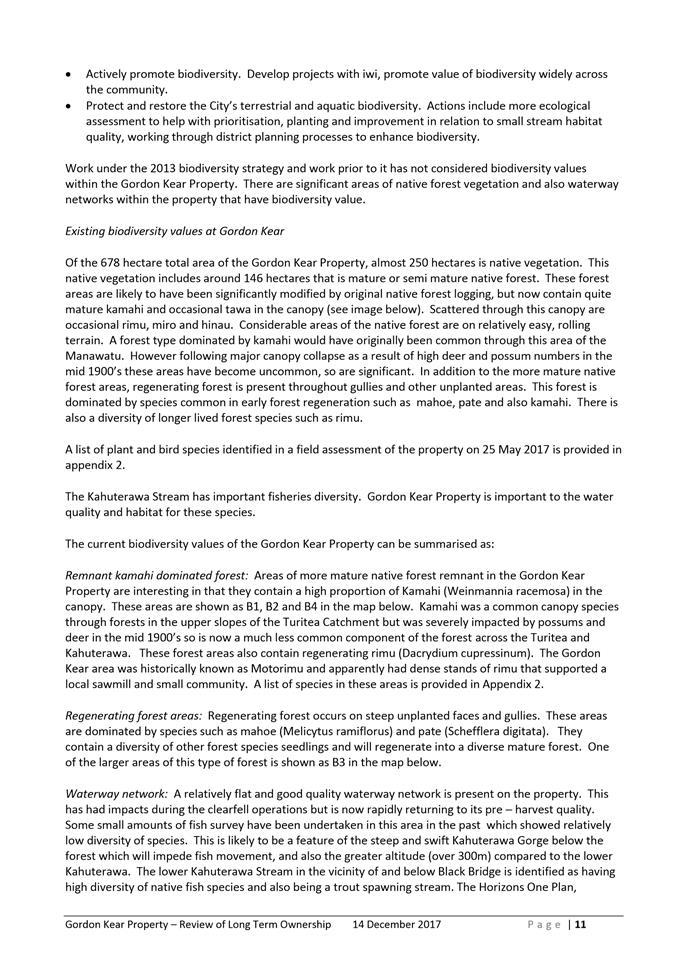

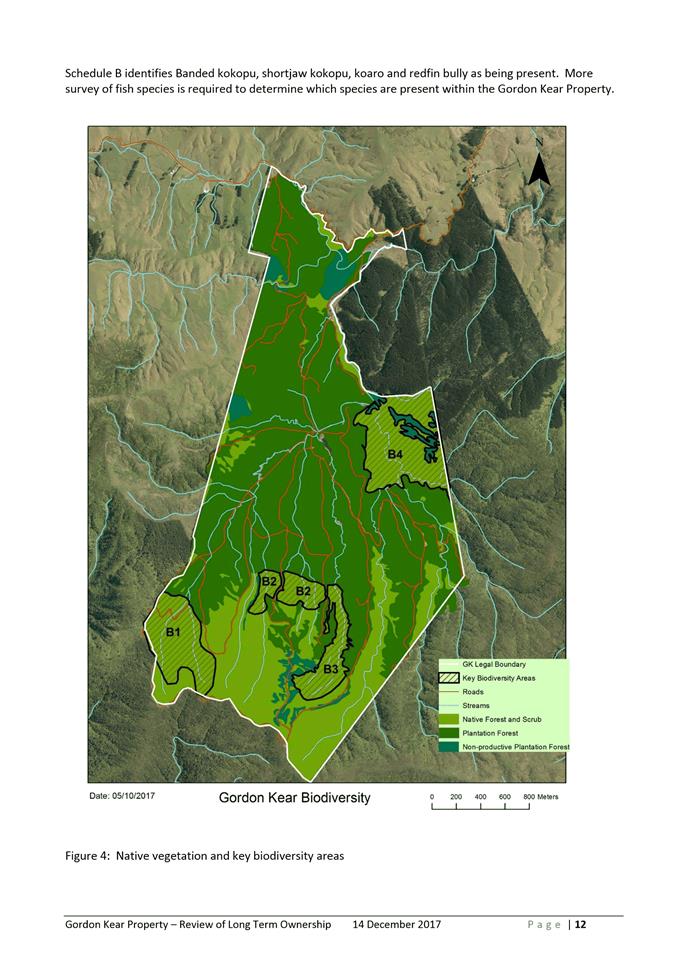

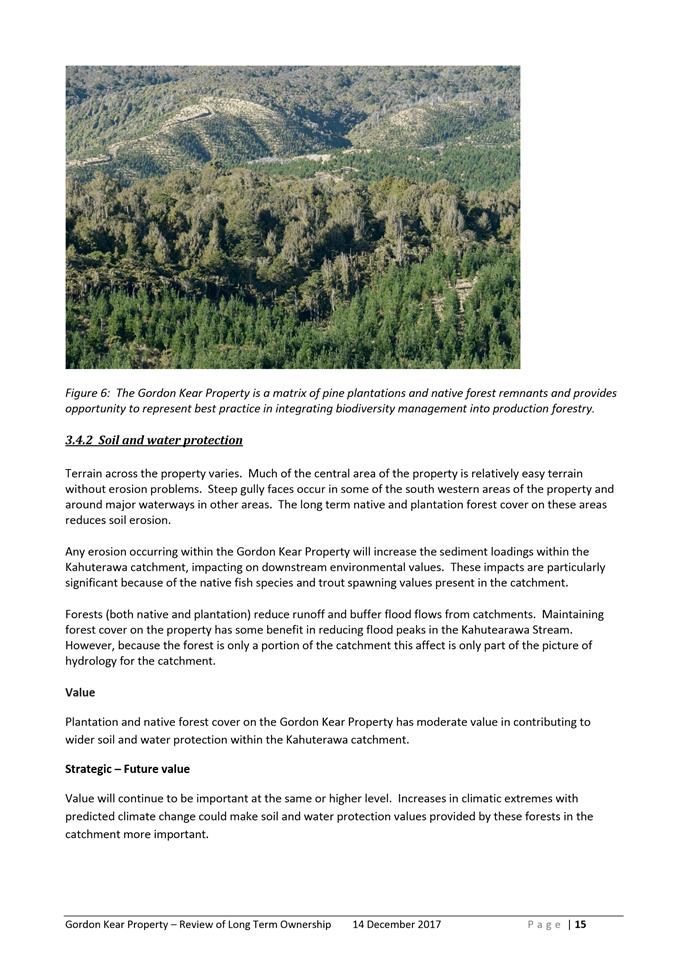

of approximately 250 hectares is native forest and shrublands.

In 2006 part

of the pine plantation and land was exchanged for what is now Arapuke Forest

Park. The exchange enabled Council to develop recreation in and around

Arapuke Forest Park and to continue to focus on commercial outcomes in Gordon

Kear Forest.

The total area

of the Council-owned Gordon Kear property post-exchange is 678 hectares.

Preparation

for clearfell harvest of the pine plantation began in 2007 with road lining

(recovery of trees along access tracks to allow road construction).

Clearfell harvest was undertaken between 2009 and 2016 and is now complete.

Replanting of

plantation areas occurred each winter following harvest and is also now

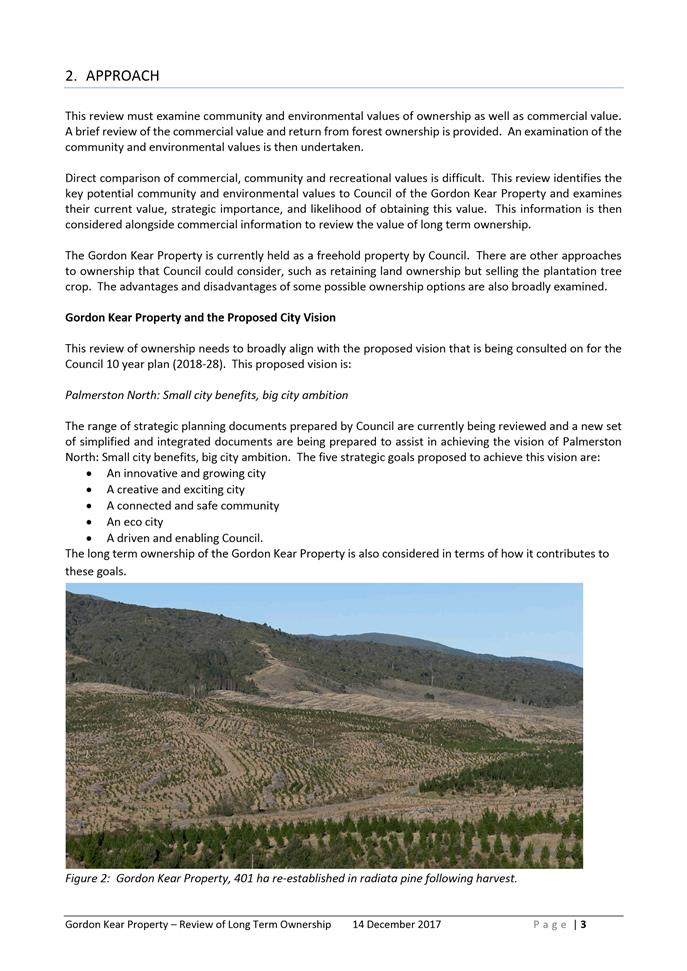

complete. The total area planted in radiata pine is currently 401

hectares.

The commercial

pine plantation and majority of the Gordon Kear land are included in

Council’s Treasury Policy as investment assets. The principal

reason for investment is as an alternative funding source for future city

development and net proceeds of harvest or sale are used to repay debt.

Forestry is a long term investment with 28-30 years between planting and

harvesting/realisation of the investment. The harvest of the second

rotation tree crop may be completed around 2044.

Officers

engaged the consultants Groundtruth to review Council’s long term

ownership of the property. In carrying out the review, the consultant was

provided with Council strategies and plans, previous reports and other

information related to the commercial pine plantation and the property as a

whole. The consultant also met with staff in areas such as planning,

policy, water supply, and recreation in order to complete some of the key

sections in the report. A copy of the consultant’s report is

attached to this memorandum.

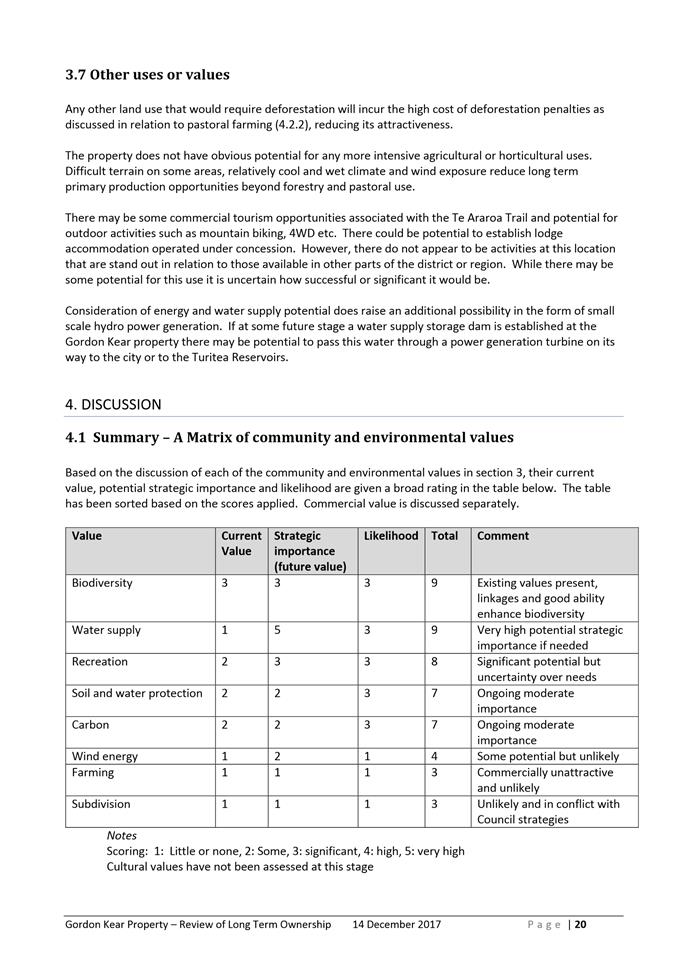

In summary,

Groundtruth have concluded that the Gordon Kear property has a number of

current and potentially strategically important social and environmental

values. These include biodiversity, water supply, recreation, soil and

water protection and carbon. In addition, the commercial pine plantation

is expected to provide a return of around 6% over the current rotation, which

is noted as being in line with other forestry investments of the same type in

New Zealand.

Groundtruth’s

recommendation is that Council maintains ownership of the Gordon Kear

property. Other key recommendations are set out in section 5 of the

attached report and are included as Recommendations to Council in this

memorandum.

3. NEXT

STEPS

Pruning of

commercial plantation areas identified as suitable for clearwood (free of knots

or blemishes caused by the original branches) and thinning (removal of trees

not selected for the final crop) will be carried out. This work commenced

during 2016/17 and is expected to continue for at least ten more years, subject

to Council’s approval to retain the property.

4. Compliance

and administration

|

Does the Committee have delegated authority to

decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they affect land or a

body of water?

|

n/a

|

|

Can this decision only be made through a 10 Year

Plan?

|

No

|

|

Does this decision require consultation through the

Special Consultative procedure?

|

No

|

|

Is there funding in the current Annual Plan for

these actions?

|

Yes

|

|

Are the recommendations inconsistent with any of

Council’s policies or plans?

|

No

|

Attachments

|

1.

