AGENDA

Finance

& Audit Committee

|

Susan Baty (Chairperson)

|

|

Karen Naylor (Deputy

Chairperson)

|

|

Grant Smith (The Mayor)

|

|

Stephen Armstrong

|

Leonie Hapeta

|

|

Vaughan Dennison

|

Lorna Johnson

|

|

Renee Dingwall

|

Bruno Petrenas

|

|

Lew Findlay QSM

|

Tangi Utikere

|

|

Patrick Handcock ONZM

|

|

|

|

|

PALMERSTON NORTH CITY COUNCIL

Finance &

Audit Committee

MEETING

19 August 2020

Order of Business

1. Apologies

2. Notification

of Additional Items

Pursuant to Sections 46A(7) and

46A(7A) of the Local Government Official Information and Meetings Act 1987, to

receive the Chairperson’s explanation that specified item(s), which do

not appear on the Agenda of this meeting and/or the meeting to be held with the

public excluded, will be discussed.

Any additions in accordance with

Section 46A(7) must be approved by resolution with an explanation as to why

they cannot be delayed until a future meeting.

Any additions in accordance with

Section 46A(7A) may be received or referred to a subsequent meeting for further

discussion. No resolution, decision or recommendation can be made in

respect of a minor item.

3. Declarations

of Interest (if any)

Members are reminded of their duty

to give a general notice of any interest of items to be considered on this

agenda and the need to declare these interests.

4. Public

Comment

To receive comments from members of

the public on matters specified on this Agenda or, if time permits, on other

Committee matters.

(NOTE: If the

Committee wishes to consider or discuss any issue raised that is not specified

on the Agenda, other than to receive the comment made or refer it to the Chief

Executive, then a resolution will need to be made in accordance with clause 2

above.)

5. Confirmation

of Minutes Page 7

“That the minutes of the

Finance & Audit Committee meeting of 17 June 2020 Part I Public be confirmed

as a true and correct record.”

6. Human

Resources and Health, Safety and Wellbeing Report Page 13

Memorandum, presented by Alan

Downes, Health Safety & Wellbeing Manager.

7. S17A

Review of Economic Development Page 21

Memorandum, presented by Sheryl

Bryant, General Manager - Strategy & Planning.

8. Reserve

land acquisition - unbudgeted proposals - Whakarongo Lagoon and Greens Road Page 25

Report, presented by Kathy

Dever-Tod, Manager - Parks and Reserves.

9. Whakarongo

Housing - Cashflow Analysis Page 43

Memorandum, presented by Stuart

McKinnon, Chief Financial Officer.

10. Quarterly

Performance and Financial Report - Quarter Ending 30 June 2020 Page 51

Memorandum, presented by Stuart

McKinnon, Chief Financial Officer and Andrew Boyle, Head of Community Planning.

11. Update of Treasury

Policy (including Liability Management & Investment Policies) Page 135

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

12. Treasury Report -

12 months ending 30 June 2020 Page 185

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

13. Te Huringa (ERP

Ozone Replacement) Project - Business Assurance Progress Report Page 195

Memorandum, presented by Masooma

Akhter, Business Assurance Manager.

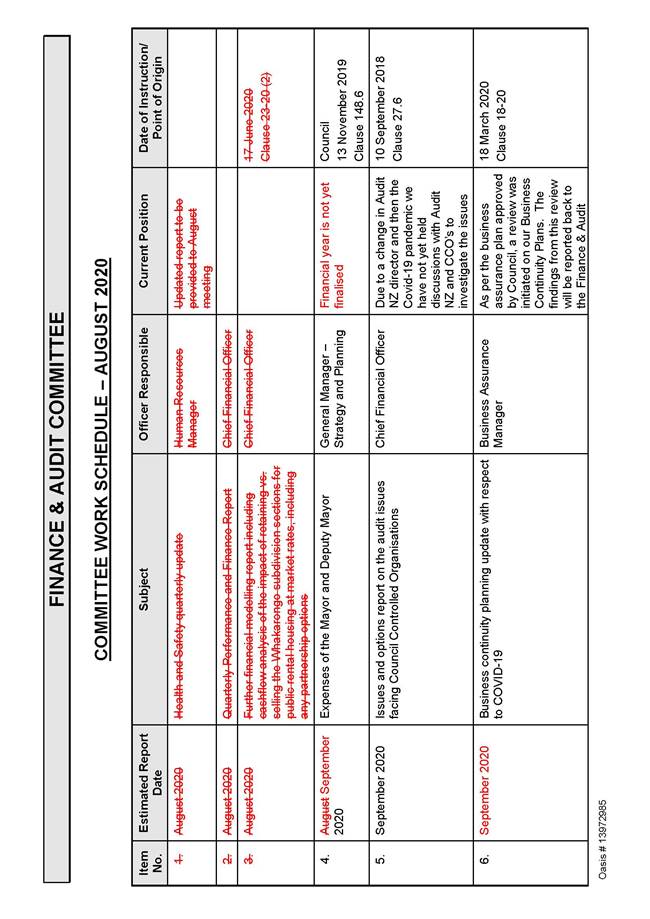

14. Committee Work

Schedule Page 229

15. Exclusion of Public

|

|

To be moved:

“That the

public be excluded from the following parts of the proceedings of this

meeting listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under Section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General

subject of each matter to be considered

|

Reason

for passing this resolution in relation to each matter

|

Ground(s)

under Section 48(1) for passing this resolution

|

|

|

|

|

|

|

|

|

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

Also that the

persons listed below be permitted to remain after the public has been

excluded for the reasons stated.

[Add Third

Parties], because of their knowledge and ability to assist the

meeting in speaking to their report/s [or other matters as specified] and

answering questions, noting that such person/s will be present at the meeting

only for the items that relate to their respective report/s [or matters as

specified].

|

Palmerston North City Council

Minutes of

the Finance & Audit Committee Meeting Part I Public, held in the Elwood

Room, Conference & Function Centre, 354 Main Street, Palmerston North on 17 June 2020,

commencing at 9.02am

|

Members

Present:

|

Councillor Susan Baty (in the Chair), The

Mayor (Grant Smith), Mr Stephen Armstrong and Councillors Vaughan Dennison,

Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Karen Naylor and Bruno Petrenas.

|

|

Non Members:

|

Councillors Brent Barrett, Rachel Bowen,

Zulfiqar Butt, Billy Meehan and Aleisha Rutherford.

|

|

Apologies:

|

Councillor Tangi Utikere.

|

NOTE: Prior to the commencement of the meeting, Mr

Stephen Armstrong was introduced as a new independent member of the Committee.

|

19-20

|

Apologies

|

|

|

Moved Susan Baty, seconded Vaughan Dennison.

The

COMMITTEE RESOLVED

1. That

the Committee receive the apologies.

|

|

|

Clause 19-20 above was carried 16 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and

Councillors Susan Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford

and Mr Stephen Armstrong.

|

|

20-20

|

Confirmation of Minutes

|

|

|

Moved Susan Baty, seconded Lorna Johnson.

The

COMMITTEE RESOLVED

1. That

the minutes of the Finance & Audit Committee meeting of 18 March 2020

Part I Public be confirmed as a true and correct record.

|

|

|

Clause 20-20 above was carried 16 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and

Councillors Susan Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha

Rutherford and Mr Stephen Armstrong.

|

|

21-20

|

Palmerston North Airport Limited - Updated draft

Statement of Intent for 2020/21

Memorandum, presented by

Steve Paterson, Strategy Manager - Finance.

After discussion Elected

Members agreed an updated company position could be provided in October, as

by then Palmerston North Airport Limited would have a better perspective of

recovery after COVID-19, and would be able to include financial information

from one quarter of the financial year. Elected Members also requested

that capital development be progressed when financially prudent.

|

|

|

Moved

Aleisha Rutherford, seconded Karen Naylor.

