AGENDA

Finance

& Audit Committee

|

Susan Baty (Chairperson)

|

|

Karen Naylor (Deputy

Chairperson)

|

|

Grant Smith (The Mayor)

|

|

Vaughan Dennison

|

Leonie Hapeta

|

|

Renee Dingwall

|

Lorna Johnson

|

|

Lew Findlay QSM

|

Bruno Petrenas

|

|

Patrick Handcock ONZM

|

Tangi Utikere

|

PALMERSTON NORTH CITY COUNCIL

Finance &

Audit Committee

MEETING

18 March 2020

Order of Business

NOTE: The

Finance & Audit Committee meeting coincides with the ordinary meeting of the Play, Recreation & Sport Committee and the Council meeting. The Committees

will conduct business in the following order:

- Council

- Finance

& Audit

- Play,

Recreation & Sport

1. Apologies

2. Notification

of Additional Items

Pursuant to Sections 46A(7) and

46A(7A) of the Local Government Official Information and Meetings Act 1987, to

receive the Chairperson’s explanation that specified item(s), which do

not appear on the Agenda of this meeting and/or the meeting to be held with the

public excluded, will be discussed.

Any additions in accordance with

Section 46A(7) must be approved by resolution with an explanation as to why

they cannot be delayed until a future meeting.

Any additions in accordance with

Section 46A(7A) may be received or referred to a subsequent meeting for further

discussion. No resolution, decision or recommendation can be made in

respect of a minor item.

3. Declarations

of Interest (if any)

Members are reminded of their duty

to give a general notice of any interest of items to be considered on this

agenda and the need to declare these interests.

4. Public

Comment

To receive comments from members of

the public on matters specified on this Agenda or, if time permits, on other

Committee matters.

(NOTE: If the

Committee wishes to consider or discuss any issue raised that is not specified

on the Agenda, other than to receive the comment made or refer it to the Chief

Executive, then a resolution will need to be made in accordance with clause 2

above.)

5. Confirmation

of Minutes Page 7

“That the minutes of the

Finance & Audit Committee meeting of 19 February 2020 Part I Public be

confirmed as a true and correct record.”

6. Palmerston

North Airport Ltd - Interim Report for 6 months to 31 December 2019 Page 17

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

7. Palmerston

North Airport Ltd - Draft Statement of Intent for 2020/21 Page 33

Memorandum, presented by Steve Paterson,

Strategy Manager - Finance.

8. Audit

New Zealand Report to Council Page 59

Memorandum, presented by Stuart

McKinnon, Chief Financial Officer.

9. Fees and

Charges Review Page 111

Report, presented by Steve

Paterson, Strategy Manager - Finance.

10. Transforming PNCC's

Business Continuity Practice Page 175

Memorandum, presented by Miles Crawford,

Risk Manager.

11. Committee Work

Schedule Page 179

12. Exclusion

of Public

|

|

To be moved:

“That the

public be excluded from the following parts of the proceedings of this

meeting listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under Section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General

subject of each matter to be considered

|

Reason for

passing this resolution in relation to each matter

|

Ground(s)

under Section 48(1) for passing this resolution

|

|

|

|

|

|

|

|

|

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

Also that the

persons listed below be permitted to remain after the public has been

excluded for the reasons stated.

[Add Third

Parties], because of their knowledge and ability to assist the

meeting in speaking to their report/s [or other matters as specified] and

answering questions, noting that such person/s will be present at the meeting

only for the items that relate to their respective report/s [or matters as

specified].

|

Palmerston North City Council

Minutes of

the Finance & Audit Committee Meeting Part I Public, held in the Council

Chamber, First Floor, Civic Administration Building, 32 The Square, Palmerston

North on 19 February 2020, commencing at 9.01am

|

Members

Present:

|

Councillor Susan Baty (in the Chair) and

Councillors Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Lorna Johnson, Karen Naylor, Bruno Petrenas and Tangi Utikere.

|

|

Non Members:

|

Councillors Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Billy Meehan and Aleisha Rutherford.

|

|

Apologies:

|

The Mayor (Grant Smith) (for lateness),

Councillors Leonie Hapeta and Rachel Bowen (early departure on Council

business)

|

The Mayor (Grant

Smith) entered the meeting at 9.09am at the conclusion

of clause 3. He was not present for clauses 1

to 3 inclusive.

Councillor Rachel Bowen left the meeting at 10.19am during

consideration of clause 6. She entered the

meeting again at 12.06pm during consideration of clause

9. She was not present for clauses 6 to 8 inclusive.

|

1-20

|

Apologies

|

|

|

Moved Susan Baty, seconded Aleisha Rutherford.

The

COMMITTEE RESOLVED

1.That

the Committee receive the apologies.

|

|

|

Clause 1-20 above was carried 14 votes to 0, the voting being as

follows:

For:

Councillors Brent Barrett,

Susan Baty, Rachel Bowen, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall,

Lew Findlay QSM, Patrick Handcock ONZM, Lorna Johnson, Billy Meehan, Karen Naylor,

Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

2-20

|

Confirmation of Minutes

|

|

|

Moved Susan Baty, seconded Karen Naylor.

The

COMMITTEE RESOLVED

1. That

the minutes of the Finance & Audit Committee meeting of 4 December 2019

Part I Public be confirmed as a true and correct record.

|

|

|

Clause 2-20 above was carried 14 votes to 0, the voting being as

follows:

For:

Councillors Brent Barrett,

Susan Baty, Rachel Bowen, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall,

Lew Findlay QSM, Patrick Handcock ONZM, Lorna Johnson, Billy Meehan, Karen

Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

3-20

|

Conference Opportunity - Rangitāne Appointed Members

Memorandum, presented by

Hannah White, Democracy & Governance Manager.

After discussion Elected

Members requested that the scope of the Expenses Policy be broadened to allow

for other items to be included in the review.

|

|

|

Moved

Rachel Bowen, seconded Karen Naylor.

The COMMITTEE RESOLVED

1. That the

attendance of Rangitāne Appointed Member Mr Chris Whaiapu, with expenses

paid, at the Te Maruata Hui of LGNZ being held in South Taranaki on 11 and 12

March 2020, be approved.

2. That

a review of the Expenses Policy be undertaken to consider whether the Policy

be extended to cover all Appointed Members, and to make recommendations for

any other changes required to update the policy including to the definition

of, and travel expenses associated with, Official Business, with a report to

Finance and Audit Committee (in September 2020).

|

|

|

Clause 3-20 above was

carried 14 votes to 0, the voting being as follows:

For:

Councillors Brent Barrett,

Susan Baty, Rachel Bowen, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall,

Lew Findlay QSM, Patrick Handcock ONZM, Lorna Johnson, Billy Meehan, Karen

Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

The Mayor (Grant Smith) entered the meeting at 9.09am

|

4-20

|

Quarterly Performance and Financial Report - Quarter

Ending 31 December 2019

Memorandum, presented by

Stuart McKinnon, Chief Financial Officer and Andrew Boyle, Head of Community

Planning.

|

|

|

Moved

Susan Baty, seconded Karen Naylor.

The COMMITTEE RESOLVED

1. That

the Committee receive the December 2019 Quarterly Performance and Financial

Report.

|

|

|

Clause 4-20 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Lorna

Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and

Tangi Utikere.

|

|

5-20

|

Treasury Report - 6 months ending 31 December 2019

Memorandum, presented by

Steve Paterson, Strategy Manager - Finance.

|

|

|

Moved

Susan Baty, seconded Karen Naylor.

The COMMITTEE RESOLVED

1. That

the performance of Council’s treasury activity for the six months ended

31 December 2019 be noted.

|

|

|

Clause 5-20 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Lorna Johnson,

Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi

Utikere.

|

|

6-20

|

New Deed of Lease for Manawatu Pony Club, Manawatu Canine

Club and Ruahine Kindergarten Milverton

Memorandum, presented by

Bryce Hosking, Manager - Property.

Councillor Rachel Bowen

left the meeting at 10.19am

|

|

|

Moved Aleisha Rutherford, seconded Brent Barrett.

The

COMMITTEE RECOMMENDS

1. That

the Council as the administering body

under the Reserves Act 1977, on behalf of the Minister of Conservation,

approve the following leases:

a. Land

lease at Ashhurst Domain, Palmerston North, to Manawatu Pony Club

Incorporated.

b. Land lease at Ashhurst

Domain, Palmerston North, to The Manawatu Canine Centre Incorporated.

c. Land lease at Milverton

Park, Palmerston North, to Ruahine Kindergarten Association Incorporated.

2. That

the Council agree to execute the following leases:

a. A new five-year lease with

renewal option between Palmerston North City Council and Manawatu Pony Club

Incorporated for the land at Ashhurst Domain, Palmerston North.

b. A new five-year lease with

renewal option between Palmerston North City Council and The Manawatu Canine

Centre Incorporated at Ashhurst Domain, Palmerston North.

c. A new five-year lease

with renewal option between Palmerston North City Council and Ruahine

Kindergarten Association Incorporated for the land at Milverton Park,

Palmerston North.

|

|

|

Clause 6-20 above was carried 14 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Lorna Johnson, Billy

Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

7-20

|

Powerco Easement at Vautier Park

Memorandum, presented by

Bryce Hosking, Manager - Property.

|

|

|

Moved

Susan Baty, seconded Grant Smith.

The COMMITTEE RECOMMENDS

1. That

Council, as the administering body of

Vautier Park (legally described as Part Section 249 Town of Palmerston

North), authorise the granting of an easement to convey electricity, to

Powerco.

2. That

Council, in exercise of the powers conferred on it by delegation under the

Reserves Act 1977, authorise the granting of an easement to convey

electricity, to Powerco.

3. That

Council note that the requirements of Section 4 of the Conservation Act 1987

have been satisfied in relation to consultation with Iwi over granting an

easement to convey electricity at Vautier Park.

4. That

Council note that the requirements of Sections 119 and 120 of the Reserves

Act 1977 have been satisfied in relation to public notification prior to the

resolution to grant an easement to convey electricity over Vautier Park.

|

|

|

Clause 7-20 above was

carried 14 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Lorna Johnson, Billy

Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

The meeting adjourned at

10.26am

The meeting resumed at 10.46am

|

8-20

|

Wastewater BPO Quarterly Report & Financial Status

Report, presented by Robert

van Bentum - Transport and Infrastructure Manager, Sacha Haskell, GM -

Communications and Marketing.

|

|

|

Moved

Susan Baty, seconded Vaughan Dennison.

The COMMITTEE RESOLVED

1. That

the Committee receive the update for the Wastewater BPO Project as detailed

in the report titled `Wastewater Best Practicable Option Quarterly Report

& Financial Status’ dated 19 February 2020.

|

|

|

Clause 8.1 above was carried 14 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Brent

Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew

Findlay QSM, Patrick Handcock ONZM, Lorna Johnson, Billy Meehan, Karen

Naylor, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

|

Moved Susan Baty, seconded Vaughan Dennison.

The

COMMITTEE RECOMMENDS

2. That

Council approves additional budget of $470,700 in order to complete the

technical work and marketing and communications input scoped for the BPO

Project for the 2019/2020 financial year.

|

|

|

Clause 8.2 above was carried 10 votes to 4, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Brent

Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Patrick Handcock ONZM,

Lorna Johnson, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

Against:

Councillors Renee Dingwall, Lew Findlay QSM, Billy

Meehan and Karen Naylor.

|

|

|

Moved

Karen Naylor, seconded Billy Meehan.

|

|

|

Note:

On a motion that “The

Committee approves additional budget of $355,200 in order to complete the

technical work scoped for the BPO project for the 2019/2020 financial year”,

the motion was lost 5 votes to 8, with 1 abstention, the voting being as

follows:

For:

The Mayor (Grant Smith) and

Councillors Renee Dingwall, Billy Meehan, Karen Naylor and Bruno Petrenas.

Against:

Councillors Brent Barrett,

Susan Baty, Zulfiqar Butt, Vaughan Dennison, Patrick Handcock ONZM, Lorna

Johnson, Aleisha Rutherford and Tangi Utikere.

Abstained:

Councillor Lew Findlay QSM.

|

|

9-20

|

PNCC Animal Shelter Options

Report, presented by Bryce

Hosking, Manager - Property.

During discussion Elected

Members felt there was a level of urgency to progress this project, as the

current facility is non-compliant and animal welfare continues to be a

concern. Elected Members therefore requested the design and consent

phase be brought forward to the current year.

Councillor Rachel Bowen

returned to the meeting at 12.06pm

|

|

|

Moved

Lorna Johnson, seconded Lew Findlay QSM.

The COMMITTEE RECOMMENDS

1. That Council agrees to proceed with Option 2 and builds a new Animal

Shelter next to the existing facility in Totara Road, Palmerston North for $2,925,919 + GST. This will be a multi-year Programme split over the 2020/21 and 2021/22 financial years.

The proposed programme budget (not currently budgeted for) will be split:

2020/21 $300,000 – Design and Consent Phase

2021/22 $2,625,919 – Construction Phase

Amended by Council on 26 February 2020

Clause 14-20

|

|

|

Clause 9.1 above was

carried 14 votes to 1, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Lorna

Johnson, Billy Meehan, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

Against:

Councillor Karen Naylor.

|

|

|

Moved

Lorna Johnson, seconded Aleisha Rutherford.

2. That

consideration be given by the Chief Executive to bringing the design and

consent phase into the current year if possible.

|

|

|

Clause 9.2 above was

carried 12 votes to 3, the voting being as follows:

For:

Councillors Brent Barrett,

Rachel Bowen, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay

QSM, Patrick Handcock ONZM, Lorna Johnson, Karen Naylor, Bruno Petrenas,

Aleisha Rutherford and Tangi Utikere.

Against:

The Mayor (Grant Smith) and

Councillors Susan Baty and Billy Meehan.

|

|

|

Moved

Susan Baty, seconded Karen Naylor.

|

|

|

Note:

On a motion that “The

scope of a new Animal Shelter is referred to a Councillor workshop with revised

options being reported back to the Finance & Audit Committee as soon as

practicable”, the motion was lost 5 votes to 10, the voting being as

follows:

For:

The Mayor (Grant Smith) and

Councillors Susan Baty, Billy Meehan, Karen Naylor and Bruno Petrenas.

Against:

Councillors Brent Barrett,

Rachel Bowen, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay

QSM, Patrick Handcock ONZM, Lorna Johnson, Aleisha Rutherford and Tangi

Utikere.

|

|

10-20

|

Committee Work Schedule

|

|

|

Moved

Susan Baty, seconded Lew Findlay QSM.

The COMMITTEE RESOLVED

1. That

the Finance & Audit Committee receive its Work Schedule dated February

2020.

|

|

|

Clause 10-20 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Lorna

Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and

Tangi Utikere.

|

The meeting finished at 1.28pm

Confirmed 18 March 2020

Chairperson

PALMERSTON NORTH CITY COUNCIL

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 18

March 2020

TITLE: Palmerston

North Airport Ltd - Interim Report for 6 months to 31 December 2019

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

|

RECOMMENDATION(S)

TO Council

1. That the

Interim Report and Financial Statements of Palmerston North Airport Ltd for

the period ended 31 December 2019 be received.

