PALMERSTON NORTH CITY

COUNCIL

Finance and

Performance Committee MEETING

19 March 2018

LATE ITEMS

Consideration of the items is subject to the provisions of the

urgent item clause, pursuant to Section 46A(7) of the Local Government Official

Information and Meetings Act 1987.

The

Chairperson recommends that the items be considered as:

- The items were not available at the time the Agenda was circulated;

and

- Consideration of the items is a matter of urgency, requiring a

decision without delay to enable the Council to meet deadlines, finaslise

decisions and receive information within agreed timeframes.

16. Fees

and Charges Review Page 5

Report, dated 15

March 2018 from the Strategy Manager Finance, Steve Paterson.

PALMERSTON NORTH CITY

COUNCIL

Report

TO: Finance and Performance Committee

MEETING DATE: 19 March 2018

TITLE: Fees and Charges Review

DATE: 15 March 2018

AUTHOR/S: Steve

Paterson, Strategy Manager Finance, City Corporate

|

RECOMMENDATION(S) TO Council

1. That

the report be received and the current status

of fees and charges be noted.

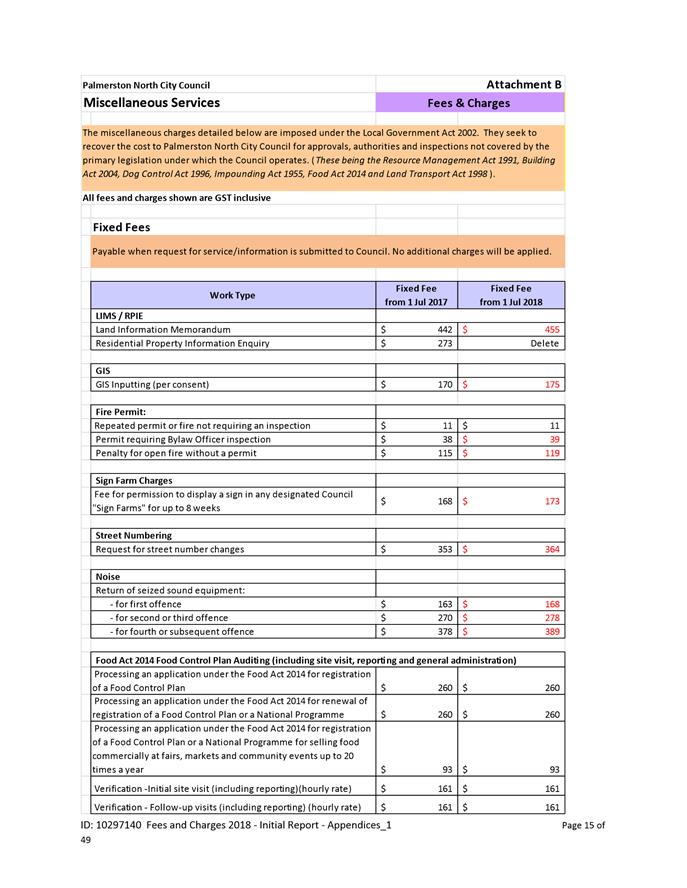

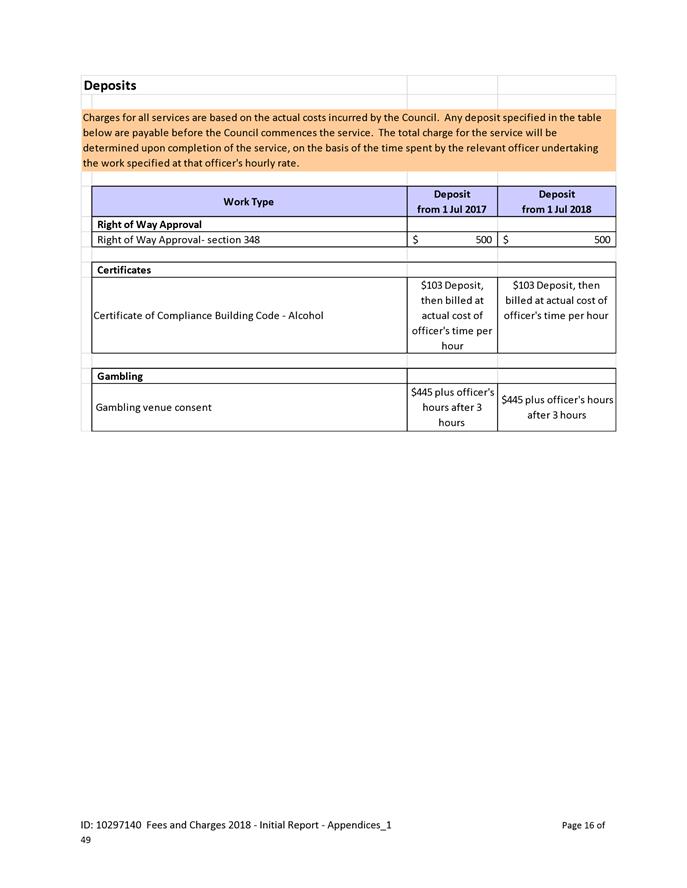

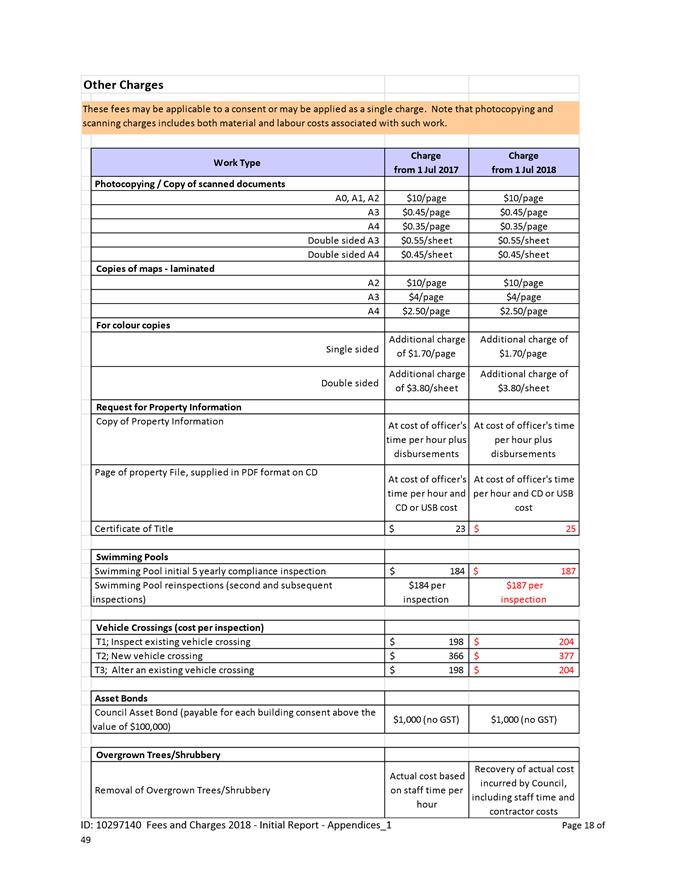

Planning &

Miscellaneous

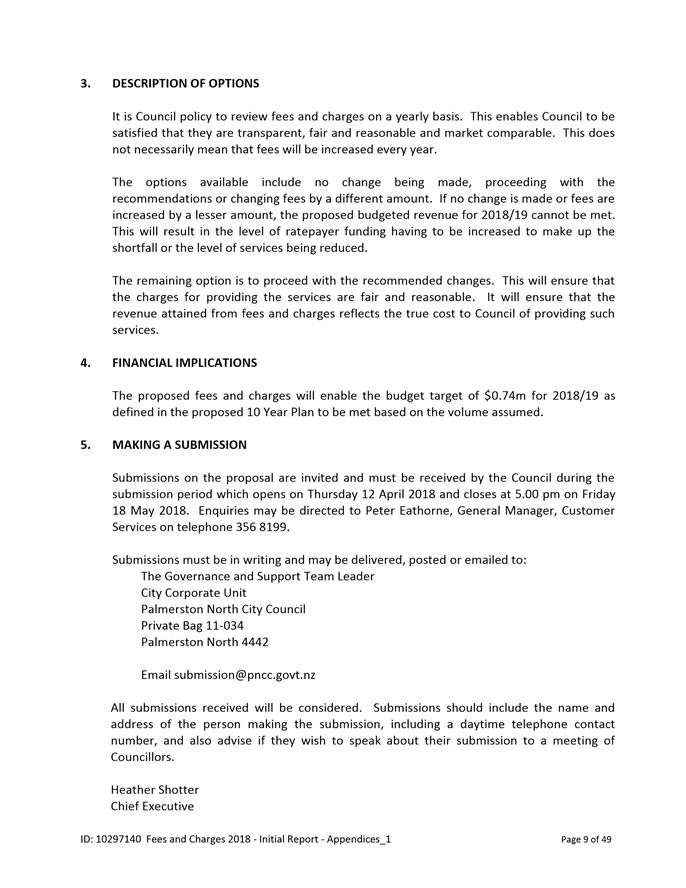

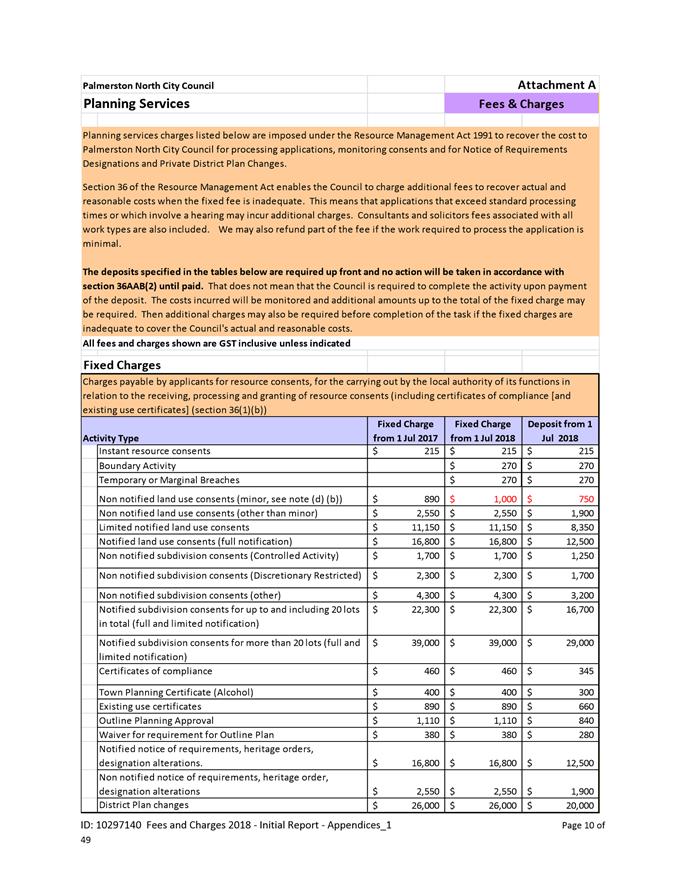

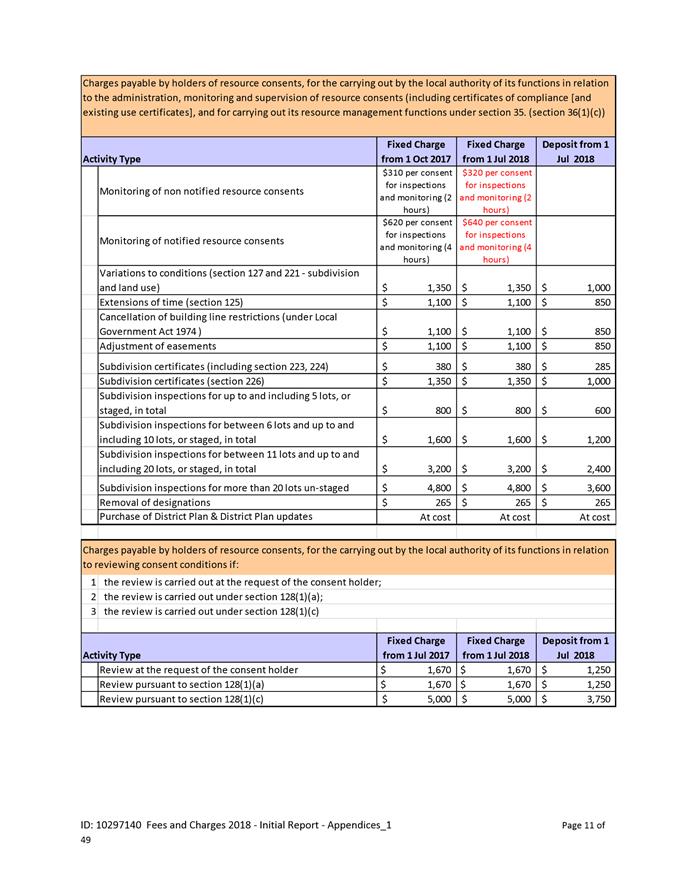

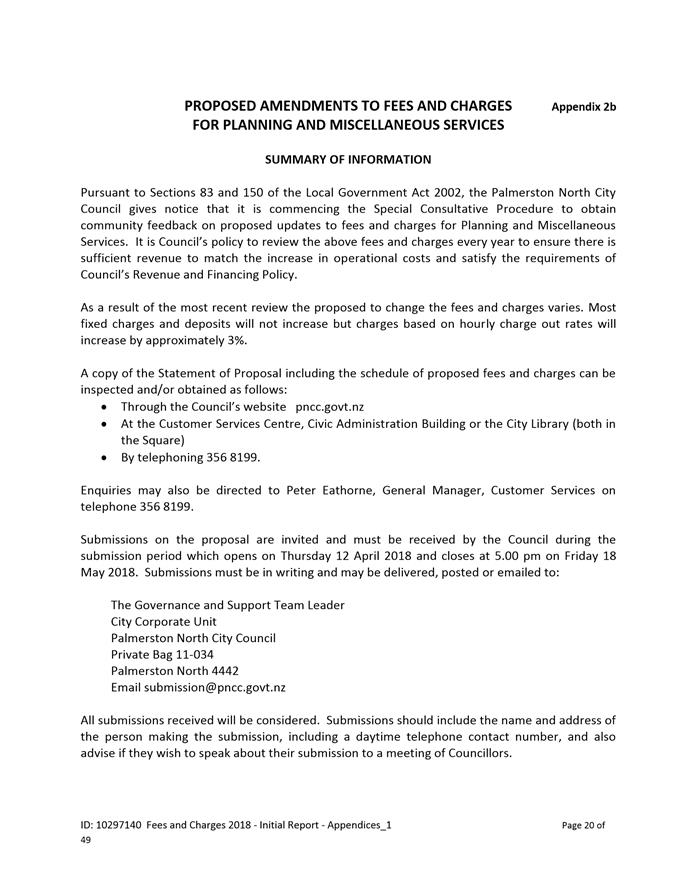

2. That

the Statement of Proposal (and the associated summary) to adopt updated fees

and charges for Planning Services and Miscellaneous Services effective from 1

July 2018 as attached in Appendix 2, be approved for public consultation and

the Chief Executive be authorised to undertake the necessary consultative

process under sections 83 and 150 of the Local Government Act 2002.