|

Groundtruth Report Gordon Kear Property

Ownership Review ⇩

|

|

|

Fiona Dredge

Business Development Executive

|

|

|

PALMERSTON NORTH CITY

COUNCIL

Memorandum

TO: Finance and Performance Committee

MEETING DATE: 19 February 2018

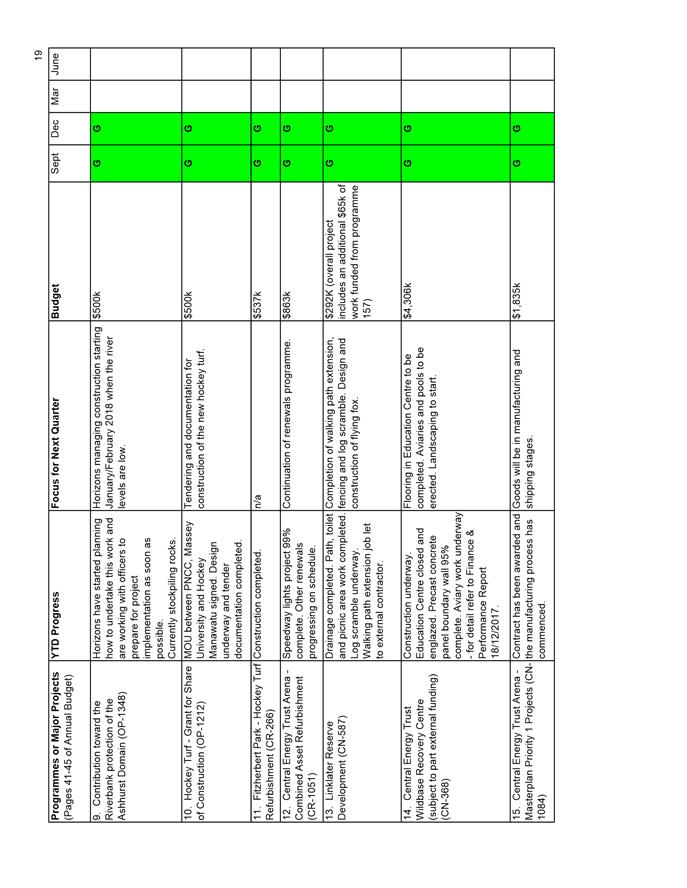

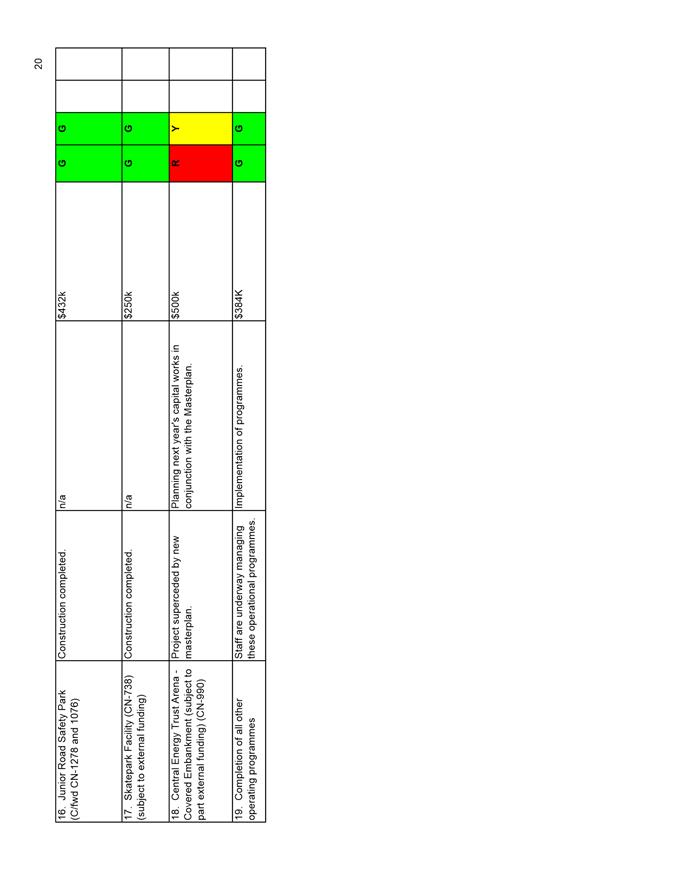

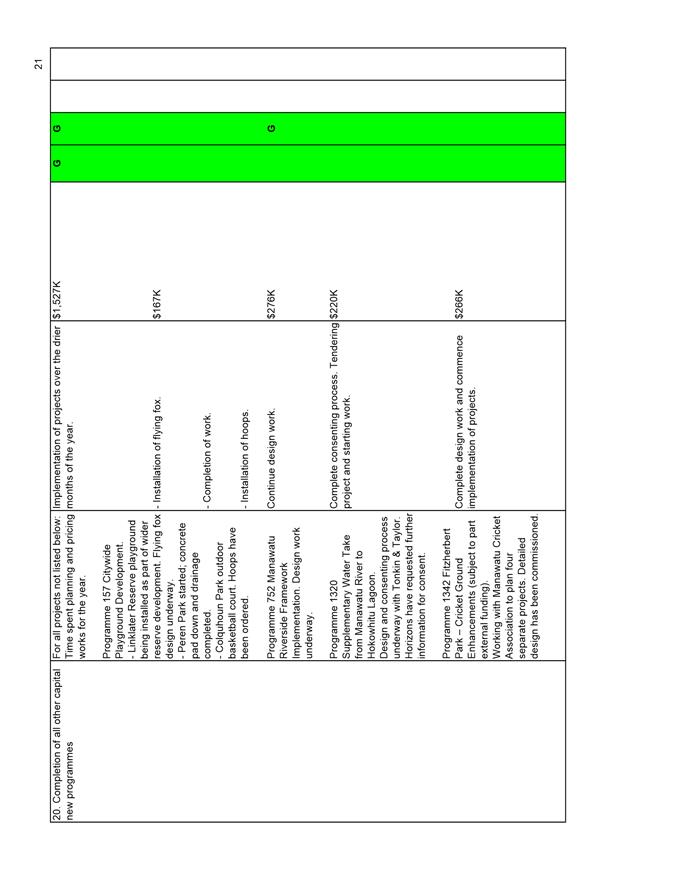

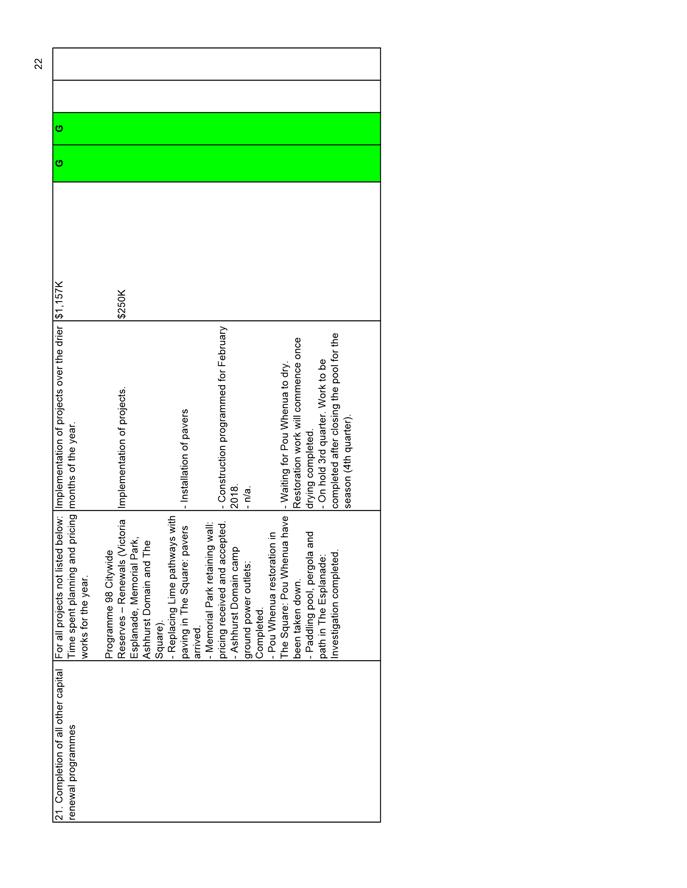

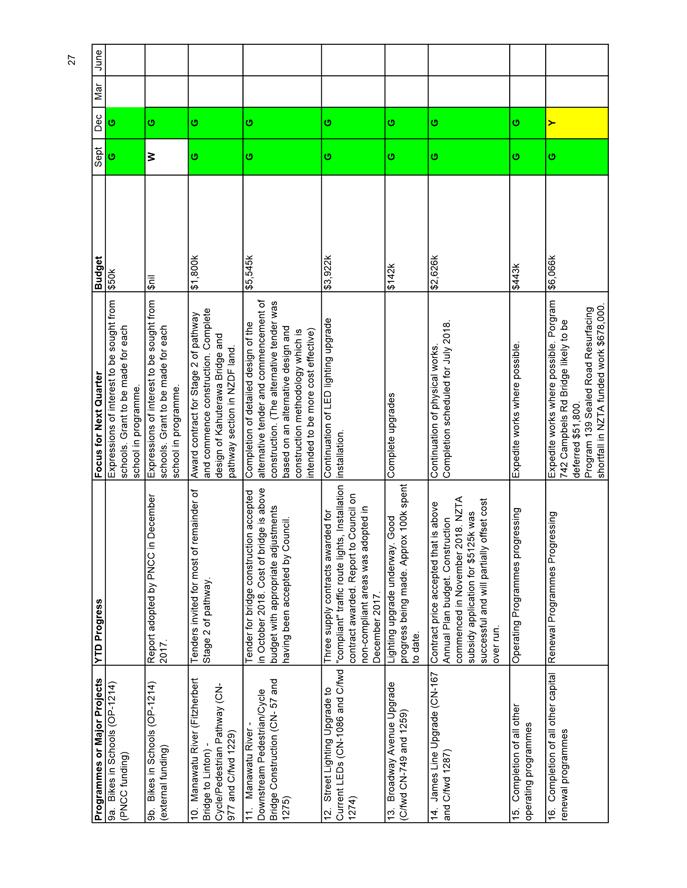

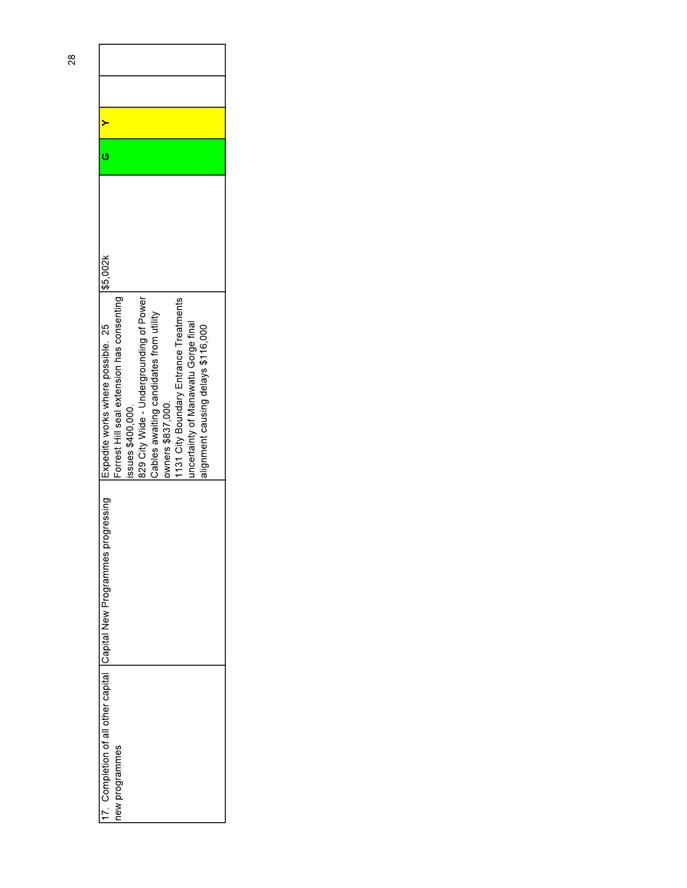

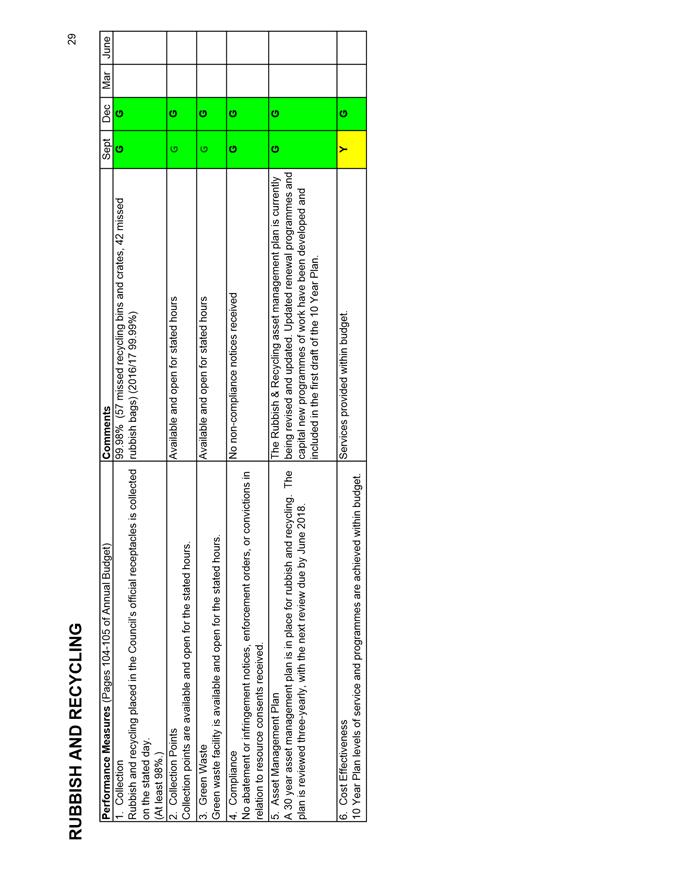

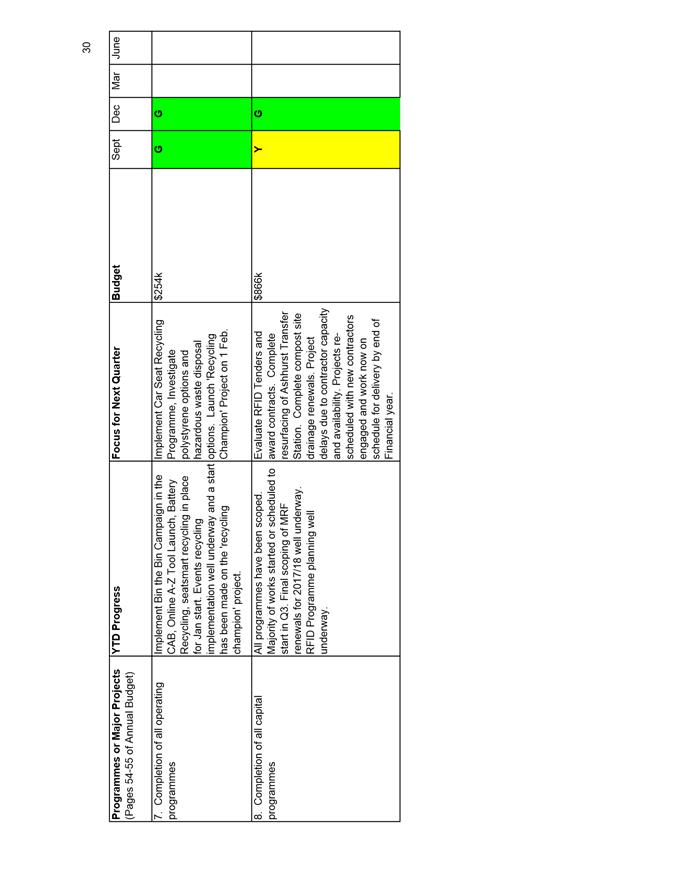

TITLE: Quarterly Performance and Financial Report - Quarter Ending 31

December 2017

DATE: 2 February 2018

AUTHOR/S: Keith Allan, Financial Accountant, City Corporate

Andrew Boyle, Head

of Community Planning, City Future

|

RECOMMENDATION(S)

