AGENDA

Finance

& Audit Committee

|

Susan Baty (Chairperson)

|

|

Karen Naylor (Deputy

Chairperson)

|

|

Grant Smith (The Mayor)

|

|

Stephen Armstrong

|

Leonie Hapeta

|

|

Vaughan Dennison

|

Lorna Johnson

|

|

Renee Dingwall

|

Bruno Petrenas

|

|

Lew Findlay QSM

|

Tangi Utikere

|

|

Patrick Handcock ONZM

|

|

|

|

|

PALMERSTON NORTH CITY COUNCIL

Finance &

Audit Committee

MEETING

17 June 2020

Order of Business

NOTES:

·

The Finance & Audit

Committee meeting coincides with the ordinary meeting of the Play, Sport &

Recreation Committee. The Committees will conduct business in the

following order:

- Finance

& Audit Committee

- Play,

Sport & Recreation Committee

·

This meeting will also

be held via audio visual links. A recording of the meeting will be made

available on our website shortly after the meeting has finished.

If you wish to attend

this meeting via audio visual link then please contact the Democracy &

Governance Administrator, Natalya Kushnirenko, on natalya.kushnirenko@pncc.govt.nz to

request a link.

1. Apologies

2. Notification

of Additional Items

Pursuant to Sections 46A(7) and

46A(7A) of the Local Government Official Information and Meetings Act 1987, to

receive the Chairperson’s explanation that specified item(s), which do

not appear on the Agenda of this meeting and/or the meeting to be held with the

public excluded, will be discussed.

Any additions in accordance with

Section 46A(7) must be approved by resolution with an explanation as to why

they cannot be delayed until a future meeting.

Any additions in accordance with

Section 46A(7A) may be received or referred to a subsequent meeting for further

discussion. No resolution, decision or recommendation can be made in

respect of a minor item.

3. Declarations

of Interest (if any)

Members are reminded of their duty

to give a general notice of any interest of items to be considered on this

agenda and the need to declare these interests.

4. Public

Comment

To receive comments from members of

the public on matters specified on this Agenda or, if time permits, on other

Committee matters.

(NOTE: If the

Committee wishes to consider or discuss any issue raised that is not specified

on the Agenda, other than to receive the comment made or refer it to the Chief

Executive, then a resolution will need to be made in accordance with clause 2

above.)

5. Confirmation

of Minutes Page 7

“That the minutes of the

Finance & Audit Committee meeting of 18 March 2020 Part I Public be confirmed

as a true and correct record.”

6. Palmerston

North Airport Limited - Updated draft Statement of Intent for 2020/21 Page 13

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

7. Fees and

Charges - Confirmation Following Public Consultation Page 35

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

8. Public

Rental Housing within Council's Whakarongo Subdivision Page 49

Memorandum, presented by Bryce

Hosking, Manager - Property.

9. CET

Arena - Commercial Building Opportunity Page 59

Report, presented by Bryce

Hosking, Manager - Property.

10. Committee Work

Schedule Page 97

11. Exclusion of Public

|

|

To be moved:

“That the

public be excluded from the following parts of the proceedings of this

meeting listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under Section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General

subject of each matter to be considered

|

Reason

for passing this resolution in relation to each matter

|

Ground(s)

under Section 48(1) for passing this resolution

|

|

|

|

|

|

|

|

|

|

This

resolution is made in reliance on Section 48(1)(a) of the Local Government

Official Information and Meetings Act 1987 and the particular interest or

interests protected by Section 6 or Section 7 of that Act which would be

prejudiced by the holding of the whole or the relevant part of the

proceedings of the meeting in public as stated in the above table.

Also that the

persons listed below be permitted to remain after the public has been

excluded for the reasons stated.

[Add Third

Parties], because of their knowledge and ability to assist the

meeting in speaking to their report/s [or other matters as specified] and

answering questions, noting that such person/s will be present at the meeting

only for the items that relate to their respective report/s [or matters as

specified].

|

Palmerston North City Council

Minutes of

the Finance & Audit Committee Meeting Part I Public, held in the Council

Chamber, First Floor, Civic Administration Building, 32 The Square, Palmerston

North on 18 March 2020, commencing at 9.01am

|

Members

Present:

|

Councillor Susan Baty (in the Chair), The

Mayor (Grant Smith) and Councillors Vaughan Dennison, Renee Dingwall, Lew

Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno

Petrenas and Tangi Utikere.

|

|

Non Members:

|

Councillors Brent Barrett, Zulfiqar Butt and

Aleisha Rutherford.

|

|

Apologies:

|

Councillors Rachel Bowen, Billy Meehan

and Karen Naylor.

|

Councillor Aleisha Rutherford left

the meeting at 11.05am during consideration of clause 14. She entered the

meeting again at 11.18am at the conclusion of clause 14. She was not

present for clause 14.

Councillor Vaughan Dennison was not present when the

meeting resumed at 3.50pm. He was not present for clauses 16 to 18

inclusive.

Councillor Lew Findlay QSM was not present when the

meeting resumed at 3.50pm. He was not present for clauses 16 to 18

inclusive.

|

11-20

|

Apologies

|

|

|

Moved Susan Baty, seconded Tangi Utikere.

The

COMMITTEE RESOLVED

1. That

the Committee receive the apologies.

|

|

|

Clause 11-20 above was

carried 13 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

The meeting adjourned at 9.02am

The meeting resumed at 10.46am

|

12-20

|

Confirmation of Minutes

|

|

|

Moved Susan Baty, seconded Patrick Handcock ONZM.

The

COMMITTEE RESOLVED

1. That

the minutes of the Finance & Audit Committee meeting of 19 February 2020

Part I Public be confirmed as a true and correct record.

|

|

|

Clause 12-20 above was

carried 12 votes to 0, with 1 abstention, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Lorna Johnson, Bruno

Petrenas, Aleisha Rutherford and Tangi Utikere.

Abstained:

Councillor Leonie Hapeta.

|

|

13-20

|

Audit New Zealand Report to Council

Memorandum, presented by

Stuart McKinnon, Chief Financial Officer.

|

|

|

Moved

Susan Baty, seconded Leonie Hapeta.

The COMMITTEE RESOLVED

1. That the

interim 2018/19 Management Report from Audit New Zealand be received.

2. That

the final 2018/19 Management Report from Audit New Zealand be received.

|

|

|

Clause 13-20 above was

carried 13 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Bruno Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

14-20

|

Palmerston North Airport Ltd - Interim Report for 6

months to 31 December 2019

Memorandum, presented by

Steve Paterson, Strategy Manager - Finance.

Councillor

Aleisha Rutherford left the meeting at 11.05am.

|

|

|

Moved

Susan Baty, seconded Grant Smith.

The COMMITTEE RECOMMENDS

1. That

the Interim Report and Financial Statements of Palmerston North Airport Ltd

for the period ended 31 December 2019 be received.

|

|

|

Clause 14-20 above was

carried 12 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Bruno Petrenas and Tangi Utikere.

|

Councillor Aleisha Rutherford entered the meeting at

11.18am.

|

15-20

|

Palmerston North Airport Ltd - Draft Statement of Intent

for 2020/21

Memorandum, presented by

Steve Paterson, Strategy Manager - Finance.

|

|

|

Moved

Vaughan Dennison, seconded Grant Smith.

The COMMITTEE RECOMMENDS

1. That

the Palmerston North Airport Ltd (PNAL) draft Statement of Intent (SOI) for

2020/21 be received and the associated presentation, including the

preliminary assessments from the Board Chair and Chief Executive of the

impact of COVID-19 on the company, be noted.

|

|

|

Clause 15.1 above was carried 13 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Brent

Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew

Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno

Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

|

Moved Vaughan Dennison, seconded Grant Smith.

2. That

PNAL be advised the Council supports the proposed direction and

implementation strategy and that an updated version of the SOI be prepared

for Council consideration following the Board’s consideration of the

potential impact of COVID-19 on the budgeted financial position.

|

|

|

Clause 15.2 above was carried 13 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Brent

Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew

Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno

Petrenas, Aleisha Rutherford and Tangi Utikere.

|

|

|

Moved Vaughan Dennison, seconded Grant Smith.

3. That

PNAL be advised that in the interests of supporting the proposed Terminal

Development Plan, the Council is prepared to consider an amendment to the

dividend policy, though the nature of that policy will need to be considered

in the light of the updated financial forecasts.

|

|

|

Clause 15.3 above was carried 13 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Brent

Barrett, Susan Baty, Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew

Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno

Petrenas, Aleisha Rutherford and Tangi Utikere.

|

The meeting adjourned at 12.02pm.

The meeting resumed at 3.50pm.

When the meeting resumed Councillors Vaughan Dennison

and Lew Findlay were not present.

|

16-20

|

Fees and Charges Review

Report, presented by Steve

Paterson, Strategy Manager - Finance.

|

|

|

Moved

Susan Baty, seconded Brent Barrett.

The COMMITTEE RECOMMENDS

1. That the Fees

and Charges Review report be received and the current status of fees and

charges be noted.

Trade waste

2. That the

proposal to adopt updated fees and charges for Trade Waste services effective

from 1 July 2020 as attached in Appendix 2, be approved for public

consultation and the Chief Executive be authorised to undertake the necessary

consultative process under sections 82 and 150 of the Local Government Act

2002.

Planning & Miscellaneous

3. That the Statement

of Proposal (and the associated summary) to adopt updated fees and charges

for Planning Services and Miscellaneous Services effective from 1 July 2020

as attached in Appendix 3, be approved for public consultation and the Chief

Executive be authorised to undertake the necessary consultative process under

sections 83 and 150 of the Local Government Act 2002.

Building

4. That the fees

and charges for Building Services, as proposed in Appendix 4 be adopted and

following public notification take effect from 1 July 2020.

Environmental Health

5. That the fees

and charges for Environmental Health Services (in terms of regulation 7 of

the Health (Registration of Premises) Regulations 1966) as proposed in

Appendix 5, be adopted and following public notification, take effect from 1

July 2020.

Animal Control

6. That the fees

and charges for the Impounding of Animals (in terms of section 14 of the

Impounding Act 1955) and for Dog Registration and Dog Impounding (in terms of

sections 37 and 68 of the Dog Control Act 1996) as proposed in Appendix 6 be

adopted, and following public notification, take effect from 1 July 2020 and

that the preferred owner application and suggested process to retain

preferred owner status – current preferred owner fee be deleted.

Amended by Council on 25 March 2020

Clause 35-20

Burial & Cremation

7. That the fees

and charges for Burial and Cremation, as proposed in Appendix 7 be adopted

and following public notification, take effect from 1 July 2020.

Service Connections

8. That the fees

and charges for Service Connections, as proposed in Appendix 8 be adopted and

take effect from 1 July 2020.

Sportsfields

9. That the fees

and charges for Sportsfields as proposed in Appendix 9 be adopted and take

effect from 1 July 2020.

Bulk Water Filling Station

10. That the

fees and charges for the Bulk Water Filling Station as proposed in Appendix

10 be adopted and take effect from 1 July 2020.

|

|

|

Clause 16-20 above was

carried 11 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Renee Dingwall, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno Petrenas, Aleisha

Rutherford and Tangi Utikere.

|

|

|

Moved

Tangi Utikere, seconded Lorna Johnson.

An amendment was made that

the words “and that the preferred owner application and suggested

process to retain preferred owner status – current preferred owner fee

be deleted” be added to Clause 16.6. The motion was carried 11

votes to 0, the voting being as follows:

|

|

|

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Renee Dingwall, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno Petrenas, Aleisha

Rutherford and Tangi Utikere.

|

|

17-20

|

Transforming PNCC's Business Continuity Practice

Memorandum, presented by

Miles Crawford, Risk Manager.

|

|

|

Moved

Susan Baty, seconded Brent Barrett.

The COMMITTEE RESOLVED

1. That

the Finance & Audit Committee note progress made in developing

Council’s business continuity arrangements.

|

|

|

Clause 17-20 above was

carried 11 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Renee Dingwall, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno Petrenas, Aleisha

Rutherford and Tangi Utikere.

|

|

18-20

|

Committee

Work Schedule

After discussion Elected

Members requested a business continuity planning update be added to the work

schedule for April 2020 with respect to COVID-19.

|

|

|

Moved

Patrick Handcock ONZM, seconded Lorna Johnson.

The COMMITTEE RESOLVED

1. That

the Finance & Audit Committee receive its Work Schedule dated March 2020.

2. That

a business continuity planning update be added to the work schedule for April

2020 with respect to COVID-19.

|

|

|

Clause 18-20 above was

carried 11 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Susan Baty, Zulfiqar Butt, Renee Dingwall, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Bruno Petrenas, Aleisha

Rutherford and Tangi Utikere.

|

The meeting finished at 4.35pm

Confirmed 17 June 2020

Chairperson

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 17

June 2020

TITLE: Palmerston

North Airport Limited - Updated draft Statement of Intent for 2020/21

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

|

RECOMMENDATION(S)

TO Council

1. That the

Palmerston North Airport Ltd updated draft Statement of Intent for 2020/21 be

received and the Company be advised that:

· Council

supports the draft SOI recognising the uncertainty of significant assumptions

that have had to be made in its preparation

· Council

requests an updated company position be provided at the same time as the

annual report for 2019/20 is presented (in September) and if changes have

been significant that an amended SOI (including projections for 2021/22 and

2022/23) be provided to the Council for consideration

· Council

encourages the Board to progress its capital development programme as soon as

this becomes practicable.