The COMMITTEE RECOMMENDS

1. That the

Palmerston North Airport Ltd updated draft Statement of Intent for 2020/21,

presented to the Finance & Audit Committee on 17 June 2020, be received

and the Company be advised that:

· Council

supports the draft SOI recognising the uncertainty of significant assumptions

that have had to be made in its preparation

· Council

requests an updated company position be provided (in October) and if changes

have been significant that an amended SOI (including projections for 2021/22

and 2022/23) be provided to the Council for consideration

· Council

encourages the Board to progress its capital development programme when

financially prudent.

|

|

|

Clause 21-20 above was

carried 16 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Susan Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha

Rutherford and Mr Stephen Armstrong.

|

|

22-20

|

Fees and Charges - Confirmation Following Public

Consultation

Memorandum, presented by

Steve Paterson, Strategy Manager - Finance.

|

|

|

Moved

Susan Baty, seconded Aleisha Rutherford.

The COMMITTEE RECOMMENDS

1. That the

submission relating to planning fees, as attached in Appendix A of the

memorandum titled ‘Fees and Charges – Confirmation Following

Public Consultation’ presented to the Finance & Audit Committee on

17 June 2020, be received.

2. That

the fees and charges for Trade Waste Services, as scheduled in Appendix C of

the memorandum titled `Fees and Charges – Confirmation Following Public

Consultation’, presented to the Finance & Audit Committee on 17

June 2020, be approved, effective from 1 July 2020.

|

|

|

Clauses 22.1 and 22.2 above were carried 16 votes to

0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Susan Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha

Rutherford and Mr Stephen Armstrong.

|

|

|

Moved

Susan Baty, seconded Aleisha Rutherford.

3. That the fees

and charges for Planning & Miscellaneous Services, as scheduled in

Appendix B of the memorandum titled `Fees and Charges – Confirmation

Following Public Consultation’ presented to the Finance & Audit

Committee on 17 June 2020, be approved, effective from 1 July 2020.

|

|

|

Clause 22.3 above was carried 15 votes to 1, the

voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Susan Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Mr

Stephen Armstrong.

Against:

Councillor Vaughan Dennison.

|

|

23-20

|

Public Rental Housing within Council's Whakarongo

Subdivision

Memorandum, presented by

Bryce Hosking, Manager - Property.

During discussion Elected

Members requested further financial modelling be undertaken to include

cashflow analysis of the impact of retaining the Whakarongo subdivision

sections vs. selling the sections, and to include any partnership

options. Elected Members also requested a report regarding energy and

environmental efficiency options for any public housing opportunities, and

that the conversation around wider housing development opportunities for

Council be referred to the Long Term Plan process.

The meeting adjourned at 10.41am

The meeting resumed at 11.04am

|

|

|

Moved

Susan Baty, seconded Brent Barrett.

The COMMITTEE RESOLVED

1. That

the memorandum titled ‘Public Rental Housing within Council’s

Whakarongo Subdivision’, presented to the Finance and Audit Committee

on 17 June 2020, be received for information.

2. That

further financial modelling be undertaken to include cashflow analysis of the

impact of retaining the sections vs. selling the Whakarongo subdivision

sections and to include any partnership options, and that this be reported

back to the August meeting of the Finance & Audit Committee.

|

|

|

Clauses 23.1 and 23.2 above were carried 15 votes

to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Susan

Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Renee Dingwall, Lew Findlay

QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna Johnson, Billy Meehan, Karen

Naylor, Bruno Petrenas, Aleisha Rutherford and Mr Stephen Armstrong.

|

|

|

Moved Brent Barrett, seconded Susan Baty.

3. That

the Chief Executive be instructed to report back to the October meeting of

the Finance & Audit Committee regarding energy and environmental

efficiency options for any public housing opportunities.

|

|

|

Clause 23.3 above was carried 15 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Susan

Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Renee Dingwall, Lew Findlay

QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna Johnson, Billy Meehan, Karen

Naylor, Bruno Petrenas, Aleisha Rutherford and Mr Stephen Armstrong.

|

|

|

Moved Aleisha Rutherford, seconded Leonie Hapeta.

4. That

the conversation around wider housing development opportunities for Council

be referred to the Long Term Plan process.

|

|

|

Clause 23.4 above was carried 15 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Susan

Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Renee Dingwall, Lew Findlay

QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna Johnson, Billy Meehan, Karen

Naylor, Bruno Petrenas, Aleisha Rutherford and Mr Stephen Armstrong.

Note:

Councillor Vaughan Dennison declared a conflict of interest and withdrew from

the discussion.

|

|

24-20

|

CET Arena - Commercial Building Opportunity

Report, presented by Bryce

Hosking, Manager - Property.

|

|

|

Moved

Susan Baty, seconded Vaughan Dennison.

The COMMITTEE RECOMMENDS

1. That Council

does not proceed with the balance of programme #1514 – Central Energy

Trust Arena Manawatu – Commercial Building in the current financial

year.

|

|

|

Clause 24-20 above was carried 16 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Susan

Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Vaughan Dennison, Renee

Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie Hapeta, Lorna

Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha Rutherford and Mr

Stephen Armstrong.

|

|

|

Moved Susan Baty, seconded Vaughan Dennison.

|

|

|

Note:

On a motion that: “Council considers

the construction of a commercial building at Arena, along with the timing of

such a development, as part of the 2021-31 Long-Term Plan” the motion

was lost 5 votes to 10, with 1 abstention, the voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Vaughan

Dennison, Patrick Handcock ONZM, Leonie Hapeta and Billy Meehan.

Against:

Councillors Susan Baty, Brent Barrett, Rachel

Bowen, Zulfiqar Butt, Renee Dingwall, Lew Findlay QSM, Lorna Johnson, Karen

Naylor, Bruno Petrenas and Aleisha Rutherford.

Abstained:

Mr Stephen Armstrong.

|

|

25-20

|

Committee Work Schedule

|

|

|

Moved

Susan Baty, seconded Karen Naylor.

The COMMITTEE RESOLVED

1. That

the Finance & Audit Committee receive its Work Schedule dated June 2020.

|

|

|

Clause 25-20 above was

carried 16 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Susan Baty, Brent Barrett, Rachel Bowen, Zulfiqar Butt, Vaughan

Dennison, Renee Dingwall, Lew Findlay QSM, Patrick Handcock ONZM, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Karen Naylor, Bruno Petrenas, Aleisha

Rutherford and Mr Stephen Armstrong.

|

The meeting finished at 12.03pm

Confirmed 19 August 2020

Chairperson

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 19

August 2020

TITLE: Human

Resources and Health, Safety and Wellbeing Report

Presented By: Alan

Downes, Health Safety & Wellbeing Manager

APPROVED BY: Patrick

Watson, Chief People & Performance Officer

|

RECOMMENDATION

TO Finance & Audit

Committee

1. That

the memorandum entitled ‘Human Resources and Health, Safety and

Wellbeing Report’ presented to the Finance & Audit Committee on 19

August 2020, be received.

|

1. REPORT

This

report covers the period 1 April to 30 June 2020.

The information included in this report is discussed at the appropriate H&S

Committees.

