Finance & Audit Committee

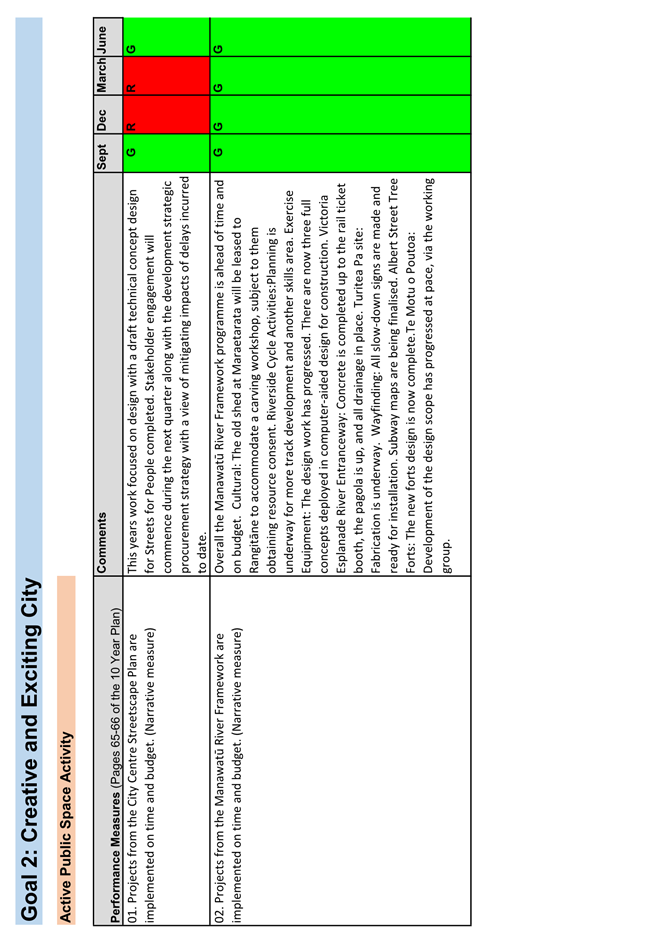

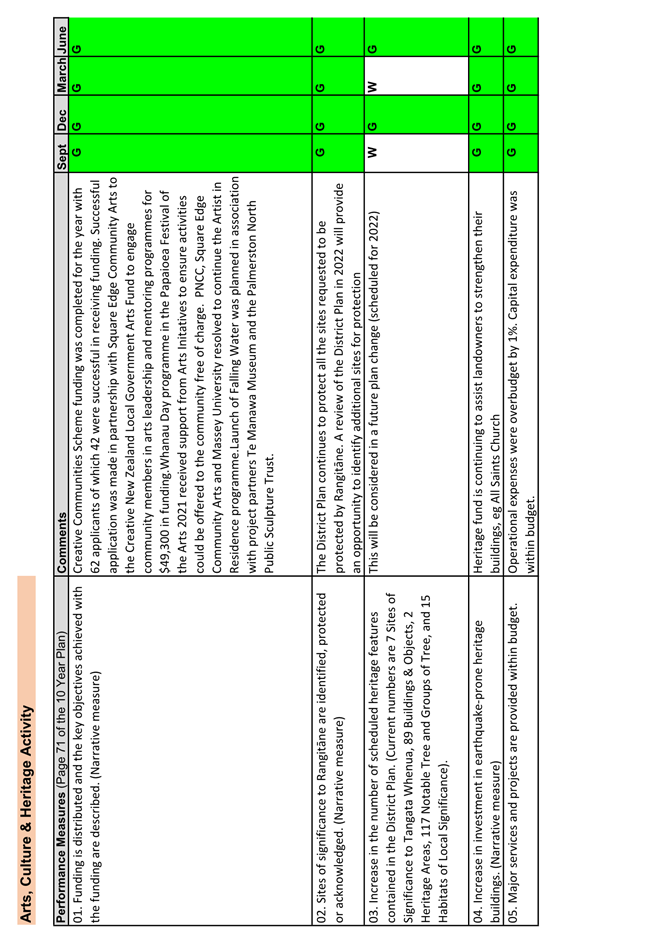

|

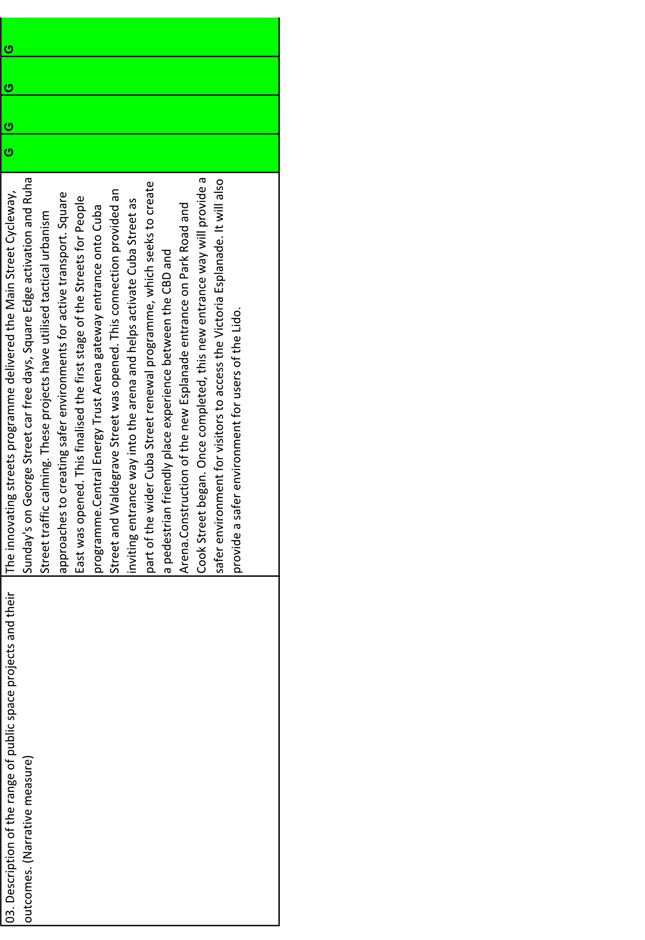

Susan Baty (Chairperson)

|

|

Karen Naylor (Deputy Chairperson)

|

|

Grant Smith (The Mayor)

|

|

Vaughan Dennison

|

Lorna Johnson

|

|

Renee Dingwall

|

Bruno Petrenas

|

|

Lew Findlay QSM

|

Aleisha Rutherford

|

|

Patrick Handcock ONZM

|

Stephen Armstrong

|

|

Leonie Hapeta

|

|

Finance & Audit Committee

MEETING

25 August 2021

Order of Business

1. Apologies

2. Notification

of Additional Items

Pursuant to Sections 46A(7) and

46A(7A) of the Local Government Official Information and Meetings Act 1987, to

receive the Chairperson’s explanation that specified item(s), which do

not appear on the Agenda of this meeting and/or the meeting to be held with the

public excluded, will be discussed.

Any additions in accordance with

Section 46A(7) must be approved by resolution with an explanation as to why

they cannot be delayed until a future meeting.

Any additions in accordance with

Section 46A(7A) may be received or referred to a subsequent meeting for further

discussion. No resolution, decision or recommendation can be made in

respect of a minor item.

3. Declarations

of Interest (if any)

Members are reminded of their duty

to give a general notice of any interest of items to be considered on this

agenda and the need to declare these interests.

4. Public

Comment

To receive comments from members of

the public on matters specified on this Agenda or, if time permits, on other

Committee matters.

(NOTE: If

the Committee wishes to consider or discuss any issue raised that is not

specified on the Agenda, other than to receive the comment made or refer it to

the Chief Executive, then a resolution will need to be made in accordance with

clause 2 above.)

5. Confirmation

of Minutes Page 7

“That the minutes of the

Finance & Audit Committee meeting of 23 June 2021 Part I Public be confirmed

as a true and correct record.”

6. Victoria

Esplanade - Mini Golf Course Lease Proposal Page 13

Report, presented by Bryce

Hosking, Manager - Property and Kathy Dever-Tod, Parks & Reserves Manager.

7. Quarterly

Performance and Financial Report - Quarter Ending 30 June 2021 Page 25

Memorandum, presented by Stuart

McKinnon, Chief Financial Officer and Andrew Boyle, Head of Community Planning.

8. Treasury

Report - 12 months ending 30 June 2021 Page 109

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

9. Clearview

Reserve - Easement Proposal to Powerco Page 121

Report, presented by Bryce

Hosking, Manager - Property and Kathy Dever-Tod, Parks & Reserves Manager.

10. Committee Work

Schedule Page 129

11. Exclusion of Public

|

|

To be moved:

“That the

public be excluded from the following parts of the proceedings of this

meeting listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the specific

grounds under Section 48(1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for

passing this resolution

|

|

12.

|

Minutes of the Finance & Audit Committee

meeting - Part II Confidential - 23 June 2021

|

For the reasons setout in the Finance & Audit

Committee minutes of 23 June 2021, held in public present.

|

|

13.

|

Assurance Report on Review of Health & Safety

|

Safety and Health Safety

|

s6(b) and s7(2)(d)

|

|

14.

|

Tamakuku Terrace - Negotiations with Affordable

Housing Providers

|

Negotiations

|

s7(2)(i)

|

This resolution is made in reliance on Section 48(1)(a) of the

Local Government Official Information and Meetings Act 1987 and the particular

interest or interests protected by Section 6 or Section 7 of that Act which

would be prejudiced by the holding of the whole or the relevant part of the

proceedings of the meeting in public as stated in the above table.

Also that the

persons listed below be permitted to remain after the public has been

excluded for the reasons stated.

[Add Third

Parties], because of their knowledge and ability to assist the

meeting in speaking to their report/s [or other matters as specified] and

answering questions, noting that such person/s will be present at the meeting

only for the items that relate to their respective report/s [or matters as

specified].

|

Palmerston North City Council

Minutes of the Finance & Audit Committee Meeting Part

I Public, held in the Council Chamber, First Floor, Civic Administration

Building, 32 The Square, Palmerston North on 23 June 2021, commencing

at

9.01am

|

Members

Present:

|

Councillor

Susan Baty (in the Chair), The Mayor (Grant Smith) and Councillors Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Mr Stephen

Armstrong.

|

|

Non

Members:

|

Councillors

Brent Barrett, Rachel Bowen, Zulfiqar Butt, Billy Meehan and Orphée

Mickalad.

|

|

Apologies:

|

Councillor

Orphée

Mickalad (early departure on Council business).

|

Councillor Vaughan Dennison entered the meeting

at 9.03am after

consideration of clause 47. He

was not present for clause 47.

Councillor Orphée

Mickalad left the meeting at 11.18am during consideration of clause 53.

He was not present for clauses 53 to 55 inclusive.

|

47-21

|

Apologies

|

|

|

Moved Susan Baty,

seconded Karen Naylor.

The COMMITTEE

RESOLVED

1. That

the Committee receive the apologies.

|

|

|

Clause 47-21 above was carried 16

votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie

Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan, Orphée Mickalad,

Bruno Petrenas, Aleisha Rutherford and Mr Stephen Armstrong.

|

Councillor Vaughan Dennison entered the

meeting at 9.03am.

|

48-21

|

Petition:

PNCC – Keep the parking times as they are

Mr Gerry Keating presented a petition

signed by 2,547 residents of Palmerston North, and a further 168 people

residing in the surrounding area (Foxton, Levin, Bulls, Feilding).

Mr

Keating spoke to the petition focusing on his concerns regarding parking

meter times being extended into late-week evenings and weekends, and the

effect this could have on people attending events and shows at local theatres

and venues.

|

|

|

Moved Susan Baty, seconded Rachel Bowen.

The COMMITTEE RESOLVED

1. That the Finance

& Audit Committee receive the petition from Gerry Keating for

information.

|

|

|

Clause

48-21 above was carried 17 votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan,

Orphée Mickalad, Bruno Petrenas, Aleisha Rutherford and Mr Stephen

Armstrong.

|

|

49-21

|

Confirmation

of Minutes

|

|

|

Moved Susan Baty,

seconded Vaughan Dennison.

The COMMITTEE

RESOLVED

1. That the minutes of the Finance & Audit Committee meeting of

26 May 2021 Part I Public be confirmed as a true and correct record.

|

|

|

Clause 49-21 above was carried 17

votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan,

Orphée Mickalad, Bruno Petrenas, Aleisha Rutherford and Mr Stephen

Armstrong.

|

|

50-21

|

Palmerston

North Airport Limited - Final Statement of Intent for 2021/22

Memorandum, presented by Steve Paterson,

Strategy Manager – Finance, David Lanham, Palmerston North Airport

Limited (PNAL) Chief Executive and Murray Georgel, PNAL Board Chair.

|

|

|

Moved Grant Smith, seconded Patrick

Handcock ONZM.

The COMMITTEE RECOMMENDS

1. That the Statement of

Intent for Palmerston North Airport Limited for 2021/22, presented to the

Finance & Audit Committee on 23 June 2021, be agreed.

|

|

|

Clause

50-21 above was carried 17 votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan,

Orphée Mickalad, Bruno Petrenas, Aleisha Rutherford and Mr Stephen

Armstrong.

|

|

51-21

|

Health,

Safety and Wellbeing Report January to March 2021

Memorandum, presented by Alan Downes,

Health, Safety and Wellbeing Manager and Patrick Watson, Chief People &

Performance Officer.

|

|

|

Moved Brent Barrett, seconded Aleisha

Rutherford.

The COMMITTEE RESOLVED

1. That the memorandum

titled ‘Health, Safety and Wellbeing Report January to March

2021’, presented to the Finance & Audit Committee on 23 June 2021,

be received for information.

|

|

|

Clause

51-21 above was carried 17 votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan,

Orphée Mickalad, Bruno Petrenas, Aleisha Rutherford and Mr Stephen

Armstrong.

|

The meeting adjourned at 10.47am.

The meeting resumed

at 11.05am.

The Mayor (Grant Smith) and Councillors

Vaughan Dennison and Billy Meehan were not present when the meeting resumed.

|

52-21

|

Assurance

Report on Review of Council Policy Framework

Memorandum, presented by Masooma Akhter,

Business Assurance Manager and Julie Macdonald, Strategy & Policy

Manager.

Councillor Billy Meehan entered the meeting

at 11.07am.

The Mayor (Grant Smith) entered the meeting

at 11.12am.

Councillor Vaughan Dennison entered the

meeting at 11.13am.

|

|

|

Moved Karen Naylor, seconded Leonie Hapeta.

The COMMITTEE RESOLVED

1. That the memorandum

titled ‘Assurance Report on Review of Council

Policy Framework’ and its attachment, presented to the Finance &

Audit Committee on 23 June 2021, be received for information.

|

|

|

Clause

52-21 above was carried 16 votes to 0, with 1 abstention, the voting being as

follows:

For:

Councillors

Susan Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Vaughan Dennison,

Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Karen Naylor, Billy Meehan, Orphée Mickalad, Bruno Petrenas,

Aleisha Rutherford and Mr Stephen Armstrong.

Abstained:

The

Mayor (Grant Smith).

|

|

53-21

|

Business

Assurance Accountability Report

Memorandum, presented by Masooma Akhter,

Business Assurance Manager.

Councillor Orphée Mickalad left the

meeting at 11.18am.

|

|

|

Moved Susan Baty, seconded Leonie Hapeta.

The COMMITTEE RESOLVED

1. That the memorandum titled

‘Business Assurance Accountability Report’ presented to the

Finance & Audit Committee on 23 June 2021, be received for information.

|

|

|

Clause

53-21 above was carried 16 votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan,

Bruno Petrenas, Aleisha Rutherford and Mr Stephen Armstrong.

|

|

54-21

|

Committee

Work Schedule

|

|

|

Moved Susan Baty, seconded Aleisha

Rutherford.

The COMMITTEE RESOLVED

1. That the Finance

& Audit Committee receive its Work Schedule dated June 2021.

|

|

|

Clause

54-21 above was carried 16 votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan,

Bruno Petrenas, Aleisha Rutherford and Mr Stephen Armstrong.

|

Exclusion of Public

|

55-21

|

Recommendation to

Exclude Public

|

|

|

Moved Susan Baty,

seconded Karen Naylor.

The COMMITTEE

RESOLVED

1. That

the public

be excluded from the following parts of the proceedings of this meeting

listed in the table below.