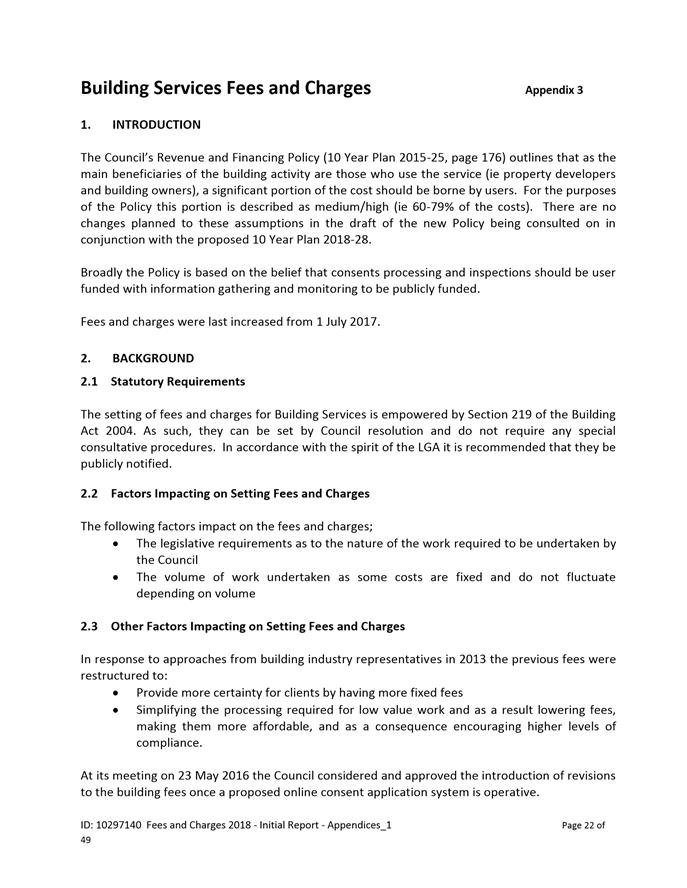

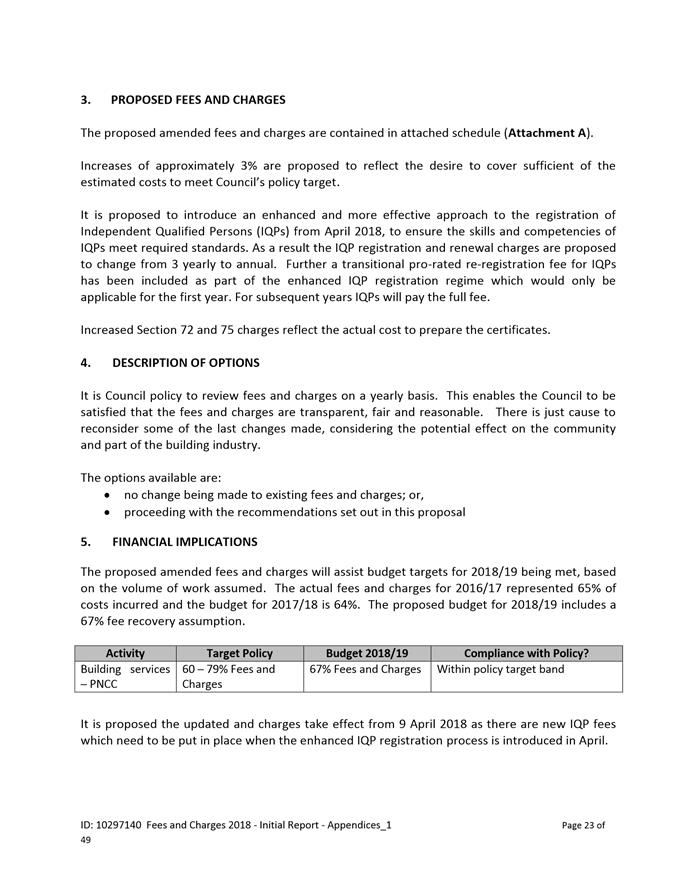

Building

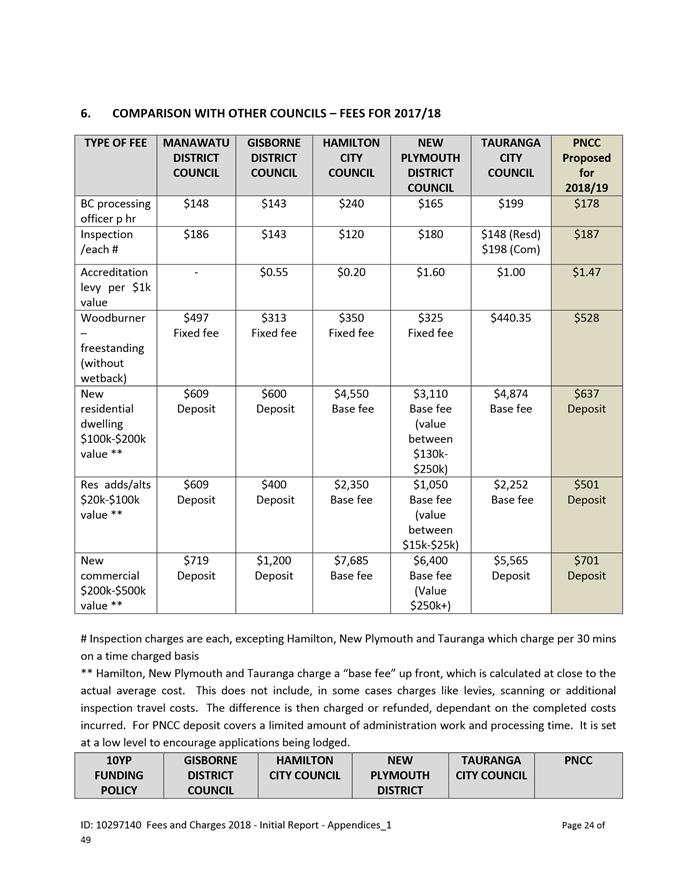

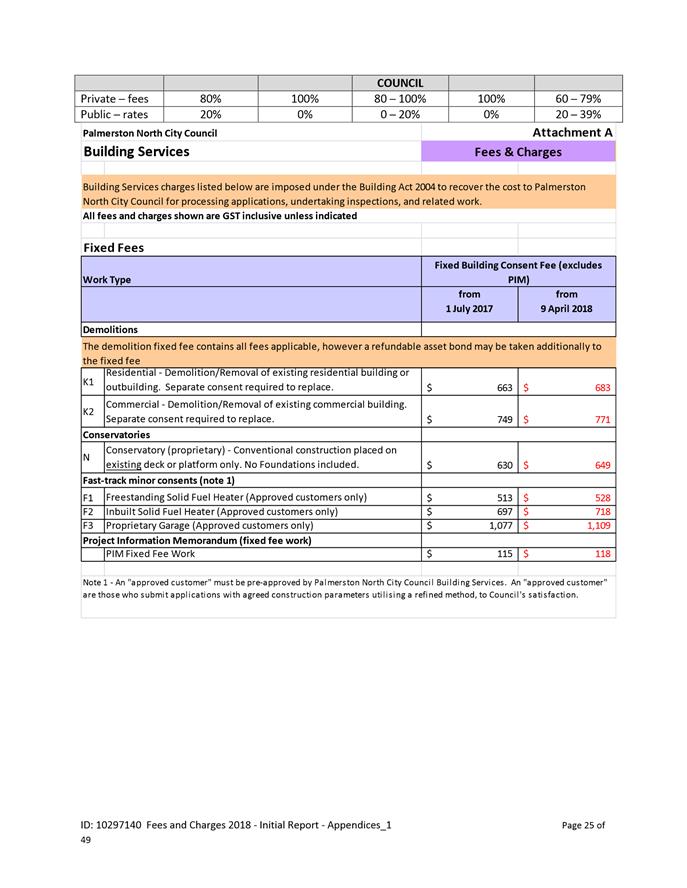

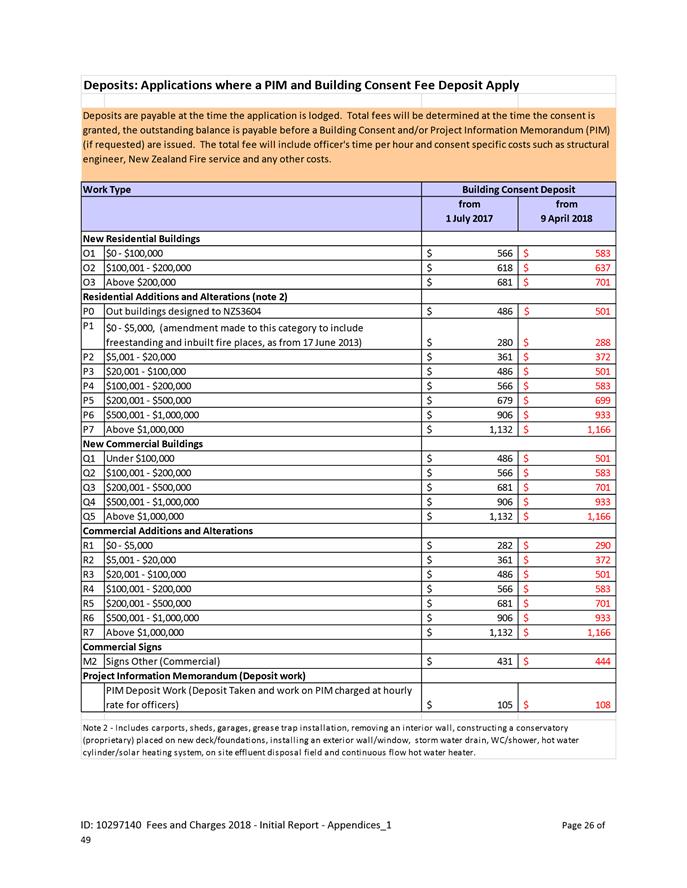

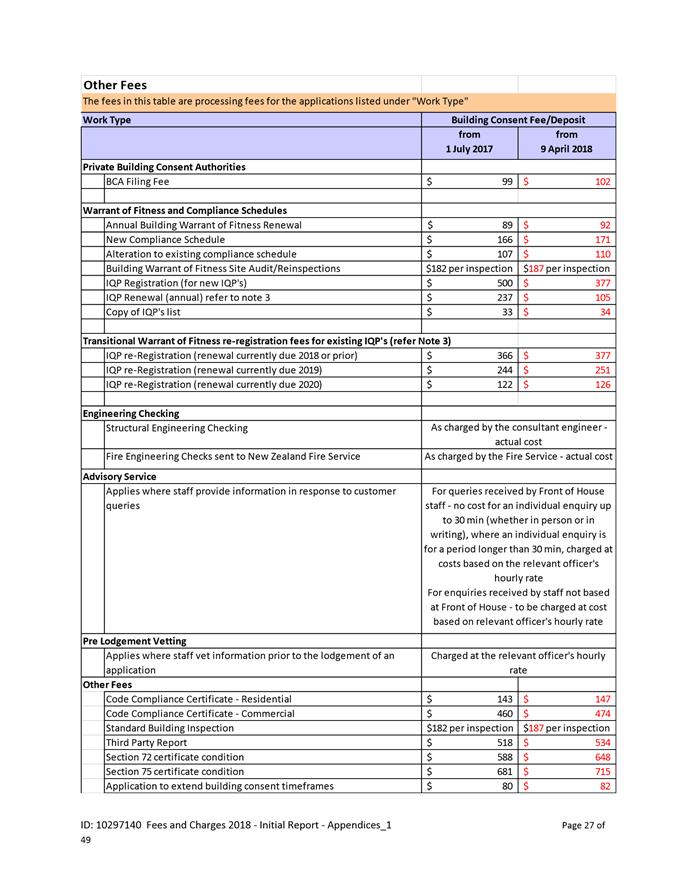

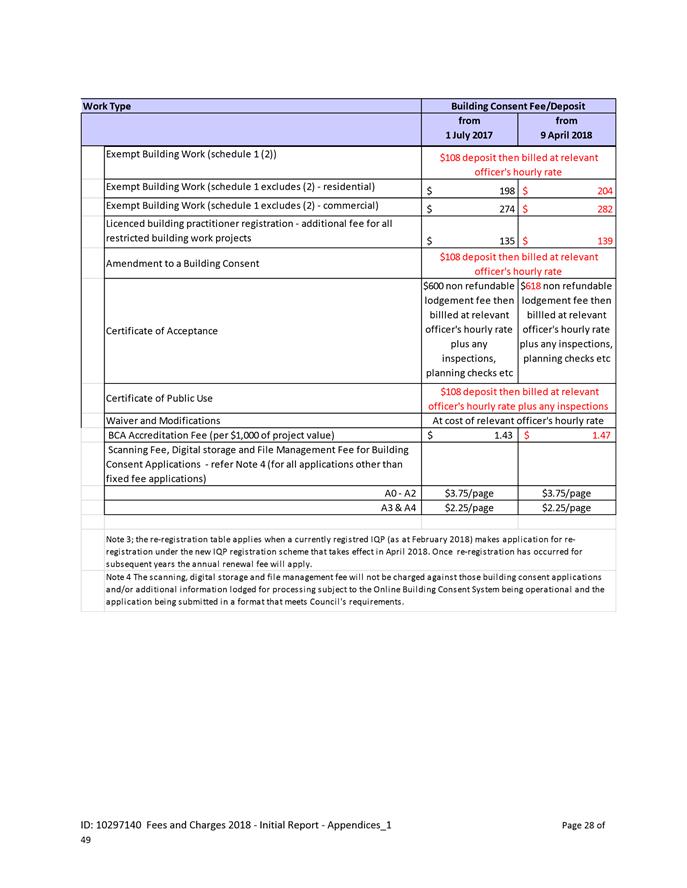

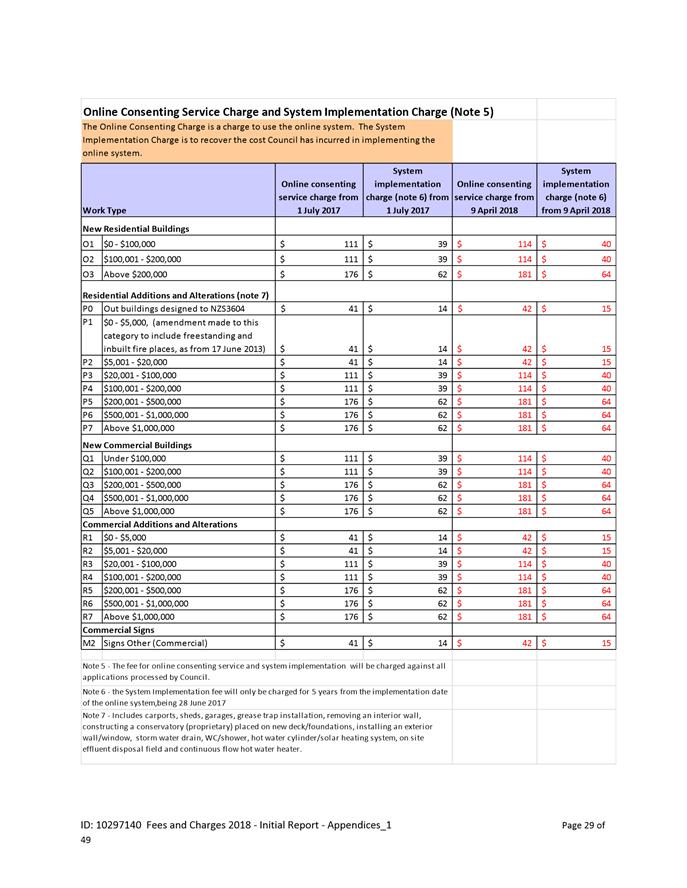

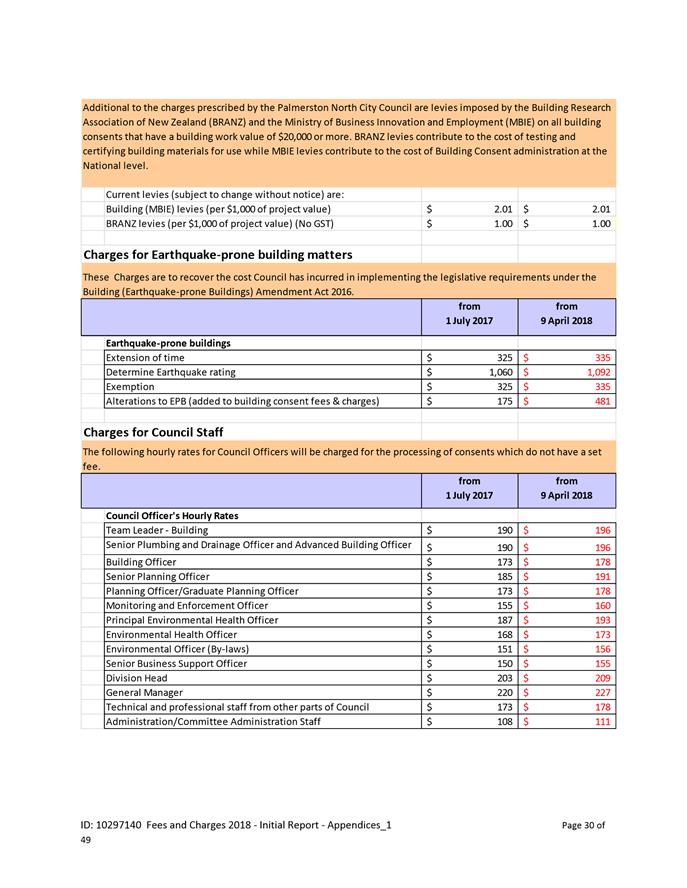

3. That

the fees and charges for Building Services, as proposed in Appendix 3 be

adopted and following public notification take effect from 9 April 2018.

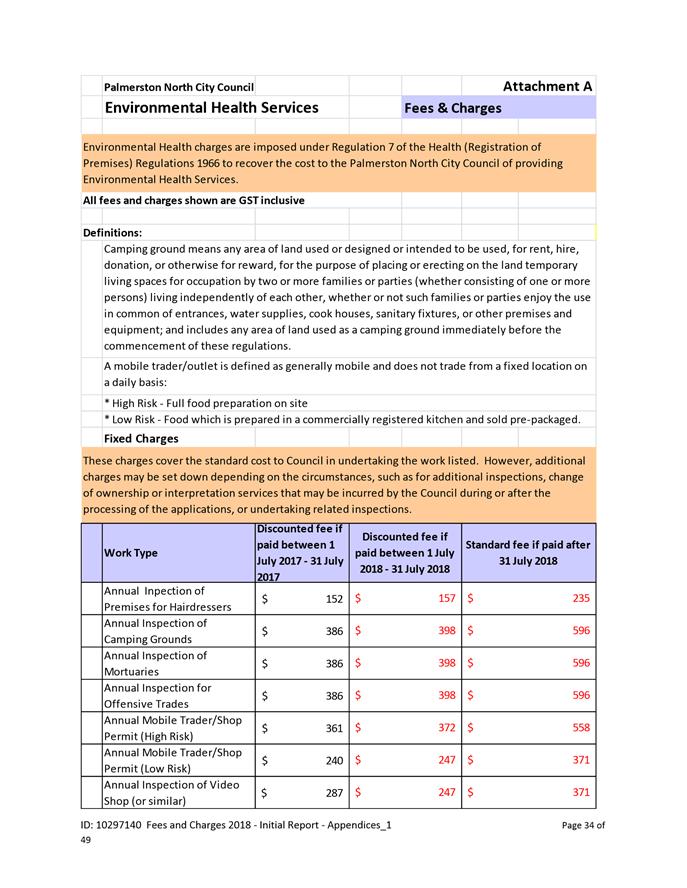

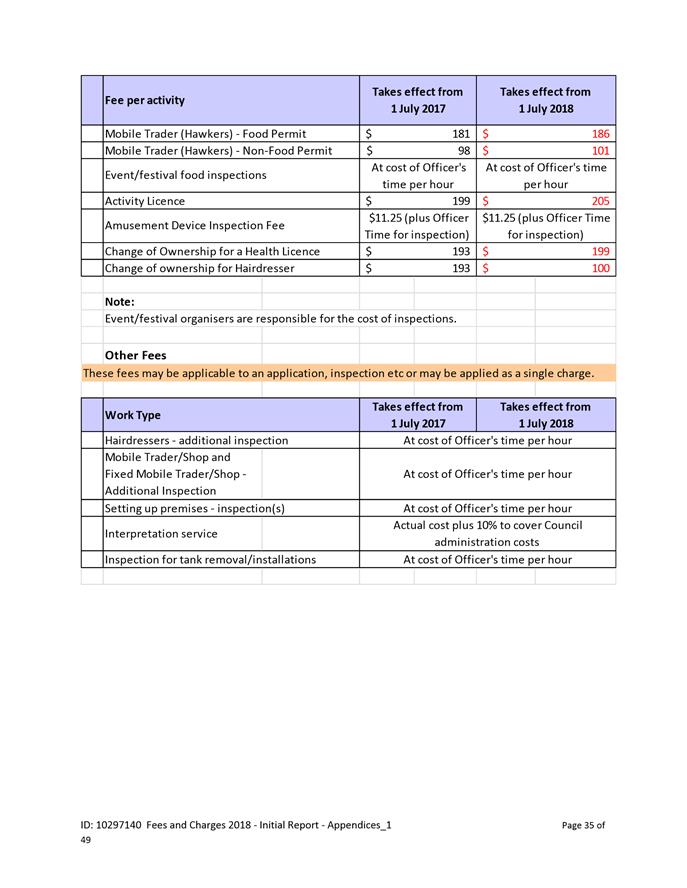

Environmental Health

4. That

