Economic Growth Committee

|

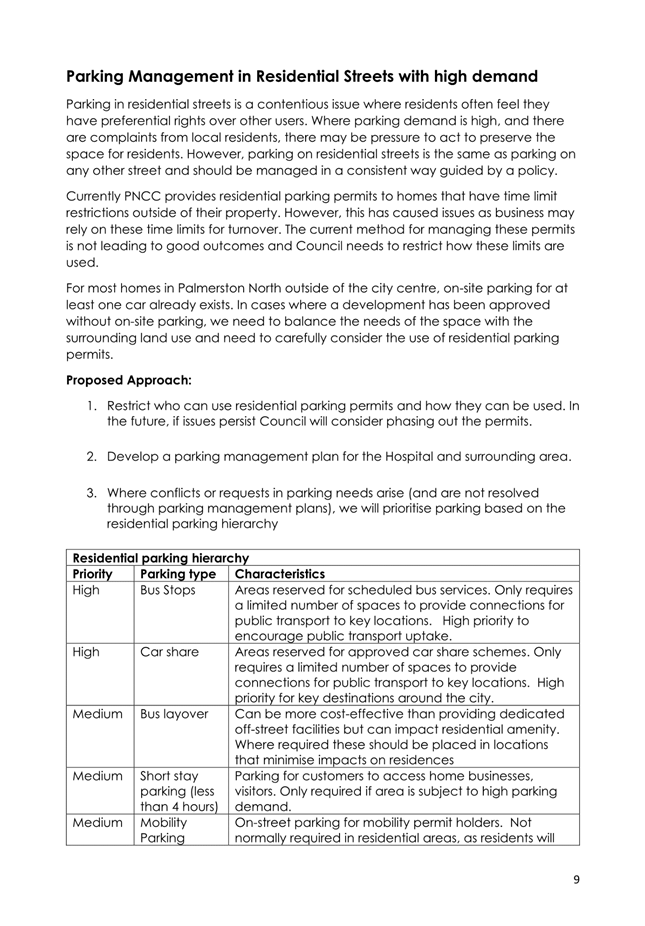

Leonie

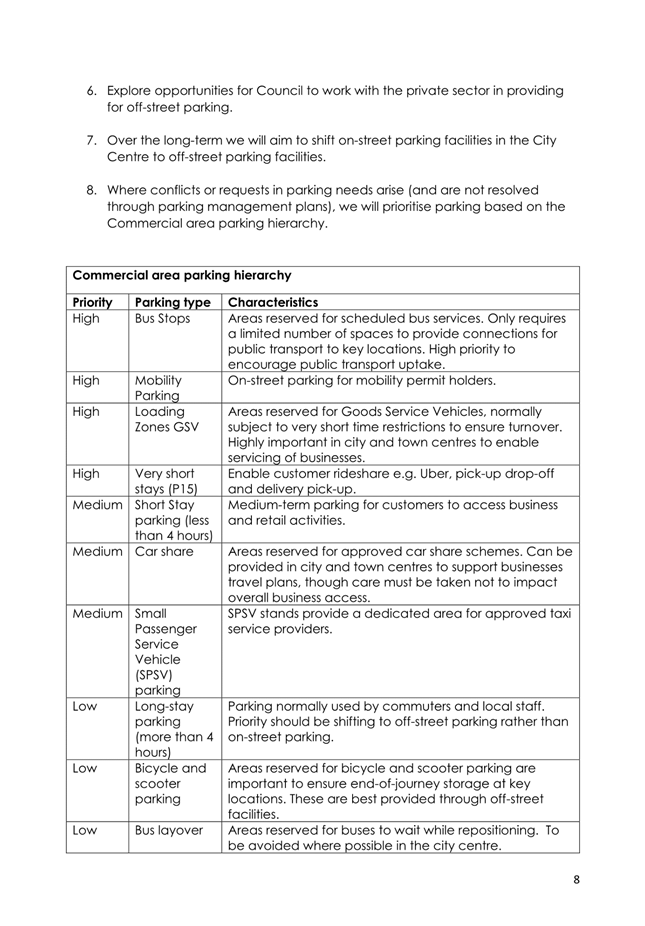

Hapeta (Chair)

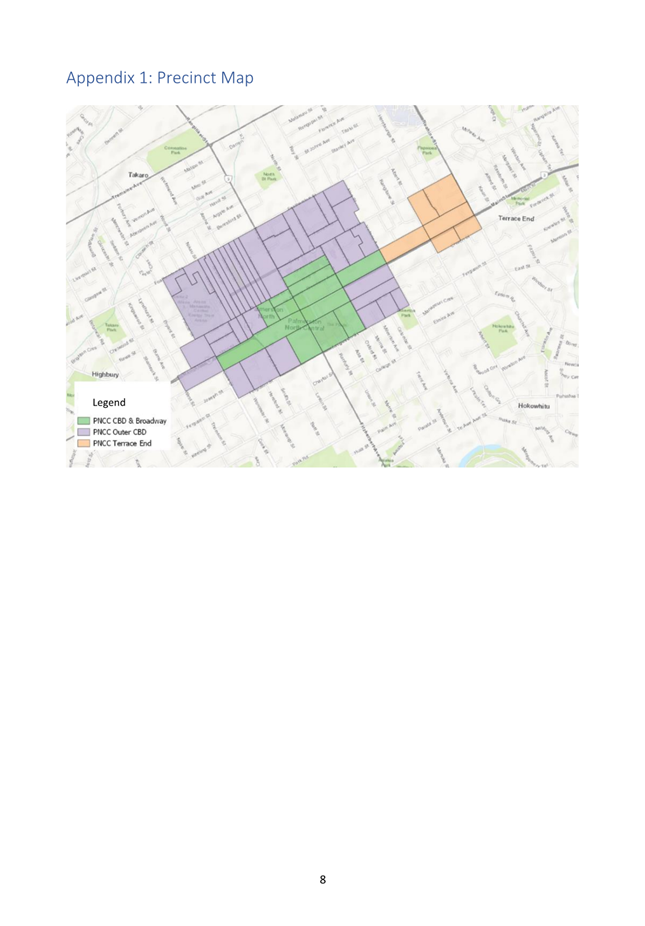

|

|

William

Wood (Deputy Chair)

|

|

Grant

Smith (The Mayor)

|

|

Mark

Arnott

|

Lorna

Johnson

|

|

Brent

Barrett

|

Debi

Marshall-Lobb

|

|

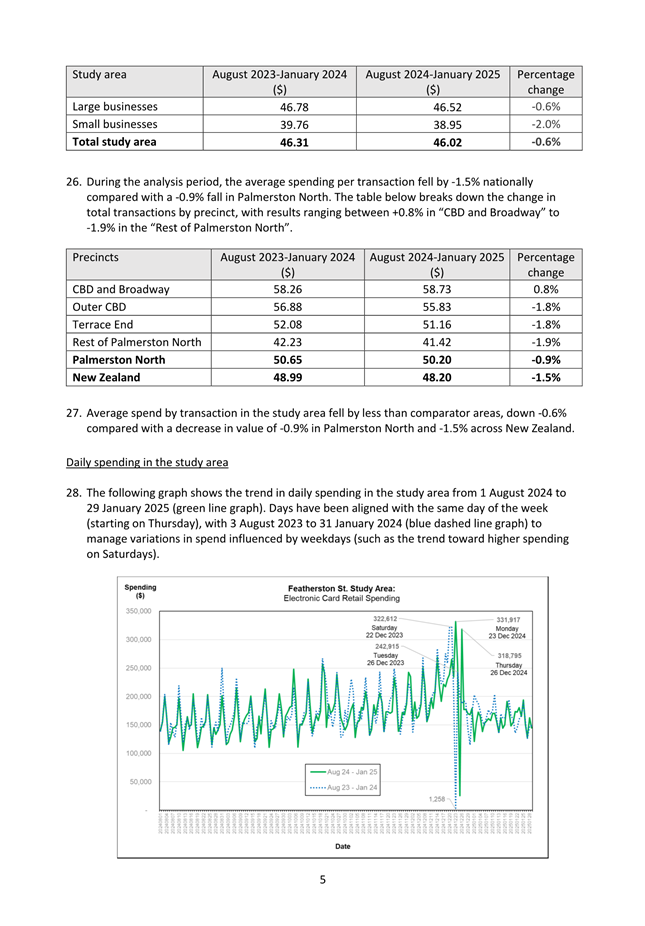

Rachel

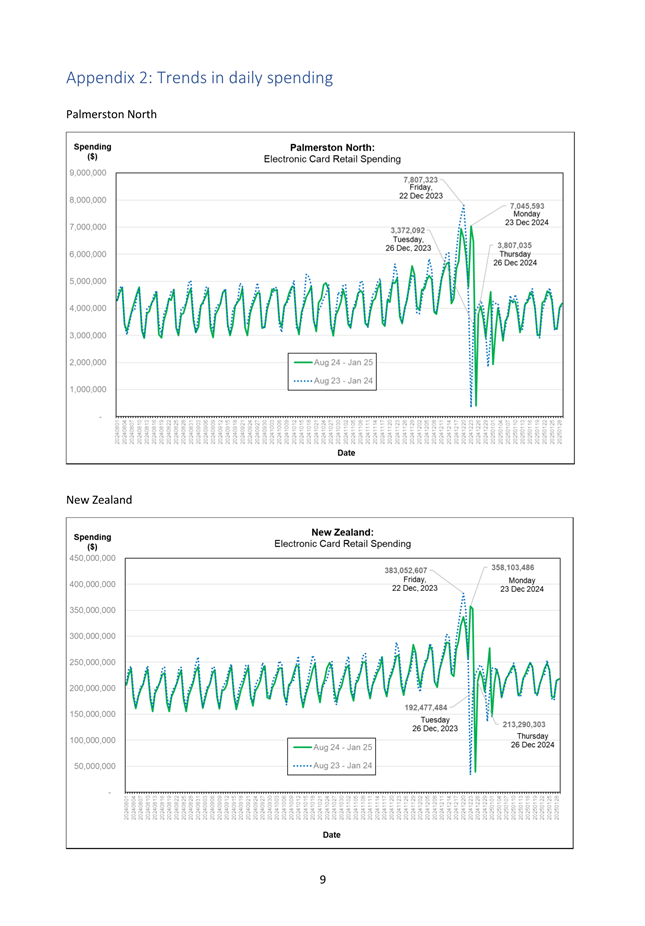

Bowen

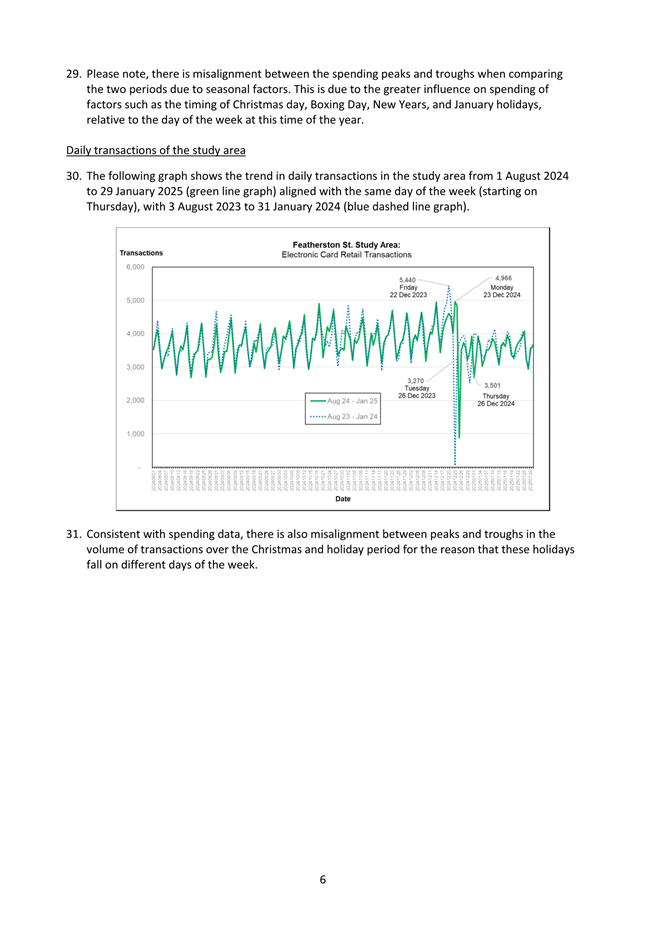

|

Billy

Meehan

|

|

Vaughan

Dennison

|

Orphée

Mickalad

|

|

Roly

Fitzgerald

|

|

Economic Growth Committee

MEETING

9 April 2025

Order of Business

1. Karakia Timatanga

2. Apologies

3. Notification

of Additional Items

Pursuant to

Sections 46A(7) and 46A(7A) of the Local Government Official Information and

Meetings Act 1987, to receive the Chairperson’s explanation that

specified item(s), which do not appear on the Agenda of this meeting and/or the

meeting to be held with the public excluded, will be discussed.

Any additions

in accordance with Section 46A(7) must be approved by resolution with an

explanation as to why they cannot be delayed until a future meeting.

Any

additions in accordance with Section 46A(7A) may be received or referred to a

subsequent meeting for further discussion. No resolution, decision or

recommendation can be made in respect of a minor item.

4. Declarations

of Interest (if any)

Members are

reminded of their duty to give a general notice of any interest of items to be

considered on this agenda and the need to declare these interests.

5. Public

Comment

To receive

comments from members of the public on matters specified on this Agenda or, if

time permits, on other Committee matters.

6. Confirmation

of Minutes Page 7

That the minutes of the Economic Growth Committee meeting

of 20 November 2024 Part I Public be confirmed as a true and correct record.

Reports

7. Featherston

Street Safety Improvements Project Update Page 17

Memorandum, presented by Glen

O'Connor, Manager Transport and Development and Michael Bridge, Service Manager

Active Transport.

8. Draft

Parking Framework - Approval for Public Consultation Page 95

Report, presented by James Miguel,

Senior Transport Planner.

9. Street

Light Infill Page 127

Memorandum, presented by Glen

O'Connor, Group Manager - Transport and Development.

10. Central

City Transformation - Streets for People Six Monthly Update Page 131

Memorandum, presented by Glen

O'Connor, Group Manager – Transport and Development and James Miguel,

Senior Transport Planner.

11. Road

Maintenance Contract - 6 Monthly Update Page 135

Memorandum, presented by Glen

O'Connor, Manager - Transport and Development.