2. Key

Point Summary

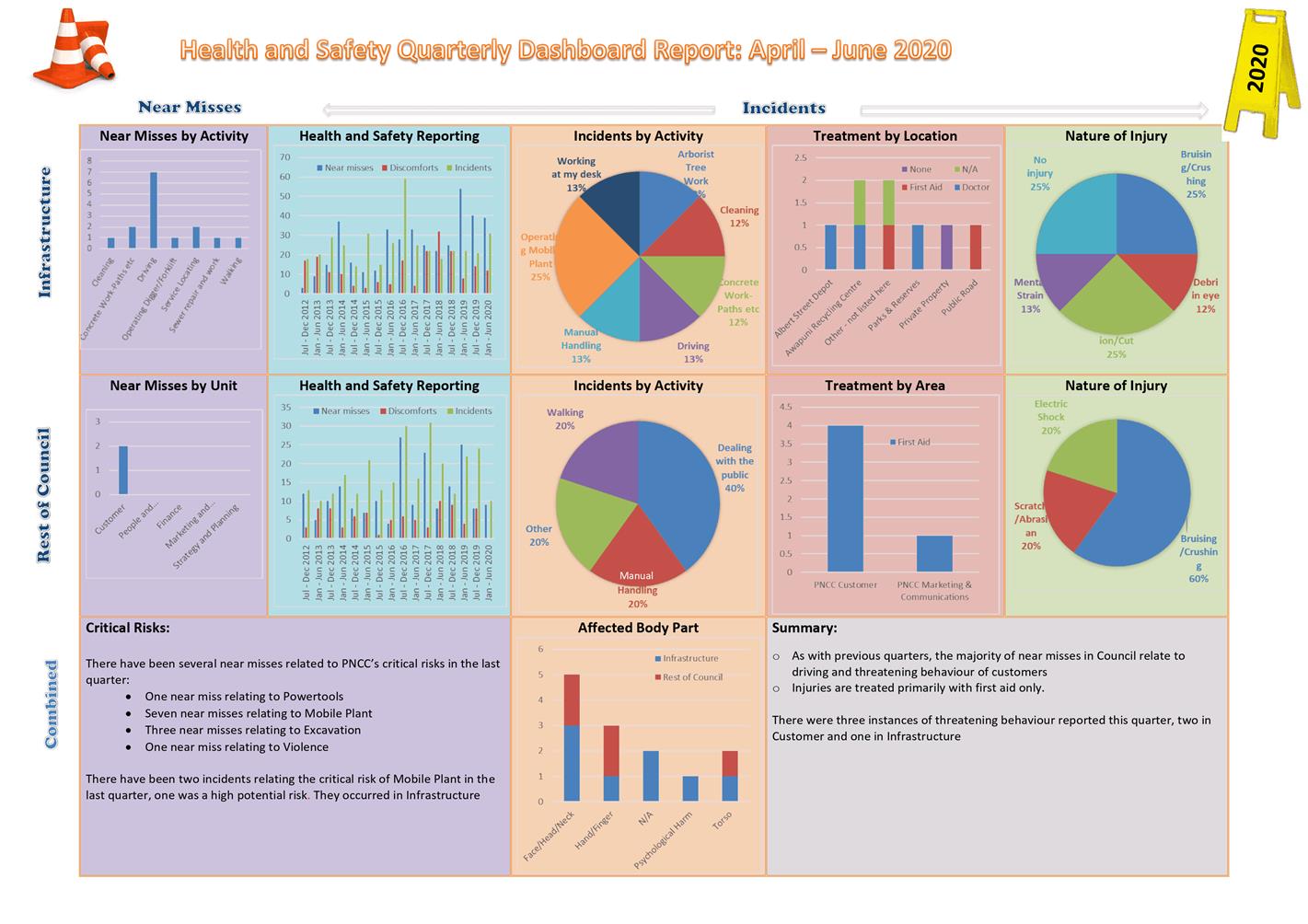

· The quarterly dashboard illustrates an increase in

incidents across PNCC and within the Infrastructure unit, however overall trend

is unchanged. This increase in reporting is an indication of improvements

in the reporting culture and effectiveness of reporting tools.

· There were eleven injury incidents with three requiring

professional medical attention. Threatening behaviour by customers and driving

incidents continue to feature in near miss reports.

· PNCC successfully

transitioned personnel back to work following COVID-19 restrictions.

· Alan Downes

commenced the position of Health, Safety & Wellbeing Manager on 1 July.

· Immediate

Safety, Health & Wellbeing focus is in understanding effectiveness of

controls in critical risk areas with particular emphasis on the risk

consequence.

· Annual Leave liability has grown during COVID-19 by 4%. It

is expected to be managed back to normal levels within the next six

months. Management is exploring leave liability from a wellbeing,

financial liability and process perspective.

· Annual

staff turnover is slightly above the 12% target but no immediate management

action is required.

3. Training

COVID-19 inhibited progression of

training during the lockdown period. A remediation plan is in place.

|

|

Mar 19

|

Jun 19

|

Sep 19

|

Dec 19

|

Mar 20

|

Jun 20

|

|

Total

Number of Events

|

13

|

21

|

21

|

19

|

20

|

14

|

|

Total

Number of Staff Attending

|

102

|

374

|

106

|

48

|

99

|

34

|

4. PNCC

Critical Risk Table

|

Whole of

PNCC

|

Infrastructure

& Whole of PNCC

|

|

Mental

Health

|

Excavation

|

|

Violence /

Robbery

|

Bodies of

Water

|

|

Working

Alone

|

Tree-Felling

|

|

Asset

Failure

|

Working at

Height

|

|

Mobile

Plant

|

Confined

Spaces

|

|

Stationary

Plant & Powered Hand Tool

|

Hazardous

Substances

|

5. Critical

incidents (July 2019 – June 2020)

|

Type

|

Description

|

Mitigating

/ remedial controls

|

|

Excavation

|

9 underground strikes:

4 power cable strikes and 5 gas service strikes.

7 near miss

incidents were also recorded.

Mitigating factors -

Service line plan information can be inaccurate, or line is unknown and/or

the line has no detection capability.

|

Work

organisation includes securing service line plans and site marking prior to

starting work (dial before you dig). Note: Older gas lines do not have a

detection capability.

Safe

systems of work item 3: underground and overhead services procedure in place.

An

educational programme from service providers started in July 2020.

|

|

Mobile plant

|

During

training the trainer was injured when the safety mode was not engaged

(digger).

|

Both the

trainer and trainee have been advised to ensure the safe mode is engaged when

the digger is not in use.

|

|

Powered hand tools/stationary plant

|

Incorrect

use of a hand tool resulted in injury to employee (router).

|

Employee

advised to use safe work practices.

|

|

Powered hand tools/stationary plant

|

While sawing tree and doing tree work, grit got into right eye and eye

became infected.

|

Safety

glasses were being used.

Saline

solution available in first aid kit.

Process

discussed with operator.

Explore use

of goggles.

|

|

Working at height

|

While

stepping backwards down a ladder the employee slipped and sprained his ankle

(3 step ladder).

|

Employees

reminded of the rules around ladder use and the importance of staying engaged

in the task.

|

|

Asset Failure

|

Employee

received an electric shock when she pushed the call button of the staff lift

on the second floor at the Library.

|

The lift

was isolated and service provider called to assess it.

Their service provider

advised the sanitiser spray residue is causing the problem. Direct

spraying has been stopped.

|

|

Members of the public (violence)

|

Customer

with knife threatened to attack staff member.

Customer on

premises with an axe.

|

Police

called, contact with appropriate agencies, security assessment occurred.

|

|

Members of the public (violence)

|

Seven other

threatening behaviour incidents.

|

Provision

of body camera, EAP/Vitae support and de-escalation training provided.

Reminder to

staff on processes for dealing with aggressive behaviour.

|

|

Members of the public (violence)

|

Armourguard

attended a noise complaint.

Security

officer received 3 stab wounds (not life threatening).

|

Property

placed on a dangerous property list requiring police presence if an END* is

being issued. Refresher training for all security officers on

assessing risk, adherence to operating procedures and PPE use and wearing

requirements, e.g. stab resistant protective vest, body camera and

high-viz.

|

*

Excessive noise direction

6. Annual

leave

The average annual leave balance

per staff member is 25.2 days (entitled plus accrued leave). This rose

during the Covid19 lockdown when staff did not take leave.