|

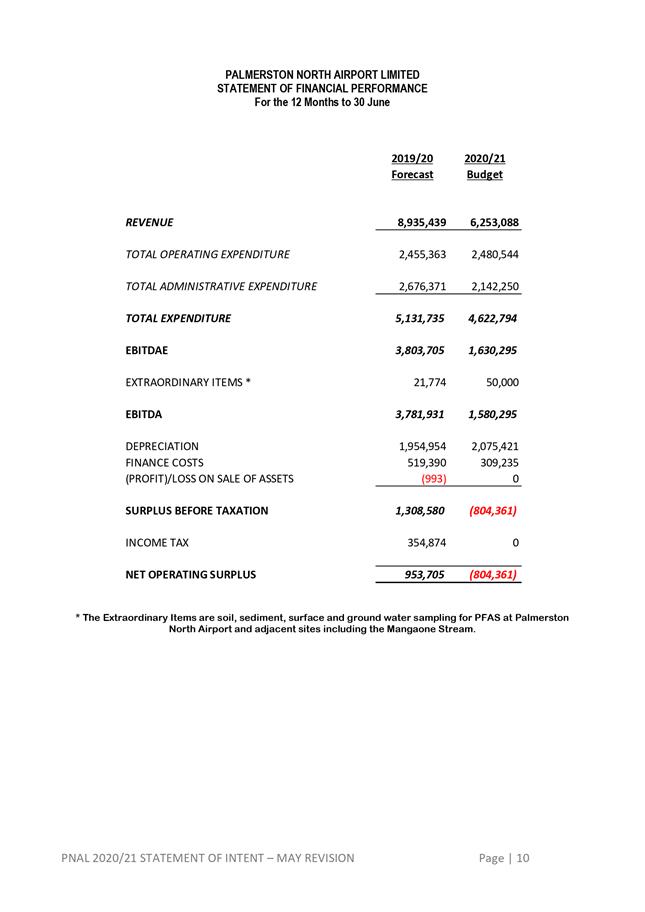

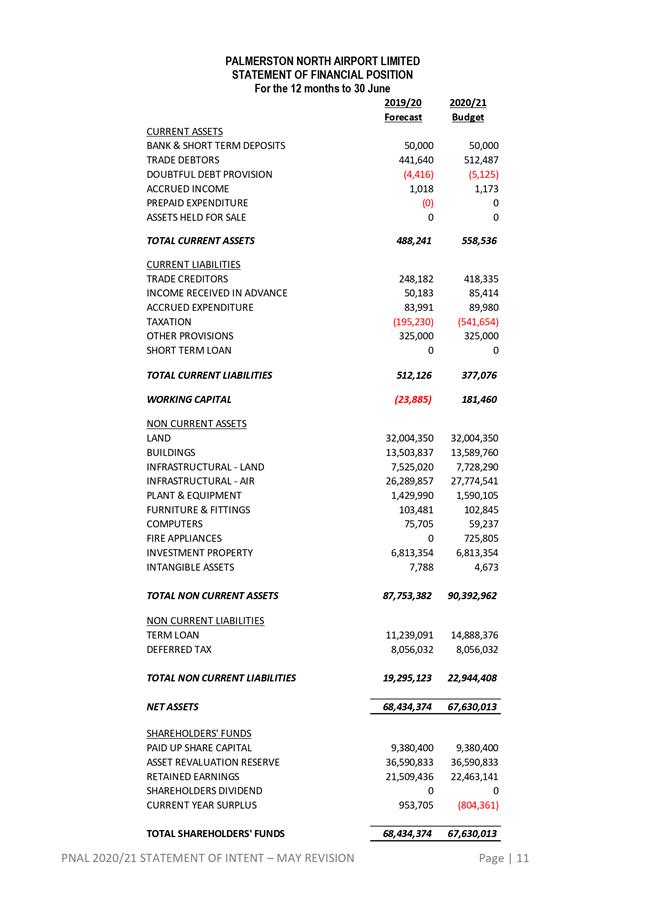

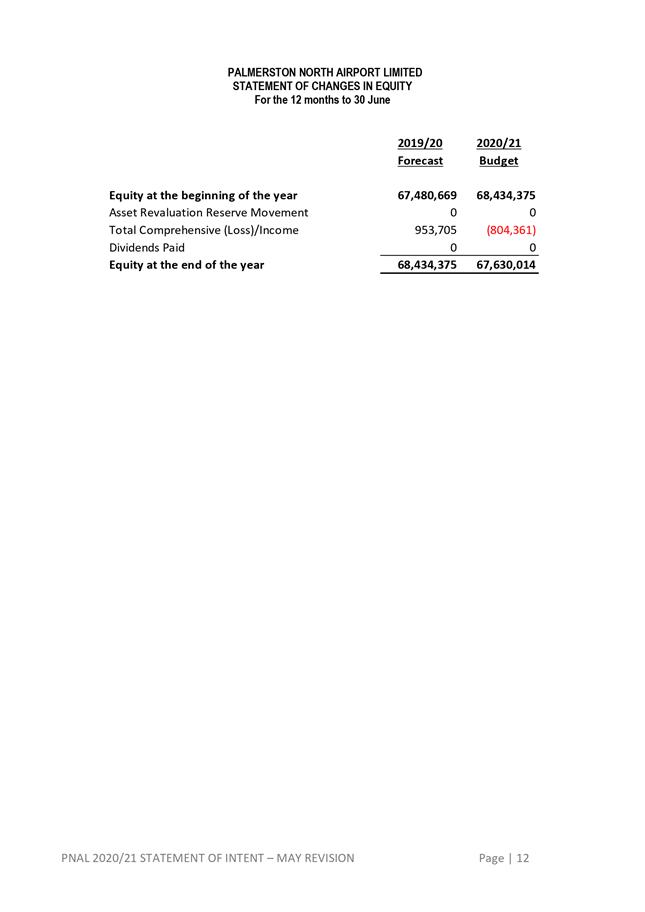

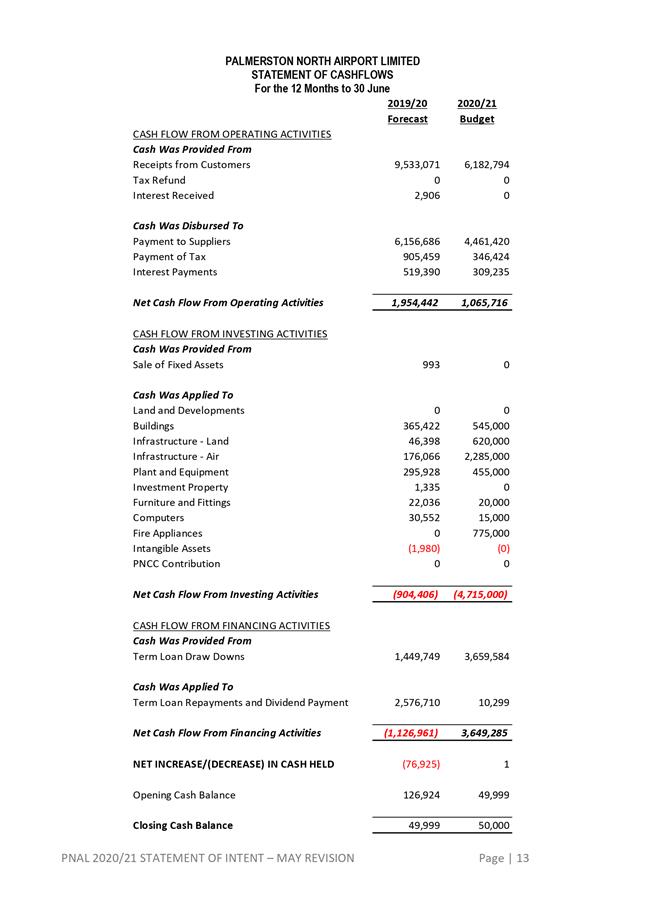

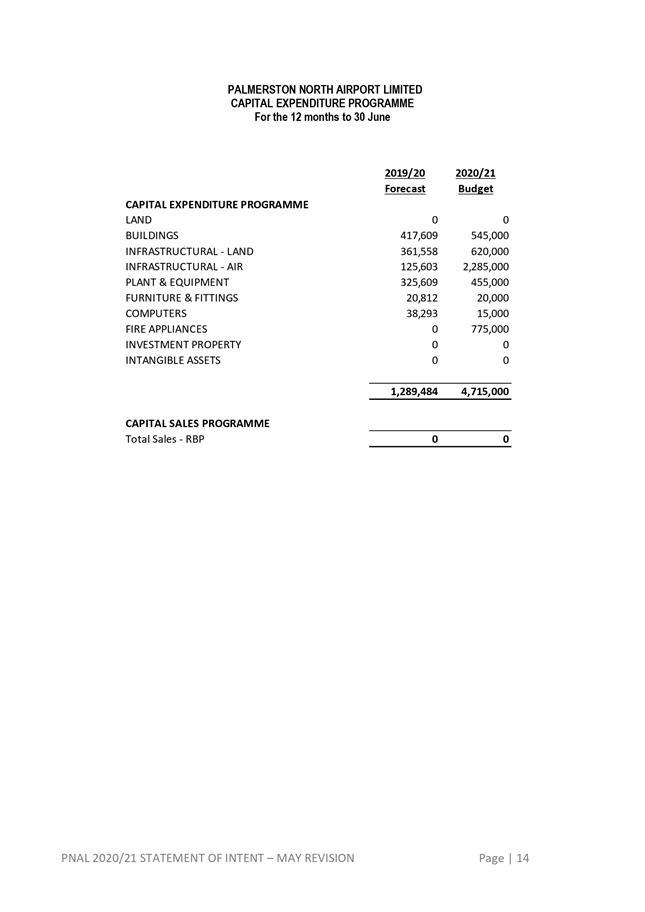

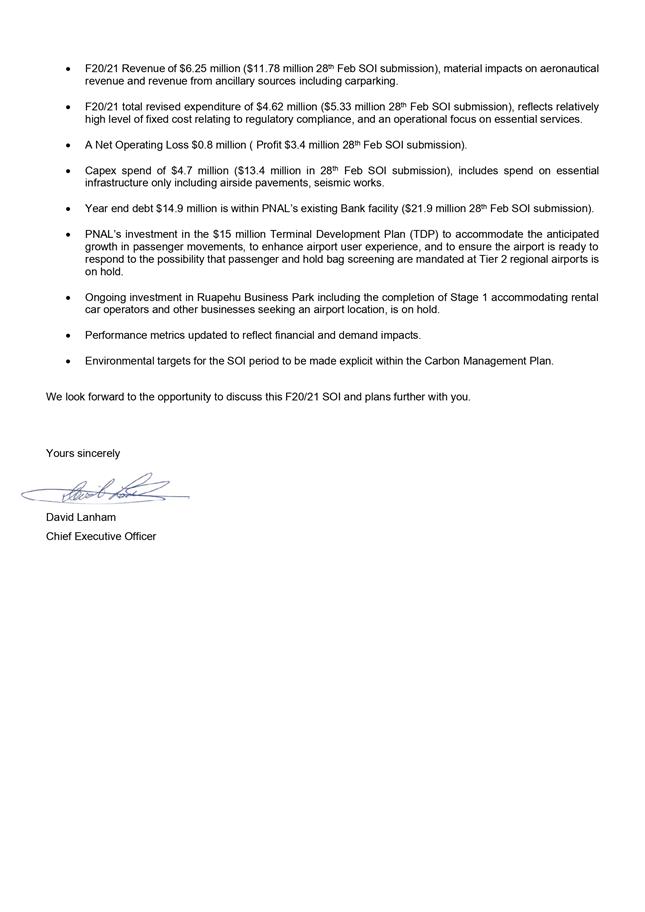

1. ISSUE

Palmerston North Airport Ltd

(PNAL) as a Council controlled trading organisation is required to prepare and

adopt a Statement of Intent (SOI) each year before 30 June. An updated

draft SOI for 2020/21 is attached for Council consideration.

2. BACKGROUND

PNAL’s draft

SOI for 2020/21 was considered by the Finance & Audit Committee on 18 March

2020. The draft was prepared in advance of the implications of the

COVID-19 pandemic becoming known.

At the meeting the

PNAL Chair and Chief Executive provided an assessment of the potential

implications of COVID-19 on the airport operations and in particular the

assumptions and financial forecasts in the SOI.

The Committee

resolved:

“That the

Palmerston North Airport Ltd (PNAL) draft Statement of Intent (SOI) for2020/21

be received and the associated presentation, including the preliminary

assessments from the Board Chair and Chief Executive of the impact of COVID-19

on the company, be noted.

That PNAL be advised

the Council supports the proposed direction and implementation strategy and

that an updated version of the SOI be prepared for Council consideration

following the Board’s consideration of the potential impact of COVID-19

on the budgeted financial position.

That PNAL be advised

that in the interests of supporting the proposed Terminal Development Plan, the

Council is prepared to consider an amendment to the dividend policy, though the

nature of that policy will need to be considered in the light of the updated

financial forecasts.”

PNAL’s Board

has reconsidered the draft and has approved a radically changed one that is

attached under cover of the introductory letter dated 11 May 2020 from the

Chief Executive.

PNAL’s approach

and the key changes are highlighted in the letter. Due to the high level

of uncertainty about the recovery profile the Board has needed to take action

that is focused on preserving capital and taking a prudent approach to its

borrowings and the associated caveats.

The previous draft

had a strong emphasis on growth, terminal and property development.

Whilst these are still medium to longer term goals the immediate focus is on

facilitating re-establishing its core passenger travel activity. A

significant planning assumption in the revised draft is that there will be

passenger movements of 265,000 for the 2020/21 year with Air New Zealand

recovering to 50% of its 2018/19 passenger levels by 30 June 2021. Given

the relatively fixed cost profile of a significant portion of PNAL’s

operating costs the forecast financial outcome is sensitive to the actual level

of passenger movements. The financial projections are therefore subject

to a high level of risk, though PNAL believes the scenario they have adopted is

their worst case one.

Although PNAL is

still forecasting an operating surplus for the 2019/20 year a loss of $0.8m is

budgeted (under the scenario selected) for 2020/21. Council’s usual

expectation is that a dividend of approx. 40% of after-tax profit will be

paid. Due to the forecast operating and liquid position during 2020/21 it

would not be prudent for the directors to declare a dividend based on the

2019/20 results. The SOI indicates the suspension of the dividend policy

during 2020/21.

Due to the level of

uncertainty financial projections have not been provided for the following two

years as is our usual expectation.

It is pleasing to

note that with the recent move to alert level 2 Air New Zealand has recommenced

a basic flight schedule that will hopefully grow to at least the levels assumed

in the draft SOI. However due to the physical distancing requirements at

present flights have restricted passenger numbers.

At this stage it is

suggested that the most practical approach to adopt is to advise PNAL:

· the

Council supports the draft SOI recognising the uncertainty of the significant

assumptions that have had to be made in its preparation

· the

Council requests an updated company position be provided at the same time as

the annual report for 2019/20 is presented (in September) and if changes have

been significant that an amended SOI (including projections for 2021/22 and

2022/23) be provided to the Council for consideration

· the

Council encourages the Board to progress its capital development programme as

soon as this becomes practicable.

3. NEXT

STEPS

Council’s

decisions with be conveyed to PNAL and the Board will decide whether to adopt

the draft in its current form or make further changes. The final SOI will

then be provided to the Council and it will be made publicly available as

required by the Local Government Act.