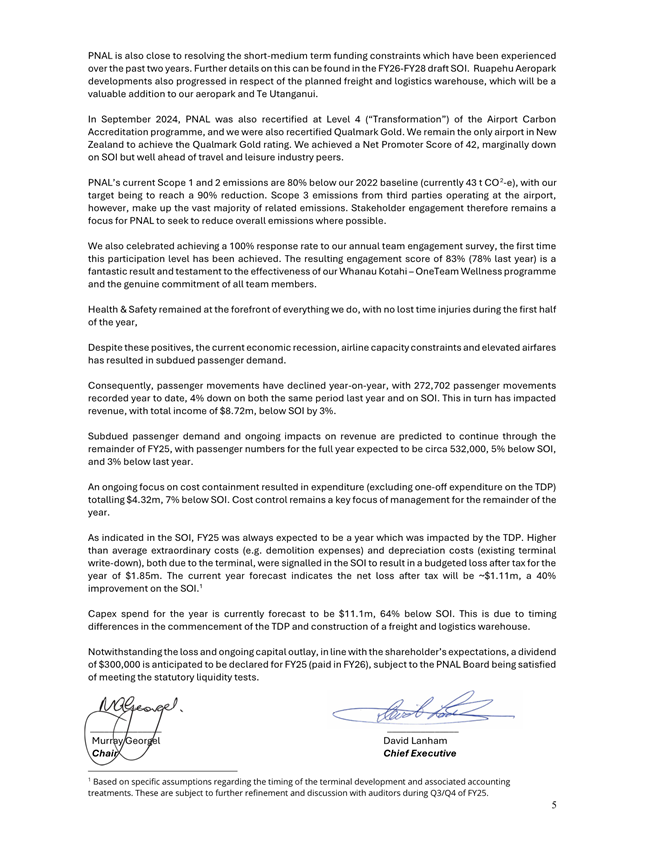

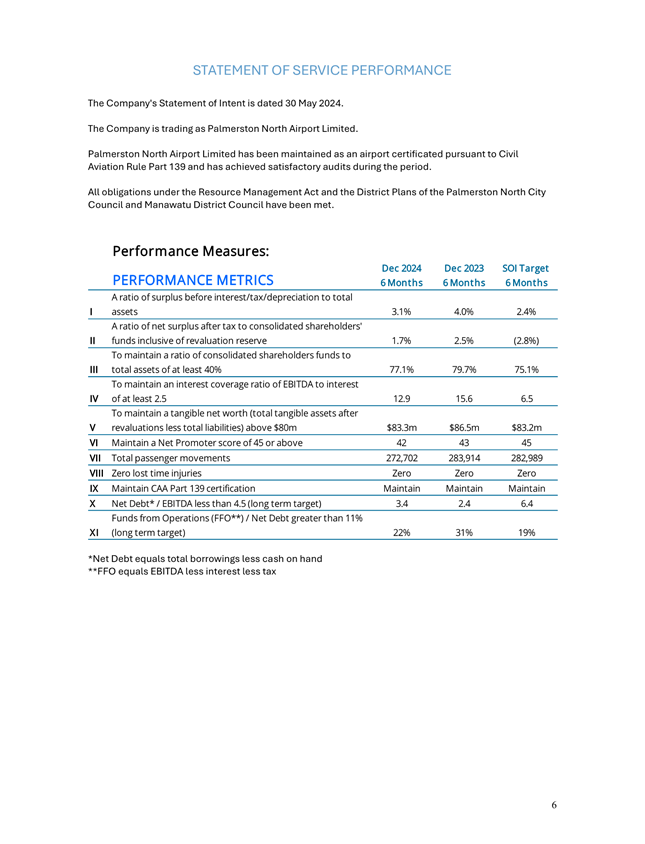

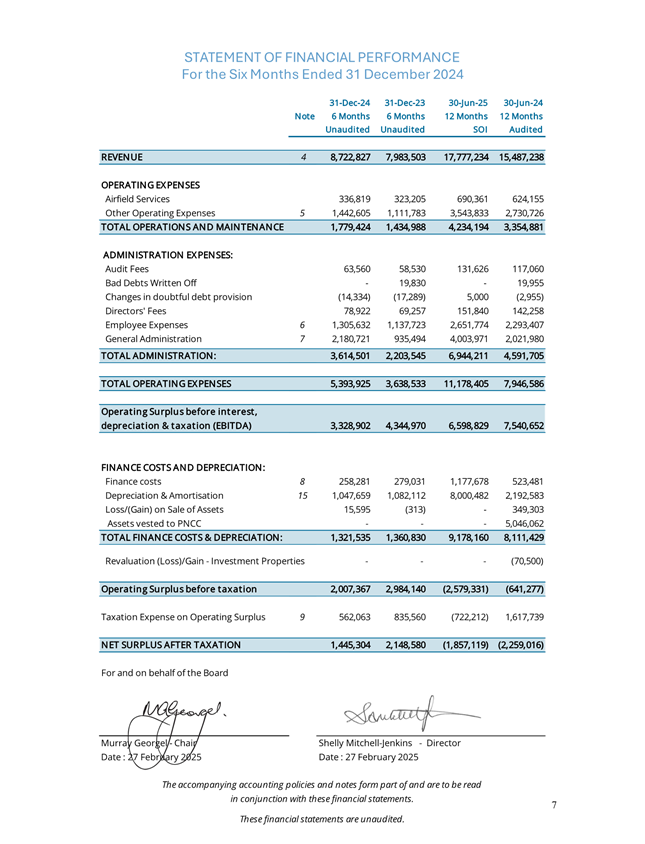

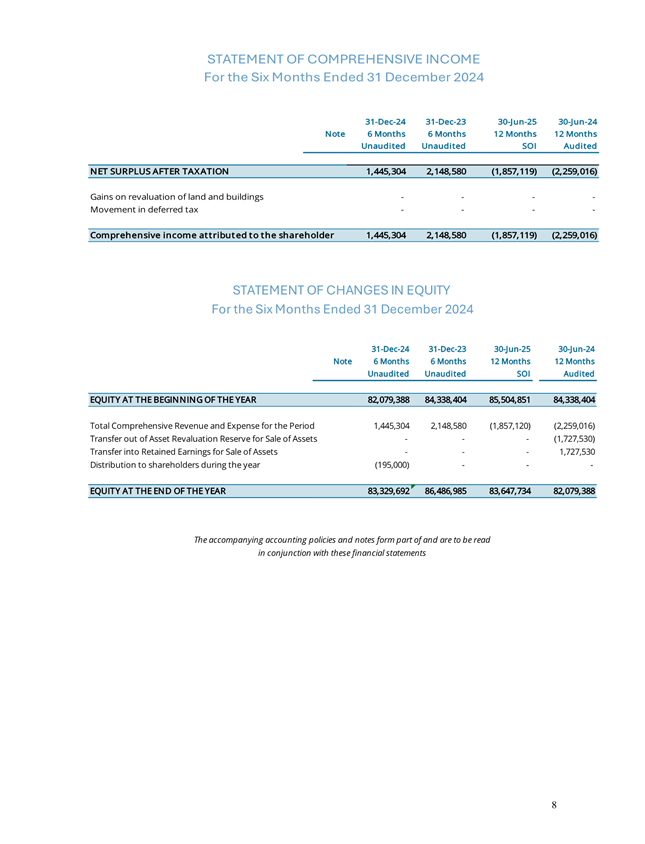

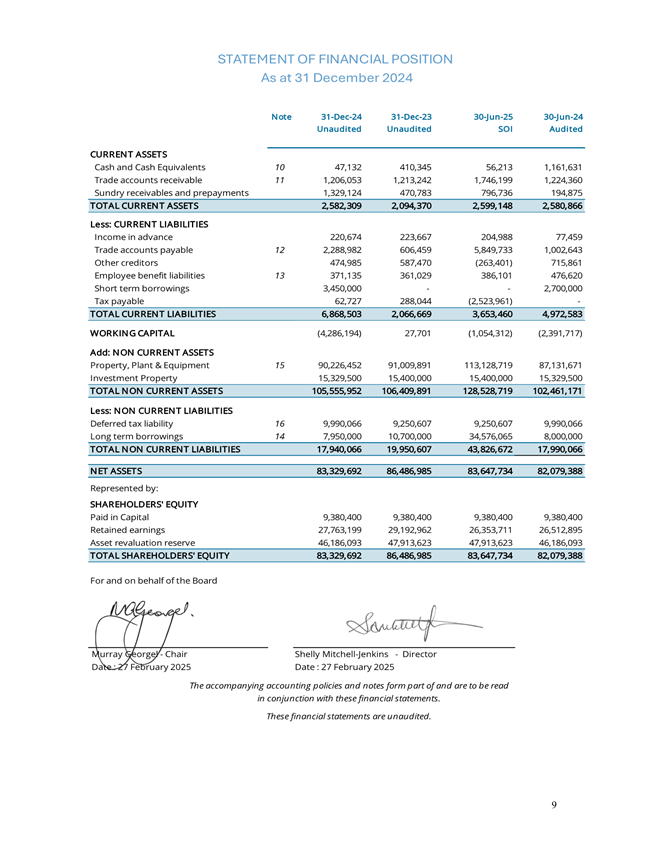

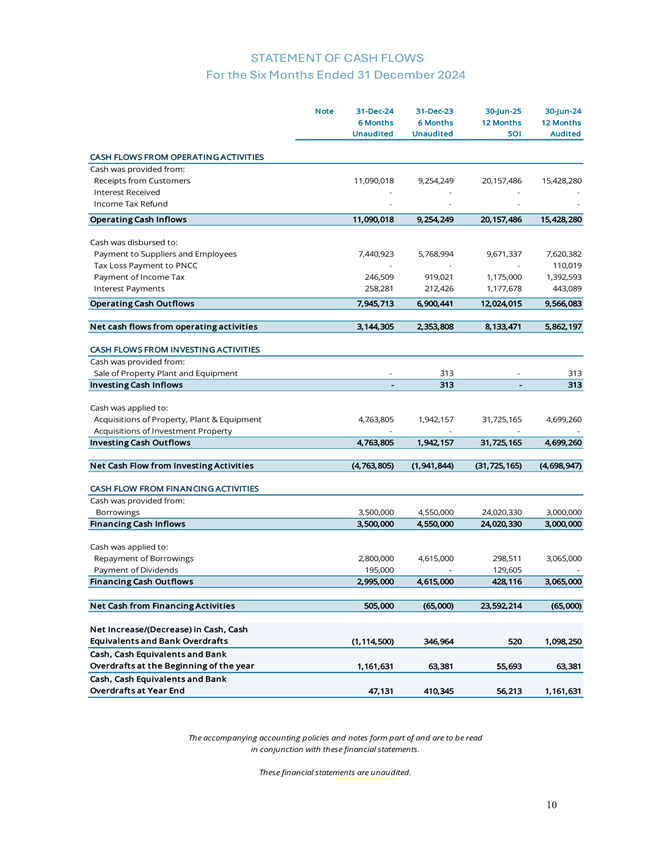

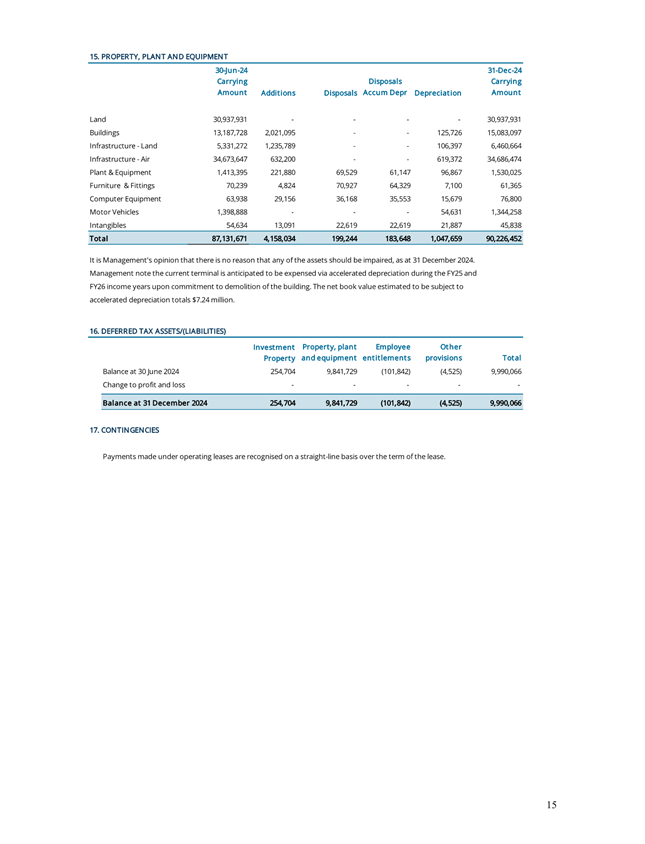

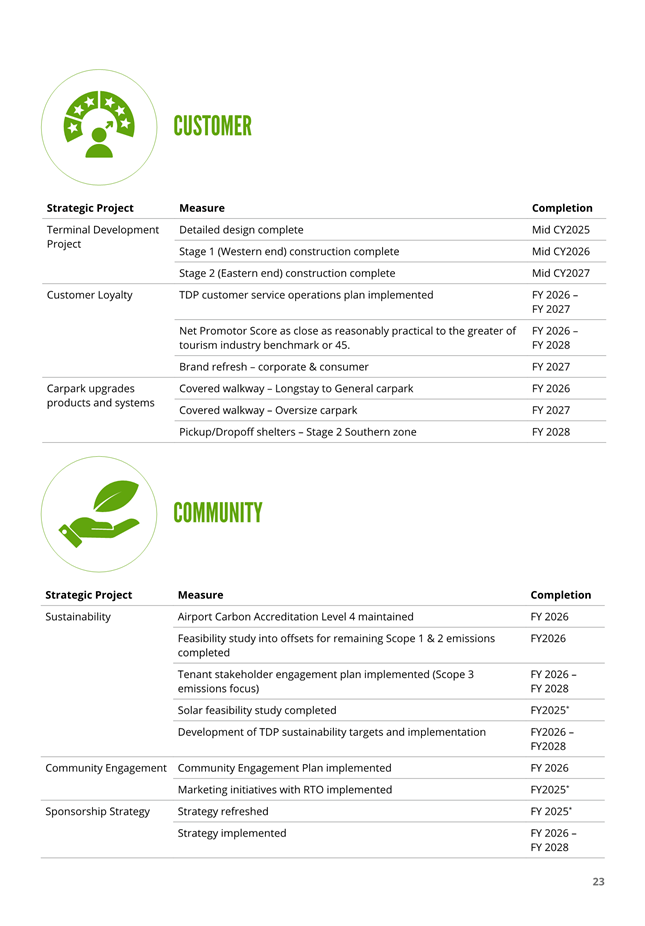

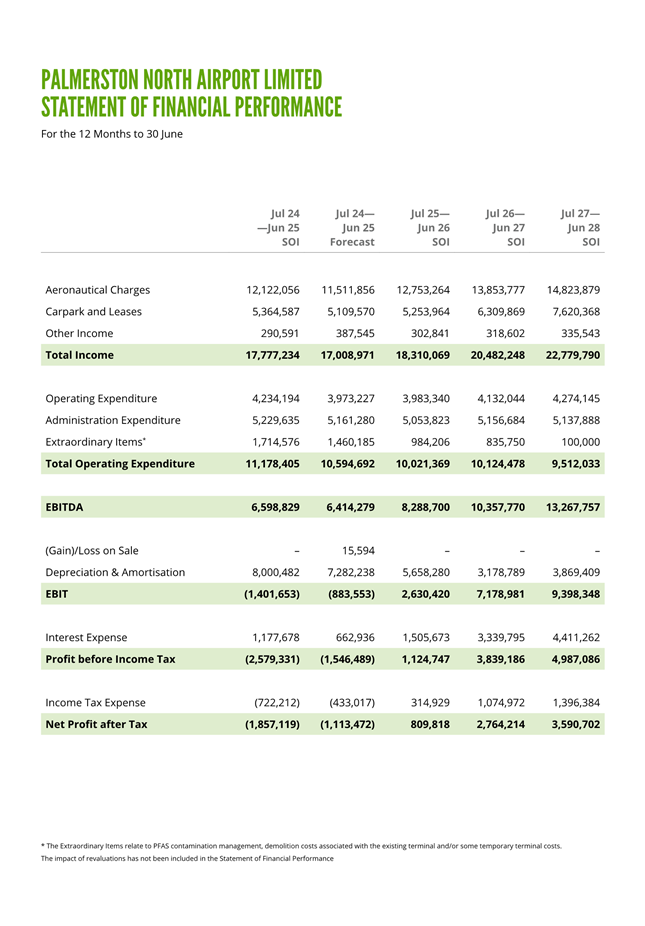

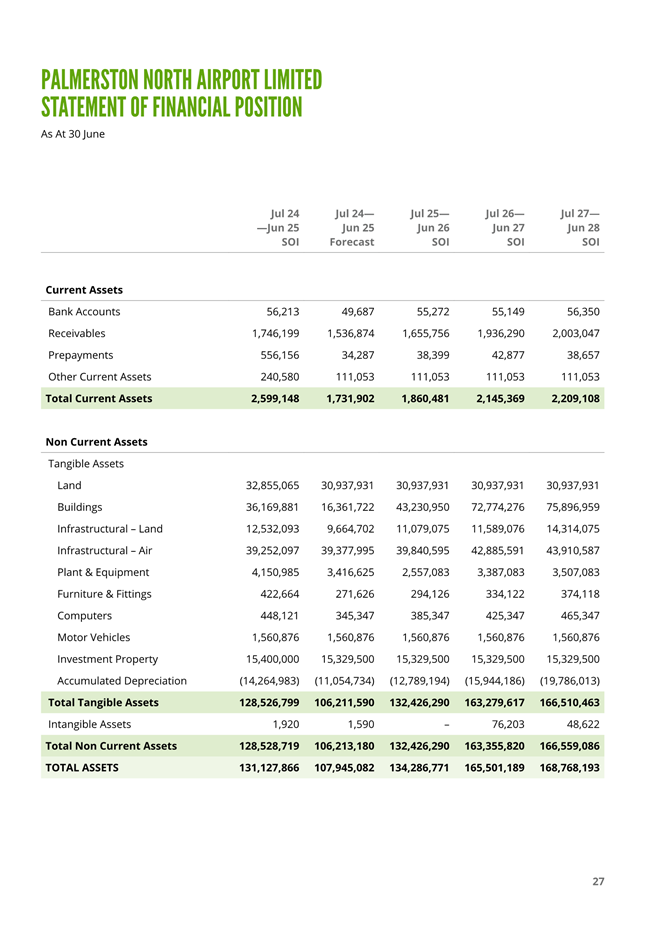

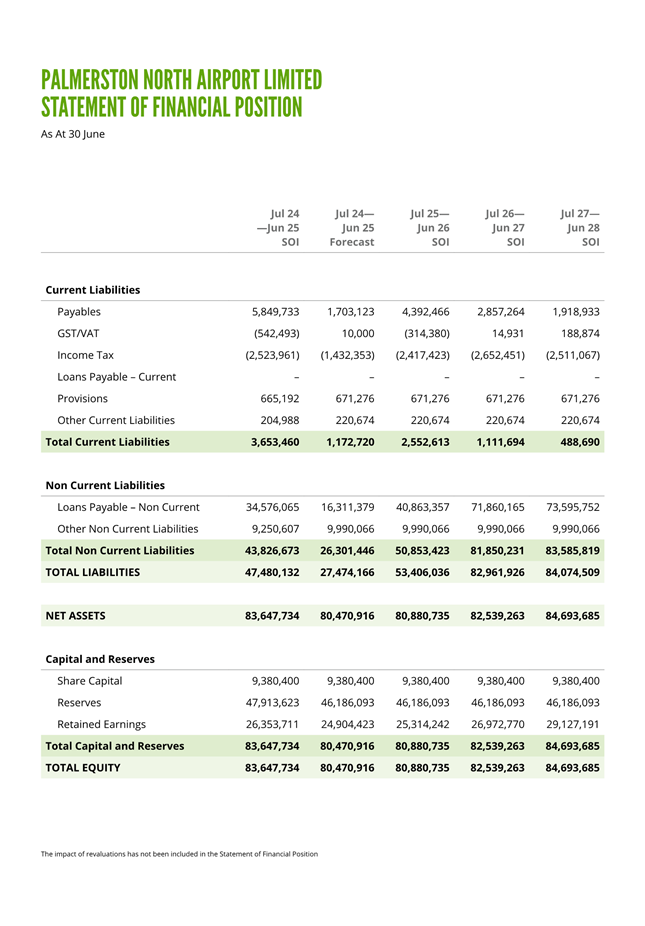

12. Palmerston

North Airport Limited - Interim Report for 6 months to 31 December 2024 Page 141

Memorandum, presented by Steve

Paterson, Manager - Financial Strategy.

13. Palmerston

North Airport Limited - Draft Statement of Intent for 2025/26 to 2027/28 Page 159

Memorandum, presented by Steve

Paterson, Manager - Financial Strategy.