|

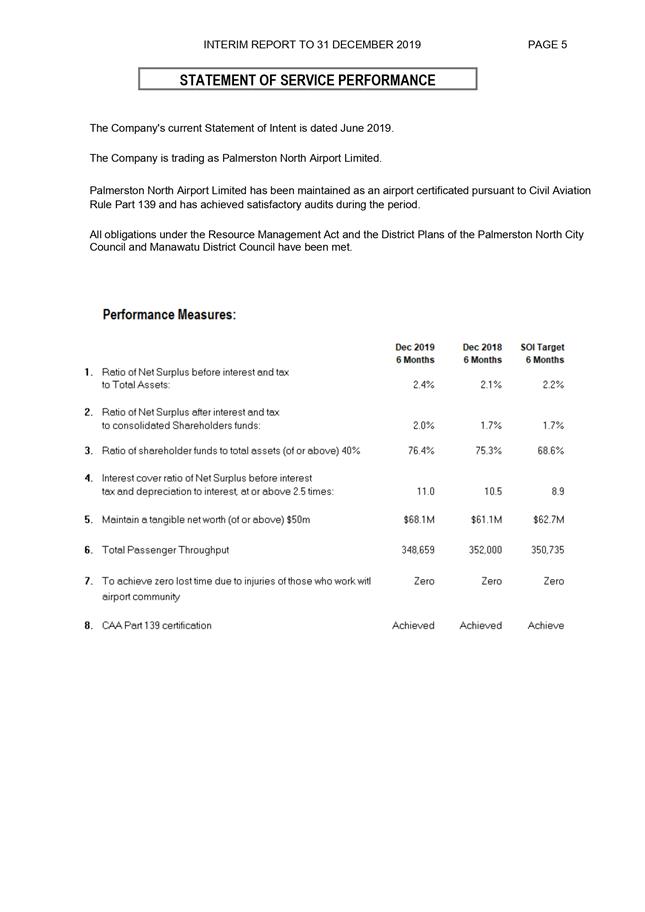

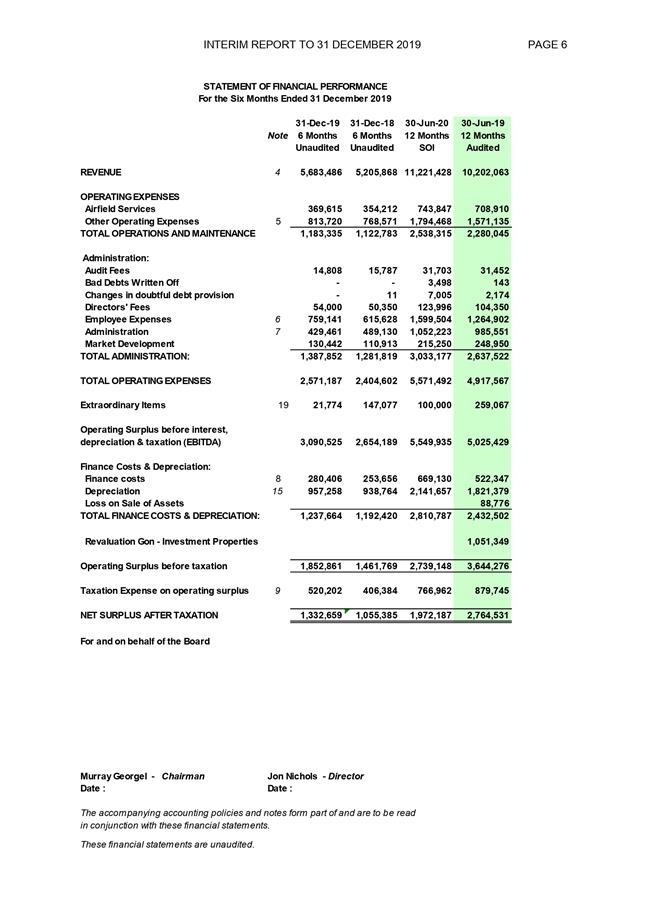

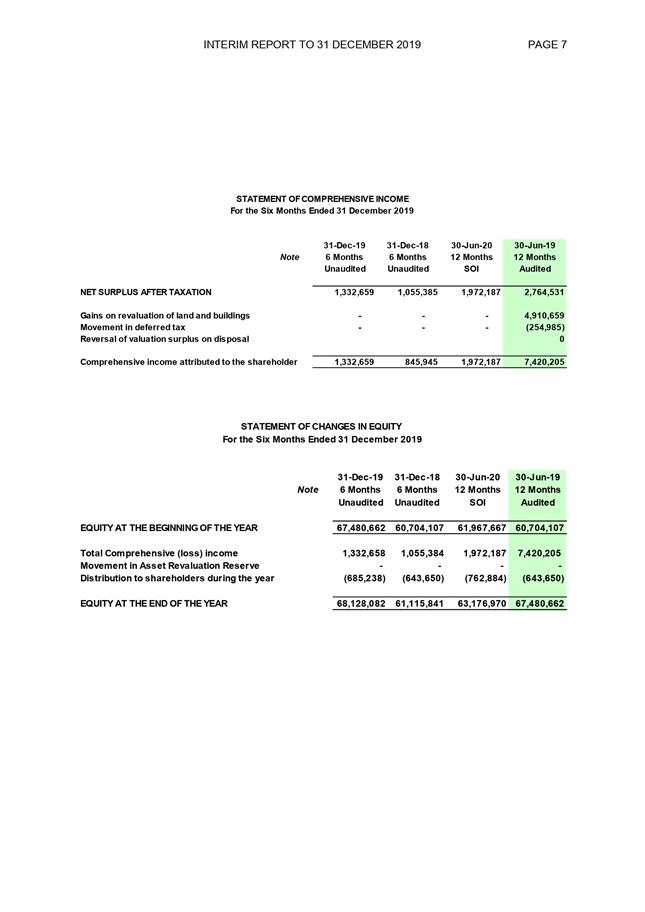

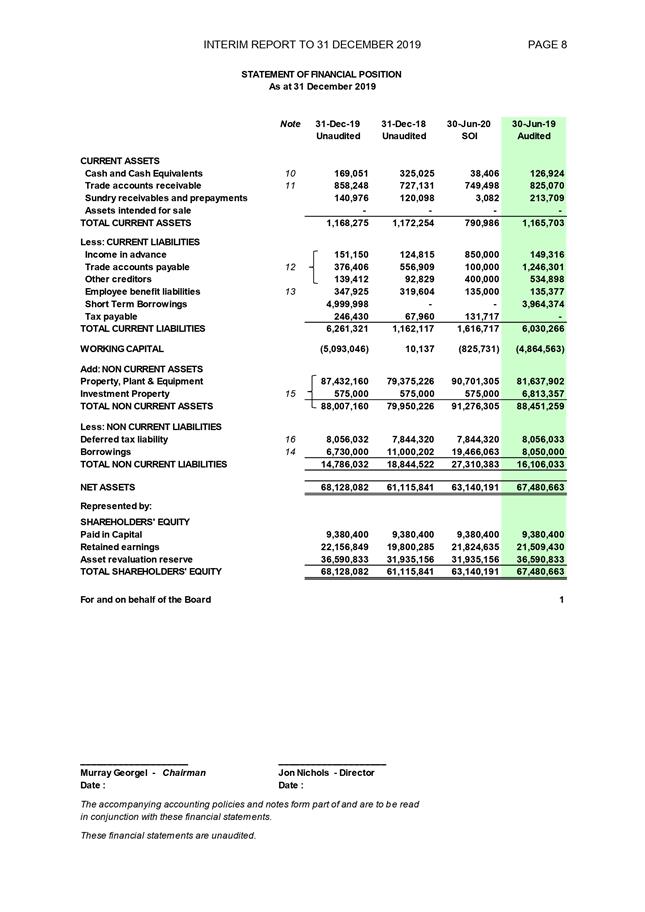

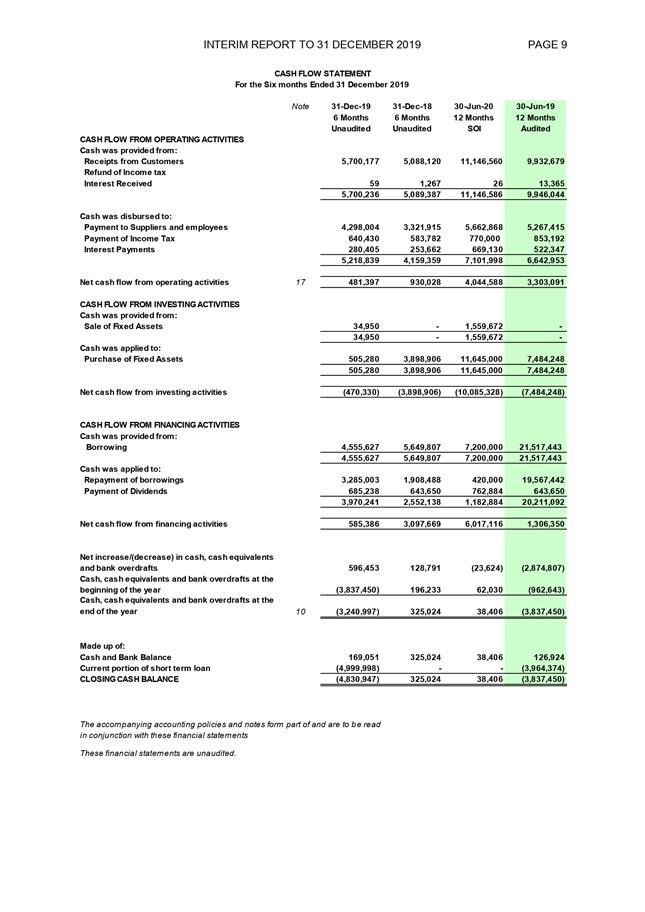

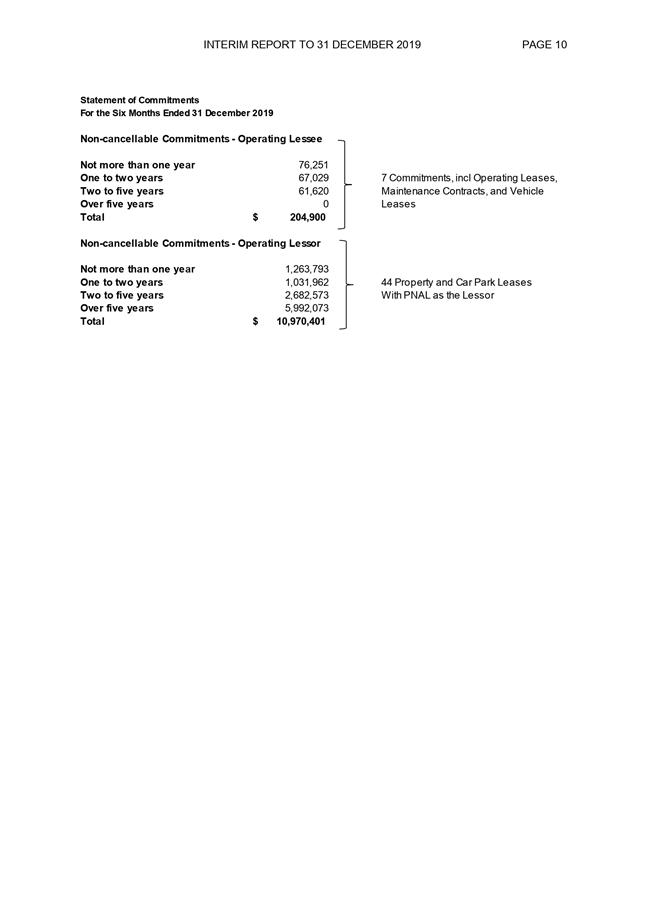

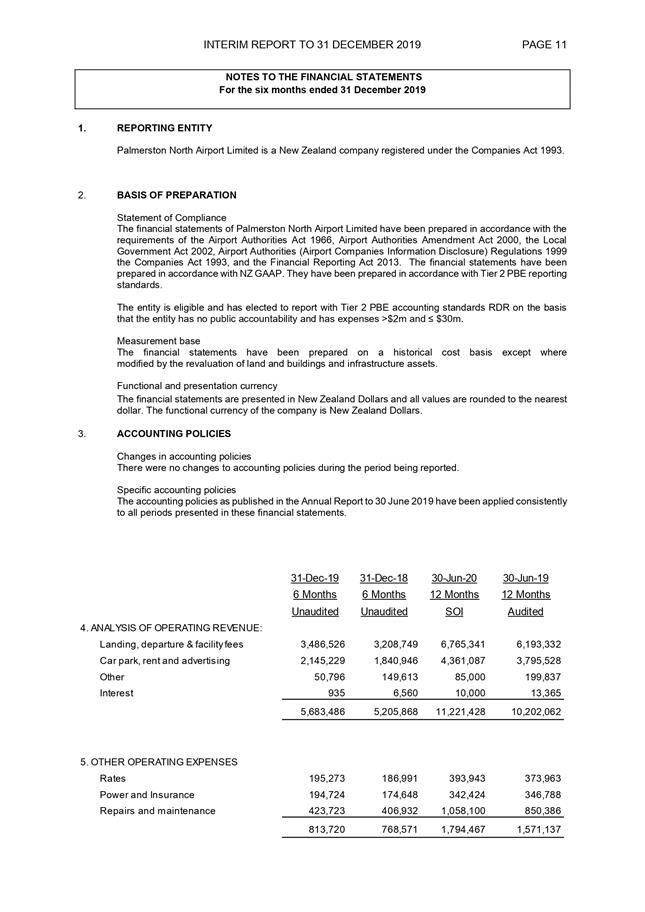

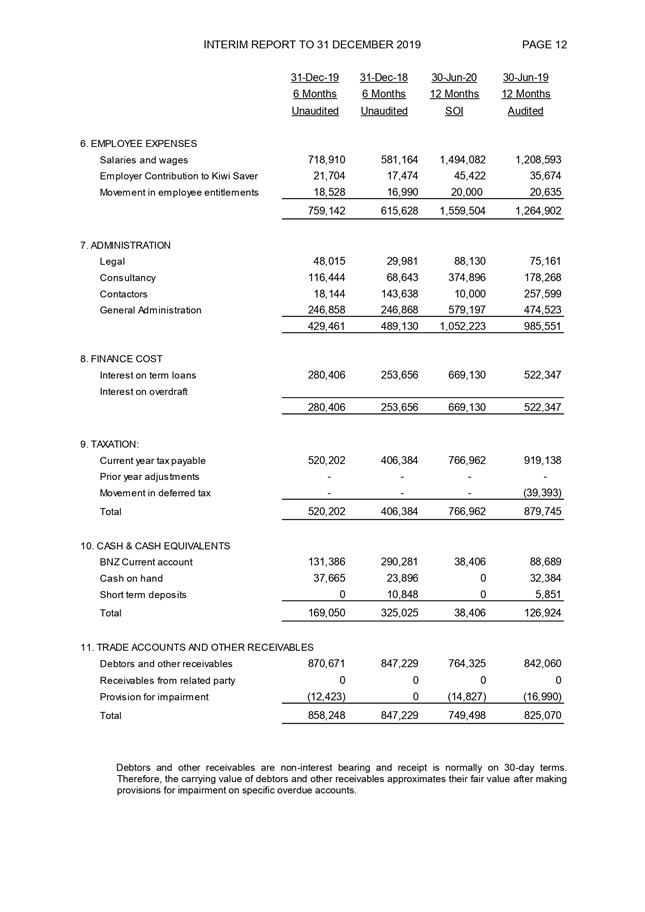

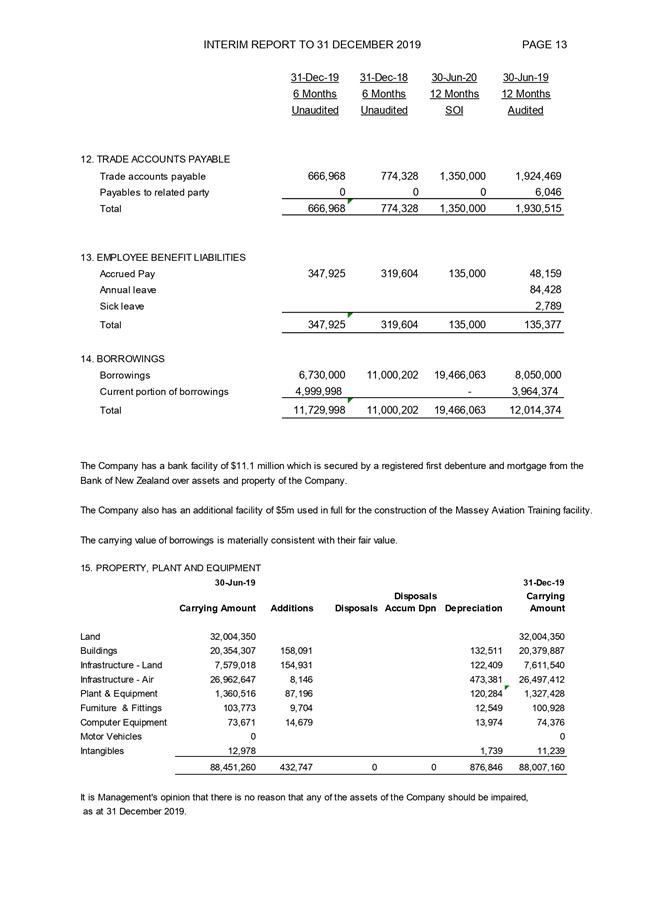

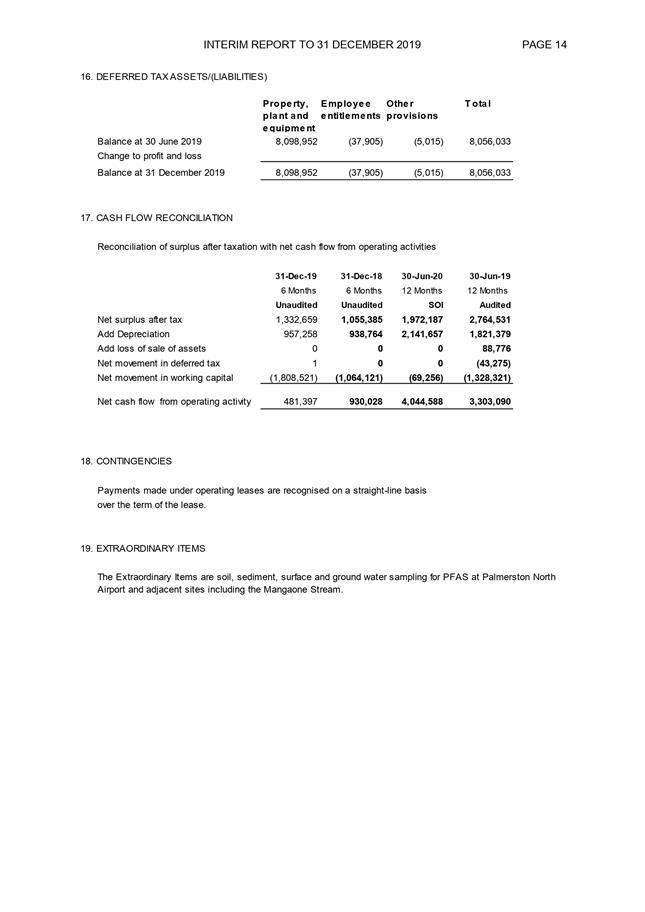

1. ISSUE

Palmerston North Airport Ltd

(PNAL), as a Council-Controlled Organisation, is required to provide a

6-monthly report to the Council. The report for the period ending 31

December 2019 is attached.

2. BACKGROUND

PNAL’s draft Statement of

Intent (SOI) for 2019/20 was considered by the Council in March 2019 and the

final SOI was considered by the Council in June 2019.

Performance for the year to

date is covered in the report by the Chair and Chief Executive. They

outline the key components of what has been another busy period for PNAL with

an improved overall financial performance compared with the same period the

previous year. They signal an expectation of a second half year where

revenue falls behind budget with the withdrawal of the Jetstar service.

However, they forecast a year-end tax paid surplus that exceeds budget.

The Council has been paid a

dividend of $685,238 based on the previous year’s results – this

compares with the Council’s budget for 2019/20 of $550,000.

PNAL has prepared its draft SOI

for the 2020/21 year and this is being considered under a separate

report.

3. NEXT

STEPS

PNAL will prepare and forward

an annual report after 30 June 2020.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the outcomes of the City Development Strategy

|

|

The recommendations contribute

to the achievement of action/actions in the Strategic Transport Plan

The action is: Work with the

airport company to ensure the airport’s strategic intent aligns with

the City’s aspirations

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

This report outlines progress

to date.

|

|

|

|

Attachments

|

1.

|

PNAL Interim Report to 31 December 2019 ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 18

March 2020

TITLE: Palmerston

North Airport Ltd - Draft Statement of Intent for 2020/21

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

|

RECOMMENDATION(S) TO Council

1. That the

Palmerston North Airport Ltd (PNAL) draft Statement of Intent for 2020/21 be

received and PNAL be advised that the Council supports the proposed direction

and implementation strategy.

2. That PNAL

also be advised that in the interests of supporting the proposed Terminal

Development Plan, the Council agree to an amendment to the dividend policy

although its expectation is that the dividend payable should increase each

year.

3. That to

recognise this, it is proposed the new dividend policy be as follows:

Dividend Policy

The shareholder’s expectation is that a

dividend of 40% of after-tax profit be paid. To facilitate PNAL’s

investment in the Terminal Development Plan (TDP), PNAL will seek to limit

the dividend to $600,000 for 2019/20, $650,000 for 2020/21; $700,000 for

2021/22 and 2022/23 with the balance that would usually be paid being

re-invested in the TDP.

|

1. ISSUE

To present and provide comment

on the draft Statement of Intent for Palmerston North Airport Ltd (PNAL) for

2020/21.

2. BACKGROUND

2.1 Introduction

PNAL is deemed a

Council-Controlled Trading Organisation (CCTO) under the Local Government Act

2002. A CCTO must deliver a draft Statement of Intent (SOI) to

shareholders by 1 March each year and adopt it by 30 June. The Council

must, as soon as possible after a draft SOI is delivered to it agree to a

CCTO’s SOI or, if it does not agree, take all practicable steps under

clause 6 of Schedule 8 of the Local Government Act 2002 to require the SOI to

be modified. The Board of the CCTO must consider any shareholder feedback

by 1 May.

The Council’s reason for

its shareholding in PNAL is to ensure that the capacity and image of the

City’s key transportation gateway is consistent with the Council’s

economic development objectives.

As a CCTO PNAL is required under the Local Government Act

2002 to have the following principal objective:

· Achieve

the objectives of its shareholders, both commercial and non-commercial, as

specified in the Statement of Intent; and

· Be

a good employer; and

· Exhibit

a sense of social and environmental responsibility by having regard to the

interests of the community in which it operates and by endeavouring to

accommodate or encourage these when able to do so; and

· Conduct

its affairs in accordance with sound business practice.

The Council’s

shareholding represents 100% of the issued and paid-up capital.

2.2 Draft

SOI - overview

Attached is a letter

from PNAL to shareholders explaining the enclosed draft SOI and

outlining the key assumptions.

The draft SOI retains the

vision from the current year ‘New Zealand’s leading regional

airport’. However, a new purpose statement “Launching our

communities into a promising future” has been introduced and the

strategic objectives sections have been updated and extended to include

‘Culture’.

It has been assumed the airport

will operate as a Tier 2 domestic regional one over the next three years.

Modest passenger growth is assumed in 2020/21 accelerating in the following two

years to the point of nearing terminal capacity. Revenue and operating

expenses are forecast to increase as a consequence.

PNAL is working proactively

with Air New Zealand to sustainably grow the Auckland - Palmerston North route,

maintaining and growing frequency but increasing capacity at peak times.

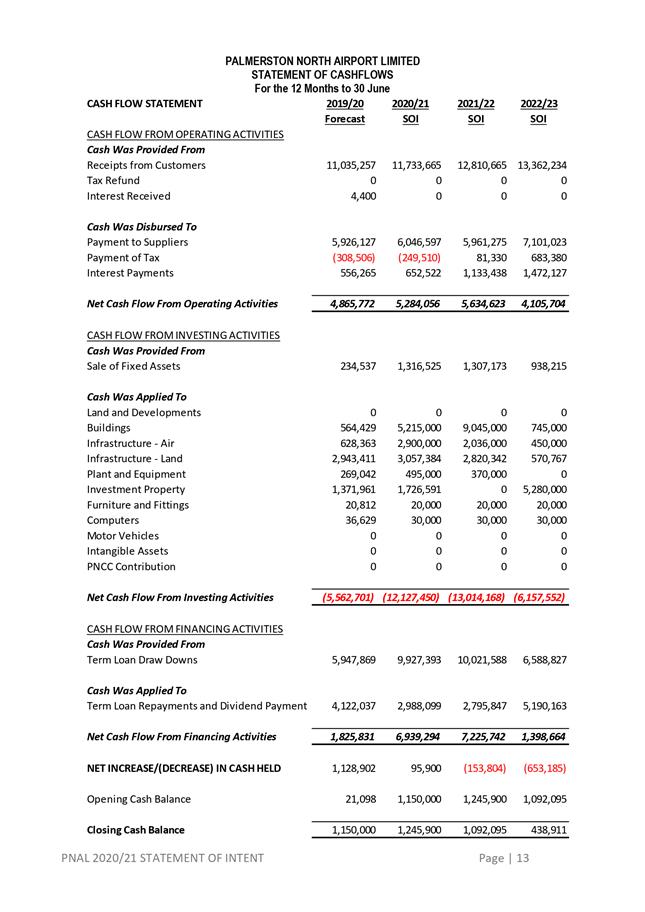

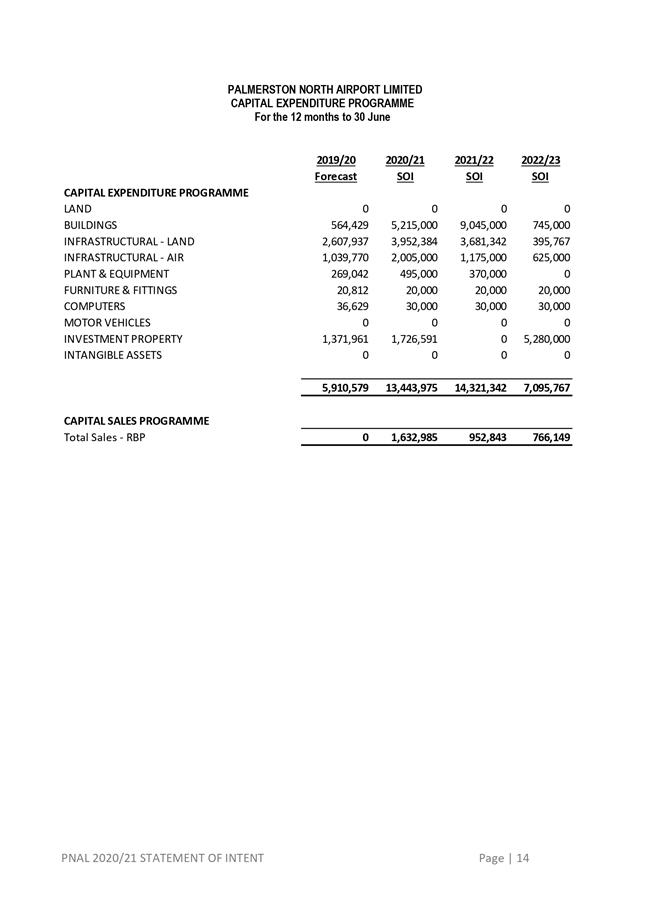

The draft SOI contains an

assumption that capital expenditure of $34.8m will be phased across the three

years, funded in part ($3.4m) from the sale of non-strategic land and a net

increase of $17.4m in term borrowing, with the balance from retained earnings.