The

general subject of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter, and the

specific grounds under Section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for passing

this resolution

|

|

13.

|

Minutes of the

Finance & Audit Committee meeting - Part II Confidential - 26 May 2021

|

For the reasons

set out in the Finance & Audit Committee minutes of 26 May 2021, held

in public present.

|

|

|

14.

|

Business

Assurance Accountability Report - Confidential Items

|

Third Party

Commercial, Health Safety and Gain Advantage

|

s7(2)(b)(ii),

s7(2)(d) and s7(2)(j)

|

|

15.

|

Award of Contract

4058 - Supply of Pipes and Fittings - 2021-22

|

Third Party

Commercial

|

s7(2)(b)(ii)

|

This resolution is

made in reliance on Section 48(1)(a) of the Local Government Official

Information and Meetings Act 1987 and the particular interest or interests

protected by Section 6 or Section 7 of that Act which would be prejudiced by

the holding of the whole or the relevant part of the proceedings of the

meeting in public as stated in the above table.

|

|

|

Clause 55-21 above was carried 16

votes to 0, the voting being as follows:

For:

The

Mayor (Grant Smith) and Councillors Susan Baty, Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Vaughan Dennison, Renee Dingwall, Lew Findlay QSM, Patrick

Handcock ONZM, Leonie Hapeta, Lorna Johnson, Karen Naylor, Billy Meehan,

Bruno Petrenas, Aleisha Rutherford and Mr Stephen Armstrong.

|

The public

part of the meeting finished at 11.25am

Confirmed 25 August 2021

Chairperson

REPORT

TO: Finance

& Audit Committee

MEETING DATE: 25

August 2021

TITLE: Victoria

Esplanade - Mini Golf Course Lease Proposal

PRESENTED BY: Bryce

Hosking, Manager - Property and Kathy Dever-Tod, Parks & Reserves Manager

APPROVED BY: Sarah

Sinclair, Chief Infrastructure Officer

RECOMMENDATION(S) TO Council

1. That

Council agrees to:

a) Approve the extended lease

term of ten (10) years for The Lions Club of Middle Districts Incorporated to

enable development of an 18-hole mini golf course within the Play Zone of the

Victoria Esplanade, and remove the early termination clause within the Lease;

or

b) Approve the extended lease

term of ten (10) years for The Lions Club of Middle Districts Incorporated to

enable development of an 18-hole mini golf course within the Play Zone of the

Victoria Esplanade, and retain the early termination clause within the Lease.

Summary of options analysis for

|

Problem

or Opportunity

|

The Victoria Esplanade Masterplan

2018 has provision for an 18-hole mini golf course to be located within the

Play Zone of the Victoria Esplanade.

The Lions Club of Middle

Districts Incorporated (“the Lions”) provided a submission as

part of the 2018-28 Ten Year Plan to develop and operate the mini golf

facilities at their cost. This was approved by Council.

Once the Lions had obtained the

resource consent in early 2021, negotiations commenced to determine the

proposed lease terms.

Council’s policy for

leasing land within reserves directs that the length of the lease term is no

longer than five (5) years with a single right of renewal of another five (5)

years. It is also standard practise for an early termination clause to be

included in all recreational leases.

Given the Lions’ level of

capital investment in the Project, they have requested a ten (10) year lease

term with a right of renewal of another ten (10) years. In addition, they

have also requested that the early termination clause be removed from the

lease documentation.

As the Lion’s request

differs from Council’s policy and standard practice, this report seeks

approval from Council of these extended terms, so a lease can be formally

entered into.

|

|

OPTION

1:

|

Approve the extended lease

term and remove the early termination clause within the Lease

|

|

Benefits

|

This is the Lion’s

preferred Option.

· A

20-year lease term will provide security to the Lions and will support their

internal fund-raising efforts for the project.

· The

longer lease term will support the Lions to continue to invest in the project

through ongoing maintenance expenses for the operation of the mini golf

facilities.

|

|

Risks

|

· Should

the mini golf course not be operating in accordance with the consent

conditions or the general principles of the proposal consented upon, or the

course not be operating in a way that meets Council’s expectations and

these matters cannot be resolved through arbitration, Council would not be

able to bring the Lease to an end without the agreement of the Lions.

· The

lease term of 20 years may limit Council’s strategic options around the

future use of the lease area. However, the risk is low as this proposal has

been consulted and approved by Council in the Long Term Plan and the

Esplanade Master Plan.

|

|

Financial

|

· Council

will receive an annual rental of $150 + GST.

|

|

OPTION

2:

|

Approve the extended lease

term but retain the early termination clause within the Lease

|

|

Benefits

|

· The

Lions are still provided with considerable lease security and can continue to

invest in the project through ongoing maintenance expenses for the operation

of the mini golf facilities with confidence.

· In

the event that the mini golf is not operated in accordance with the resource

consent conditions or the general principles of the proposal consented upon,

or the course is not operating in a way that meets Council’s expectations

and these matters cannot be resolved through arbitration, the inclusion of

the early termination clause helps to mitigate Council’s risk to enable

Council to bring the lease to an end.

|

|

Risks

|

· The lease

term of 20 years may limit Council’s strategic options around the

future use of the lease area.

· The

inclusion of a termination clause will be viewed negatively by the Lions as

they consider it reduces their lease security moving forward.

|

|

Financial

|

· Council

will receive an annual rental of $150 + GST.

|

|

OPTION

3:

|

Decline the current proposed

lease terms, with Council Officers entering back into negotiations to

determine new lease terms in line with Council’s policy and standard

practice

|

|

Benefits

|

· Council

Officers will negotiate the lease terms in accordance with existing policy

and standard practice, consistent with the approach taken for other community

groups.

|

|

Risks

|

· The

Lions may not agree with the terms in line with Council’s policy and

standard practice which may delay or jeopardise the project.

· The

Lions may perceive Council as being difficult to deal with and causing

unnecessary delays.

|

|

Financial

|

· As

negotiations would be recommencing, no rental income will be received until

terms have been reached.

· It

is likely that the final rental received will remain the same at $150 + GST

as this is already in line with Council’s policy.

|

Rationale for the recommendations

1. Overview of the problem or opportunity

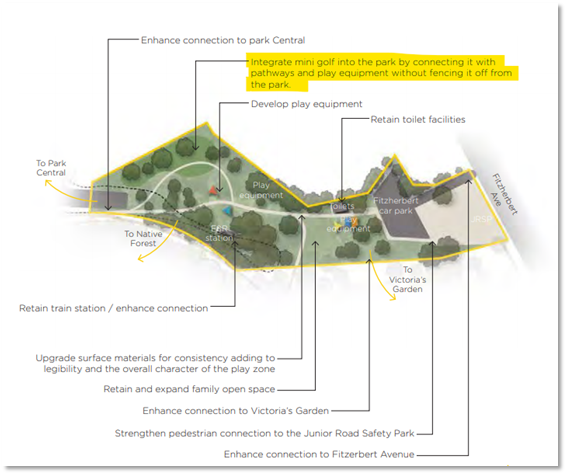

1.1 The

Victoria Esplanade Masterplan 2018 has provision for an 18-hole mini golf

course to be located within the Play Zone of the Victoria Esplanade.

1.2 The

Lions Club of Middle Districts Incorporated (“the Lions”) provided

a submission as part of the 2018-28 Long Term Plan to develop and operate the

mini golf facilities at their cost. This was approved by Council.

1.3 Once

the Lions had obtained the resource consent in early 2021, negotiations

commenced to determine the proposed lease terms.

1.4 The

proposed location and site plan approved under the resource consent is shown in

Figure 1.

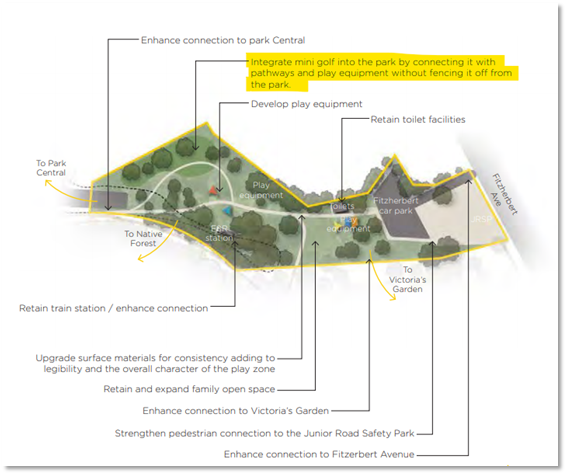

Figure 1: Mini golf course plan as per Resource

Consent

1.5 Council’s

policy for leasing land within reserves directs that the length of the lease

term is no longer than five (5) years with a single right of renewal of another

five (5) years. It is also standard practise for an early termination clause to

be included in all recreational leases.

1.6 Given

the Lions’ level of capital investment in the Project, they have

requested a ten (10) year lease term with a right of renewal of another ten

(10) years. In addition, they have also requested that the early termination

clause be removed from the lease documentation.

1.7 As

the Lion’s request differs from Council’s policy and standard

practice, this report seeks approval from Council of these extended terms, so a

lease can be formally entered into.

2. background

2.1 The

Victoria Esplanade Masterplan was developed in 2017 and 2018 to guide the

development of the Victoria Esplanade.

2.2 It

identified the Lions’ mini golf as a development project within the Play

Zone, as per Figure Two.

Figure 2: Mini golf in the Victoria Esplanade

Masterplan - page 89

2.3 The

Masterplan was consulted with the Victoria Esplanade User Group and community,

and the mini golf proposal was well received.

Extended Lease Terms

2.4 For

most of Council’s existing recreation leases, the lease terms are capped

to no more than ten (10) years in accordance with the existing Council Policy,

ie. a 5-year term with a right of renewal of another 5 years.

2.5 There

are seven (7) approved leases that have lease terms longer than 10 years. These

leases are:

|

Tenant

|

Location

|

Lease Term

|

|

Manawatu Smallbore Rifle

Association

|

Totara Road

|

15 Years

|

|

Manawatu Cricket

Association

|

Practice-wicket, Park

Road

|

15 Years

|

|

Palmerston North Golf

Club

|

Brightwater Terrace

|

30 Years

|

|

Menzshed Manawatu

|

Rangitāne Pavilion

|

25 Years

|

|

Palmerston North

Esplanade Scenic Railway

|

The Esplanade

|

20 Years

|

|

YMCA Central

|

Park Road

|

31 Years

|

|

The Scout Association NZ

|

Ashhurst Domain

|

20 Years

|

2.6 The

above leases were granted extended lease terms to provide additional security

of lease term to reflect the organisation’s considerable financial

investment into their respective facilities.

3. lease termination

3.1 Within

Council’s standard lease documentation for recreational leases or leases

on reserves there are two clauses that enable Council to terminate a lease

early; a clause for a breach of lease conditions, and a more broadened early

termination clause. These are explored below.

Lease Termination – Breach of Lease

3.2 If

a tenant is breaching the lease conditions such as not paying rent or not using

a lease area for the use prescribed/ agreed to within the lease, Council can

terminate the lease through Clause 9.2. This clause reads:

“If the Landlord after making such enquiries as it

thinks fit and giving the Tenant the opportunity of explaining the usage of the

property is satisfied that the property is not being used or being sufficiently

used for the Prescribed Use then the Landlord may terminate this lease on such

terms as it thinks fit but without prejudice to any antecedent right or action

which the Landlord may have against the Tenant however it arose.”

3.3 In

the situation where a breach of lease had occurred, prior to any termination of

the lease being sought, the two parties would always look to engage in a

thorough arbitration process to try to resolve the issues. However, should the

issue/s not be able to be resolved, the legal process to terminate the lease

can begin.

3.4 This

clause will remain in all lease documentation, including the proposed lease

discussed in this report with the Lions.

3.5 However,

providing a tenant is not breaching the terms of a lease, this clause does not

allow Council to terminate a lease should the operation of that facility not

meet Council’s expectations, ie. providing poor service, not being opened

for desired hours, not upkeeping the facility to Council’s desired

standards, etc.

Early Termination Clause

3.6 To

reduce Council’s risk in relation to the operation of the facility not

meeting Council’s expectations, it is standard practice for Council to

also include a more broadened early termination clause in its lease

documentation, in addition to Clause 9.2, for recreational leases or leases on

reserves. This is Clause 47 which reads:

“Notwithstanding any other provision in this

Lease, the Landlord may terminate this Lease by giving three (3) months’

notice in writing to the Tenant. Termination pursuant to this clause shall not

give the Tenant any right or claim whatsoever against the Landlord.”

3.7 For

clarity, an arbitration process like that mentioned above to resolve lease

issues would still be undertaken in this instance, however, should a resolution

of issues that do not constitute a breach of lease not be able to be reached,

Council will have the ability to terminate a lease. If this clause is not

included in the lease, these types of issues are very difficult to address.

3.8 Whilst

this clause is included in leases to help mitigate Council’s risk,

Council does have two (2) approved leases which have had this clause removed.

They are:

|

Tenant

|

Location

|

Lease Term

|

|

Manawatu Cricket

Association

|

Practice-wicket, Park

Road

|

15 Years

|

|

YMCA Central

|

Park Road

|

31 Years

|

3.9 As

with the extended lease terms, the early termination clause was removed from

these leases to reflect the considerable financial investment from the

organisations into their respective facilities.

4. Description of options

4.1 Council

has three (3) options to consider:

· Approve the

extended lease term and remove the early termination clause within the Lease;

· Approve the

extended lease term but retain the early termination clause with the Lease; or

· Decline

the current proposed lease terms, with Council Officers entering back into

negotiation to determine new lease terms in line with Council’s policy

and standard practice.

5. analysis of options

OPTION 1: Approve the extended lease term and

remove the early termination clause with the Lease

5.1 Option

1 sees Council enter a lease with the Lions within the Victoria Esplanade.

5.2 The

lease is proposed to be for a ten (10) year lease term with a right of renewal

of another ten (10) years. In addition, the Lions have requested that the standard

early termination clause be removed from the lease documentation.

5.3 This

is the Lion’s preferred option.

5.4 Note:

The benefits and risks within this report relate to the options being

considered, not in relation to having a mini golf course within the Victoria

Esplanade.

Benefits

5.5 Option

1 has the following benefits:

· A 20-year lease

term clause will provide security to the Lions and will support their internal

fund-raising efforts for the project.

· The

added security of the lease will support the Lions to continue to invest in the

project through ongoing maintenance expenses for the operation of the mini golf

facilities with confidence.

· The

Lions perceive that the removal of the early termination clause will give them

more security of the Lease.

Risks

5.6 The

risks identified for Option 1 are:

· Should the mini

golf course not be operating in accordance with the consent conditions or the

general principles of the proposal consented upon, or the course not be

operating in a way that meets Council’s expectations and these matters

cannot be resolved through arbitration, Council would not be able to bring the

Lease to an end without the agreement of the Lions.

· The

lease term of 20 years may limit Council’s strategic options around the

future use of the lease area. However, the risk is low as this proposal has

been consulted and approved by Council in the Long Term Plan and the Esplanade

Master Plan.

Financial

5.7 Council

will receive an annual rental of $150 + GST.

5.8 There

will be no ongoing operational costs to Council associated with the lease as it

is a land lease only. The club will be responsible for their own repair

and maintenance of the mini golf facilities.

OPTION 2: Approve the extended lease term but

retain the early termination clause with the Lease.

5.9 As

with Option 1, Option 2 sees Council enter a lease with the Lions within the

Victoria Esplanade.

5.10 Again, the

lease is proposed to be for a ten (10) year lease term with a right of renewal

of another ten (10) years. However, this option will retain the early

termination clause in the lease documentation in line with Council’s

standard practice.

Benefits

5.11 Option

2 has the following benefits:

· The Lions are

still provided considerable lease security and can continue to invest in the

project through ongoing maintenance expenses for the operation of the mini golf

facilities with confidence.

· In

the event that the mini golf is not operated in accordance with the resource

consent conditions or the general principles of the proposal consented upon, or

the course was not operating in a way that meets Council’s expectations

and these matters cannot be resolved through arbitration, the inclusion of the

early termination clause helps to mitigate Council’s risk to enable Council

to bring the lease to an end.

Risks

5.12 The

risks identified for Option 2 are:

· Given the proposed

lease will be potentially 20 years, this may limit Council’s strategic

options around the future use of the lease area.

· The

inclusion of a termination clause will be viewed negatively by the Lions as

they consider it to reduce their lease security moving forward.

Financial

5.13 Council

will receive an annual rental of $150 + GST.

5.14 As with

Option 1, there will be no ongoing operational costs to Council associated with

the lease as it is a land lease only. The club will be responsible for

their own repair and maintenance of the mini golf facilities.

OPTION 3: Decline the current proposed lease

terms, with Council Officers entering back into negotiations to determine new

lease terms in line with Council’s policy and standard practice

5.15 Option 3

sees Council decline the current proposed lease terms and directs Council

Officers to go back to the Lions and renegotiate terms that are in line with

Council’s policy and standard practice.

5.16 This would

be the least favourable option for the Lions and will at minimum cause delays

to the project.

Benefits

5.17 Council

Officers will negotiate the lease terms in accordance with existing policy and

standard practice.

Risks

5.18 The

risks identified for Option 3 are:

· The Lions may not

agree with the terms in line with Council’s policy and standard practice

which may delay or jeopardise the project.

· The

wider public and the Lions may perceive Council as being difficult to deal with

and causing unnecessary delays.

Financial

5.19 As

negotiations would be recommencing, no rental income will be received until

terms have been reached.

5.20 It is

likely that the final rental received will remain the same at $150 + GST as

this is already in line with Council’s policy.

6. Conclusion

Options 1 and 2

6.1 Despite

the extended lease term limiting Council’s future use of the site upon

which it will sit, given the mini golf course was included in the 2018 Victoria

Esplanade Masterplan, this is considered a low and unlikely risk to Council.

6.2 The

removal of the early termination clause increases Council’s risk should

the venture not be operated in a way that meets Council’s expectations.

Whilst this is also considered an unlikely risk, Council will need to decide

whether they are willing to accept this risk.

Option 3

6.3 Unlike

the risks for Options 1 and 2, the risks associated with Option 3 are

considerably more likely to occur and will potentially have a much higher

impact.

6.4 The

risks around delay, straining Council’s relationship with the Lions, and

even jeopardising the project altogether if terms cannot be reached, are

considered to far outweigh the benefits of this option.

6.5 Considering

the above, it is recommended that Council proceed with either Option 1 or 2

depending on their risk appetite around the removal of the early termination

clause.

7. Next actions

7.1 Proceed

with signing a Deed of Lease between Council and The Lions for the mini golf

course land within Victoria Esplanade.