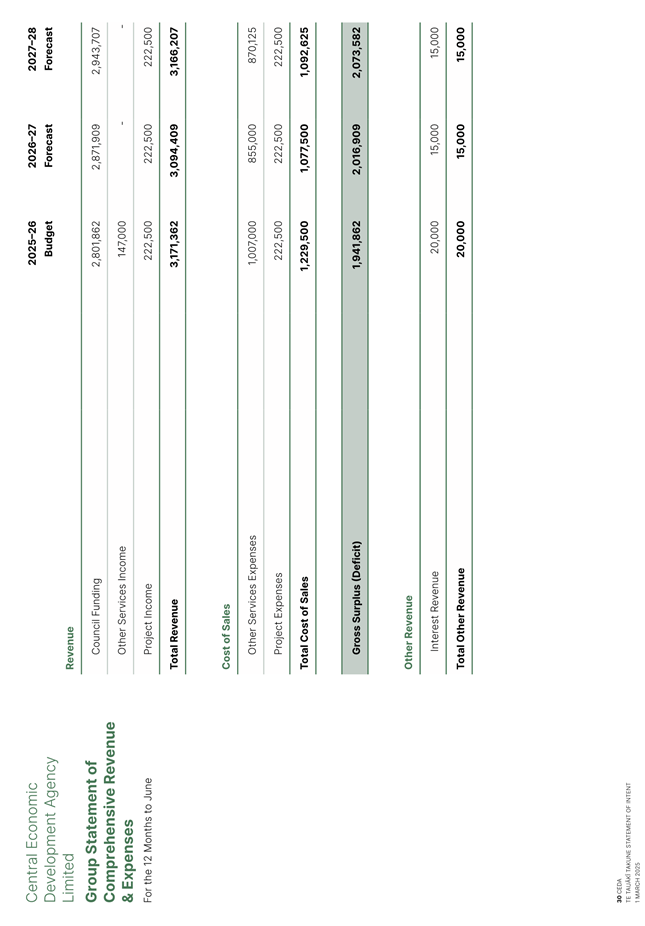

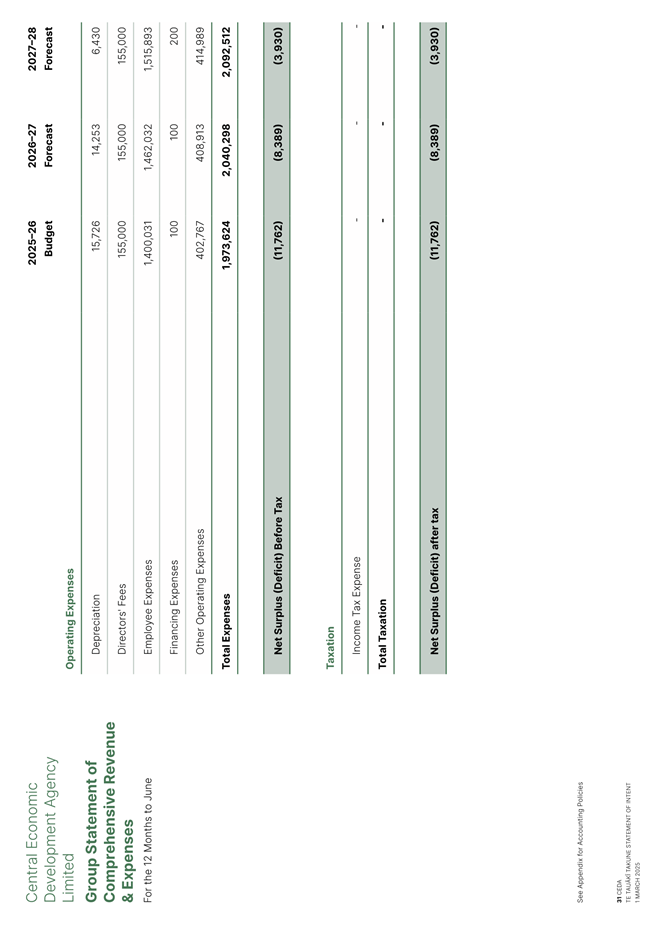

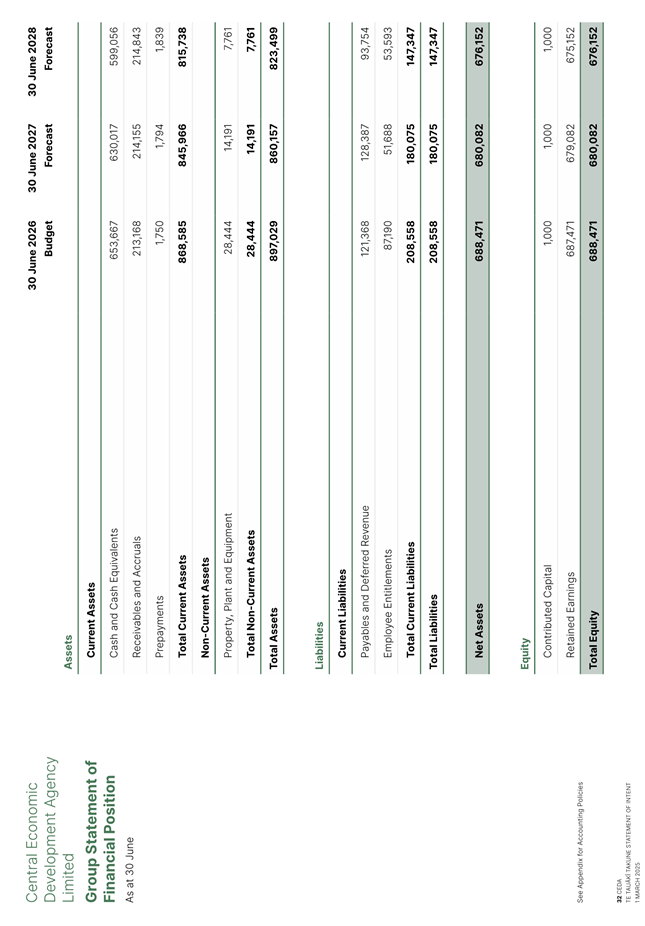

14. Central

Economic Development Agency (CEDA): 6 month Report 1 July 2024 to 31 December

2024 and Draft Statement of Intent 2025/26 Page 213

Memorandum, presented by David Murphy,

General Manager - Strategic Planning.

15. Manawatū

Regional Freight Ring Road - Update Page 293

Memorandum, presented by James Miguel,

Senior Transport Planner.

16. Palmerston

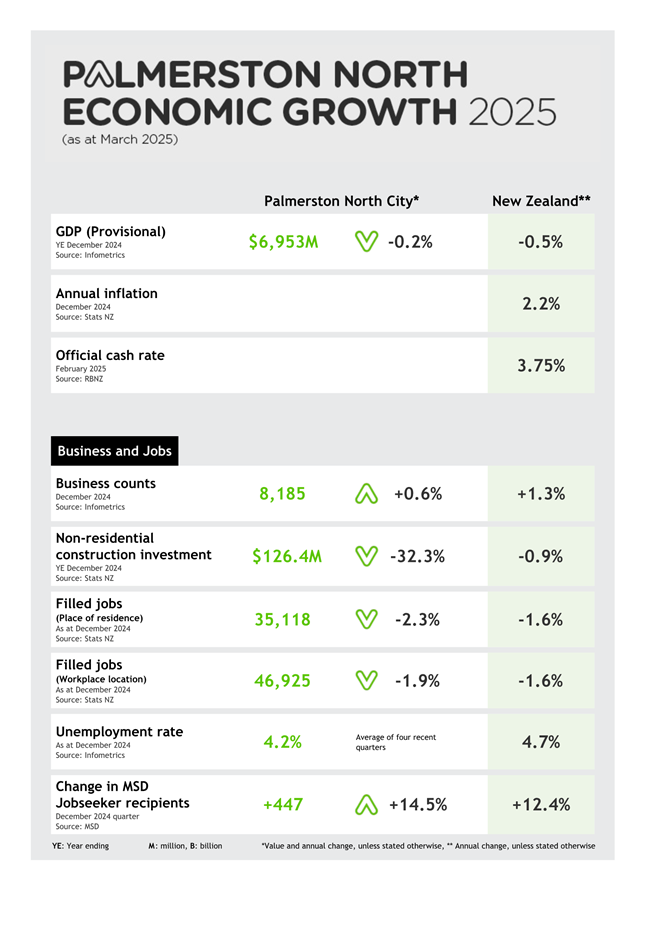

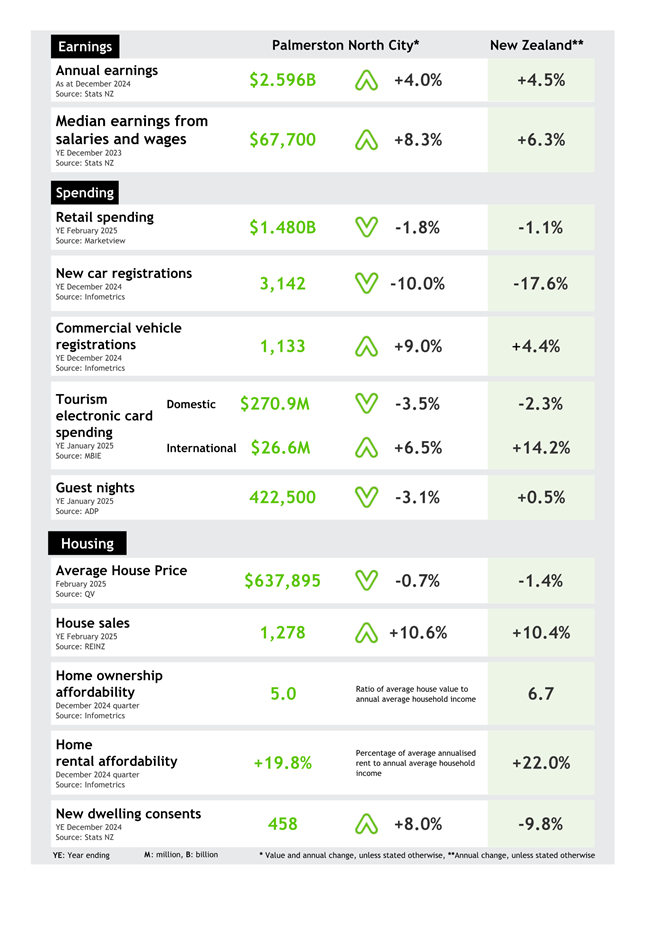

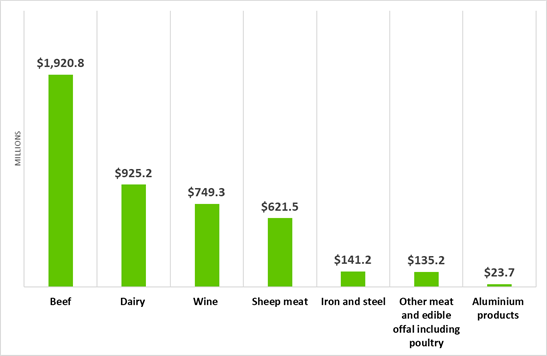

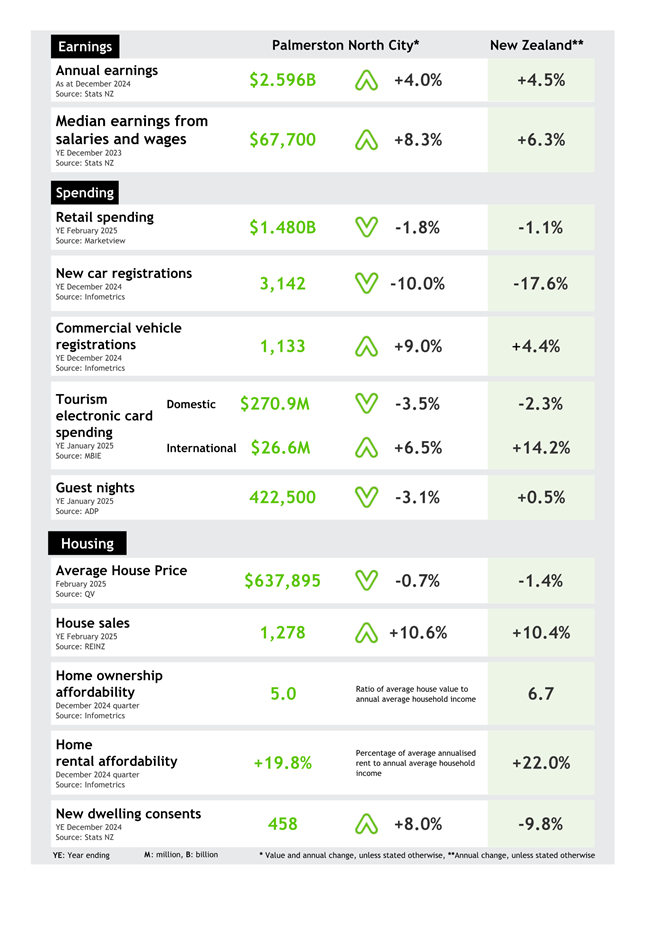

North Quarterly Economic Update - April 2025 Page 303

Memorandum, presented by Stacey

Andrews, City Economist.

17. 6

month report on International Relations and Education Activities Page 333

Memorandum, presented by Gabrielle

Loga, Manager International Relations and Kate Harridge, International

Relations and Education Advisor.

18. Committee

Work Schedule - April 2025 Page 369

19. Karakia

Whakamutunga

20. Exclusion

of Public

|

|

To be

moved:

That the public be excluded from the following parts

of the proceedings of this meeting listed in the table below.

The general subject of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under Section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for

passing this resolution

|

|

|

|

|

|

|

|

|

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

Also that the persons listed below be permitted to

remain after the public has been excluded for the reasons stated.

[Add Third Parties], because of their knowledge and ability to assist the

meeting in speaking to their report/s [or other matters as specified] and

answering questions, noting that such person/s will be present at the meeting

only for the items that relate to their respective report/s [or matters as

specified].

|

Palmerston North City Council

Minutes of

the Economic Growth Committee Meeting Part I Public, held in the Council Chamber,

First Floor, Civic Administration Building, 32 The Square, Palmerston North on 20 November 2024,

commencing at 9.03am.

|

Members

Present:

|

Leonie Hapeta (in the Chair), and

Councillors William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Debi Marshall-Lobb, Billy Meehan and Orphée Mickalad.

|

|

Non Members:

|

Councillor Lew Findlay, Councillor

Patrick Handcock and Councillor Karen Naylor.

|

|

Apologies:

|

The Mayor (Grant Smith) (on Council

business), Councillor Lorna Johnson (late arrival), Councillor Kaydee Zabelin

(late arrival)

|

Councillor Lorna

Johnson entered the meeting at 9.10am during consideration of clause 57. She

was not present for clauses 55 and 56.

Councillor Kaydee Zabelin entered the meeting

at 9.06am during consideration of clause 57. She was not present when the

meeting resumed, at 11.38am; entering the meeting at 11.41am, after

consideration of clause 62. She left the meeting at 3.51pm after consideration

of clause 66. She was not present for clauses 55, 56, 62, 67 to 70.

Councillor Karen Naylor left the meeting at

12.11pm during consideration of clause 63. She entered the meeting again at

12.40pm during consideration of clause 64. She was not present for clause 63.

Councillor Lew Findlay left the meeting at

4.13pm after consideration of clause 67. He was not present from clauses 68 to

70.

Councillor Billy Meehan left the meeting at

4.29pm before consideration of clause 69. He was not present for clauses 69 and

70.

|

|

Karakia

Timatanga

|

|

|

Councillor

Roly Fitzgerald opened the meeting with karakia.

|

|

55-24

|

Apologies

|

|

|

Moved Leonie Hapeta, seconded William Wood.

The

COMMITTEE RESOLVED

1. That

the Committee receive the apologies.

|

|

|

Clause 55-24 above was carried 13 votes to 0, the voting being as

follows:

For:

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett,

Rachel Bowen, Vaughan Dennison, Roly Fitzgerald, Debi Marshall-Lobb, Billy

Meehan, Orphée Mickalad, Lew Findlay, Patrick Handcock and Karen

Naylor.

|

|

56-24

|

Public

Comment

|

|

|

Alice

Williamson, representing The Greasy Chain, made a public comment in

support of Item 17 - Featherston Street Safety Improvements Project Update.

She encouraged the Council to finalise the project and keep extending the

cycleway in the future.

|

|

|

Moved Leonie Hapeta, seconded William Wood.

The

COMMITTEE RESOLVED

1. That the Committee

receive the public comment for information.

|

|

|

Clause 56-24 above was carried 13 votes to 0, the voting being as

follows:

For:

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett,

Rachel Bowen, Vaughan Dennison, Roly Fitzgerald, Debi Marshall-Lobb, Billy

Meehan, Orphée Mickalad, Lew Findlay, Patrick Handcock and Karen

Naylor.

|

|

57-24

|

Petition

- Streets Ahead Palmerston North

James Irwin, representative

of Streets Ahead Palmerston North presented to the Committee.

James presented a Petition in

support of Council completing the cycleway on Featherston Street. He

summarised the benefits this project generated for residents who walk, cycle

and use public transport. Street Ahead Palmerston North, requested that

Council finish the cycleway on Featherston Street and continue to install

cycleways in the city.

Councillor

Kaydee Zabelin entered the meeting at 9.06am.

Councillor

Lorna Johnson entered the meeting at 9.10am.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the Committee receive the petition for information.

|

|

|

Clause 57-24 above was

carried 15 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

|

58-24

|

Presentation

- The Factory

Nick Gains, General Manager

of The Factory presented to the Committee.

He summarised the activities,

and projects worked on during the year, and highlighted several

businesses The Factory had assisted in 2024.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the Committee receive the presentation for

information.

|

|

|

Clause 58-24 above was

carried 15 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

|

59-24

|

Confirmation

of Minutes

Councillor

Vaughan Dennison asked for his vote to be recorded in favour for clause 49-24.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

That the minutes of the Economic Growth Committee meeting

of 18 September 2024 Part I Public and Part II Confidential (as amended) be

confirmed as a true and correct record.

|

|

|

Clause 59-24 above was

carried 13 votes to 2, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Roly Fitzgerald,

Lorna Johnson, Debi Marshall-Lobb, Orphée Mickalad, Lew Findlay,

Patrick Handcock, Karen Naylor and Kaydee Zabelin.