A significant component of the

capital programme ($15m) relates to the proposed Terminal Development Plan,

including a proposed extension to the footprint of the building to cope with

increased passenger volumes and the possibility of passenger security screening

being mandated for tier 2 regional airports.

The SOI also provides for the

on-going development of the Ruapehu Business Park.

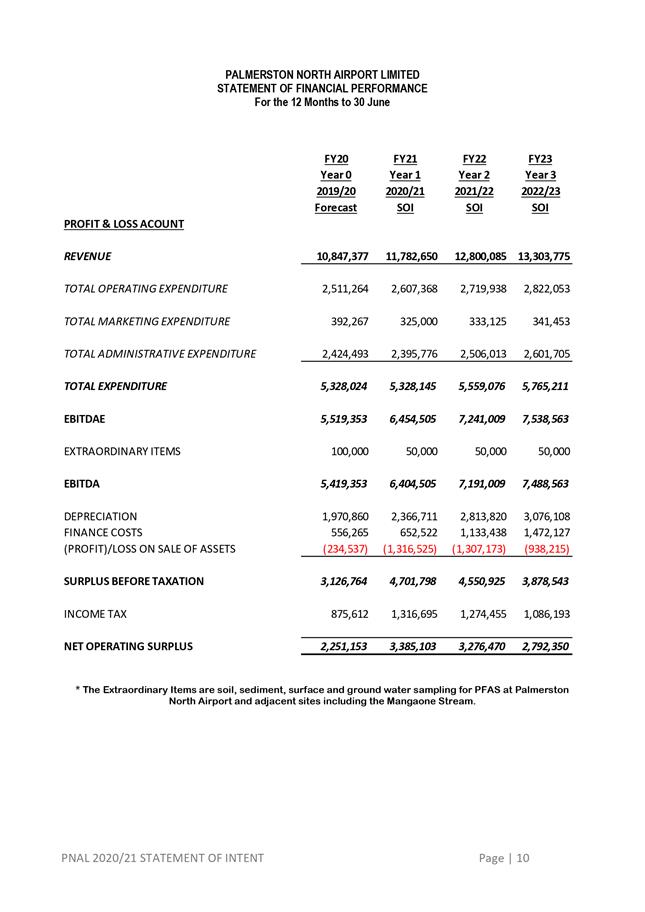

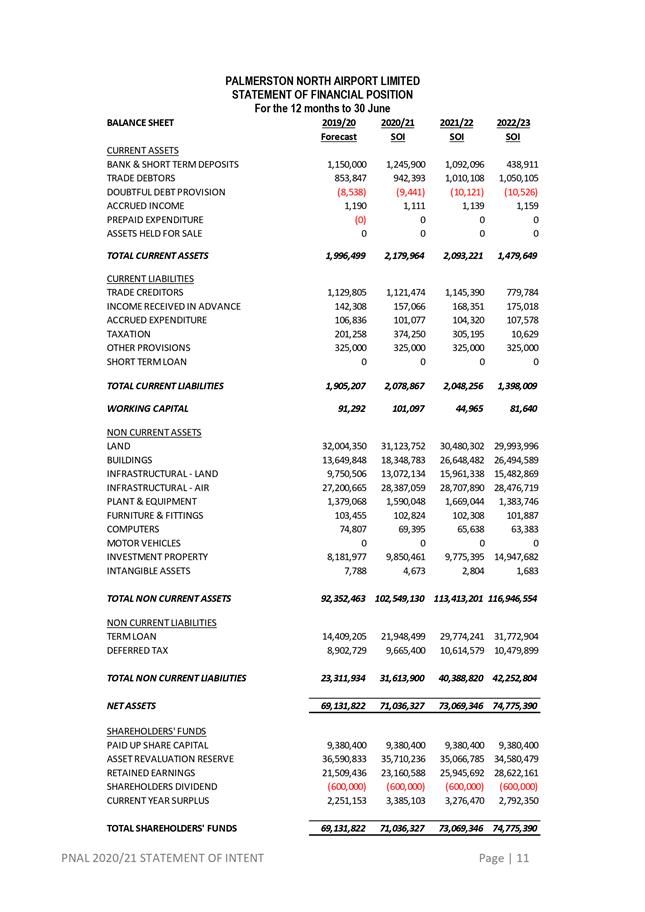

Shareholders’ funds are

forecast to reduce marginally to 68% then 63% of total assets through the

three-year term of the SOI. This is still well above the

expectation that it will remain over 40%.

2.3 Draft

SOI – Performance targets

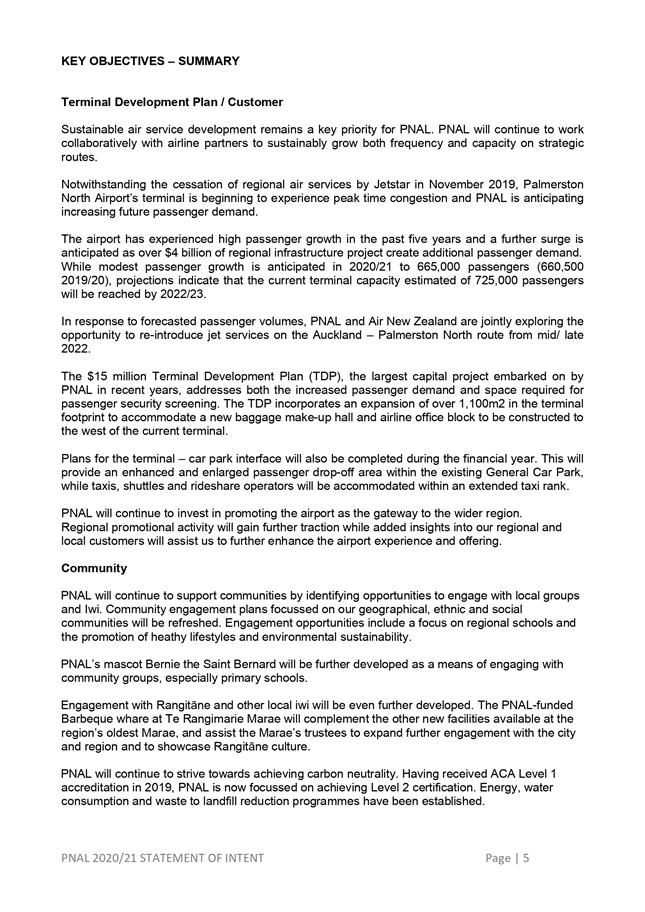

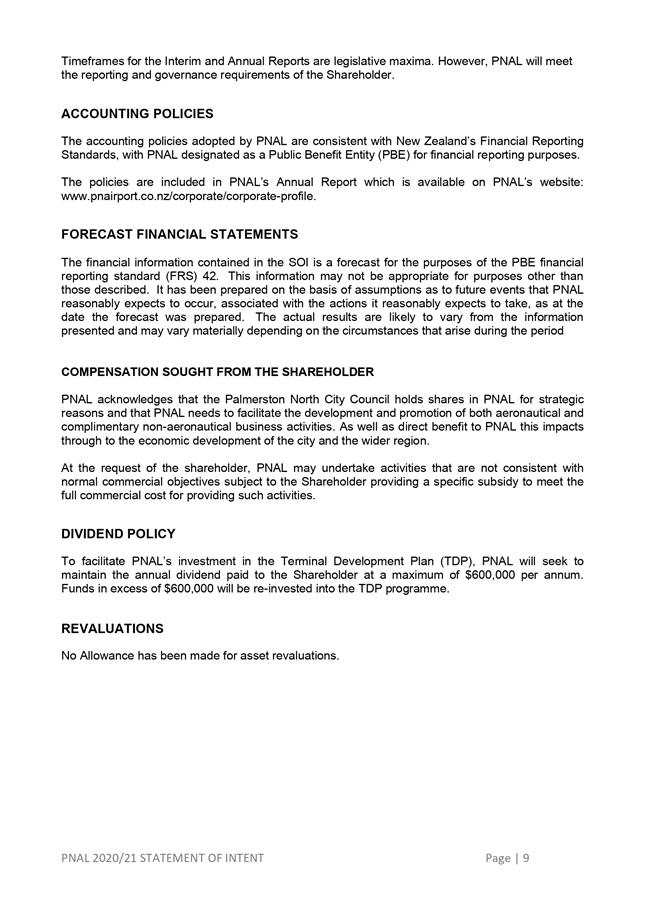

The following financial

performance targets are included:

|

|

Draft SOI

2020/21

Budget

|

SOI

2019/20

Budget

|

|

NPBIT: Total assets

|

6%

|

6%

|

|

NPAIT: Shareholders’

funds

|

5%

|

3.1%

|

|

Shareholders’ funds:

Total assets (>40%)

|

68%

|

69%

|

|

Interest cover (>2.25)

|

8.2

|

4.8

|

|

Tangible Net Worth (>$50m)

|

$71m

|

$63.1m

|

|

Dividends - % of NPAT

|

$600k

(equates 17.7%)

|

40%

|

Non-financial targets relate

to:

· Maintaining

a customer satisfaction Net Promoter score of 55 or above (measured annually

– target 55 for 2020/21)

· Serving

665,000 passengers during the 2020/21 year increasing to 705,000 for the

following year and 725,000 in the June 2023 year (660,500 forecast for 2019/20)

· Maintaining

Civil Aviation Rule Part 139 certification

· Zero

lost time injuries to those who work within the airport community

· Safety

management system implemented

· Executing

the roadmap to carbon neutrality

· Achievement

of emission reduction & energy consumption reduction targets.

· Completing

35% of the terminal development during 2020/21

2.4 Draft

SOI – Dividend policy

Council’s 10 Year Plan

2018-28 assumes PNAL will pay the Council shareholder dividends of $600,000

during 2020/21 increasing to $650,000 for 2021/22 and $700,000 for the

following years.

PNAL has incorporated an SOI

assumption the dividend payment will be limited to $600,000 in 2020/21 and in

each of the next three years. The Board has sought Council agreement to

this arrangement as a means of enabling PNAL to invest a greater level of

retained earnings in the terminal development plan.

If the Council were to be paid

dividends representing 40% of tax paid surplus (as in the past) the dividend

for 2019/20 (based on the forecast year end position) that is payable in

2020/21 would amount to $900,000 and dividends for the succeeding three years

would be $1.36m, $1.31m and $1.12m.

A portion of the after-tax

profit in each year is assumed to be derived from the net profit on the sale of

assets. If these were removed from the dividend calculation then at 40%

projected dividends payable to the Council would be $830,000 in 2020/21 then

$980,000, $940,000 and $840,000 in the succeeding three years.

If the Council agreed with the

dividend being limited to $600,000 p.a. then over the four year period the

potential dividend being retained by PNAL would amount to $2.3m (if the profits

from assets sales are included in the dividend calculation) or $1.2m (if they

were not).

The draft SOI contains the

following section relating to dividend policy:

“To facilitate

PNAL’s investment in the Terminal Development Plan (TDP), PNAL will seek

to maintain the annual dividend paid to the Shareholder at a maximum of

$600,000 per annum. Funds in excess of $600,000 will be re-invested into the

TDP programme.”

In assessing PNAL’s

dividend policy change request it is suggested the following be amongst the

matters that are considered:

· Is

the proposed terminal development essential for the future success of PNAL and the

city?

An appropriately sized, functional & inviting

terminal is an important element of Council’s strategy for investing in

the airport company i.e. capacity and image of a key transportation gateway.

Airport companies to the east and west of the City

are investing heavily in terminal redevelopment so it is important the City

maintain its facilities to a standard that meets the expectations of a growing

City and the travelling public.

There is strong evidence the City will grow

significantly in the near future so it is realistic to believe this will mean

growing air passenger numbers and more demand on the current facilities.

The existing terminal facilities have an estimated

capacity of 725,000 passenger movements p.a. (current 660,500). Based on PNAL’s

latest forecasts this level of passenger movements may be reached by Year 3 of

the SOI and therefore start to constrain passenger growth with flow on impacts

on our city and regional economies, including the various regional

infrastructure projects planned.

It is not certain PNAL will be mandated to add new

security screening facilities, but it is possible and therefore it is prudent

to be capable of handling such an eventuality.

PNAL and Air NZ are working on a plan to reintroduce

jet services on the Auckland – Palmerston North route by late 2022, early

2023. The re-introduction of Jet services will require the terminal

development to have been completed due to the anticipated growth in passenger

volumes using the terminal at peak times, and because Jet operations will

trigger a mandatory requirement for passenger and hold bag screening to be

introduced.

· Is

PNAL capable of funding the development without undue financial risk, if the

present dividend policy of 40% is retained?

The forecasts of financial performance are based on

a number of significant assumptions about passenger numbers, revenue growth

etc. However, it appears PNAL may be capable of paying a higher dividend

than proposed without putting the company at risk of breaching any covenants.

Limiting the dividend distribution does mitigate against this risk. It is

recognised as well that this development is being proposed without needing to

seek additional capital from the Council as shareholder.

· Is

it reasonable that PNAL retain all surpluses from its property development and

they be excluded from any dividend calculation?

The SOI does assume an after-tax profit in relation

to asset sales of approximately $2.6m over the three-year period. It

seems not unreasonable that PNAL retains these profits to re-invest in terminal

development.

· If

PNAL is successful in its application to the Provincial Growth Fund for a

five-year interest free loan would this alter Council’s views about

dividend policy?

For every $5m of interest free loan PNAL would save

approximately $200,000 p.a. in interest. Assuming this would lead to a

higher taxable profit of $200,000 the saving would be approximately $160,000

p.a. after tax. Savings of this magnitude would enable PNAL to pay a higher

dividend without impacting on its financial position.

· Does

the Council rely on the payment of dividends?

Council has set budgets that make conservative

assumptions about what dividend might actually be paid by PNAL. This

recognises there is a reasonable level of risk PNAL will face market conditions

or extra-ordinary events that will impact on its after-tax profits and

therefore ability to generate dividends. Council’s main reason for

investing in PNAL is not a financial but a strategic one relating to the provision

of a key transportation gateway i.e. it is seen as being a key part of the

City’s infrastructure.

The Council will face increasing pressure on its

ability to fund services, facilities and infrastructure over the next few years

and efforts are being made to find alternate funding sources to help moderate

the impact on rates. Although it may be a worthwhile thing to do,

foregoing potential dividend income does not assist this quest.

Directors of companies have an

obligation to undertake appropriate solvency tests each year before declaring a

dividend. A dividend in any year is therefore subject to successfully

completing this test.

Whether or not to agree to

PNAL’s dividend policy request is a judgement call by the Council.

If the Council believes it does

wish to support PNAL’s request it is suggested PNAL be advised the

proposed SOI dividend policy wording be amended, as follows, to more clearly

outline Council expectations:

“Dividend Policy

The shareholder’s

expectation is that a dividend of 40% of after-tax profit be paid. To

facilitate PNAL’s investment in the Terminal Development Plan (TDP), PNAL

will seek to limit the dividend to $600,000 per annum from 2019/20 until

2022/23 with the balance that would usually be paid being re-invested in the TDP.”

Another option could be to

include provision for the limit to be $600,000 for 2019/20 and an increasing

sum in the following years. Such an outcome could be embraced in a policy

such as:

“Dividend Policy

The shareholder’s expectation is that a dividend of

40% of after-tax profit be paid. To facilitate PNAL’s investment in

the Terminal Development Plan (TDP), PNAL will seek to limit the dividend to

$600,000 for 2019/20, $650,000 for 2020/21; $700,000 for 2021/22 and 2022/23

with the balance that would usually be paid being re-invested in the

TDP.”

This latter option is being recommended.

3. NEXT

STEPS

The Council can either endorse

the SOI as presented or make suggestions for change to a greater or lesser

extent. The proposed dividend policy is the most significant matter upon

which feedback is to be given.

PNAL is obliged to consider

shareholder comments by 1 May then decide whether or not to make any changes to

the draft when adopting the final SOI before 30 June 2020.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the outcomes of the City Development Strategy

|

|

The recommendations contribute

to the achievement of action/actions in the Strategic Transport Plan

The action is: Work with the

airport company to ensure the airport’s strategic intent aligns with

the City’s aspirations

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The draft Statement of Intent

includes a direction and specific actions that are designed to continue to

improve the airport for customers and stimulate growth

|

|

|

|

Attachments

|

1.

|

PNAL - Cover letter for draft SOI 2020/21 ⇩

|

|

|

2.

|

PNAL Draft SOI for 2020/21 ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 18