TO Council

1. That the

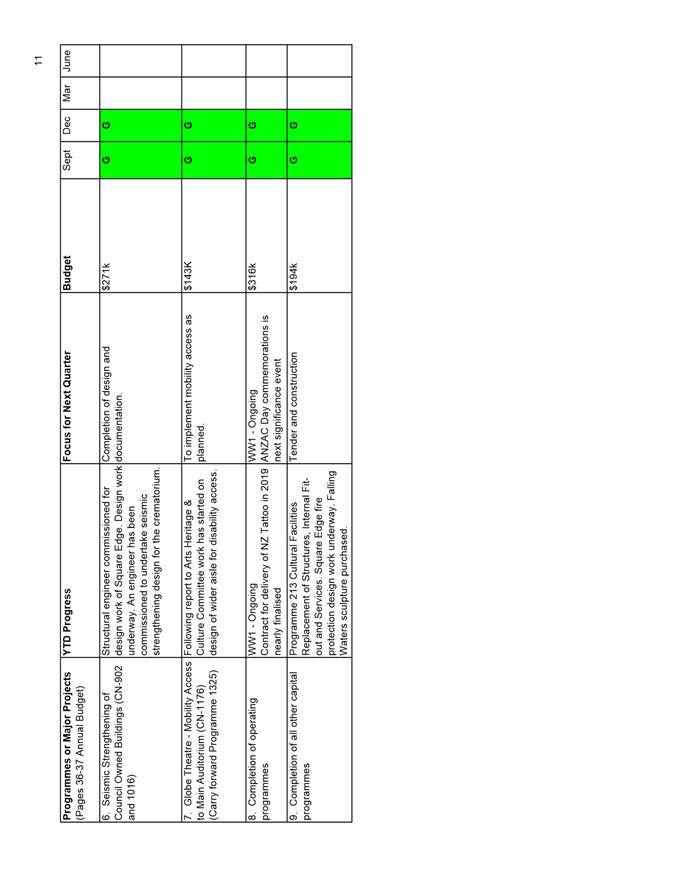

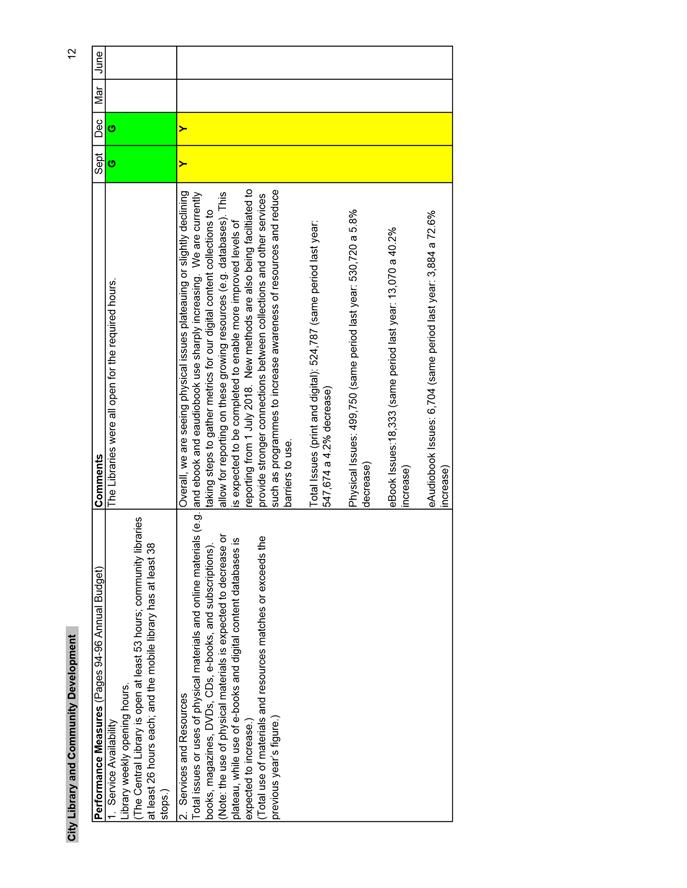

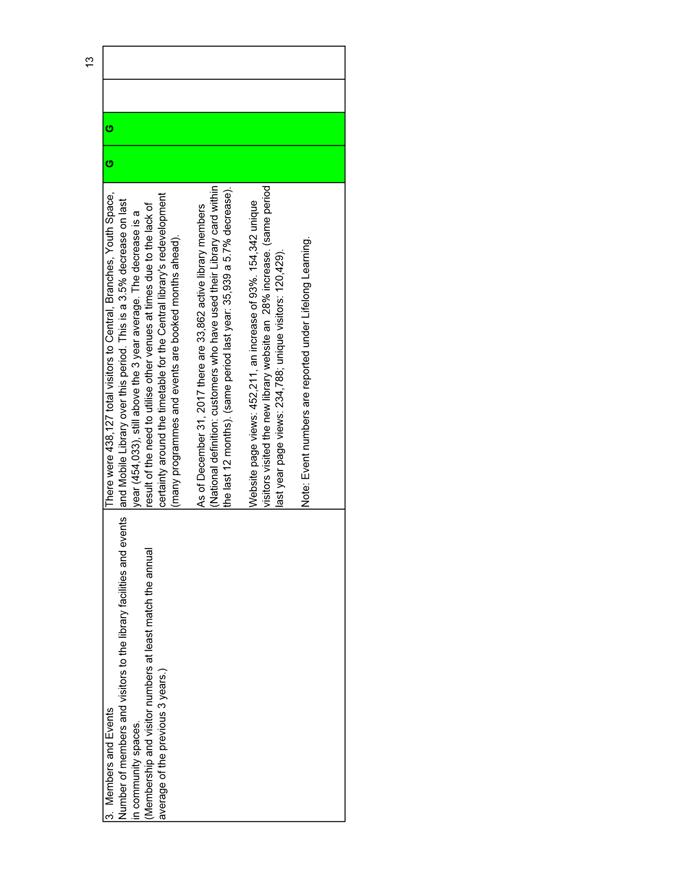

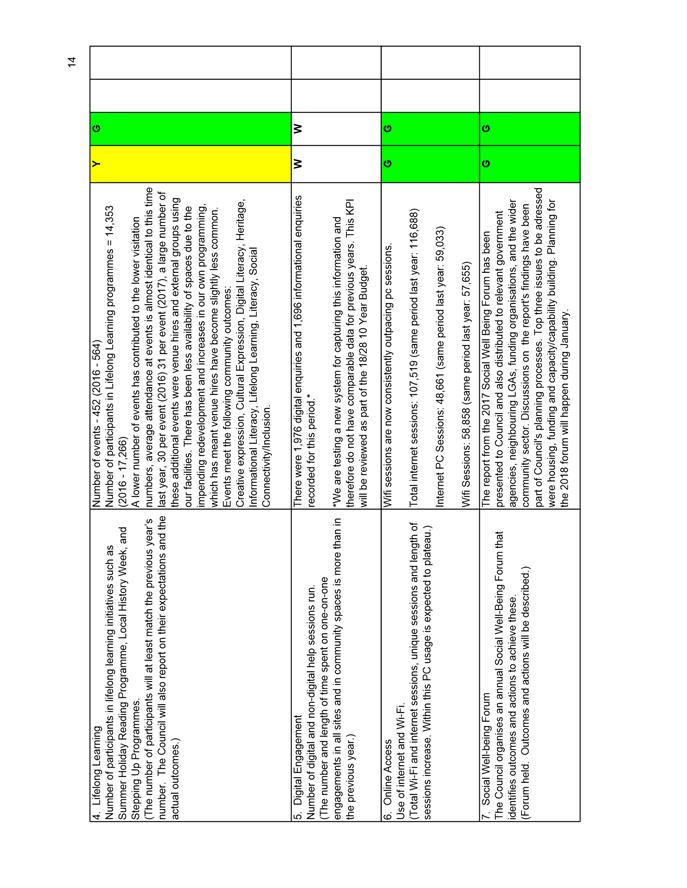

Committee receive the December 2017 Quarterly Performance and Financial

Report and note:

a. The December 2017 financial performance and operating performance.