Against:

Councillors Vaughan

Dennison and Billy Meehan.

|

|

60-24

|

International

Trip to China, April 2024, and International Relations and Education - 6

Monthly Report

Memorandums, presented

by Councillor Debi Marshall-Lobb and Gabrielle Loga, Manager

International Relations.

Items 9 and 10 were taken

together.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the

Committee receive the memorandum titled ‘International visit to China,

April 2024’ presented on 20 November 2024.

2.

That the Committee receive the report

titled ‘International Relations and Education – 6 Monthly

Report’ presented on 20 November 2024.

|

|

|

Clause 60-24 above was

carried 14 votes to 1, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock and Kaydee Zabelin.

Against:

Councillor Karen Naylor.

|

|

61-24

|

Palmerston

North Quarterly Economic Update - September 2024

Memorandum, presented by

Stacey Andrews, City Economist.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the

Committee receive the Palmerston North Quarterly Economic Update –

September 2024, including:

a. Palmerston

North Economic Growth Indicators - September 2024 (Attachment 1), and

b. Palmerston

North Quarterly Economic Card Spending Report - June 2024 (Attachment 2),

presented to the Economic

Growth Committee on 20 November 2024.

|

|

|

Clause 61-24 above was

carried 15 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

|

62-24

|

Road

Maintenance Contract - 6 Monthly Update and Street Light Infill

Memorandums, presented by

Glen O'Connor, Manager - Transport and Development.

Items 12 and 13 were taken

together.

Elected Members discussed

referring a street lighting survey to the Annual Budget process. A motion was

moved to refer the Street Lighting survey to the Annual Budget 2025-26

process, as pushing the survey to the 2026-27 year was considered too

much of a delay.

An additional motion was

moved to refer a programme to begin upgrading the streets lighting on the streets

listed in the Report - Progress Update on Programme

1367 (City-wide - Street Light Infill), received by the Economic

Growth Committee on 19 June 2024 to the Annual Budget 2025-26 process.

|

|

|

Moved

Lorna Johnson, seconded Patrick Handcock.

Note:

On

an amendment (to recommendation 2): “That a budget of $120,000 to

support a Street Lighting survey be referred to the Annual Budget 2026-27 2025-26 process.

The

amendment was carried 10 votes to 5,

the voting being as follows

For:

Councillors Leonie Hapeta,

William Wood, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lorna Johnson,

Debi Marshall-Lobb, Billy Meehan, Patrick Handcock and Kaydee Zabelin.

Against:

Councillors Mark Arnott,

Roly Fitzgerald, Orphée Mickalad, Lew Findlay and Karen Naylor.

|

|

|

The meeting was adjourned at 11.19am

The meeting resumed at 11.38am

Councillor Kaydee Zabelin was not present when the

meeting resumed.

|

|

|

Moved Leonie Hapeta, seconded William Wood.

The

COMMITTEE RESOLVED

1. That

the Committee receive the memorandum titled ‘Road Maintenance Contract

- 6 Monthly Update’ presented to the Economic Growth Committee on 20

November 2024.

1. That

the Economic Growth Committee receive the report Street Light Infill

presented on 20 November 2024.

|

|

|

Clause 62-24 above was carried 14 votes to 0, the voting being as

follows:

For:

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett,

Rachel Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna Johnson, Debi

Marshall-Lobb, Billy Meehan, Orphée Mickalad, Lew Findlay, Patrick

Handcock and Karen Naylor.

|

|

|

Moved

Lorna Johnson, seconded Patrick Handcock.

The COMMITTEE RESOLVED

2. That a

budget of $120,000 to support a Street Lighting survey be referred to the

Annual Budget 2025-26 process.

|

|

|

Clause 62-24 above was

carried 9 votes to 5, the voting being as follows:

For:

Councillors Leonie Hapeta,

Brent Barrett, Rachel Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna

Johnson, Debi Marshall-Lobb, Billy Meehan and Patrick Handcock.

Against:

Councillors William Wood,

Mark Arnott, Orphée Mickalad, Lew Findlay and Karen Naylor.

|

|

|

Moved

William Wood, seconded Orphée Mickalad.

The COMMITTEE RESOLVED

3. That a

programme to begin upgrading the street lighting on the already identified

streets (listed in the Roading Report to the Economic Growth Committee in

June 2024) be referred to the Annual Budget 2025-2026 process.

|

|

|

Clause 62-24 above was

carried 14 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock and Karen Naylor.

|

Councillor Kaydee Zabelin entered the meeting at 11.41am

|

63-24

|

Palmerston

North Airport Limited - Annual report for 12 months ended 30 June 2024 &

Instructions relating to Annual Meeting

Memorandum, presented by David

Lanham, Chief Executive, Shelly Mitchell Jenkins, Chair Audit & Risk

Committee and Jonathon Baker, Chief Financial Officer, Palmerston North

Airport Limited.

Councillor Karen Naylor

left the meeting at 12.11pm.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the Committee receive the Annual Report and

Financial Statements of Palmerston North Airport Limited for the year ended

30 June 2024, presented to the Economic Growth Committee on 20 November 2024.

The COMMITTEE RECOMMENDS

2. That the Council shareholder representative be

instructed to support the proposed resolutions (section 2.9) to be considered

at the Annual meeting of Palmerston North Airport Limited to be conducted by

way of resolution in writing.

|

|

|

Clause 63-24 above was

carried 14 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock and Kaydee Zabelin.

|

|

64-24

|

Palmerston

North Airport Ltd - Statement of Expectations 2025/26-2027/28

Memorandum, presented by Cameron

McKay, General Manager Corporate Services.

An additional motion was moved to adjust annually the

Council’s dividend in the Statement of Expectations 25/26 –

27/28.

Councillor Karen Naylor entered

the meeting again at 12.40pm.

|

|

|

Moved Brent Barrett, seconded Karen Naylor.

The

COMMITTEE RESOLVED

2. That the PNAL Statement of Expectations for 25/26

– 27/28 include PNCC’s dividend expectation as follows:

· 25/26

no less than 20% of NPAT or $300,000, whichever is greater

· 26/27

no less than 40% of NPAT or $400,000, whichever is greater

· 27/28

no less than 40% or NPAT or $500,000, whichever is greater

|

|

|

Clause 64-24 above was carried 8 votes to 7, the

voting being as follows:

For:

Councillors William Wood,

Mark Arnott, Brent Barrett, Roly Fitzgerald, Debi Marshall-Lobb, Billy

Meehan, Karen Naylor and Kaydee Zabelin.

Against:

Councillors Leonie Hapeta,

Rachel Bowen, Vaughan Dennison, Lorna Johnson, Orphée Mickalad, Lew

Findlay and Patrick Handcock.

|

|

|

Moved

Leonie Hapeta, seconded Lorna Johnson.

The COMMITTEE RESOLVED

1. That the Committee adopt the Statement of

Expectations for Palmerston North Airport Ltd 2025/26-2027/28 (Attachment 1)(as

amended).

|

|

|

Clause 64-24 above was

carried 15 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

|

65-24

|

Central

Economic Development Agency (CEDA) Annual Report 2023-24

Memorandum, presented by Jerry

Shearman, Chief Executive, Katie Brosnahan, Board Member and Jacqui

Middleton, Finance and Operation Manager from the Central Economic

Development Agency.

|

|

|

Moved

Leonie Hapeta, seconded Debi Marshall-Lobb.

The COMMITTEE RESOLVED

1. That the

Committee receive the Central Economic Development Agency (CEDA) Annual

Report 2023-34 (Attachment 1).

|

|

|

Clause 65-24 above was

carried 15 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

The

meeting adjourned at 1.19pm.

The

meeting resumed at 2.20pm.

|

66-24

|

Featherston

Street Safety Improvements Project Update

Memorandum, presented by Glen

O'Connor, Manager Transport and Development and Michael Bridge, Service

Manager Active Transport.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the Committee receive the memorandum titled ‘Featherston Street Safety

Improvements Project Update’ dated 20 November 2024.

|

|

|

Clause 66-24 above was

carried 14 votes to 1, the voting being as follows:

For:

Councillors William Wood,

Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Roly Fitzgerald,

Lorna Johnson, Debi Marshall-Lobb, Billy Meehan, Orphée Mickalad, Lew

Findlay, Patrick Handcock, Karen Naylor and Kaydee Zabelin.

Against:

Councillor Leonie Hapeta.

|

Councillor Kaydee Zabelin left the meeting at 3.51pm

|

67-24

|

Draft

Parking Framework - Approval for Public Consultation

Report, presented by James

Miguel, Senior Transport Planner.

Councillor Bowen moved a

procedural motion to lie the report on the table to allow a workshop on the

Parking Framework to occur. The motion was moved to allow Elected Members

more time to re-consider the framework.

The

meeting adjourn at 4.02pm

The

meeting resumed at 4.08pm.

|

|

|

Moved

Rachel Bowen, seconded Lorna Johnson.

The COMMITTEE RESOLVED

That the report lie on the table

to allow a workshop on the Parking Framework to occur.

|

|

|

Clause 67-24 above was

carried 11 votes to 3, the voting being as follows:

For:

Councillors Mark Arnott,

Brent Barrett, Rachel Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna

Johnson, Debi Marshall-Lobb, Billy Meehan, Orphée Mickalad, Lew

Findlay and Patrick Handcock.

Against:

Councillors Leonie Hapeta,

William Wood and Karen Naylor.

|

Councillor Lew Findlay left the meeting at 4.13pm.

|

68-24

|

Annual

Summary of Economic Impact and Benefits of Council Supported Events

Memorandum, presented by Luke

McIndoe, Head of Events.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the

Committee receive the memorandum titled ‘Annual Summary of Economic

Impact and Benefits of Council Supported Events’, dated 20 November

2024.

|

|

|

Clause 68-24 above was

carried 13 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Patrick Handcock and Karen Naylor.

|

Councillor Billy Meehan left the meeting at 4.29pm.

|

69-24

|

Tamakuku

Terrace Six Monthly Update

Memorandum, presented by Bill

Carswell, Acting Manager - Property, and Anna Saunders, Capital Projects

Officer.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the

Committee receive the memorandum titled ‘Tamakuku Terrace Six Monthly

Update’, presented to the Economic Growth Committee on 20 November

2024.

|

|

|

Clause 69-24 above was

carried 12 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Orphée Mickalad,

Patrick Handcock and Karen Naylor.

|

|

70-24

|

Committee

Work Schedule - November 2024

|

|

|

Moved

Leonie Hapeta, seconded Patrick Handcock.

The COMMITTEE RESOLVED

1. That the

Economic Growth Committee receive its Work Schedule dated November 2024.

|

|

|

Clause 70-24 above was

carried 12 votes to 0, the voting being as follows:

For:

Councillors Leonie Hapeta,

William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Orphée Mickalad,

Patrick Handcock and Karen Naylor.

|

|

|

Karakia

Whakamutunga

|

|

|

Councillor

Roly Fitzgerald closed the meeting with karakia.

|

The meeting

finished at 4.41pm.

Confirmed 9 April 2025.

Chair

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 9

April 2025

TITLE: Featherston

Street Safety Improvements Project Update

Presented

By: Glen

O'Connor, Manager Transport and Development and Michael Bridge, Service Manager

Active Transport

APPROVED BY: Chris

Dyhrberg, General Manager Infrastructure

RECOMMENDATION TO Economic Growth Committee:

1. That the

Committee receive the memorandum titled ‘Featherston Street Safety

Improvements Project Update’ presented to the Economic Growth Committee

on 9 April 2025.

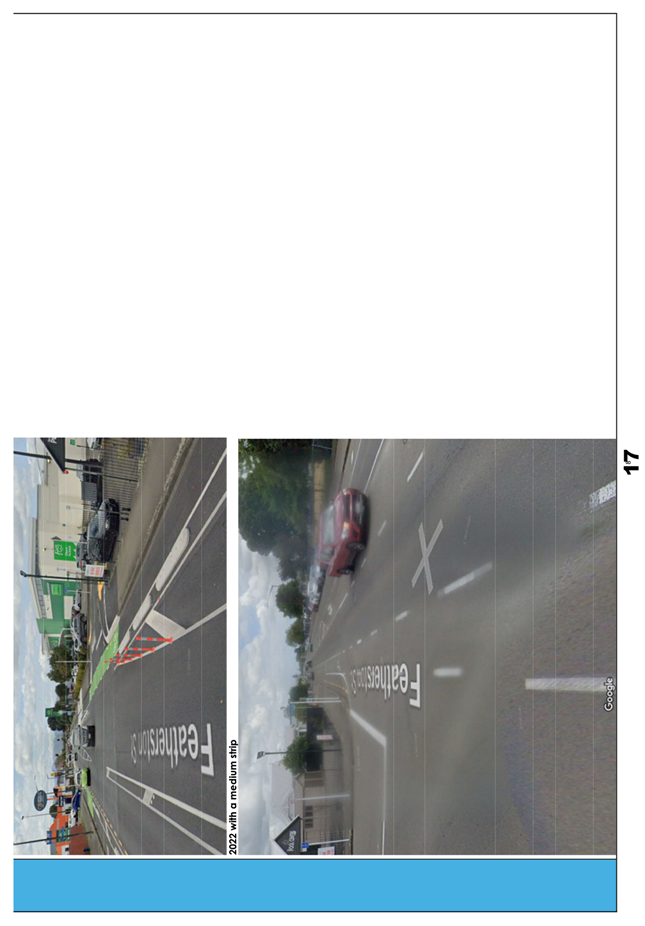

1. ISSUE

1.1 At

the 5 June 2024 Council meeting, the Chief Executive was directed to monitor and evaluate the functionality of the Featherston

Street safety improvements and report back in November 2024 and again in

April 2025. This is the second of those reports.

1.2 The

purpose of this report is to update Council on the post-construction operation

of the Featherston Street Safety Improvements Project.

1.3 This

memorandum reports on three elements since construction was completed and

Officers last reported in November 2024:

a) The

function of this segment of Featherston Street;

b) The

effect on adjacent businesses; and

c) Feedback

on the completed project.

2. BACKGROUND AND PREVIOUS COUNCIL DECISIONS

2.1 The

Featherston Street Safety Improvements Project, between Palmerston North

Boys’ High School and Central Normal School, has been delivered through

NZTA Waka Kotahi’s Streets for People and Transport Choices programmes. The works

included:

a) Separated

cycleway

b) Raised

crossings

c) In-lane

bus stops

d) Narrowing

and raising side street intersections

e) Placemaking

2.2 The

project objectives are to provide safe, accessible transport options for people

who would like to ride a bike, walk or take the bus and increase participation

in active transport. This aligns with Council’s Strategic Networks, which has Featherston Street

as a priority corridor for public transport and cycling.

2.3 At

the same time as Council made changes on Featherston Street, NZTA Waka Kotahi

made complementary minor improvements to the intersection with Rangitikei

Street, mostly around safety improvements and changes to the signal phasing to

maintain and improve the level of service for traffic on Rangitikei Street.

2.4 Construction

was completed in July 2024.

2.5 Previous

Council decisions regarding Featherston Street:

|

Date

|

Detail

|

|

15 February 2023

|

Council approved the

programme for the wider Featherston Street Safety Improvements Project, which

brought together two NZTA Waka Kotahi funding streams – Streets for

People (90% NZTA Waka Kotahi funding) and Transport Choices (100% NZTA Waka

Kotahi funding).

|

|

April-June 2023

|

Co-design workshops with

stakeholders, businesses and residents; involving some Councillors and senior

Officers.

|

|

28 June 2023

|

Council endorsed the

preferred unidirectional cycleway option. Council also noted trials

would be undertaken and feedback from the trials would be brought back to

Council for consideration.

|

|

August 2023

|

Trials were undertaken of key

elements of the Featherston Street Safety Improvements Project.

|

|

27 September 2023

|

Council endorsed the design

for the Featherston Street Safety Improvements Project. A report on the

August trials were presented to Council.

|

|

December 2023

|

NZTA Waka Kotahi advised

Officers that Transport Choices funding for cycleways was withdrawn.

|

|

February 2024

|

Construction work commenced

on Featherston Street.

|

|

3 April 2024

|

Council agreed to additional

Streets for People funding for capital expenditure on Featherston Street for

additional improvements.

|

|

1 May 2024

|

Council resolved to pause

further work on the Featherston Street Safety Improvements Project, pending a

report on alternative options for the bus stops.

|

|

5 June 2024

|

Council resolved to retain

the existing bus stops and other elements. Council also directed

Officers to report back to Council on the project in November 2024 and again

in April 2025.

|

|

July 2024

|

Construction work was

completed.

|

|

20 November 2024

|

Council received the first of

two reports on the function of Featherston St, as well as effects on adjacent

businesses and public feedback since construction was completed.