March 2020

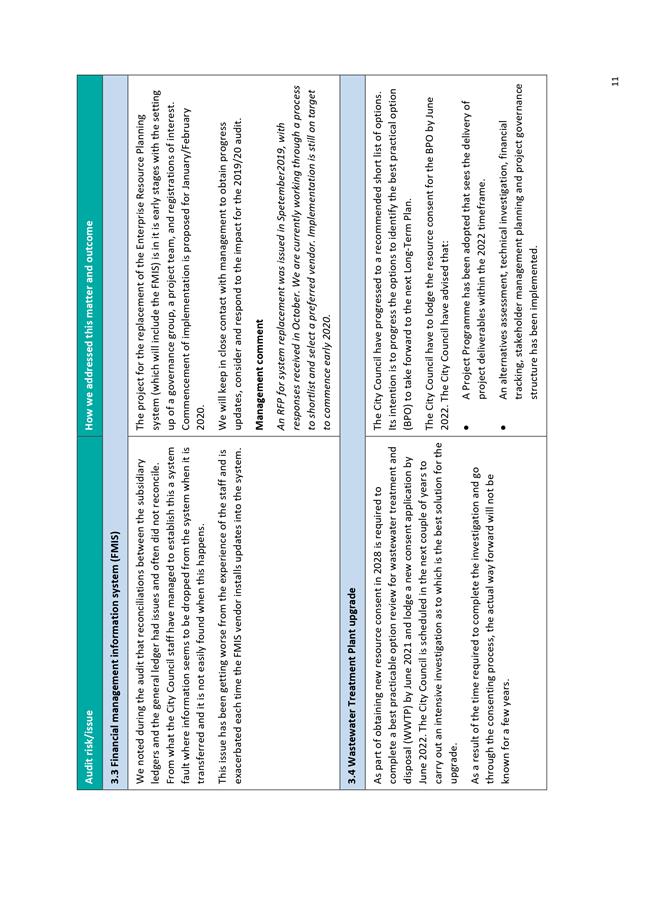

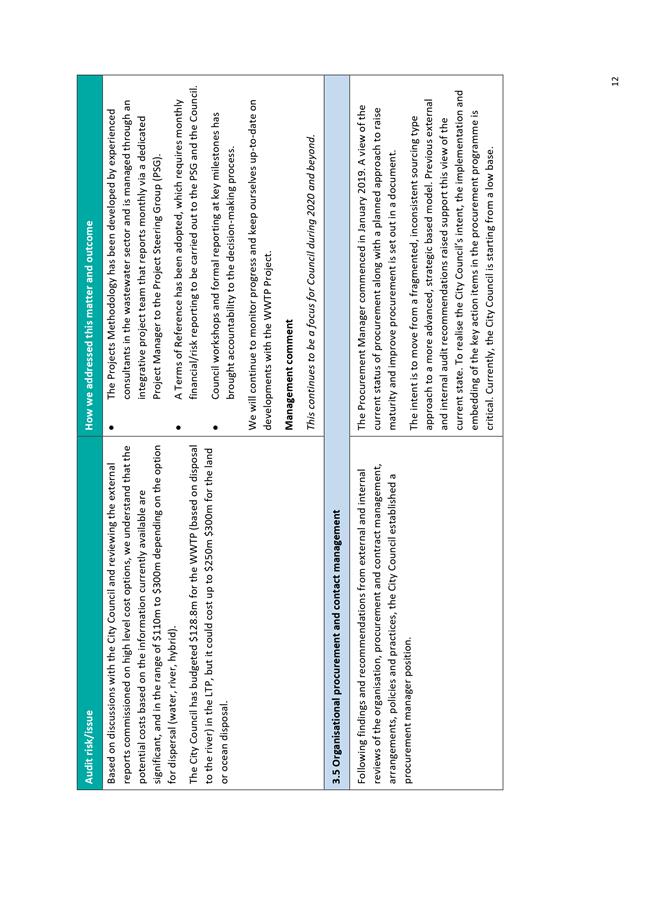

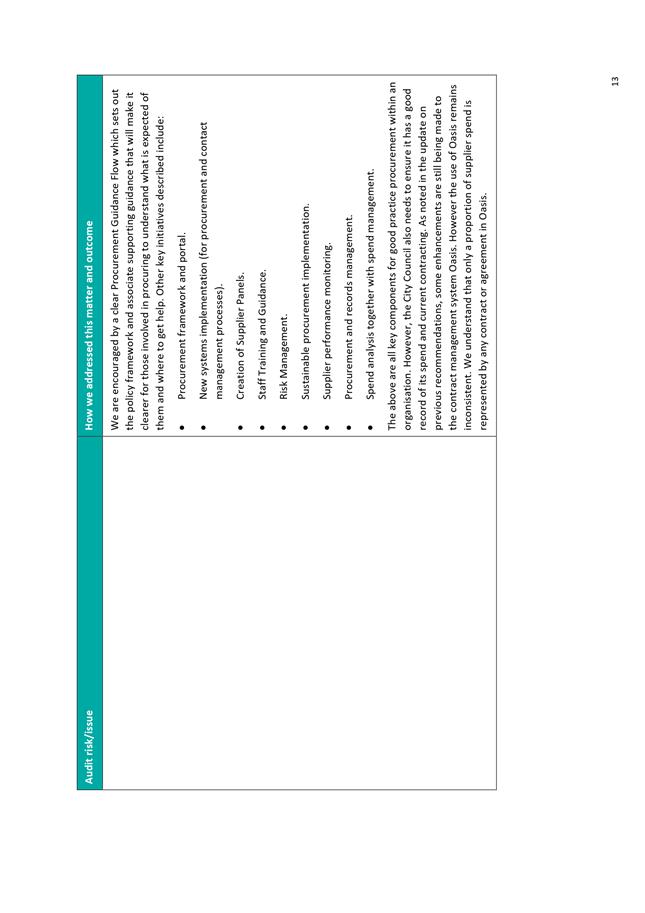

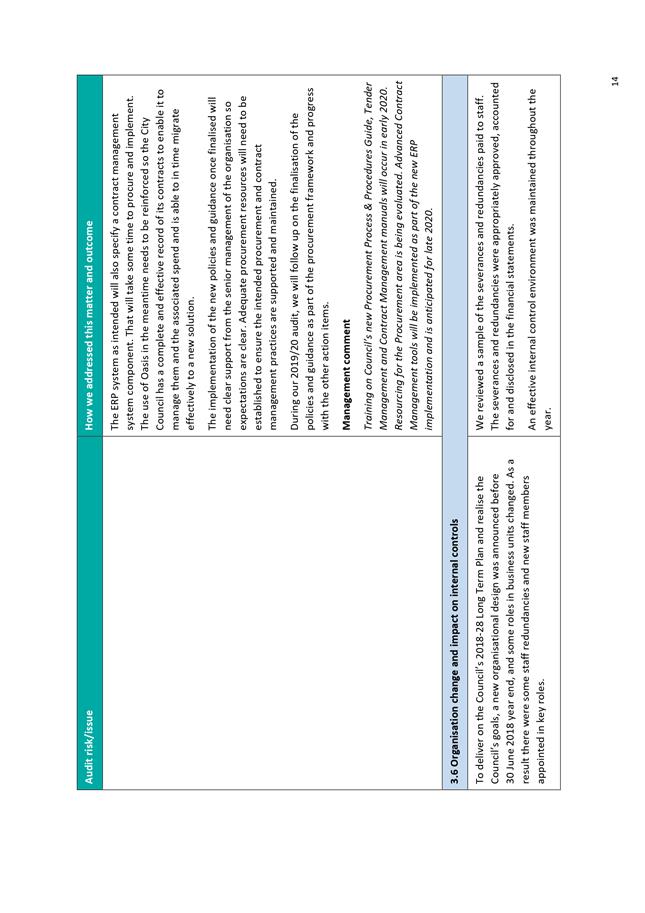

TITLE: Audit

New Zealand Report to Council

Presented By: Stuart

McKinnon, Chief Financial Officer

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

|

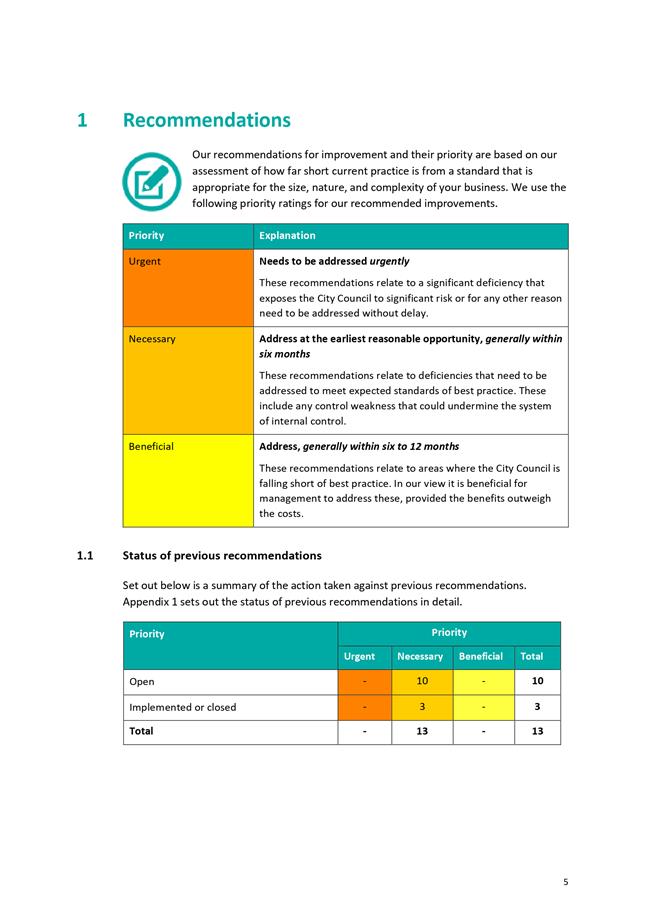

RECOMMENDATION(S) TO Finance & Audit Committee

1. That the

interim 2018/19 Management Report from Audit New Zealand be received.

2. That the

final 2018/19 Management Report from Audit New Zealand be received.

|

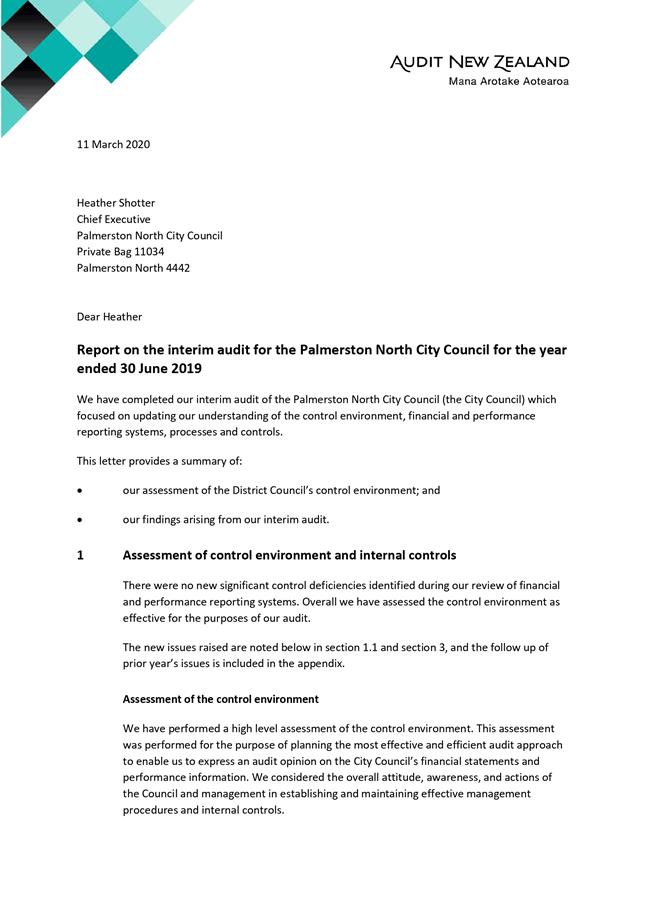

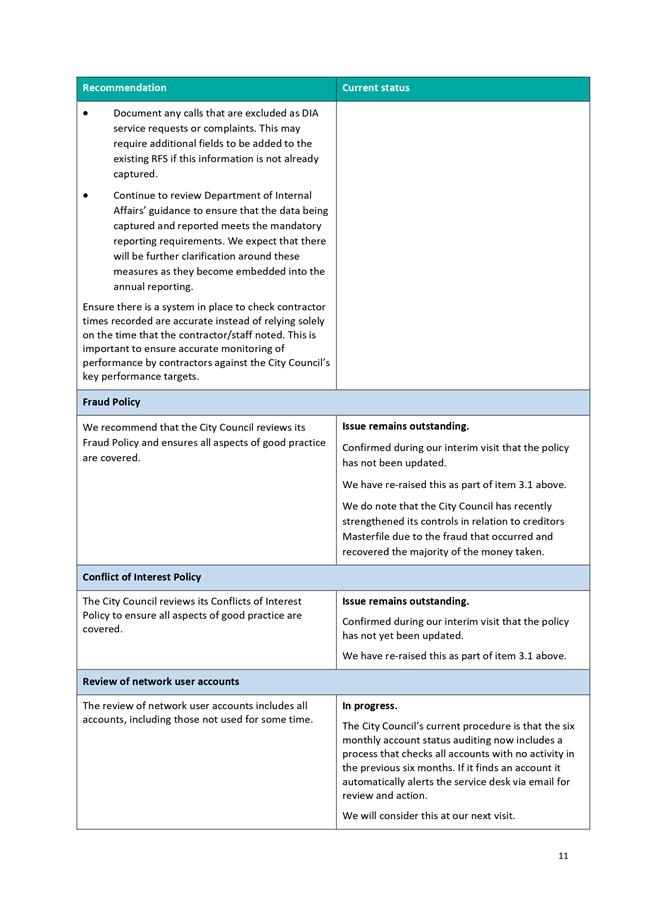

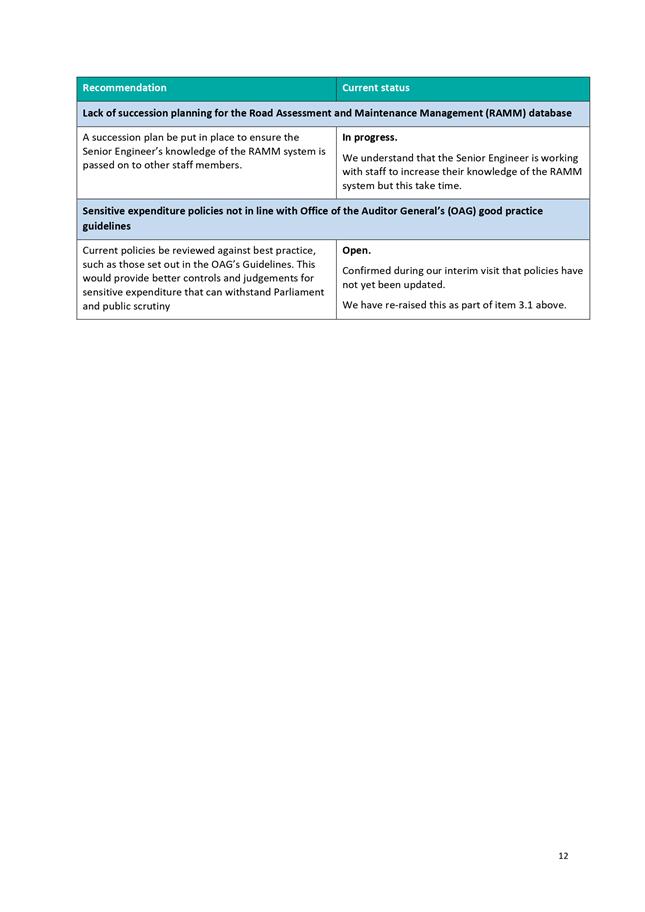

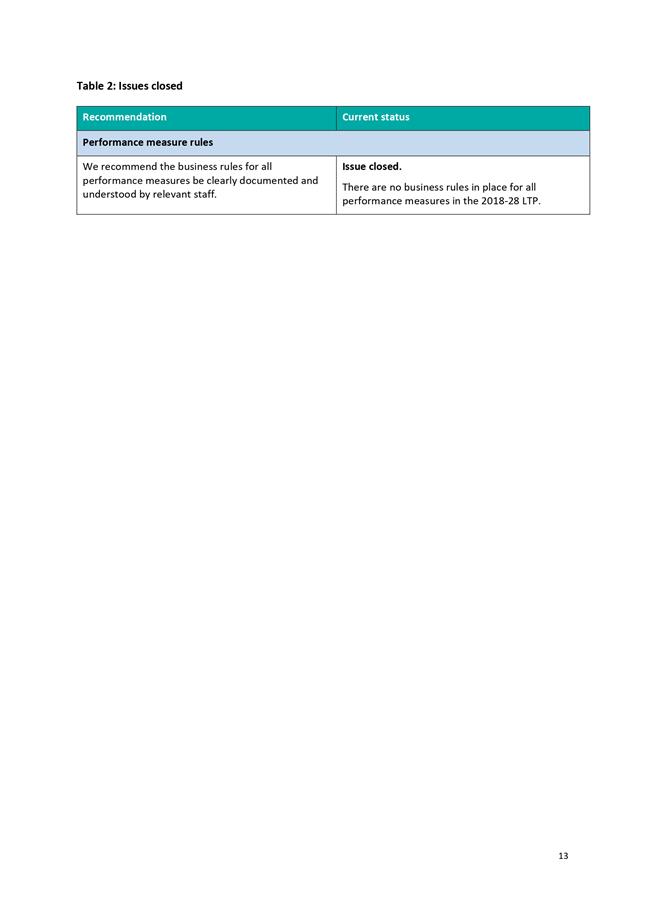

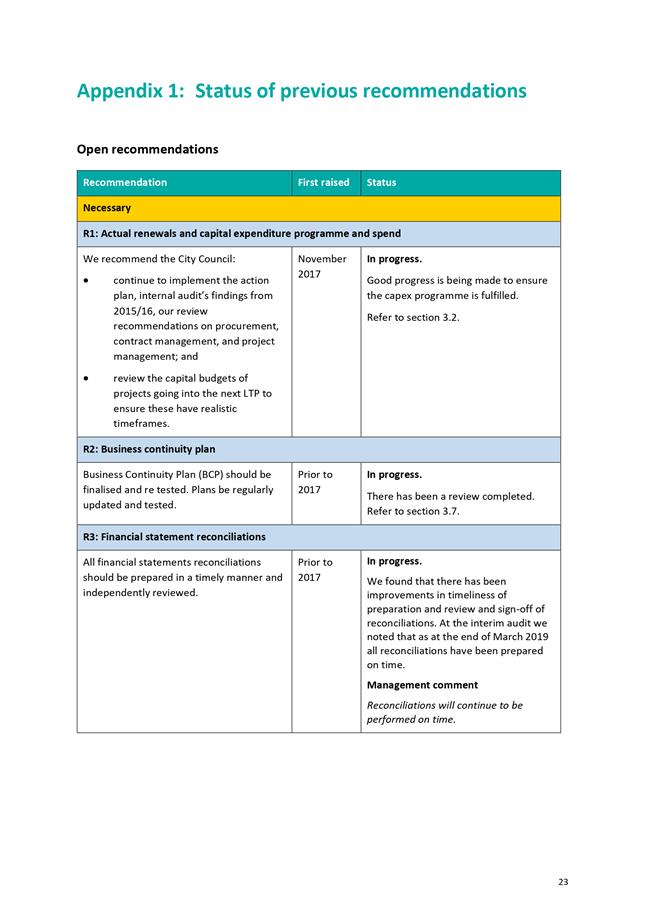

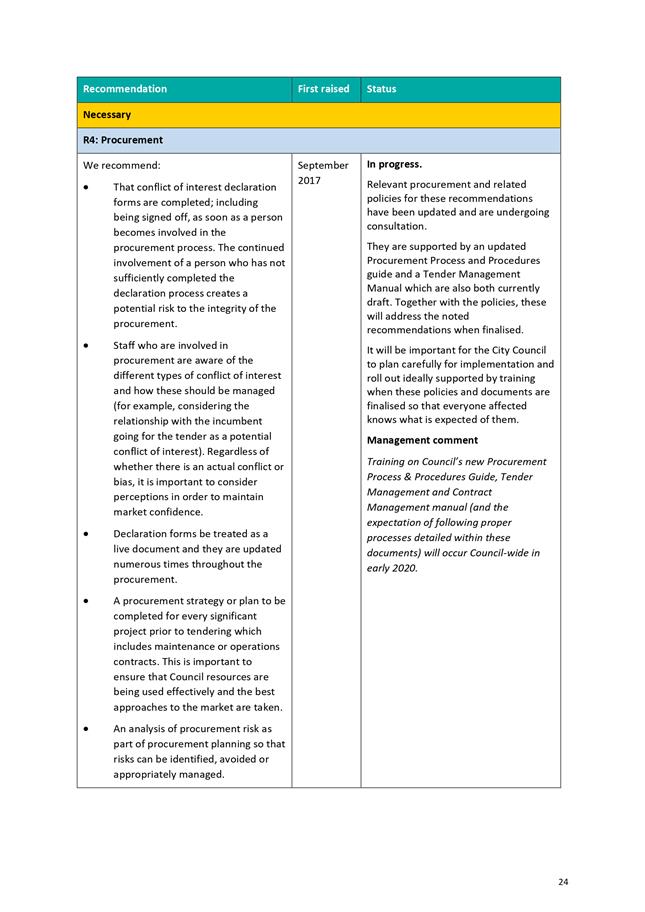

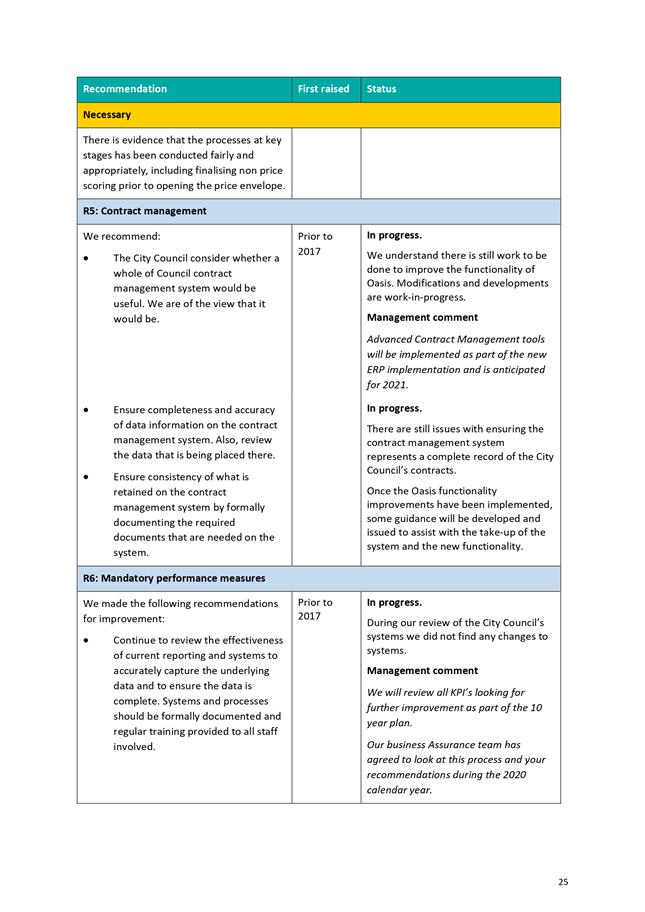

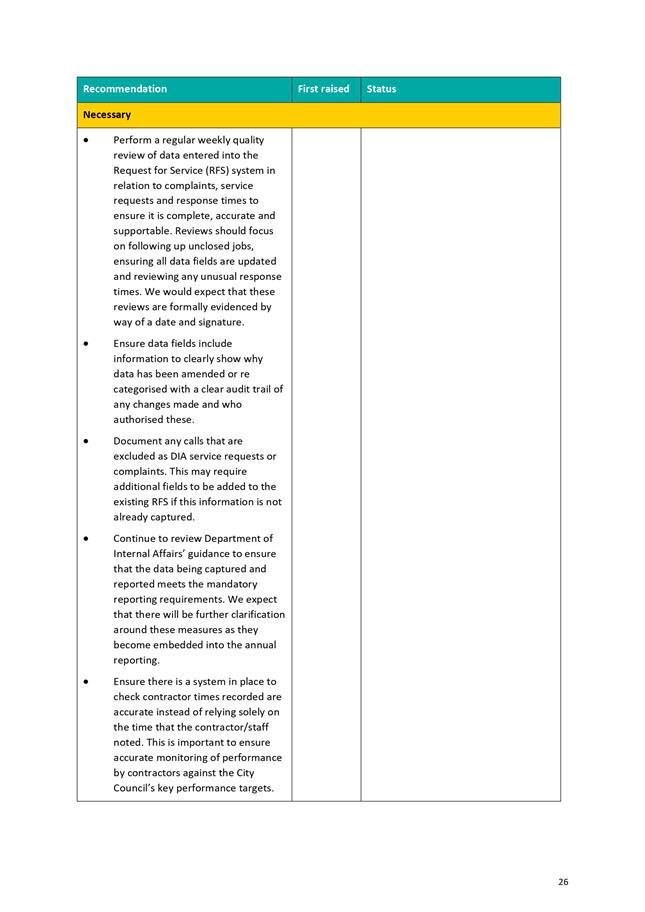

1. ISSUE

The interim and final reports on the audit of the

Council for the year ended 30 June 2019 have been received from the Council

Auditors, Audit New Zealand. In the reports, the auditors outline

significant matters considered, and areas of interest they have reviewed during

the course of their audit. Where applicable, management have commented on audit’s

recommendations and these are incorporated in the report. This report

includes an update on the matters outstanding from previous reports.

Where appropriate, management will be reviewing

and considering the recommendations for implementation.

2. NEXT

STEPS

It is recommended that the

Committee receive the interim and final 2019 audit management reports.

3. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

If Yes quote relevant clause(s)

from Delegations Manual <Enter text>

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 5: A Driven and Enabling Council

|

|

The recommendations contribute

to the outcomes of the Driven and Enabling Council Strategy

|

|

The recommendations contribute

to the achievement of action/actions in a plan under the Driven and Enabling

Council Strategy

The action is: to enable Council

to exercise governance by reviewing the report of the Auditors relating to

their review of financial performance and operating performance and provide

accountability for these to the public.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

As above.

|

|

|

|

Attachments

|

1.

|

Interim management report to Council 2019 ⇩

|

|

|

2.

|

Final management report to Council 2019 ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Report

TO: Finance

& Audit Committee

MEETING DATE: 18

March 2020

TITLE: Fees

and Charges Review

PRESENTED BY: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

|

RECOMMENDATION(S) TO Council

1. That the

Fees and Charges Review report be received and the current status of fees and

charges be noted.