It is intended that

PNAL’s annual report for the year to 30 June 2020 will be considered by

the Finance & Audit Committee at its September meeting.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the outcomes of the City Development Strategy

|

|

The recommendations contribute

to the achievement of action/actions in the Strategic Transport Plan

The action is: Work with the

airport company to ensure the airport’s strategic intent aligns with

the City’s aspirations

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The airport is a key

strategic gateway to the City

|

|

|

|

Attachments

|

1.

|

Letter from Palmerston North Airport Ltd dated 11 May 2020 ⇩

|

|

|

2.

|

Updated Draft Statement of Intent 2020/21 for PNAL ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 17

June 2020

TITLE: Fees

and Charges - Confirmation Following Public Consultation

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

|

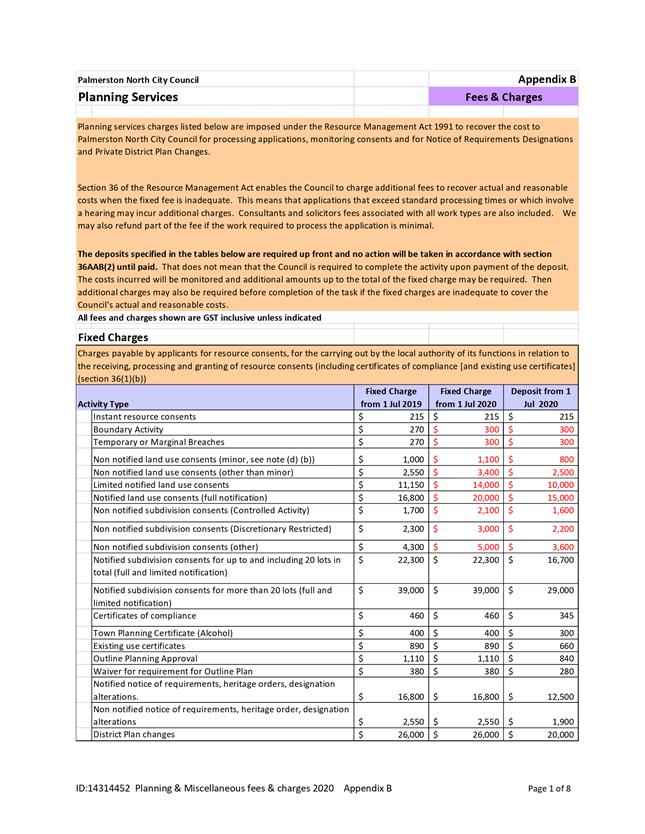

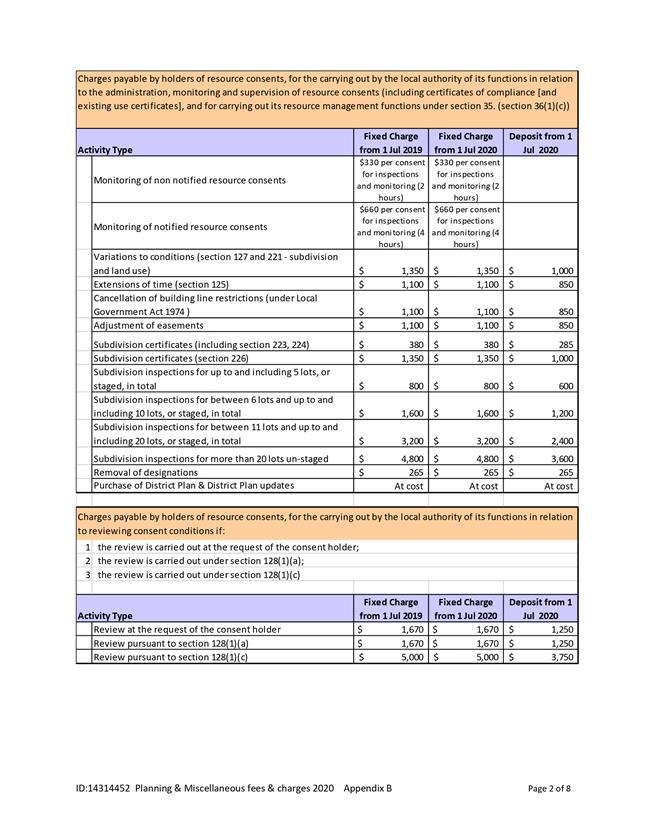

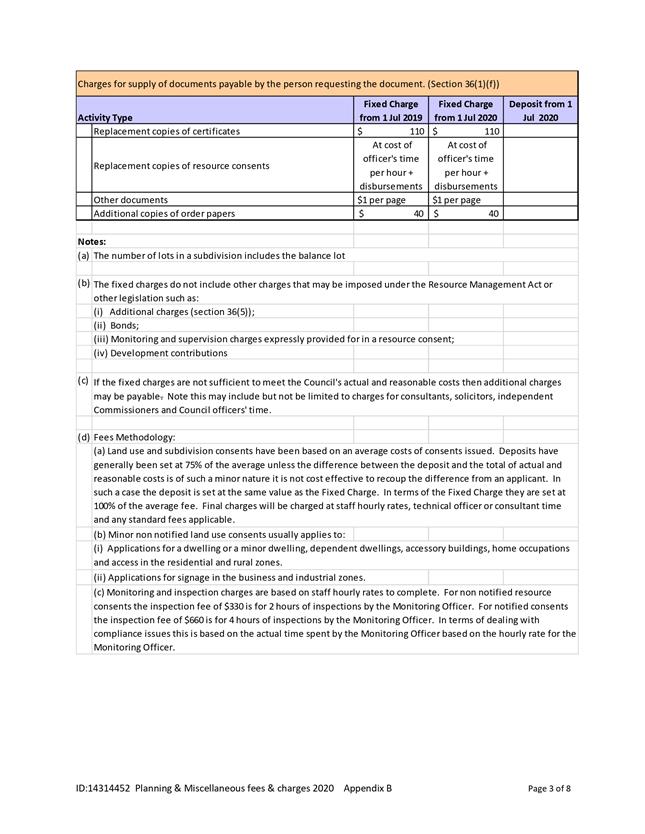

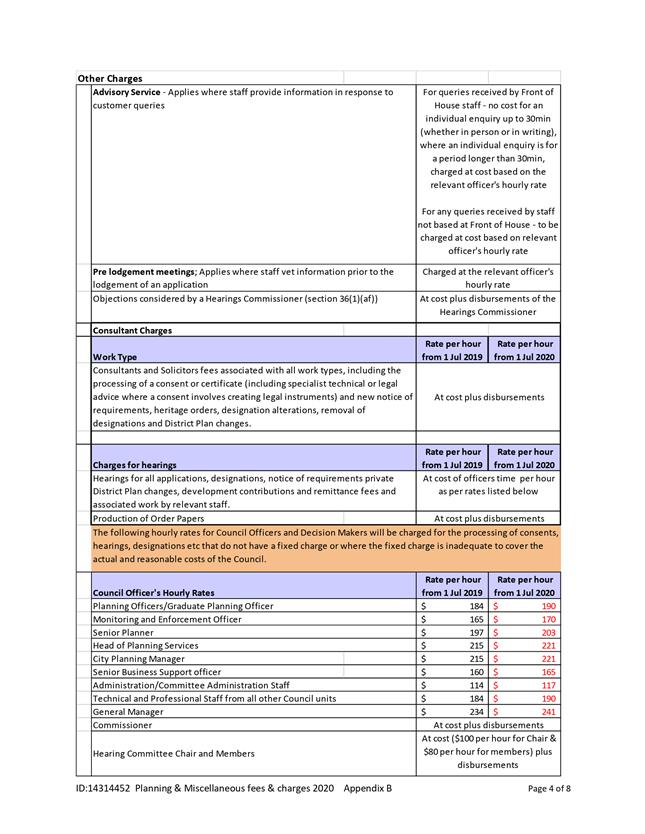

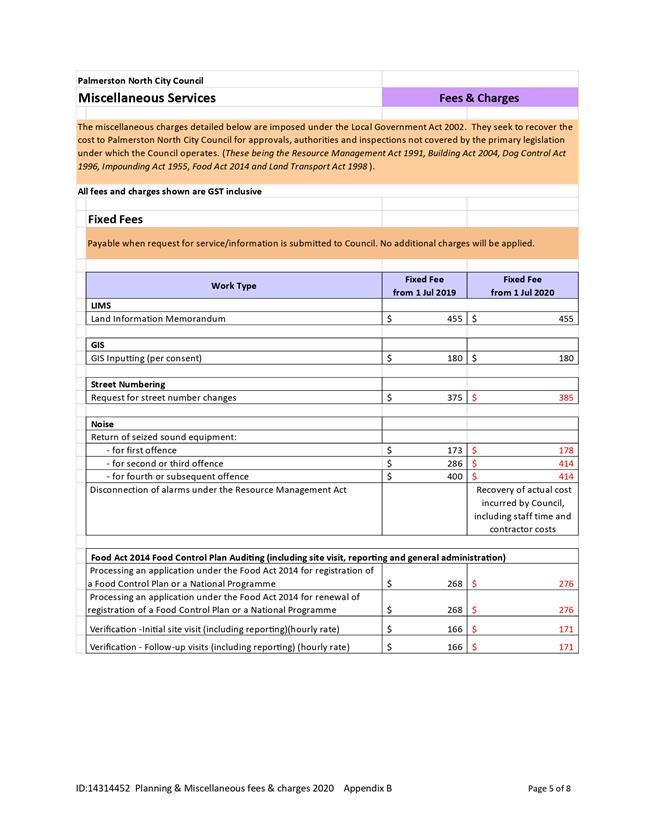

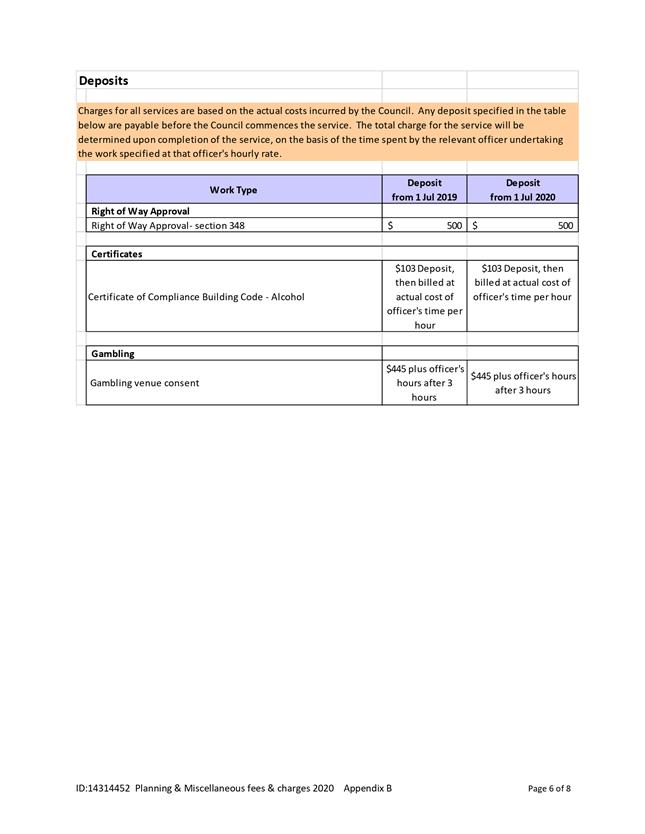

RECOMMENDATION(S) TO Council

1. That the

submission relating to planning fees, as attached in Appendix A of the

memorandum titled ‘Fees and Charges – Confirmation Following

Public Consultation’ presented to the Finance & Audit Committee on

17 June 2020, be received.

2. That the

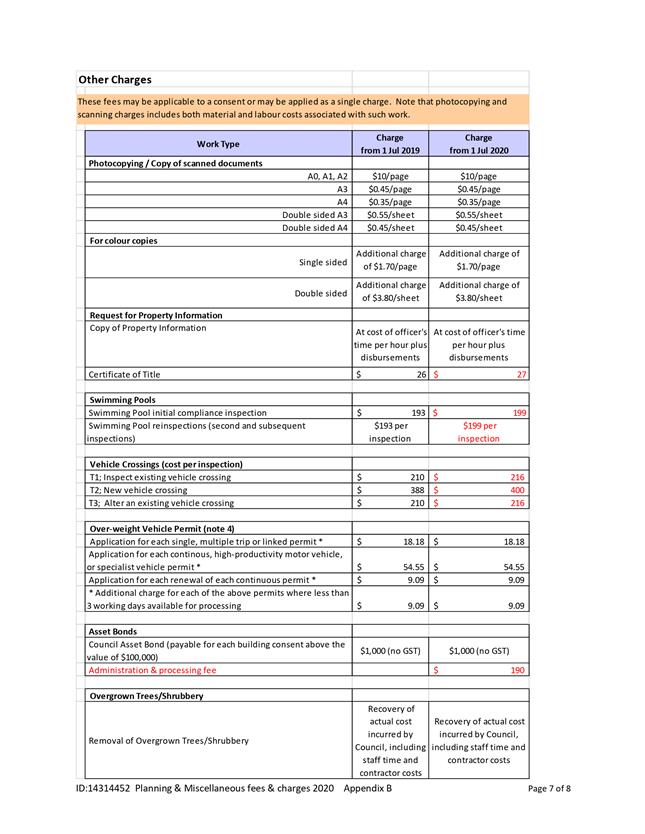

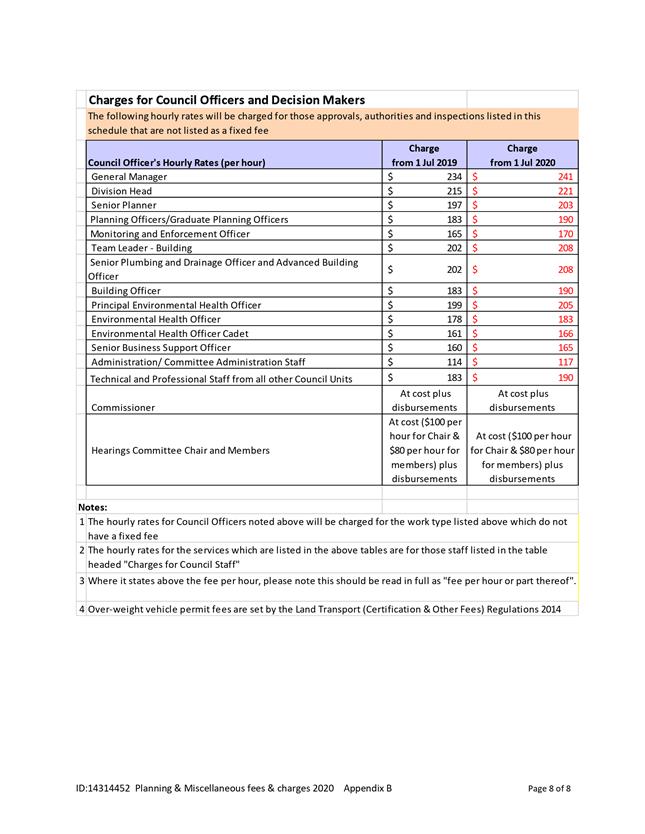

fees and charges for Planning & Miscellaneous Services, as scheduled in

Appendix B of the memorandum titled `Fees and Charges – Confirmation

Following Public Consultation’ presented to the Finance &

Audit Committee on 17 June 2020, be approved, effective from 1 July

2020.

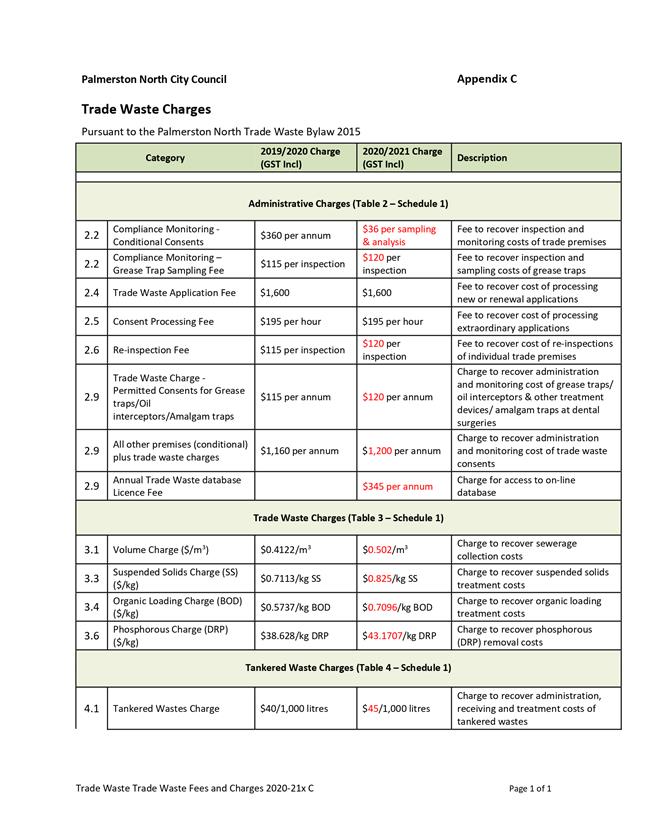

3. That the

fees and charges for Trade Waste Services, as scheduled in Appendix C of the

memorandum titled `Fees and Charges – Confirmation Following Public

Consultation’, presented to the Finance & Audit Committee on

17 June 2020, be approved, effective from 1 July 2020.

|

1. ISSUE

At its meeting on 25 March 2020 the Council approved fees

and charges for planning and miscellaneous services and for trade waste

services, all subject to public consultation. This memo addresses

submissions received and recommends confirmation of the fees and charges as

attached.