the fees and charges for Environmental Health Services (in terms of

regulation 7 of the Health (Registration of Premises) Regulations 1966 and

regulation 83 of the Food Hygiene Regulations 1974) as proposed in Appendix

4, be adopted and following public notification, take effect from 1 July

2018.

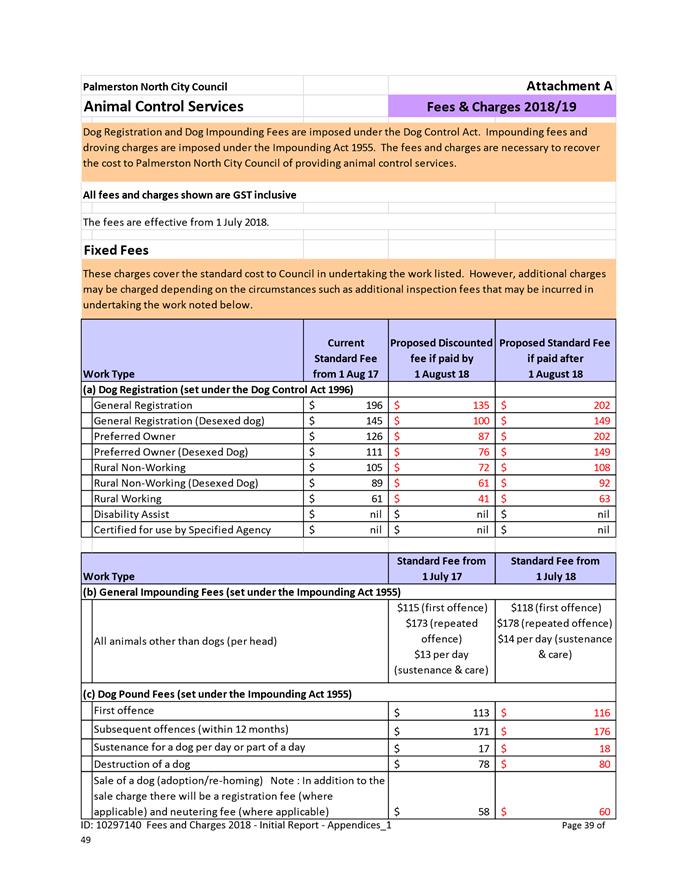

Animal Control

5. That

the fees and charges for the Impounding of Animals (in terms of section 14 of

the Impounding Act 1955) and for Dog Registration and Dog Impounding (in

terms of section 37 of the Dog Control Act 1996) as proposed in Appendix 5 be

adopted, and once following public notification, take effect from 1 July

2018.