8. Outline of community engagement process

8.1 The

Victoria Esplanade is subject to the Palmerston North Reserves Act 1922 and has

its own Reserve Management Plan and therefore is

not subject to the consultation requirements of the Reserves Act 1977.

8.2 Given

this the lease proposal was not required to be publicly notified.

8.3 The

Esplanade Steering Group was consulted on this lease proposal and there were no

objections.

8.4 Council

Officers presented the Club’s proposal in the bimonthly meeting with

Rangitāne o Manawatu on 28 June 2019 and Iwi representatives were

supportive of the lease term and suggested that the signage have dual English

and Te Reo wording to be consistent with new signage across the city. This

recommendation was adopted as a condition of the resource consent.

8.5 Iwi

were further consulted on this matter in July 2021 as part of the July 2021

bimonthly meeting with Council Officers. They had no objections to either

option 1 or option 2.

Compliance and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do, they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 2: A Creative and Exciting City

|

|

The recommendations contribute

to the achievement of action/actions in Active

Communities

The action is: To carry out

recreation and reserves planning functions under the Palmerston North

Reserves Act 1922 and Local Government Act including the preparation of

Reserve Management and Development Plans and Master Plans.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

This aligns will with the

direction to create a city that has great places for all people, particularly

families, and have the most active community in New Zealand (Priorities 1 and

5, Creative Land Liveable Strategy).

|

|

|

|

Attachments

Nil

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 25

August 2021

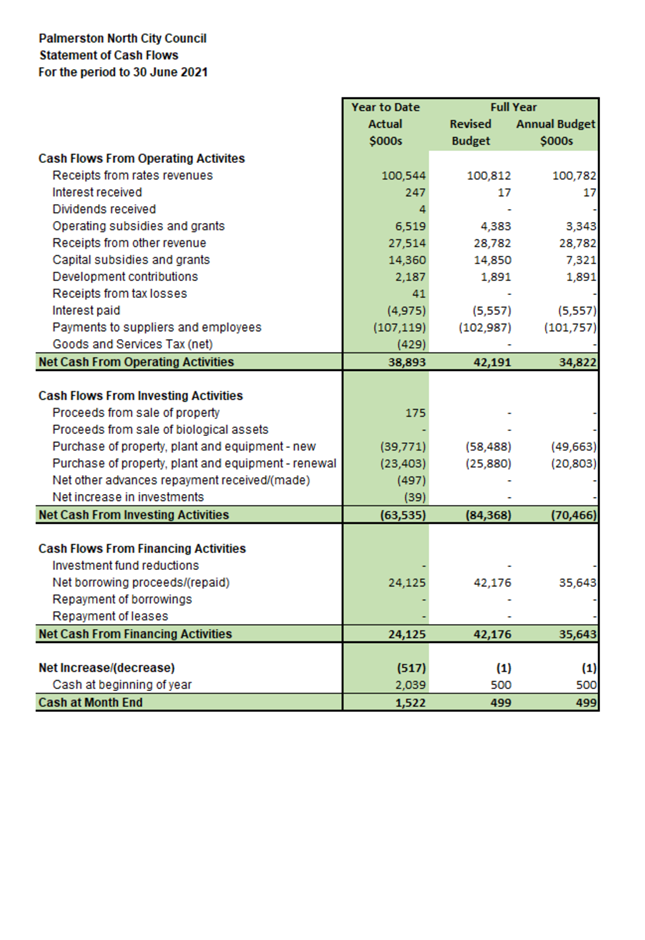

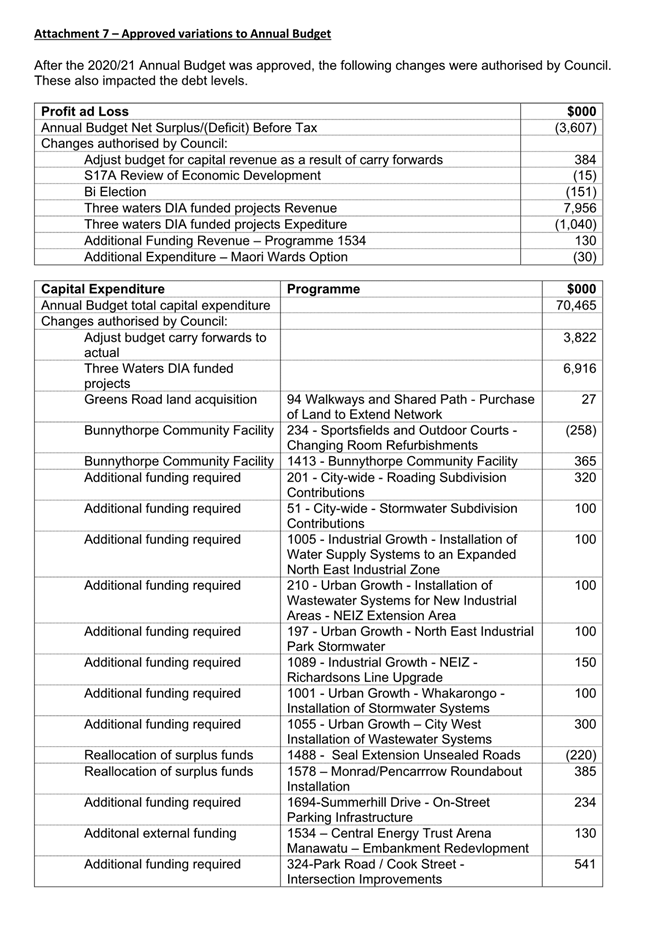

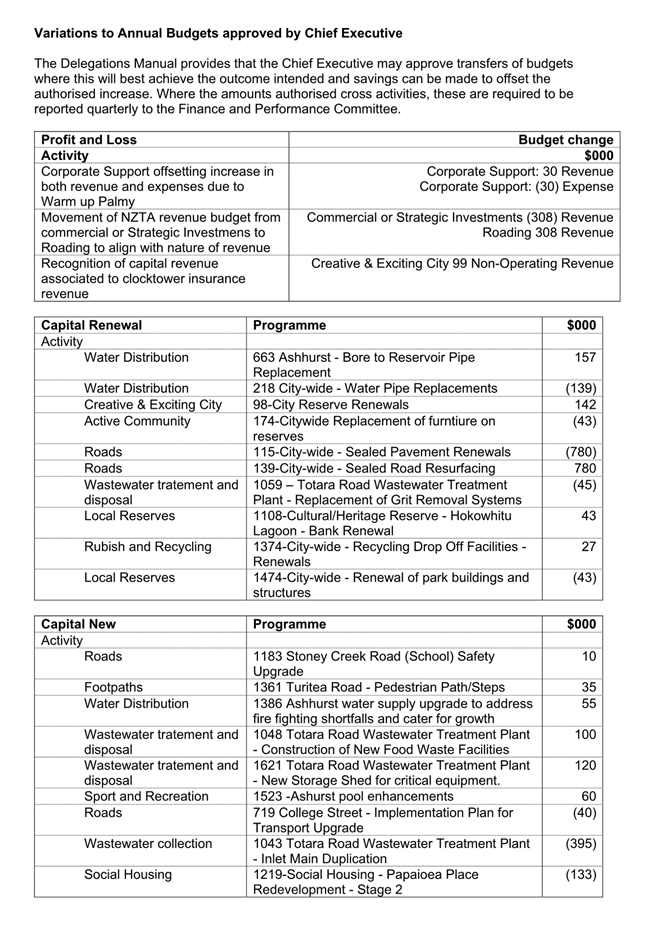

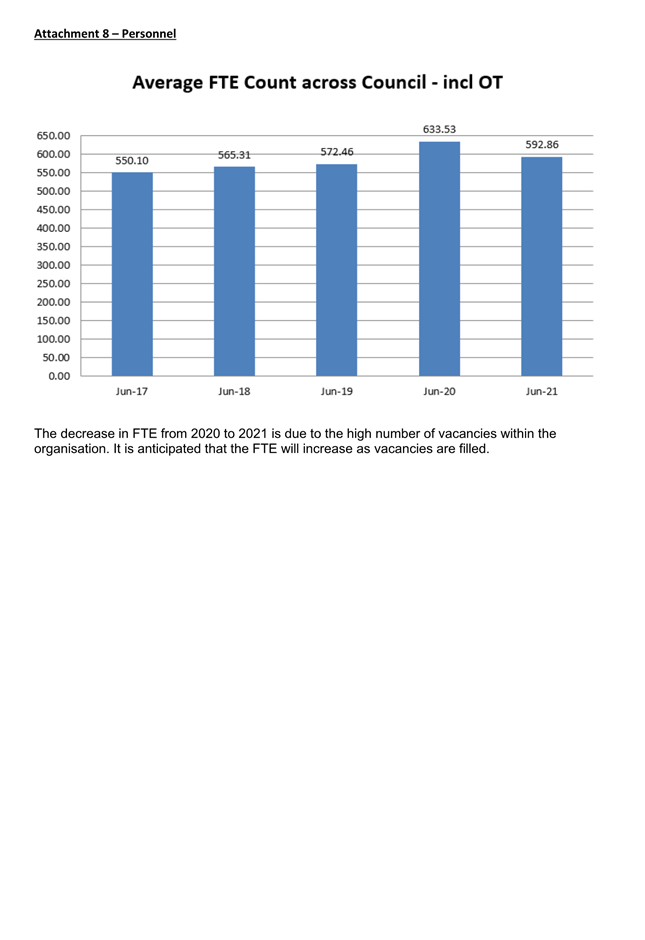

TITLE: Quarterly

Performance and Financial Report - Quarter Ending 30 June 2021

Presented By: Stuart

McKinnon, Chief Financial Officer and Andrew Boyle, Head of Community Planning

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

RECOMMENDATION(S)

TO Council

1. That the memorandum

entitled ‘Quarterly Performance and Financial Report - Quarter Ending 30

June 2021’, presented to the Finance & Audit Committee on 25 August

2021, be received.