2. BACKGROUND

2.1 Previous

Council Decisions

On 25 March Council adopted recommendations from the

18 March meeting of the Finance and Audit Committee. These approved a

schedule of fees and charges for planning and miscellaneous services and trade

waste services subject to public consultation.

2.2 Public

Consultation

Public consultation was carried out over the period

from 1 April to 4 May 2020. It involved direct written communication with

planning consultants and trade waste users as well as public notices in local

media and on Council’s website.

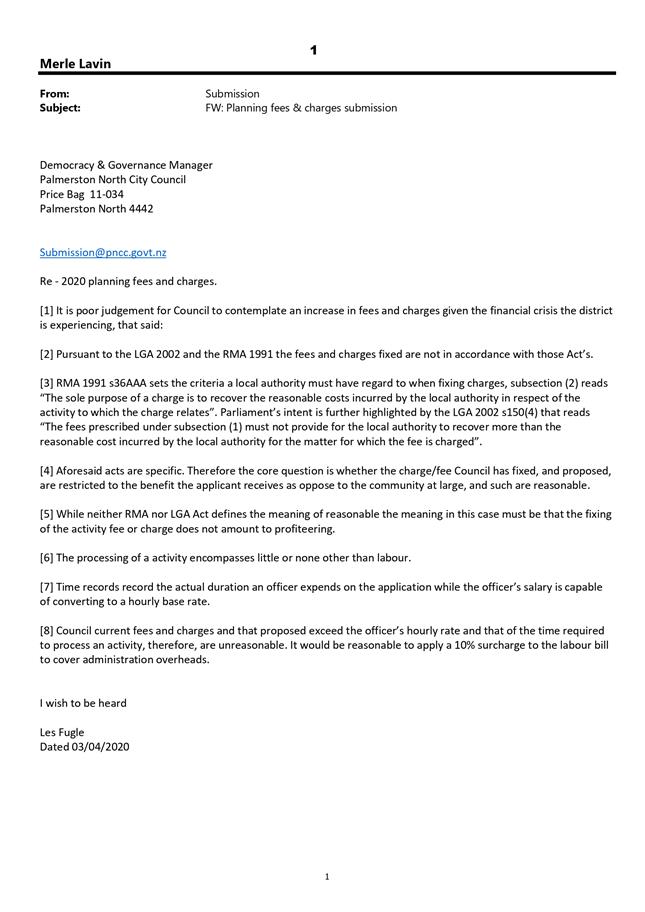

One submission was received in relation to planning

fees. A copy is attached as Appendix A. No submissions

were received in relation to trade waste charges.

In his submission Mr Fugle mentions that he wished

to be heard and he was provided was a number of opportunities to do this but

chose not to do so.

His submission contends in summary that the fees and

charges proposed have been set in a manner than does not comply with the

requirements of the Local Government and Resource Management Acts as the levels

proposed exceed what would be necessary to recover reasonable costs.

The Council’s Revenue & Financing Policy

recognises that some services provided by planning staff (planning advice,

information, consent monitoring and enforcement) are of a public good nature

and as a consequence these are funded from general rates. Those services

related to resource consent processing are private in nature and the policy

expectation is these will be funded from fees and charges. Fees and

charges are set at levels necessary to cover these costs and not at levels with

the objective of making a profit. Time spent on processing each consent

is recorded and the charge made reflects this.

No changes are recommended to the fees provisionally

adopted at the March meeting as a consequence of the public consultation

process.

3. NEXT

STEPS

Once approved the fees and charges will be published

on Council’s website and in all relevant fees and charges brochures and

implemented from 1 July 2020.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require consultation

through the Special Consultative procedure?

|

Yes

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 5: A Driven and Enabling Council

|

|

The recommendations contribute

to the outcomes of the Driven and Enabling Council Strategy

|

|

The recommendations contribute

to the achievement of action/actions in Not Applicable

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

Setting fees and charges as

proposed is consistent with the Council’s Revenue & Financing

Policy and therefore with the strategic direction of the Council.

|

|

|

|

Attachments

|

1.

|

Appendix A - Submission from Les Fugle ⇩

|

|

|

2.

|

Appendix B - Planning & Miscellaneous fees & charges

⇩

|

|

|

3.

|

Appendix C - Trade Waste fees & charges ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 17

June 2020

TITLE: Public

Rental Housing within Council's Whakarongo Subdivision

Presented By: Bryce

Hosking, Manager - Property

APPROVED BY: Tom

Williams, Chief Infrastructure Officer

|

RECOMMENDATION(S) TO FINANCE &

AUDIT COMMITTEE

1. That the

memorandum titled ‘Public Rental Housing within Council’s

Whakarongo Subdivision’ presented to the Finance and Audit Committee on

17 June 2020 be received for information.

|

1. ISSUE

1.1 The

report titled ‘Housing Portfolio Update (February 2020)’ was

presented by Councillor Baty to the Economic Development Committee on 11 March

2020.

1.2 The

Committee Resolved:

1. That

the Housing Portfolio update report for February 2020 be received for

information.

2. That the Chief

Executive be instructed to undertake financial modelling on the possibility of

retaining one third of sections at Whakarongo for public rental housing at

market rates and reported back to the May 2020 Finance and Audit Committee

meeting.

1.3 This

report is in response to the second resolution.

1.4 Due

to the COVID-19 Alert Level 3 and 4 restrictions this report was unable to be

presented to the Finance and Audit Committee in May 2020 as requested, hence is

being presented in June 2020.

1.5 In

order to address the intent of the recommendation the following areas are

addressed within this report:

Section 2 – Background

· A brief overview

of the Whakarongo Subdivision;

· Cost and revenue

expectations of the Whakarongo Subdivision under the existing scope;

Section 3

– Retaining Sections for Public Housing

· Critical

assumptions;

· Estimate cost of

construction of the public rental houses;

· Rental market

overview and potential rental rates that could be achieved;

· Revenue

implications of retaining sections; and

Section 4

– Additional Considerations

· Additional

considerations.

2. BACKGROUND

Overview of the Whakarongo Subdivision

2.1 Palmerston

North City Council owns an area of 9.63ha within the upper terrace of the

Whakarongo residential growth area off James Line.

2.2 The

land was acquired by Council for cemetery purposes but was no longer required.

As obliged under the public works process the land was offered back to the

previous owners to purchase, but no offer was received.

2.3 Given

no offer was received, the parcel of land was subsequently rezoned for

residential use.

2.4 The

Long-Term Plan anticipated that Council will develop this land and funding was

allocated beginning in the 2018/19 financial year through Programme 1485.

2.5 Once

developed the site will create 115 new residential sections. Sections will be

of a variety of sizes to appeal to a wide variety of purchasers by giving

options regarding design, build type and purchase price.

2.6 Below

is the proposed layout submitted with the resource consent approval:

Note, while this is the proposed layout of the site, it may

be subject to minor changes as part of the consent process with PNCC and

Horizons.

2.7 The

development of the site will be split into two stages. The current consents

that have been submitted are for Stage 1 (circa 79 sections), with the balance

of sections to be delivered in Stage 2.

2.8 Stage

2 is subject to the approval of the comprehensive discharge consent (CDC) from

Horizons Regional Council and is anticipated to closely follow, but remain

distinct from, Stage 1.

2.9 Ideally,

the timing of the CDC ties in with the completion of Stage 1 construction works

to enable us to seamlessly roll from Stage 1 to 2 without further mobilisation

and establishment of a contractor. This is subject to the performance and

throughput of Stage 1 and approval of KiwiRail.

2.10 For

clarity, as part of our stormwater requirements of the development, Council

will be installing a culvert from our stormwater dry pond area, under the rail

corridor, and into the oxbow in the below property on the other side of the

rail tracks. Whilst provision will be made for this in stage 1 of the

development, this will not actually be constructed until stage 2. KiwiRail

require a specific formal approval process for this undertaking over and above

the resource consent. There have been ongoing discussions with KiwiRail

regarding this, but formal approval is still required in due course.

2.11 Below is a summary of the

Stage 1 Development Programme:

· May/June

2020 – consent

· June/July

2020 – detailed design

· July/August

2020 – presales and procurement

· September

2020 – contract negotiations and mobilisation of contractors

· October

2020 – earthworks commencement

· February

2021 – civil works commencement

· August 2021

– titles issued.

Cost and revenue

expectations – existing Whakarongo Subdivision scope

2.12 The

development of the Whakarongo Subdivision is estimated as having a total

project cost of $16.8 million plus GST. This includes items such as

design and consent fees, professional fees, earthworks, construction, sales

costs etc.

2.13 This

estimated total project cost is to take the development through to fully

serviced sections which are then sold. It did not include any dwelling

construction.

2.14 It is also

important to note that as we have not yet gone out for tender for construction

phase of the project, this project cost is only an ‘educated

estimate’ and will not be able to be confirmed until a tender is

accepted, and Council enters into a construction contract.

2.15 The

sections will be marketed for sale at competitive, but market determined sale

rates.

2.16 Obviously

with such a variety of section sizes the exact sale prices for each section

will vary. Residential sections around the city are selling for $400-$450 per m2.

2.17 For the

purpose of this report and to provide an indicative total sales revenue figure,

an average section sale price of $250,000 incl. GST will be adopted.

This is based on an average section size of 588m2 within the subdivision

@$425 per m2 (mid-range).

2.18 Confirmed

sale prices for each section will be confirmed in July/ August as part of the

Presales and Procurement phase.

2.19 Given the

above the potential sales revenue from the subdivision could be calculated as around

$28.75 million incl. GST. (115 sections @$250,000 each) or $25 million plus

GST.

2.20 For

clarity this means:

· There will be a

potential profit (excluding GST) of around $8.2 million for Council once all

sections are sold; and

· Crudely

calculated, Council would need to sell 77 sections to cover the cost of the

project.

3. Retaining

sections for Public housing

Critical

Assumptions

3.1 To

assist in the financial modelling exercise, the following critical assumptions

have been made in writing this report:

· That “retaining

one third of sections” applies to the first stage of 79 sections of

the development only, not the total development of 115 sections. This equates

to 26 sections being retained.

· That any public

housing built will be retained by Council and rented out at market dictated

rates, not on-sold to the market in the foreseeable future.

· That the public

housing built will be mid-range, 2 and 3-bedroom homes but constructed in line

with what would be appropriate within a new housing development.

· That the sections

retained will be “pepper-potted” throughout the subdivision rather

than a concentrated Papaioea Place type complex.

· The sections

retained will be a variety of sizes as opposed to just the smaller ones etc.

· There will be a

continued high demand for purchasing sections, and as such sections will sell

for market rates in a timely manner.

· The potential

average sale price will be $250,000 incl. GST as per Clause 2.17.

· The development

contributions (DC) for stormwater and local reserves is high for this

catchment, although this might change given the plan to develop stormwater

detention areas to meet Horizon’s requirements. This report will be

adopting the current DC rate of $12,435 plus GST per section.

· A section with a

$250,000 land value would pay annual rates of $2,680 incl. GST or $2,330 plus

GST in 2020/21.

· There will be a

continued extremely high demand for rental property in the region and as such

rental houses will be tenanted quickly and low vacancy rates will be expected.

· The additional

rental properties would be managed by Council’s housing tenancy team.

Council would need to increase its staffing resources to manage the additional

26 houses effectively thus a property management cost will need to be

considered.

· The current

average market property management fee rate in Palmerston North is 8.5% of the

gross rental collected. This includes a profit margin. A reduced property

management cost of 6% will be applied when calculating costs to reflect management

costs only.

· It

is common for external property management companies to recommend landlords

allow between 40-50% of the weekly rental to cover the ongoing costs of a

rental property. Considering the properties would be new builds and rates are an

internally charged expense, a 30% allowance will be used to calculate the net

rental returns for the properties.

Estimated cost of

construction of the public rental houses

3.2 Council

Officers engaged with an experienced building company to get an idea of the

appropriate housing build costs in the current market.

3.3 A

summary of their feedback:

· $300,000 –

$350,000 plus GST per house would be achievable and appropriate from a

budgeting perspective;

· 2 and 3-bedroom,

single bathroom houses would be most appropriate;

· There can be

options to build houses with and without garages; and

· Brick

cladding with a pitched roof is the most cost-effective option, and brick

cladding will have less maintenance.

3.4 Given

the feedback from the building company the cost of construction would be

between $7.8 – $9.1 million plus GST (26 sections @$300/$350,000 each).

This cost will allow for consenting and essentially make them available as

‘turn-key’ homes.

3.5 In

addition to this it would be appropriate to allow $200,000, for professional

and project management fees on top of the construction costs. From a budgeting

perspective this would mean an effective budget of $8 – $9.3 million plus

GST to deliver these 26 public rental houses.

3.6 This

would be an additional, unbudgeted capital new expense.

Rental market

overview and potential rental rates that could be achieved

3.7 At

the time of writing this report there is a significant shortage of supply vs.

the demand for housing, both for sale and in the rental market.

3.8 As

a result, the achievable market rental rates have increased significantly over

the last 18 months.

3.9 Considering

these would be new homes, in the Kelvin Grove/ Whakarongo area, and low

maintenance; Rental agents and Council Officers have indicated a weekly rental

of $450-$550 would be achievable.

3.10 Assuming

the 26 homes were rented out, below is some potential gross annual rental

scenarios that could be achieved (‘x’ weeks tenanted @$450/$550 per

week x 26 homes):

· 48/52 weeks

tenanted – return would be $561,600 and $686,400.

· 50/52 weeks

tenanted – return would be $585,000 and $715,000

· 52

weeks tenanted – return would be between $608,400 and $743,600.

3.11 Note: the

above rental figures are gross rent. Expenses such as rates, insurance, and

repairs and maintenance still need to be deducted.

3.12 Using

the same vacancy scenarios as Clause 3.10 and the 30% allowance for expenses

(as per the Critical Assumptions section, Clause 3.1), below is the potential

net annual rental scenarios that could be achieved:

· 48/52 weeks

tenanted – return would be $393,120 and $480,480.

· 50/52 weeks

tenanted – return would be $409,500 and $500,500.

· 52

weeks tenanted – return would be between $425,880 and $520,520.

3.13 Note: this

does not consider the interest cost of the capital new borrowings for the

construction of the houses.