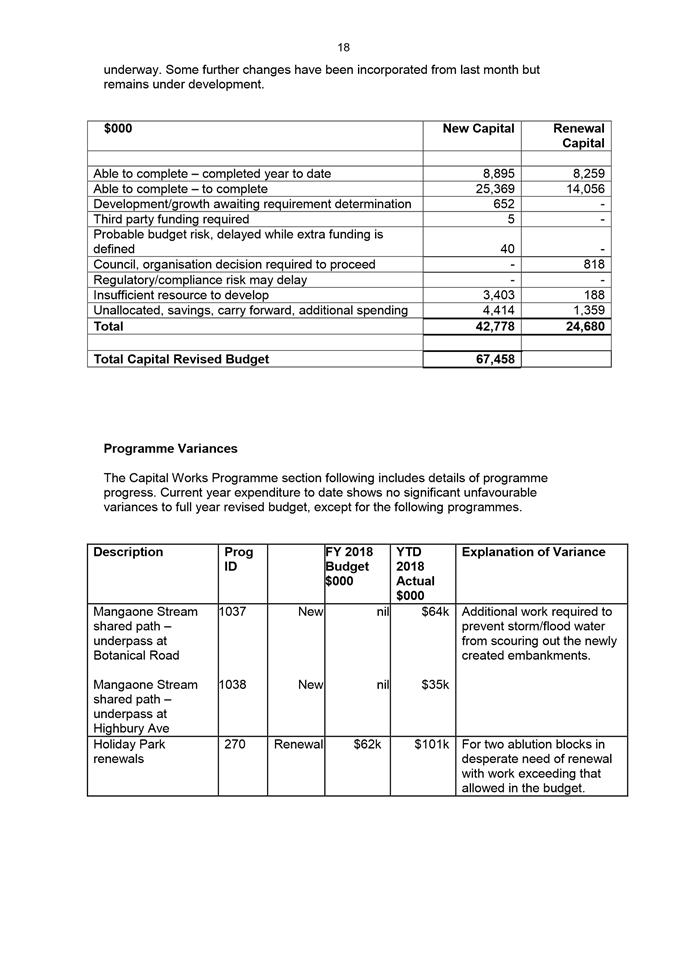

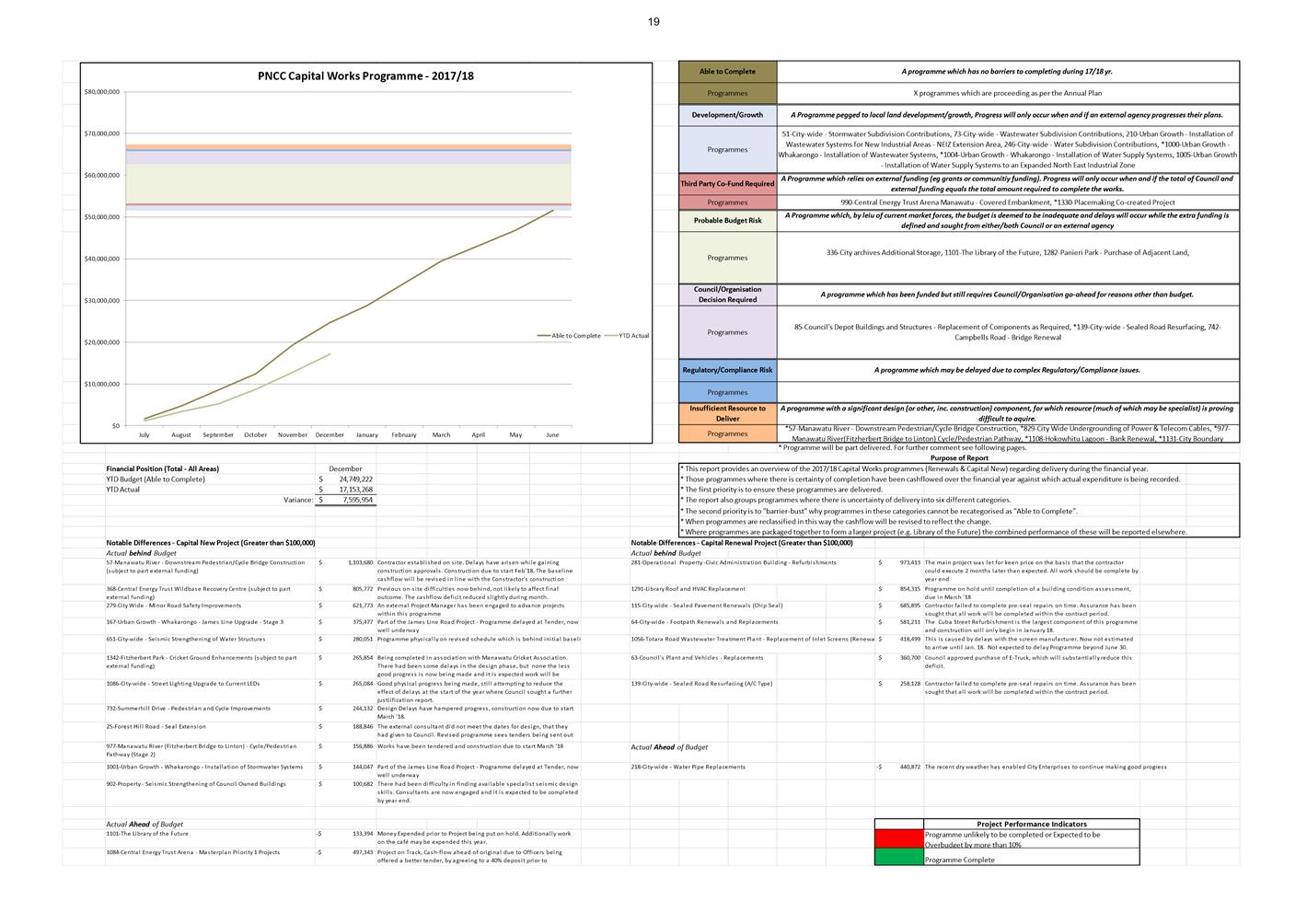

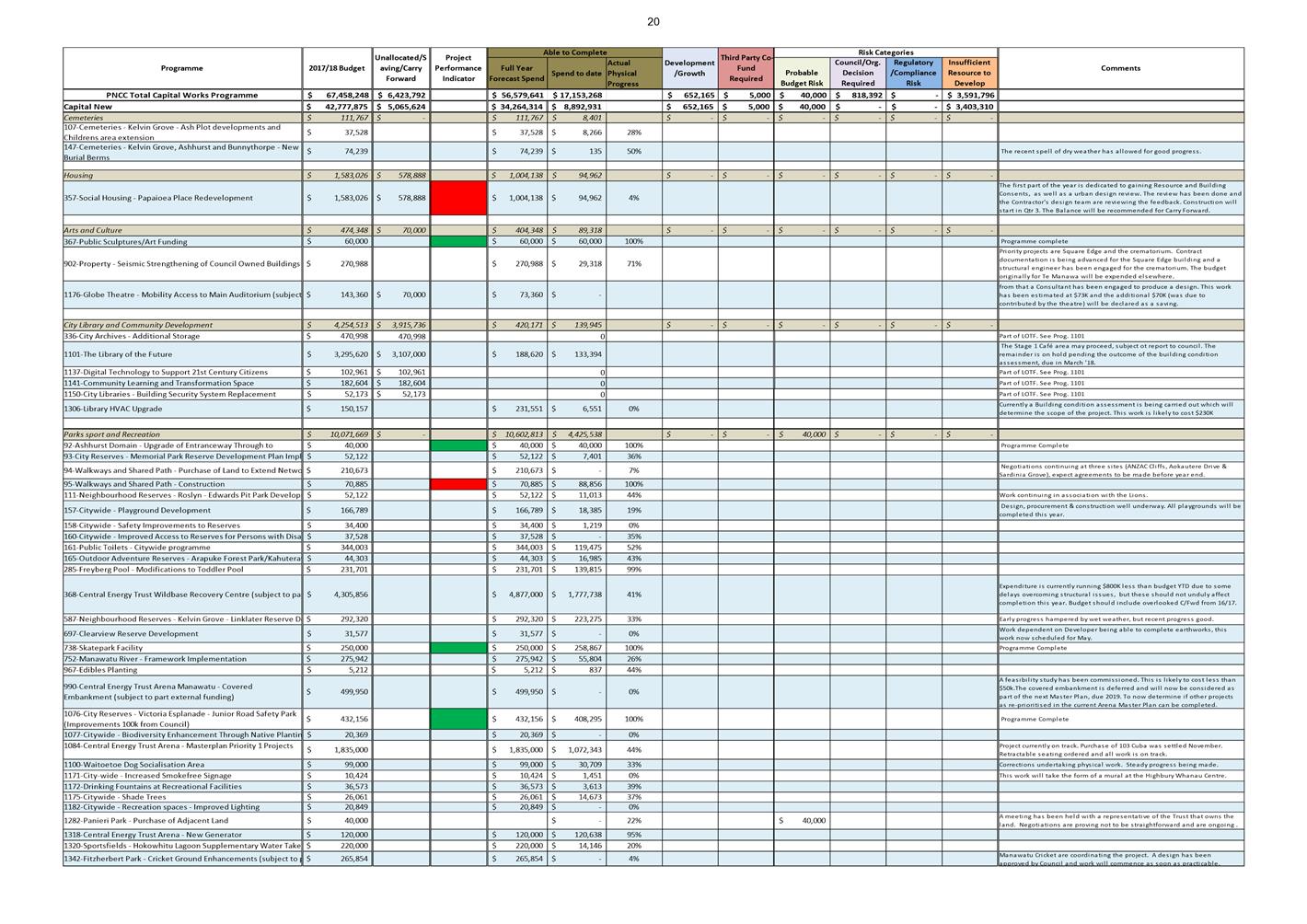

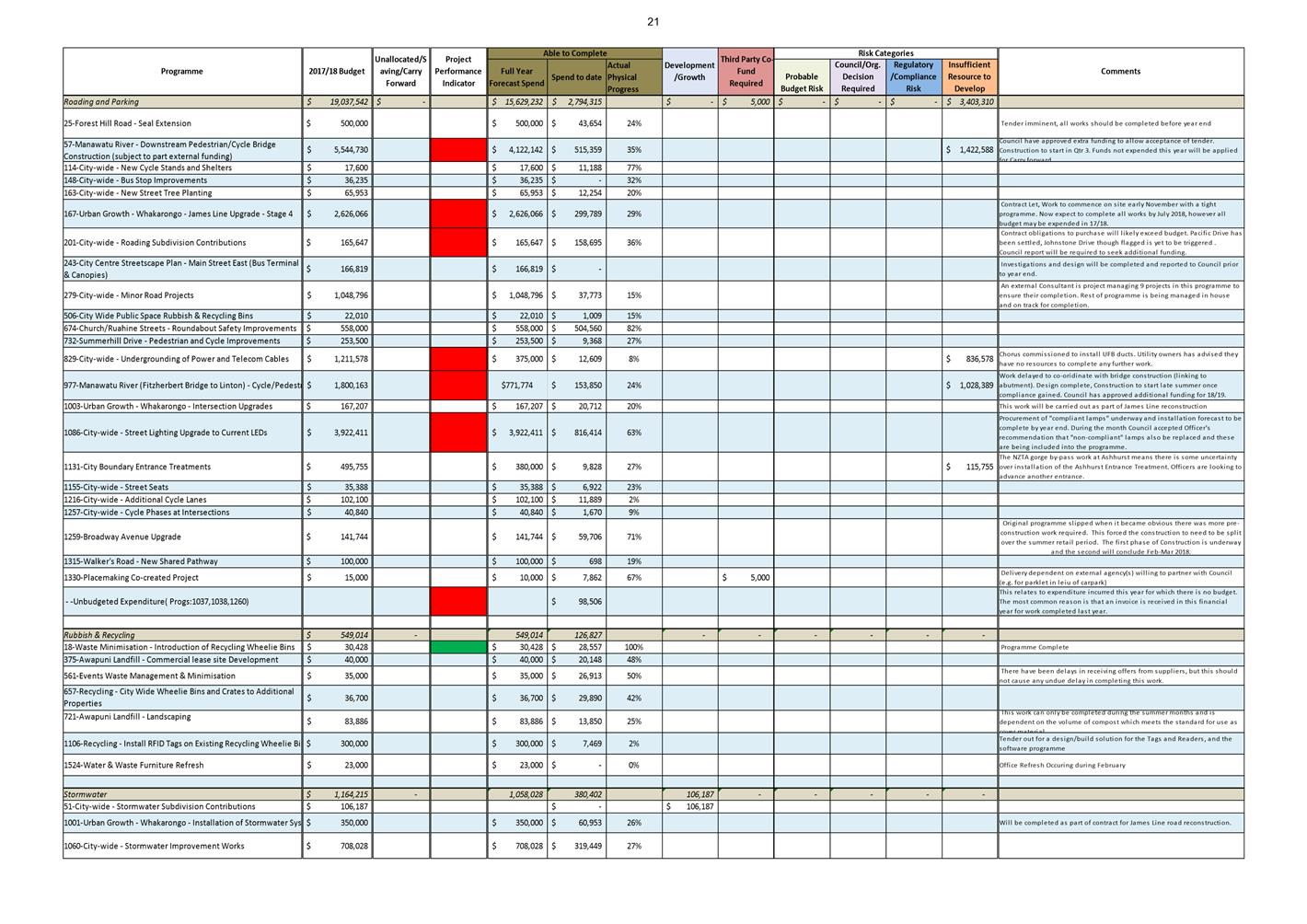

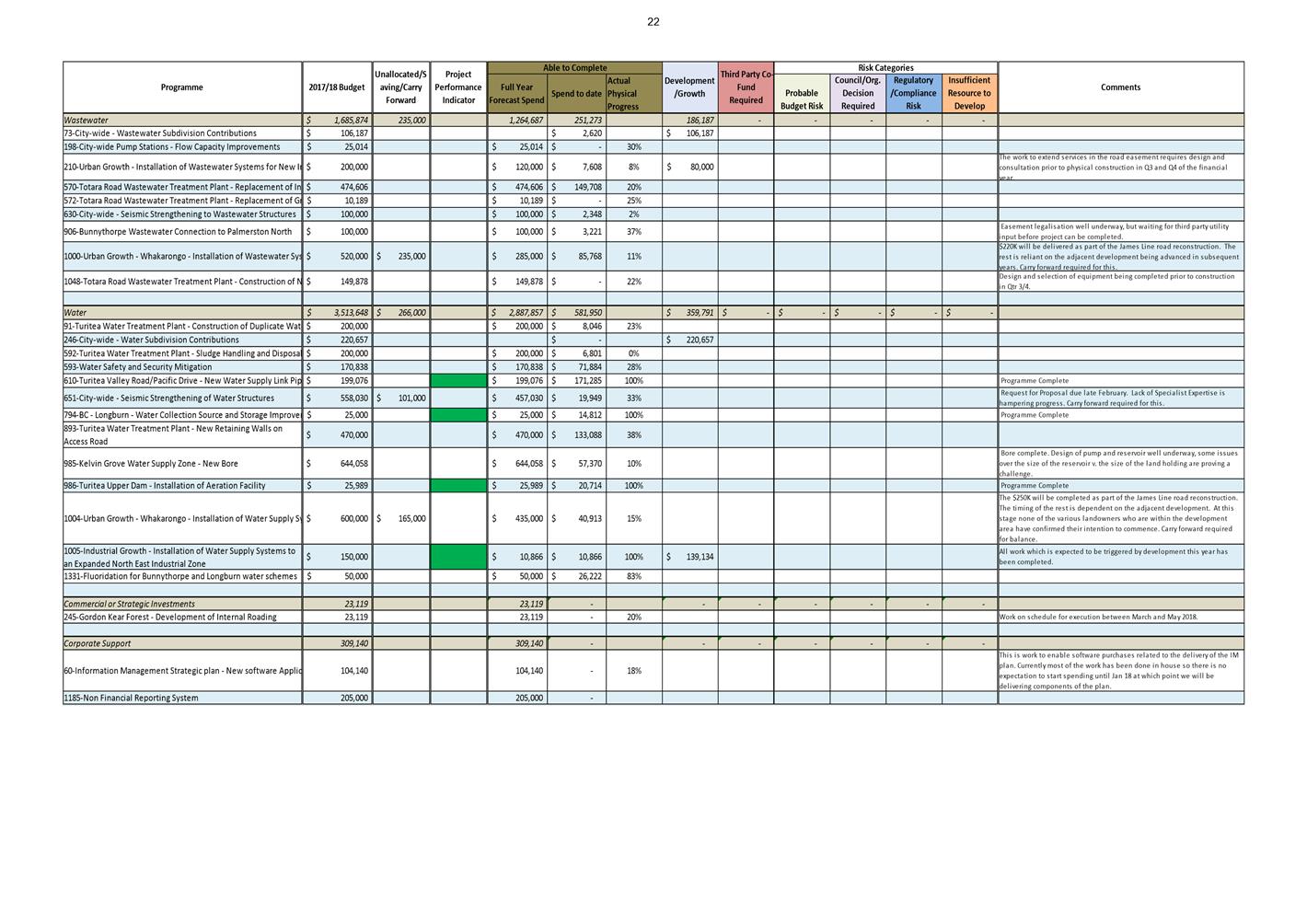

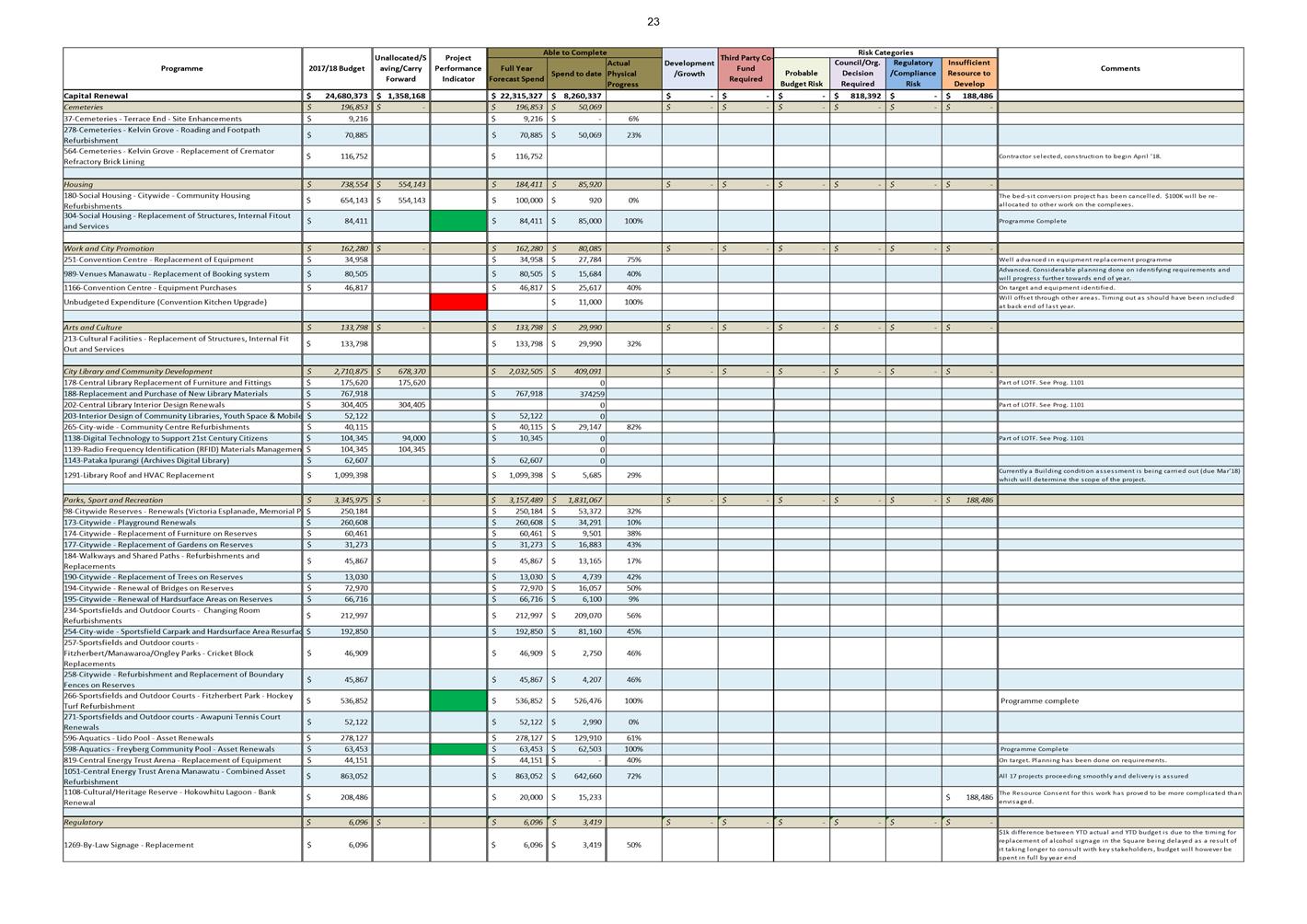

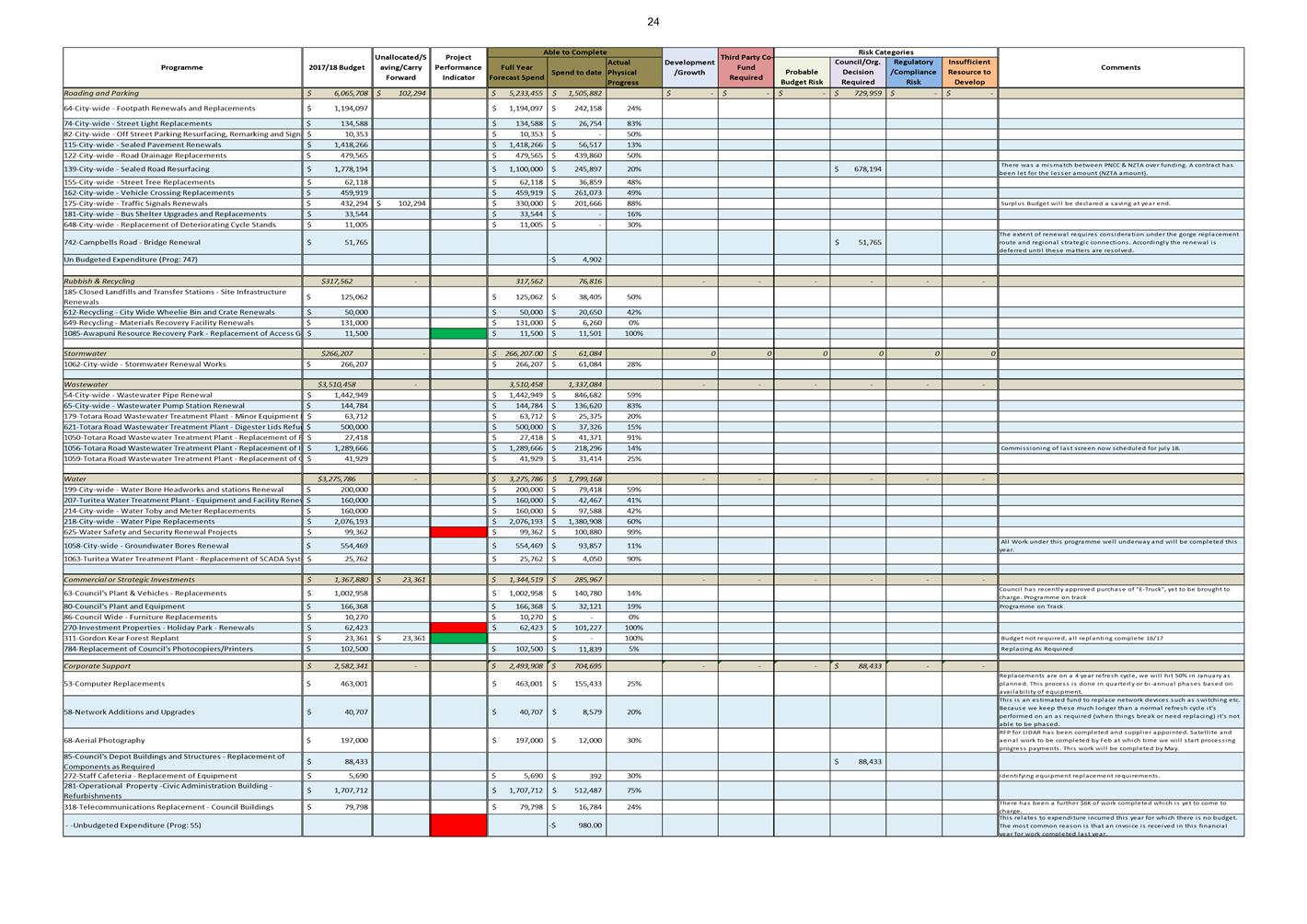

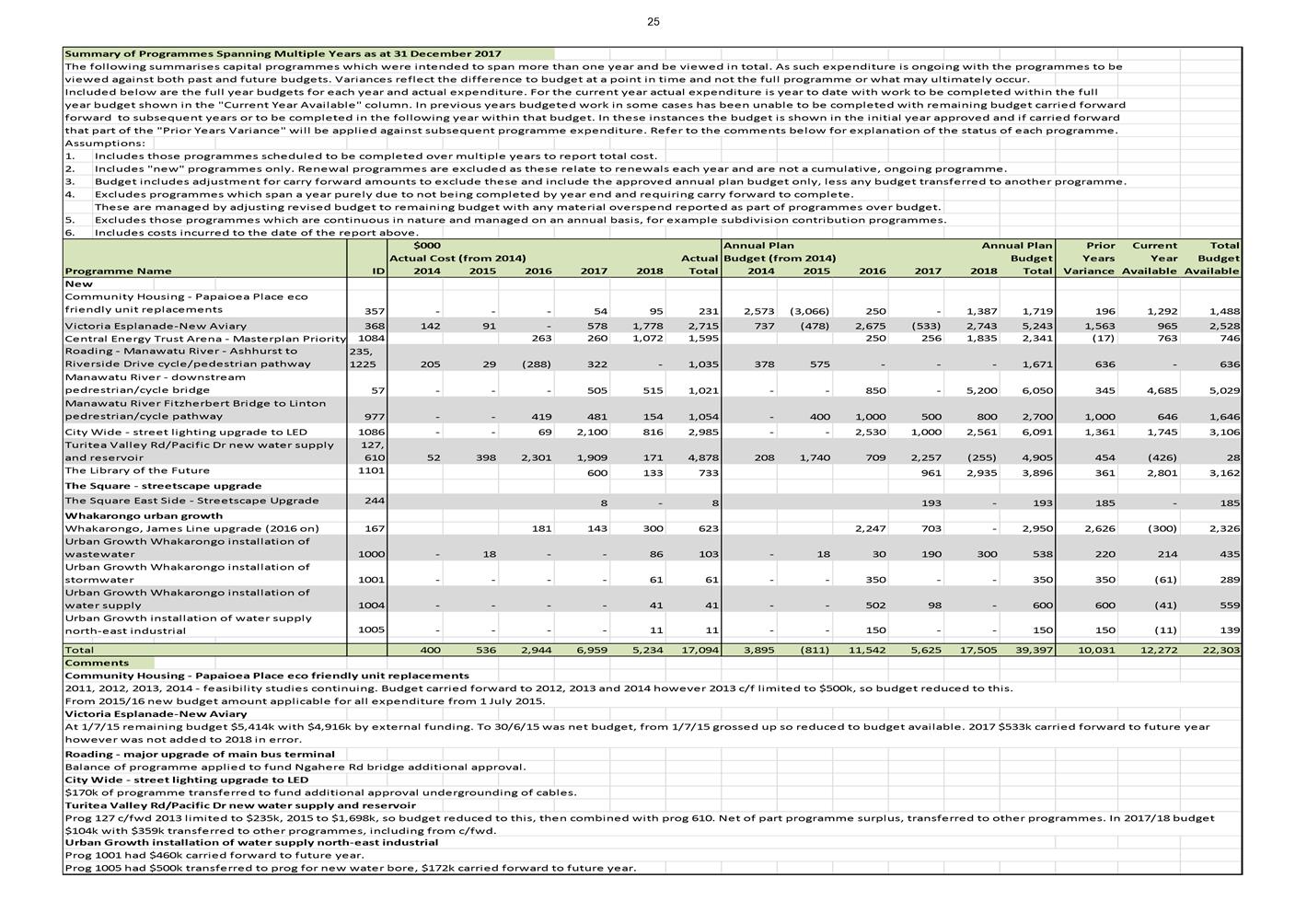

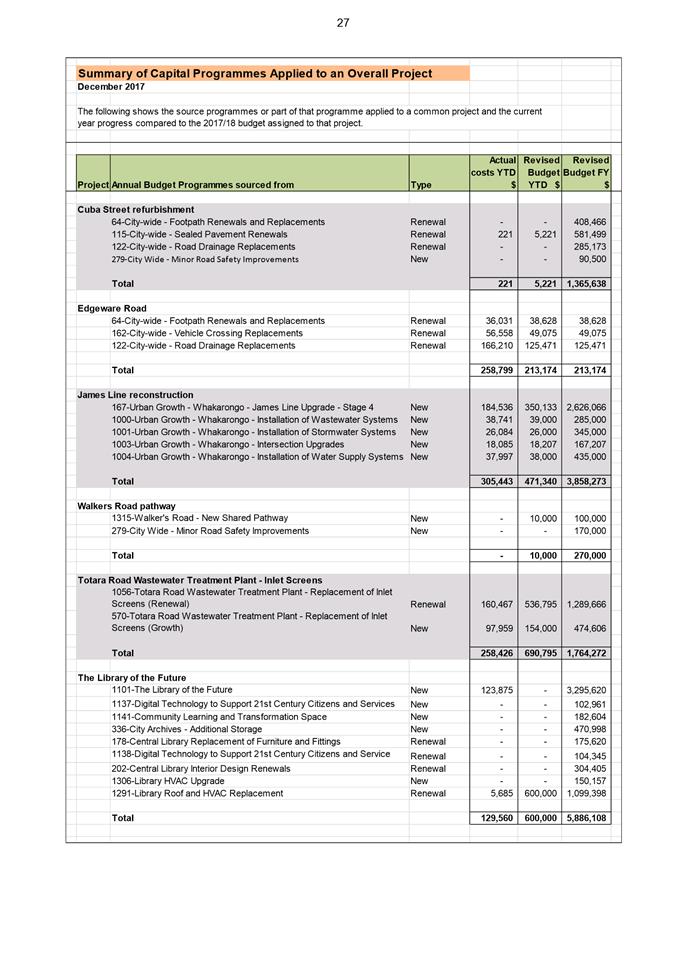

b. The December 2017 capital expenditure programme progress together

with those programmes identified as unlikely to be completed this financial

year.