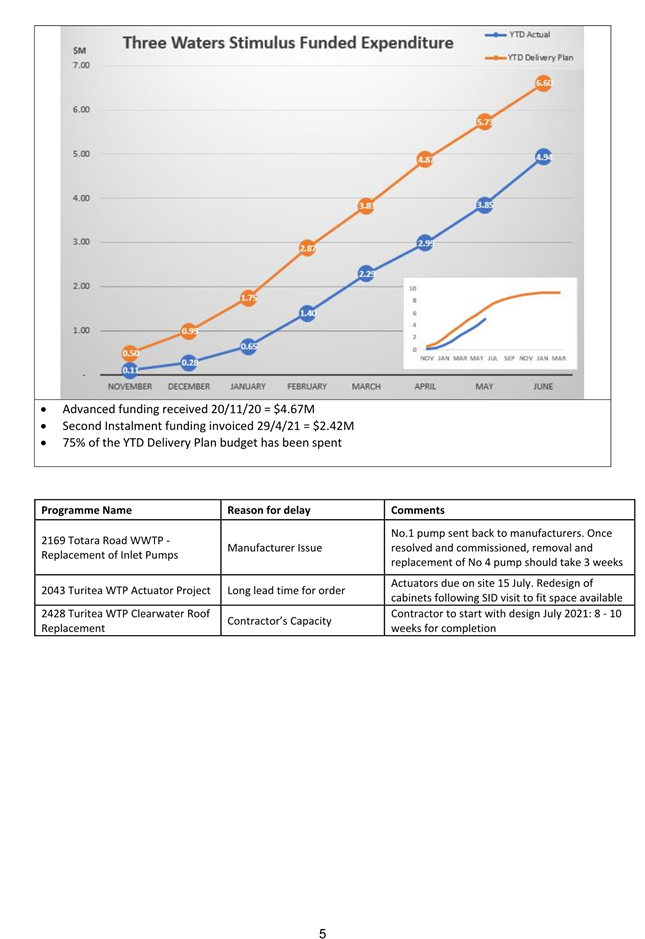

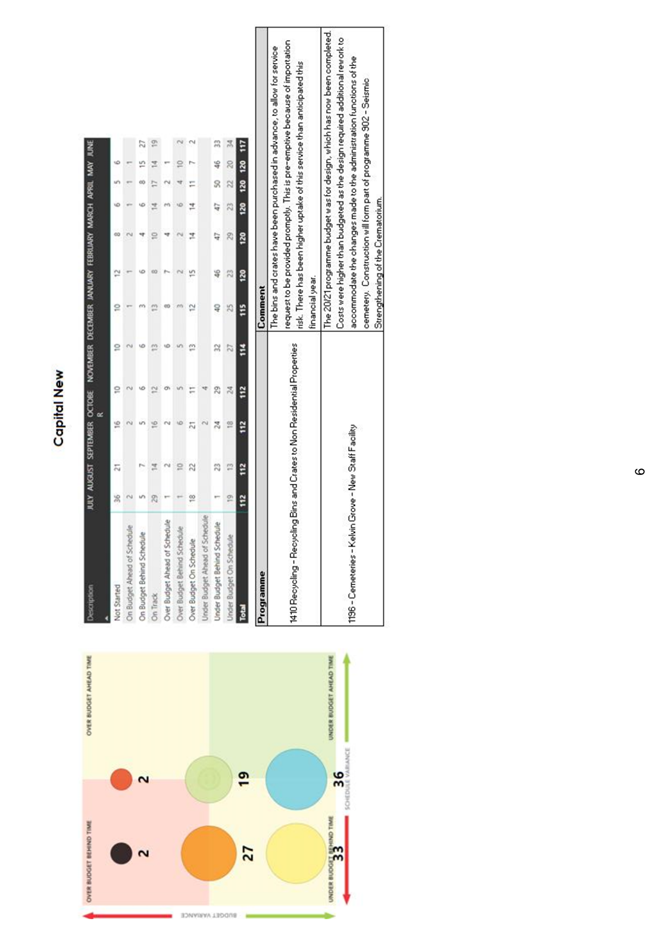

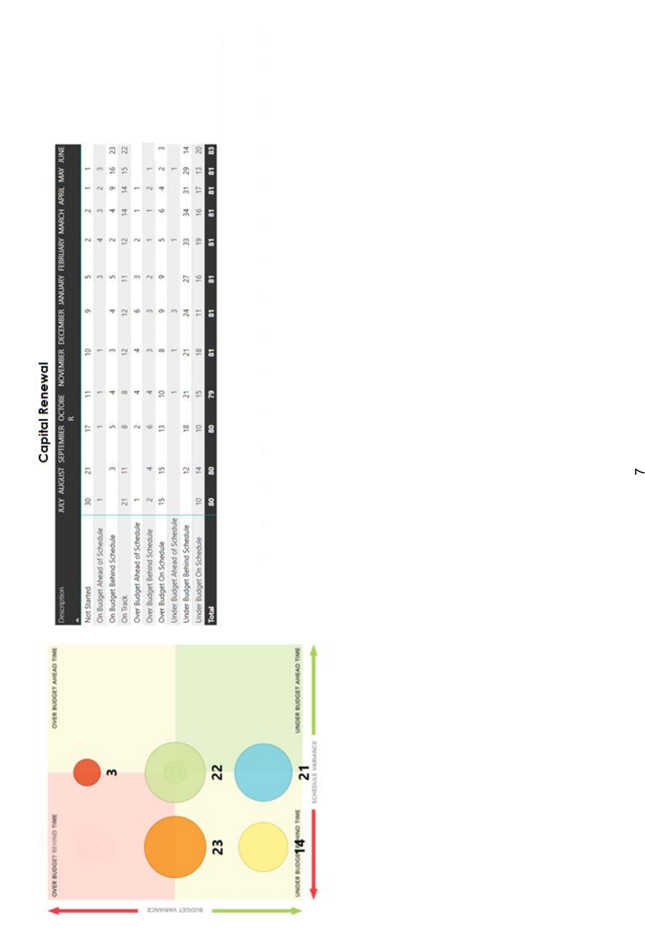

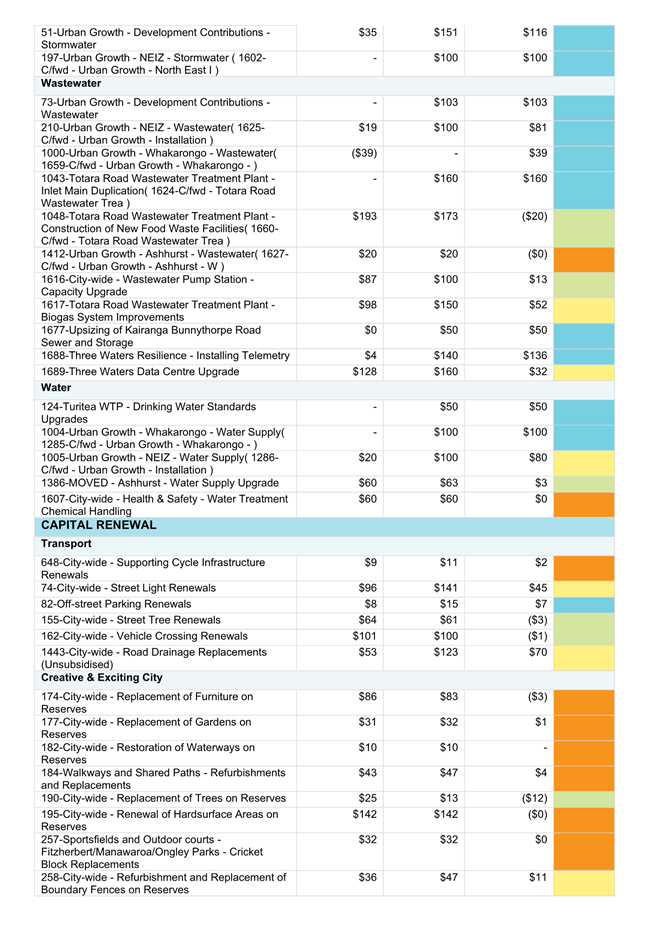

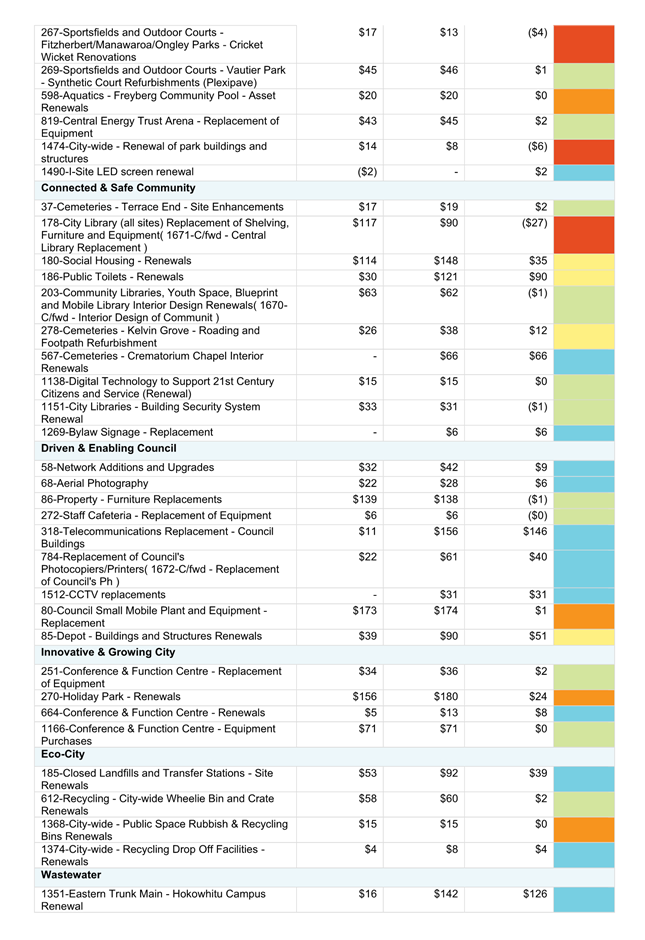

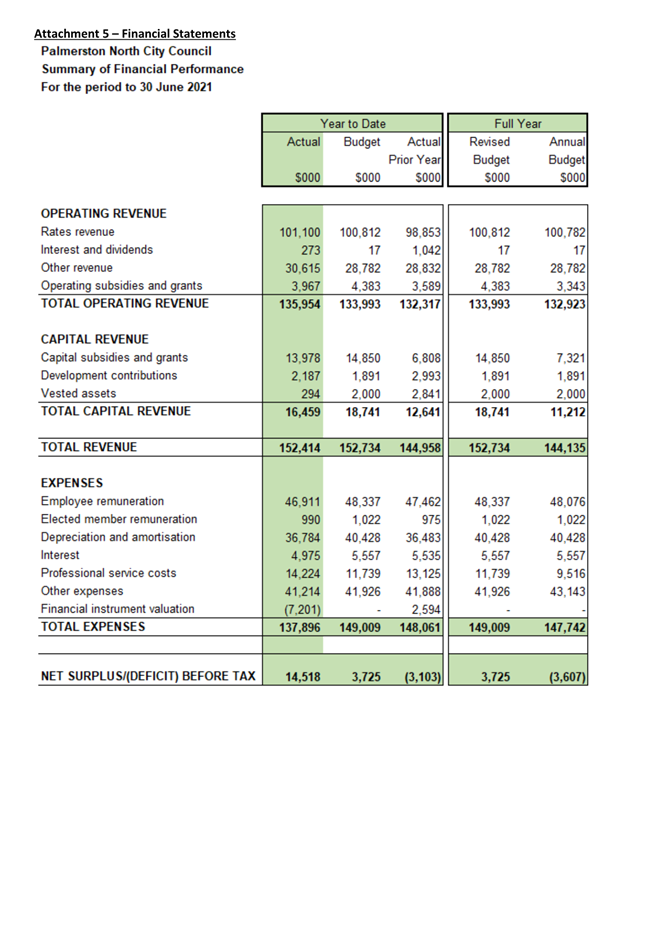

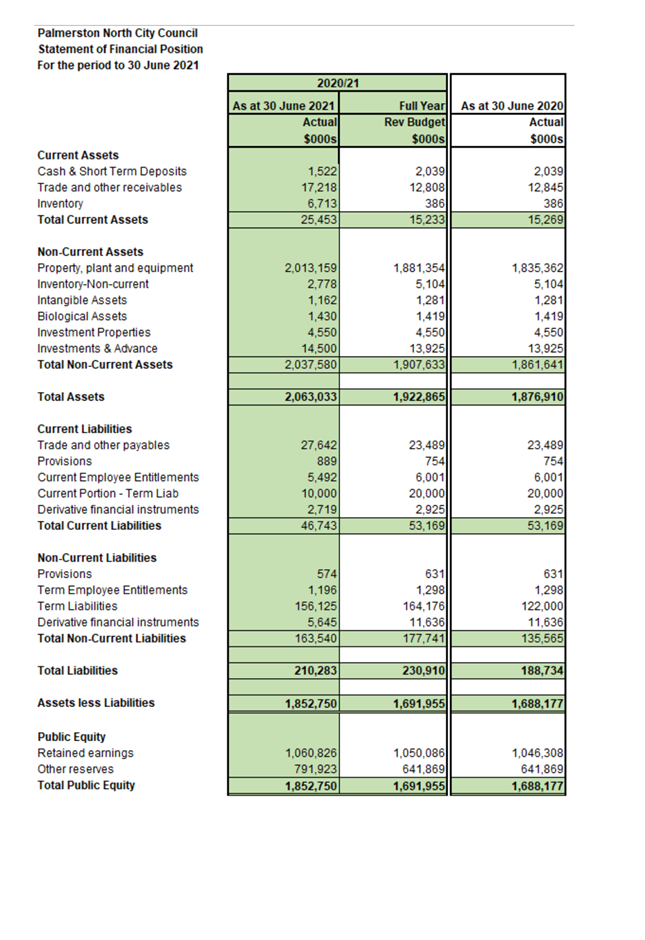

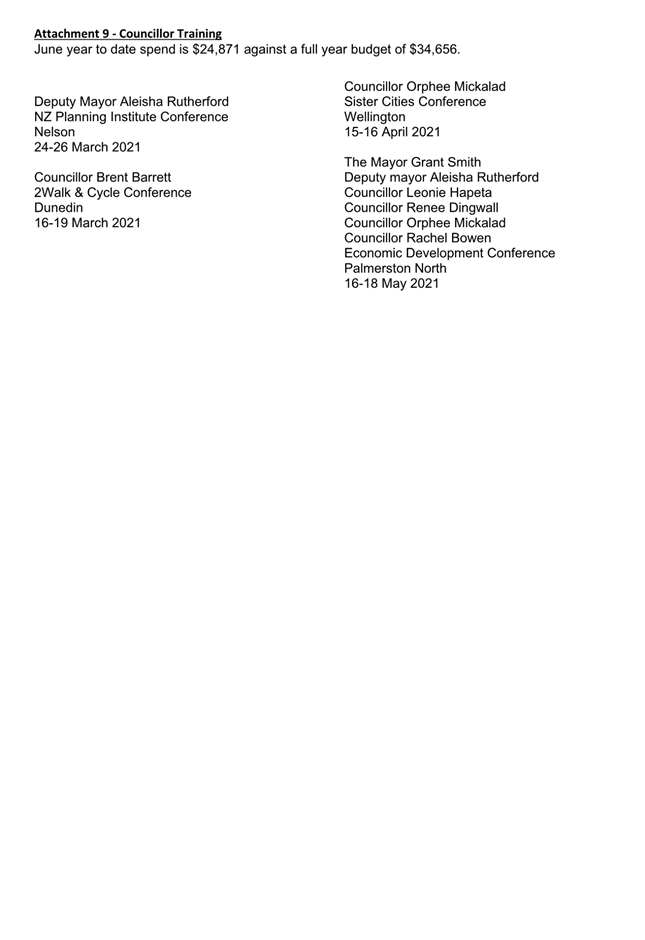

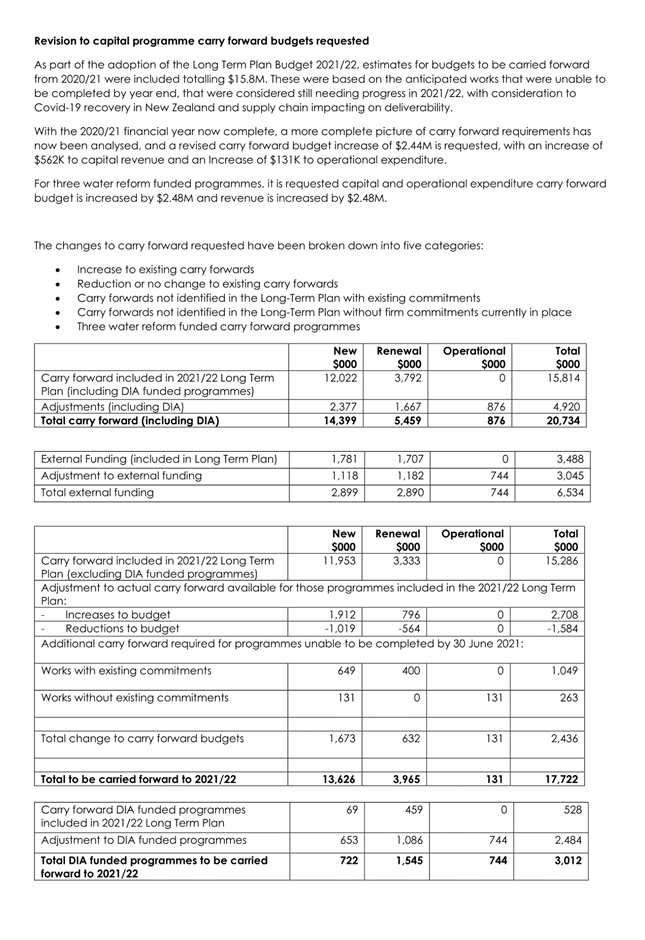

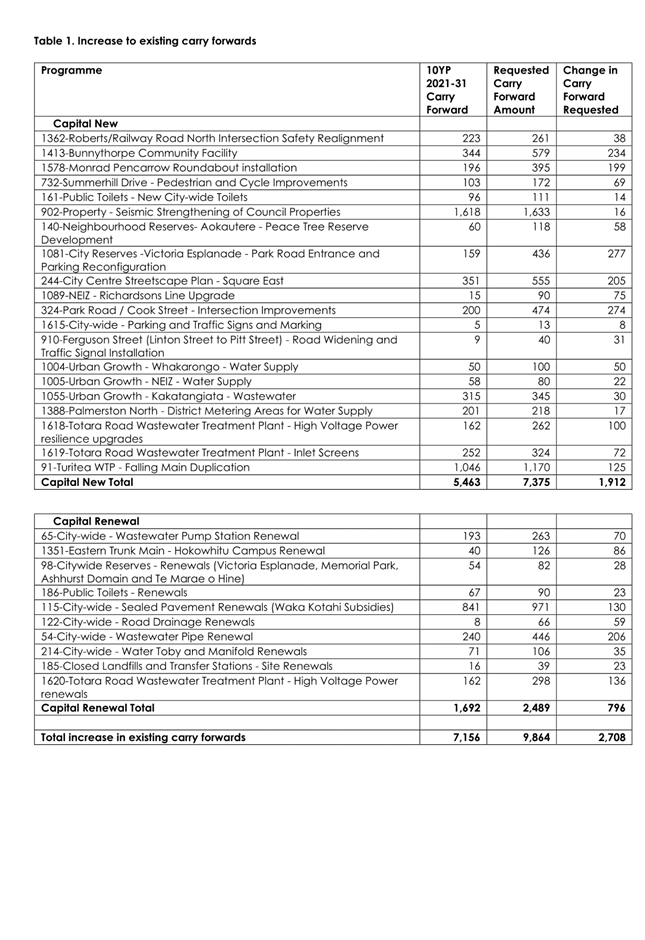

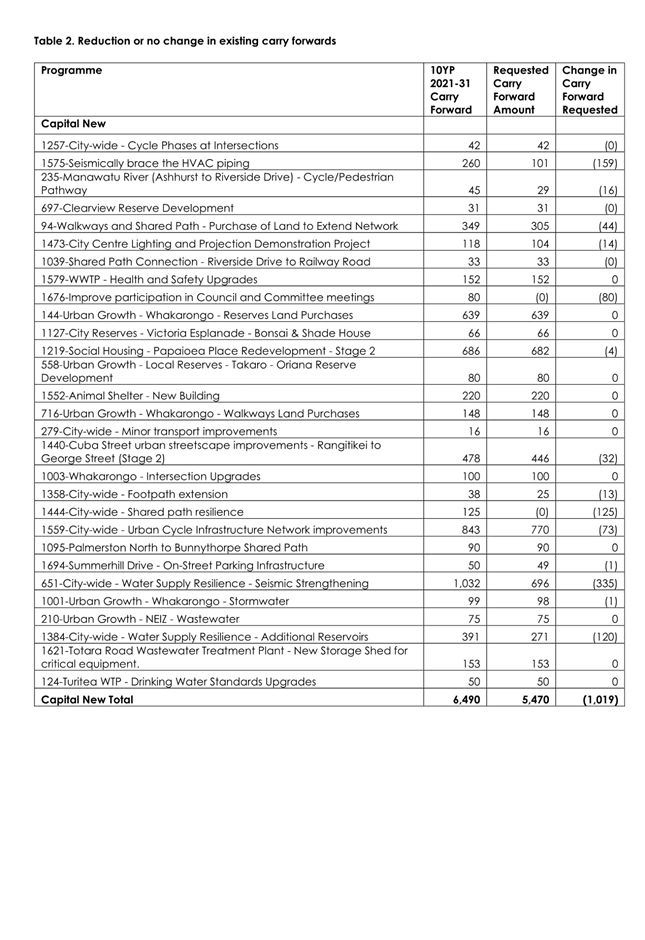

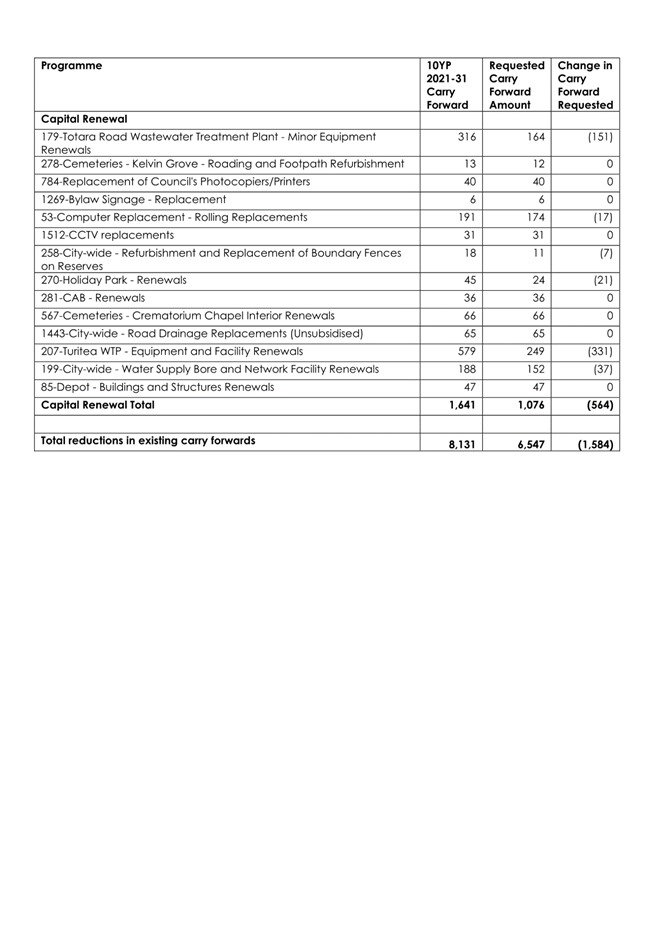

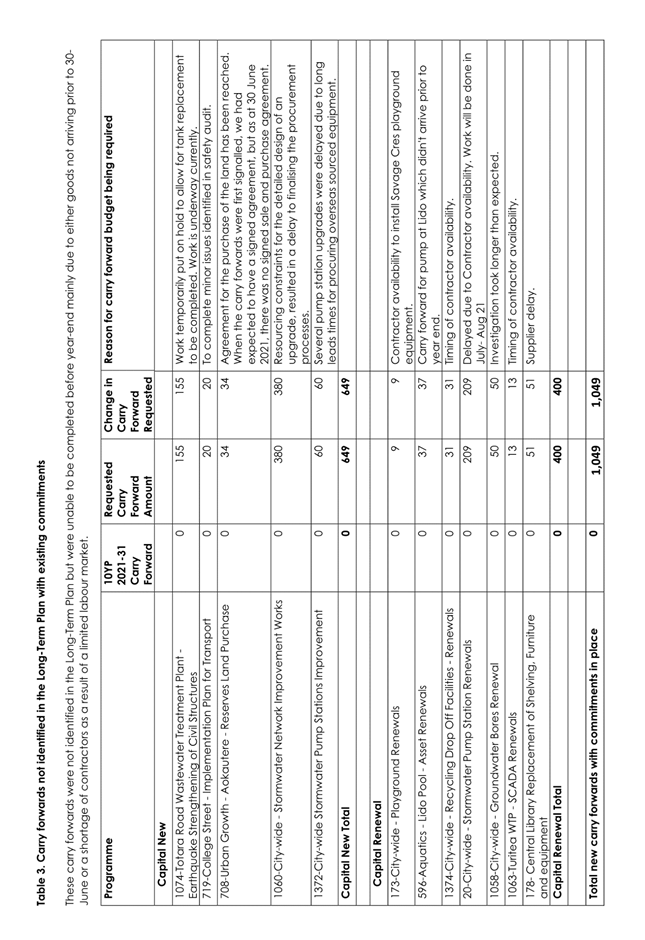

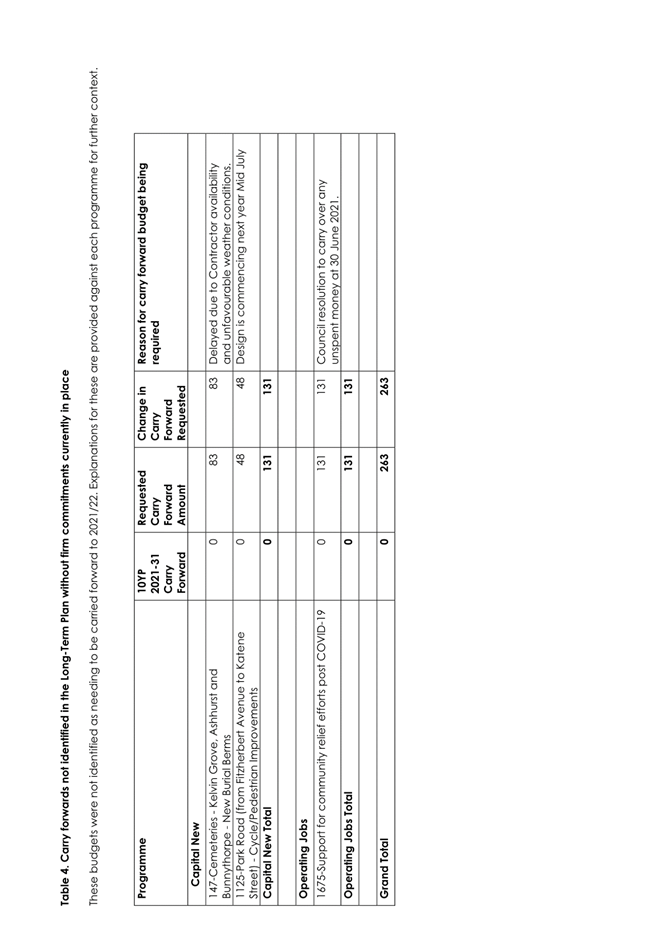

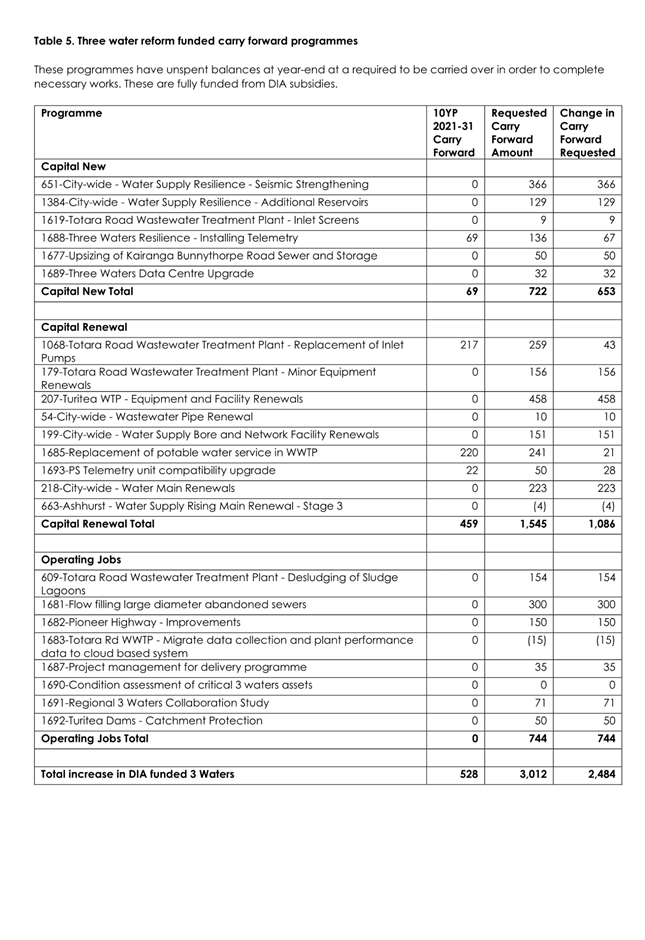

2. That Council note

that the capital expenditure carry forward values in the 2021/22 Long Term Plan

Budget will be increased by $2.44M, capital revenue will be increased by $562K