Revenue

implications of retaining sections

3.14 There

are several revenue and profit implications of retaining sections and

subsequently building public rental housing. They can be summarised as:

· Reduced revenue

and profit from the sale of sections – Based on the average sale price of

$250,000 incl. GST per section, there would be a deduction of sales revenue of

$6.5 million incl. GST or $5.65 million plus GST. This equates to around 69% of

the potential profit.

· The development

would not “pay for itself” in Stage 1 – Council would have to

wait until Stage 2 sections sales to start making a profit.

· While development

contributions will still be paid, it would be an internal transaction. By

retaining 26 of the sections, Council would be forgoing this income. This would

equate to $323,310 plus GST in lost revenue (26 sections @$12,435 plus GST per

section).

· Rates for the

sections would also be an internal transaction and thus not be collected as an

external revenue. This would equate to $60,600 plus GST in lost revenue (26

sections @$2,330 plus GST per section).

· An additional

property management cost of effectively managing the additional 26 rental

houses. This equates to between $33,696 and $44,616 per annum depending on the

vacancy rate ($561,600 @6% and $743,600 @6% - the minimum and maximum gross

figures in Clause 3.10).

· Crudely,

without considering interest, it would take approximately between 11 – 15

years of net rental income from the 26 homes to make up the profit Council

would have made from section sales and development contributions.

4. additional

considerations

4.1 The

construction of the 26 houses would be an additional, unbudgeted capital new

expense.

4.2 As

mentioned throughout this report there is a significant shortage of supply vs.

the demand for housing, both for sale and in the rental market.

4.3 A

positive consideration for retaining sections is it would allow Council to

directly provide an additional 26 homes for rent in the marketplace in a timely

manner, rather than waiting on the private sector or other government agencies.

4.4 Some

multi-unit development (e.g. Papaioea Housing) may provide more efficient

land-use opportunities. This approach could allow supply of 26 dwellings in a

smaller footprint of sections, although would require blocks of units to be

retained rather than “pepper-potting” throughout the development.

In turn this would free up more sections to sell to the market. Alternatively,

PNCC could retain 26 sections and increase the number of units within these,

rather than building 26 stand-alone dwellings.

4.5 The

new home construction market, while being the most competitive it has ever

been, is still under pressure to meet the demand due to contractor

availability. Some group builders have 18-month wait times before construction

begins. This has been further extended as a result of the COVID-19 restrictions

and delays.

4.6 Depending

on the desired outcomes Councillors are looking for, an alternative option

could be to sell some sections to a government agency such as Kāinga Ora to

build rental housing or “Kiwi-Build” houses themselves.

4.7 Currently

there are limited amenities such as supermarkets in the area (the closest being

the Countdown complex on Roberts Line) and the subdivision is not on a current

public transport route. This may have some implications for tenants without

vehicles and make the properties unsuitable for social housing until this was

remedied.

4.8 Providing

unsubsidised public rental housing is in direct competition to the private

rental market. This could be viewed negatively by sectors of the market.

4.9 The

Social Housing Plan focuses on providing warm, safe, and affordable housing for

people on low incomes who:

· Are

Super-annuitants;

· Have long term

disabilities; or

· Experience

barriers to renting in the private market.

4.10 Whilst

providing more housing is in line with the Social Housing Plan; public rental

housing will potentially be targeting a different user-group as market rental

would be sought for these properties.

5. NEXT

STEPS

5.1 Council

to consider its options in respect to retaining one third of the sections

within the Whakarongo subdivision for the construction of public rental

housing, including the timing of construction.

6. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do, they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 3: A Connected and Safe Community

|

|

The recommendations contribute

to the outcomes of the Connected Community Strategy

|

|

The recommendations contribute

to the achievement of action/actions in the Social Housing Plan

The action is: Build new Council housing (by end of 2020/2021)

|

|

Contribution

to strategic direction and to social, economic, environmental and cultural

well-being

|

Build

new Council housing (by end of 2020/2021)

|

|

|

|

Attachments

Nil

PALMERSTON NORTH CITY COUNCIL

Report

TO: Finance

& Audit Committee

MEETING DATE: 17

June 2020

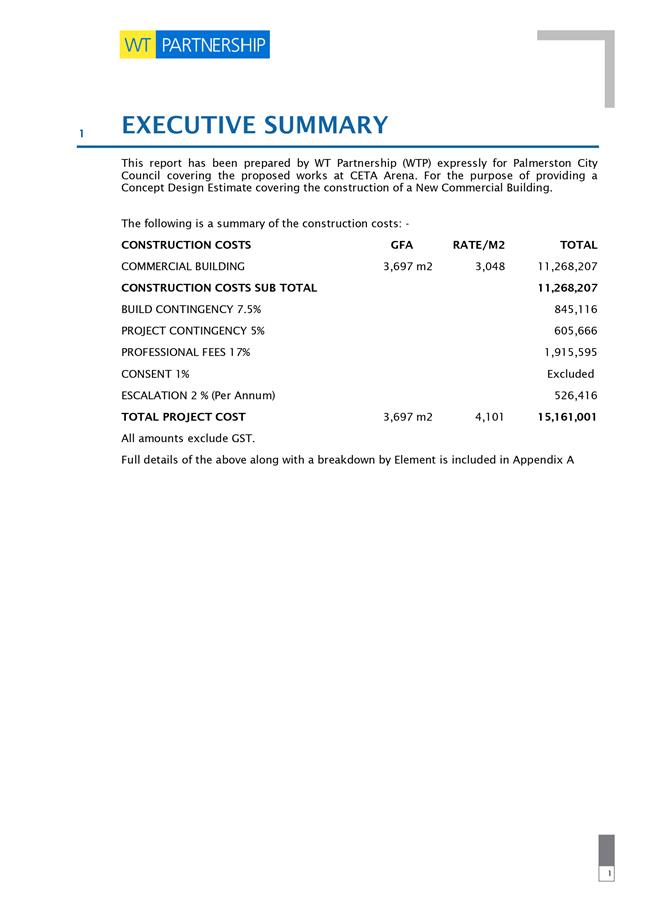

TITLE: CET

Arena - Commercial Building Opportunity

PRESENTED BY: Bryce

Hosking, Manager - Property

APPROVED BY: Tom

Williams, Chief Infrastructure Officer

|

RECOMMENDATION(S) TO COUNCIL

1. That

Council does not proceed with programme #1514 – Central Energy Trust

Arena Manawatu – Commercial Building in the current financial year.

2. That

Council considers the construction of a commercial building at Arena, along

with the timing of such a development, as part of the 2021-31 Long-Term Plan.

|

Summary of options analysis for

|

Problem

or Opportunity

|

Council has an opportunity to

build a ‘Commercial Building’ next to the new embankment which

will see the public enter from the pedestrian bridge through the building

into Arena 1. The building would incorporate multiple tenancies which will be

strategically leased out for a commercial return and with a lens to add value

to the Arena.

This building is an additional

unbudgeted expense, and as such Council needs to decide whether to proceed

with its construction or not.

|

|

OPTION

1:

|

Build a Commercial Building

including a hospitality/ function facility on the top floor

|

|

Community Views

|

· No formal public

consultation has been undertaken on the construction of a commercial building

on the site.

|

|

Benefits

|

· The building

would create unique feature building in the Arena entrance with potential to

be a real showcase for the city.

· A financial

return can be achieved from the building helping with investment payback.

· The strategic

selection of tenants will add value to, and compliment, the Arena and its

activities.

· Multiple

tenancies allow for the spreading of vacancy risk.

· The creation of

high-quality corporate hospitality and function space on the top floor

creates future ‘game day’ opportunities and income, as well as

functions and conference opportunities.

· The building

will help to create excitement and build anticipation for events as public

approach the stadium and cross the bridge.

|

|

Risks

|

· The building

would be a significant additional expense in the next 10-year plan, which is

currently unbudgeted.

· There are

several competing financial interests in the 10-year plan. Accommodating an

additional project of this size may be difficult.

· The building is

not an essential function of the Arena, and the redevelopment work currently

underway can proceed without the building and still achieve an excellent

outcome.

· The construction

of a building for commercial business purposes does not align with the

current zoning at Arena and would require a discretionary resource consent to

proceed.

· The rental

return on investment rate is below what could be achieved in the commercial

property marketplace.

· As Council would

want to be selective in its tenants and coupled with the location not being a

traditional location for some of the tenant industries, this may result in

the building having an extended vacancy period or being hard to tenant.

|

|

Financial

|

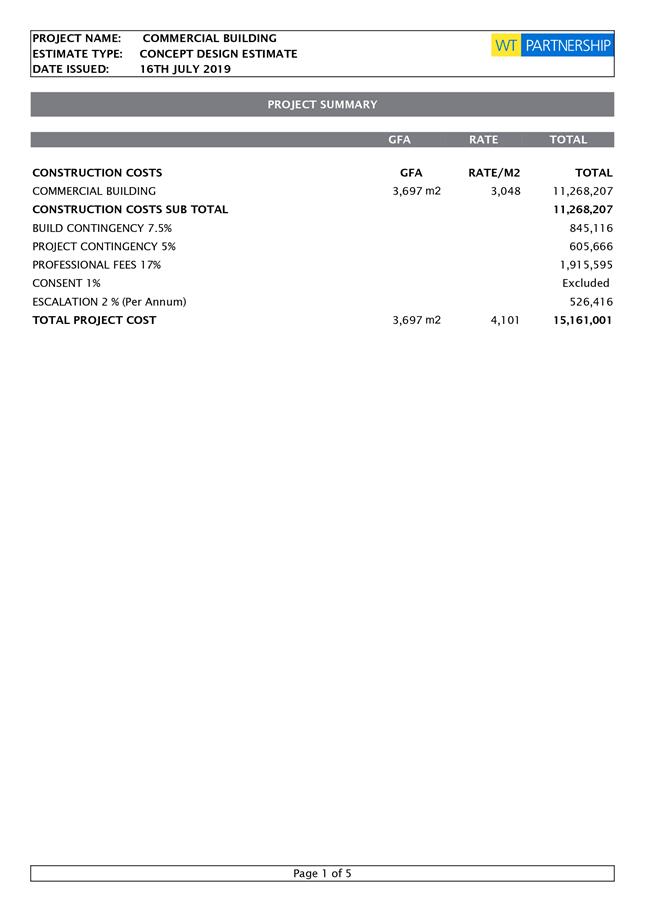

$15,161,000 + GST

|

|

OPTION

2:

|

Build a Commercial Building

without a hospitality/ function facility

|

|

Community Views

|

· No formal public

consultation has been undertaken on the construction of a commercial building

on the site.

|

|

Benefits

|

· The building

would create unique feature building in the Arena entrance with potential to

be a real showcase for the city.

· A financial

return can be achieved from the building helping with investment payback.

· Multiple

tenancies allow for the spreading of vacancy risk.

· The strategic

selection of tenants will add value to, and compliment, the Arena and its

activities.

· The building

will help to create excitement and build anticipation for events as public

approach the stadium and cross the bridge.

|

|

Risks

|

· The building

would be a significant additional expense in the next 10-year plan, which is

currently unbudgeted.

· There are

several competing financial interests in the 10-year plan. Accommodating an

additional project of this size may be difficult.

· The building is

not an essential function of the Arena, and the redevelopment work currently

underway can proceed without the building and still achieve an excellent

outcome.

· Quality

hospitality, function and conference facilities are desirable in the city, so

this may be a missed opportunity by not including this, especially in this

unique setting and outlook.

· The construction

of a building for commercial business purposes does not align with the

current zoning at Arena and would require a discretionary resource consent to

proceed.

· The rental

return on investment rate is below what could be achieved in the commercial

property marketplace.

· As Council would

want to be selective in its tenants and coupled with the location not being a

traditional location for some of the tenant industries, this may result in

the building having an extended vacancy period or being hard to tenant.

|

|

Financial

|

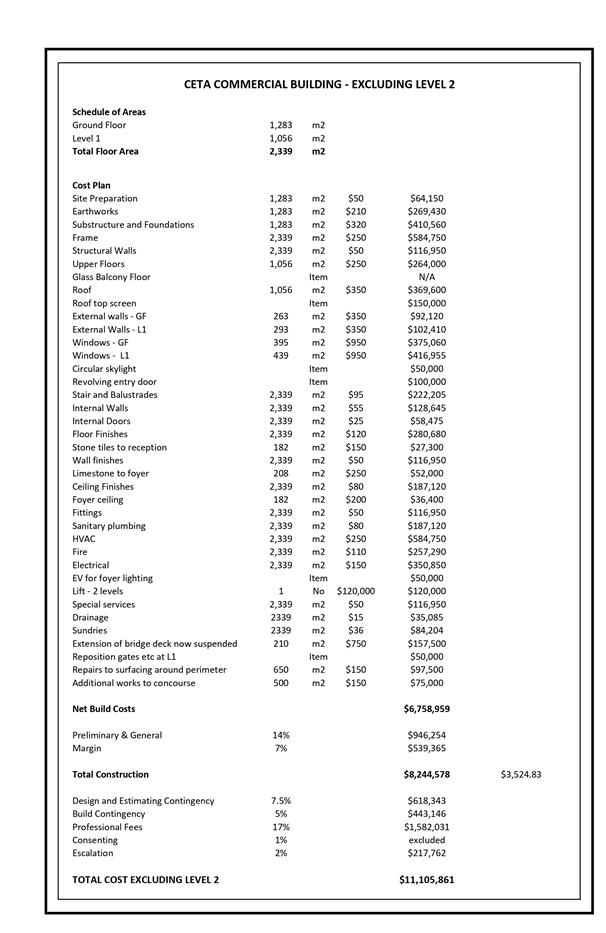

$11,105,861 + GST

|

|

OPTION

3:

|

Do not proceed with the construction

of a Commercial Building

|

|

Community Views

|

· No formal public

consultation has been undertaken on the construction of a commercial building

on the site.

|

|

Benefits

|

· As there are

several competing financial interests in the 10-year plan, so not proceeding

frees up finances for other programmes.

· The building is

not an essential function of the Arena, and the redevelopment work currently

underway can proceed without the building and still achieve an excellent

outcome.

|

|

Risks

|

· May be viewed as

a missed opportunity by the public, stakeholders and users of the Arena.

|

|

Financial

|

None.

|

Rationale for the recommendations

1. Overview

of the problem or opportunity

1.1 As

part of the redevelopment of the CET Arena there are three projects which have

physical works commencing in the current 2019/20 financial year – The

Speedway Pits Relocation, the new Entrance Plaza, and the Embankment

Redevelopment. The construction of these projects will conclude in the 2020/21

financial year.

1.2 There

were several complex safety issues associated with access, security and public

separation with the speedway cars during events, while still allowing for the

pits area to be viewed by the public.

1.3 The

creation of a bridge from the entrance plaza to the embankment was selected

through design and development as the best solution to overcome these safety

issues and is to be constructed as part of the entrance plaza project.