|

Jun 18

|

Sep 18

|

Dec 18

|

Mar 19

|

Jun 19

|

Sep 19

|

Dec 19

|

Mar 20

|

Jun 20

|

|

1556

|

1660

|

3287

|

2051

|

1884

|

1749

|

3006

|

1775

|

585

|

Total

days of annual leave taken over the quarter

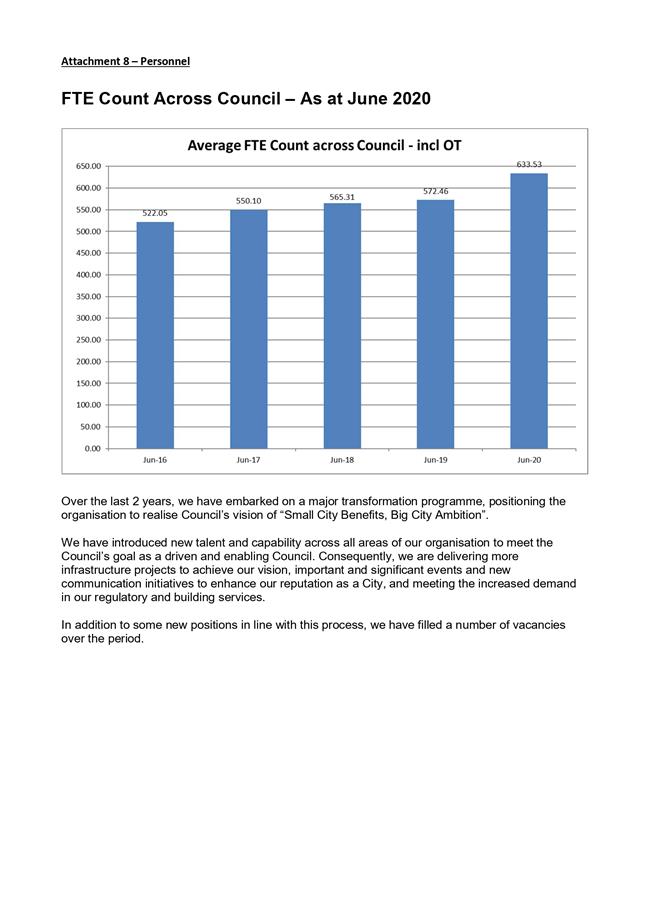

7. Turnover

Turnover for the quarter of permanent staff was 11 or 1.83%.

The annual turnover rate was 14.45%. Normally we measure employee

initiated turnover only which is 12.1%. Employee initiated turnover are

resignations and retirements. Our benchmark is 12% which ensures that we

have enough turnover to refresh the organisation.

|

Date

|

Jun 18

|

Sep 18

|

Dec 18

|

Mar 19

|

Jun 19

|

Sep 19

|

Dec 19

|

Mar 20

|

Jun 20

|

|

Employee

Initiated

|

11

|

12

|

20

|

15

|

11

|

19

|

19

|

26

|

9

|

|

Other

|

0

|

0

|

11

|

3

|

5

|

8

|

2

|

2

|

2

|

The attachment is the H&S

Dashboard for the quarter that is discussed at H&S committees.

8. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current Annual

Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 5: A Driven and Enabling Council

|

|

The recommendations contribute

to the outcomes of the Driven and Enabling Council Strategy

|

|

The recommendations contribute

to the achievement of action/actions in Not Applicable

The action is: Providing a safe

and healthy workplace

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

Providing a safe and healthy

workplace

|

|

|

|

Attachments

|

1.

|

H&S Dashboard June 2020 ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 19

August 2020

TITLE: S17A

Review of Economic Development

Presented By: Sheryl

Bryant, General Manager - Strategy & Planning

APPROVED BY: Heather

Shotter, Chief Executive

|

RECOMMENDATION TO Council

1. That Council

undertake a Section 17A review under the Local Government Act 2002 of

Economic Development and that an unbudgeted expense of $15,000 be approved

for the review.

|

1. ISSUE

Primarily

budget provision is being sought to undertake a review of economic development

activities.

2. BACKGROUND

Under the Local Government Act 2002, Section 17A, the

Council is required to “review the

cost-effectiveness of current arrangements for meeting the needs of communities

within its district or region for good-quality local infrastructure, local

public services, and performance of regulatory functions.”

In this case, it is to be no

later than every 6 years. CEDA was established to deliver economic

development activities for Palmerston North City Council and Manawatu District

Council and started operating 1 September 2016.

The Joint Strategic Planning

Committee, in a workshop setting, has requested that a S17A review be

undertaken in the lead up to the Long Term Plan and before the expiry of the

current contract with CEDA, being 30 June 2021. This report will formalise

that request as well as seek funding to undertake the review.

Officers have developed terms

of reference for the review based on the provisions of S17A and sought

proposals to undertake the review.

No budget provision has been

made to undertake this review. Any costs will be shared between Manawatu

District and Palmerston North City Councils equally.

3. NEXT

STEPS

Once approved, the review can

progress. The review will be reported back to the Joint Strategic

Planning Committee with any recommendations being referred to each Council.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

Yes

|

|

The recommendations contribute

to Goal 5: A Driven and Enabling Council

|

|

The recommendations contribute

to the outcomes of the Driven and Enabling Council Strategy

|

|

The recommendations contribute

to the achievement of action/actions in Not Applicable

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

Section 17 A reviews are a

requirement under the Local Government Act 2002.

|

|

|

|

Attachments

|

1.

|

Extract Local Government Act 2002 Section 17A ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Report

TO: Finance

& Audit Committee

MEETING DATE: 19

August 2020

TITLE: Reserve

land acquisition - unbudgeted proposals - Whakarongo Lagoon and Greens Road

PRESENTED BY: Kathy

Dever-Tod, Manager - Parks and Reserves

APPROVED BY: Tom

Williams, Chief Infrastructure Officer

|

RECOMMENDATIONS TO Council

1. That the

report entitled ‘Reserve land acquisition – unbudgeted proposals

– Whakarongo Lagoon and Greens Road’ presented to the Finance

& Audit Committee on 19 August 2020, be received.

2. That

Council approve acquisition of approximately 3,300m2 of part of

Lot 1 DP 467810, east of the Whakarongo Lagoon, from the Etheridge family,

noting that new operational funding of $10,000 per year for three years, and

$8,000 per annum thereafter, will be required to maintain this land.

3. That

subject to acquisition of the Whakarongo land being approved, Council approve

utilisation of Programme 144 Urban Growth – Whakarongo – Reserve

Land Purchase in the 2020/21 financial year to fund costs associated with the

land acquisition, which are estimated to be $10,000.

4. That

Council approve acquisition of approximately 1.19ha, being part of Lot

1 DP 541201, adjacent to Greens Road, noting that new operational

funding of $1,600 per annum will be required to maintain the land.

5. That

subject to acquisition of the Greens Road land being approved, Council

approve unbudgeted expenditure of up to $27,000 in the 2020/21 financial year

to purchase the property.

6. That

Council note that operational costs associated with land acquisitions

approved by Council, as part of report entitled ‘Reserve land

acquisition – unbudgeted proposals – Whakarongo Lagoon and Greens

Road’, will be added to existing operating budgets as part of the

development of the draft 2021/31 Ten Year Plan.

|

Summary of options analysis for

|

Problem or Opportunity

|

Two opportunities have arisen to acquire approximately

1.52ha of additional reserve areas, which would complement the existing

reserve and walkways networks.

The owners of 3,300m2 of escarpment

associated with the Whakarongo Lagoon are proposing to gift it to

Council. Council needs to decide if it accepts the costs associated

with acquiring and maintaining the land that is proposed to be gifted.

The owners of land adjacent to Greens Road are

proposing to grant Council an easement over or sell approximately 1.19ha of

land alongside the Greens Road boundary of their property. This would

make the current temporary off-road path, constructed to improve pedestrian

safety during the windfarm development, a permanent feature. Council

needs to decide if the costs associated with acquiring and maintaining this

easement are acceptable.

|

|

Whakarongo Lagoon escarpment extension

|

|

OPTION 1:

|

Accept the gift of approximately 3,300m2

of land, to be part of the Whakarongo Lagoon.

|

|

Community Views

|

Rangitāne o Manawatū are supportive of the

land being added to the Whakarongo Lagoon area and restored.

The general community has not been consulted.

|

|

Benefits

|

A larger ecological restoration area supporting

biodiversity of flora and fauna will be available. This assists with

restoring the mauri of the Whakarongo Lagoon. There would be a

consistent terrace and lagoon management approach.

|

|

Risks

|

Pest management and restoration planting costs more

than estimated.

|

|

Financial

|

$10,000 subdivision and acquisition costs using budget

from Programme 144 Urban Growth – Whakarongo – Reserve Land

Purchase.

$5,000 fencing capital costs covered within Programme

95.

$1,000 one-off unbudgeted operational cost to relocate

a pohutukawa tree.

$10,000 per year unbudgeted operational costs, for

three years, for plant pest control, planting and general maintenance and

$8,000 per annum thereafter.

|

|

OPTION 2:

|

Decline the gift of approximately 3,300m2

land to be part of the Whakarongo Lagoon.

|

|

Community Views

|

Rangitāne o Manawatū are supportive of the

land acquisition.