and operational expenditure will be increased by $131K as per the details in

Appendix 4 of this report.

3. That Council note

that capital expenditure carry forward values in the 2021/22 Long Term Plan

Budget relating to the three water reform funding will be increased by $1.74M,

capital revenue will be increased by $1.74M, operational expenditure will be

increased by $744K and operational revenue will be increased by $744K as per

the details in Appendix 4 of this report.

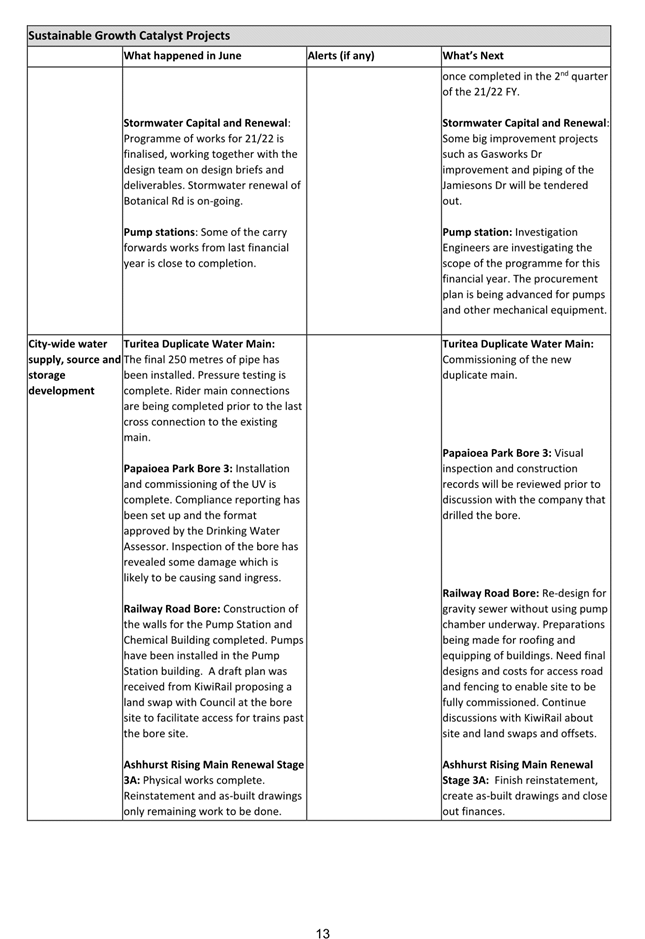

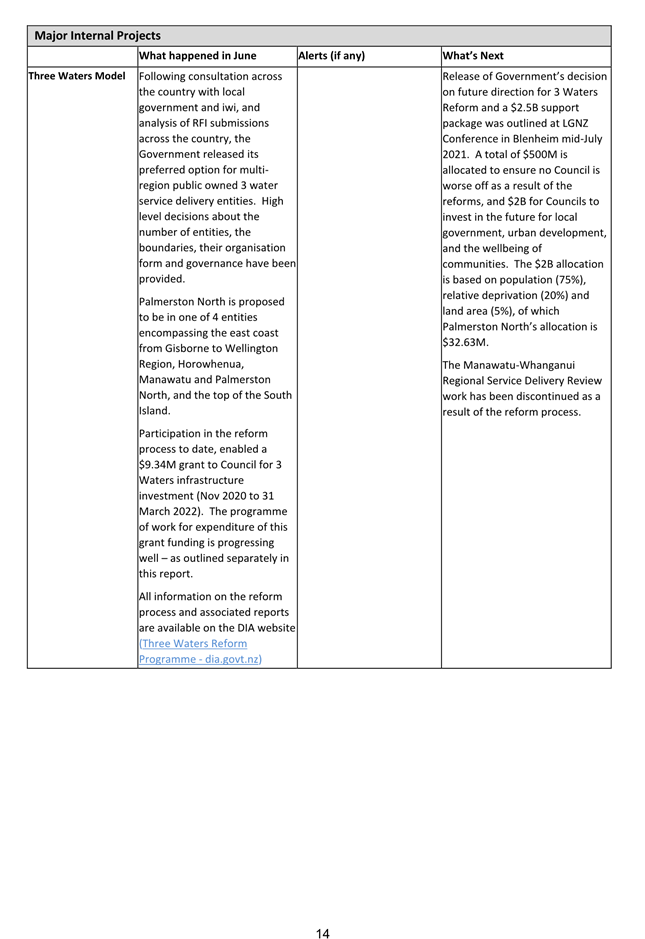

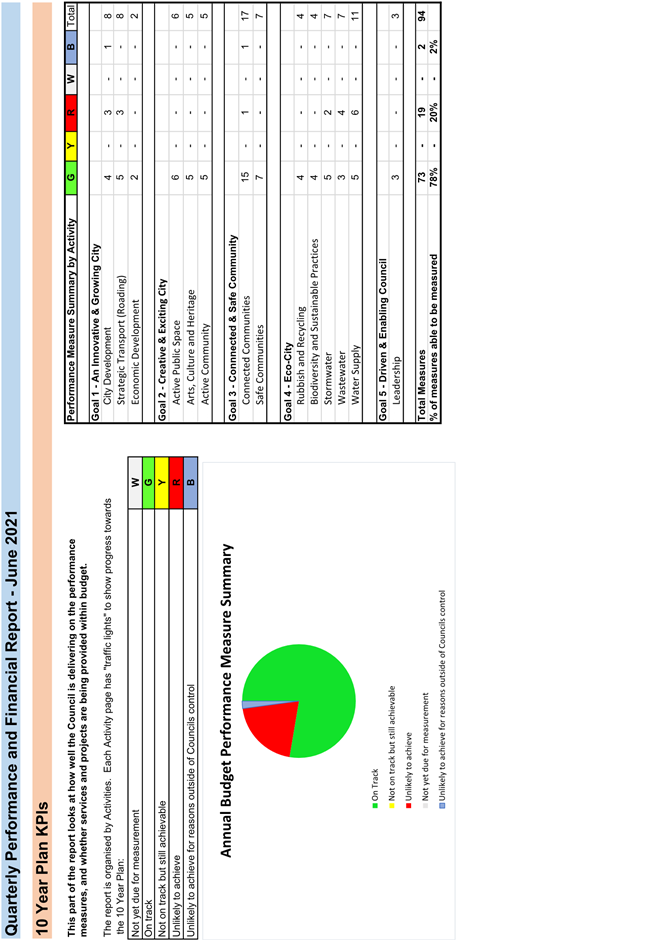

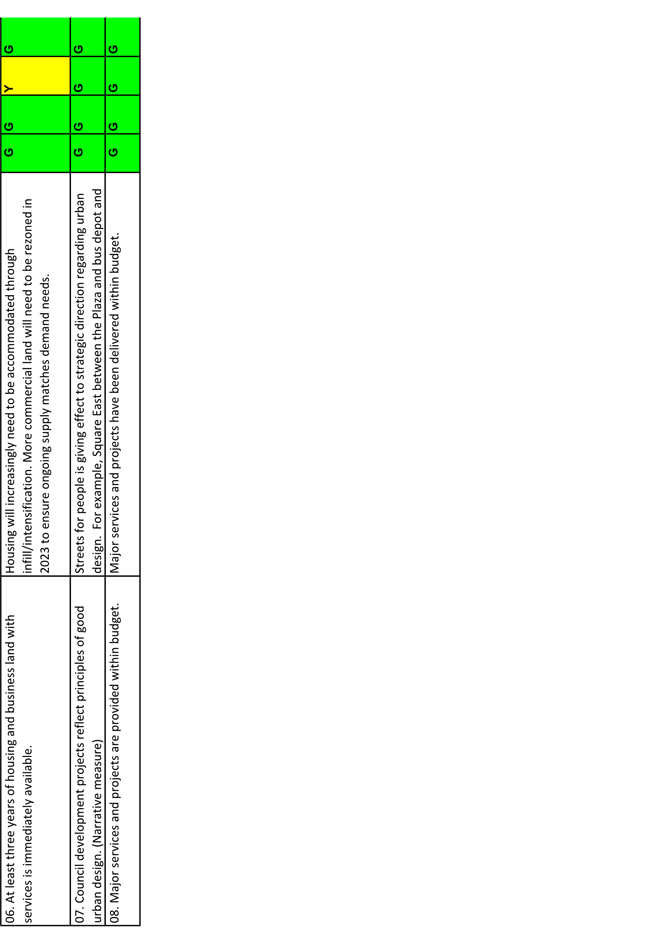

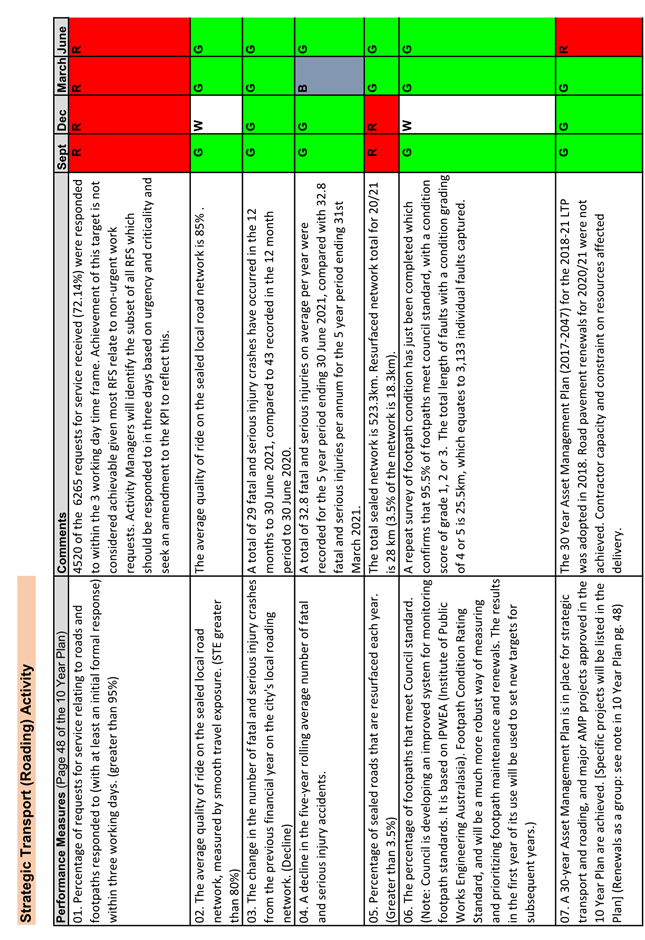

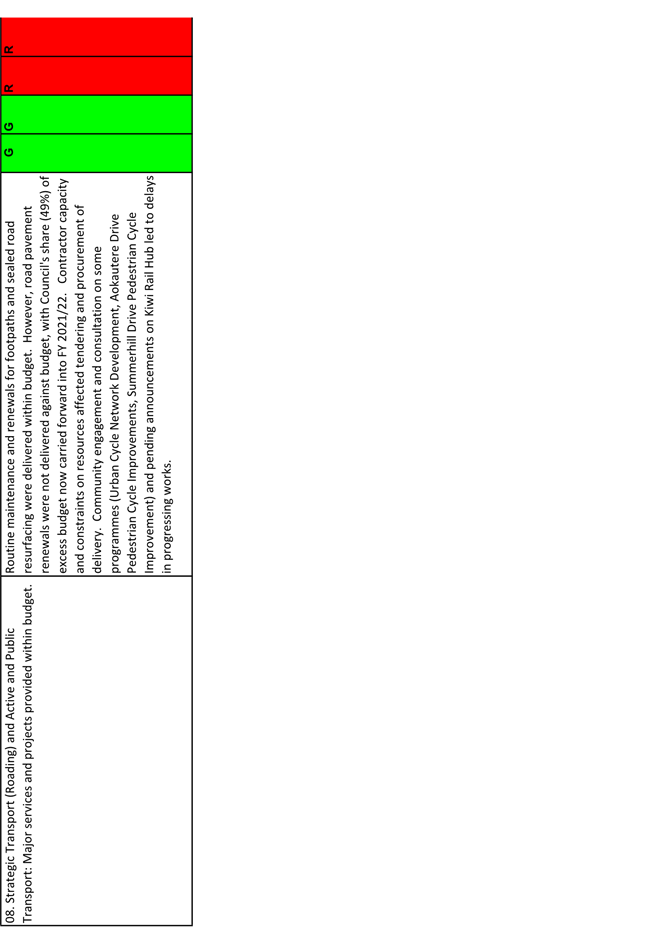

1. ISSUE

To provide an update on the

performance and financial achievements of the Council for the period ending 30

June 2021.