Trade waste

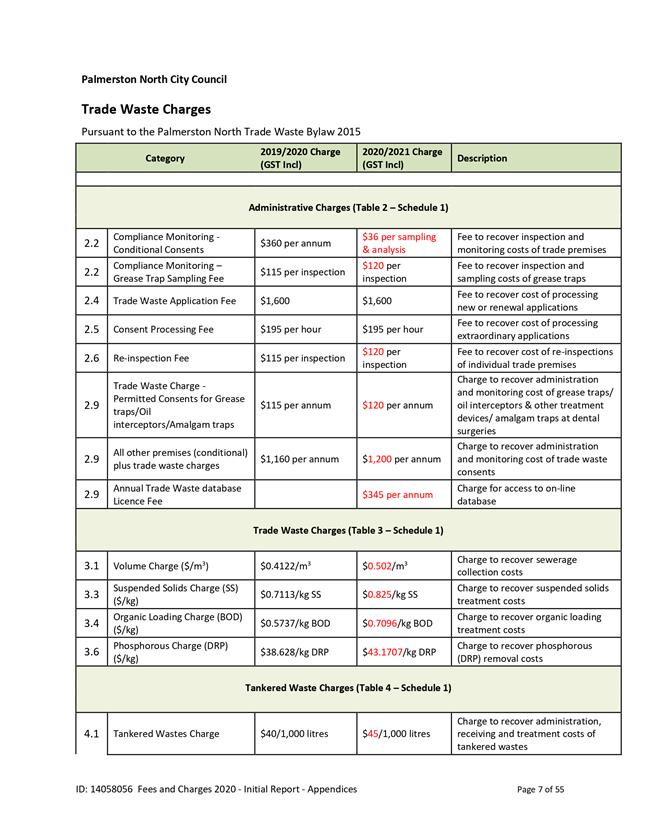

2. That the

proposal to adopt updated fees and charges for Trade Waste services effective

from 1 July 2020 as attached in Appendix 2, be approved for public

consultation and the Chief Executive be authorised to undertake the necessary

consultative process under sections 82 and 150 of the Local Government Act

2002.

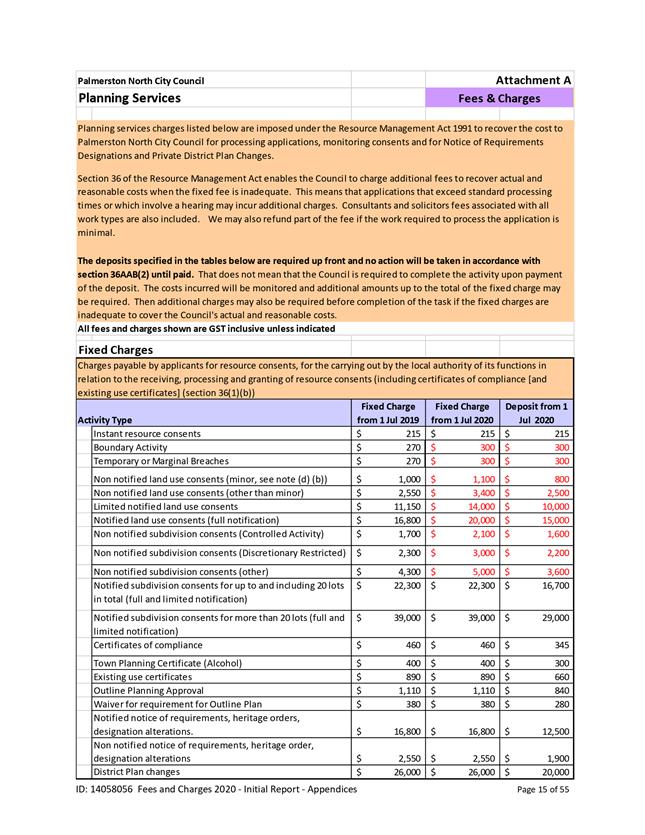

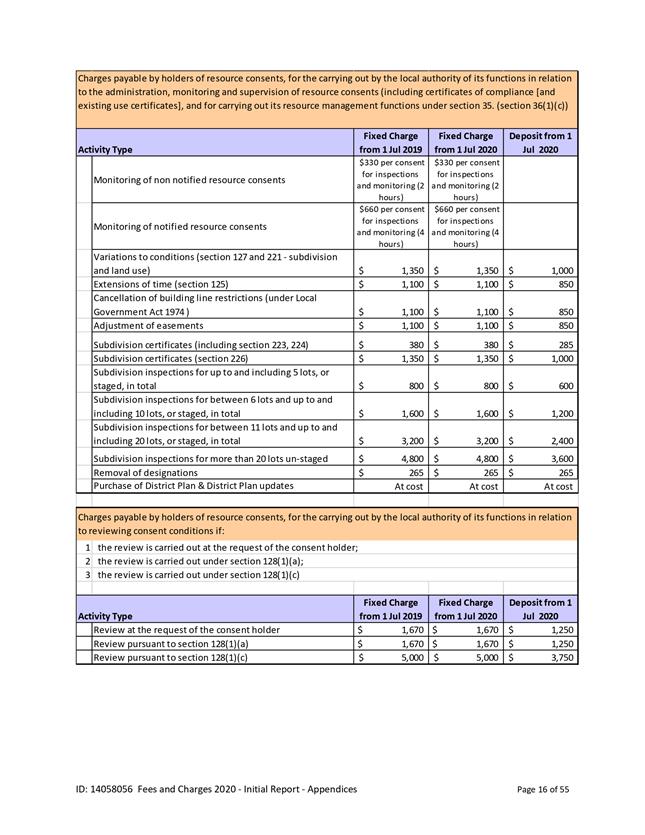

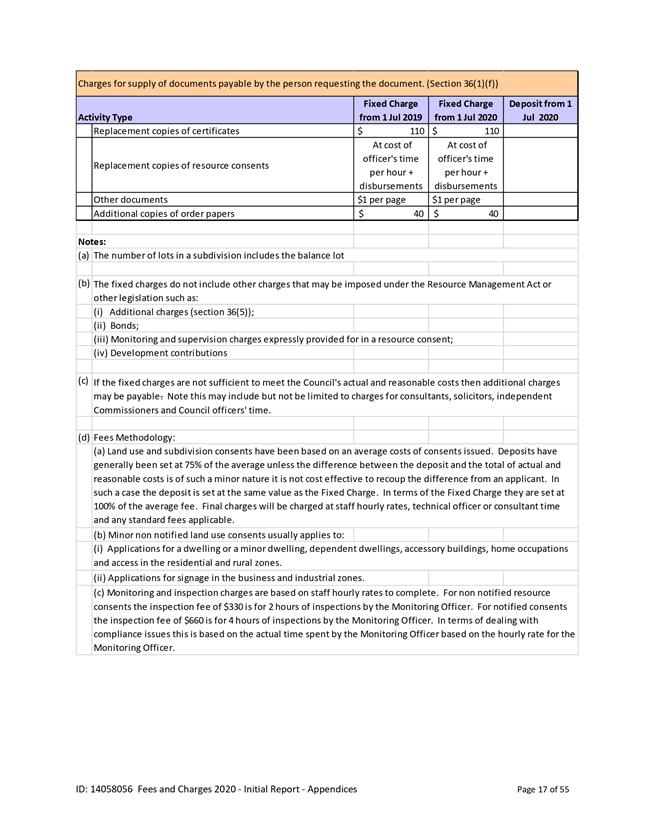

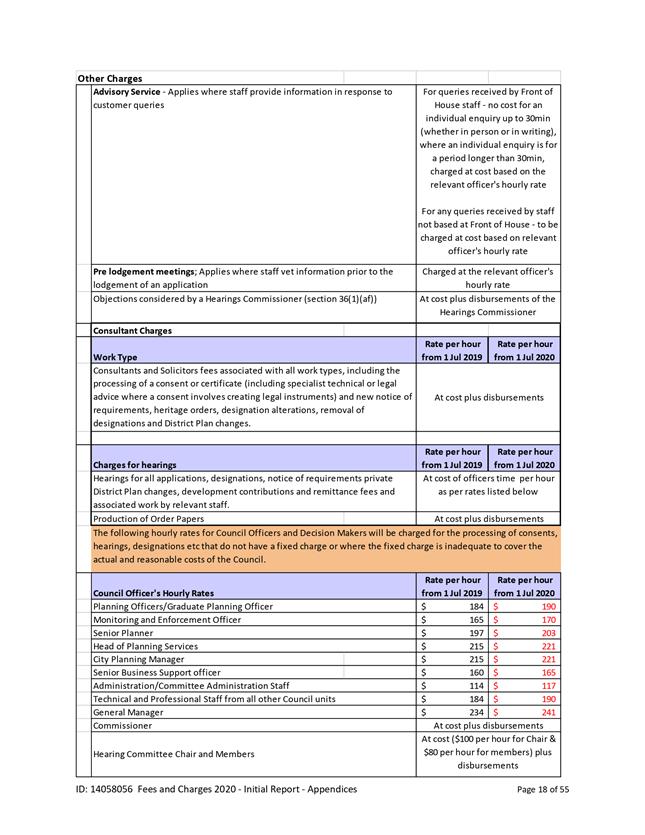

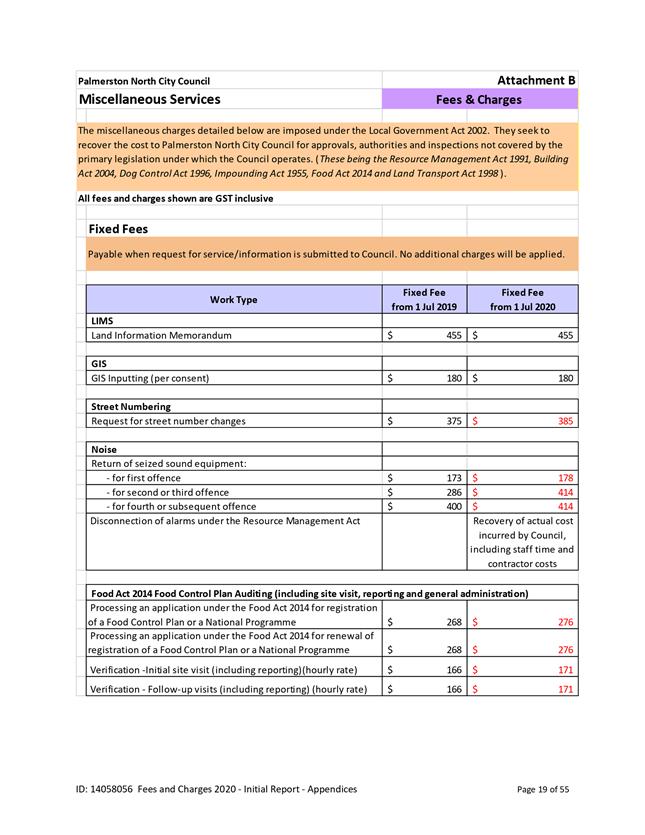

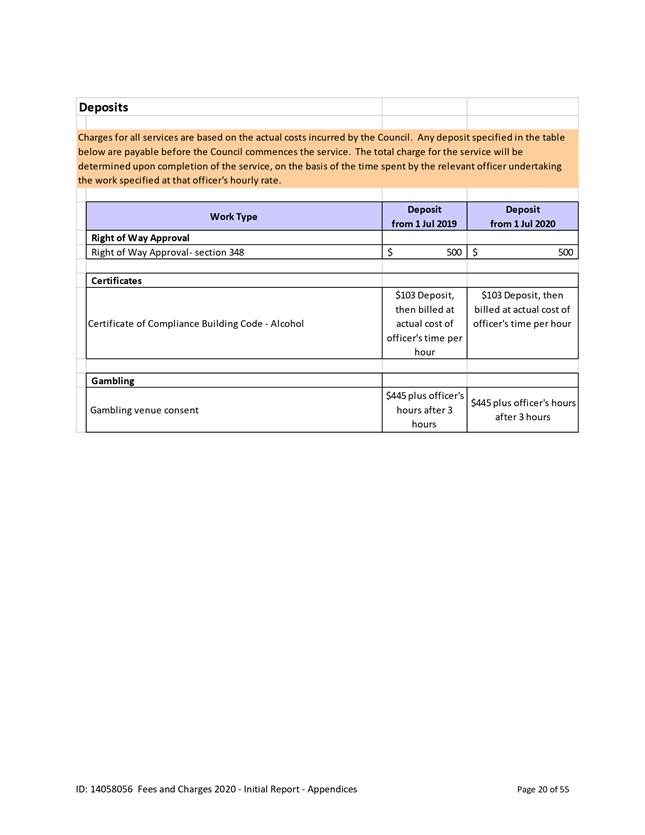

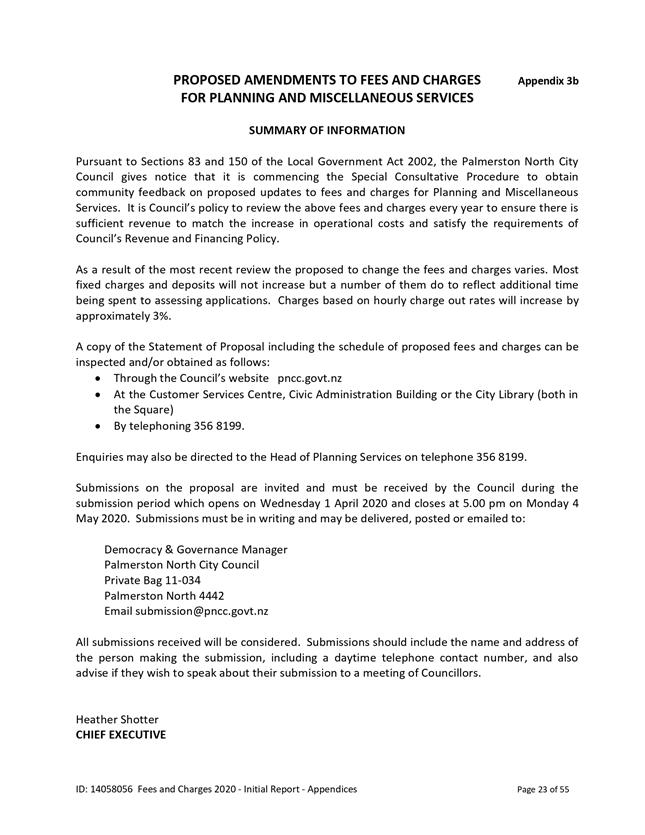

Planning & Miscellaneous

3. That the

Statement of Proposal (and the associated summary) to adopt updated fees and

charges for Planning Services and Miscellaneous Services effective from 1

July 2020 as attached in Appendix 3, be approved for public consultation and

the Chief Executive be authorised to undertake the necessary consultative

process under sections 83 and 150 of the Local Government Act 2002.