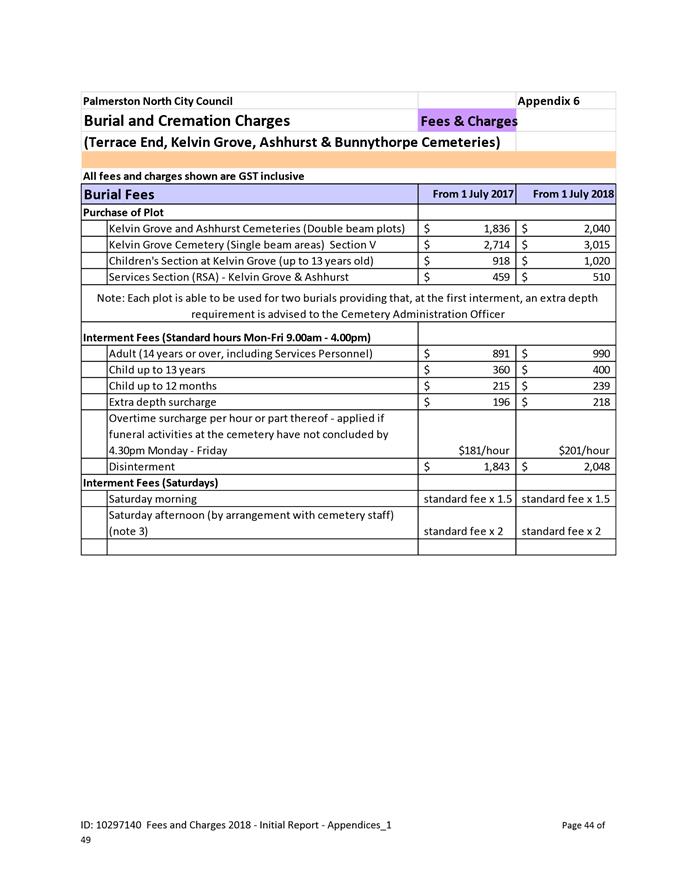

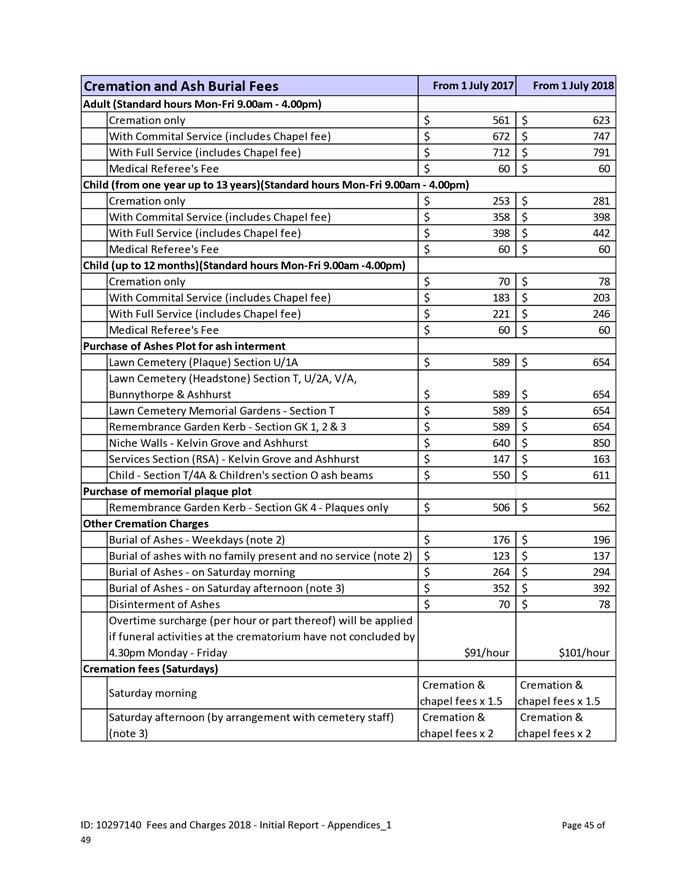

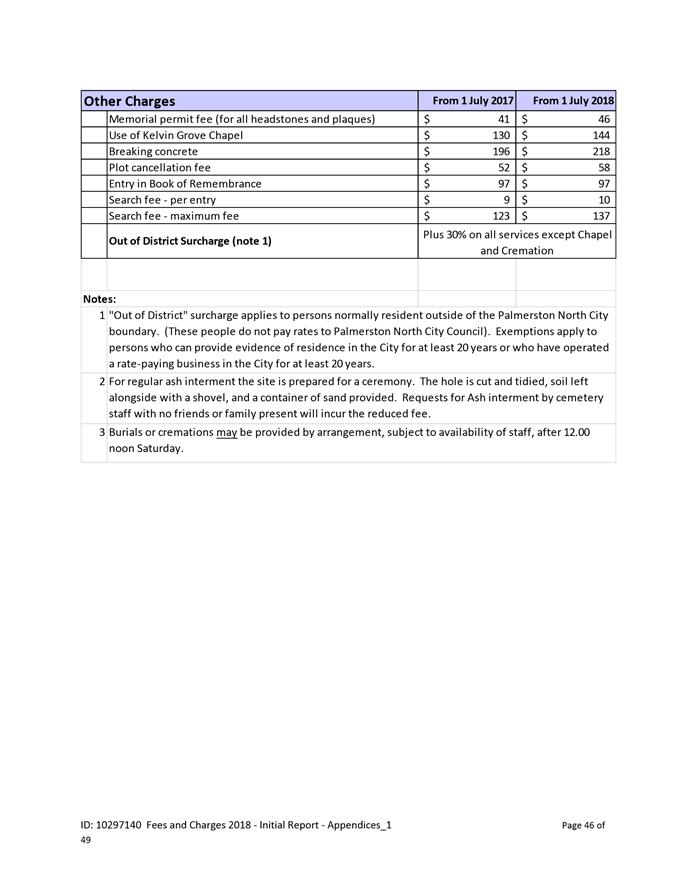

Burial & Cremation

6. That

the fees and charges for Burial and Cremation, as proposed in Appendix 6 be

adopted and following public notification take effect from 1 July 2018.

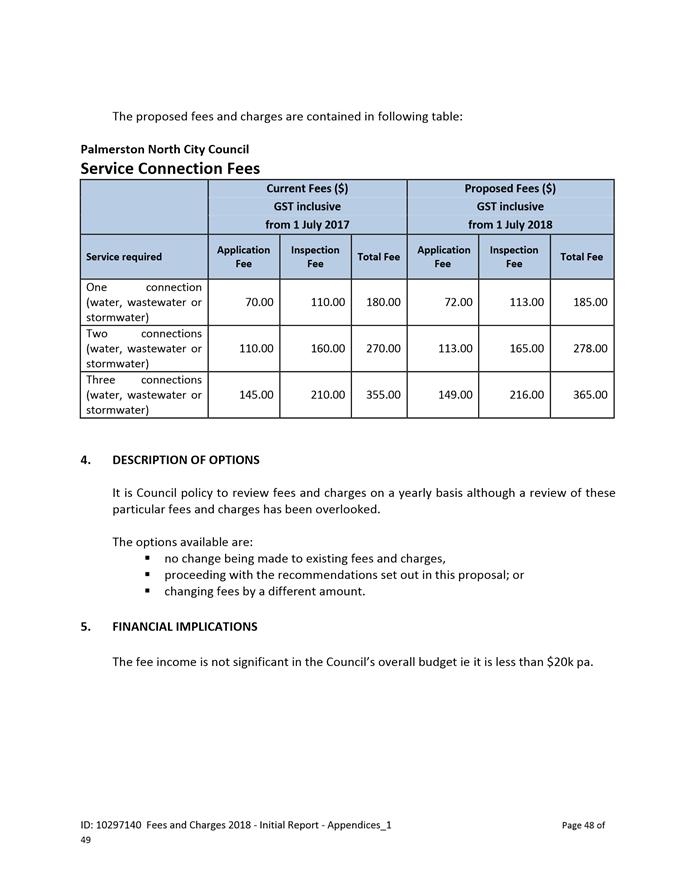

Service Connections

7. That

the fees and charges for Service Connections, as proposed in Appendix 7 be

adopted and take effect from 1 July 2018.

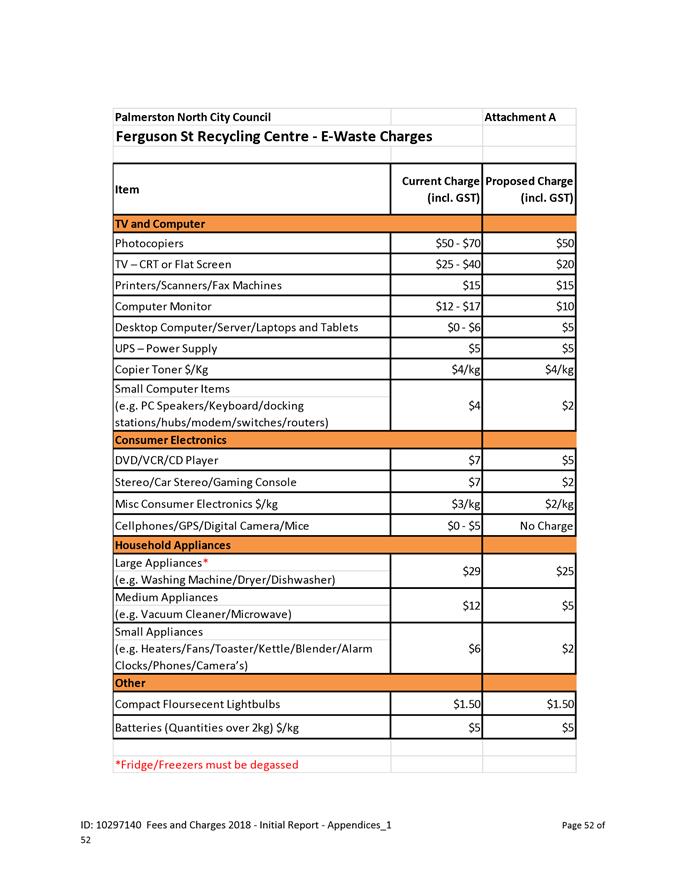

E-Waste Charges

8. That

the fees and charges for e-waste disposal as proposed in Appendix 8 be

adopted and take effect from 1 July 2018.