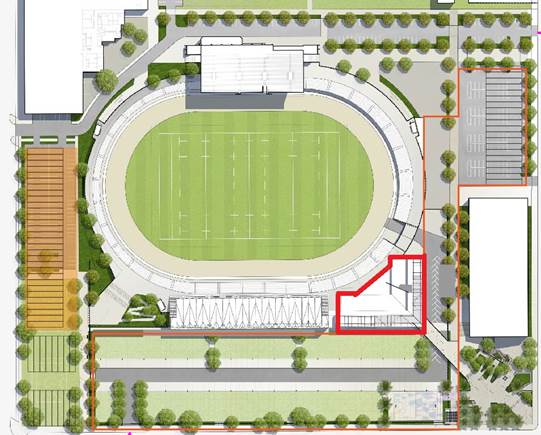

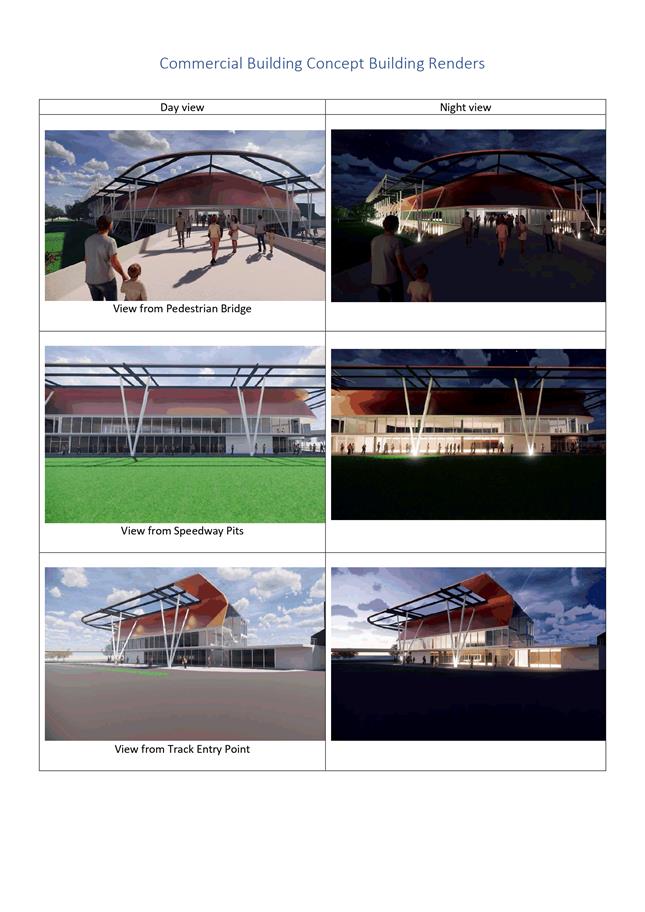

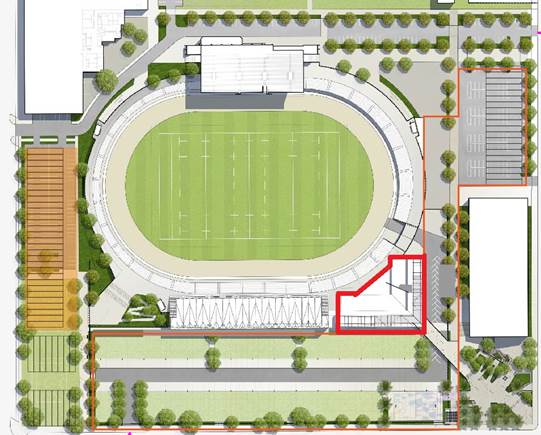

1.4 Council

has an opportunity to build a ‘Commercial Building’ next to the new

embankment which will see the public enter Arena 1 from the pedestrian bridge,

through into an atrium area within the building, and then through into Arena 1

itself. This is indicatively shown in red on the below plan.

1.5 In

addition to the entrance atrium, the building would incorporate multiple

tenancies. These will be strategically leased out for a commercial return and

to tenants which would add value to the Arena and its activities.

1.6 Please

note: This building is an additional unbudgeted expense, and as such,

Council needs to decide whether to proceed with its construction or not.

1.7 If

Council decides to proceed, the timing of the construction and availability of

funds would need to be determined within the 2021-31 10-year plan.

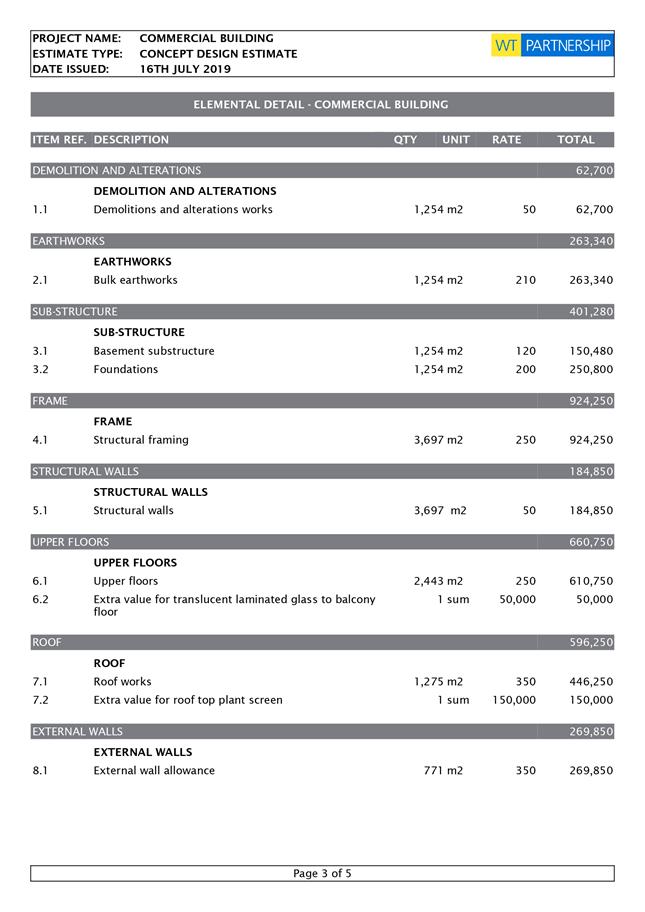

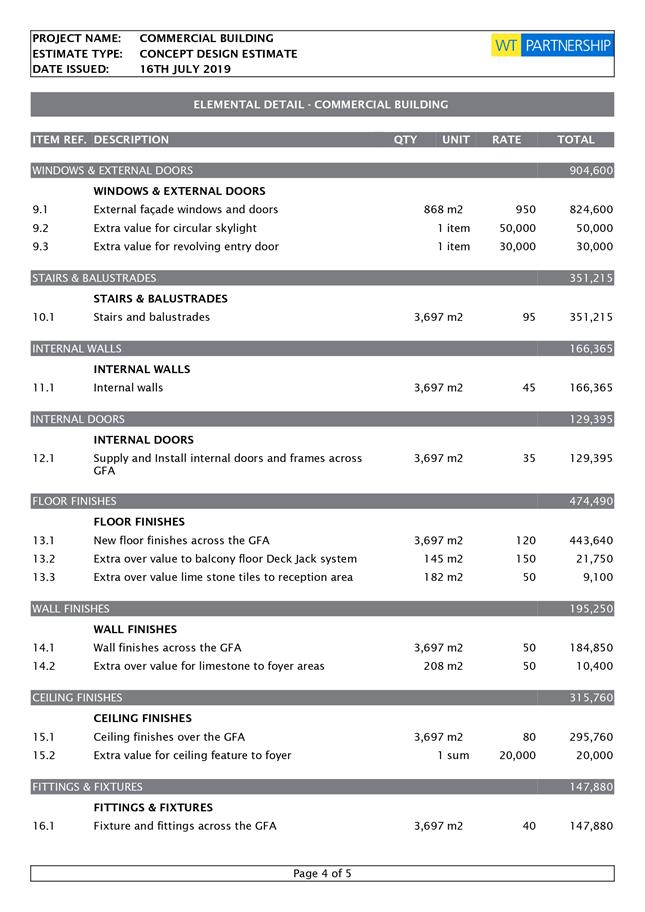

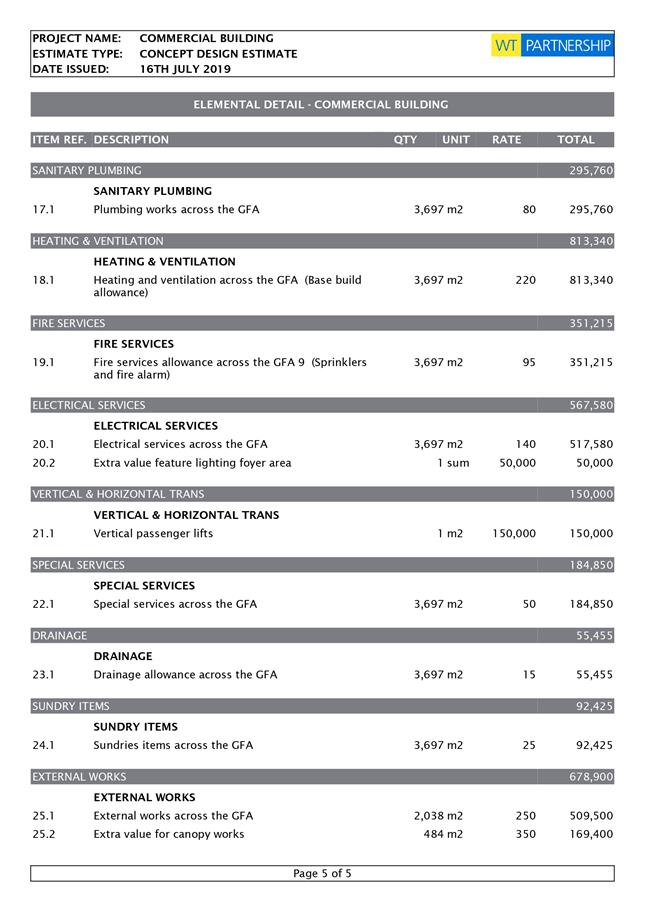

1.8 To

assist in Council’s decision making, Council Officers in conjunction with

WT Partnership, have explored some high-level feasibility analysis including:

· Proposed building

and tenancy sizes;

· Indicative

construction materials and project costs; and

· Tenancy

mix options and potential commercial returns.

This analysis work is detailed in

Section 4 of this report.

1.9 Please

note: the construction costs presented in this report are for planning and

budgeting purposes only. While efforts have been made to ensure the costs are

as accurate as possible, these figures are subject to change as scope is

refined and detailed designs are formed.

2. Background

and previous council decisions

Sports House

Withdrawal

2.1 The

Sports House building was proposed to be located and built next to the new

entrance plaza near the Cuba Street edge of the Arena. The concept was set to

include a mix of sports related tenants, commercial leasing opportunities and

potentially even a ticket purchasing area for events.

2.2 However,

Sports House was formally withdrawn from the Arena redevelopment in 2019, and

this was an important change to the design for the Arena redevelopment.

2.3 While

a disappointing outcome, the Pits and Plaza designs were able to be modified

following withdrawal of Sports House to provide a range of design benefits

including:

· Continued

utilisation of existing buildings to reduce spend;

· Less impact on

existing operations; and

· A

reduction in long term impact to adjacent residents.

2.4 The

withdrawal of Sports House also created the opportunity for a

‘replacement’ building of sorts to be considered as a feature of

the entrance redevelopment in a revised location.

2.5 The

final Pits and Plaza designs were created to allow an opportunity such as this

building to be incorporated at a later stage in the development if desired by

Council while still allowing for the Speedway Pits, Embankment and Entrance

Plaza projects to still proceed immediately.

2.6 Equally,

if Council chose not to proceed with a commercial building, the designs would

still provide an excellent outcome for the site.

2.7 These

designs were endorsed against the Arena Masterplan and deemed to be within the

Masterplan parameters. These were presented to the independent planning

commissioner and a non-notified resource consent has been granted.

2.8 In

theory, it is possible for the building to house a revised Sports House concept

once constructed on the ground floor. However, the feasibility analysis in

Section 3 of this report is based on achieving commercial rentals for the

space.

2.9 For

clarity, if a favourable rate was offered for the Sports House tenant, it will

further reduce the commercial return rate that can be achieved, and be

association reduce the building’s ability to “stack up”.

Existing Financial

Provisions

2.10 Following

the withdrawal of Sports House, the $1,500,000 operational grant that was in

the 10-year plan to contribute towards the Sports House construction project,

was repurposed as part of the 2019/20 Annual Plan as a capital new programme:

Programme 1514 – Central Energy Trust Arena Manawatu – Commercial

Building.

2.11 As all

work to date has been initial feasibility work. All analysis, high-level

concept design, and commercial viability work to date is an operational expense

and not capitalised against this Programme.

2.12 For

clarity, if Council decides to proceed with the commercial building, some

detailed design and planning could be undertaken this financial year and be

capitalised against this Programme. However, this would not be anywhere near

the $1,500,000 budget.

2.13 The

balance of the Programme could be carried forward and form part of the

construction programme budget provision.

City Planning and

Zoning Considerations

2.14 Overall,

the proposal to create a tenanted commercial building within CET Arena is a

poor fit with the District Plan.

2.15 CET

Arena has a very specific and unique ‘Arena Zoning’. It was created

to provide for sport and recreation-based activities. This was a deliberate

decision that was made in 2017 when the Recreation Chapter of the District Plan

was reviewed.

2.16 Seeking

to establish activities such as a commercial office, retail etc. unrelated to

recreation or sport would trigger a Discretionary Activity resource consent,

which would need to be assessed against the Arena Zone’s Objectives and

Policies and the City-wide Objectives.

2.17 The

Arena Zone’s Objectives and Policies only provide for recreation and

sport-based activities and City View Objective 14 seeks to retain the City

Centre as the primary focus for office and retail activities within the City.

This suggests that a resource consent application would be difficult to obtain.

2.18 City

View Objective 13 does provide some counterbalancing. It states that

“investment within the City is stimulated and identified priority sectors

such as education and public administration are well supported”.

2.19 Availability,

or lack of, high-quality office space in the city centre could also form part

of the application. However, if there is a lack of space this may not be enough

grounds for consent approval given the other factors already mentioned.

2.20 If there

was a sizeable new anchor tenant that could tenant the building on Arena, this

same tenant could be better suited to work with a developer in the private

sector to justify upgrades to existing buildings within the city centre, or to

build something new.

2.21 Ultimately,

there is no guarantee that a resource consent application would be granted for

a commercial building to be built and tenanted, and depending on the industries

tenanting the building, it could be viewed as these being better suited to

being within the city centre, rather than at Arena.