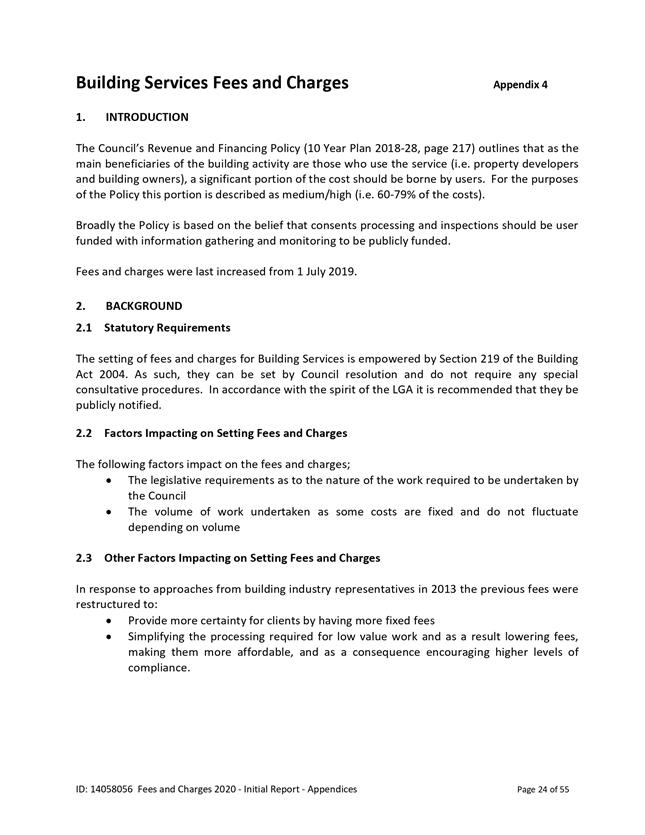

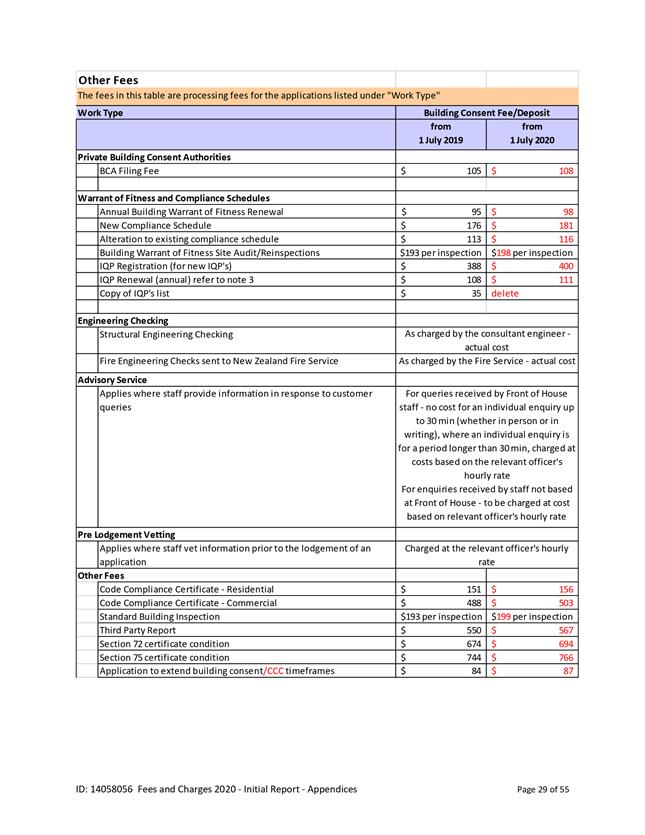

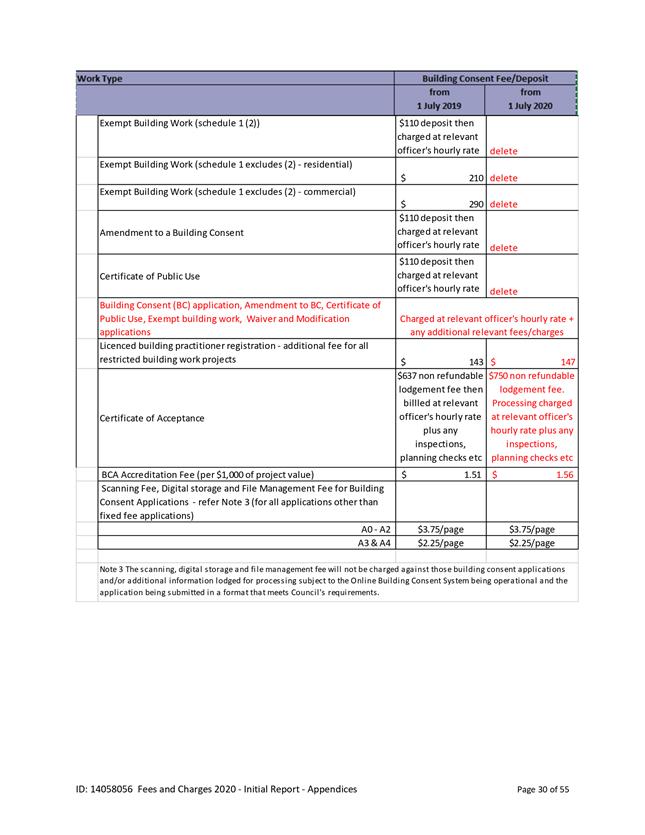

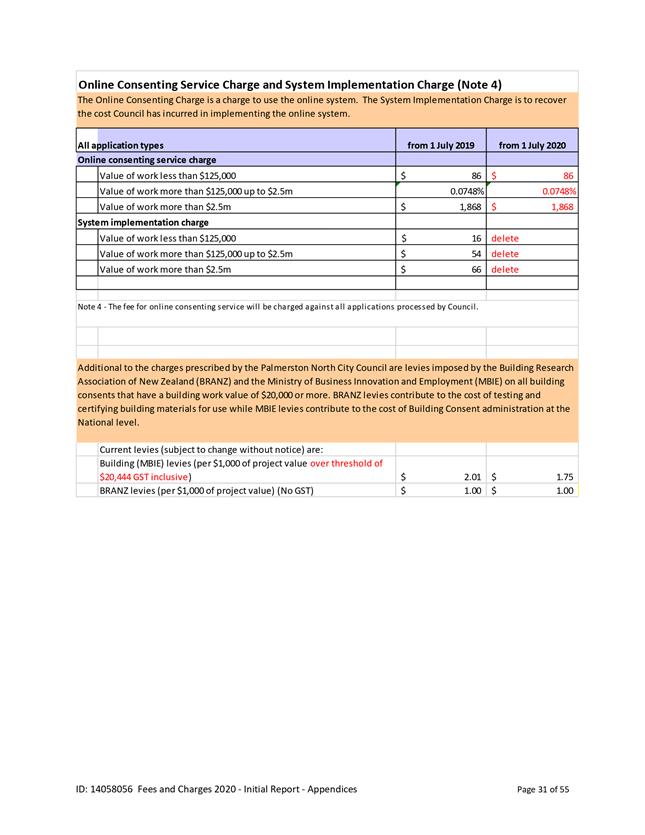

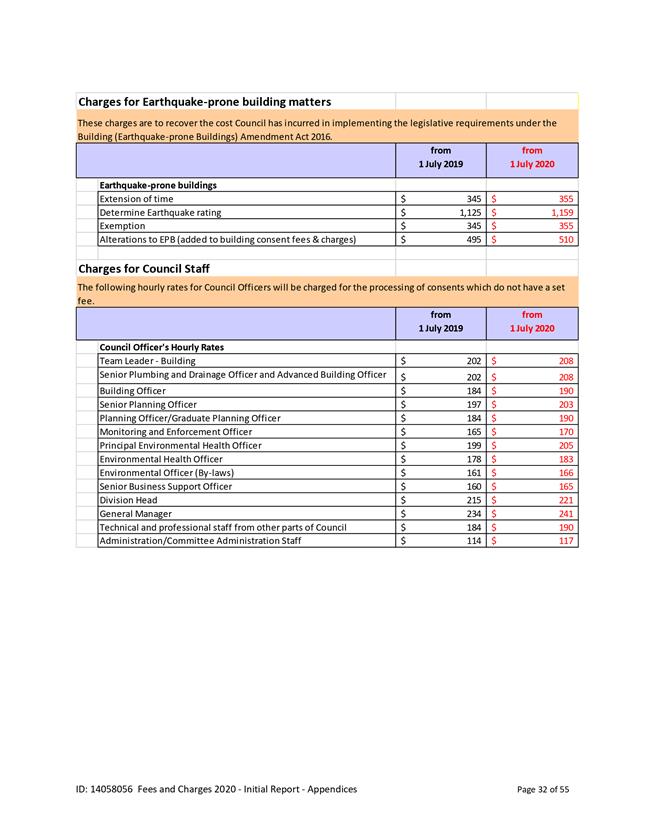

Building

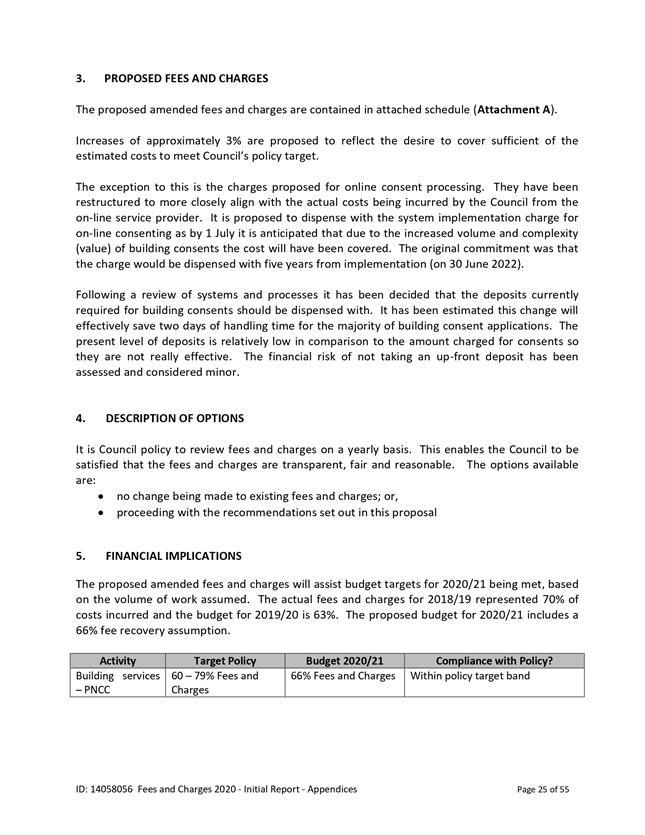

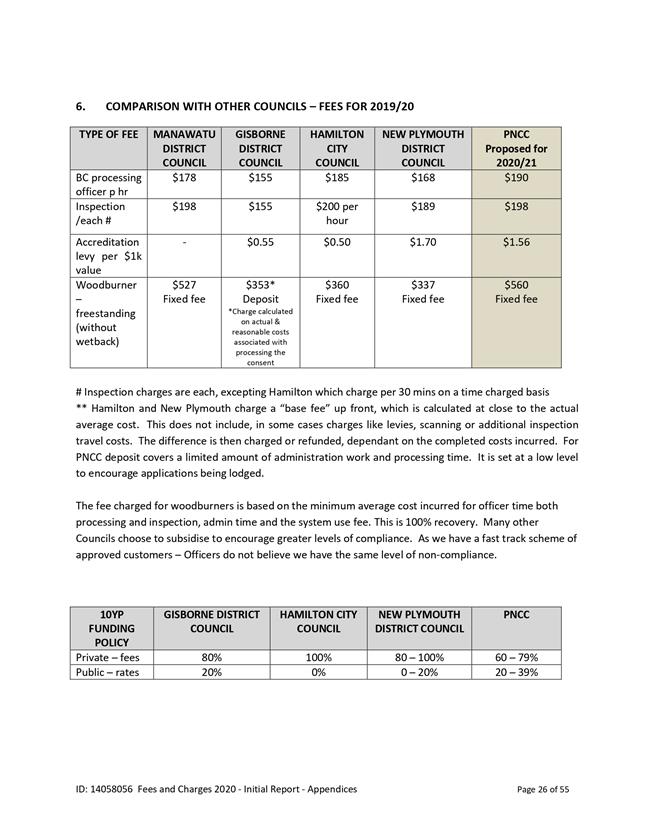

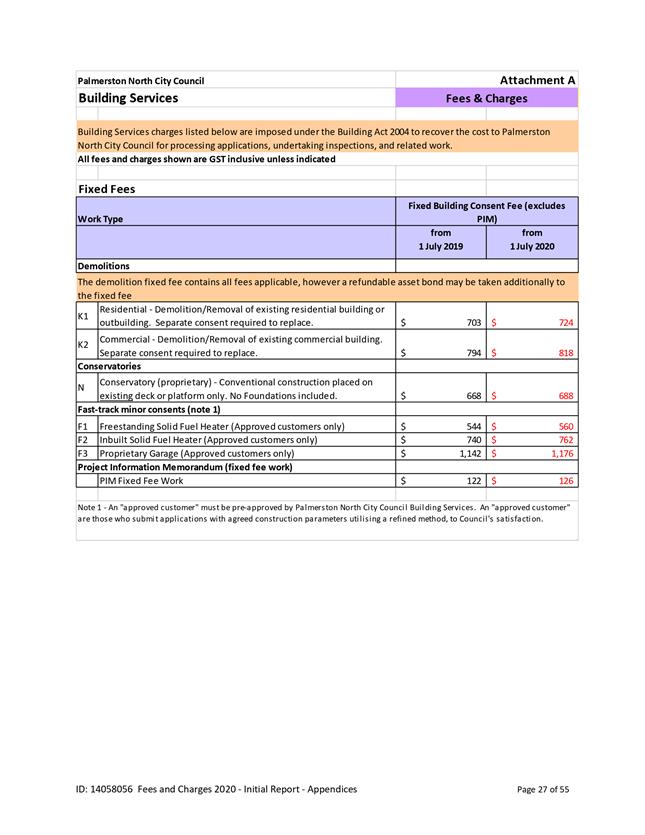

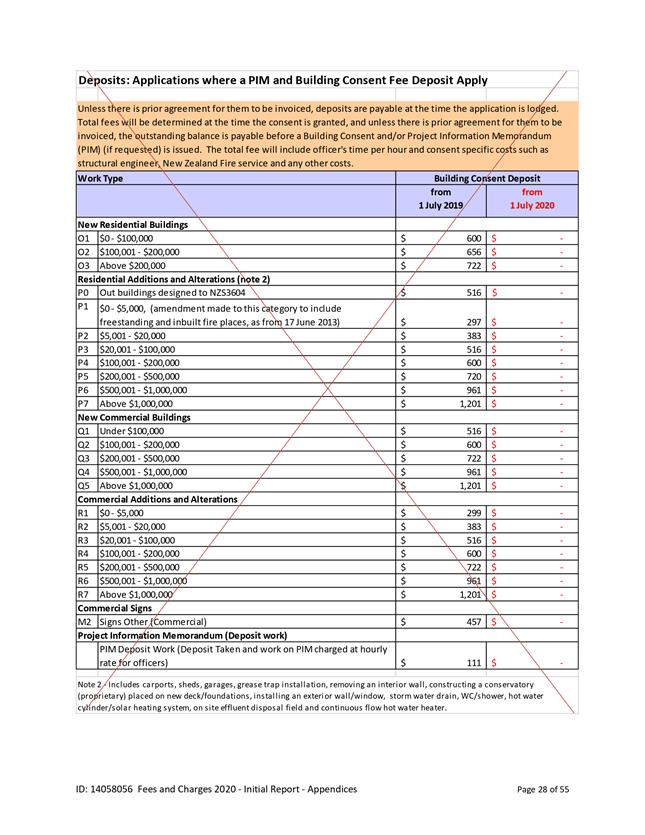

4. That the

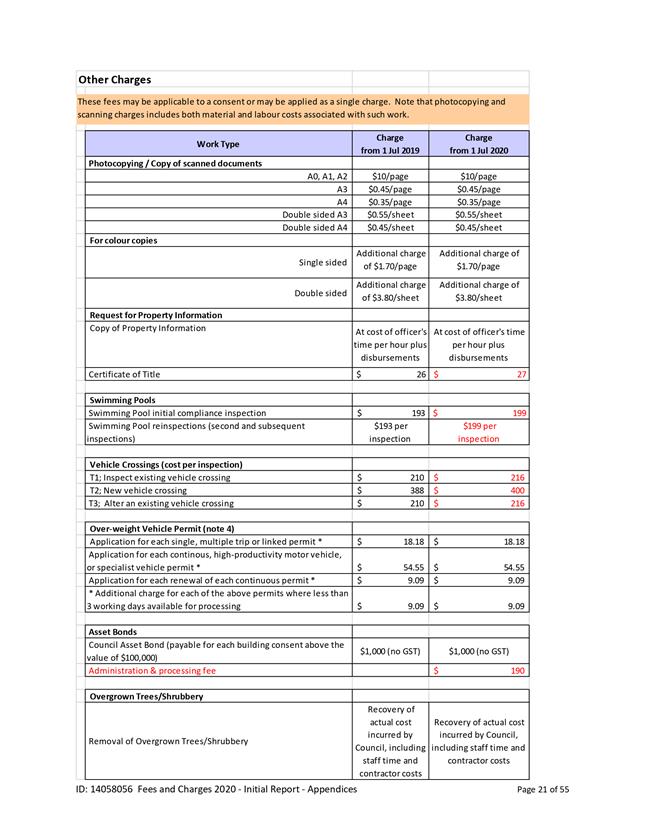

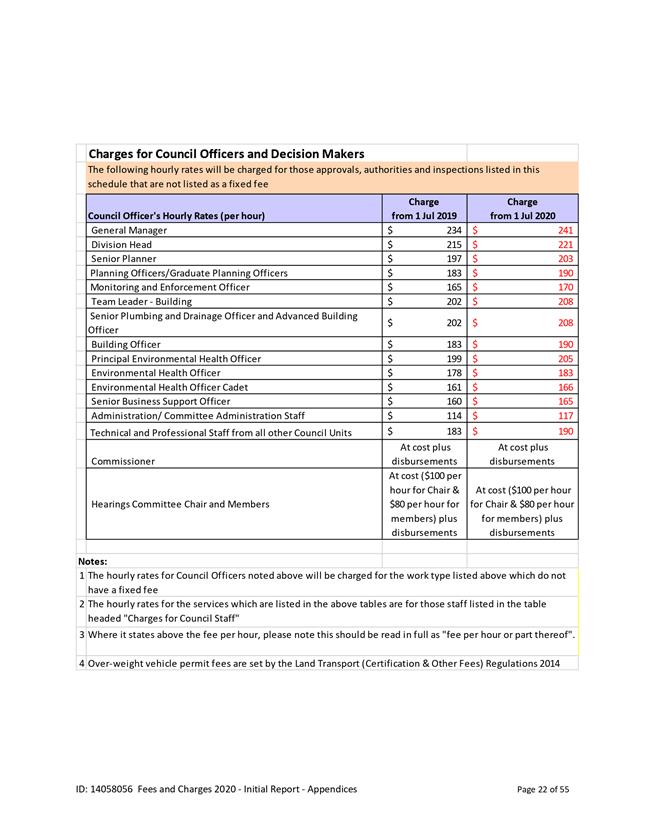

fees and charges for Building Services, as proposed in Appendix 4 be adopted

and following public notification take effect from 1 July 2020.

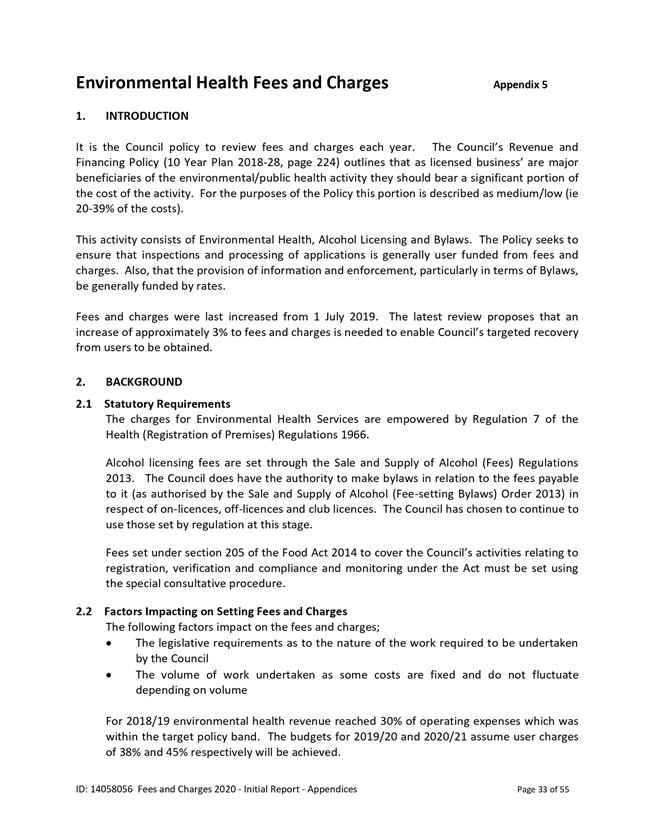

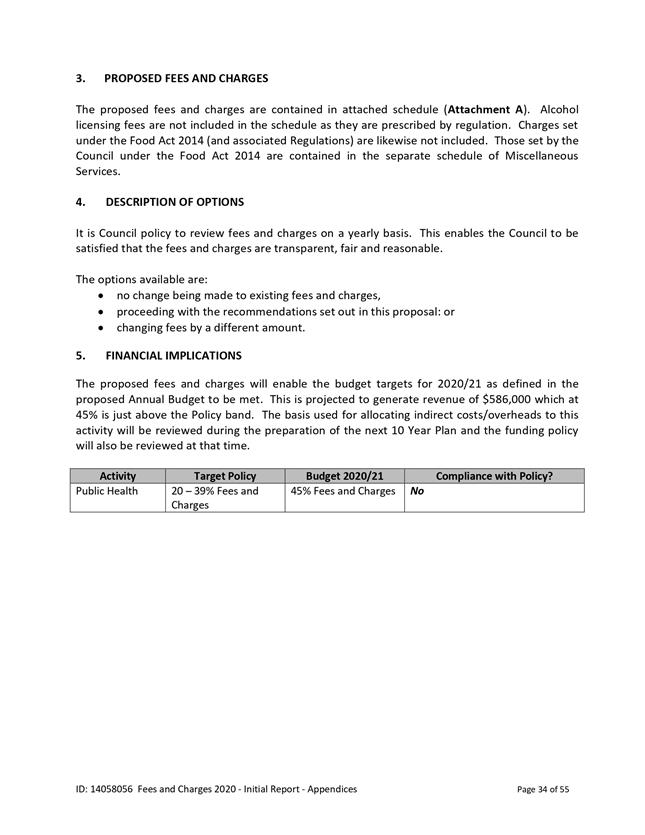

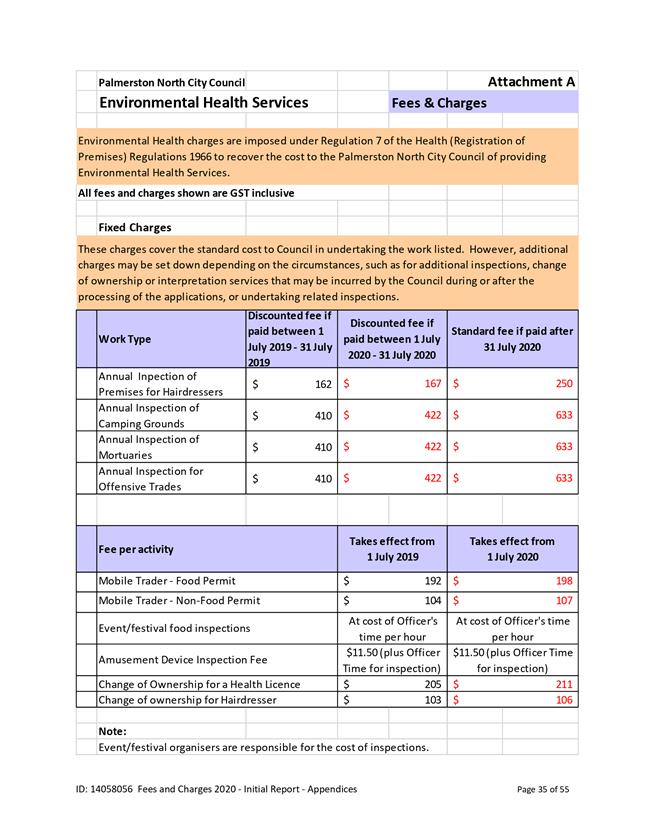

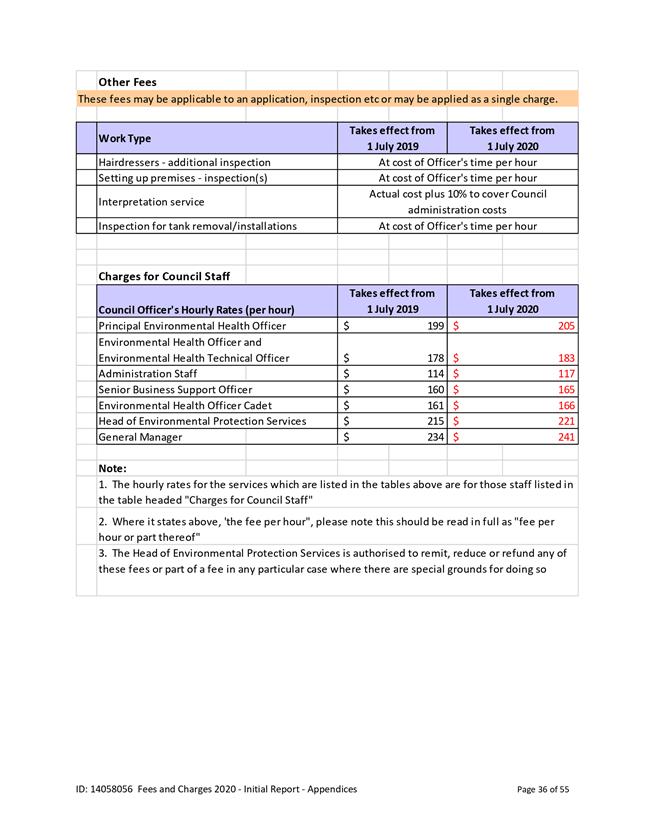

Environmental Health

5. That the

fees and charges for Environmental Health Services (in terms of regulation 7

of the Health (Registration of Premises) Regulations 1966) as proposed in

Appendix 5, be adopted and following public notification, take effect from 1

July 2020.

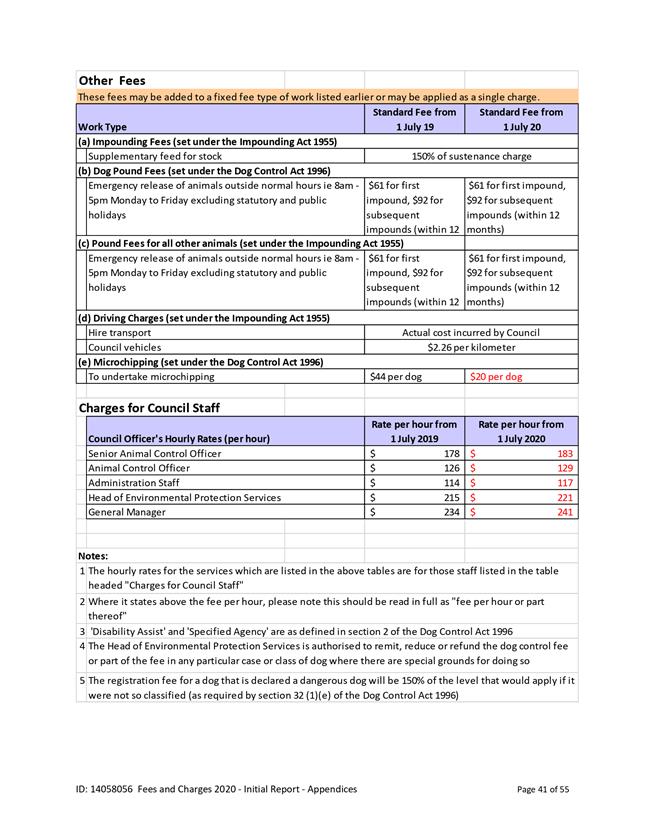

Animal Control

6. That the

fees and charges for the Impounding of Animals (in terms of section 14 of the

Impounding Act 1955) and for Dog Registration and Dog Impounding (in terms of

sections 37 and 68 of the Dog Control Act 1996) as proposed in Appendix 6 be

adopted, and following public notification, take effect from 1 July 2020.