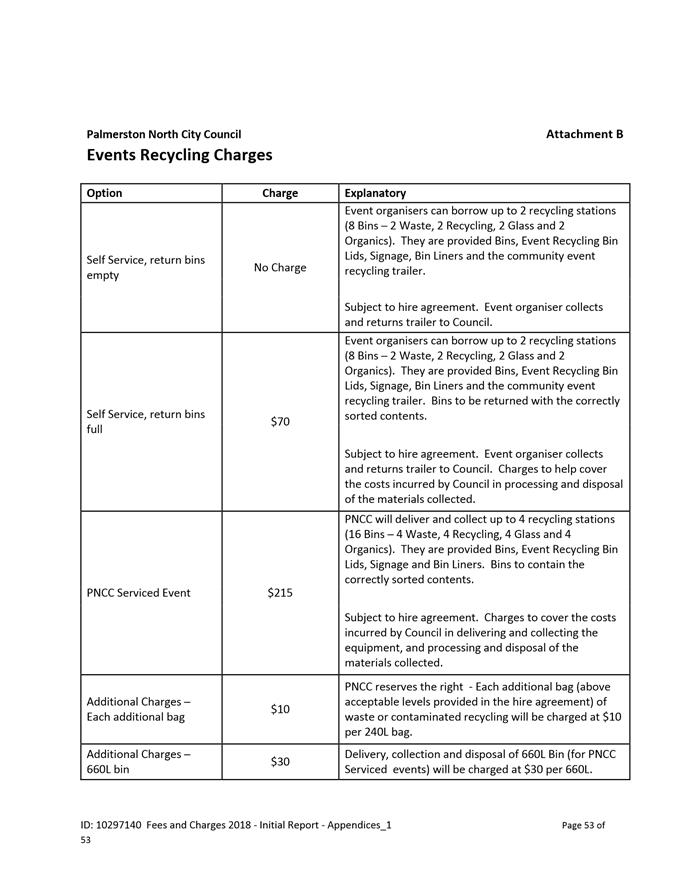

Event Recycling Fees

9. That

the fees and charges for event recycling as proposed in Appendix 8 be adopted

and take effect immediately.

|

Summary of options analysis for

|

Problem or Opportunity

|

Fees and charges need to be reviewed

annually to ensure they adequately meet Revenue & Financing policy,

budgetary and other objectives

|

|

OPTION 1:

|

Approve fee increases as proposed

|

|

Community Views

|

Each of different types of fees requires a different

process for community engagement. Where this is legislatively

controlled it is identified in the report

|

|

Benefits

|

More likely to comply with funding proportions

contained in Revenue & Financing Policy

|

|

Risks

|

Public criticism of increases

Increased charges for some activities may discourage

compliance or reduce volumes

|

|

Financial

|

Budgeted revenue targets more likely to be achieved

|

|

OPTION 2:

|

Approve fee amendments for some of those

proposed at greater or lesser levels

|

|

Community Views

|

As above

|

|

Benefits

|

Lower fees than recommended likely to mean policy

targets will not be achieved

Higher fees than recommended in some instances will

increase likelihood of policy user fee target being achieved

|

|

Risks

|

Higher fees than recommended may increase the risk

of public criticism

|

|

Financial

|

If lower increases are approved for some fees likely

that budgeted revenue will not be achievable

|

|

OPTION 3:

|

Do not approve any fee increases

|

|

Community Views

|

As above

|

|

Benefits

|

Lower fees than recommended likely to mean policy

targets will not be achieved

|

|

Risks

|

When increases eventually are made (to reduce the

pressure on rates increases) the extent of the increase required will be

publicly and politically unacceptable

|

|

Financial

|

If no increases are approved likely that budgeted

revenue will not be achievable

|

|

Contribution of Recommended Option to

Council’s Strategic Direction

|

Council’s Financial Strategy and

Revenue & Financing Policy strive to ensure those who benefit from the

provision of services are the ones who pay, where this is practicable.

The proposed changes to fees and charges attempt to ensure there is a reasonable

chance of this happening

|

Rationale for the recommendations

1. Overview

of the problem or opportunity

1.1 The

purpose of this report is to provide an overview of the current status of fees

and charges made by the Council and to recommend the adoption of updated fees

for some of them.

1.2 It

is important that fees and charges be regularly reviewed. There are a

variety of reasons for this including:

· Compliance with legislative requirements – many fees and

charges made by the Council are governed by specific legislation

· Consistency with Council’s Revenue and Financing policy

– for each activity the Council has adopted targets for the funding mix

i.e. the proportion of costs to be funded from fees and charges

· Transparency – in some instances it is important to be able to

demonstrate that the charge being made represents a fair and reasonable

recovery of the costs of providing a particular service

· Market comparability – for some services the Council operates

in a contestable market and it is important that fees and charges are

responsive to market changes.

1.3 However

as a review process is sometimes very time-consuming the depth of the review

for each type of fee or charge may vary depending on the circumstances.