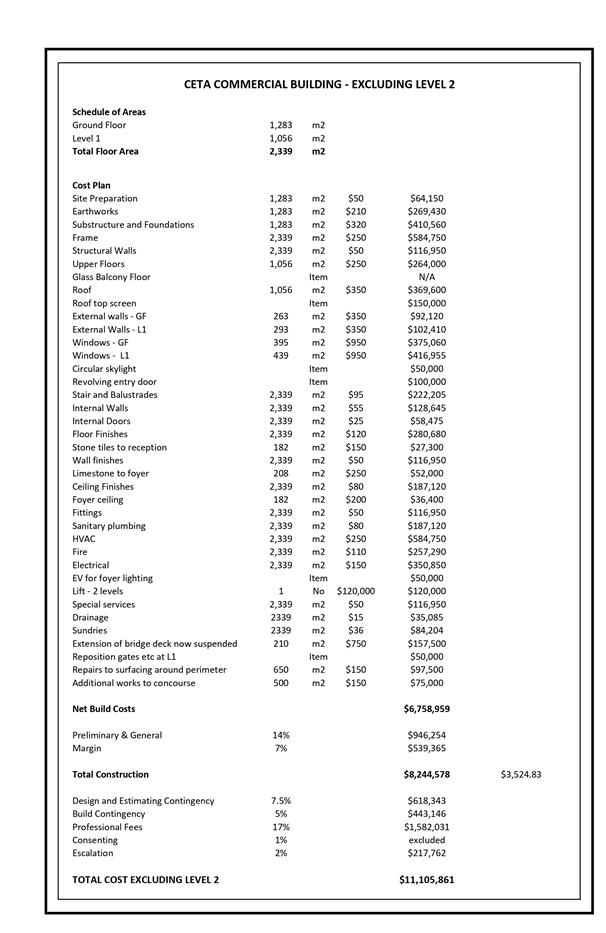

3. Description

of options

Build a commercial

building including a hospitality/ function facility on the top floor

3.1 The

proposed building is to be located next to the newly redeveloped embankment and

will see the public enter Arena 1 from the pedestrian bridge, through into an

atrium area within the building, and then through into Arena 1 itself.

3.2 In

addition to the entrance atrium, the building would incorporate multiple

tenancies. These will be strategically leased out for a commercial return and

to tenants which would add value to the Arena and its activities.

3.3 The

following description of the building is only an indicative construction and

layout. Floor and tenancy sizes and layouts may be subject to change upon

completion of final designs.

3.4 The

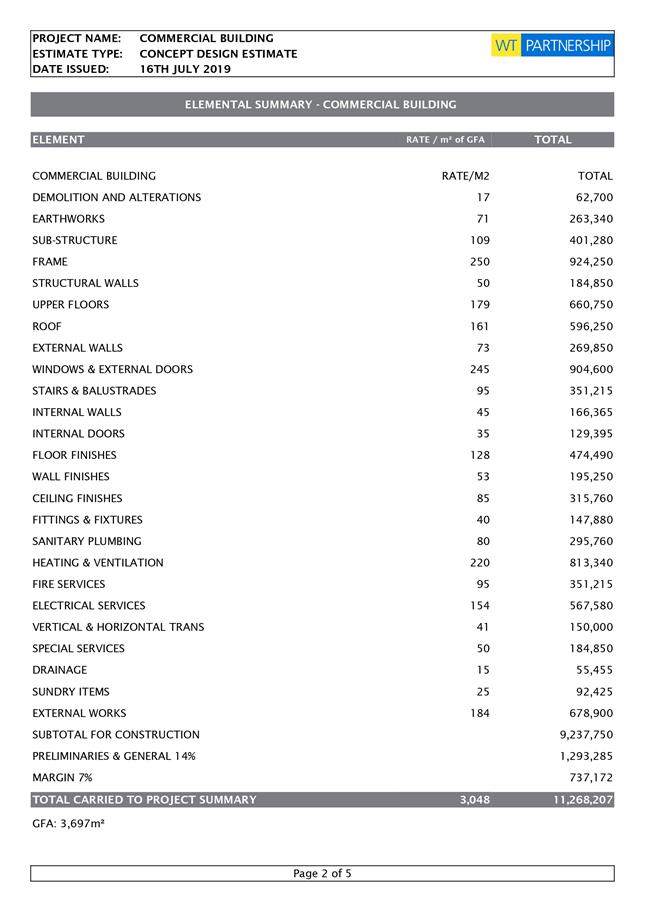

proposed high-level dimensions of the building are:

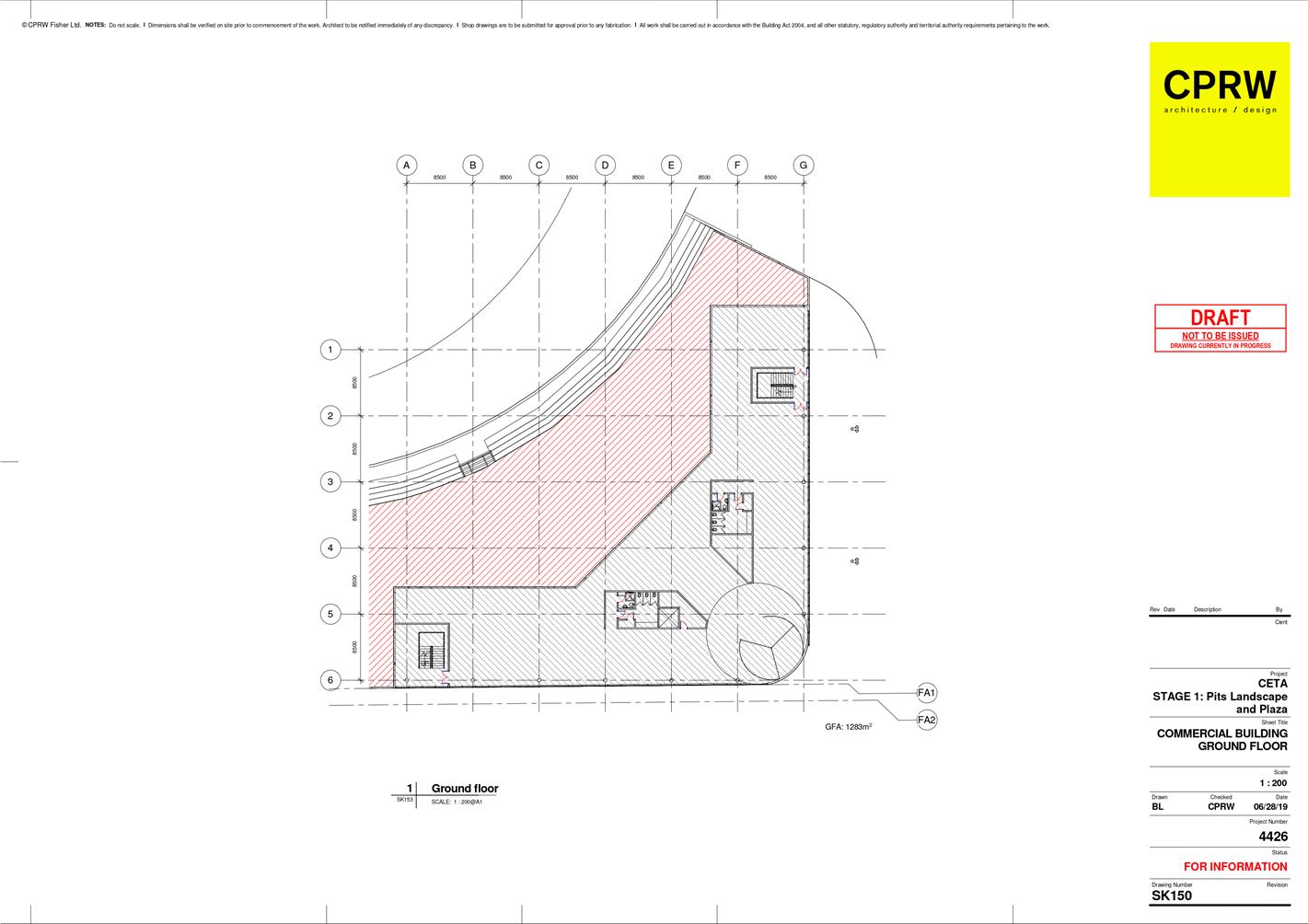

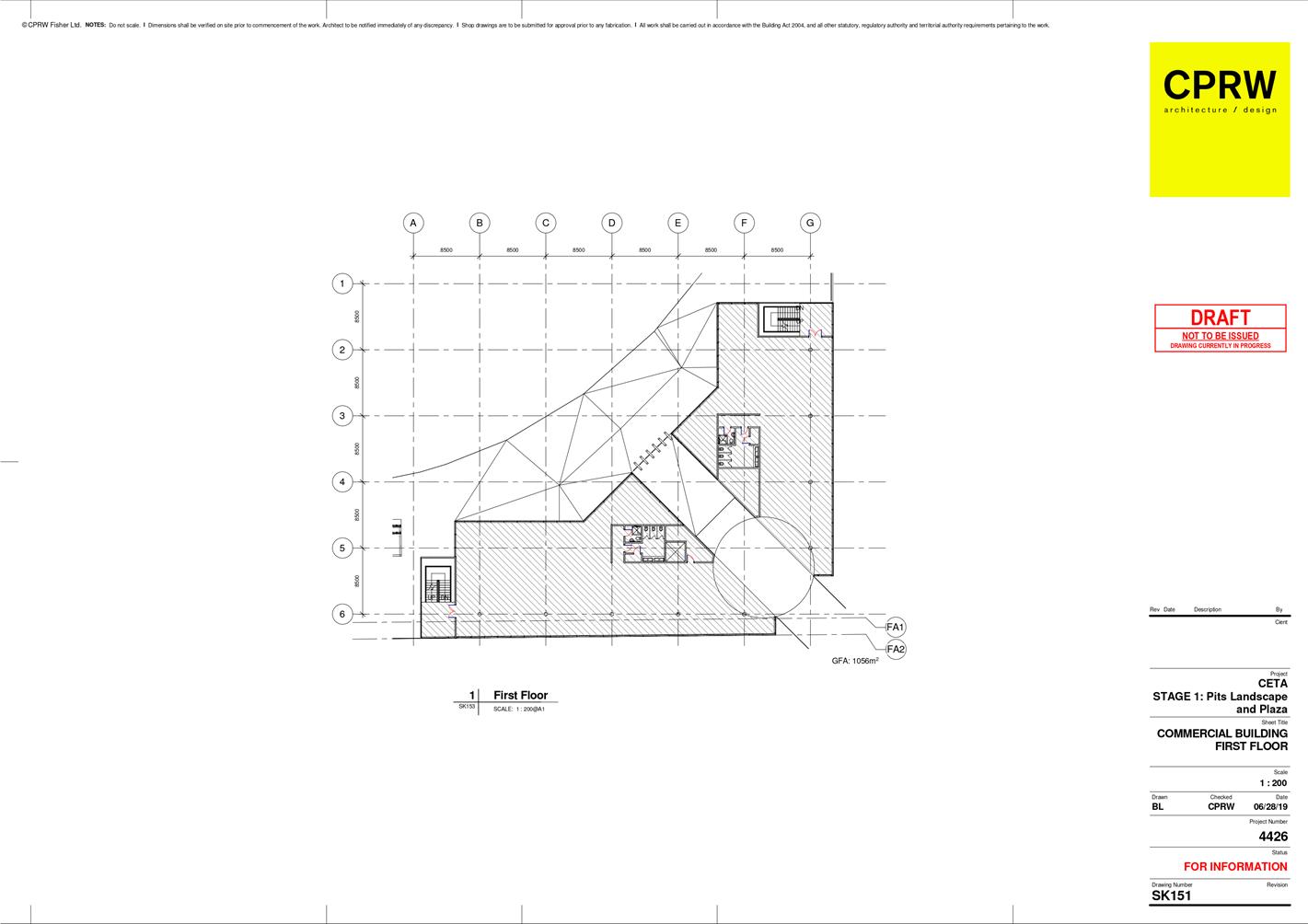

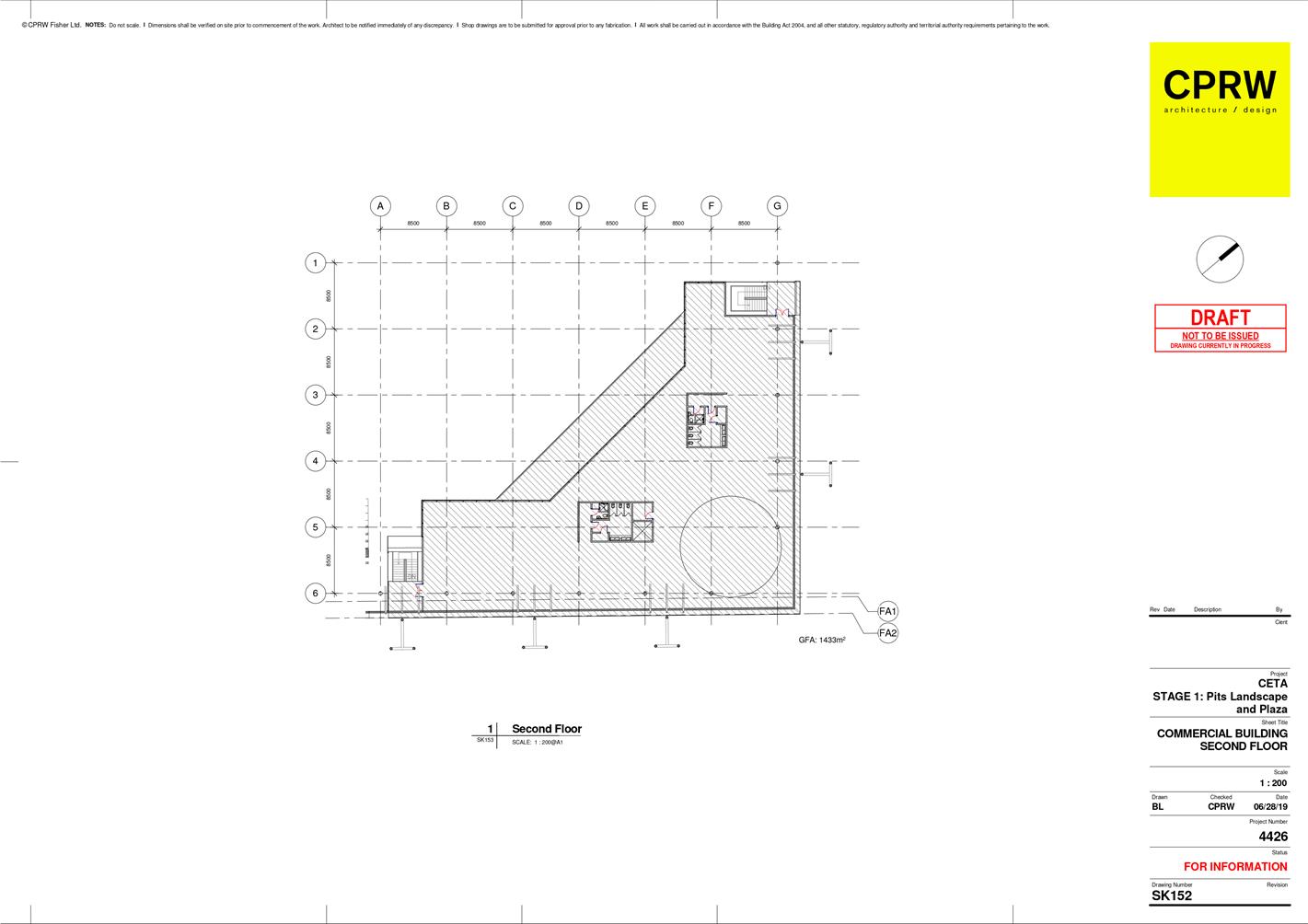

|

Floor

|

Floor Size

|

Additional Features

|

|

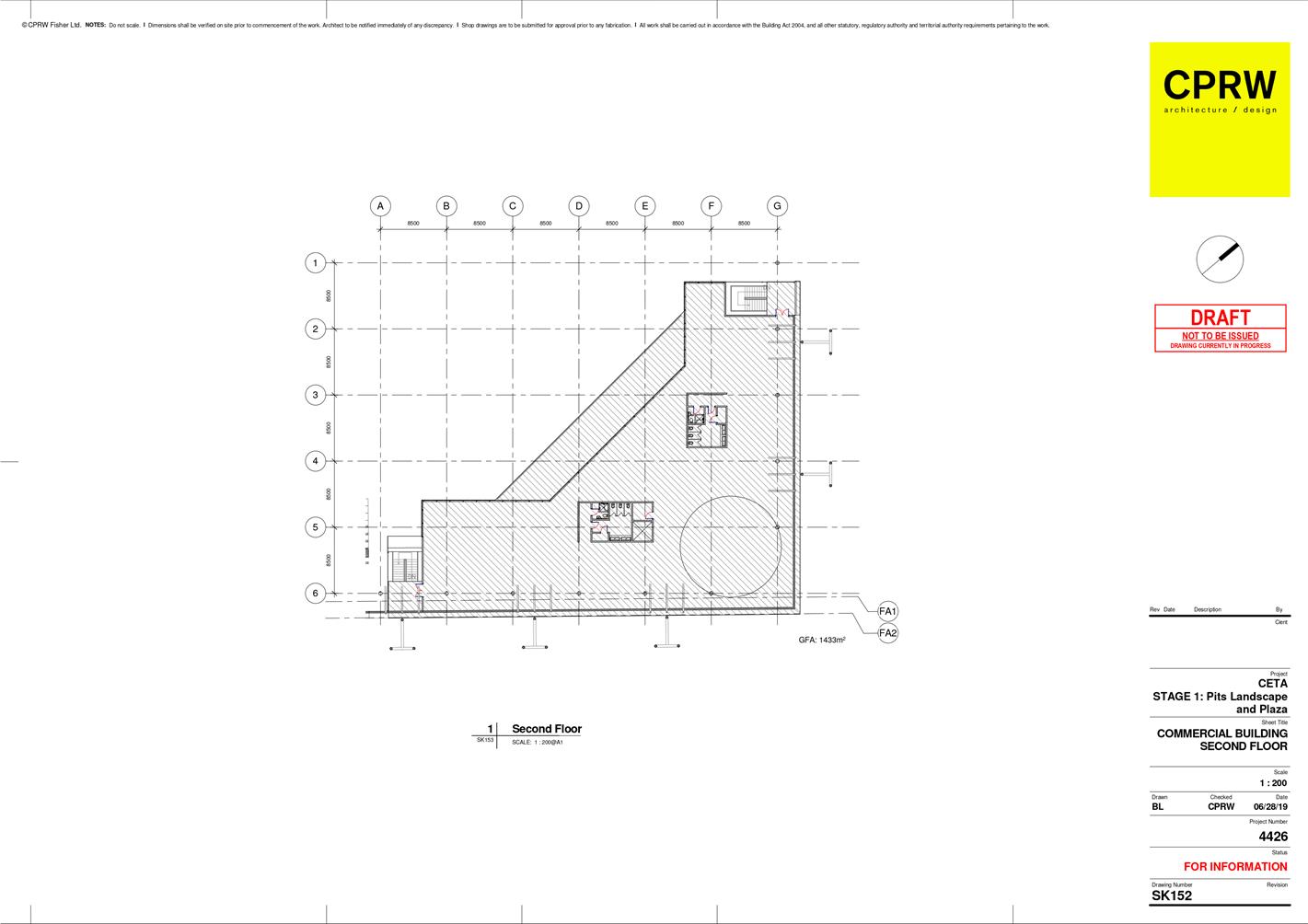

Ground

|

1,283m2

|

|

|

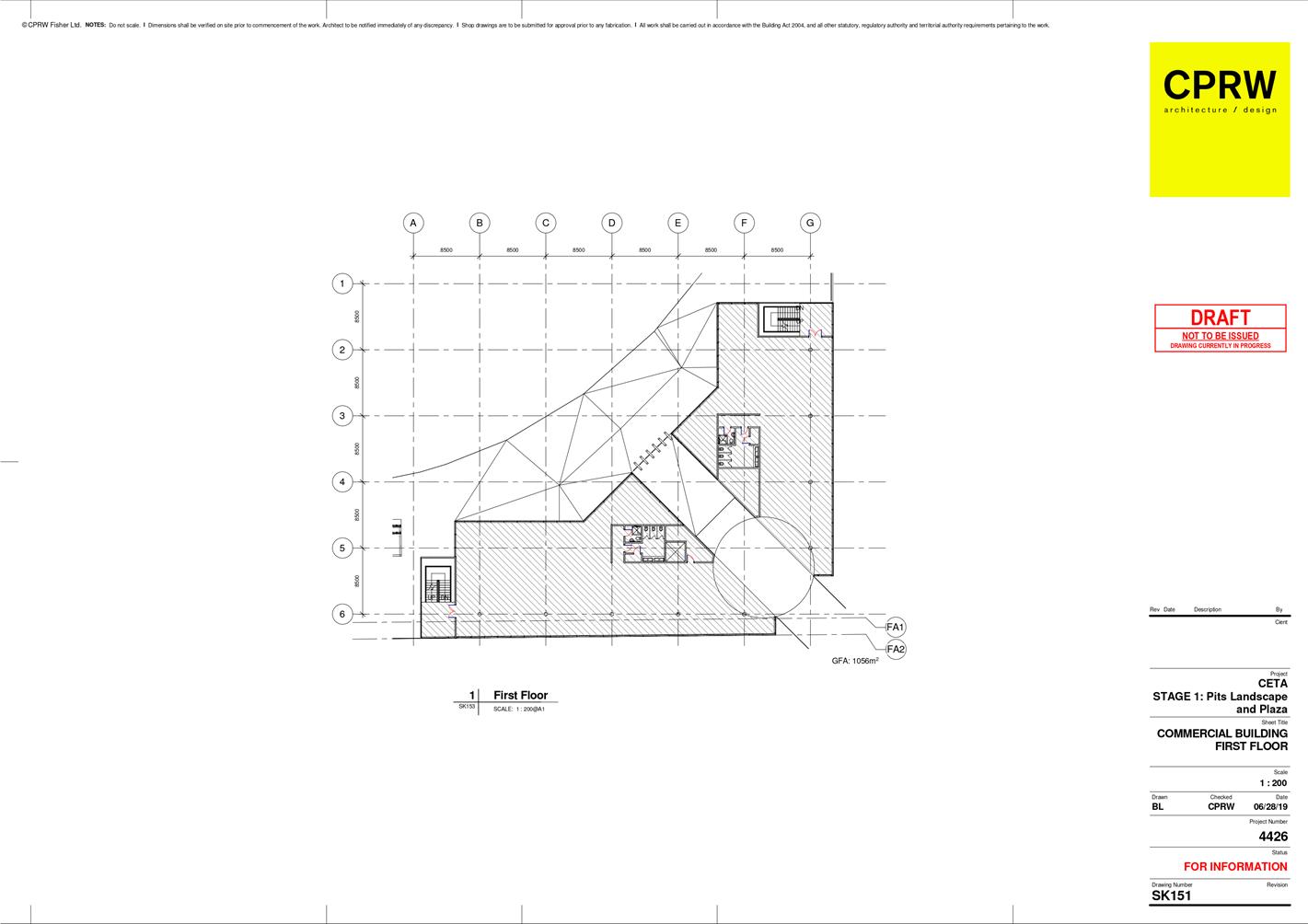

First

|

1,056m2

|

Includes the atrium

area/ connection to Arena 1

|

|

Second/ Top

|

1,358m2

|

Additional 75m2

balcony overlooking Arena 1

|

|

Total

|

3,697m2

|

|

3.5 Please

refer to Appendix 3: ‘Indicative Floor Plans’ and Appendix

4: ‘Commercial Building Concept Building Renders’ attached

to this report.

3.6 Ground

Floor

· 1,283m2

of fully tenantable building space

· Will have a common

lobby so it can accommodate two tenancies as well as a lift to upper floors.

· Independent ground

floor access point for tenants and clientele to enter the building (as opposed

to access along the pedestrian bridge).

· Both tenancies

would have a lettable area of 550m2 each.

· An

alternative could be to combine these into one large tenancy.

3.7 First

Floor

· 1,056m2

floor which includes the pedestrian access and atrium area in through the

middle of the floor.

· There is provision

for two tenancies on this floor; one each side of the atrium. Both tenancies

will have a lettable area of 400m2 each.

· Primary

access to these tenancies will be off the atrium and potentially have a 2nd

entrance off the embankment.

3.8 Top

Floor

· The 2nd

floor / top floor being 1,358m2 would be used as a corporate and

hospitality function space.

· The space would

also include a 75m2 balcony that extends out over the embankment

overlooking Arena 1.

· The space could be

used for hospitality when events are on in Arena 1.

· Alternatively,

the space would be fully bookable as a function/ corporate/ conference space

for both the public and the tenants within the building.

3.9 Estimated

construction cost: $15,161,000 + GST.

3.10 Please

refer to Appendix 1: ‘Option 1: Indicative Project Costs’

attached to this report for a breakdown of the cost for Option 1.

Build a commercial building without a hospitality/

function facility

3.11 This

option is essentially the same as the above, accept without the 2nd/

top floor.

3.12 Given the

primary function of the building as being a commercial building, the assumption

has been made that the focus would remain on achieving lettable tenancies for a

commercial return, as opposed to a hospitality and function space.

3.13 As such,

by removing the 2nd floor, there would not be a hospitality and

function space in the building, nor would there be a balcony overlooking Arena

1.

3.14 Estimated

construction cost: $11,105,861 + GST.

3.15 Please

refer to Appendix 2: ‘Option 2: Indicative Project Costs’

attached to this report for a breakdown of the cost for Option 2.

Do not proceed with the construction of a commercial

building

3.16 As the

commercial building is not being built, the pedestrian bridge would instead

connect straight to the embankment.

3.17 As the

building is not being built, there is no construction cost for this option,

however, there is an opportunity cost in not proceeding.

4. Analysis

of options

4.1 For

the purpose of analysis of the feasibility and viability of a commercial

building on the site as described in Section 3 of this report, this section

will focus on exploring the use of building, potential tenant mix and projected

returns.

Overarching

principles for tenanting the building

4.2 The

commercial building will present a unique proposition in the marketplace unlike

any other options in Palmerston North. Not only would it provide a unique

location and views, but also provide a regular captured audience for the

tenants whenever events are taking place within Arena.

4.3 The

flipside of this, is the importance of selecting tenant industries who will add

value to the Arena and its activities.

4.4 It

would be recommended that PNCC carefully select the tenant industries and

operators for the facility with the following considerations:

· Tenants are fit

for purpose for Arena and compliment other Arena activities;

· Tenant businesses

bring ‘attraction and excitement’ to the building and Arena and

support the building as a drawcard;

· Businesses have

stability and proven operational ability; and

· Tenants

can reasonably meet the foreseeable growth and demand of the commercial

activities (sustainability).

4.5 The

benefits in taking this approach is Council is more likely to result in a lower

turnover of tenants in the long-run and the tenants chosen will be more

resilient.

4.6 The

risk is, as Council would want to be selective in its tenants and coupled with

the location not being a traditional location for some of the tenant

industries, this may result in the building having an extended vacancy period

or potentially being hard to tenant.

Tenant industry typologies

considered

4.7 Putting

aside the zoning considerations mentioned in Clause 2.14 – 2.21 of this

report, the following tenant industry types were considered:

4.8 Conference and

Function Centre

· Council’s

existing Conference & Function Centre on Main Street has shown solid

bookings over the last few years and has strong future bookings levels.

· A corporate and

hospitality function space right next to Arena 1 could host private functions,

conferences, game day corporate hospitality and should bring significant

economic benefit to the Arena.

· As

this industry is not relying on foot traffic or pedestrian flow, this removes

any location issues the Arena may have compared to the city centre.

4.9 Hospitality

· This is a logical

choice from a value-add point of view to the Arena as it would support a variety

of events and activities.

· The tenant/s would

have the ability to operate under standard business hours and not just during

Arena events.

· Hospitality has a

reputation for subjective popularity and is not as stable as other industries

such as office tenants.

· Further to this,

there are concerns around the potential lack of pedestrian flow and foot

traffic outside of events, so the operators would need a robust marketing

strategy to ensure the business remains viable.

· Options

could be a sports bar, café and/or a restaurant.

4.10 Health providers

· A tenancy of

health providers, such as physio and sport science centre are fit for purpose

for Arena activities and could provide several synergies.

· The industry is

not relying on foot traffic or pedestrian flow, this removes any location

issues the Arena may have compared to the city centre.

· However,

the demand and business growth of the industry is uncertain over and above

existing providers already in the city.

4.11 Commercial Office

· High-quality

office space is in strong demand in the city at present.

· Office space has a

good rental return compared to other lease types.

· Office tenants do

not particularly add value to the Arena and its activities however are one of

the most appealing options rental-wise.

· Again, it is not

particularly reliant on foot traffic or pedestrian flow, and removes location

issues the Arena may have compared to the city centre.

· Typically, this is

a stable industry type compared to others like retail and hospitality.

· A

business hub concept could also be considered and would create different vibe

from the traditional office space.

4.12 Retail

· Foot traffic is

important to retail business so this would need to be a consideration.

· Since the Arena is

not a typical retail zone, the tenant would need to have strong customer

loyalty and attraction to sustain sales during the times when there is no event

in the Arena 1 to draw enough pedestrian flow.

· A

sportwear chain store could be an example of what could be considered on the

site.

Tenant mix options

for the building

4.13 With the

above tenant typologies considered, there are three broad options for a

building tenant mix that best support the desired outcomes from the building.

4.14 The most

suitable option for the top floor is the conference and function centre. This

is consistent through each of the tenant mix options.

4.15 The 1st

floor is best suited to house the hospitality tenancies such as a bar and a

café/ restaurant. This allows for pedestrians to access these through

the atrium and from both Arena 1 during game days, and via the pedestrian

bridge.

4.16 The tenant

mix options then consider the different complimenting options for the ground

floor.

4.17 The

following table provides three potential tenant mixes options considered:

|

|

Tenant Mix 1

|

Tenant Mix 2

|

Tenant Mix 3

|

|

2nd

floor

|

Conference and

function centre

|

Conference and

function centre

|

Conference and

function centre

|

|

1st

floor

|

2x Hospitality

|

2x Hospitality

|

2x Hospitality

|

|

Ground

floor

|

Health provider/s

|

Retailer/s

|

Office/ Biz Hub

|

4.18 The below

table compares the optimal combined annual rentals for each tenant mix that

could be achieved and estimated return on investment based on the construction

price for each option:

|

|

Tenant Mix 1

|

Tenant Mix 2

|

Tenant Mix 3

|

|

Option 1 – 3 floor bldg.

|

|

|

|

|

Optimal

Annual Rental

|

$915,500 + GST and

outgoings