2. BACKGROUND

Details of operating and financial

performance are included in the following sections. Reports are against the

goals as detailed in the 10 Year Plan 2018-28.

3. NEXT STEPS

The next performance and

financial report will be provided after the end of the September 2021 quarter.

4. Compliance and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations

contribute to Goal 5: A Driven and Enabling Council

|

|

The recommendations

contribute to the outcomes of the Driven and Enabling Council Strategy.

|

|

The recommendations contribute

to the achievement of action/actions in a plan under the Driven and Enabling

Council Strategy

The action is: to enable

Council to exercise governance by reviewing financial performance and

operating performance and provide accountability for these to the public.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

As above.

|

|

|

|

Attachments

|

1.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2021 - CE and Catalyst Report ⇩

|

|

|

2.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2021 - Performance Measures ⇩

|

|

|

3.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2021 - Supplementary Material ⇩

|

|

|

4.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2021 - Revision to carry forwards 2021-22 ⇩

|

|

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 25

August 2021

TITLE: Treasury

Report - 12 months ending 30 June 2021

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

RECOMMENDATION(S)

TO Council

1. That the

performance of Council’s treasury activity for the 12 months ending 30

June 2021 be noted.

1. ISSUE

To provide an update on the

Council’s treasury activity for the 12 months ending 30 June 2021.

2. BACKGROUND

The Council’s Annual

Budget for 2020/21 forecast additional debt of $35.643m would need to be raised

during the year to fund the $46.754m of new capital expenditure programmes

(including assumed carry forwards from 2019/20). In June 2020 the Council

resolved to specifically authorise the raising of up to $36m of additional

debt. In August 2020 the Council approved increasing the new capital

expenditure programme for the year by a further $3.8m due to a revised

assessment of the level of carry forwards from 2019/20. In December 2020

the Council approved further additional capital expenditure of approx.

$1.27m. As there was a high likelihood the full capital expenditure

programme for the year would not be achieved there was no change to the additional

debt that was authorised for either of these changes.

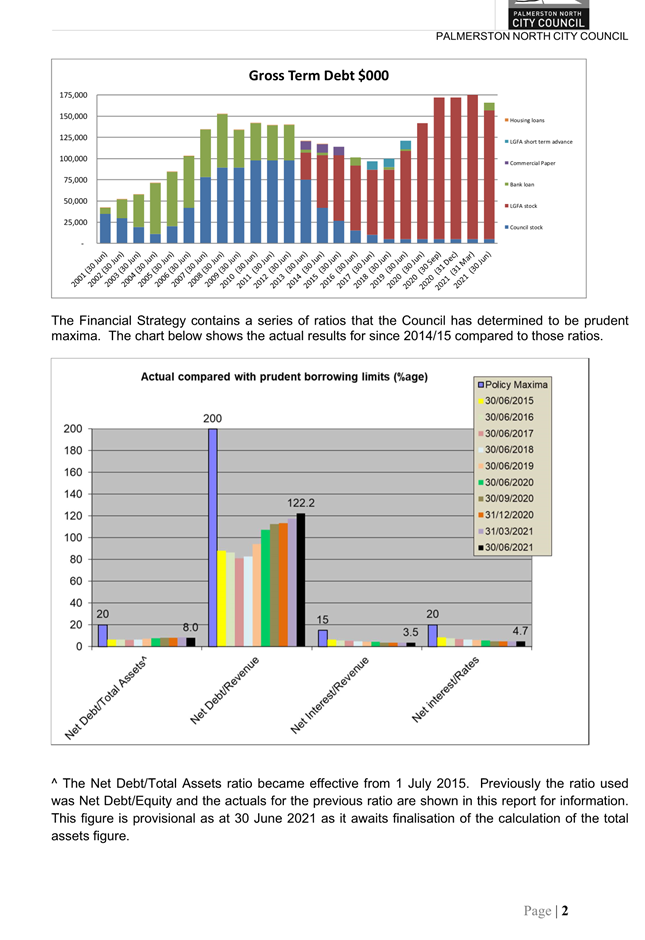

Council’s Financial

Strategy (updated version adopted 25 June 2018) contains the following ratios

which the Council has determined to be prudent maxima:

• Net

debt as a percentage of total assets not exceeding 20%

• Net

debt as a percentage of total revenue not exceeding 200%

• Net

interest as a percentage of total revenue not exceeding 15%

• Net

interest as a percentage of annual rates income not exceeding 20%

An updated version of the

Treasury Policy (embracing the Liability Management and Investment Policy),

adopted by the Council in August 2020, also contains a number of other criteria

regarding debt management. On 7 July 2021 Council adopted its updated Financial

Strategy for 2021-31. No changes were made to these prudent debt ratios.

3. PERFORMANCE

Following the annual review

published on 3 May 2021 Council’s S&P Global Rating’s credit

rating remained unchanged at AA / A-1+.

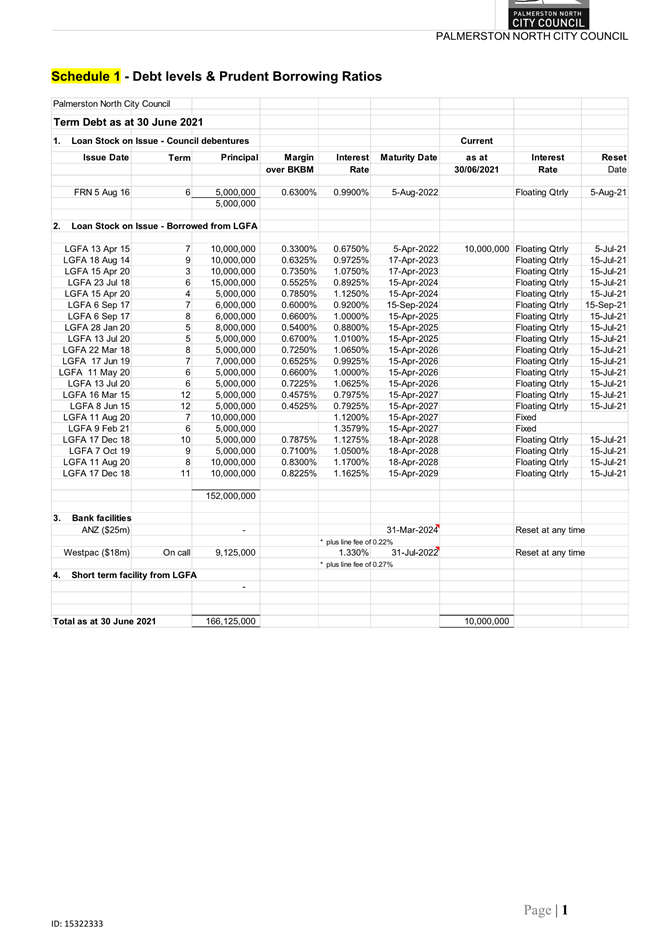

Schedule 1 attached

shows the details of Council’s debt as at 30 June 2021. Debt levels

were within the policy parameters outlined in section 2 of this report.

The summarised gross term debt

movements are shown in the following table:

|

|

Annual Budget for year (2020/21)

$000

|

Actual – 3 months (2020/21)

$000

|

Actual – 6 months (2020/21)

$000

|

Actual – 9 months (2020/21)

$000

|

Actual – 12 months (2020/21)

$000

|

|

Debt Balance at 1 July 2020

New Debt #

Debt repayments #

|

142,597

35,643

|

142,000

30,000

|

142,000

30,000

|

142,000

35,000

|

142,000

44,125

(20,000)

|

|

Closing Balance

Comprising:

Bank advance (on call)

LGFA short term advance

LGFA & Council stock

|

178,240

|

172,000

172,000

|

172,000

172,000

|

177,000

177,000

|

166,125

9,125

0

157,000

|

# A

portion of the Council’s debt is drawn on a daily basis – daily

drawdowns and repayments are not included in these figures but the net draw or

repayment for the year to date is shown as part of new debt or debt repayment

as appropriate.

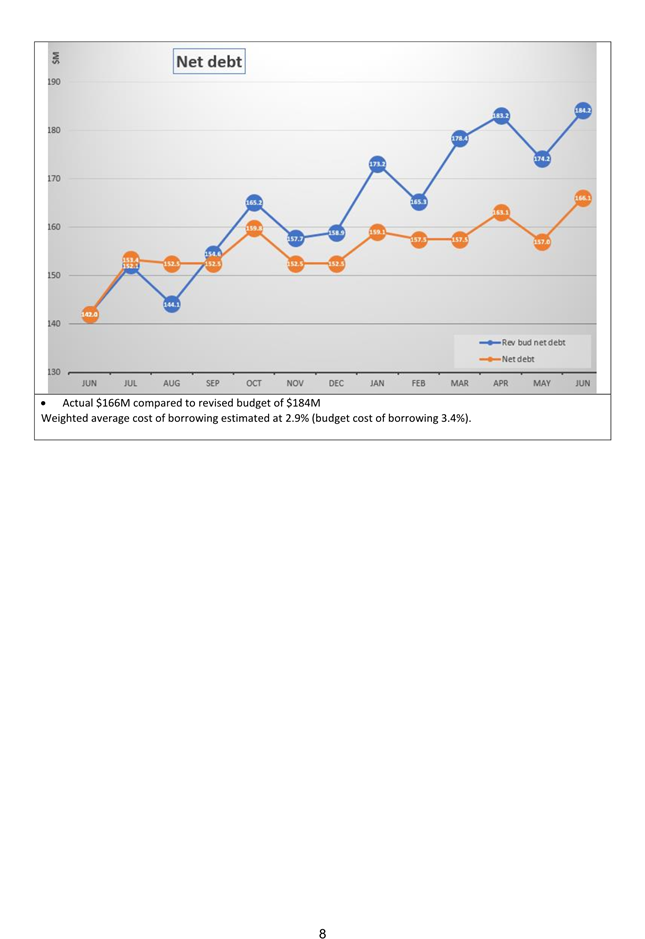

Gross debt at 30 June 2021 was

$166.125m compared with $142m at 1 July 2020.

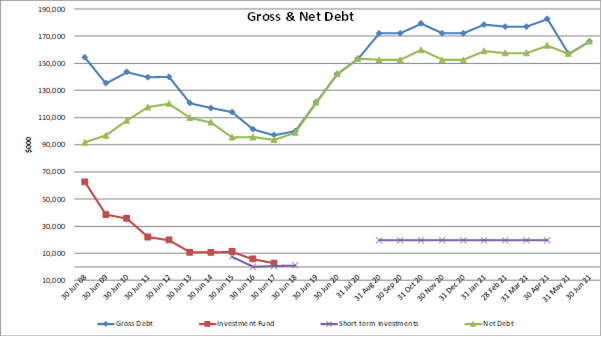

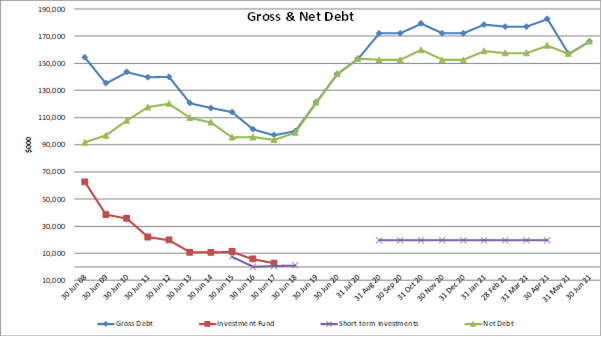

Movements in recent years are

shown in the following graph:

Actual finance costs incurred during the 12 months

(including interest, line fees and the effects of payments relating to swaps)

amounted to $4.975m compared with the budget for the year of $5.557m.

$168k of this expense related to $20m of new loans raised in August 2020 to

prefund debt maturing on 15 May 2021. This cost was more than offset by

unbudgeted interest income of $242k received from short term investment of this

$20m. The effective average interest rate for the year was 2.9% compared with

the budgetary assumption of 3.4% and this translated to a saving of

approximately $825k.

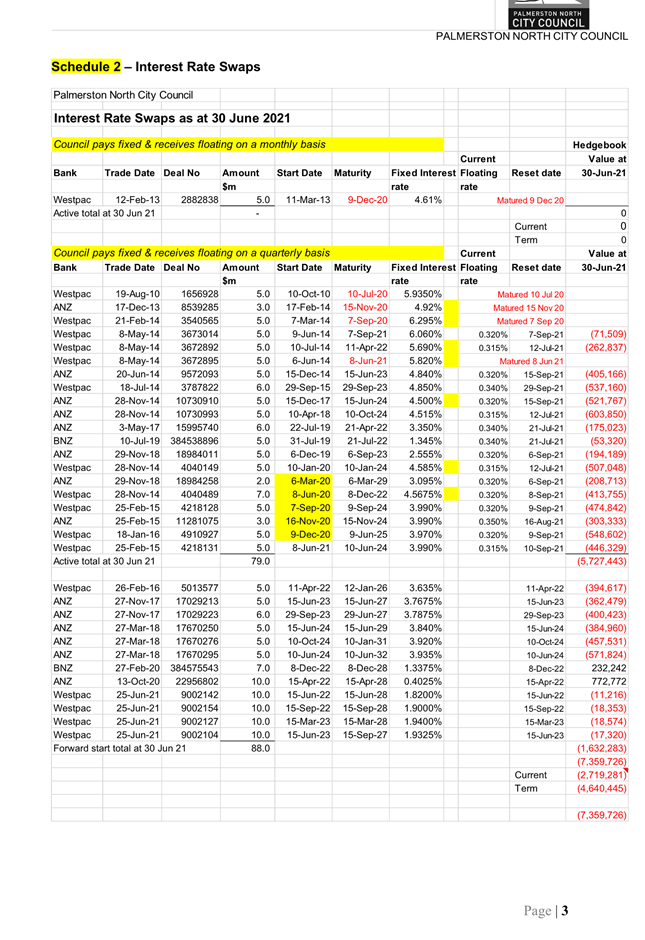

The Council has entered

financial instruments related to its debt portfolio utilising swap trading

lines established with Westpac, ANZ and BNZ. The details of these are

shown in Schedule 2 attached.

The value of these instruments

is measured in terms of its ‘mark-to-market’, ie. the difference

between the value at which the interest rate was fixed and the current market

value of the transaction. Each of these transactions was valued at the

date they were fixed and again at the reporting date. Financial reporting

standards require the movement in values to be recorded through the

Council’s Statement of Comprehensive Income (Profit & Loss

Account). They have been revalued as at 30 June 2021 and show a reduction

in the book value liability of $779k for the quarter and $7.575m for the year.

Swaps with a notional value of

$18m matured during the year and new forward start swaps with a notional value

of $40m (maturing in 2027 and 2028) were entered in June 2021. These new

swaps were entered to ensure the Council remained within its interest rate risk

policy framework.

The Council’s Treasury

Policy contains guidelines regarding the measurement of treasury risk as

follows:

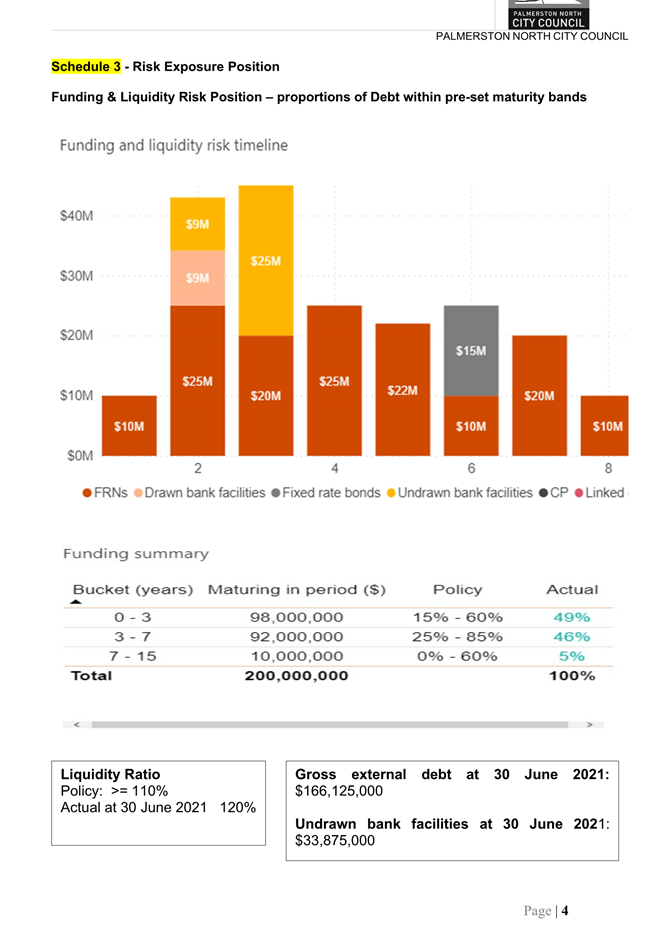

· Funding and

liquidity risk is managed by the Council maintaining a pre-set portion of its

debt in a range of maturity periods, eg. < 3 years, 3 - 7 years, 7 years

+.

· Interest

rate risk is managed by the Council maintaining the ratio of debt that is

subject to floating versus fixed interest rates within pre-set limits.

The position compared to the

policy is illustrated in the graphs in Schedule 3 attached.

The funding & liquidity

risk position can be summarised as follows:

· Council’s

liquid position complies with policy, and debt that matured in May 2021 was

repaid using sums raised in advance and temporarily invested.

· Since

30 June $20m of term debt has been raised. $10m of this is to pre-fund

debt maturing in April 2022 and has been invested in the meantime at a rate

that more than covers the cost of the interest expense. The remainder is

funding activity in the 2021/22 year.