The general community has not been consulted.

|

|

Benefits

|

Declining the proposal avoids unbudgeted capital and

operating costs.

|

|

Risks

|

Any future owner of the escarpment may not undertake

planting and animal pest control. This would negatively impact on the

aesthetics of the area.

|

|

Financial

|

There are no financial implications associated with

declining the proposal.

|

|

Greens Road pedestrian easement

|

|

OPTION 1:

|

Approve the creation of an easement approximately

1km long, over property Lot 1 DP 541201, adjacent to Greens Road to enable

off-road walking and running to continue.

|

|

Community Views

|

The local Te Araroa Trail Committee support the

proposed easement. Te Araroa Manawatu Trust has an ongoing objective to move

more of the trail off the road.

The owners of Greens Estate support this proposal as

contributing to their future vision for their property.

The general community has not been consulted on the

proposal.

|

|

Benefits

|

Improves safety by keeping walkers, runners and Te

Araroa hikers off the road for approximately 1km.

Adds approximately 1.5ha of biodiversity planting

opportunities.

|

|

Risks

|

If the Te Araroa Trail was diverted to another route

in the future, the benefits would be reduced.

Walkers and runners may choose to use the road anyway.

|

|

Financial

|

$19,239 in unbudgeted legal and easement purchase

costs.

$33,750 fencing and minor upgrade costs covered within

Programme 95.

$1,600 per year unbudgeted operational maintenance

costs.

|

|

OPTION 2:

|

Approve the purchase of a strip of land 1km long on

the property, Lot 1 DP 541201, adjacent to Greens Road to enable walking and

running access to remain off the road.

|

|

Community Views

|

The local Te Araroa Trail Committee support the

proposed easement. Te Araroa Manawatu Trust has an ongoing objective to move

more of the trail off the road.

The owners of Greens Estate support this proposal as

contributing to their future vision for their property.

The general community has not been consulted on the

proposal.

|

|

Benefits

|

Improves safety by keeping walkers, runners and Te

Araroa hikers off the road for approximately 1km.

Adds approximately 1.5ha of biodiversity planting

opportunities.

Purchasing the land provides greater control and less

risk for future public use.

|

|

Risks

|

If the Te Araroa trail was diverted to another route

in the future, the benefits would be reduced.

Walkers and runners may choose to use the road anyway.

|

|

Financial

|

$26,825 in unbudgeted legal and land purchase costs.

$33,750 fencing and minor upgrade costs covered within

Programme 95.

Operational costs - $1,600 per year additional

maintenance.

|

|

OPTION 3:

|

Decline the creation of an easement or purchase of

approximately 1km long on property, Lot 1 DP 541201, adjacent to Greens Road

to enable walking and running access to remain off the road.

|

|

Community Views

|

The local Te Araroa Trail Committee support the

proposed easement.

The general community has not been consulted as part

of the proposal development.

|

|

Benefits

|

No unbudgeted capital and operational expenditure.

|

|

Risks

|

The opportunity for improving the safety and

experience of Te Araroa and community walkers for this section of road may

not arise again.

|

|

Financial

|

No effect on existing budgets.

|

Rationale for the recommendations

1. Overview

of the problem or opportunity

1.1 Council

has two opportunities to enhance the recreational and ecological environments

that have not been planned or budgeted for in the current financial year.

1.2 The

opportunity to accept a gift of approximately 3,300m2 of escarpment

associated with the Whakarongo Lagoon and connected to James Line, which comes

with associated costs.

1.3 The

opportunity to create an easement on, or purchase of, land adjacent to Greens

Road, at the Kahuterawa Road end, allowing walkers and runners to remain off

the road. This also comes with associated costs.

1.4 This

report seeks Council direction on whether to accept or decline these proposals.

2. Background

and previous council decisions

2.1 Whakarongo

Lagoon escarpment extension

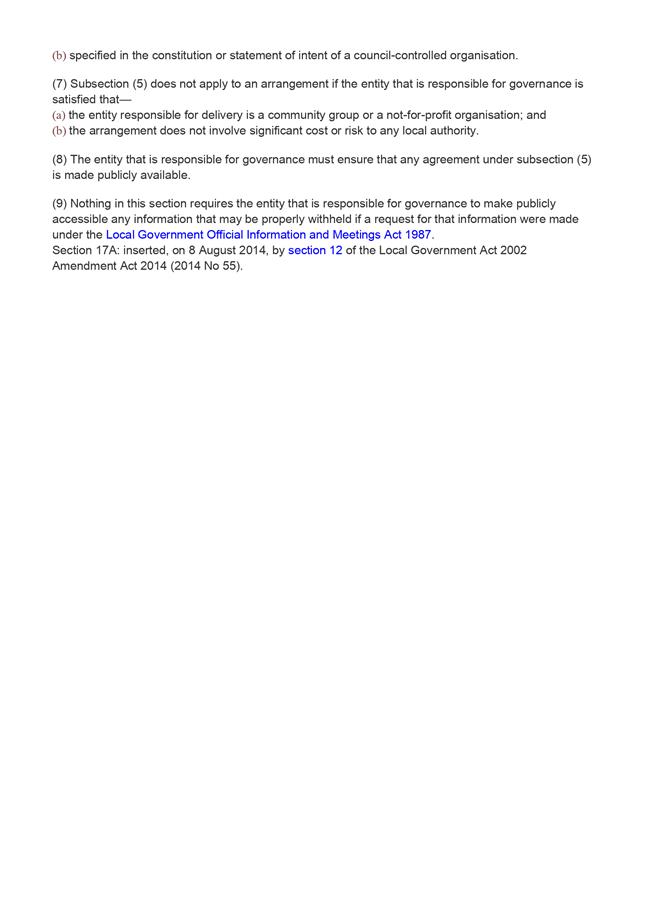

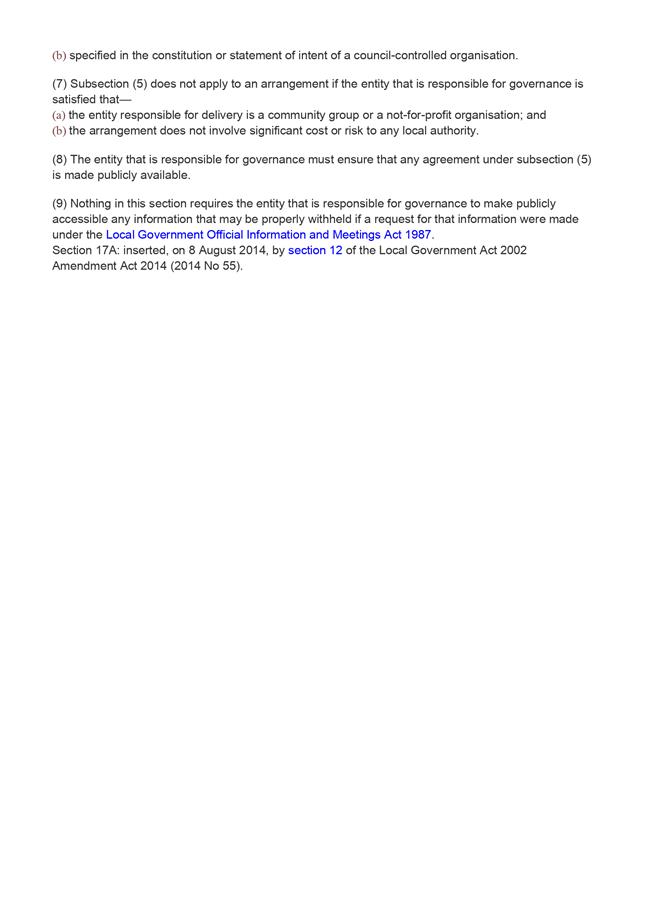

2.1.1 Whakarongo

Lagoon and the associated escarpment sits within the Napier Road Residential

area as shown in Map 7.5, Section 7, of the District Plan – refer Figure

One.