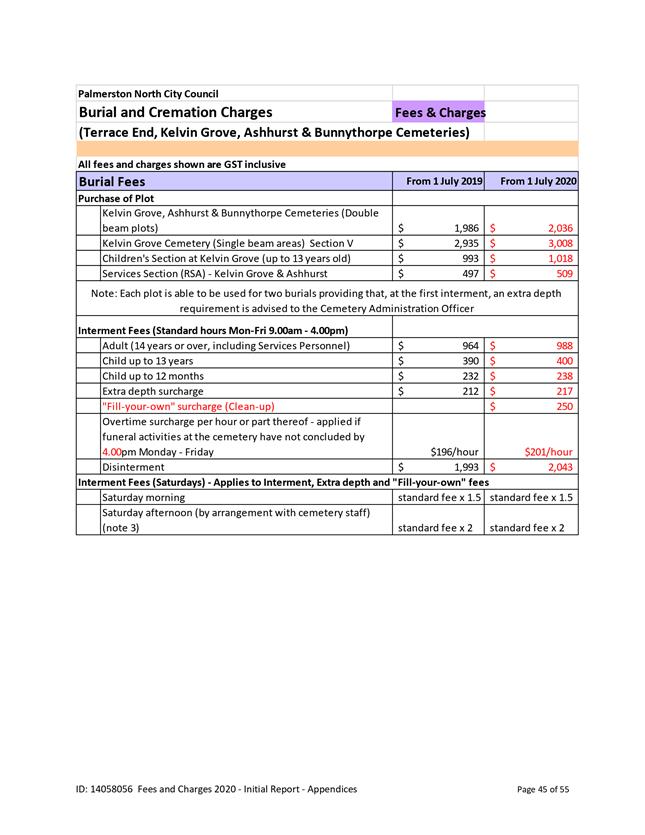

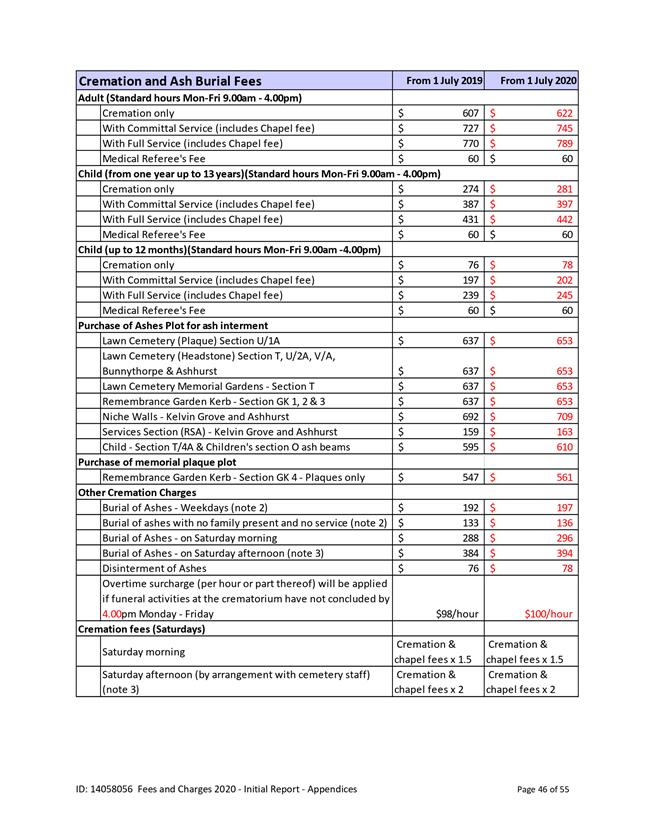

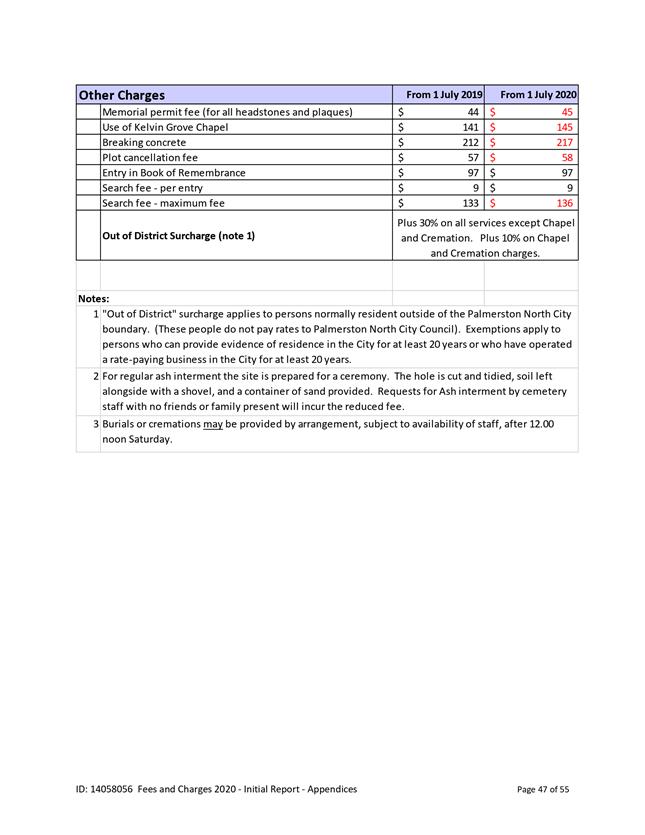

Burial & Cremation

7. That the

fees and charges for Burial and Cremation, as proposed in Appendix 7 be

adopted and following public notification, take effect from 1 July 2020.

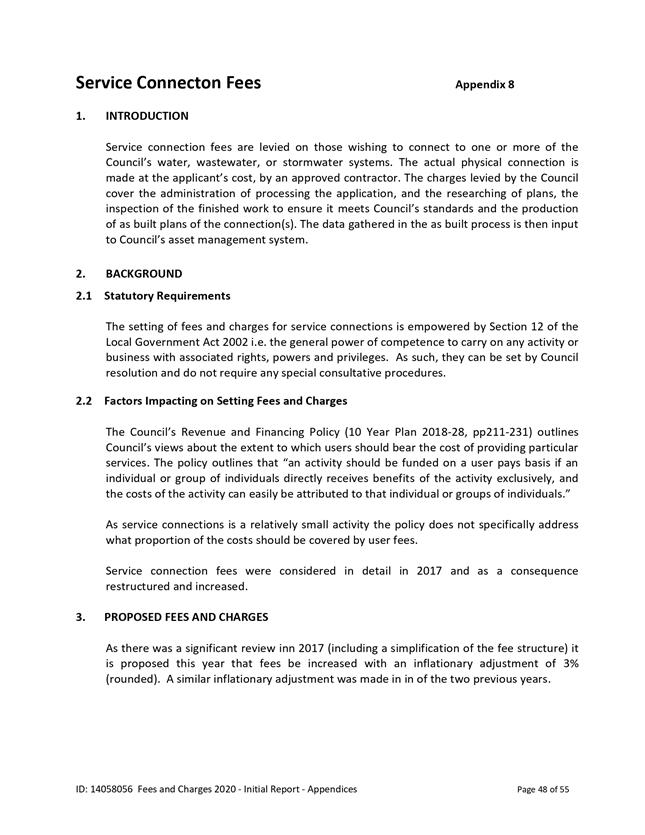

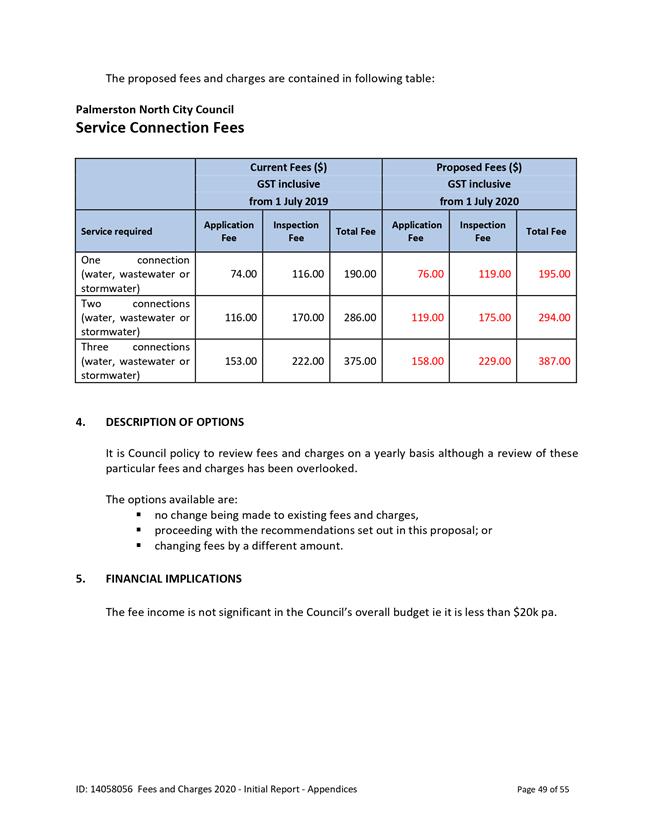

Service Connections

8. That the

fees and charges for Service Connections, as proposed in Appendix 8 be

adopted and take effect from 1 July 2020.

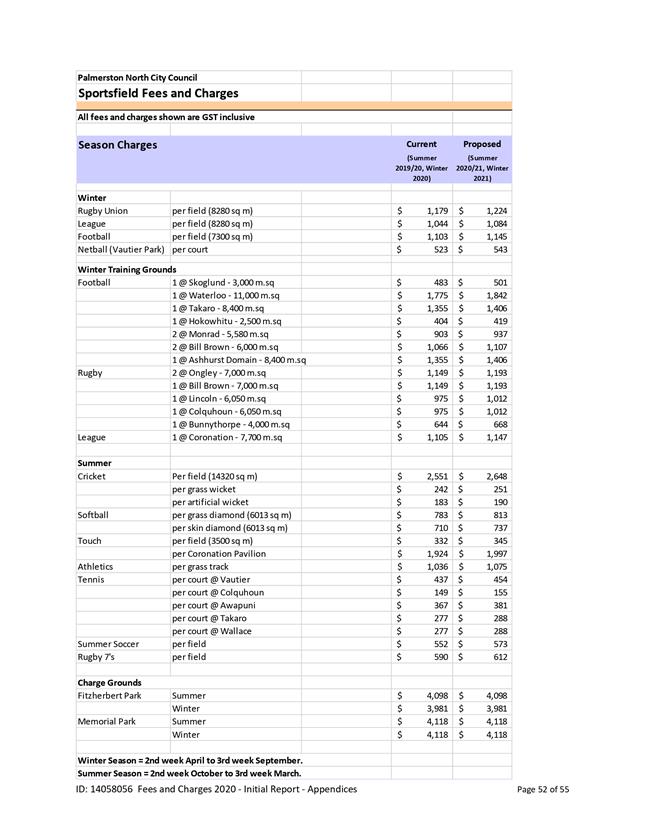

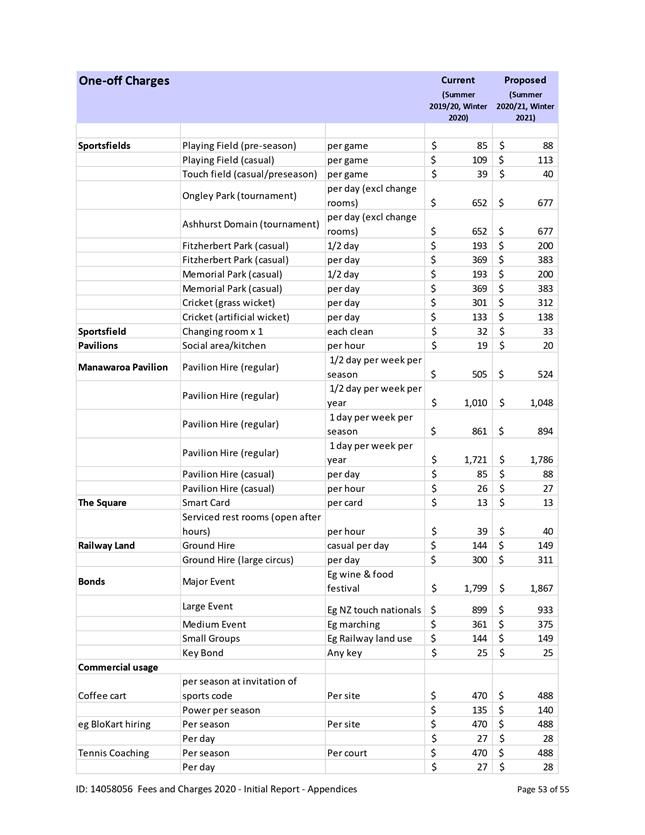

Sportsfields

9. That the

fees and charges for Sportsfields as proposed in Appendix 9 be adopted and

take effect from 1 July 2020.

Bulk Water Filling Station

10. That the fees

and charges for the Bulk Water Filling Station as proposed in Appendix 10 be

adopted and take effect from 1 July 2020.

|

Summary of options analysis for

|

Problem or Opportunity

|

Fees and charges need to be reviewed annually to ensure

they adequately meet Revenue & Financing policy, budgetary and other objectives

|

|

OPTION 1:

|

Approve fee increases as proposed

|

|

Community Views

|

Each of different types of fees requires a different

process for community engagement. Where this is legislatively

controlled it is identified in the report

|

|

Benefits

|

More likely to comply with funding proportions contained

in Revenue & Financing Policy

|

|

Risks

|

Public criticism of increases

|

|

|

Increased charges for some activities may discourage

compliance or reduce volumes

|

|

Financial

|

Budgeted revenue targets more likely to be achieved

|

|

OPTION 2:

|

Approve fee amendments for some of those proposed at

greater or lesser levels

|

|

Community Views

|

As above

|

|

Benefits

|

Lower fees than recommended likely to mean policy targets

will not be achieved

|

|

|

Higher fees than recommended in some instances will

increase likelihood of policy user fee target being achieved

|

|

Risks

|

Higher fees than recommended may increase the risk of

public criticism

|

|

Financial

|

If lower increases are approved for some fees likely that

budgeted revenue will not be achievable

|

|

OPTION 3:

|

Do not approve any fee increases

|

|

Community Views

|

As above

|

|

Benefits

|

Lower fees than recommended likely to mean policy targets

will not be achieved

|

|

Risks

|

When increases

eventually are made (to reduce the pressure on rates increases) the extent of

the increase required will be publicly and politically unacceptable

|

|

Financial

|

If no increases are

approved likely that budgeted revenue will not be achievable

|

Rationale for the recommendations

1. Overview

of the problem or opportunity

1.1 The

purpose of this report is to provide an overview of the current status of fees

and charges made by the Council and to recommend the adoption of updated fees

for some of them.

1.2 It

is important that fees and charges be regularly reviewed. There are a

variety of reasons for this including:

· Compliance

with legislative requirements – many fees and charges made by the Council

are governed by specific legislation

· Consistency

with Council’s Revenue and Financing policy – for each activity the

Council has adopted targets for the funding mix i.e. the proportion of costs to

be funded from fees and charges

· Transparency

– in some instances it is important to be able to demonstrate that the

charge being made represents a fair and reasonable recovery of the costs of

providing a particular service

· Market

comparability – for some services the Council operates in a contestable

market and it is important that fees and charges are responsive to market

changes.

1.3 However,

as a review process is sometimes very time-consuming the depth of the review

for each type of fee or charge may vary depending on the circumstances.

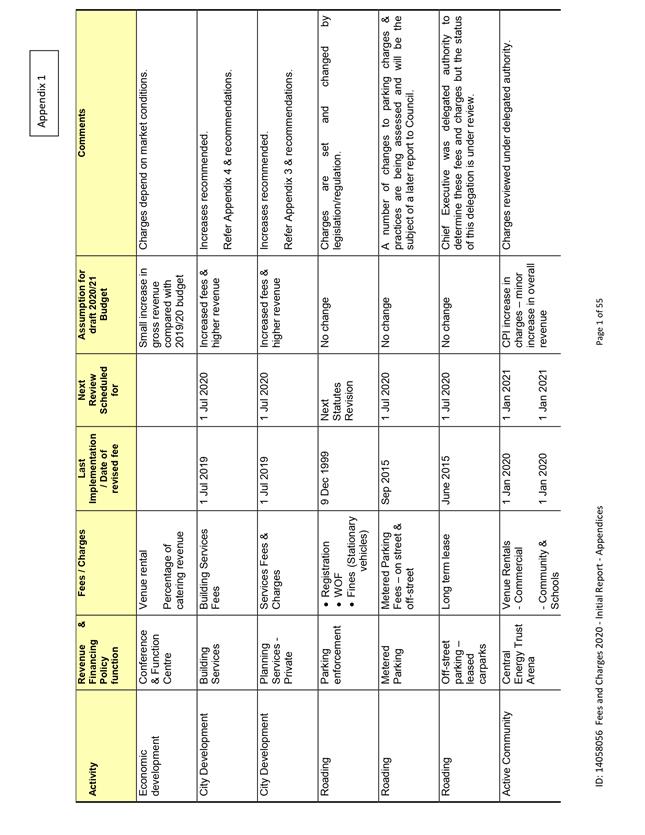

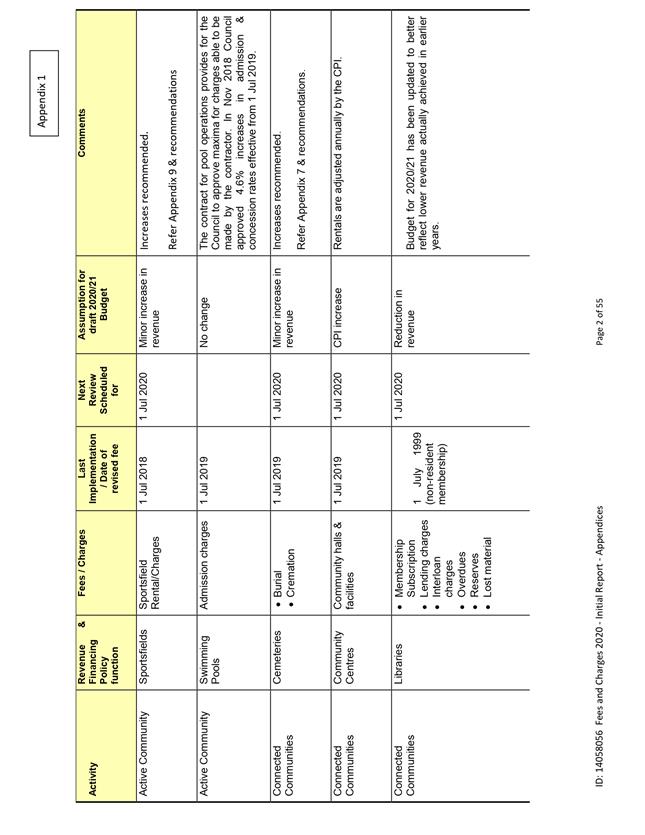

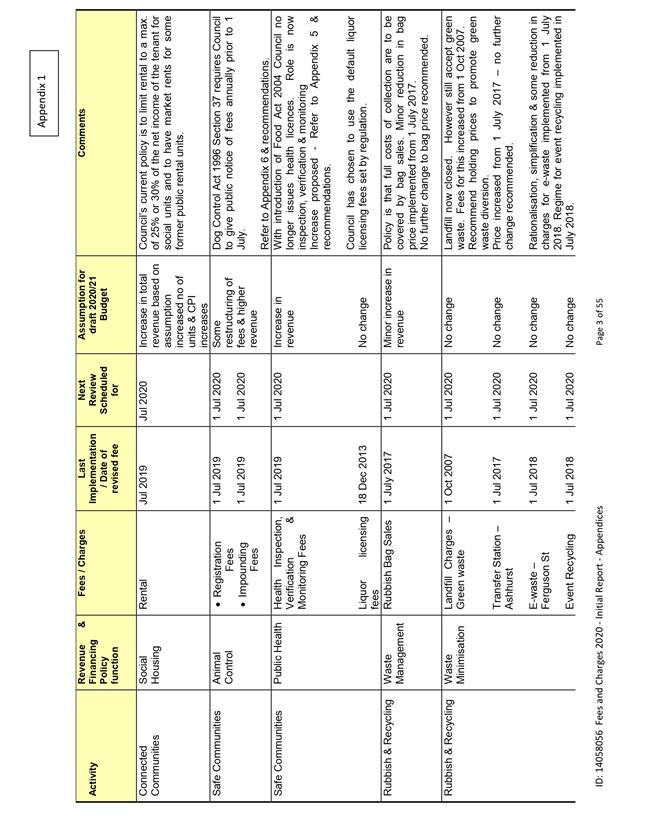

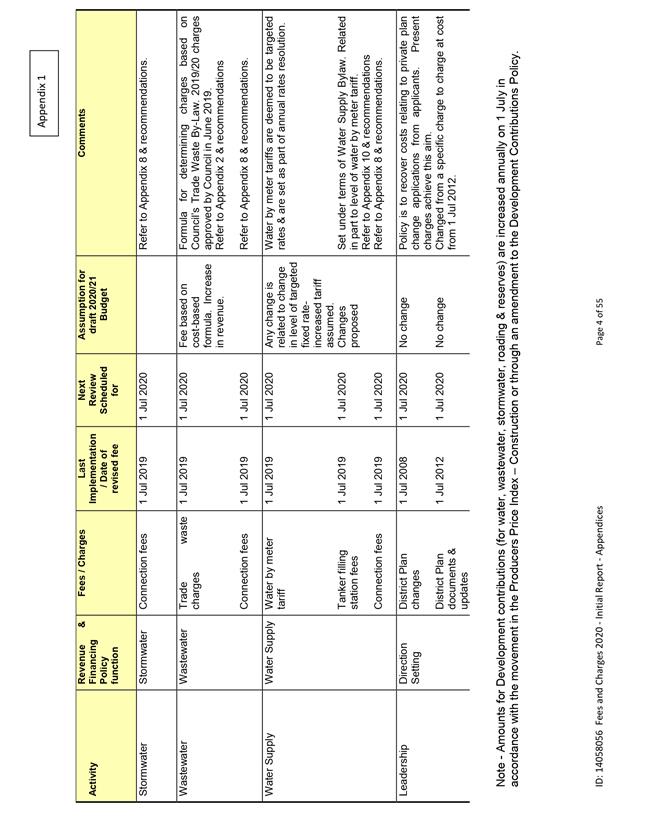

1.4 Attached

as Appendix 1 is a schedule listing, in broad terms, the various types of fees

and charges made by the Council. The schedule is ordered by activity

(consistent with the 10 Year Plan 2018-28) and within that by function

(consistent with the Revenue & Financing Policy). Comments are made

within the schedule outlining the reasons for there being no change recommended

to a particular fee or charge. In cases where changes are recommended

more detail is provided in the appendices.