2. That

the Committee recommend to Council that the capital expenditure carry forward

values in the 2017/18 Annual Budget, as varied August 2017, for programme

368, Central Energy Trust Wildbase Recovery Centre, be increased by a further

$533,499 to the amount of the remaining programme budget.

|

1. ISSUE

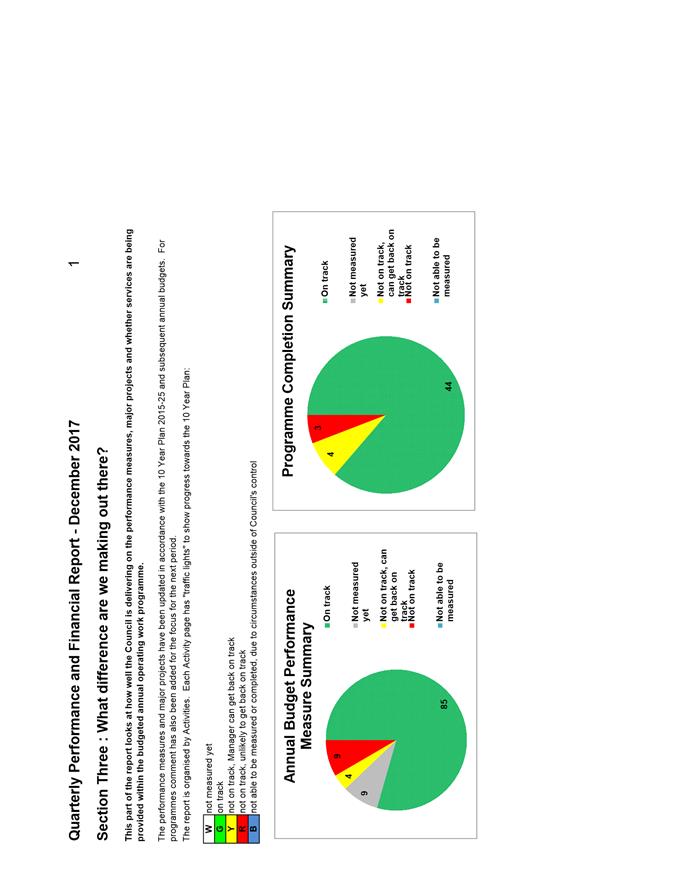

To provide a quarterly update on the

performance and financial achievements of the Council for the period ending 31

December 2017. This is the second quarterly report for the year.