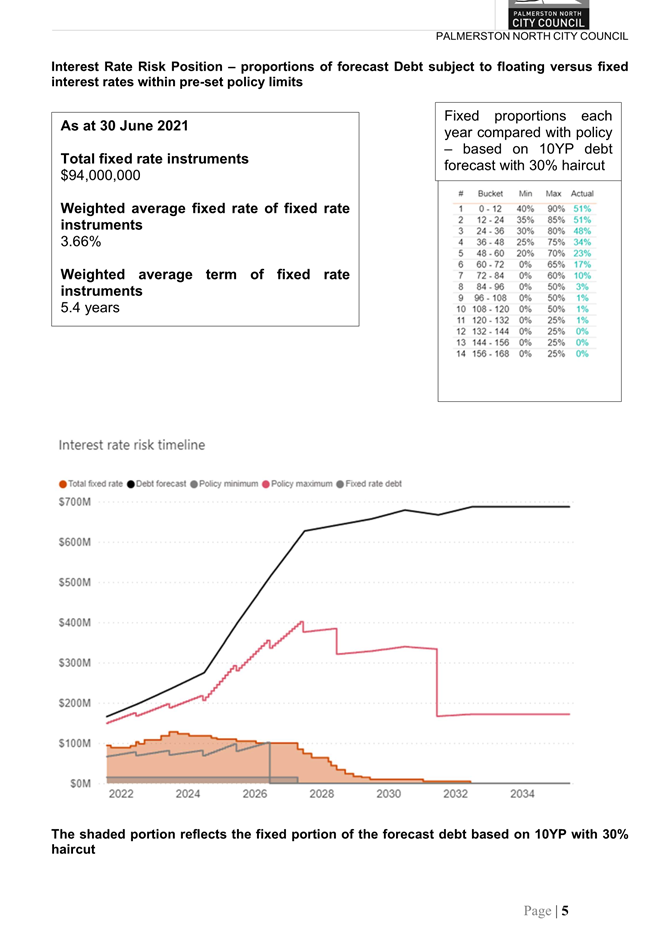

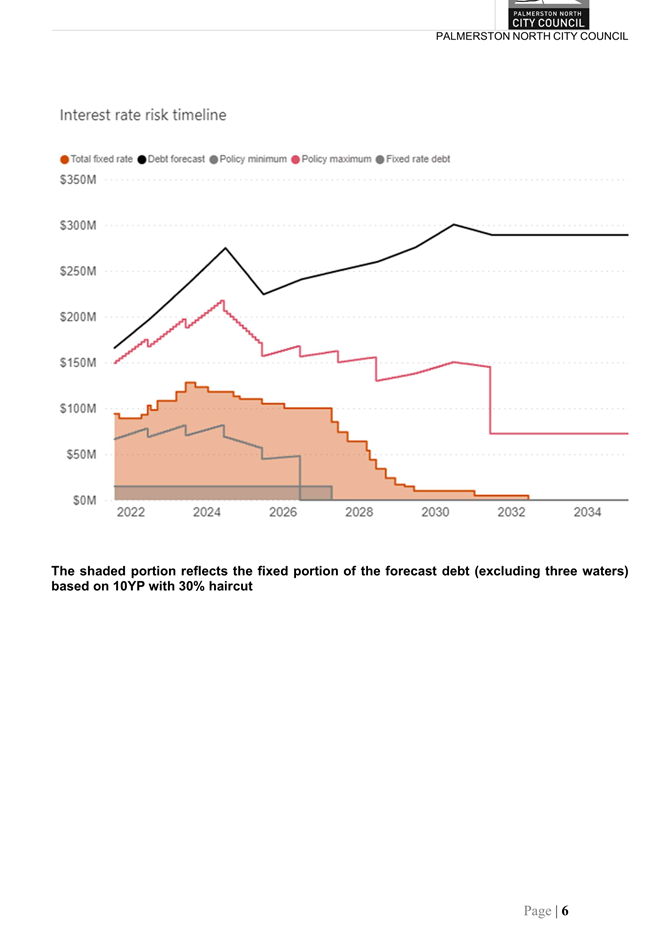

The interest rate risk position

describes the portion of the overall forecast debt that is fixed versus

floating and can be summarised as follows:

· Changes to the

Treasury Policy adopted in August 2020 mean the calculations are no longer

based on the rolling debt forecast for the next 12 months but rather the

rolling debt forecasts for up to 11 years plus.

· There is

significant uncertainty about forecast levels of future debt – this very

much depends on a number of factors including future Council decisions on the

proposed capital expenditure programme and Government decisions on the future

structure of the provision of three waters.

· At the present time

the strategy being adopted is to use the forecast debt figures from the

recently adopted 2021-31 10 Year Plan but reducing them by 30% each year.

Past experience is the Council has struggled to deliver its full programme of

budgeted work so it is prudent to assume this reduced requirement.

Failing to do this would likely lead to the Council’s portfolio becoming

over hedged.

· At the present

time projected debt levels that exclude debt assigned for three waters

programmes are also being considered to make sure the Council is not over

hedged if water related debt is effectively transferred (or paid off) on 30

June 2024.

· At

the present time interest rates are being fixed at or near policy minimums

based on the debt forecasts mentioned above and that is the position as at 30

June. This approach is kept under constant review in the light of

changing market conditions.

As at 30 June 2021 all policy

targets had been met.

Council’s credit lines

with the banks include a $18m four-year credit facility with Westpac Bank

(maturing 31 July 2022) and a revolving $25m three-year facility with ANZ Bank

(maturing 31 March 2024).

4. CONCLUSION & NEXT STEPS

Finance costs for the year

(including interest, line fees and the effect of swaps) was $4.975m compared

with budget for the year of $5.557m. The variances from budget were due

to a variety of factors including prefunding of maturing debt, actual interest

rates lower than the budget assumption, capital expenditure and consequentially

debt being lower than budget.

In conjunction with

Council’s treasury advisors hedging instruments are regularly reviewed in

an effort to ensure the instruments are being utilised to best advantage as

market conditions change. The level of hedging cover is also reviewed as the forecasts

of future debt levels are revised.

Council’s borrowing

strategy is continually reviewed, in conjunction with Council’s treasury

advisors, to ensure best advantage is taken of Council’s quality credit

rating. In recent weeks there has been upward market movement in NZ short

term interest rates (90 Bank bill rates) and these will be reflected in the 90

interest rate resets for Council’s floating rate borrowing. However

margins for present borrowing are fixed. Council’s hedging strategy is

based on the use of forward start swaps. These are influenced by

international market movements for long term bonds and there has been little

movement in these – if anything they have reduced in recent months.

A further performance report

will be provided after the September 2021 quarter.

5. Compliance and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made through

a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 5: A Driven & Enabling Council

This report outlines the

outcomes of a fundamental administrative activity of the Council.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

Managing the Council’s

treasury activity is a fundamental component of day to day administration of

the Council.

|

|

|

|

Attachments

|

1.

|

Schedules 1 to 3 ⇩

|

|

report

TO: Finance

& Audit Committee

MEETING DATE: 25

August 2021

TITLE: Clearview

Reserve - Easement Proposal to Powerco

PRESENTED BY: Bryce

Hosking, Manager - Property and Kathy Dever-Tod, Parks & Reserves Manager

APPROVED BY: Sarah

Sinclair, Chief Infrastructure Officer

RECOMMENDATION(S)

TO Council

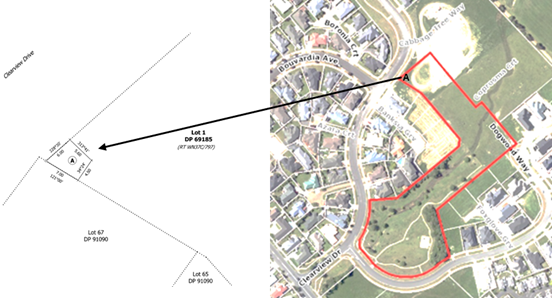

1. That Council,

as the administering body of Clearview Reserve (legally described as Part of

Lot 1 DP 69185), authorise the granting of an easement to convey electricity,

to Powerco.

2. That Council, in exercise

of the powers conferred on it by delegation under the Reserves Act 1977,

authorise the granting of an easement to convey electricity, to Powerco.

3. That Council note

that the requirements of Section 4 of the Conservation Act 1987 have been

satisfied in relation to consultation with Iwi over granting an easement to

convey electricity at Clearview Reserve.

4. That Council

note that the requirements of Sections 119 and 120 of the Reserves Act

1977 have been satisfied in relation to public notification prior to the

resolution to grant an easement to convey electricity over Clearview Reserve.

Summary of options analysis for

|

Problem

or Opportunity

|

Powerco has existing transformer

and associated services within Clearview Reserve for the supply of electricity

to Clearview Drive. These utility services were established within the

reserve land in 2003 as part of the Clearview Drive Subdivision.

The Reserves Act 1977 requires

utility services on reserve land to be covered by an easement, however, there

is currently no easement registered for this matter within Clearview Reserve.

Powerco has identified this

matter during their recent upgrade work and has requested an easement be

created to ensure the legal status of these utilities align with the Reserves

Act.

The public consultation process

has been completed in accordance with Section 48 of the Reserves Act 1977.

There were no submissions received.

This report seeks approval from

Council to grant the formal easement for this matter.

|

|

Community

Views

|

· The

transformer has physically been in place since its establishment in 2003.

Council has never received any feedback in relation to this transformer

during this time.

· The

public consultation process was completed and there were no submissions

received.

· Iwi

were consulted and were in support of the easement being granted.

|

|

OPTION

1:

|

Approve the proposed easement

at Clearview Reserve to Powerco

|

|

Benefits

|

· Registering

an easement within Clearview Reserve is considered good governance and

ensures the activity is compliant with the requirements of the Reserves Act

1977.

|

|

Risks

|

· None.

|

|

Financial

|

· There

are no financial implications with this easement as all costs are met by

Powerco as the owner of the services as per Council’s Easements Policy.

|

|

OPTION

2:

|

Decline

the proposed easement to Powerco at Clearview Reserve and require the

services to be relocated

|

|

Benefits

|

· None.

|

|

Risks

|

· If

a formal easement is not granted Powerco will need to relocate the

transformer which will cause disruption to the surrounding residents.

· Declining

an easement may be perceived as causing unnecessary disruption.

|

|

Financial

|

· None.

|

Rationale for the recommendations

1. Overview of the problem or opportunity

1.1 Powerco

has existing transformer and associated services within Clearview Reserve for

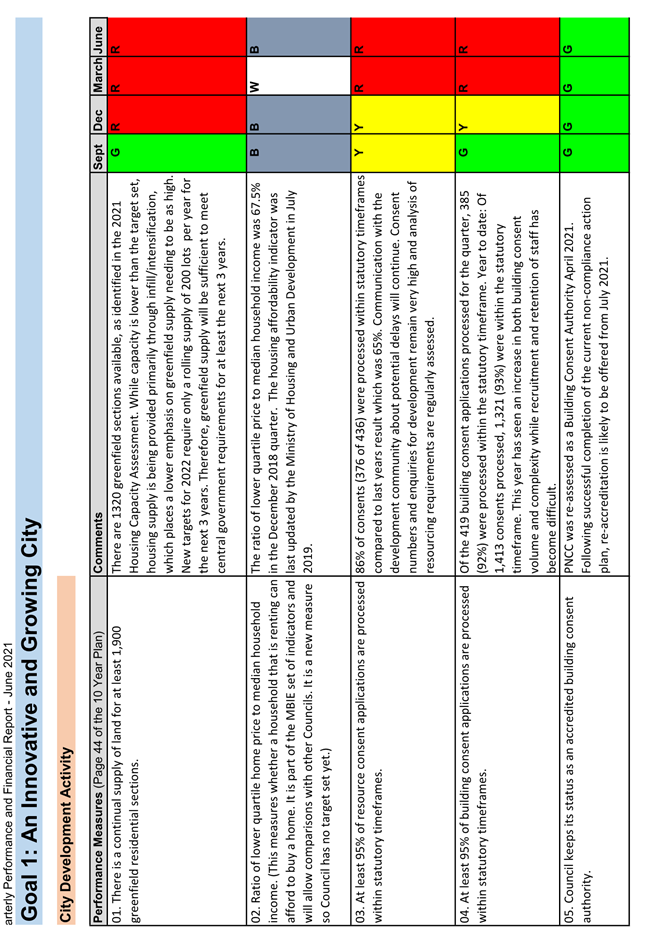

the supply of electricity to Clearview Drive.

1.2 The

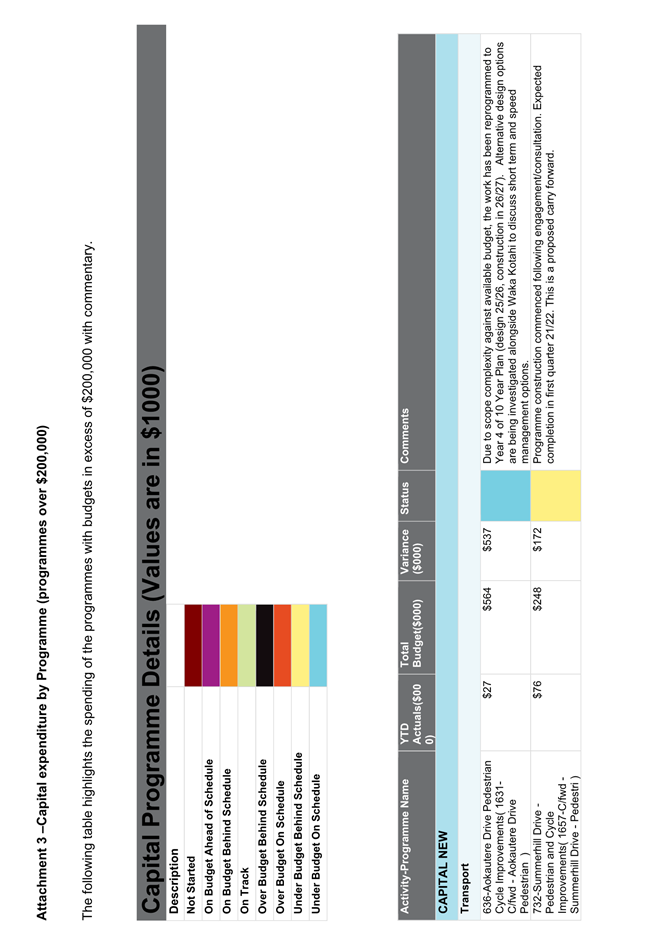

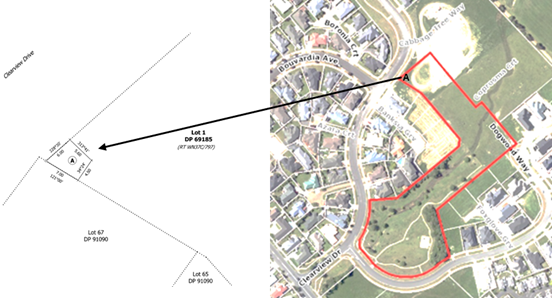

location of the transformer within Clearview Reserve is shown below:

1.3 The

Reserves Act 1977 requires any form of utility for services on reserve land to

be covered by an easement, however, there is currently no easement registered

for this utility within Clearview Reserve.

1.4 Powerco

identified this matter during their recent upgrade work to connect a new cable

from Dogwood Way to the transformer and have requested an easement be created

to ensure the legal status of these utilities align with the Reserves Act.