Agenda – Agenda of Economic Growth Committee - Wednesday, 20

November 2024

Minutes – Minutes of Economic Growth Committee - Wednesday, 20

November 2024

|

Table 1: Timeline of Council

decisions

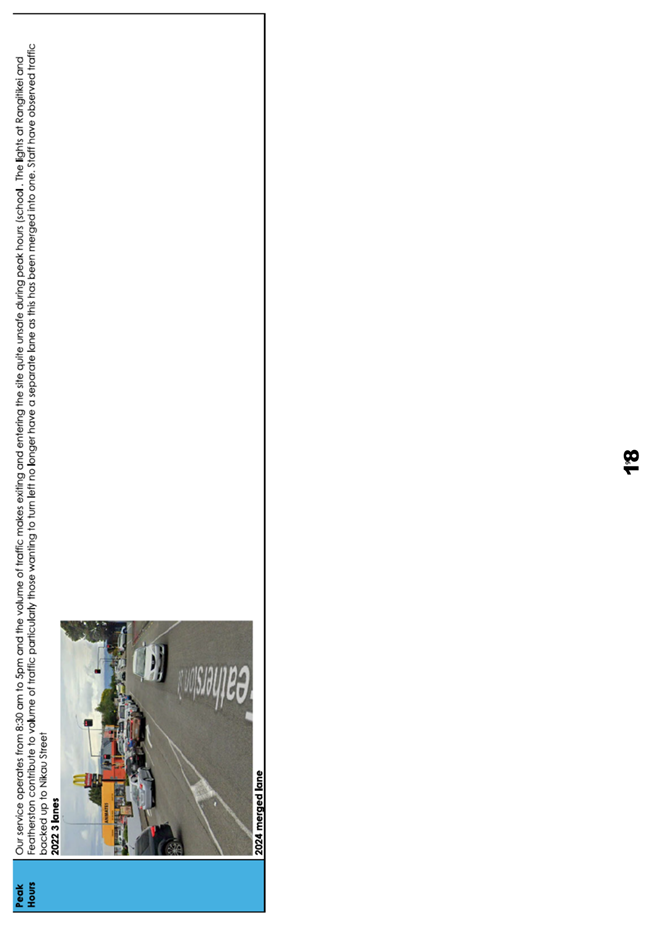

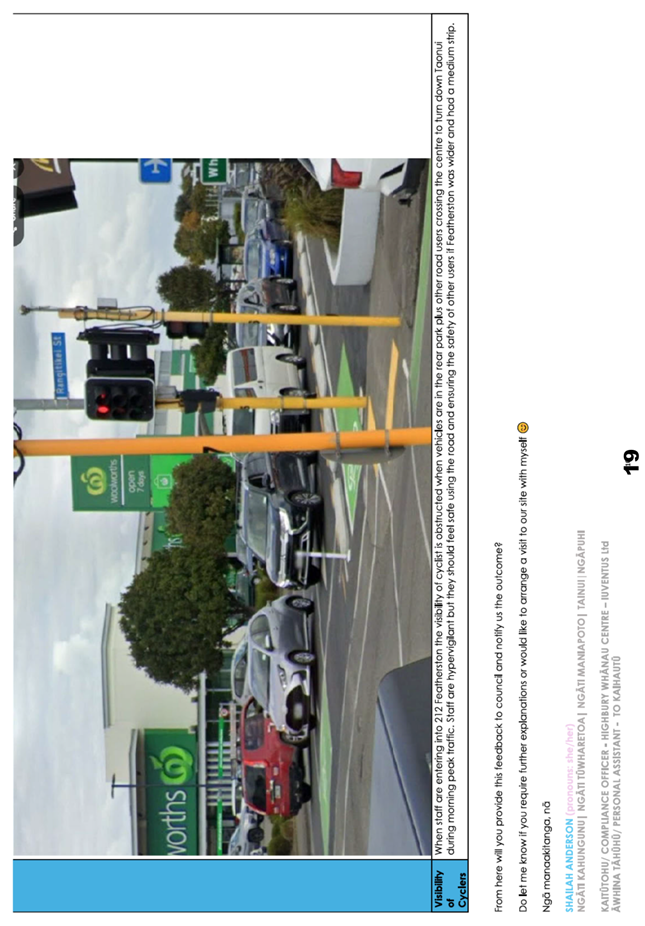

3. HOW FEATHERSTON STREET IS FUNCTIONING

3.1 Officers

have monitored and evaluated the function of Featherston Street between North

Street and Aroha Street since construction was completed in July 2024 and since

we last reported in November 2024.

MOTOR VEHICLES

3.2 Two

sets of data have been gathered to measure traffic flow. The two sets

used different methodologies and show contrasting findings. Both are

valid.

3.3 The

latest set of data from WSP (consulting engineers, who are part of Palmerston

North City Council’s Design Panel) was captured between 17 February and 2

March 2025. Measurements were taken by sensors positioned in the vehicle

lanes. These measurements show:

a) The

volume of motor vehicle movements has reduced. The average daily vehicle

movements range from 10,386 to 12,368 (compared with 13,187 to 14,268 measured

pre-construction).

b) The

volume of medium and heavy vehicle movements has reduced: The average

percentage of medium and heavy vehicle movements ranges from 3.1% to 4.0%

(compared with 6.4% to 7.8% measured pre-construction).

c) Traffic

speeds have reduced: The 85th percentile average vehicle speeds

range from 44km/h to 46km/h (compared with 50km/h to 51km/h measured

pre-construction).

d) Traffic queuing

Measurements were taken between

2:30pm and 5:30pm over five weekdays between 17 and 21 February 2025.

These snapshot measurements show:

a) The

time it takes to drive westbound has increased since the November 2024 report,

but is less than measurements taken pre-construction. The weekday mean is

213 seconds for a westbound motor vehicle to get from the back of the traffic

queue through the intersection (compared with 190 seconds reported in November

2024 and 241 seconds measured pre-construction).

b) The

time it takes to drive eastbound has reduced since the November 2024 report and

pre-construction measurements. The weekday mean is 134 seconds for an

eastbound motor vehicle to get from the back of the traffic queue through the

intersection (compared with 146 seconds reported in November 2024 and 142

seconds measured pre-construction).

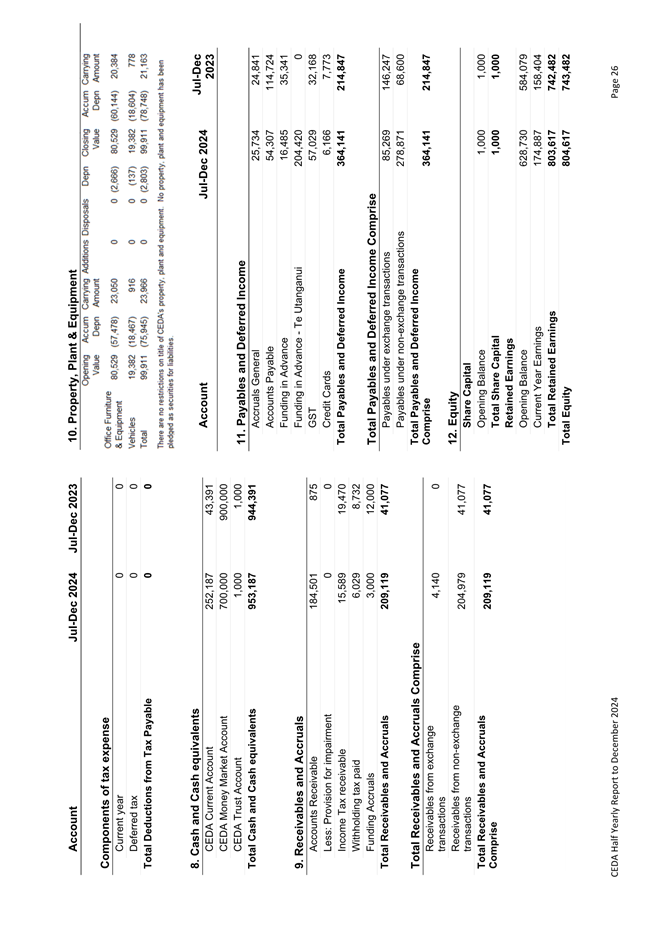

|

|

Pre-construction

|

Post-construction

|

|

Westbound queue time

|

241 seconds

|

|

|

November 2024 report

|

|

190 seconds

|

|

April 2025 report

|

|

213 seconds

|

|

Eastbound queue time

|

142 seconds

|

|

|

November 2024 report

|

|

146 seconds

|

|

April 2025 report

|

|

134 seconds

|

|

Traffic volumes

|

13,187 to 14,268

|

|

|

November 2024 report

|

|

10,879 to 11,865

|

|

April 2025 report

|

|

10,386 to 12,368

|

|

Medium / heavy vehicles

|

6.4% to 7.8%

|

|

|

November 2024 report

|

|

5.3% to 5.9%

|

|

April 2025 report

|

|

3.1% to 4.0%

|

|

Traffic speeds

|

50km/h to 51km/h

|

|

|

November 2024 report

|

|

46km/h to 51km/h

|

|

April 2025 report

|

|

44Km/h to 46km/h

|

Table 2: Motor vehicle pre and post-construction data

3.4 The

second set of TomTom GPS data has been provided by NZTA Waka Kotahi. This

data, covering 24/7 activity over eight months between July 2024 and February

2025, shows contrasting findings for post-construction travel times for

motorists, compared with the same period in 2023-2024:

a) Median travel times for

westbound traffic has increased by 17 seconds (compared with an increase of 20

seconds, as reported in November 2024) and by 13 seconds for eastbound traffic

(compared with an increase of 14 seconds, as reported in November 2024);

b) Median speeds have reduced

from 37km/h down to 31km/h eastbound (no change compared with the November 2024

report) and from 35km/h down to 29km/h westbound (compared with 36km/h down to

28km/h, as reported in November 2024).

BIKE RIDERS AND PEDESTRIANS

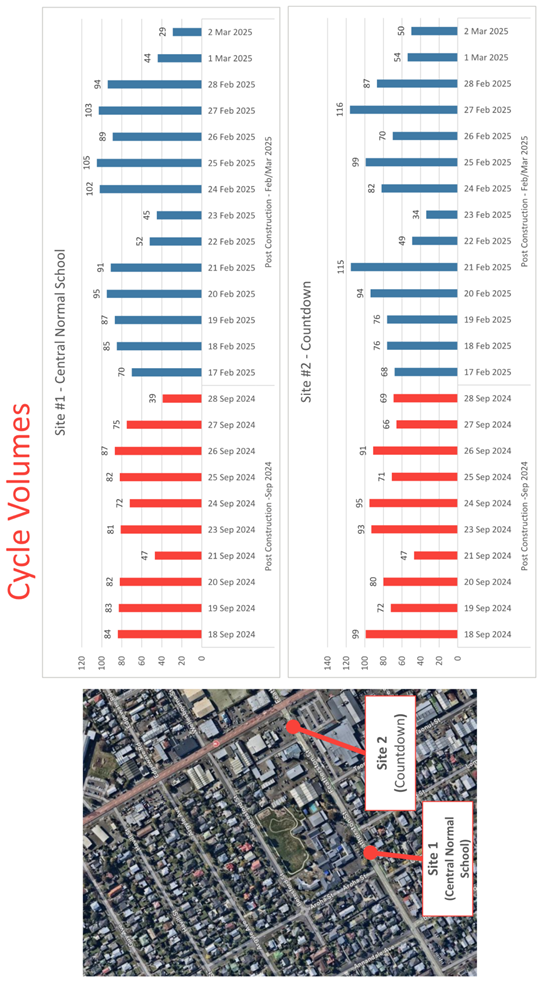

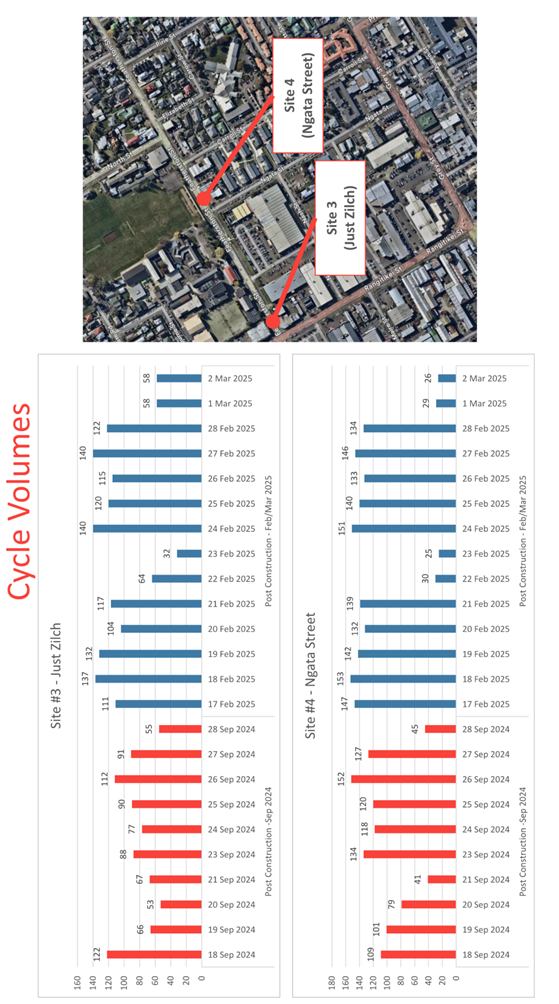

3.5 Four

sets of cameras were used to capture the numbers of bike rider and pedestrian

movements between 17 February and 2 March 2025, along the section of

Featherston Street between Palmerston North Boys’ High School and Central

Normal School. The data shows:

Bike riders

a) The

data shows that there has been an increase in the total and average number of

bike rider movements since the last count reported in November 2024.

b) Across

the four count sites, a total of 3,992 bike rider movements were counted over

ten of the measured days (eight weekdays and two Saturdays), with the majority

around Palmerston North Boys’ High School. This compares with 3,362

bike rider movements counted over a similar period, as reported in November

2024.

c) Individually,

across the four count sites, the average per weekday ranged between 88 and 142

bike rider movements. This compares with an average of 81-118 bike rider

movements counted for the November 2024 report.

Pedestrians

d) The

data shows that there has been an increase in the total and average number of

pedestrian movements since the last count reported in November 2024.

e) Across

the four count sites, a total of 32,983 pedestrian movements were counted over

ten of the measured days (eight weekdays and two Saturdays), with the majority

during the weekday school peak periods. This compares with 29,458

pedestrian movements counted over a similar period, as reported in November

2024.

f) Individually,

across the four count sites, the average per weekday ranged between 464 and

1,312 pedestrian movements. This compares with an average of 396-1,103

pedestrian movements counted for the November 2024 report.

3.6 For

the April 2025 report, we used the same methodology as we used for the November

2024 report, providing an accurate comparison. The bike rider and

pedestrian counts undertaken pre-construction in 2023 (see the Featherston

Street Cycleway Update report to Council on 28 June 2023; specifically,

Attachment ‘Co-design Session 3 Report’) used a

different methodology.

For a breakdown of the latest bike rider and pedestrian

counts, refer to Attachment 1 ‘Featherston Street pedestrian and cycle

counts Feb-March 2025’.

PARKING

3.7 There

are 12 on-street carparks along this segment of Featherston Street, between

Palmerston North Boys’ High School and Central Normal School:

· 6

between Rangitikei Street and North Street.

· 6

between Rangitikei Street and Aroha St.

3.8 Parking

occupancy was captured across four days between 18 and 27 February 2025 (three

weekdays and one Saturday), measuring the peak periods between 10am to 11:30am

and 2:30pm to 4pm (weekdays) and 10am to midday (Saturday).

3.9 The

data shows the average occupancy of the on-street parking during the morning

and afternoon peak was 42%. This compares with 51% reported in November

2024.

3.10 The car

parks that had the highest average weekday occupancy were the five car parks in

front of Ebony Coffee (opposite Central Normal School). The car parks

that had the lowest average weekday occupancy were the three car parks in front

of Troy Howard Motors (opposite Palmerston North Boys’ High School).

BUS SERVICE

3.11 The bus

network on Featherston Street is serviced by four in-lane bus stops, adjacent

to Suzuki, Woolworths, Office Products and Palmerston North Boy’s High

School (PNBHS).

3.12 The bus

services using these four stops are:

· Route

104 (using the stops at Woolworths and Office Products)

· Route

106 (using the stops at PNBHS and Suzuki)

· Route

311 (using the stop at PNBHS)

3.13 At peak,

buses can service these stops every 15 minutes, though in practice buses do not

pick up or drop off passengers at each bus stop on every journey.

3.14 The

following data provided by Horizons is for the 2-week period 17 February to 1

March 2025:

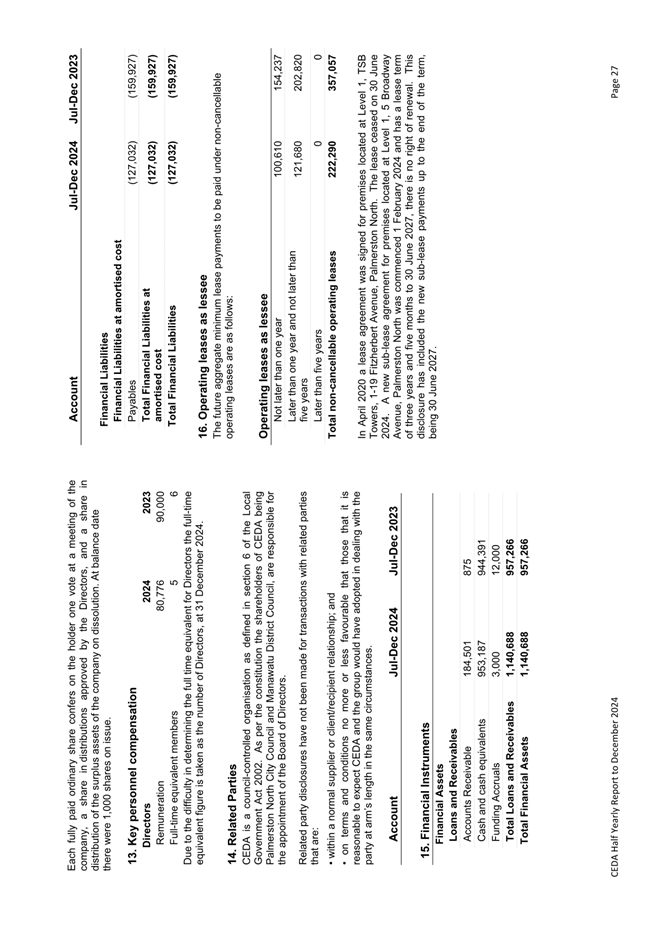

|

Bus stop

|

Dates

|

Total passengers boarding /

alighting / transferring over the 2-week period

|

Percentage of times buses

stopped at this location

|

Average dwell times of buses

when stopped for passengers

|

|

Suzuki

|

|

|

|

|

|

|

4-17 Sept. 2023

(pre-construction)

|

52

|

|

|

|

|

9-22 Sept. 2024

(post-construction)

|

322

|

22%

|

25 seconds

|

|

|

17 Feb. -1 March 2025

|

529

|

35%

|

28 seconds

|

|

Woolworths

|

|

|

|

|

|

|

4-17 Sept. 2023

(pre-construction)

|

183

|

|

|

|

|

9-22 Sept. 2024

(post-construction)

|

198

|

25%

|

18 seconds

|

|

|

17 Feb. -1 March 2025

|

184

|

29%

|

18 seconds

|

|

Office Products

|

|

|

|

|

|

|

4-17 Sept. 2023

(pre-construction)

|

134

|

|

|

|

|

9-22 Sept. 2024

(post-construction)

|

164

|

20%

|

31 seconds

|

|

|

17 Feb. -1 March 2025

|

142

|

44%

|

26 seconds

|

|

PNBHS

|

|

|

|

|

|

|

4-17 Sept. 2023

(pre-construction)

|

137

|

|

|

|

|

9-22 Sept. 2024

(post-construction)

|

393

|

24%

|

21 seconds

|

|

|

17 Feb. -1 March 2025

|

444

|

29%

|

20 seconds

|

Table 3: Bus passenger data

3.15 The

data shows that the in-lane bus stops have a less than minor effect on overall

traffic flow and efficiency. Using the bus stop at Office Products as an

example:

o In

a ‘busiest case scenario’ – with a bus stopping every fifteen

minutes during the peak period – there would be a consequential 4.4

second addition to the total journey time for vehicles using that section of

road during the peak period.