2. BACKGROUND

|

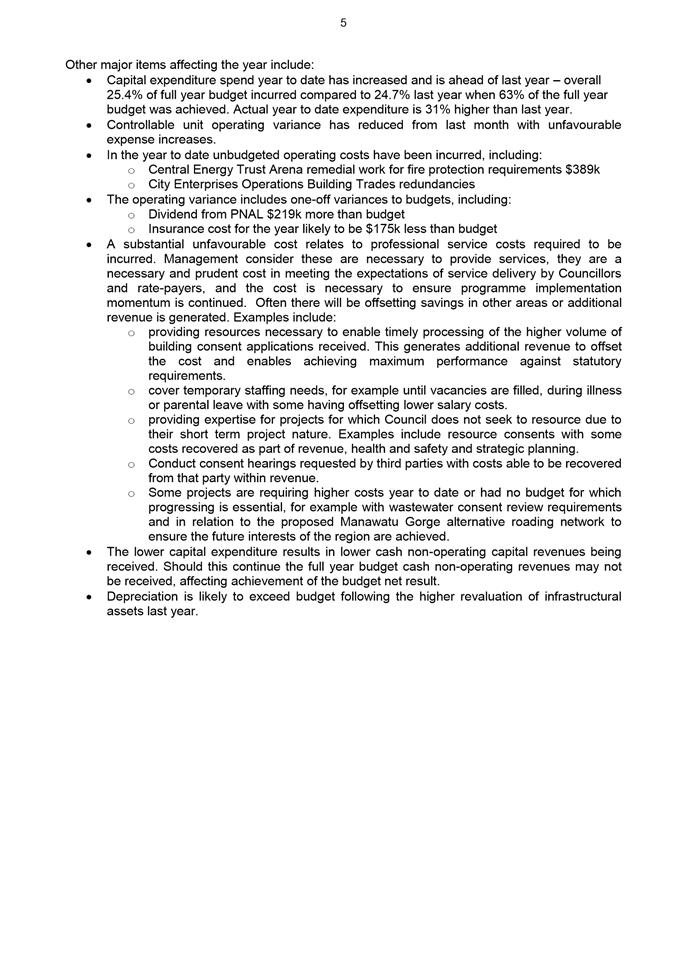

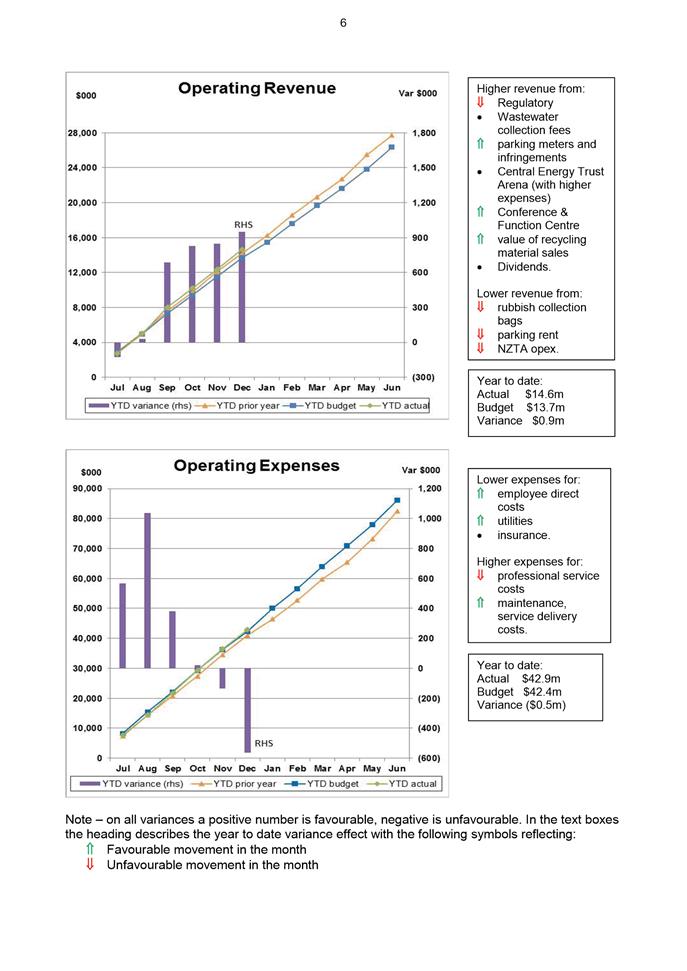

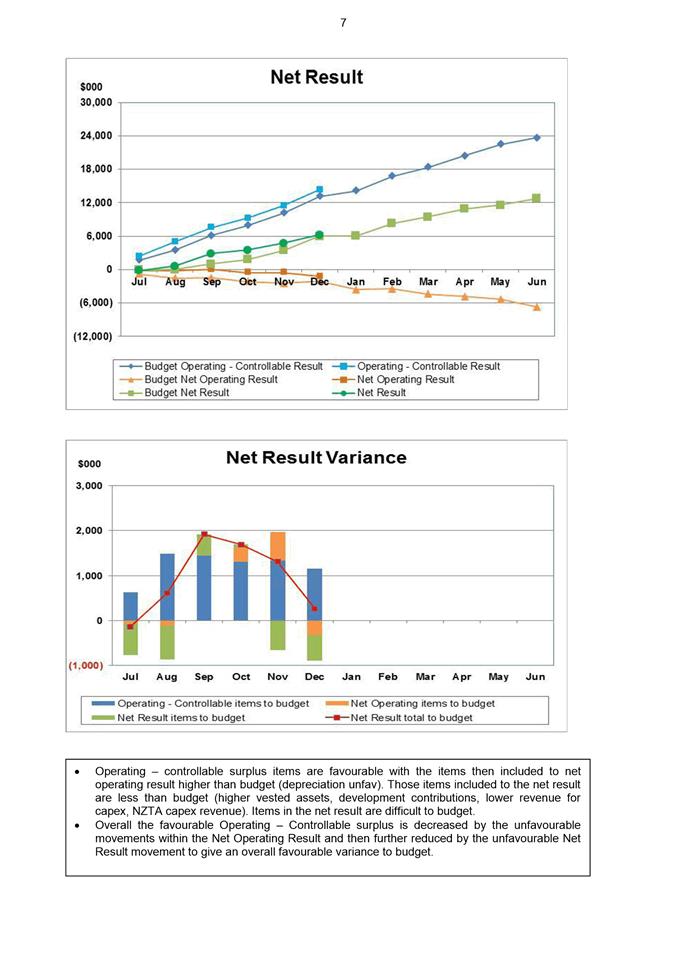

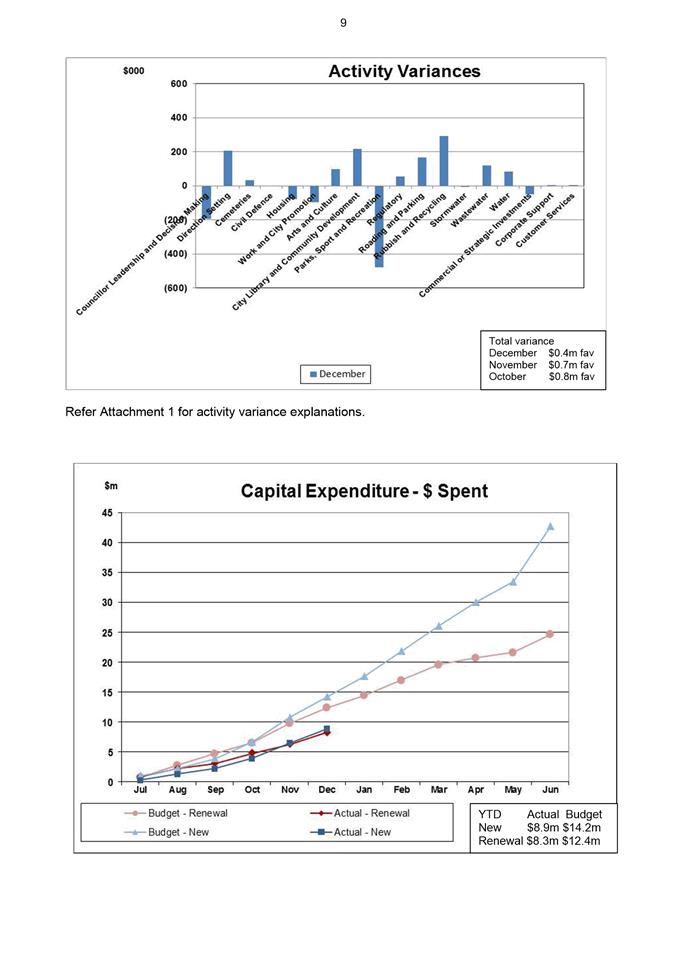

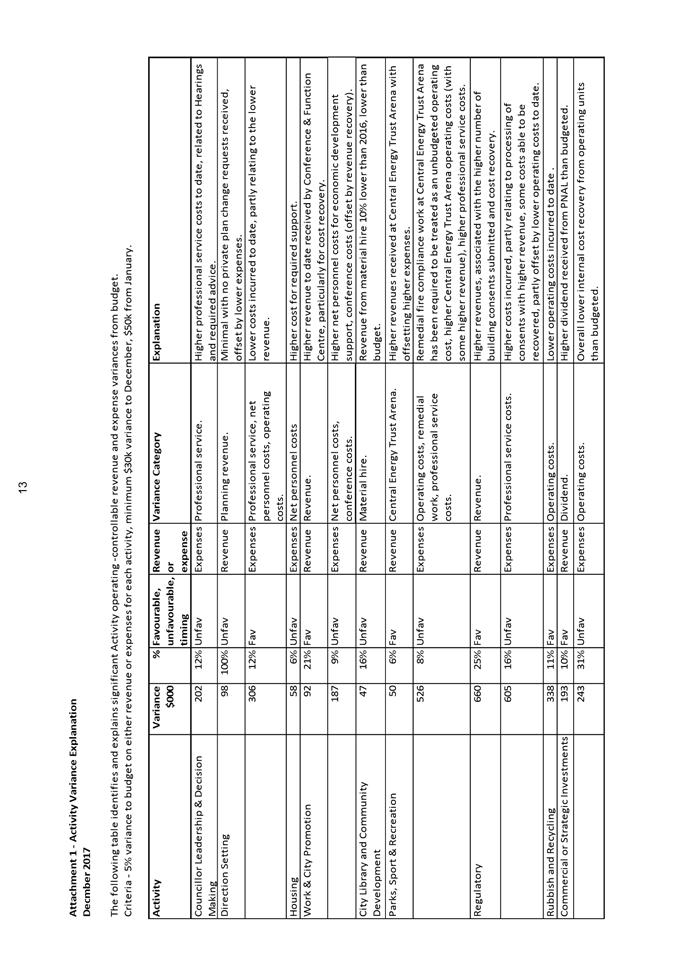

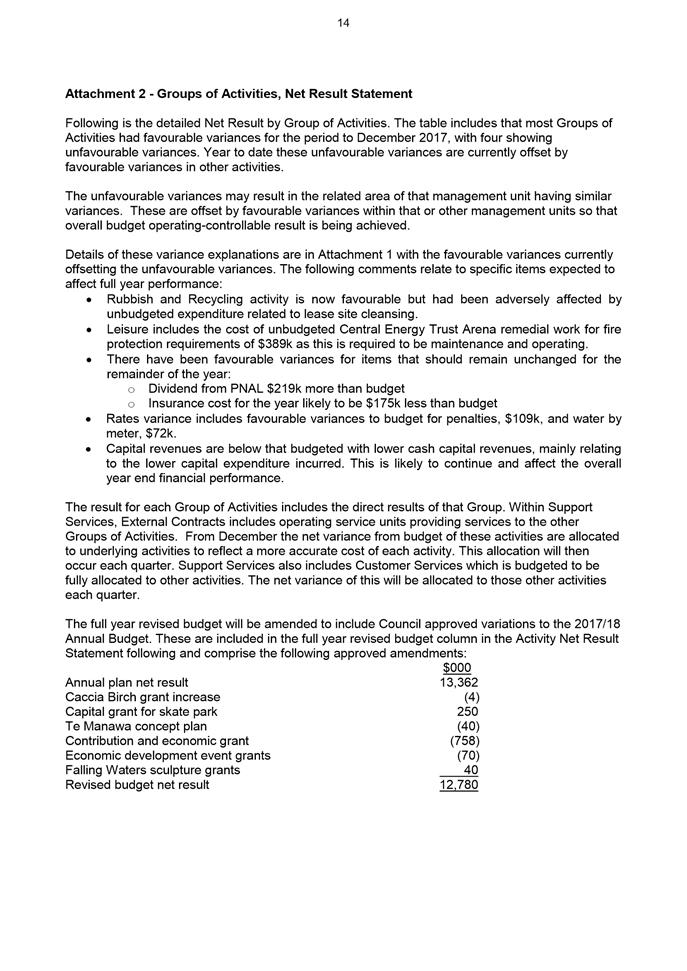

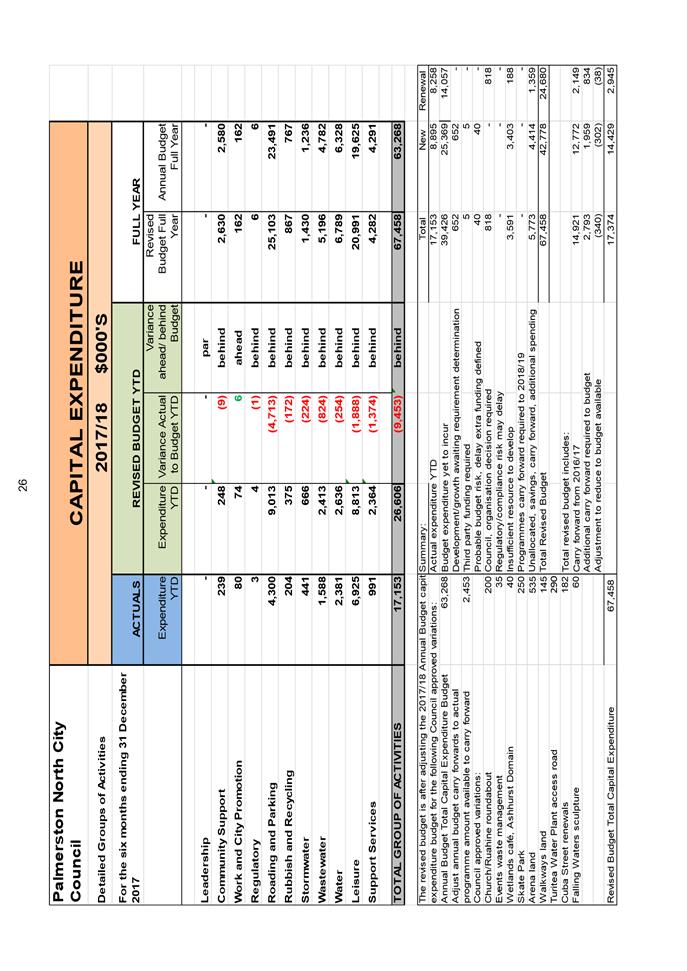

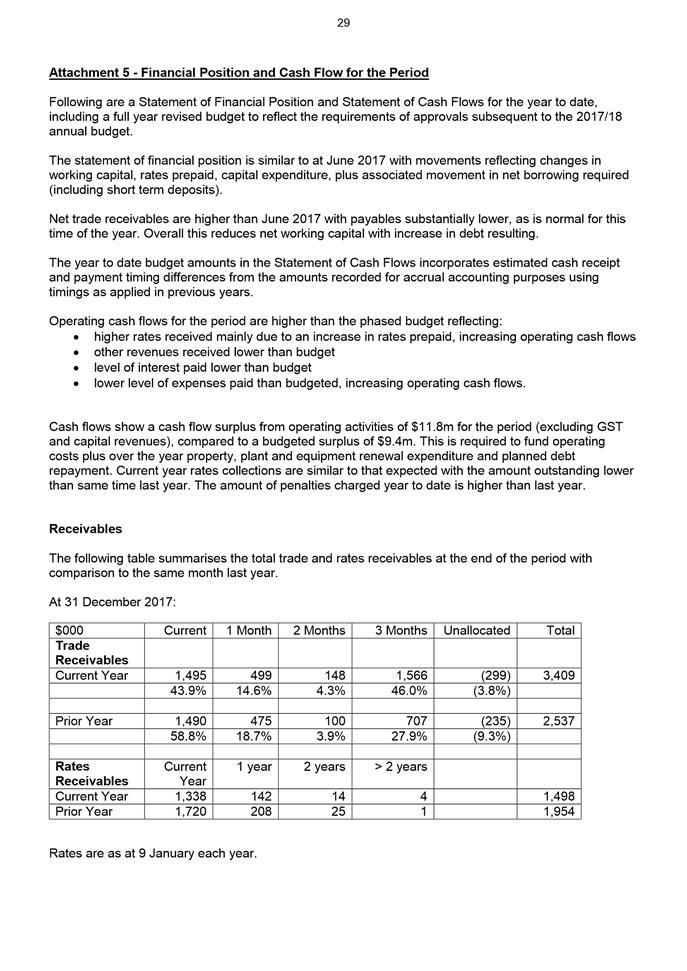

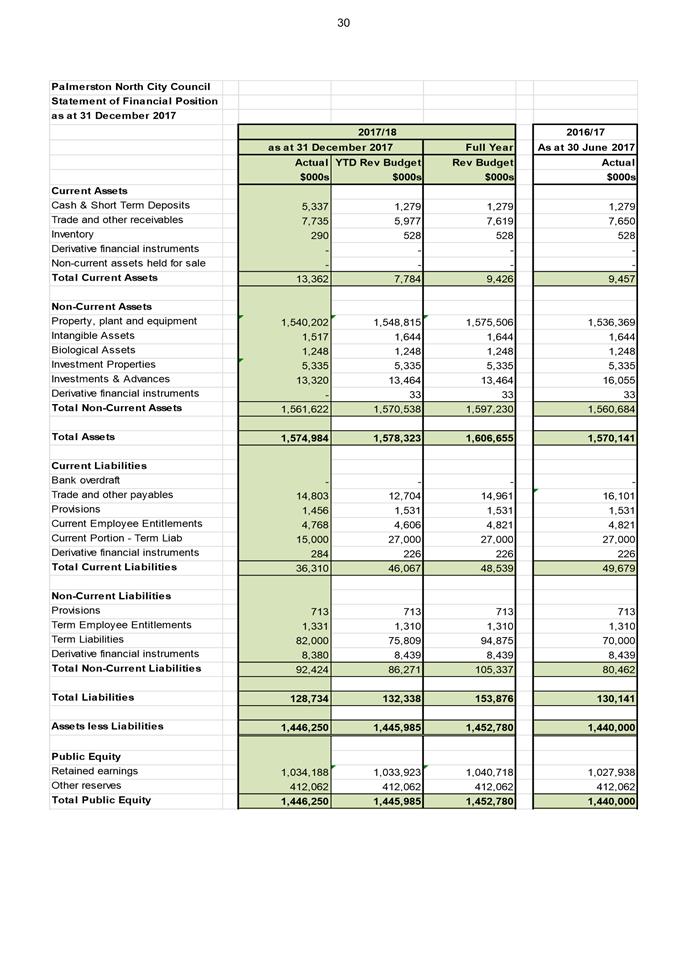

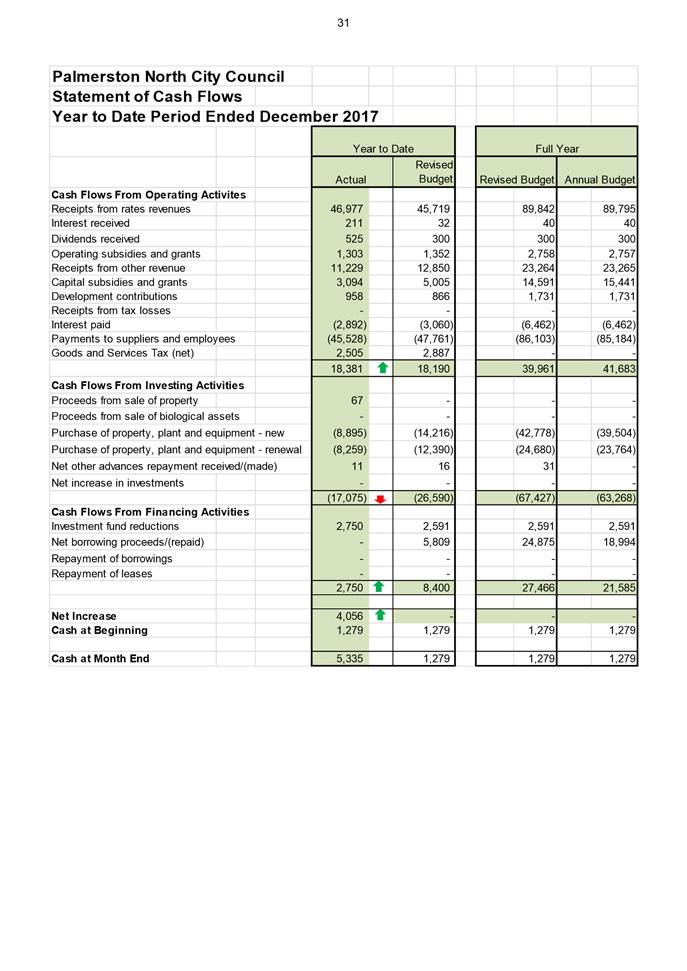

Cost

of services delivered year to date:

- Operating-controllable

variance

- Variance with interest and

rates included

|

$0.4m

fav

$1.2m

fav

|

Services

are being delivered within budget with some higher revenues received, part

with higher offsetting costs, and a reduced call for some service delivery

costs.