1.5 The

public consultation process has been completed in accordance with Section 48 of

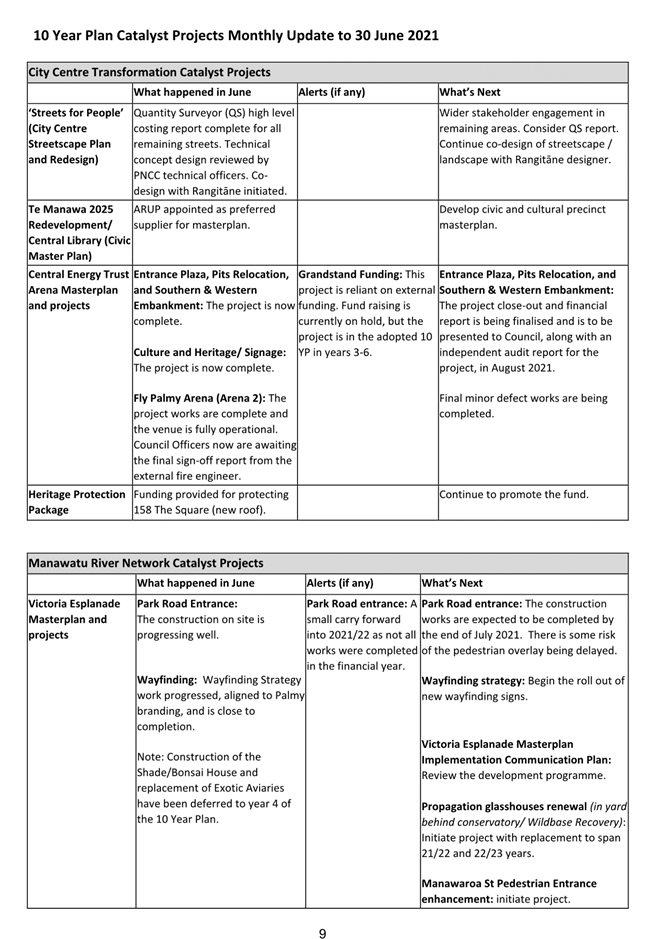

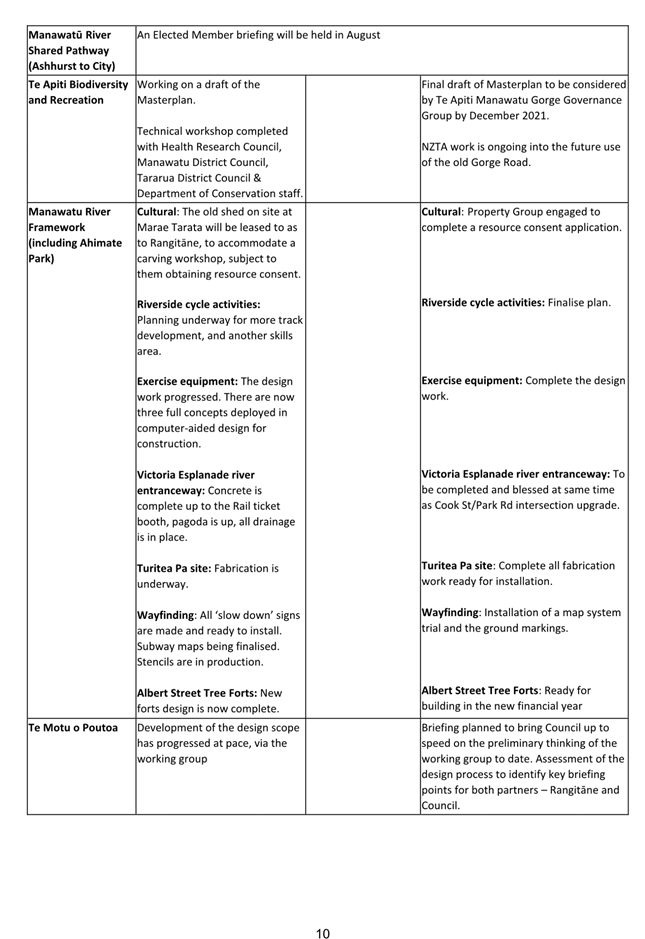

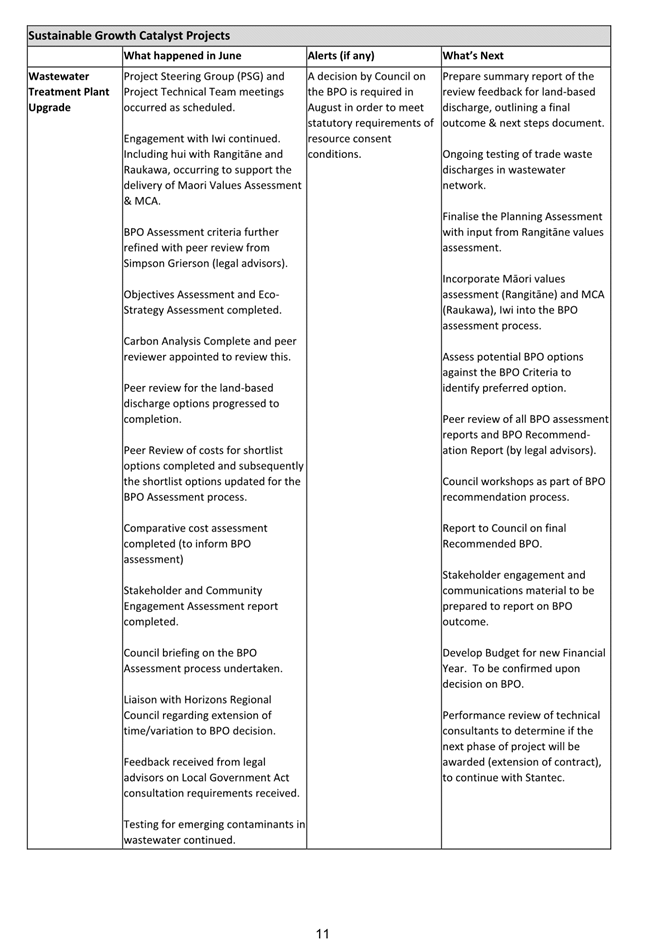

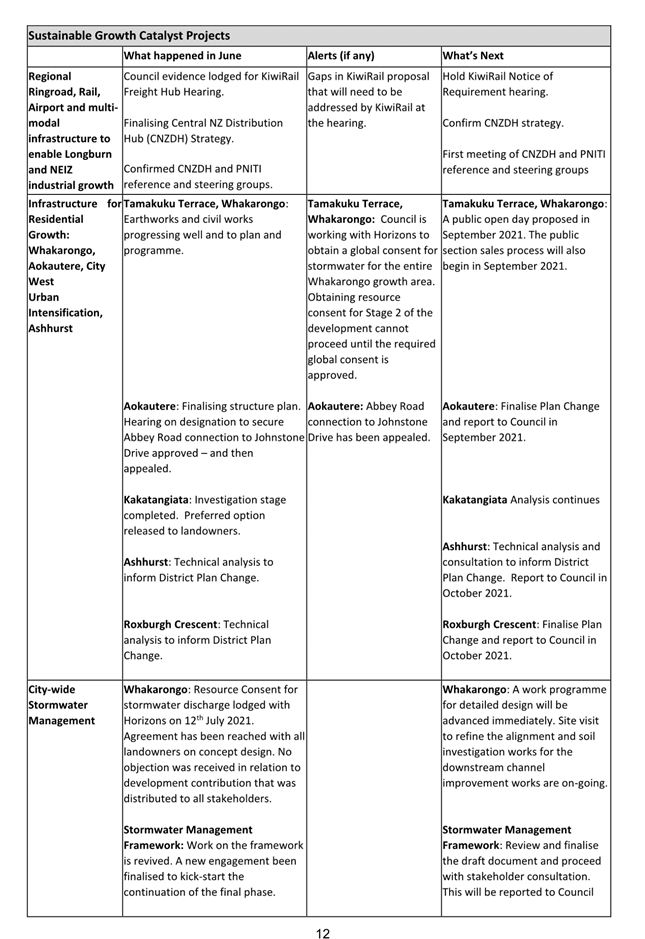

the Reserves Act 1977. There were no submissions received.

1.6 This

report seeks approval from Council to grant the formal easement for this

matter.

2. Background and previous council decisions

2.1 Powerco’s

utility services at Clearview Reserve include a transformer and associated

services such as underground cables. These utility services were established

within the reserve land in 2003 as part of the Clearview Drive Subdivision.

2.2 In

general Council encourages, wherever possible, service companies to locate

their services in the road corridor. Road corridors are often increased in new

subdivisions to include ‘alcoves’ that will house transformers. This

allows service companies to operate under a standard roading corridor

right-of-way.

2.3 This

is not always possible or an appropriate outcome however, hence on occasion

these utility services are required to be located within reserve land.

2.4 In

these situations, Council encourages companies to situate these utility

services underground. In this case the transformer needed to be located above

ground for access, so the best outcome was to set this back off the road or

footpath and to be located ‘out of the way’.

Requirement for

Easements

2.5 In

1968 the Electricity Act provided the legal basis for utilising land for the

purposes of conveying electricity. In 1977 this method of utilising land in

reserves for the purposes of conveying electricity was superseded by the

Reserves Act 1977.

2.6 In

recent years Powerco has been bringing the legal status of all their

electricity conveyance utilities in line with the Reserves Act, including the

establishment of easements when required.

2.7 The

easements proposed cover the transformer site and the recent upgrade works

area.

Previous Council

Decisions

2.8 The

Finance and Audit Committee received a report on the proposed easement at their

meeting on 24 February 2021.

2.9 Council

subsequently approved the proposal to proceed to community consultation.

2.10 Community

consultation occurred during the period 28 April to 27 May 2021. There were no

submissions received.

3. Description and analysis of options

Community Views

3.1 The

transformer has physically been in place since its establishment in 2003.

Council has never received any feedback in relation to this transformer during

this time.

3.2 The

public consultation process was completed and there were no submissions received.

3.3 Iwi

were consulted and were in support of the easement being granted.

Option 1:

Approve the proposed easement at Clearview Reserve to Powerco

3.4 Option

1 sees Council authorise the granting of an easement to convey electricity to

Powerco within Clearview Reserve.

Benefits

3.5 The

registration of an easement is an administrative matter. As such registering

this easement within Clearview Reserve is considered good governance and

ensures the activity is compliant with the requirements of the Reserves Act

1977.

Risks

3.6 No

risks have been identified for this option.

Financial Implications

3.7 There

are no financial implications with this easement as all costs are met by

Powerco as the owner of the services as per Council’s Easements Policy.

Option 2: Decline the proposed easement to Powerco

at Clearview Reserve and require the services to be relocated

3.8 Option

2 would see Council declining the proposed easement and require Powerco to

relocate the transformer and its associated services off Clearview Reserve.

Benefits

3.9 No

benefits have been identified for this option.

Risks

3.10 If a

formal easement is not granted Powerco will need to relocate the transformer

which will cause disruption to the surrounding residents.

3.11 Given the transformer

and its services have been in place since 2003, declining an easement may be

perceived as causing unnecessary disruption by both Powerco and the general

public.

Financial Implications

3.12 No costs

will be incurred.

4. Conclusion

4.1 As

this is an administrative matter, Option 1 is considered good governance and

will ensure the activity is compliant with the requirements of the Reserves Act

1977.

4.2 Council

has met the requirements of the Reserves Act and Conservation Act in considering

the easement.

4.3 There

was no submission in support or opposition received from the community

consultation and no concerns raised by Rangitāne.

4.4 It

is recommended that Council proceeds with Option 1 and grants an easement to

Powerco at Clearview Reserve.

5. Next actions

5.1 The

easement instrument will be entered between Council and Powerco and added to

the relevant property title.

6. Outline of community engagement process

6.1 Public

notification was undertaken through an advertisement in the Manawatu Standard

and on the Palmerston North City Council website from 28 April 2021 until 27

May 2021.

6.2 No

submissions or objections were received.

6.3 Iwi

were consulted on this matter both in January 2021 and as part of the July 2021

bimonthly meeting with Council Officers. They were in support of the easement

being granted.

Compliance and administration

|

Does

the Committee have delegated authority to decide?

|

No

|

|

Are

the decisions significant?

|

No

|

|

If

they are significant do, they affect land or a body of water?

|

No

|

|

Can

this decision only be made through a 10 Year Plan?

|

No

|

|

Does

this decision require consultation through the Special Consultative

procedure?

|

No

|

|

Is

there funding in the current Annual Plan for these actions?

|

No

|

|

Are

the recommendations inconsistent with any of Council’s policies or

plans?

|

No

|

|

The

recommendations contribute to Goal 3: A Connected and Safe Community

|

|

The

recommendations contribute to the achievement of action/actions

in Economic Development

The

action is: Carry out recreation and reserves planning functions under the

Reserves Act 1977 and LGA including the preparation of Reserve Management and

Development Plans and Master Plans.

|

|

Contribution

to strategic direction and to social, economic, environmental and cultural

well-being

|

This

action ensures Council meets its legal obligations under the Reserves Act

1977 with regards to reserves planning and legislative requirements for

utilities sited in reserves.

|

|

|

|

Attachments

Nil

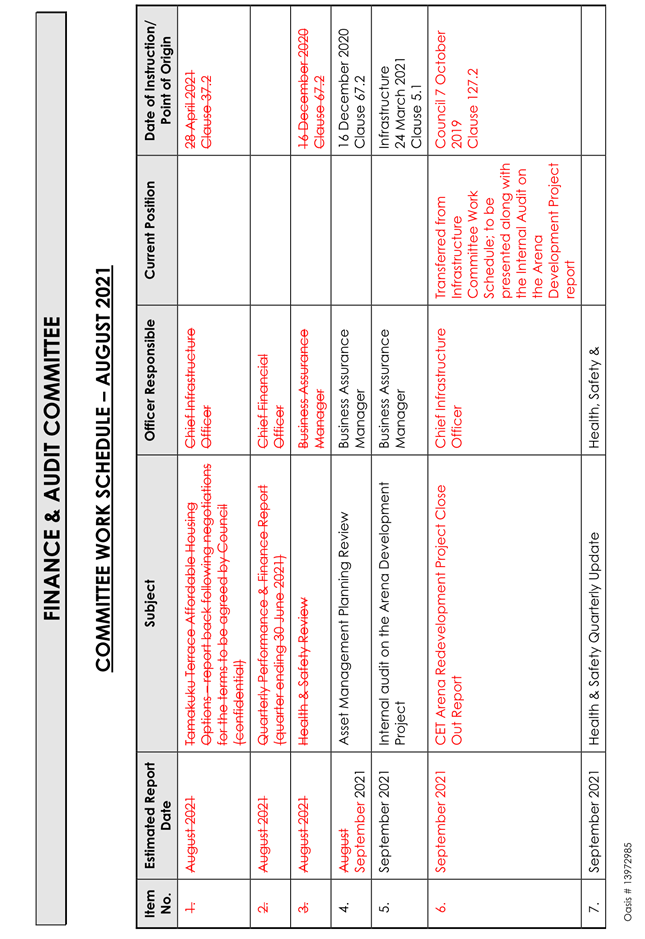

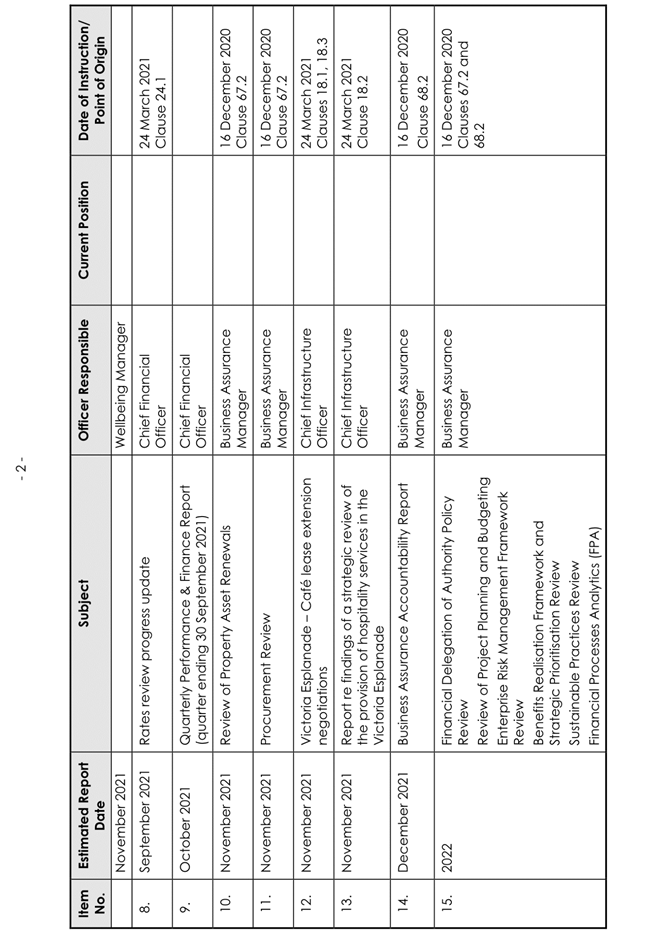

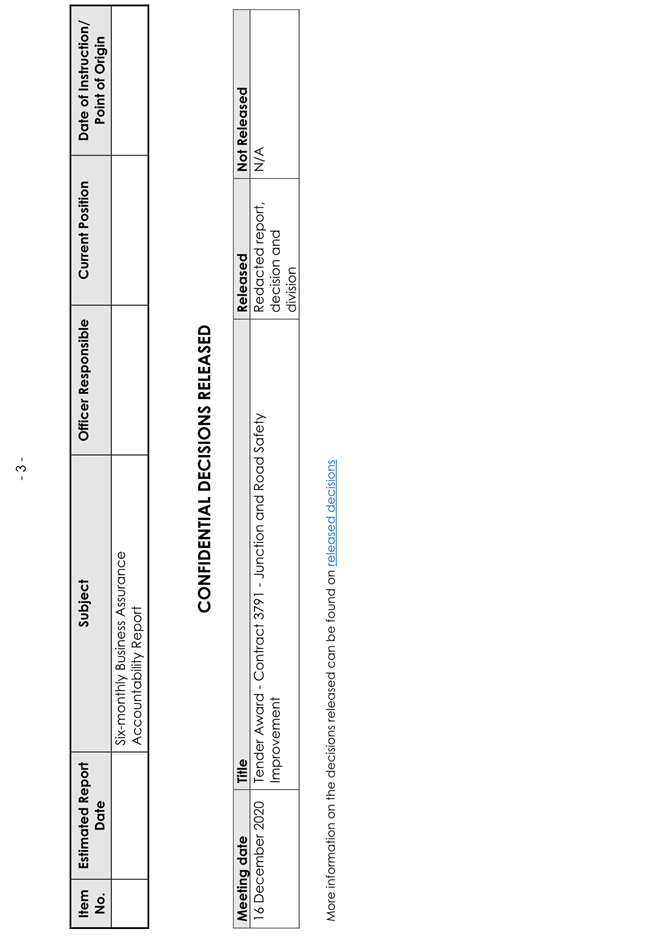

Committee Work Schedule

TO: Finance

& Audit Committee

MEETING DATE: 25

August 2021

TITLE: Committee

Work Schedule

RECOMMENDATION(S) TO Finance & Audit Committee

1. That the Finance

& Audit Committee receive its Work Schedule dated August 2021.

Attachments

|

1.

|

Committee Work Schedule_August 2021 ⇩

|

|