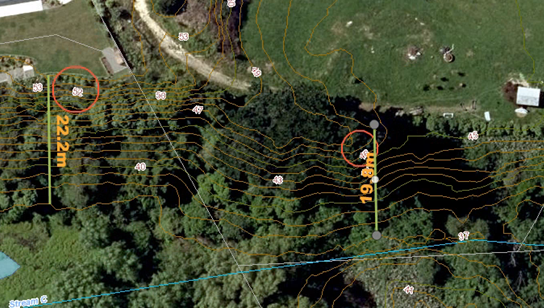

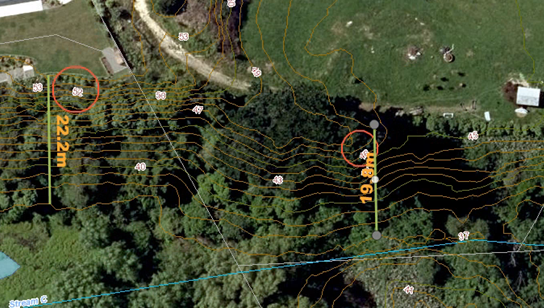

Figure One: Whakarongo Lagoon and Etheridge

property

2.1.2 Residential

development in the area is underway.

2.1.3 The developer

is required to undertake restoration works on the Whakarongo Lagoon and

escarpment before vesting these with Council.

2.1.4 Officers

identified that there will be a potential disjoint with the restoration of the

Lagoon/escarpment and the management of the escarpment in private ownership to

the immediate east of the Whakarongo Lagoon. This property is owned by the

Etheridges, as shown in Figure One.

2.2 Greens

Road pedestrian easement or purchase

2.2.1 Greens Road

forms part of a popular recreational loop used by walkers, runners, cyclists

and horse riders. Greens Road connects the top end of Turitea Road to

Kahuterawa Road via a 1.5km section closed to vehicle traffic since the

1990s.

2.2.2 Greens Road is

also part of the Te Araroa Trail. The Te Araroa route south from

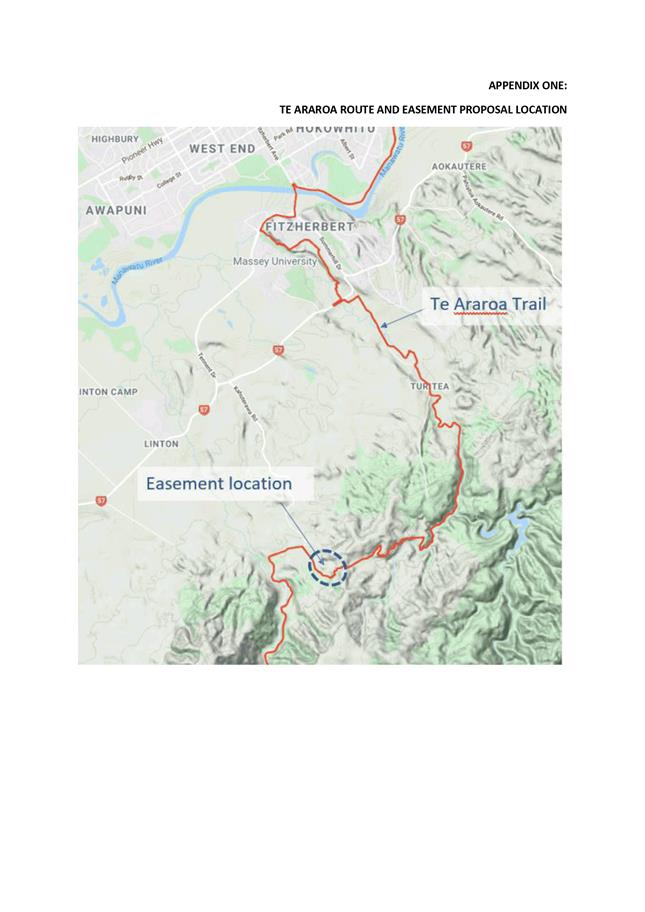

Palmerston North, is shown in Appendix One.

2.2.3 Over the years

Council has supported enhancements to the Te Araroa Trail, which also support

local walking and running, through the city with projects such as:

- Up

to 2006, working with the Te Araroa Manawatu Trust to establish the route;

- 2017

Turitea Green Corridor bridge over Turitea Stream $40,000;

- 2019

Moturimu Whare and toilet at Gordon Kear Forest $50,000;

- 2020

off-road path to take walkers off the Turitea Road escarpment bends $70,000

2.2.4 The landowner

adjacent to Greens Road was approached by Electrix and Mercury to facilitate a

safe off-road option for cyclists and walkers via his property during the

construction of the Turitea Wind Farm. Contours proved difficult for cyclists,

but a walking option was feasible.

2.2.5 An off-road

walking route, marked with poles, was created as an alternative for Te Araroa

hikers as the Turitea Wind farm construction commenced during the summer of

2019/20.

2.2.6 Mercury and the

landowner funded construction of several stiles and small boardwalks over

streams and swamps. The Te Araroa Manawatu Trust funded and installed a picnic

table. The route was well used by Te Araroa hikers and runners during the

summer, reducing on-road conflict with vehicles and tree felling contractors.

2.2.7 The property

owner, Brad Nieunkoop, is developing the property as a boutique downhill

mountain bike venue with longer term aspirations to provide accommodation for

users of Arapuke Mountain Bike Park and Te Araroa hikers. He views the

hiker/runner use of the proposed easement or land sale as an enhancement to the

vision for his property and the district.

2.2.8 The upgrade of

the road for windfarm construction access has likely resulted in higher

operating speeds for general traffic as the road has been widened and sealed.

3. Description

of options

3.1 Whakarongo

Lagoon escarpment extension

3.1.1 Council

officers approached the owners to ascertain their intentions for the land

including whether they would consider sale to Council.

3.2 The

owners of the property, Leonie and Roderick Etheridge, were not only receptive

to the idea but were considering subdividing their property for sale.

They are bird enthusiasts and wished to see the retention of the escarpment in

a reserve.

3.3 Since

discussions with the Etheridges, the property has been placed on the

market. It is advertised for sale with the caveat that the owners are

currently negotiating possible vesting of a portion of the land with

Council.

3.4 The

Etheridges are aware that a decision of Council is required regarding the

vesting of the land, and have asked that this be given some urgency in order to

give surety to potential purchasers of their property.

3.4.1 Option One:

Accept the gift of approximately 3,300m2 land, to become part of

the Whakarongo Lagoon.

3.4.2 The donation

would be executed though a sale and purchase agreement with a sale price of $1.

3.4.3 The approximate

area is shown in Figure Two. The actual area gifted would be subject to survey

and agreement.

Figure Two:

Approximate area of escarpment proposed to be accepted

3.4.4 The area forms

part of the margins of the Whakarongo Lagoon to the east, being the slope

between the terrace and the road being formed as part of the residential

development. Accepting the gifted land would essentially extend the Whakarongo

Lagoon area.

3.4.5 The proposed

area comprises a variously sloped bank/terrace area and is heavily vegetated as

shown in Figures Three and Four.

3.4.6 Work on

planting and pest control would be required to progressively bring it up to the

same standard as the restored Whakarongo Lagoon.

Figure Three: View of escarpment

Figure Four: Close view of escarpment

3.4.7 The Etheridges

are keen bird enthusiasts and follow the roosting habits of the birds in large

trees located on the land proposed to be gifted. They wish to ensure

trees are not removed unnecessarily.

3.4.8 A ten to

twelve-year-old, 3.5m tall pohutukawa tree is considered particularly special

by the Etheridges. It is situated in an awkward location in relation to the

land proposed to be gifted, as shown in Figure Five.

3.4.9 A cul-de-sac of

land would be created to retain it in its present location. The maintenance

costs and the potential for issues with the neighbours when the tree matures

means it would be better to relocate the tree than amend the land boundary to

include it. The cost to relocate the tree to the Whakarongo walkway

linking James Line and the Whakarongo School, is estimated at $1,000.

Figure Five: View of escarpment

3.4.10 Proposed conditions of the

gifting of the land include:

· That

the ten to twelve-year-old pohutukawa tree on the property which is being sold

into private ownership be relocated to a Council park.

· That

the land be retained by Council as a reserve in perpetuity.