|

|

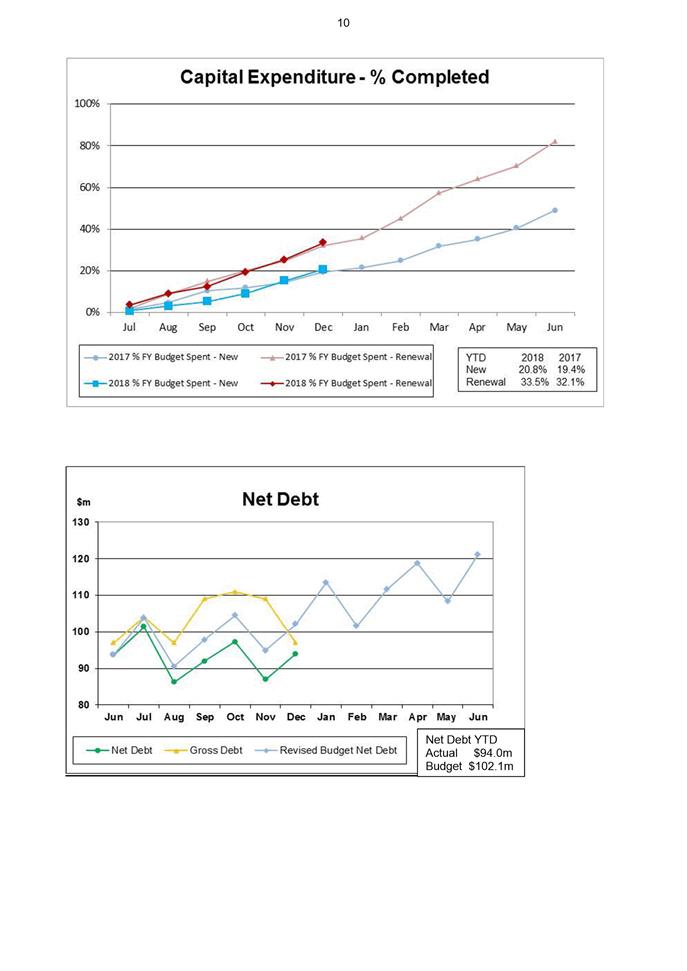

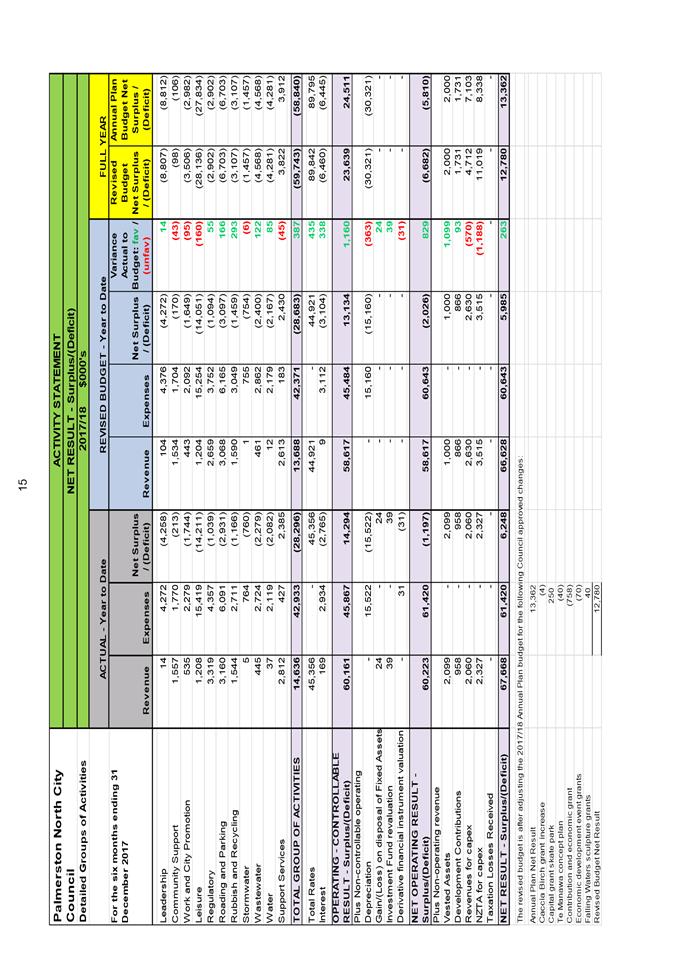

Percent

of full year capital expenditure budget completed:

- Renewal

- New

|

33.5%

20.8%

|

Compares

with amounts completed same time in 2016/17:

32.1%

19.4%

|

|

Operating

cash flows variance to budget

|

$2.4m

fav

|

Favourable

to budget with favourable operating variance plus a favourable working

capital requirement.

|

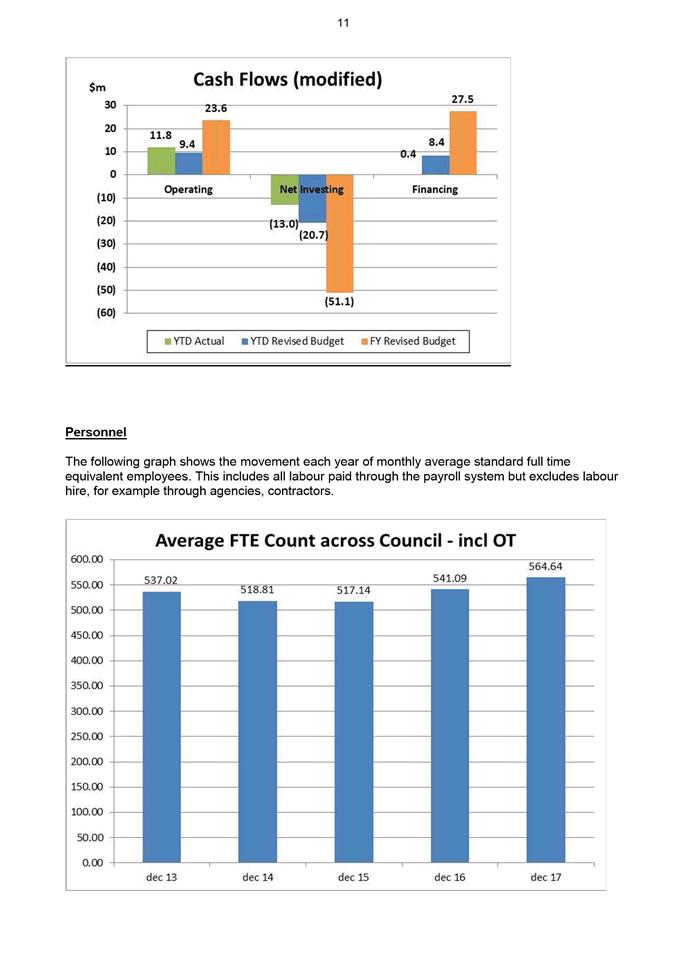

|

Increase

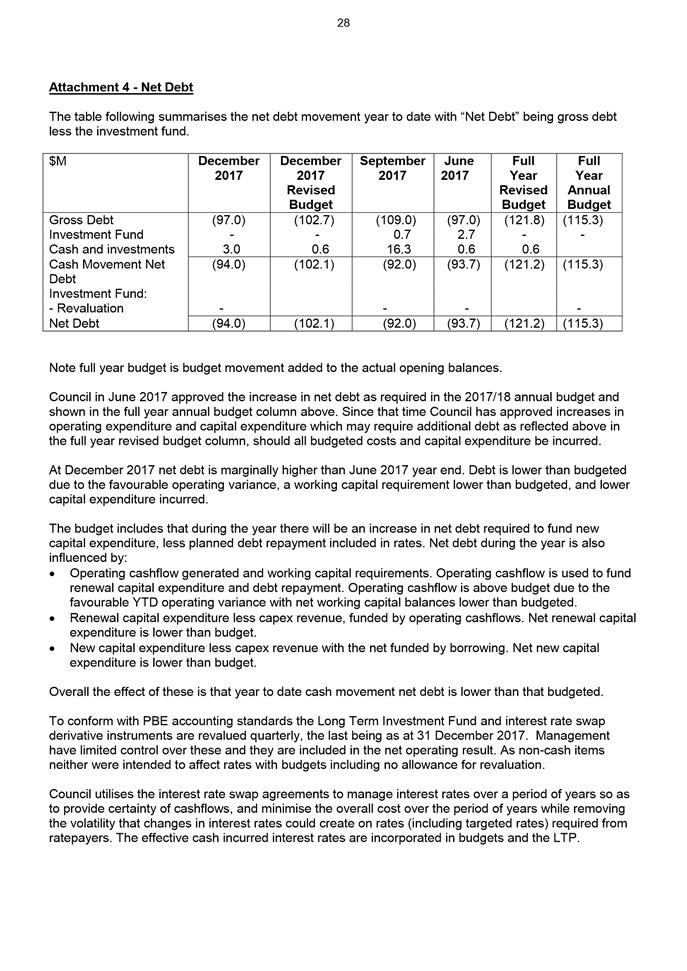

in net debt

|

$8.1m

fav

|

Lower

due to favourable operating variance and lower capital expenditure.

|

3. NEXT

STEPS

Details of

operating and financial performance are included in the following sections.

4. Compliance

and administration

|

Does the

Committee have delegated authority to decide?

If Yes quote

relevant clause(s) from Delegations Manual

|

No

|

|

Are the

decisions significant?

|

No

|

|

If they are

significant do they affect land or a body of water?

|

No

|

|

Can this

decision only be made through a 10 Year Plan?

|

No

|

|

Does this

decision require consultation through the Special Consultative procedure?

|

No

|

|

Is there

funding in the current Annual Plan for these actions?

|

No

|

|

Are the

recommendations inconsistent with any of Council’s policies or plans?

|

No

|

Attachments

|

1.

|

Section one, two, December 2017 Quarterly

Performance and Finance Report ⇩

|

|

|

2.

|

Section three, December 2017 Quarterly

Performance and Finance Report ⇩

|

|

|

Keith Allan

Financial Accountant

|

Andrew Boyle

Head of Community Planning

|

|

PALMERSTON NORTH CITY

COUNCIL

Memorandum

TO: Finance and Performance Committee

MEETING DATE: 19 February 2018

TITLE: Treasury Report for 6 months ended 31 December 2017

DATE: 8 February 2018

AUTHOR/S: Steve

Paterson, Strategy Manager Finance, City Corporate

|

RECOMMENDATION(S)

TO Finance

and Performance Committee

1. That the performance of the treasury activity for the 6 months

ending 31 December 2017 be noted.

|

1. ISSUE

To

provide an update on the performance of the Investment Fund (“the

Fund”) and the Council’s Term Debt portfolio for the 6 months ended

31 December 2017.

2. BACKGROUND

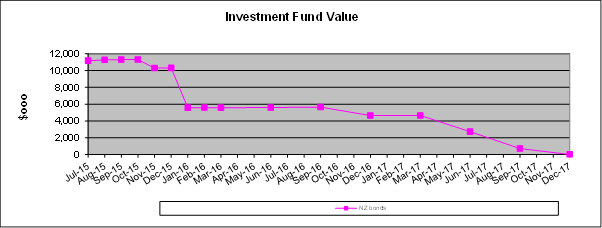

2.1 Investment

Fund

In November 2008 Council endorsed an orderly exit strategy for the

Fund which embraced holding the investments in bonds to maturity or when they

could be sold without realising a loss (ie if the yields fall below the

purchase price).

This strategy has

been encapsulated in subsequent 10 Year and Annual Plans and the realisation

process is nearing an end. The bond portfolio is managed directly by the

Council with the assistance of MCA Ltd as investment advisors.

2.2 Term

Debt

The Council’s

Annual Budget for 2017/18 forecast additional debt of $19m would need to be

raised during the year to fund the $39.5m of new capital expenditure programmes

(including assumed carry forwards from 2016/17). In June 2017 the Council

resolved to specifically authorise the raising of up to $19m of additional

debt.

Council’s

Financial Strategy (updated version adopted 24 June 2015) contains the

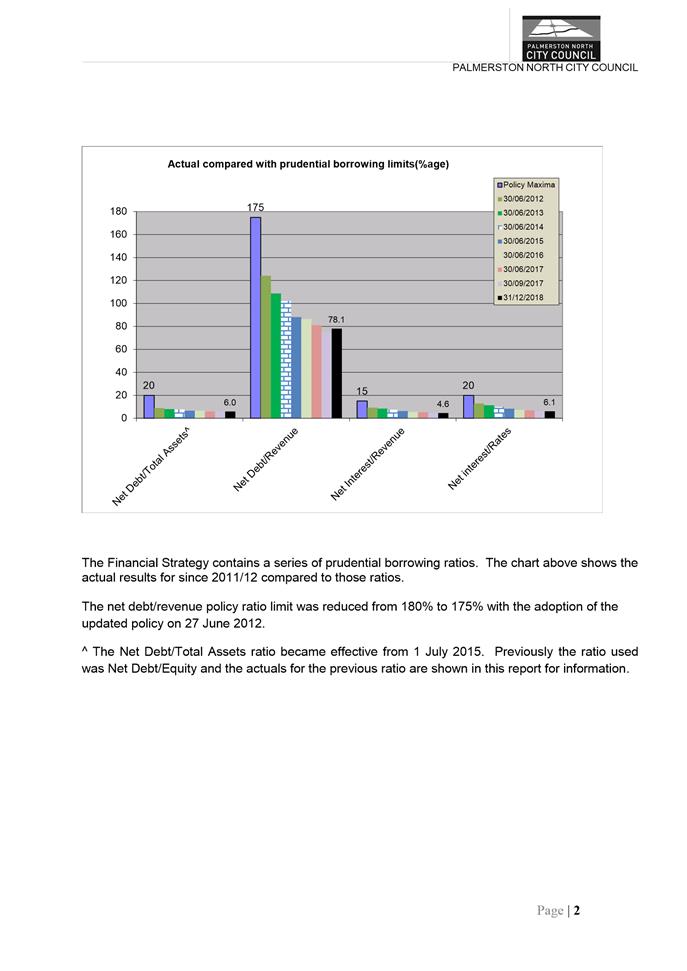

following ratios which the Council has determined to be prudent maxima:

• Net

debt as a percentage of total assets not exceeding 20%

• Net

debt as a percentage of total revenue not exceeding 175%

• Net

interest as a percentage of total revenue not exceeding 15%

• Net

interest as a percentage of annual rates income not exceeding 20%

The Treasury Policy

(embracing the Liability Management and Investment Policy) also contains a

number of other criteria regarding debt management.

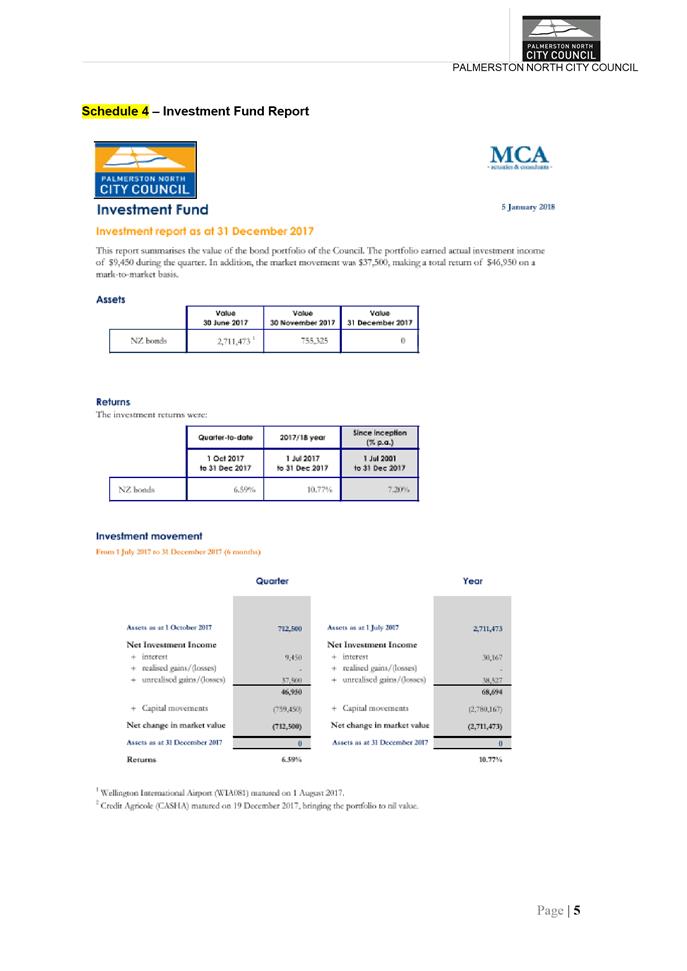

3. Performance

3.1 Investment

Fund

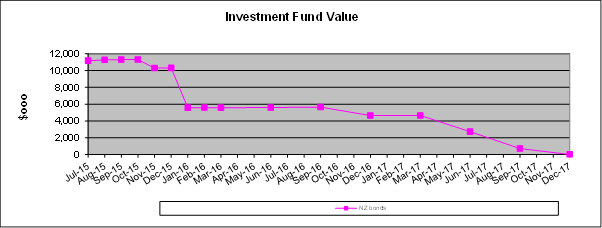

Fund performance is monitored and reviewed

by Council’s investment advisor and Council’s own staff. Attached

as schedule 4 is a consolidated report prepared by Council’s

investment advisor covering the period 1 July 2017 – 31 December

2017. The overall market value of the Fund is summarised in the following

table:

|

|

Market Value at 1 Jul 17 $m

|

Market Value at 30 Sep 17 $m

|

Market Value at 31 Dec 17 $m

|

|

NZ Bonds

|

$2.71

|

$0.72

|

$nil

|

# - bond investments of $2m and $0.75m

matured and were repaid to the Council in August 2017 and December 2017

respectively

Realised Fund

earnings from interest and dividends for the 6 months totalled $30k. $2.78m was distributed back to the

Council during the period including $2.75m of maturing investments. The

Fund is therefore now fully realised.