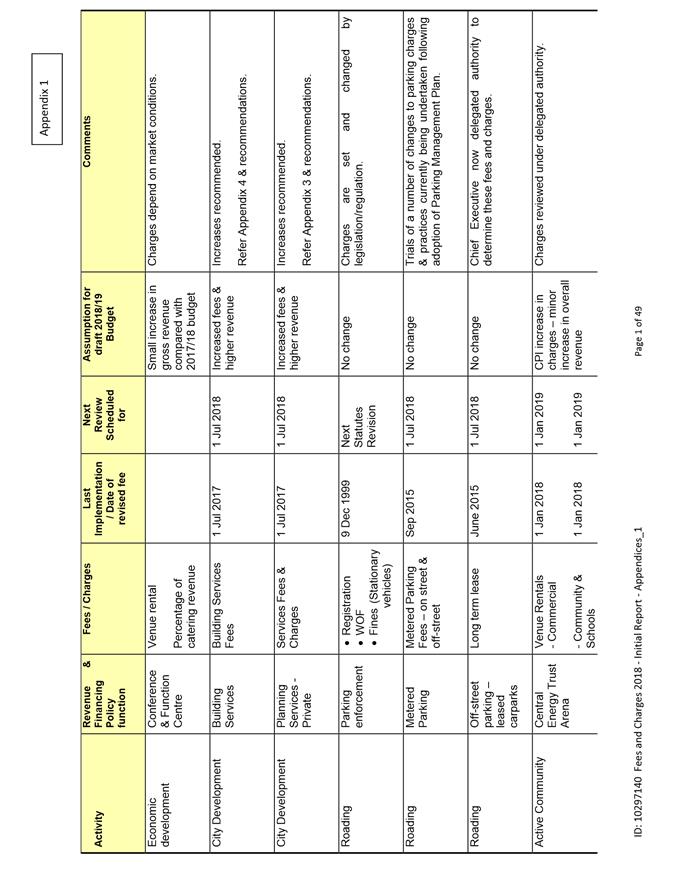

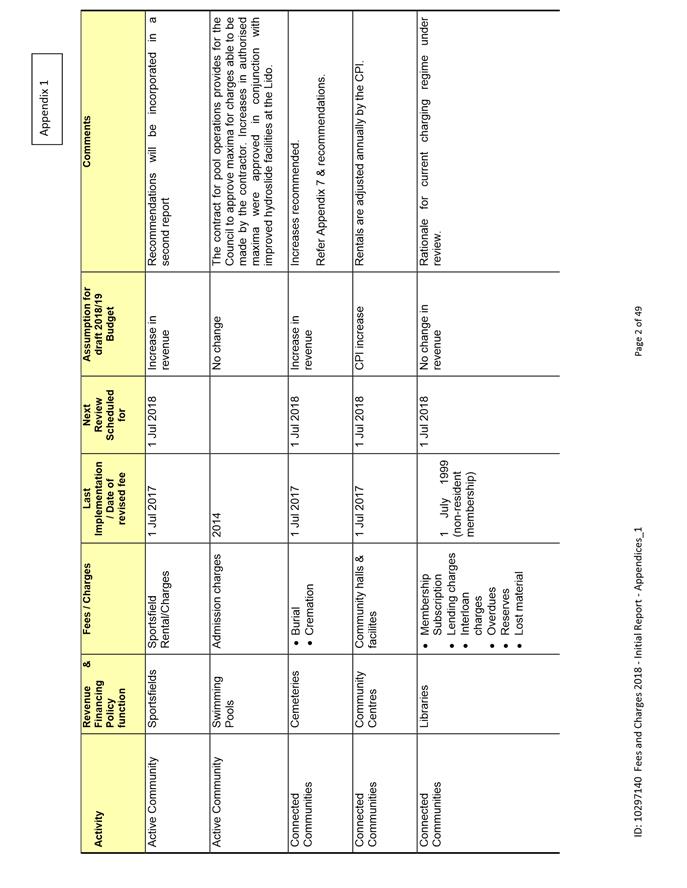

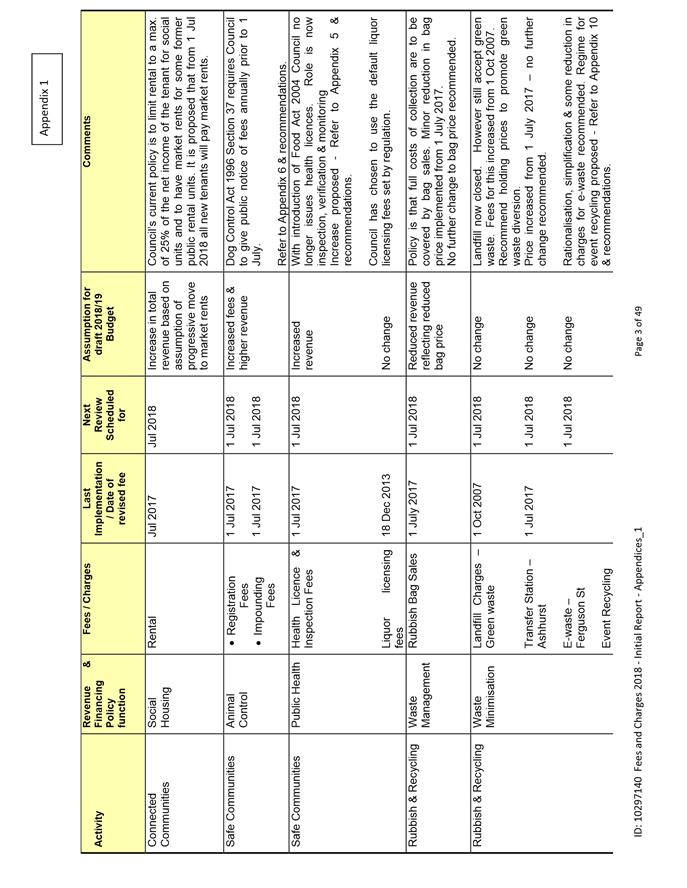

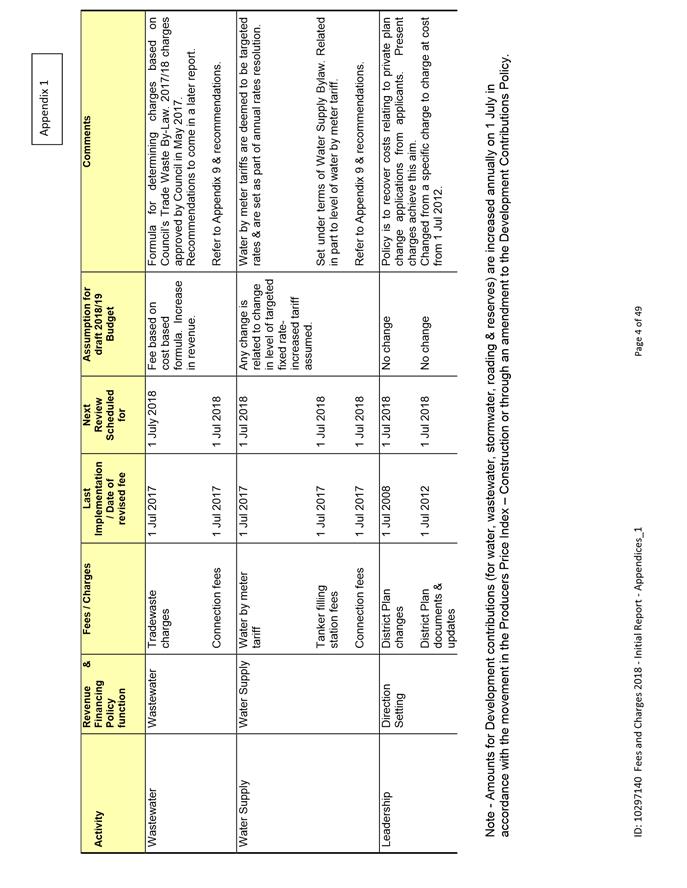

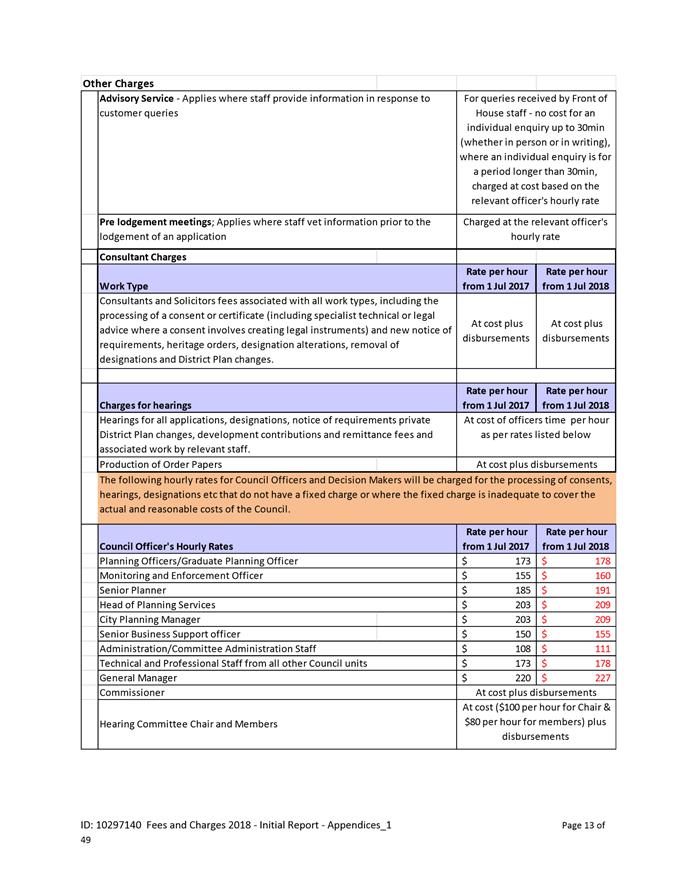

1.4 Attached

as Appendix 1 is a schedule listing, in broad terms, the various types of fees

and charges made by the Council. The schedule is ordered by activity

(consistent with the proposed 10 Year Plan 2018-28) and within that by function

(consistent with the Revenue & Financing Policy). Comments are made

within the schedule outlining the reasons for there being no change recommended

to a particular fee or charge. In cases where changes are recommended

more detail is provided in the appendices.

2. Background and

previous council decisions

2.1 Council

has previously indicated that as a matter of policy it wishes all fee and

charge revisions to be encapsulated in a single report to this Committee in

February each year. This report is a month later than planned due to

staff commitments to the 10 Year Plan process.

2.2 Council’s current Revenue & Financing Policy (10 Year Plan

2015-25 pages 165-184) describes how the Council goes about deciding who

should pay for the provision of each activity and in what proportions.

The policy should be the foundation for decisions about the levels of fees and

charges. The proposed updated policy for 2018-28 makes no fundamental

change to this.