· That

the large trees on the land being gifted, both exotic and native, be retained

until such time as they either naturally die, are assessed by a suitably

qualified person as being a danger to people or property, or be negotiated for

removal (in writing) with the Etheridges on a case-by-case basis.

3.4.11 Option Two: Decline

the gift of approximately 3,300m2 land to be part of the Whakarongo

Lagoon.

3.5 Greens

Road pedestrian easement/purchase

3.5.1 The owners

identified that this temporary safety arrangement could be made permanent, benefiting

recreation users and local community in the area. They approached Council

officers to consider an easement or sale proposal.

3.6 Option

One: Approve the creation of an easement approximately 1km long on

property, Lot 1 DP 541201, adjacent to Greens Road to enable walking and

running access to remain off the road.

3.6.1 Under Option

One Council would acquire a permanent easement permitting pedestrian access for

approximately 1 km along the private land adjacent to Greens Road shown in

Figure Six.

Figure Six: Extent of proposed Greens Road

pedestrian access length

3.6.2 The easement

would vary in width following the existing temporary off-road path varying from

3 to 20m wide. A view of the easement corridor is shown in Figure Seven.

Figure Seven: Easement location – view from top of

the hill easement path follows the road boundary to the shed visible in the mid

right of the photo

3.6.3 Council would

fence the inside boundary of the easement. Future fence maintenance costs for

the inner easement boundary would be shared 50/50, ie. the inside boundary

fence of the easement would essentially form the new boundary fence of the

useable property.

3.6.4 The existing

property boundary fence could be left to deteriorate as the easement walkway

matures and revegetate as a native roadside boarder.

3.7 Option

Two: Purchase the land and own it outright.

3.7.1 Option Two has

the same general features as Option One. Instead of securing an easement

Council would purchase the land outright.

3.7.2 Under the

purchase option there is one location at which the current owner would require

an easement across the purchased land for a potential access to his adjoining

land. This is not seen as an issue for the walking/hiking activities.

3.8 Option

Three: Decline the creation of an easement/land purchase

approximately 1km long on property, Lot 1 DP 541201, adjacent to Greens Road to

enable walking and running access off the road.

3.9 This

option would forego the recreation and safety benefits and save Council the

unbudgeted acquisition, fencing and maintenance costs.

4. Analysis

of options

4.1 Whakarongo

Lagoon escarpment extension

4.1.1 The costs and

benefits of the Whakarongo Lagoon escarpment extension proposal are contained

in Table One.

|

Costs

|

Benefits

|

|

Acquisition Costs – up to $10,000

- Subdivision

including survey costs, consent and title up to $8,000

- Legal

fees up to $2,000

|

- Larger

ecological restoration area supporting biodiversity of flora and fauna

– supporting the Biodiversity Plan purpose

- Assists

restoring the mauri of the Whakarongo Lagoon, which Rangitāne o

Manawatū support

- Allows

a consistent terrace and lagoon reserve management approach avoiding any

confusion from the public about ownership and management boundaries

|

|

Capital Development Cost - $5,000

- Fencing

(deer fence style) $5,000

|

|

Operating costs - $10,000 per year

- $1,000

expenditure in 2020/2021 to relocate the pohutukawa

- $10,000

a year for three years for planting, plant and animal pest control, tree,

fence and general maintenance. $8,000 a year thereafter

|

Table One: Whakarongo Lagoon escarpment

extension costs and benefits

4.1.2 The risks are:

- The cost of

plant pest removal and restoration planting being higher than estimated.

- No detailed

assessment of the escarpment bank stability has been undertaken. The bank

appeared stable and well vegetated during a recent site visit. There are

no adjacent hard surfaces draining to the bank, which may accelerate erosion.

The contour, at its midpoint, is six metres lower than the Whakarongo Lagoon

escarpment and is less steep as shown in Figure Eight. The bank stability risk

is considered to be very low and can be managed through maintaining vegetation

cover or specialised assessment for any proposed works.

Figure Eight: Contour comparison

4.2 Greens

Road pedestrian easement or purchase

4.3 The

costs and benefits of the Greens Road pedestrian easement or purchase proposal

are similar. The differences are:

- The cost of

buying the land is approximately $7,000 more than acquiring an easement.

- The benefits

of purchase are the rights of outright ownership reducing the risk of

negotiations and conflicts between the easement rights and land owners

activities.

4.4 Table

Two details the costs and benefits of the options.

|

Costs

|

Benefits

|

|

Acquisition Costs – Option 1 $20,000 for an

easement, or Option 2 $27,000 to purchase

- Option

1: Easement purchase valuation is $15,589. Easement creation costs

$4,000. Total $19,589

- Option

2: Purchase land freehold land valuation $20,825, plus $6,000 in survey

and legal fees. Total $26,825

|

- Improves Te Araroa Trail

quality and safety

- Provides additional

biodiversity enhancement opportunities

- Improves walker/runner safety

|

|

Capital Development Cost - $34,000

Both

options would incur capital costs of:

- Minor

improvements to track $10,000

- Fencing

950m at $25 = $23,750

|

|

Operating costs - $1,600

Both

options would incur operational costs of:

- Track

maintenance and clearance - one person for four days per year

- 50%

of boundary fence maintenance

|

Table Two: Greens Road costs and benefits

4.5 The

risks are:

- That the

initial trail is proposed to be a grass track as is being used during the

windfarm construction. There is a risk over time that an increased level

of service might be desired, costing more.

- That hikers

may choose to walk down the road as the contours and footing would make walking

easier.

- That if the

route of the Te Araroa Trail were to change in the future, the demand/use level

would reduce.

5. Financial

5.1 Acquisition

Costs

5.1.1 Programme 144

Urban Growth – Whakarongo – Reserve Land Purchase sets aside

$659,000 for reserve purchases in the Whakarongo area. Whether the budget

is fully subscribed will depend on subdivision progress and final reserve

costs. It is likely the $10,000 cost of the Whakarongo Lagoon escarpment

extension can be accommodated in this budget.

5.1.2 Programme

94, Walkways and Shared Path – Purchase of Land to Extend Network

contains $102,000 in the 2020/21 Annual Budget. The following purchases are

expected to utilise all of available budget.

- Moonshine

Valley Road to Polson Hill Drive walkway connection

- Mangaone

Stream Esplanade Reserve

5.1.3 The cost

including fees of creating and acquiring the easement, or alternatively

purchasing the land at Greens Road, cannot be accommodated within any

appropriate existing budget and would require new borrowing.

5.2 Development

costs

5.3 Programme

95, Walkways and Shared Path – Construction, has a budget of $72,000 in

2020/21. The following works are planned:

- McCraes

Bush Bridge $10,000

- Moonshine to

Polson fencing $20,000

5.4 The

fencing costs of the Whakarongo Lagoon Escarpment of $5,000 and the fencing and

development costs of the Greens Road easement of $33,750, can be accommodated

within this year’s budget provision.

5.5 The

cost to move the pohutukawa tree can be accommodated within the existing parks

tree maintenance budget.

5.6 Operating

Costs

5.6.1 There is no

provision in the existing operating budgets for these new reserve and walkway

opportunities.

5.6.2 If the

proposals were accepted, Council would be committing to additional operational

funding of $10,000 per year for three years, and $8,000 per annum thereafter

for the Whakarongo Lagoon escarpment and $1,600 per year for the Greens Road

easement or purchase. These additional operational costs would need to be

incorporated into operating budgets as part of the development of the Draft 2021/31

Ten Year Plan.

6. Conclusion

6.1 The

opportunities presented will allow for improvements to the ecology and

recreation in the Whakarongo Lagoon and Greens Road areas.

6.2 Purchasing

the 1.19ha of land at Greens Road provides greater control and reduces risks

than the option of an easement for a small increase in cost.

6.3 While

the development costs of fencing for both areas can be covered from Programme

95 and the acquisition costs for the Whakarongo Lagoon extension from

Whakarongo Urban Growth Land Purchases Programme 144, the Greens Road purchase

costs of $26,825 cannot be accommodated from existing budgets.