3.16 The data

captured during both 2-week post-construction periods shows that patronage has

more than doubled at these four bus stops, compared with the corresponding

period pre-construction (Further, the total patronage across these four bus

stops has increased by 20% since November’s post-construction reporting

period).

3.17 Horizons

report that patronage across the Palmerston North bus network has increased by

54% since the new services came into effect in March 2024. Over one million

people have used the Palmerston North bus service over the first 12 months of

operation.

CRASHES

3.18 In

the 8-month period between July 2024 and February 2025, since construction was

completed, three crashes have been reported:

· One

minor crash involving a car and motorcyclist at the intersection of Aroha

Street (this crash was included in the November 2024 report);

· One

serious crash involving a young pedestrian crossing Featherston Street near the

intersection of Taonui Street (i.e. away from any of the formal crossings);

· One

non-injury crash at the Rangitikei intersection.

3.19 By

comparison, over the five years between 2019 and 2024, there were 92 reported

crashes on Featherston Street between PNBHS and Central Normal School: 1

serious, 21 minor, 70 non-injury.

DESIGN AND OPERATIONAL ISSUES

3.20 For the

November 2024 report, we reported on some minor design and operational issues

within this segment of Featherston Street and the intersection with Rangitikei

Street, which we have been investigating and seeking to address through existing

programmes, subject to budget capacity:

a) Cycleway:

I. Some

bike riders had been experiencing issues at the intersection, with the detector

loops not picking up their presence.

a. This

issue has been resolved by adjusting the loop sensitivity.

II. Some

drivers continue to park their car in the cycleway, in the gaps between

separators near intersections. This is a safety issue that we can address

with the addition of separators in the gaps.

a. This

issue has yet to be addressed, as there is no budget to install additional

separators.

III. The

addition of the artwork provided by Rangitāne has not yet been added to

the cycleway. This artwork is intended for the approaches to the in-lane

bus stops.

a. The

Rangitāne artwork has not been added, as there is no budget for

improvements.

b) Footpath:

I. The

remaining faults along the original footpath on both sides of Featherston

Street pre-date implementation of the recent improvements. Subject to

budget capacity, these faults will be repaired, and sections of the footpath

will be renewed.

a. Repairs

to this section of footpath have not yet been carried out, as the footpath

maintenance budget is being used to address faults in other priority areas.

II. Some

motor vehicles, including heavy vehicles, are cutting across the footpath build

outs as they turn left into the side streets, which is damaging the new

grass.

a. We

are trialling the use of flexi-posts in the build-outs to discourage motorists

from mounting the curb.

III. Officers

are also considering further improvements proposed by the Disability Reference

Group and Blind Low Vision NZ.

a. These

may be captured in the Accessibility Audit, currently being investigated and

scoped in collaboration with the Disability Reference Group.

c) Public

transport

I. It

can take longer than planned for public buses turning left from Featherston

Street into Rangitikei Street, which is affecting the operator’s ability

to run one of the services to schedule. Officers from PNCC and Horizons

are investigating possible solutions with NZTA Waka Kotahi.

a. Investigations

of possible solutions are ongoing between PNCC, Horizons and NZTA Waka Kotahi.

d) Vehicles

I. Two

affected businesses have proposed minor changes to the road layout, to improve

user safety and access. Officers have considered these changes.

a. Cross

hatching has been added at the Jaycar vehicle crossing;

b. Investigations

are ongoing into queueing safety outside Mitre10, where we are measuring

vehicle volumes and speeds.

3.21 Construction

defects have all been addressed and the certificate of completion has been

issued to the contractor.

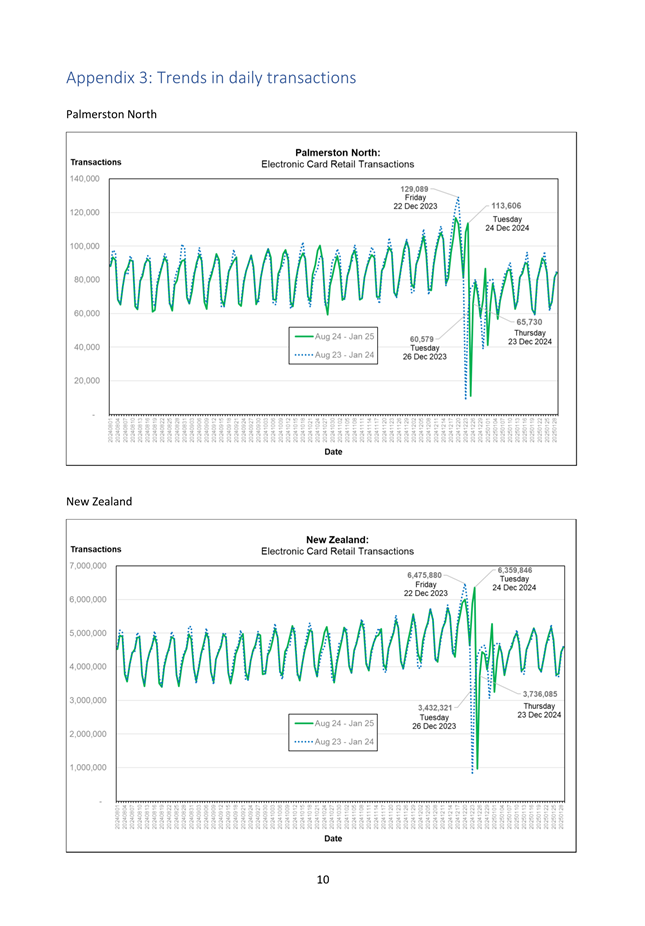

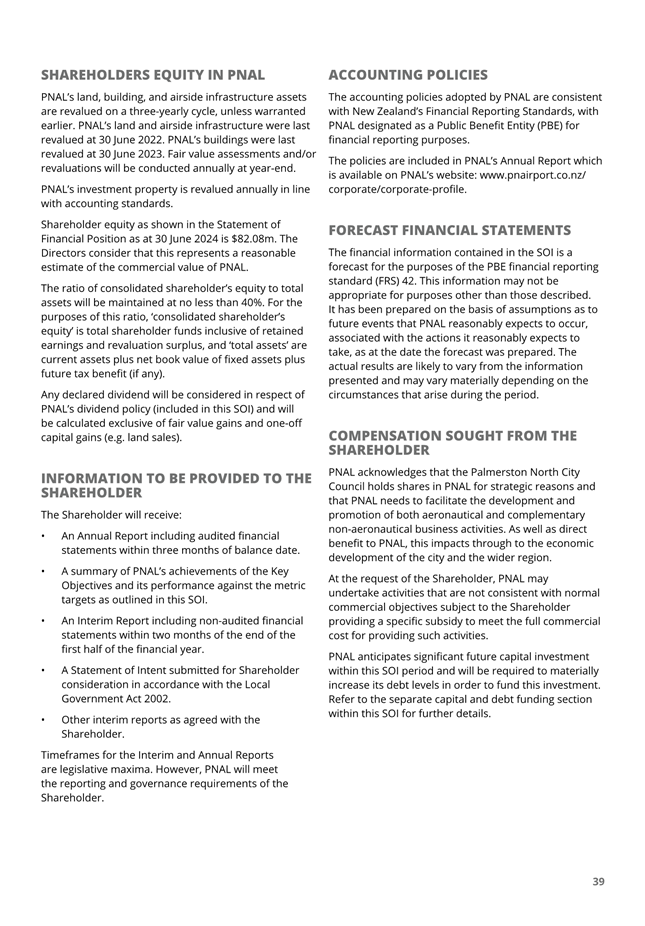

4. MARKET ANALYSIS

4.1 A

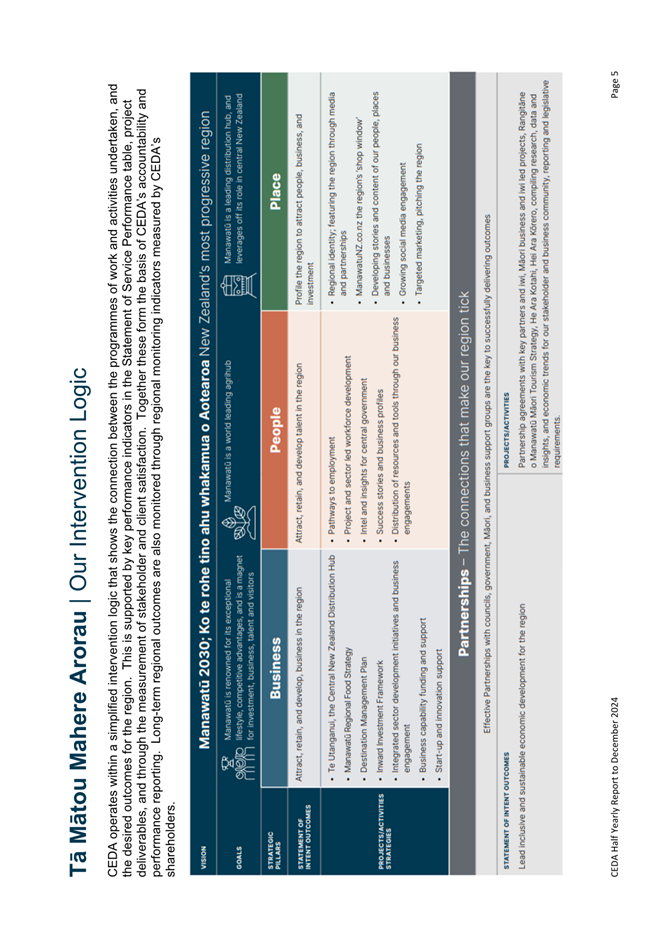

market analysis was carried out of selected businesses adjacent to the segment

of Featherston Street between North Street and Aroha Street.

4.2 The

market analysis:

a) Compared

the data for the six-month periods between August 2023 to January 2024

(pre-construction) and August 2024 to January 2025 (post-construction);

b) Measured

the number of transactions and value of electronic card spending;

c) Measured

the activity of five large retail businesses and ten smaller businesses.

4.3 The

data was compared with trends in Palmerston North and sub-precincts within the

city, as well as compared with trends nationally.

4.4 The

Featherston Street study area has maintained the same market share in terms of

spending and transactions in relation to Palmerston North:

§ Spending

in the study area represented 4.1% of total spending in Palmerston North over

both analysis periods.

§ Transactions

in the study area represented 4.5% of total transactions in Palmerston North

over both analysis periods.

4.5 For

affected businesses on Featherston Street, the data comparing both six-month

periods shows:

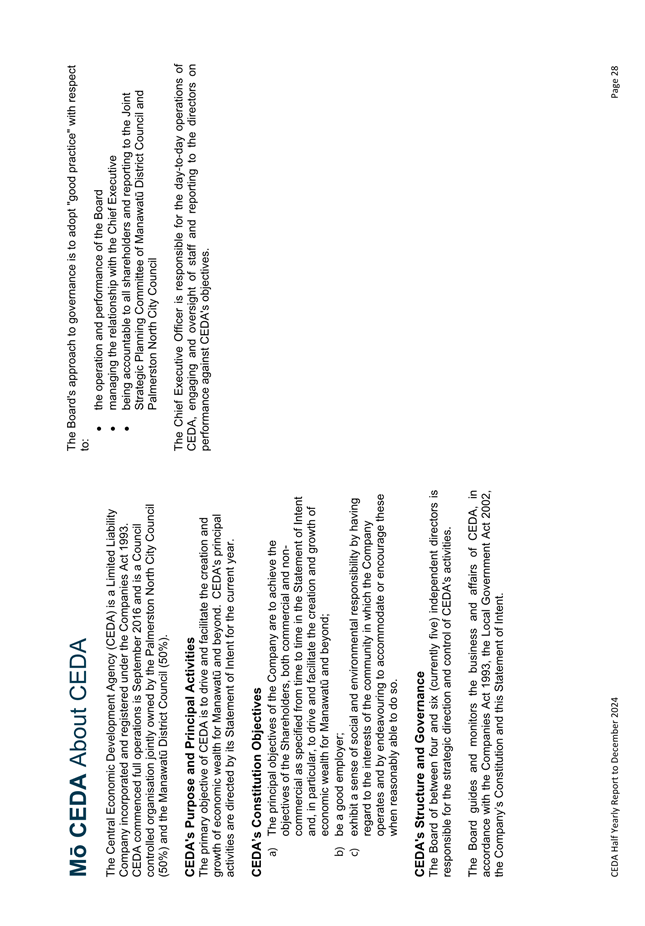

|

|

Change in spending

|

Change in the number of transactions

|

Change in average spend per transaction

|

|

Large businesses

|

-1.3%

|

-0.7%

|

-0.6%

|

|

Small businesses

|

-2.7%

|

-0.7%

|

-2.0%

|

|

Total study area

|

-1.4%

|

-0.7%

|

-0.6%

|

Table

4: Market analysis showing percentage changes

4.6 During

the same six-month periods:

a) Electronic

card spending in Palmerston North fell by -1.6%, compared with -1.3 nationally;

b) Retail

spending in the ‘CBD and Broadway precinct’ increased by 0.1%;

c) Retail spending in the ‘Terrace End

precinct’ fell by -2.2%, with spending in the ‘Outer CBD

precinct’ falling by -1.1%.

4.7 Therefore,

based on comparing both six-month data sets (pre-construction August 2023 to January

2024 and post-construction August 2024 to January 2025):

a) The

reduction in retail spending (-1.4%) in the Featherston Street study area is

slightly better than Palmerston North (-1.6%) and slightly lower than New

Zealand (-1.3%)

b) The

fall in the number of transactions in the study area (-0.7%) is the same as the

fall in Palmerston North (-0.7%), but behind New Zealand’s growth (0.2%)

c) The

fall in spending per transaction in the study area is slightly better

(-0.6%) compared to Palmerston North (-0.9%) and New

Zealand (-1.5%)

4.8 The

analysis indicates that the Featherston Street study area has maintained the

same market share in terms of spending and transactions in relation to

Palmerston North. The downturn in retail spending and transactions

experienced is largely consistent with, and in some cases better, than the

contraction in retail spending observed in comparator areas. Notably,

total spending fell less in the Featherston Street study area than in

Palmerston North overall, while the fall in average spend per transaction in

Featherston Street was less than the decline for both Palmerston North and New

Zealand. Overall, the retail spending trend for the Featherston Street study

area was stable comparing the period August 2023 to January 2024

(pre-construction) with August 2024 to January 2025 (post-construction).

4.9 Trends

over the six-month period show that changes in retail activity in the

Featherston Street study area does not depart from wider observations of retail

activity across the city and New Zealand.

4.10 The

full ‘Featherston Street electronic card retail spending analysis –

August 2024 to January 2025’ is included as Attachment 2.

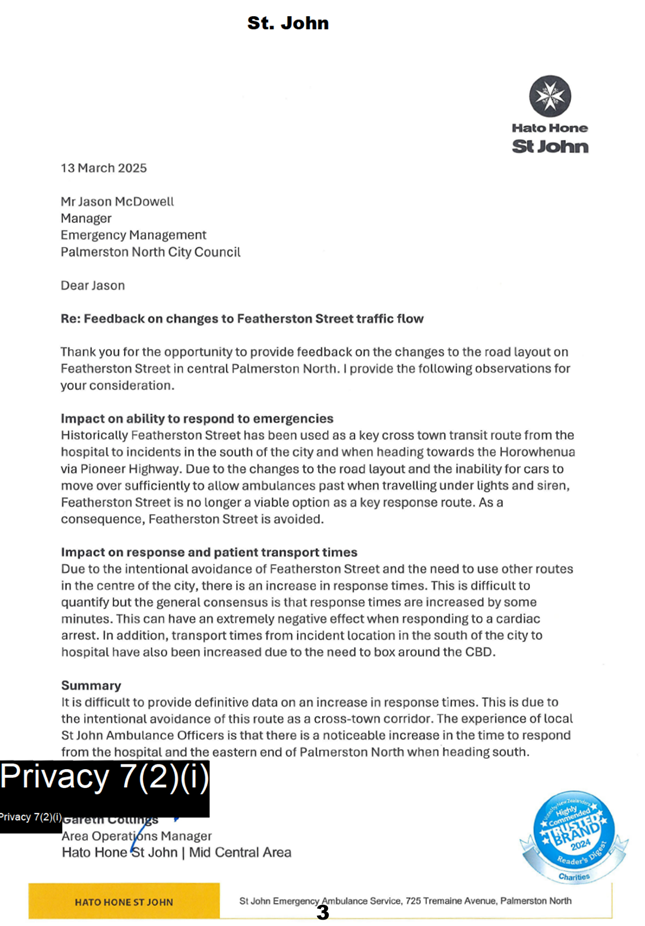

5. COMMUNITY VIEWS

5.1 We

have been receiving less public feedback through official Council channels

since construction was completed in July 2024 and since NZTA Waka Kotahi

addressed faults with the signals at the intersection with Rangitikei Street /

State Highway 3.