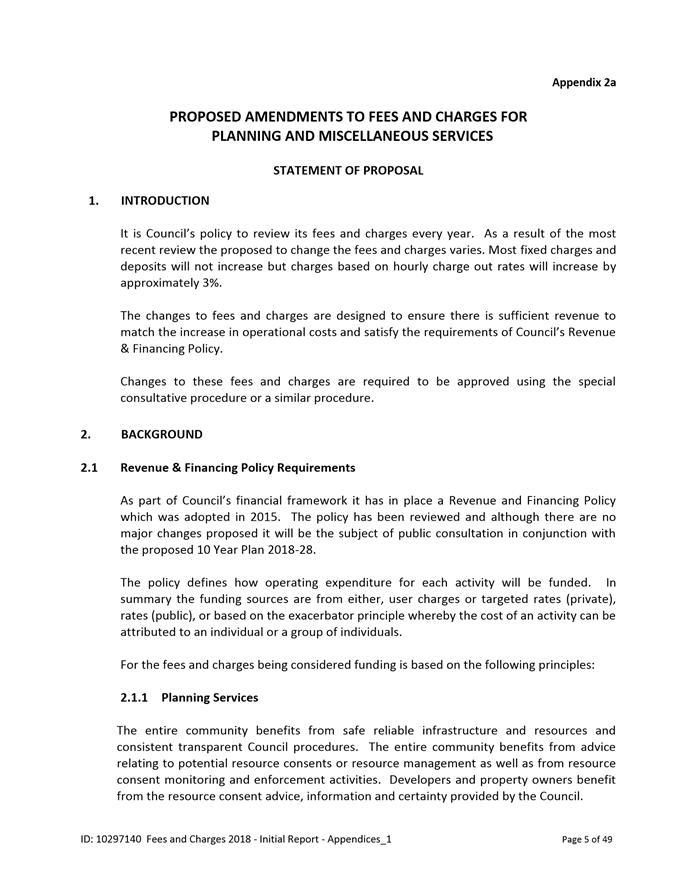

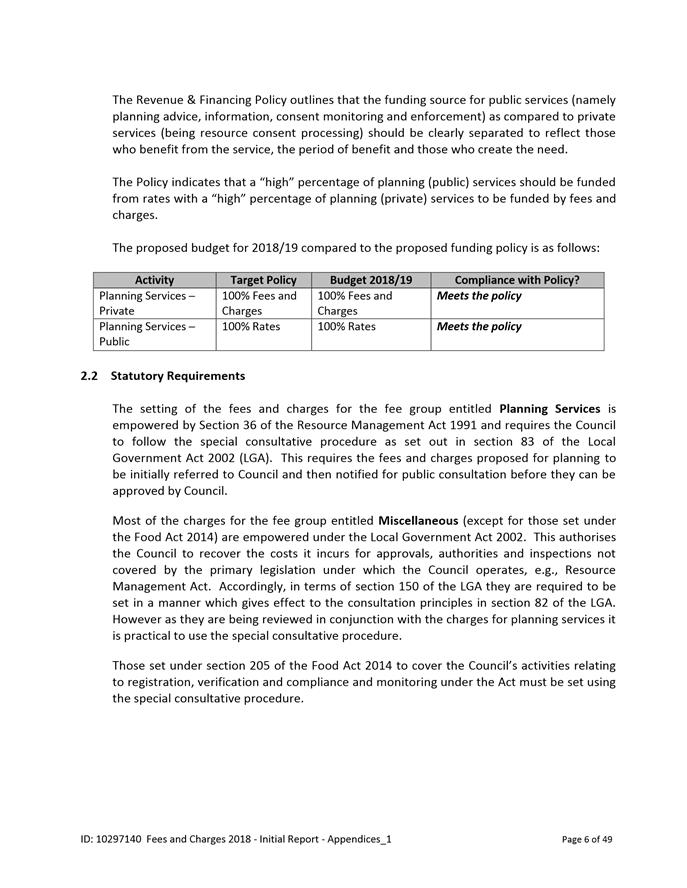

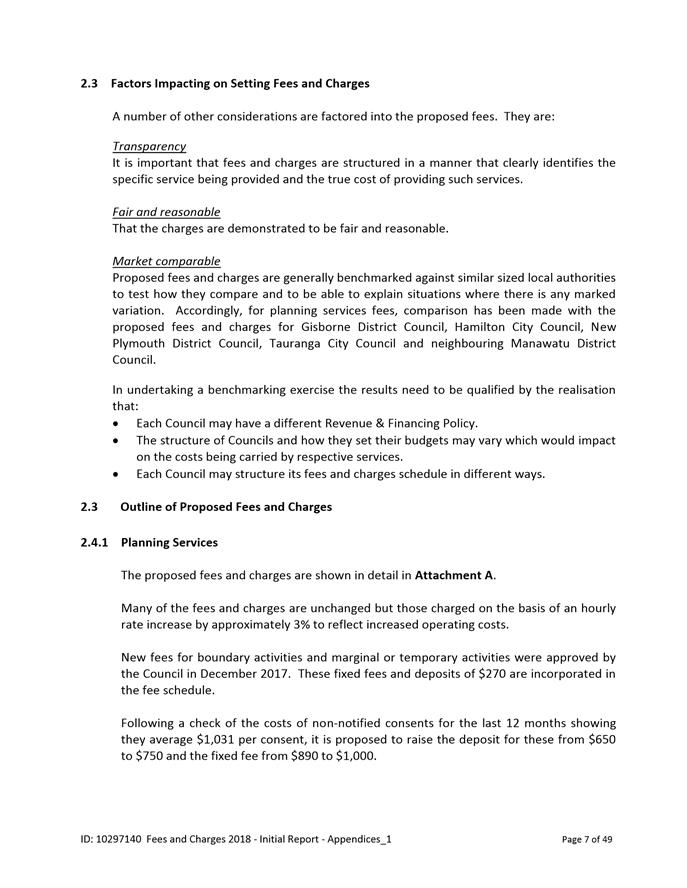

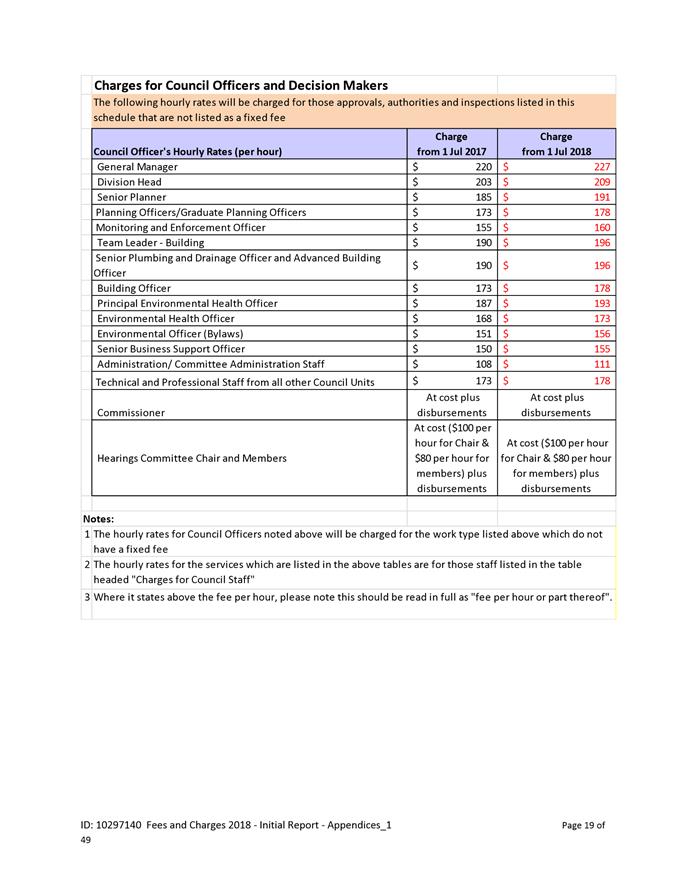

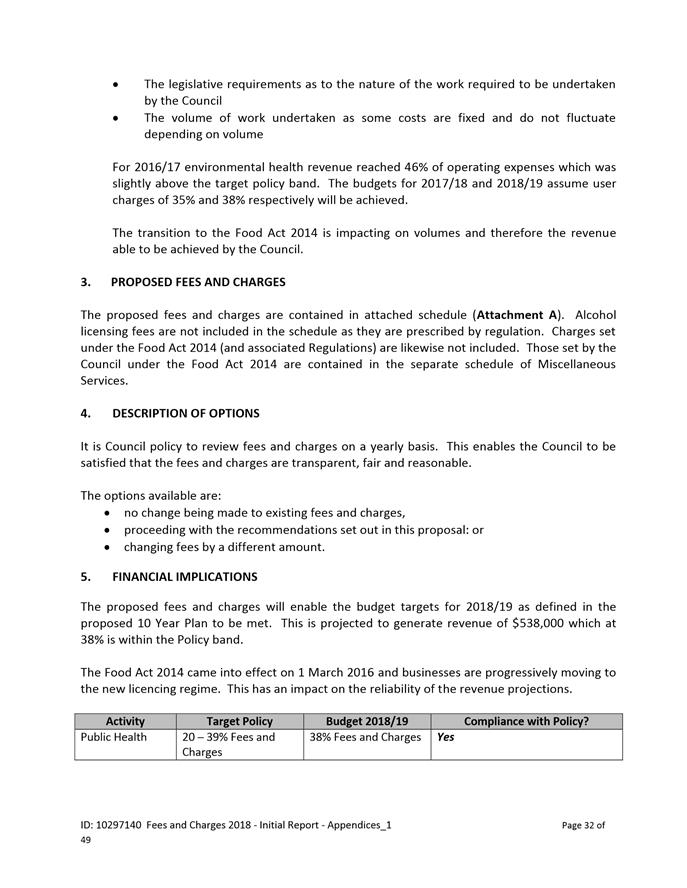

2.3 The following table shows the indicative levels of direct user

contribution (including through the use of targeted rates) sought to fund the

operating costs for each activity as described in the Revenue & Financing

Policy:

|

Revenue & Financing Policy – Indicative levels of direct

user contribution (incl. targeted rates*) sought toward activity cost

|

|

Low

0-19%

|

Med-Low

20-39%

|

Med

40-59%

|

Med-High

60-79%

|

High

80-100%

|

|

Economic development & international relations

Planning services- public

Urban design

Heritage management

Roads, street facilities, street lighting &

traffic services

Active & public transport

Creative & exciting city

Arts, culture & heritage

Reserves & sportsfields

Swimming pools

Libraries & community centres

Civil defence & safer community initiatives

Biodiversity & sustainable practices

Stormwater

Leadership

|

Central Energy Trust Arena

Public Health

|

|

Conference & Function Centre

Building services

Cemeteries

|

Planning services – private

Parking

Social housing

Animal Control

************

Rubbish & Recycling#

Wastewater#

Water#

************

|

# significant portion of funding through targeted

rates

2.4 For some activities (such as swimming pools) only a portion of the

operating costs is borne by the Council and none of the revenue is received

directly by the Council. The current policy intention is that the ratio

of external income to total operating costs is viewed taking into consideration

the consolidated view (i.e. all of the revenue & costs of the

activity). However such an approach has been difficult to administer so

the proposed policy now focuses only on the Council’s share of

funding. This means that Swimming Pools were previously included in the

Medium funding category but will in future be in the Low category.

2.5 In some of the activities shown above it is not practical to charge

users through a separate charge specifically related to use. An example

of this is water where large consumers are metered but the majority of users

are charged through the rating system by way of a fixed targeted rate as the

best proxy for direct user charge.

2.6 In

some activities a combination of charging mechanisms is used. Rubbish

& recycling is an example. Users are responsible for their own

rubbish disposal. The Council does provide a collection and disposal

service which is funded from the sale of rubbish bags. Recycling activity

is funded from the sale of recyclables and the balance through the rating

system by way of fixed targeted rates.

2.7 Council

reviewed some fees and charges in February 2017 and confirmed in May 2017 those

that were the subject of public consultation. Additional planning charges

were also considered In October and approved in December 2017.

3. Description

of options

3.1 With a few exceptions (e.g.

cemetery/crematorium, conference & function centre), draft revenue budgets

for 2018/19 have been set at levels which aim to meet the Revenue &

Financing Policy proportion targets. Achieving these revenue levels is

dependent not only on the level of fee or charge set but also the actual

volumes of activity by comparison with budget assumptions.

3.2 The

timing of this review is scheduled to fit into the annual planning timetable in