3.2 Term

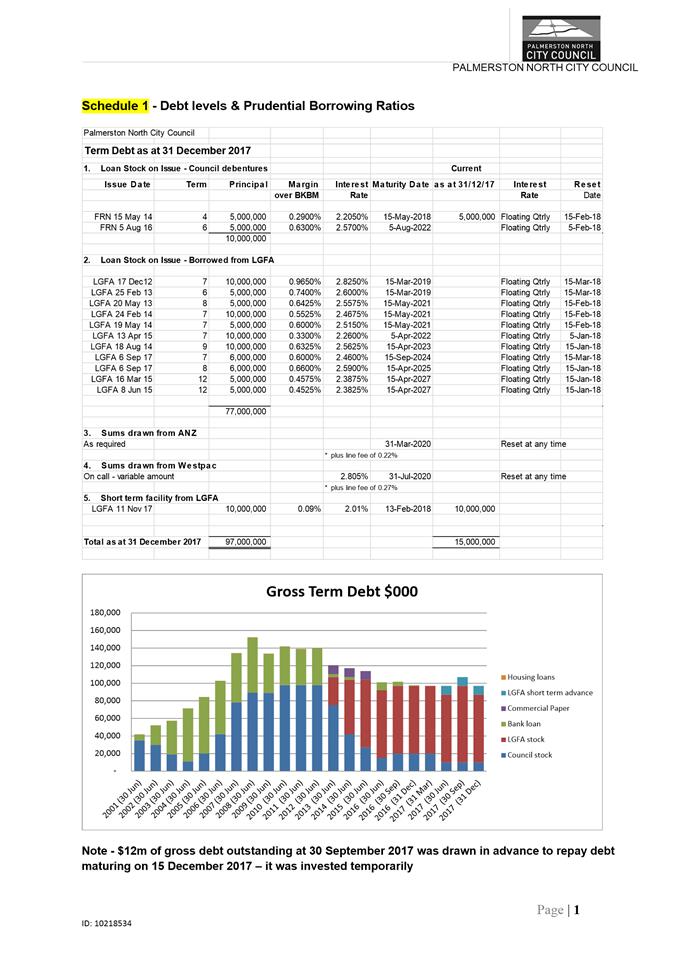

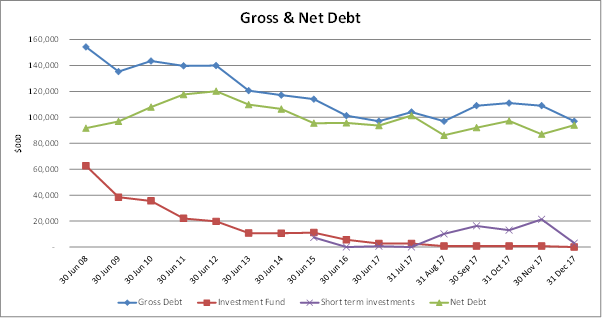

Debt

Schedule 1 attached shows the details of Council’s debt as at 31

December 2017. Debt levels were within the policy parameters

outlined in clause 2.2. of this report.

The summarised gross

term debt movements are shown in the following table:

|

|

Annual Budget for year (2017/18)

$000

|

Actual – 3 months (2017/18)

$000

|

Actual – 6 months (2017/18)

$000

|

|

Opening Debt Balance at 1 July 2017

New Debt #

Debt repayments #

|

101,600

19,000

|

97,000

12,000*

|

97,000

12,000*

12,000

|

|

Closing Balance

Comprising:

Bank advance (on call)

Commercial paper

LGFA short term advance

LGFA & Council stock

|

120,600

|

109,000

10,000

99,000

|

97,000

10,000

87,000

|

# A portion of the Council’s debt is

drawn on a daily basis – daily drawdowns & repayments are not

included in these figures but the net draw or repayment for the year to date is

shown as part of new debt or debt repayment as appropriate.

* This $12m new debt was raised to

pre-fund debt maturing in December 2017. The sum was placed on short term

deposit (at 3.03% pa) in the interim. This return is higher than the cost

of the borrowing during this period ($6m @ 2.5586% and $6m @ 2.506%).

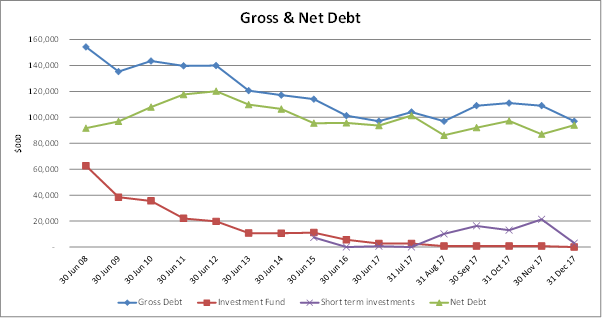

Net debt at 31

December 2017 was $94m (ie gross $97m less short term deposits of $1m and call

investment of $2m) compared with $93.665m at 1 July 2017 (ie. gross $97m less

investment fund of $2.71m and call investment of $0.625m).

Council’s

Treasury Policy prescribes under the counterparty credit risk section that

investments for any registered bank will not exceed $10m. As at 30

September 2017 $16.25m was invested with Westpac - $12m of this related to the

pre-funding of debt maturing in December 2017. The investment level

returned within policy parameters before 31 December 2017.

Movements in

recent years are shown in the following graph:

Actual finance costs incurred

during the 6 months (including interest, line fees & the effects of swaps)

amounted to $2.934m compared with the budget for the year of $6.462m.

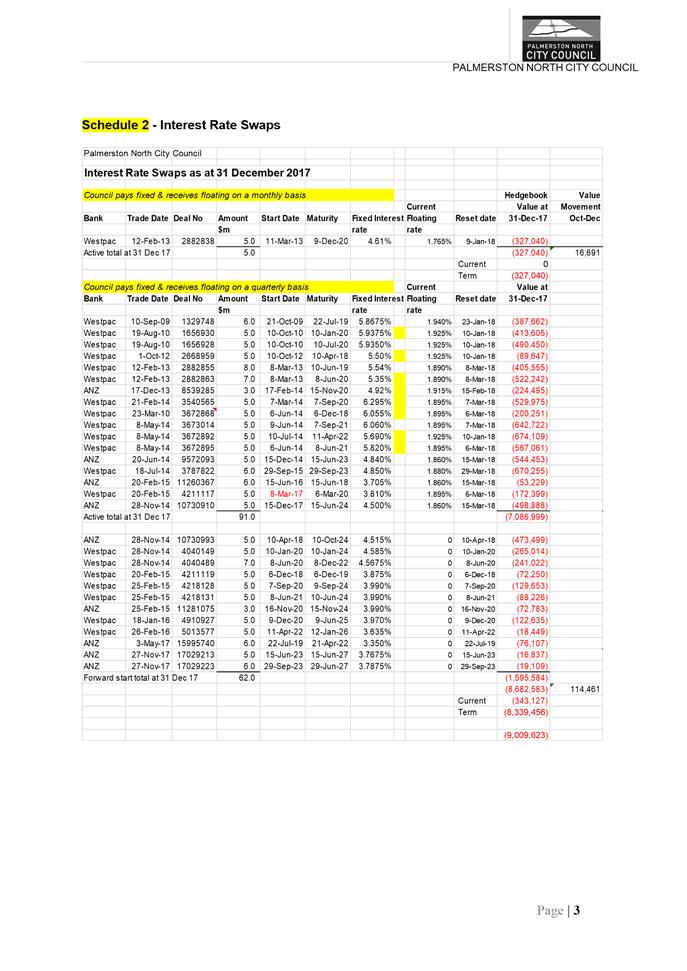

The Council has entered a number of

financial instruments related to its debt portfolio utilising swap trading

lines established with Westpac and ANZ. The details of these are shown in

Schedule 2 attached.

The value of these instruments is

measured in terms of its “mark-to-market” ie the difference between

the value at which the interest rate was fixed and the current market value of

the transaction. Each of these transactions was valued at the date they

were fixed and again at the reporting date. Financial reporting standards

require the movement in values to be recorded through the Council’s

Statement of Comprehensive Income (Profit & Loss Account). They have

been revalued as at 31 December 2017 and show an increase in book value of

$131k for the quarter, but a reduction of $439k for the year to date.

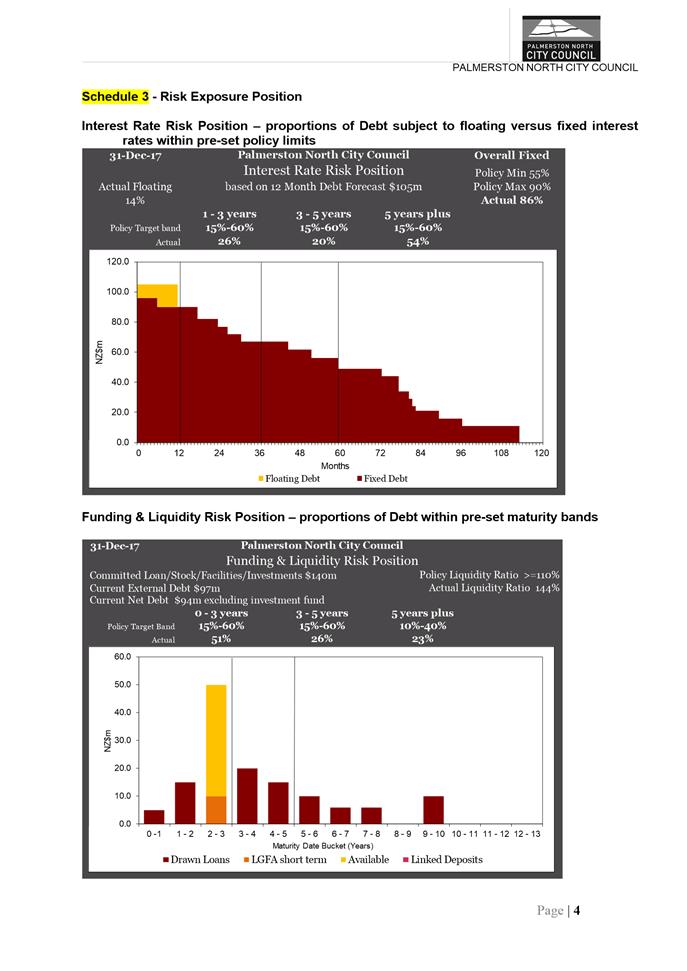

The Council’s

Treasury Policy contains guidelines regarding the measurement of treasury risk

as follows:

a. Interest rate risk is managed by the Council

maintaining the ratio of debt that is subject to floating versus fixed interest

rates within pre-set limits.

b. Funding and liquidity risk is managed by the

Council maintaining a pre-set portion of its debt in a range of maturity

periods eg < 1 year, 1 – 3 years, 5 years +.

The position

compared to the policy is illustrated in the graphs in Schedule 3.

The overall ratio of fixed v floating interest rate debt is based on the

assessed level of total debt in 12 months’ time. At the present

time we are using a rolling 12 month projection of $105m for this

assessment. This is considerably less than assumed in the Annual Budget

and reflects that at the present time actual capital expenditure (and as a

consequence total debt) is less than the budget assumption.

As at 31

December 2017 all of the policy targets had been met.

Council’s credit lines with

the banks include a $25m four year credit facility with Westpac Bank (maturing

31 July 2020) and a revolving $25m three year facility with ANZ Bank (maturing

31 March 2020).

4. CONCLUSION

& NEXT STEPS

Realised interest

and dividend returns for the 6 months from the Fund of $30k equates the

budget.

Finance

costs for the 6 month period (including interest, line

fees & the effect of swaps) was $2.934m compared with budget for the year

of $6.462m.

In conjunction with

Council’s treasury advisors hedging instruments are regularly reviewed in

an effort to ensure the instruments are being utilised to best advantage as

market conditions change. The level of hedging cover is also reviewed as the

forecasts of future debt levels are revised

Following the latest

annual review published on 18 April 2017 Council’s S&P Global

Rating’s credit rating remains unchanged at AA / A-1+.

Council’s

borrowing strategy is continually reviewed, in conjunction with Council’s

treasury advisors, to ensure best advantage is taken of this quality credit

rating.

A further

performance report will be provided after the end of the March 2018 quarter.

Attachments

|

1.

|

Schedules 1 to 4 ⇩

|

|

|

Steve Paterson

Strategy Manager Finance

|

|

|

PALMERSTON NORTH CITY

COUNCIL

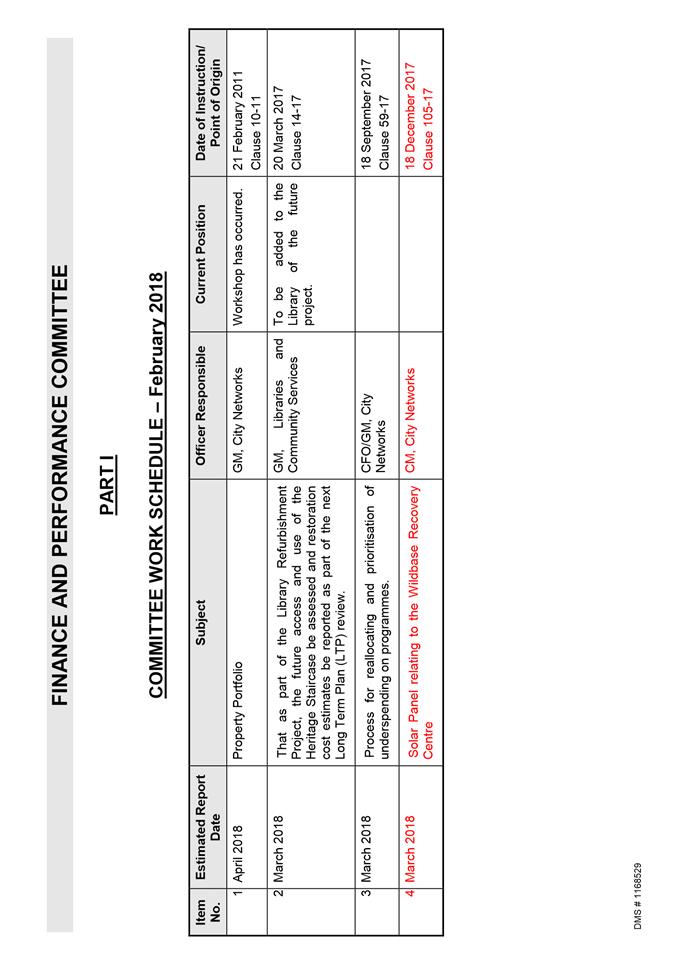

Committee Work Schedule

TO: Finance and Performance Committee

MEETING DATE: 19 February 2018

TITLE: Committee Work Schedule - February 2018

|

RECOMMENDATION(S)

TO Finance

and Performance Committee

1. That the Finance and Performance Committee receive its Work

Schedule dated February 2018.

|

Attachments

|

1.

|

Committee Work Schedule - February 2018 ⇩

|

|

![]()

![]()