5.2 We

have compiled two sets of community views on the changes to Featherston Street,

since construction was completed:

a) Direct stakeholder and user

feedback

b) Hard copy surveys

Direct User and Stakeholder feedback

o We

invited affected businesses and schools along Featherston Street to comment on

the changes. The feedback received has been compiled into a single

document, along with additional feedback from other stakeholders and users.

o See

Attachment 3 ‘Featherston Street post-construction stakeholder and user

feedback April 2025’.

Hard copy surveys

o A

post-construction survey was carried out between 3 February and 6 March 2025,

with questions about safety across different modes, issues, likes and dislikes.

o Surveys

were carried out during peak hours during weekdays and weekends, outside the

schools and businesses, as well as around the intersection and bus stops.

o Respondents

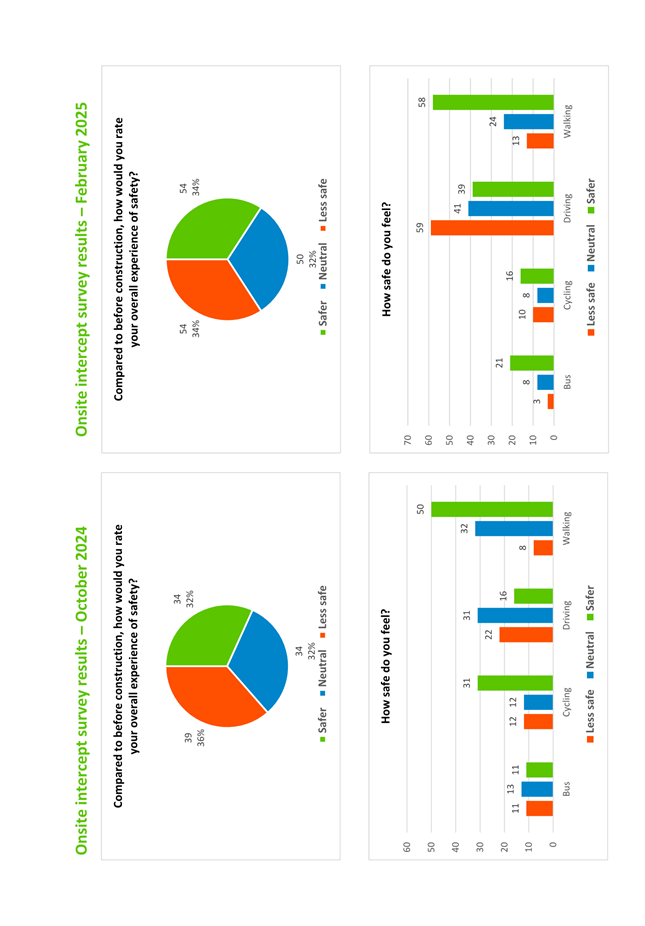

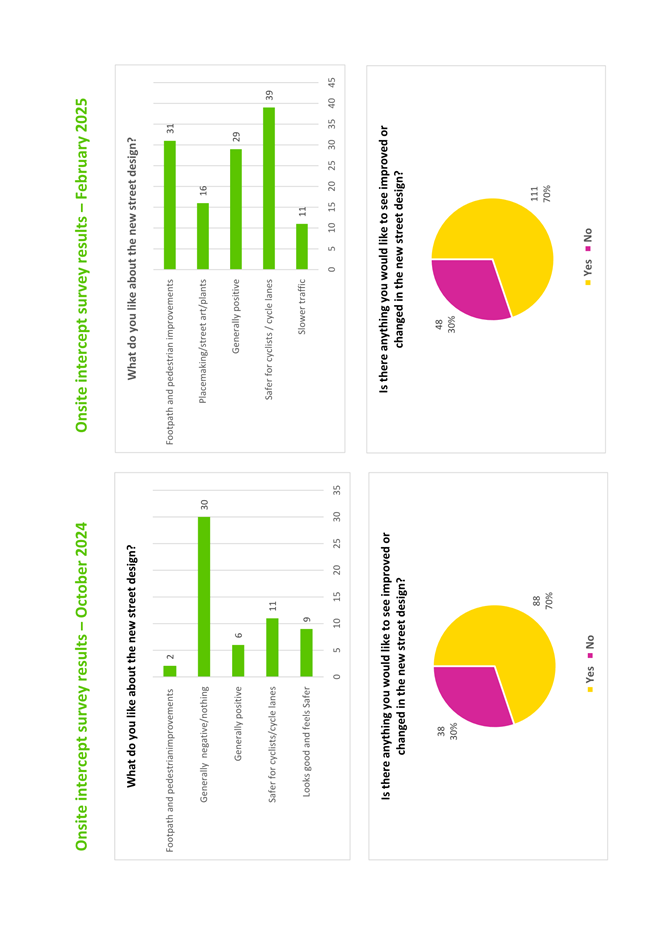

were a mix of motorists, pedestrians, bus passengers and bike riders.

o The

February results are similar to those we reported in November 2024. They

show that respondents have mixed views about safety and other benefits of each

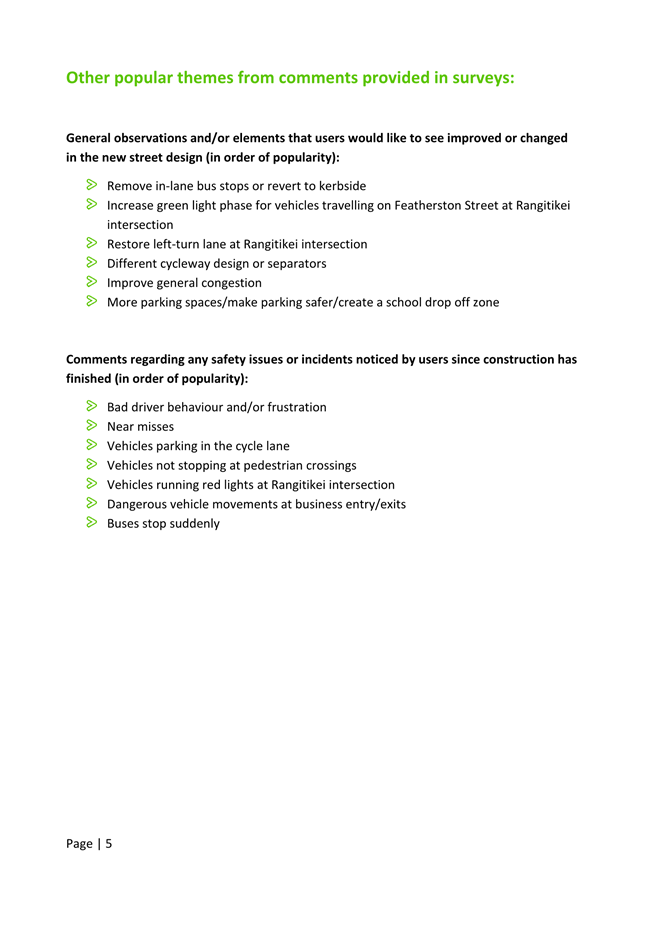

of the improvements along Featherston Street.

o Responses

continue to reflect a mix of perspectives, with many users acknowledging

improvements in safety and accessibility, while some concerns remain regarding

specific aspects of the street design.

o The

main findings are:

a) There is an even spread of opinions. Around a

third of respondents believe the new street design is safer, around a third

believe it is less safe and around a third believe the level of safety is

unchanged;

b) Most people rate walking and cycling as safer

than before, however opinions on safety are mostly negative regarding driving,

parking and bus stops;

c) The main concerns raised were around parking,

changes to the Rangitikei Street intersection and bus stops.

o Refer

to Attachment 4 ‘Featherston Street post-construction engagement report

April 2025’.

6. CONCLUSION

6.1 Safety

improvements to Featherston Street between Palmerston North Boys’ High

School and Central Normal School were completed in July 2024 and since then

users have been adapting to the changes.

6.2 Both

sets of post-construction data (April 2025 and November 2024) show there has

been a reduction in the volume of private and freight vehicles using

Featherston Street, as well as a reduction in vehicle speeds. Data on

travel times is mixed, however the latest data shows a decrease in travel times

in both directions, compared with pre-construction.

6.3 The

footpaths on both sides of Featherston Street carry an increasing number of

pedestrians at peak times. The cycleway is being well used and bus

patronage has more than doubled.

6.4 The

data shows that it is a safer environment, with proportionally fewer crashes

compared with pre-construction.

6.5 The

Featherston Street Safety Improvements Project covers 750 metres of a

4.5-kilometre road intended to prioritise public transport and cycling.

The changes completed in July 2024 are delivering localised benefits and

affecting some users’ behaviour.

6.6 The

transaction data shows that businesses along this segment of Featherston

Street, while experiencing a reduction in retail spending, performed slightly

better than the rest of the city over a six-month period.

6.7 Public

feedback has reduced since construction was completed. There are mixed

views about the changes, though there is general agreement amongst users that

the environment is safer for people walking and riding bikes.

7. NEXT

STEPS

7.1 We

are continuing to address the remaining minor design and operational issues,

subject to budget capacity.

7.2 No

further Council reports are scheduled for Featherston Street.

7.3 It

would be possible to carry out additional monitoring and evaluation, however

this would require a budget allocation in the Annual Plan.

8. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these objectives?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to:

Whāinga 1: He tāone

auaha, he tāone tiputipu

Goal 1: An innovative and

growing city

|

|

The

recommendations contribute to the achievement of objective/objectives

in:

3.

Mahere tūnuku

3. Transport Plan

The objective is: Prioritise transport programmes that

deliver on Council’s goals.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

NZTA Waka Kotahi’s Streets

for People programme aims to create liveable cities through mode shift and

creation of low carbon transport choices. Our project aims to improve

environmental and social wellbeing for our community.

|

|

|

|

Attachments

|

1.

|

Featherston

Street pedestrian and cycle counts Feb-March 2025 ⇩

|

|

|

2.

|

Featherston

Street electronic card retail spending analysis - August 2024 to January 2025

⇩

|

|

|

3.

|

Featherston

Street post-construction stakeholder and user feedback April ⇩

|

|

|

4.

|

Featherston

Street post-construction engagement report April 2025 ⇩

|

|

Report

TO: Economic

Growth Committee

MEETING DATE: 9

April 2025

TITLE: Draft

Parking Framework - Approval for Public Consultation

PRESENTED BY: James

Miguel, Senior Transport Planner

APPROVED BY: David

Murphy, General Manager Strategic Planning

RECOMMENDATION TO Economic Growth Committee

1. That the

Committee approve the draft Parking Framework (Attachment 1) for public

consultation.

Summary of options analysis for

|

Problem

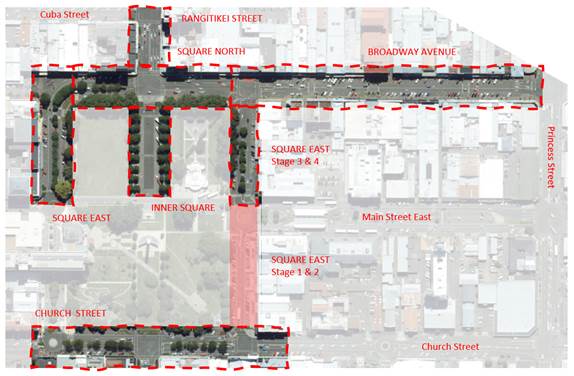

or Opportunity

|

Palmerston North does

not have a strategic plan for how parking is managed in the city. This means

that parking decisions have often been made in isolation and are not

integrated with wider transport planning considerations.

By

developing a framework that provides direction and guidance for managing

parking, the Council can align carparking management with Council’s

broader goals for the City and the transport network, and community

aspirations for specific places.

|

|

OPTION 1:

|

Approve

the draft Parking Framework for public consultation.

This option is

recommended.

|

|

Community Views

|

Community views have been provided in the

early stages of the development of the draft framework. Further community

views on the draft proposal will be sought through formal consultation.

|

|

Benefits

|

The framework will guide future parking

decisions made by the Council, therefore improving transparency and

consistency in decision-making and ensuring progress towards the

Council’s broader goals.

Council can make

changes to the draft Parking Framework prior to adopting it for public

consultation and following submissions.

|

|

Risks

|

Parking management

tends to raise competing views within the community regarding the broader

approach to managing the transport network. There is a risk that the Council

will receive mixed feedback and find it difficult to resolve these tensions.

Parking Framework seeks to manage this risk by improving transparency and

consistency in decision-making.

|

|

Financial

|

Costs are met within current budgets

|

|

OPTION

2:

|

Status Quo - Do not

approve the draft Parking Framework for public consultation

|

|

Community Views

|

Further

community views on a framework will not be sought.

|

|

Benefits

|

Consultation fatigue is

avoided, post local Water Done Well and Annual Budget.

|

|

Risks

|

Parking management will continue to be

managed as per the status quo, with issues being resolved on a somewhat

ad-hoc basis. Parking changes are less likely to align with wider transport

planning objectives. As the parking framework is a part of the Palmerston

North Integrated Transport Initiative (PNITI), there may be a perception by

our funding partners that we are not committed to progressing PNITI.

Stakeholder who have

been involved to date may be disappointed that their time has been wasted.

|

|

Financial

|

No additional costs as work on the parking

framework would cease.

|

Rationale for the recommendations

1. Overview of the problem or opportunity

1.1 The Council manages a significant amount

of on and off-street carparking and there is often competing demands for this

space and how it is utilised.

1.2 Currently Council manages its parking on

an as-needed basis, with changes being made on a case-by-case basis. While this

does allow Council to address specific parking requests, it limits

Council’s ability to align its parking management decisions with wider

Council goals.

1.3 A draft Parking Framework included as

Attachment 1 has been developed in effort to address this issue.

1.4 The

purpose of the Parking Framework is to:

· Align

carparking management with Council’s broader goals for the City and the

transport network, and community aspirations for specific places.

· Ensure

the efficient use of carparks so that there is an adequate supply now and into

the future as the city grows.

1.5 Palmerston

North is growing and is projected to continue to grow. As the City grows the

demand on the transport network is likely to grow as well. By aligning parking

management with wider transport planning, we can mitigate the worst of these

impacts on the transport network. We can ensure that there is

an appropriate supply of parking while enabling development within the

city.

1.6 Nothing

in the Parking Framework predetermines a specific carparking outcome in a

location in the city. Specific decisions will only be made following the

preparation of more detailed parking management plans, and the design and

consideration of capital programmes.

1.7 The draft Parking Framework was developed

with input from a number of community stakeholders. We are now seeking to

consult with the wider community to seek their views on the draft framework.

2. Background and previous council decisions

2.1 In 2021 NZTA Waka Kotahi completed the

Palmerston North Integrated Transport Initiative (PNITI) Network Option Report.

The report put forward a programme of interventions designed to address a

number of safety and amenity issues, while improving the overall access for the

city. The programme comprises over 70 projects, one of which is a review of the

Council’s parking management.

2.2 Work on the Parking Framework began in

October 2021 following the completion of PNITI. The project was initially scheduled

to be completed in 2022. It has been delayed due to resourcing and

budgetary constraints and to avoid consultation overlap with the 2024 Long-Term

Plan.

2.3 The project commenced with a workshop with

the elected members on 10 October 2021. This workshop was where the initial strategic

direction was laid out for the framework. Following this, the project team

commenced development of the framework. A second workshop with elected members

was undertaken in August 2023. At this workshop, elected members provided

feedback on the principles that had been drafted.

2.4 Initial stakeholder engagement was

undertaken in 2022, with key stakeholders providing input into parking

challenges and issues in the city. This helped to formulate the draft Parking Framework.

Further engagement with stakeholders occurred in 2023. The draft framework was

shared with stakeholders to seek further feedback as it was refined and

prepared for consultation.

2.5 On 27 March 2024 officers held a further

workshop with elected members to present a working draft of the Parking

Framework, ahead of presenting the draft to the Economic Growth Committee. As a

consequence of the workshop discussion, consultation was postponed until after

the Long-Term Plan consultation was completed.

2.6 The Parking Framework was also discussed

by elected members on 18 September 2024 as part of a workshop on Transport

Planning priorities (following a briefing from Waka Kotahi NZTA). There were

mixed views on the need for a Parking Framework and the content of the draft

Parking Framework. Elected members sought that the matter was to be resolved

via consideration at the next Economic Growth Committee.

2.7 A

draft parking framework was presented to the Economic Growth Committee on 20

November 2024. Prior to the Committee meeting, an elected member had circulated

an alternative version of the Parking Framework for consideration. A procedural

motion was passed which laid the November report on the table and requested

that a workshop occur in the meantime.

2.8 On

12 February 2025, a workshop was held to discuss the parking framework and the

alternative. Now, in this new report, Officers propose a draft based on the

discussion at the workshop to the Committee.

3. Overview of amendments to draft

3.1 Following the February 2025 workshop,

officers made amendments to the draft framework, to capture the discussion at

the workshop.

3.2 The alternative version of the parking

framework circulated at the 20 November 2024 Economic Growth Committee was also

used to inform the further amendments made to the draft.