a way which ensures appropriate revenue assumptions are made in the proposed 10

Year or Annual Plans and changes to fees and charges can be implemented as soon

as practicable.

3.3 Much

of this report is focused on providing an overview of Council’s fees and

charges. However the report does include specific proposals for change

for a number of fees and charges as explained in more detail in the following

appendices:

|

Appendix

|

|

|

|

2

|

Planning &

Miscellaneous

|

Proposal for

public consultation

|

|

3

|

Building

|

Proposed increases

|

|

4

|

Environmental

Health

|

Proposed increases

|

|

5

|

Animal Control

|

Proposed increases

|

|

6

|

Burial &

Cremation

|

Proposed increases

|

|

7

|

Service

Connections

|

Proposed increases

|

|

8

|

E-waste

Event Recycling

|

Proposed new

regime of fees and charges

|

4. Analysis

of options

4.1 Analysis of the options for each of the fee types for individual

activities is contained in the appendices.

5. Conclusion

A broad review of fees and charges has

been undertaken. Revenue from these is an important part of the funding

mix. There are two elements to achieving revenue budgets. The first

is the actual level of the fee or charge. The second is the volume of

sales or use. A change to the level of fee or charge can influence

demand. Achieving revenue targets is sometimes more about volumes than

the level of the charge. There is a fine balance between the two.

This report recommends increases in charges for, planning & miscellaneous,

building, environmental health, animal control, burial & cremation, service

connections, and formalises charges for e-waste and event recycling.

Fees and charges for trade waste and

sportsfields will be the subject of a separate report as soon as practicable.

6. Next

actions

6.1 There

is a series of procedural steps to be followed to enable some of the revised

fees and charges to be implemented. In some cases (as specifically

identified in the recommendations) this involves a period of public

consultation and a report back to the Council for final confirmation (taking

into account any public submissions).

7. Outline

of community engagement process

7.1 The

Revenue & Financing Policy incorporates the Council’s current views

on what portion of each activity should be directly funded from users.

This policy forms part of the 10 Year Plan which was the subject of public

consultation in 2015 and the updated policy is being consulted on in

conjunction with the proposed 2018-28 10 Year Plan.

7.2 There

are varying types of public consultation required to enable changes to be made

to fees and charges. For some the special consultative process or a

process consistent with the principles of section 82 of the Local Government

Act is to be used. More detail about each is provided in the detailed

appendices.

Compliance and administration

|

Does the Committee have delegated authority to

decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they affect land or a

body of water?

|

NA

|

|

Can this decision only be made through a 10 Year

Plan?

|

No

|

|

Does this decision require consultation through the

Special Consultative procedure?

|

Yes

|

|

Is there funding in the current Annual Plan for

these actions?

|

Yes

|

|

Are the recommendations inconsistent with any of

Council’s policies or plans?

|

No

|

Attachments

|

1.

|

Appendices 1 - 8 ⇩

|

|

|

Steve Paterson

Strategy Manager Finance

|

|

|

![]()

![]()