2. Background

and previous council decisions

2.1 Council

has previously indicated that as a matter of policy it wishes all fee and

charge revisions to be encapsulated in a single report to this Committee early

each year.

2.2 Council’s

current Revenue & Financing Policy (10 Year Plan 2018-28 pages 211-231)

describes how the Council goes about deciding who should pay for the provision

of each activity and in what proportions. The policy should be the

foundation for decisions about the levels of fees and charges.

2.3 The

following table shows the indicative levels of direct user contribution

(including through the use of targeted rates) sought to fund the operating

costs for each activity as described in the Revenue & Financing Policy:

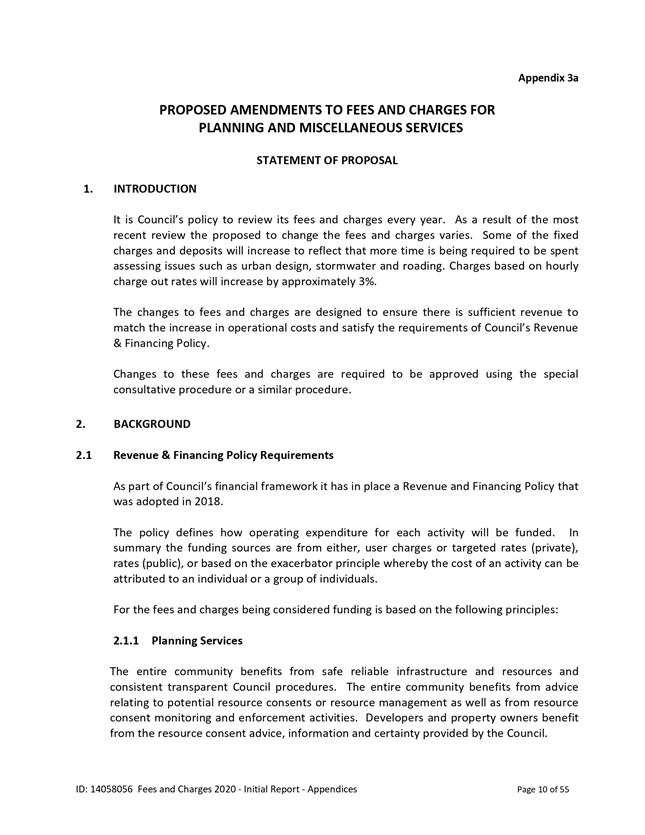

|

Revenue

& Financing Policy – Indicative levels of direct user contribution

(incl. targeted rates) sought toward activity cost

|

|

Low

0-19%

|

Med-Low

20-39%

|

Med

40-59%

|

Med-High

60-79%

|

High

80-100%

|

|

Economic development & international relations

Planning services- public

Urban design

Heritage management

Roads, street facilities, street lighting & traffic services

Active & public transport

Creative & exciting city

Arts, culture & heritage

Reserves & sportsfields

Swimming pools

Libraries & community centres

Civil defence & safer community initiatives

Biodiversity & sustainable practices

Stormwater

Leadership

|

Central Energy Trust Arena

Public Health

|

|

Conference & Function Centre

Building services

Cemeteries

|

Planning services – private

Parking

Social housing

Animal Control

************

Rubbish & Recycling#

Wastewater#

Water#

************

|

# significant portion of funding through targeted

rates

2.4 For

some activities (such as swimming pools) only a portion of the operating costs

is borne by the Council and none of the revenue is received directly by the

Council. The Council does have the right under the agreement with CLM to

set the maximum fees charged for the services. The Revenue &

Financing Policy addresses only that portion of the net operating costs funded

by the Council and therefore makes no reference to user charges for swimming

pools.

2.5 In

some of the activities shown above it is not practical to charge users through

a separate charge specifically related to use. An example of this is

water where large consumers are metered but the majority of users are charged

through the rating system by way of a fixed targeted rate as the best proxy for

direct user charge.

2.6 In

some activities a combination of charging mechanisms is used. Rubbish

& recycling is an example. Users are responsible for their own

rubbish disposal. The Council does provide a collection and disposal service

which is funded from the sale of rubbish bags. Recycling activity is

funded from the sale of recyclables and the balance through the rating system

by way of fixed targeted rates.

2.7 Council

reviewed its approach to funding the animal control activity in December but at

that time made no specific changes.

3. Description

of options

3.1 With a few exceptions (e.g. cemetery/crematorium,

animal control), draft revenue budgets for 2020/21 have been set at levels

which aim to meet the Revenue & Financing Policy proportion targets.

Achieving these revenue levels is dependent not only on the level of fee or

charge set but also the actual volumes of activity by comparison with budget

assumptions. On occasions changes are made to the way indirect costs are

allocated to activities and this impacts on whether budgeted revenue meets the

policy targets. In such situations it is appropriate to accept the policy

may not be met but that it will be reviewed at the three yearly intervals.

3.2 The

timing of this review is scheduled to fit into the annual planning timetable in

a way which ensures appropriate revenue assumptions are made in the proposed 10

Year or Annual Plans and changes to fees and charges can be implemented as soon

as practicable.

3.3 Much

of this report is focused on providing an overview of Council’s fees and

charges. However the report does include specific proposals for change

for a number of fees and charges as explained in more detail in the following

appendices:

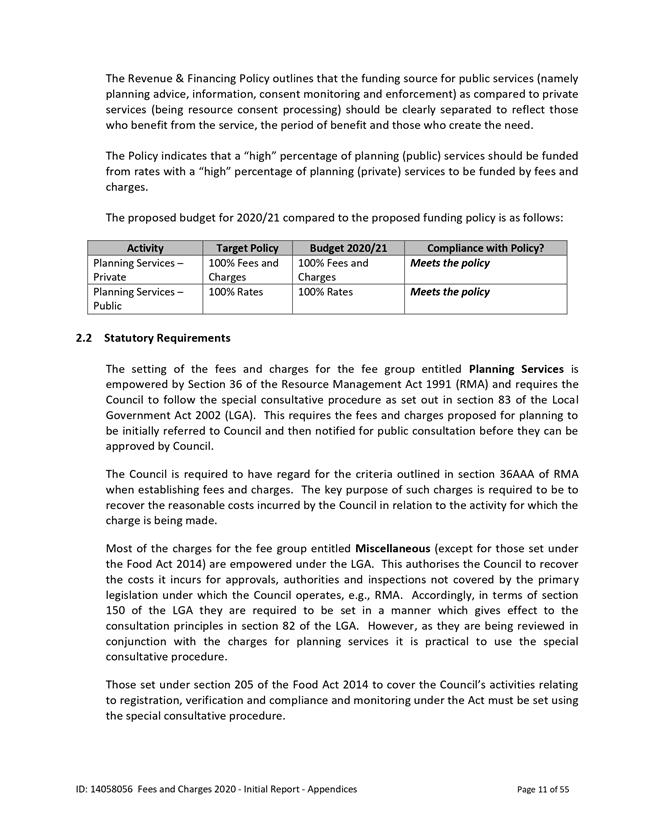

|

Appendix

|

|

|

|

2

|

Trade Waste

|

Proposal for public

consultation

|

|

3

|

Planning & Miscellaneous

|

Proposal for public

consultation

|

|

4

|

Building

|

Proposed increases

|

|

5

|

Environmental Health

|

Proposed increases

|

|

6

|

Animal Control

|

Proposed increases/changes

|

|

7

|

Burial & Cremation

|

Proposed increases

|

|

8

|

Service Connections

|

Proposed increases

|

|

9

|

Sportsfields

|

Proposed increases

|

|

10

|

Water tanker filling station

|

Proposed changes

|

4. Analysis

of options

4.1 Analysis

of the options for each of the fee types for individual activities is contained

in the appendices.

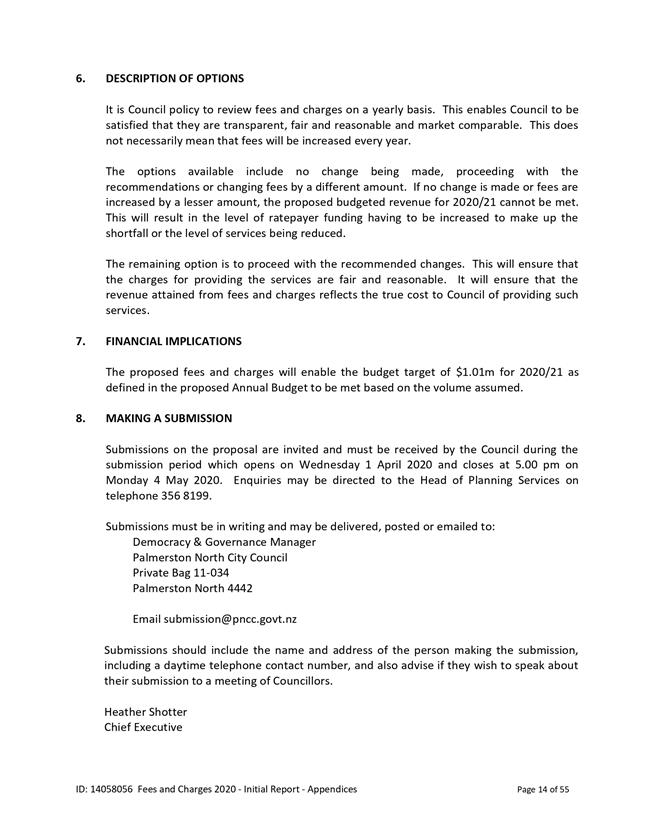

5. Conclusion

5.1 A

broad review of fees and charges has been undertaken. Revenue from these

is an important part of the funding mix. There are two elements to

achieving revenue budgets. The first is the actual level of the fee or

charge. The second is the volume of sales or use. A change to the

level of fee or charge can influence demand. Achieving revenue targets is

sometimes more about volumes than the level of the charge. There is a

fine balance between the two. This report recommends increases in charges

for tradewaste, planning & miscellaneous, building, environmental health,

animal control, burial & cremation, service connections, sportsfields and

the water tanker filling station.

6. Next

actions

6.1 There

is a series of procedural steps to be followed to enable some of the revised

fees and charges to be implemented. In some cases (as specifically

identified in the recommendations) this involves a period of public

consultation and a report back to the Council for final confirmation (taking

into account any public submissions).

7. Outline

of community engagement process

7.1 The

Revenue & Financing Policy incorporates the Council’s current views

on what portion of each activity should be directly funded from users.

This policy forms part of the 10 Year Plan which was the subject of public

consultation in 2018.

7.2 There

are varying types of public consultation required to enable changes to be made

to fees and charges. For some the special consultative process or a

process consistent with the principles of section 82 of the Local Government

Act is to be used. More detail about each is provided in the detailed

appendices.

Compliance and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

Yes

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 5: A Driven and Enabling Council

|

|

The recommendations contribute

to the outcomes of the Driven and Enabling Council Strategy

|

|

The recommendations contribute

to the achievement of action/actions in Not Applicable

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The process for setting fees

and charges depends on the nature of the activity and the particular

requirements of the relevant bylaw, legislation or Council policy.

The recommendations take

account of Council’s Revenue & Financing Policy that in turn

reflects Council’s strategic direction.

|

|

|

|

Attachments

|

1.

|

Appendices 1- 10 ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 18

March 2020

TITLE: Transforming

PNCC's Business Continuity Practice

Presented By: Miles

Crawford, Risk Manager

APPROVED BY: Chris

Dyhrberg, Chief Customer Officer

|

RECOMMENDATION(S) TO Finance & Audit Committee

1. That the

Finance & Audit Committee note progress made in developing

Council’s business continuity arrangements.

|

1. ISSUE

While business continuity plans

exist for Council’s business critical functions, recent organisational

restructures have renewed the organisation’s focus on building business

continuity into how Council operates on a day-to-day basis.

2. BACKGROUND

Resilient Organisations Ltd

(Res Orgs) was engaged in November 2019 to transform PNCC’s business

continuity practice. They were asked to build upon the Councils existing plans;

ensuring plans are progressive, agile and fit for purpose; and to use their

consultation process to grow Council awareness and engagement.

Res Orgs’ business continuity review is implemented across four

stages:

Stage 1 – (ending 28/02/20)

A review of business

unit BCPs to understand the current state of BCP arrangements and scenario

workshops with two Units within Council.

Stage 2 – (ending 31/03/20)

Scenario workshops

with the remaining Units within the Council and an online benchmark survey and

integrate transformation projects in with business continuity planning.

Stage 3 – (ending 30/06/20)

One day workshop with

resilience champions from across the organisation to assist them in updating

their BCPs and related activities.

Stage 4 – (n/a)

Engage the Executive Leadership Team via a presentation and

short interactive activity to help gain support for ongoing risk and resilience

management efforts at the senior level.

Stage 1 is now complete with

Res Orgs reporting that while teams worked collaboratively in the exercises,

further work is needed to build awareness and champions within PNCC to build an

ongoing programme of work.

3. NEXT

STEPS

The next steps in this programme are to:

· Run further

scenario workshops with other Units across Council.

· Discuss

transformation projects with appropriate staff to understand the implications

of these for BC.

· Assess the all of

staff view of PNCC resilience.

· Run training

workshops with identified BC champions.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

If Yes quote relevant clause(s)

from Delegations Manual <Enter text>

|

Yes

|

|

Are the decisions significant?

|

Yes

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 5: A Driven and Enabling Council

|

|

The recommendations contribute

to the outcomes of the Driven and Enabling Council Strategy

|

|

The recommendations contribute

to the achievement of action/actions in a plan under the Driven and Enabling

Council Strategy

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

Council’s business

continuity arrangements enable Council to maintain its service to the

community in a disruption event.

|

|

|

|

Attachments

Nil

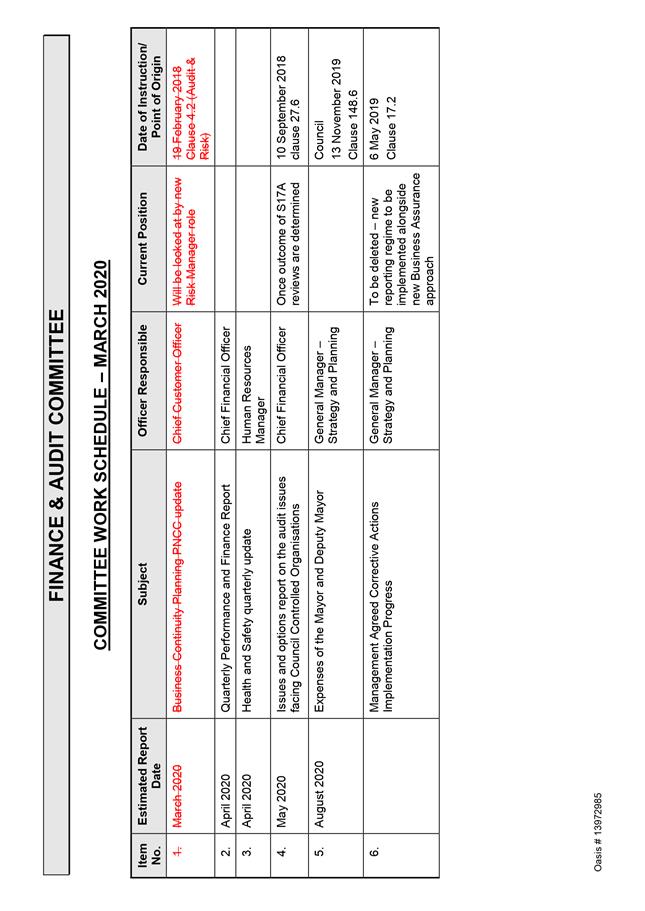

PALMERSTON NORTH CITY COUNCIL

Committee Work Schedule

TO: Finance

& Audit Committee

MEETING DATE: 18

March 2020

TITLE: Committee

Work Schedule

|

RECOMMENDATION(S) TO Finance & Audit Committee

1. That

the Finance & Audit Committee receive its Work Schedule dated March 2020.

|

Attachments

|

1.

|

Committee Work Schedule ⇩

|

|

![]()

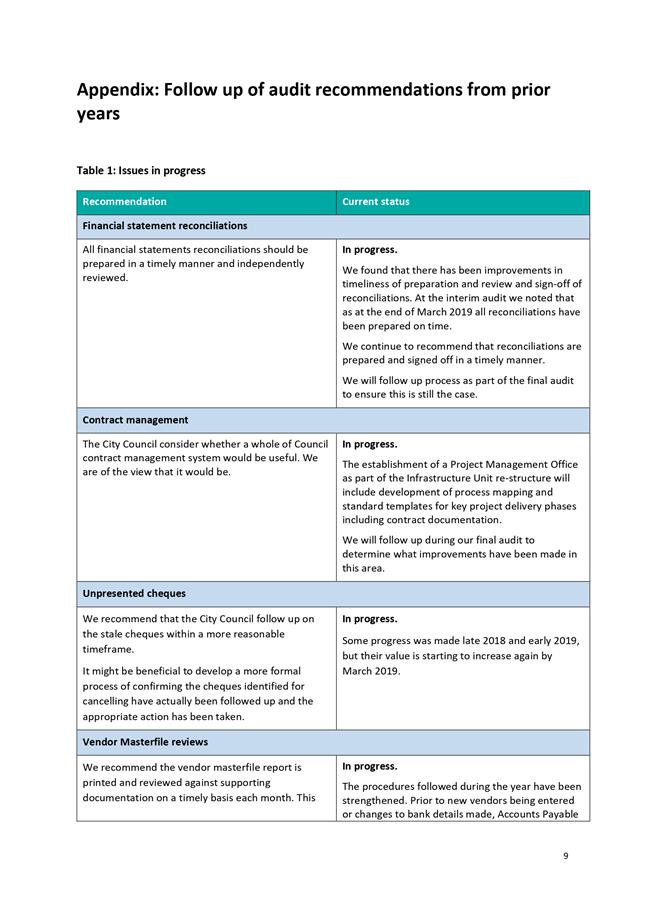

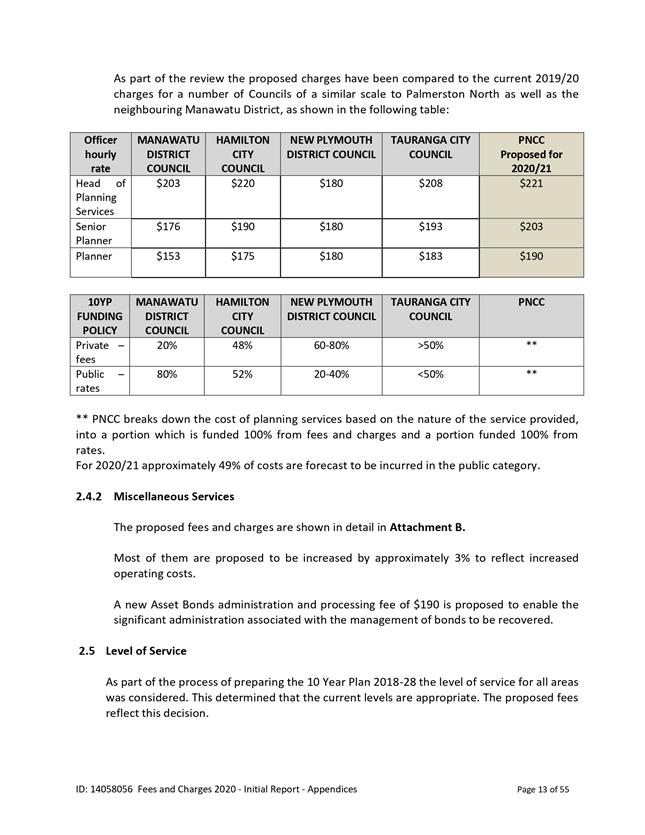

![]()