3.3 Amendments to the Introduction section:

· Updated second purpose bullet point to

include text around ensuring adequate parking supply as the city grows

· Change

to text around alternative transport modes and mode shift. The updated text

focuses more on integrated transport planning. Have included an example from

Queenstown of aligning parking changes with Public Transport changes.

· Introduced

text to discuss the role of private parking facilities and the relationship

with public parking facilities.

· Removed section ‘Too much parking

can create negative outcomes’.

3.4 Amendments to Objectives and Principles:

· Removed

objectives ‘Promote sustainable transportation’ and ‘Unify

parking for a safe and smooth transportation system;

· Added

new objective ‘Support a balanced transportation network’.

This objective brings together two removed objectives. The new objective better

reflects the general transport outcomes that the city wants to achieve.

· Minor

text change to the principle ‘Ensure parking supports a quality urban

environment’

3.5 Amendments to Parking Management in

City Centre:

· Included wording in the title and the text

to include Commercial areas. The changes mean that this approach would also

look to include the commercial areas surrounding the city centre.

· Added text to think about the interaction

between public car parking and private car parking. Included a proposed

approach seeking to explore opportunities to work with the private sector to

provide off-street parking facilities.

· Changed text around alternative modes to

better reflect the role of end-of-journey facilities.

· Updated the proposed approach to encourage

longer-stay parking to use off-street facilities.

· Included a longer-term direction to shift

more on-street parking to off-street facilities.

· Moved the placement of long-stay parking

up in the parking hierarchy.

3.6 Amendments to Parking Management in

Residential Streets with high demand:

· Changed

position on residential parking permits to impose restrictions in the first

instance, then to phase out if conflicts continue.

· Added

Long stay parking into the parking hierarchy

3.7 Amendments to Supporting Actions:

· Added

action to introduce restrictions to residential parking permits. This replaces

action to phase out residential parking permits

· Added

action to investigate off-street parking opportunities

· Added

action to regularly review/audit Council permit rules and processes

3.8 The

amendments made to the draft have not resulted in any changes to the overall

policy alignment.

4. Description of options

4.1 There are two principal options in this

report. The first is to approve the draft Parking Framework for public

consultation. If the Council chooses this option, then officers will proceed to

consult the community on the draft Parking Framework.

4.2 Council

can make changes to the draft Parking Framework prior to adopting it for public

consultation and following submissions.

4.3 The second option is to not approve the

draft Parking Framework for public consultation. If this option is chosen, we

will not proceed with public consultation and work on the Parking Framework

will stop until officers receive further instructions from elected

members.

5. Analysis of options

5.1 Option 1: Approving the draft Parking

Framework for public consultation – gives the Council the opportunity to test its

approach to parking management with the community. This allows staff to

identify improvements that can be made to the framework and understand the

views of the wider community.

5.2 Option 2: Not approving the draft Parking

Framework for public consultation – would halt progress on the Parking Framework, which

has already been delayed. Council will continue to address parking issues on a

case-by-case basis without there being a clear alignment in the desired

outcome.

6. Conclusion

6.1 Option 1 – approving the draft

Parking Framework for public consultation is the recommended option.

6.2 There are clear benefits to undertaking

consultation and giving the community an opportunity to provide feedback on the

draft Parking Framework, which is an identified action within PNITI.

7. Next actions

7.1 If the recommendation to consult on the

Parking Framework is approved, we will start preparing for public consultation,

as detailed in section 7 of this report.

7.2 The draft Parking Framework will be

developed into a refined document prior to public consultation.

7.3 Hearing of submissions has not yet been

scheduled. Subject to approval to consult, officers will work to confirm the

dates of the hearings. Following the completion of the consultation process,

the Parking Framework will be deliberated on in response to submissions and

then recommended to Council for adoption.

7.4 Once the Parking Framework has been

adopted, officers will commence work on the first parking management

plan.

8. Outline of consultation process

8.1 If the committee approves the draft for

consultation, officers propose to undertake consultation in May.

8.2 Consultation

will be limited to the resources available and involve the following:

· direct contact with identified

stakeholders;

· Public drop-in

sessions at key locations;

· Radio adverts to

target the morning commute;

8.3 In addition to the above methods, a

consultation page on the Council website will host details of the framework,

along with a submission form for people to provide feedback. The framework and

the opportunity to provide feedback will be promoted via our social media

channels. Printed copies of the consultation document and the submission form

will also be made available.

9. Compliance

and administration

|

Does the Committee have delegated

authority to decide?

If Yes quote relevant clause(s)

from Delegations Manual; 4.2 Economic Growth Committee Terms of Reference.

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to

Whāinga 1: He tāone

auaha, he tāone tiputipu

Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the achievement of action/actions in Transport

The action is: Manage parking in accordance with transport

and urban design objectives

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The completion of a Parking

Framework to guide decision-making around parking means that decisions can be

made in a coordinated manner that aligns with wider transport strategies and

achieves a more positive outcome for the community.

|

|

|

|

Attachments

|

1.

|

Draft

Parking Framework April 2025 ⇩

|

|

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 9

April 2025

TITLE: Street

Light Infill

Presented

By: Glen

O'Connor, Group Manager - Transport and Development

APPROVED BY: Chris

Dyhrberg, General Manager Infrastructure

RECOMMENDATION TO Economic Growth Committee

1. That the

Committee receive the report ‘Street Light Infill’, presented

to the Economic Growth Committee on 9 April 2025.

1. ISSUE

1.1 A

city-wide street light infill programme was included in the 2018-28 Long Term

Plan (LTP), with a total budget of $5.7M spread over seven years. This

funded the upgrading of street lighting across the city.

1.2 The

final infill work package was completed in 2023/24, with no funding for street

light infill included in the 2024-34 LTP.

1.3 At

its meeting on 19 June 2024, the Economic Growth Committee resolved:

That the Chief Executive report back on:

• timing and

cost of a city-wide survey on streetlights;

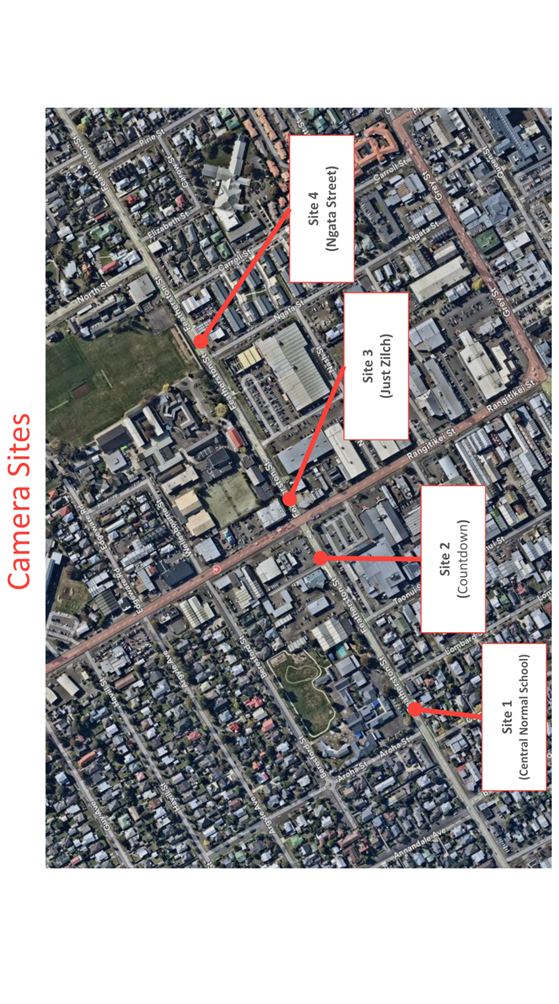

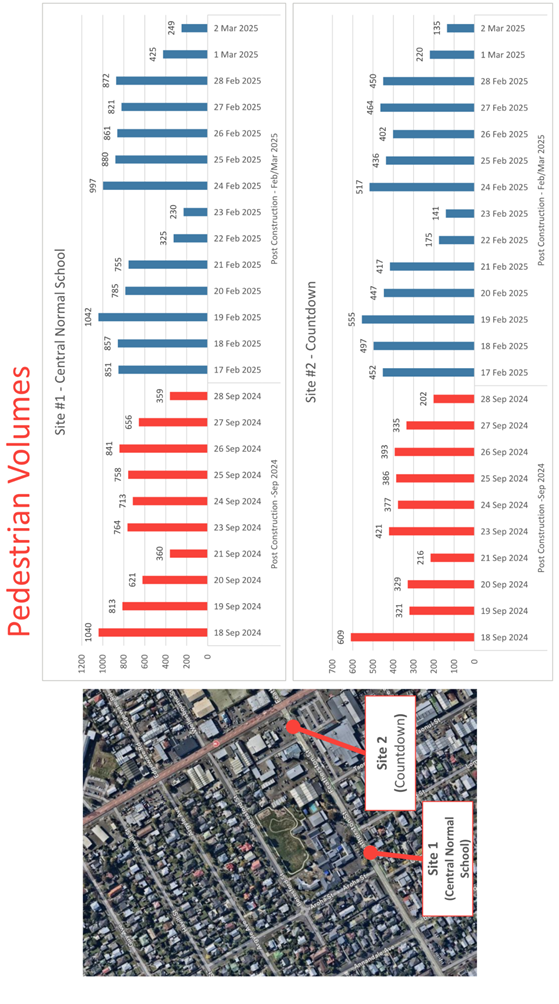

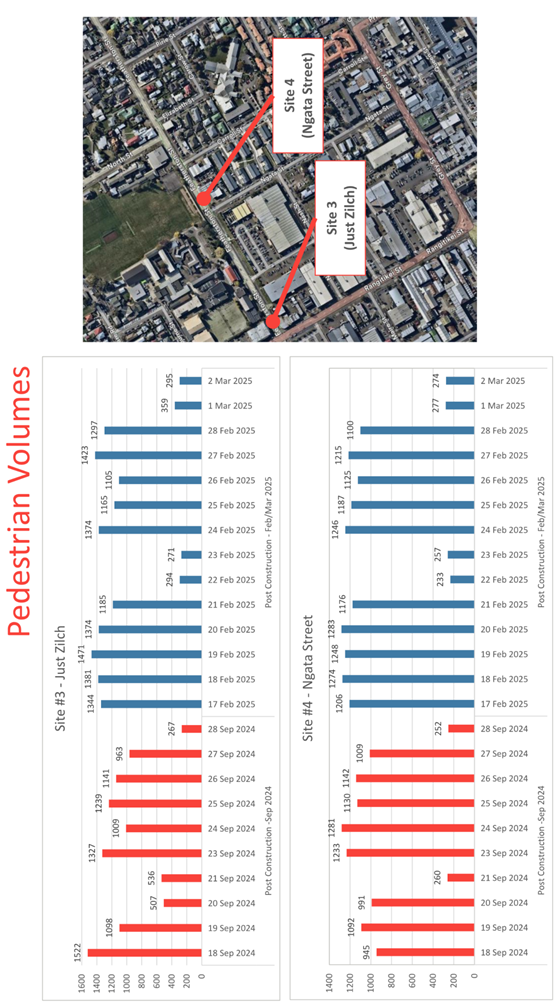

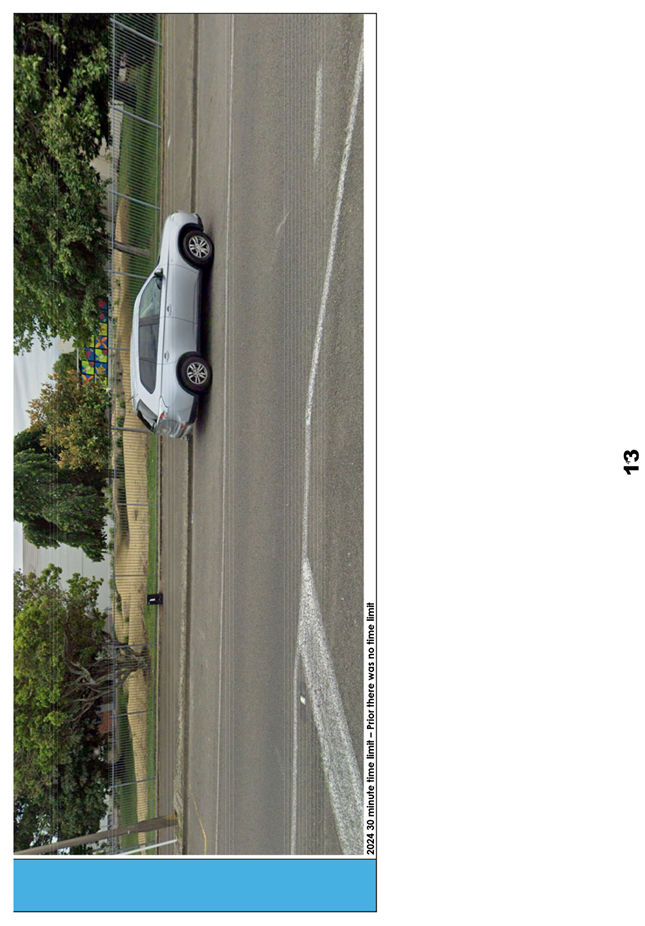

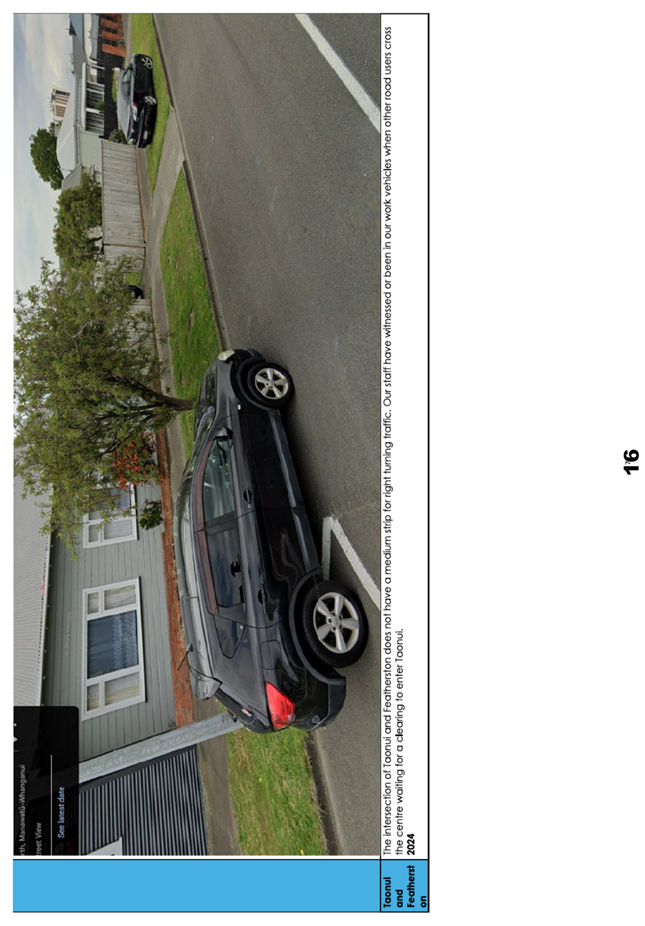

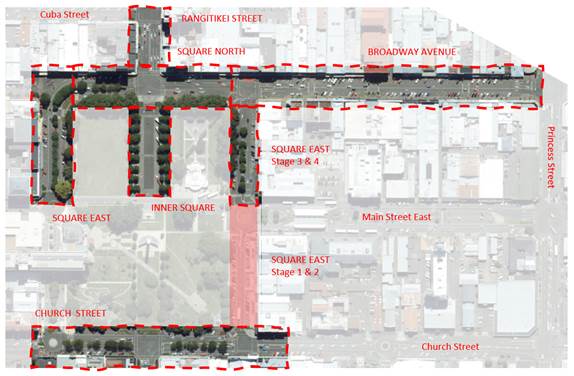

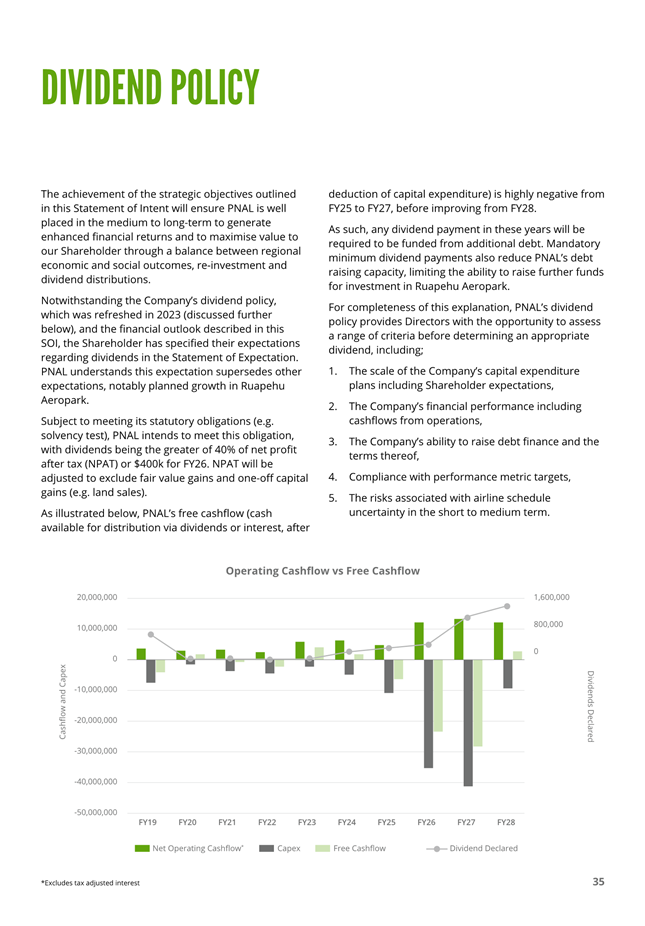

• timing and