6.4 Additional

unbudgeted operational costs of $11,600 per year would be incurred from 2021/22

should the proposals be accepted, $10,000 per year at the Whakarongo Lagoon

site and $1,600 per year at Greens Road.

6.5 It

is recommended that both proposals be approved.

7. Next

actions

7.1 Complete

survey and sale and purchase processes.

8. Outline

of community engagement process

8.1 No

general community engagement has been undertaken or is proposed. Te

Araroa Manawatu Trust support the proposed Greens Road easement and

Rangitāne o Manawatū support both proposals.

Compliance and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 2: A Creative and Exciting City

The recommendations contribute

to Goal 4: An Eco City

|

|

The recommendations contribute

to the outcomes of the Creative and Liveable Strategy

The recommendations contribute

to the outcomes of the Eco City Strategy

|

|

The recommendations contribute

to the achievement of action/actions in the Active Community Plan

The recommendations contribute

to the achievement of action/actions in the Active Community Plan

The action is: Extend the

walking and cycling network, including completing and upgrading parts of the

existing network.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The opportunities to extend

the reserve area and recreational access provide opportunities to enhance the

biodiversity and recreational opportunities in the city.

|

|

|

|

Attachments

|

1.

|

Te Araroa route - southern Palmerston North ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 19

August 2020

TITLE: Whakarongo

Housing - Cashflow Analysis

Presented By: Stuart

McKinnon, Chief Financial Officer

APPROVED BY: Heather

Shotter, Chief Executive

|

RECOMMENDATION TO Finance & Audit Committee

1. That the

memorandum entitled ‘Whakarongo Housing – Cashflow

Analysis’ presented to the Finance & Audit Committee on 19 August

2020, be received for information.

|

1. ISSUE

1.1 A

report titled ‘Public Rental Housing within Council’s Whakarongo

Subdivision’ was presented to the Finance and Audit Committee on 17 June

2020.

1.2 The

Committee Resolved

That

further financial modelling be undertaken to include cashflow analysis of the

impact of retaining the sections vs. selling the Whakarongo subdivision

sections and to include any partnership options, and that this be reported back

to the August meeting of the Finance & Audit Committee.

1.3 This report is in

response to the resolution.

2. BACKGROUND

2.1 The

above report made a number of broad assumptions regarding the financial

implications of building public rental housing at the future Whakarongo

subdivision, however the Committee requested a cashflow analysis to gain

clarity on the financial impacts of such an investment.

2.2 Through

the Chair, clarification was sought as to the specifics of the above resolution

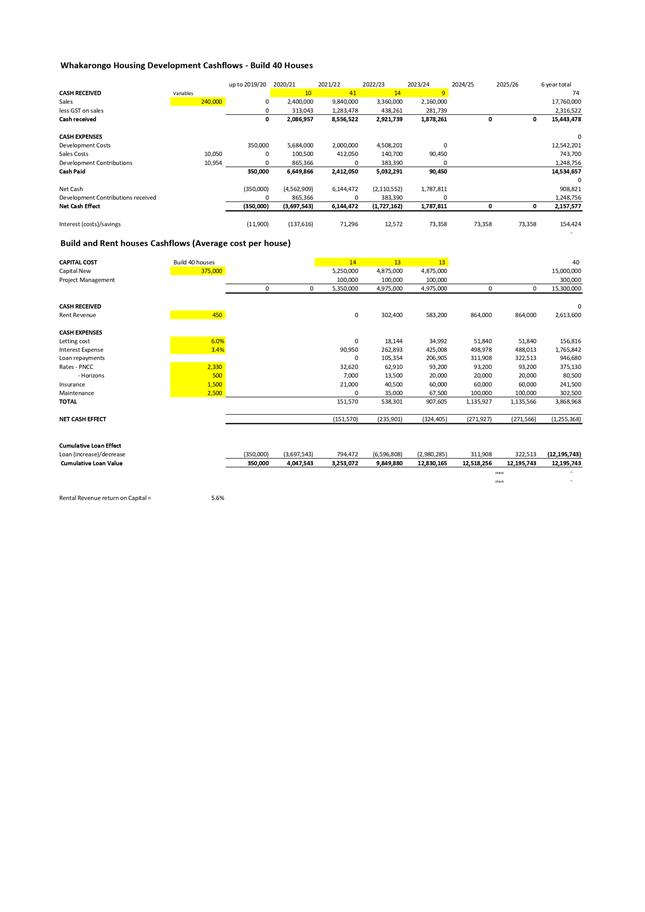

for which feedback was provided that this analysis should be based on 40 houses

being built, as opposed to the 26 discussed as part of the above report, and

that values used should be updated to reflect the best estimates available at

the time of writing.

2.3 A

number of assumptions have been made in preparing the analysis, and external

advice was sought. These include significant assumptions on variables such as

section sales price, rental incomes, cost of borrowing, the type of housing to

be built and cost of house construction. In the cashflow analysis these are

presented as average values for the purpose of the modelling. Exact values for

the elements above will be subject to market conditions and future decisions

regarding the subdivision.

2.4 The

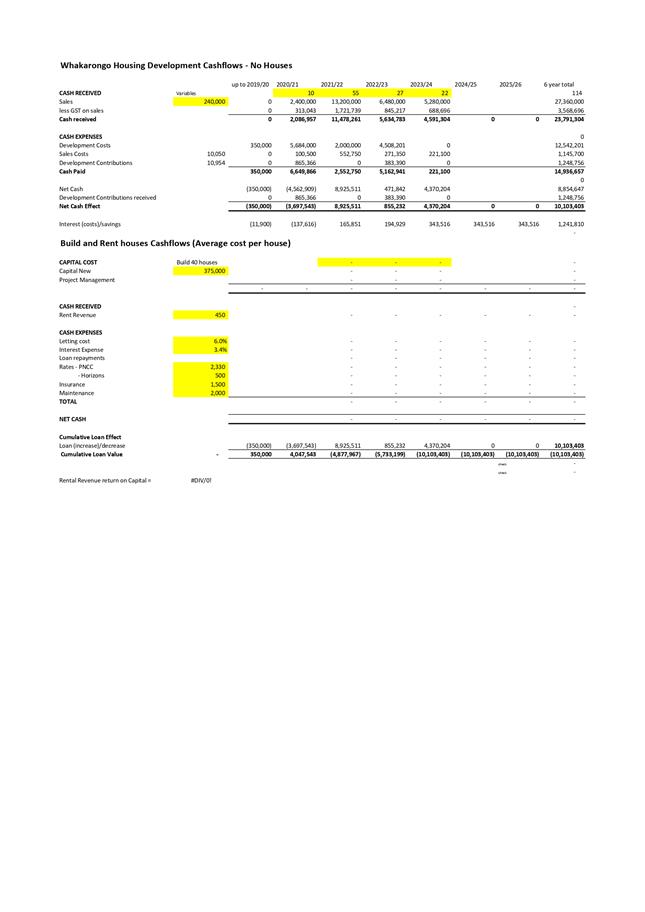

analysis presented as Appendix 1 makes the following assumptions:

- The

subdivision will get appropriate consents within the timeframes and that 114

sections will be available. Consent conditions will not result in significant

additional costs of development.

- A mix of two

and three bedroom options with an average build price of $375,000. (GST is not

claimable on residential house building of this nature, so this equates to

$326,086 excl GST). This advice was received from a reputable building company

that Council uses, and is the halfway point between $300k excl GST for two

bedroom properties and $350k excl GST for three bedroom properties.

- Development

costs based on a July 2020 assessment from Veros consultants, who are the

development team for the subdivision.

- An average

weekly rental of $450 per week, available for 48 weeks per annum to allow for

vacancies. This is based on advice from Property Market professionals and

averages at $400 per week for a two bedroom property and $500 per week for a 3

bedroom property.

- Section sale

price average of $240,000 (incl GST). This is advice received from several

Property Market professionals with whom we have engaged.

- The long-term

average cost of borrowing set at 3.4%.

- Retain houses

for 30 years, therefore a 30 year loan timeframe as per financial strategy.

- Timing of

section sales and year of building are estimates and may change.

2.5 The

cashflow impact of building houses as described above is shown in Appendix 2.

2.6 The

net impact on operating cashflows is a net cash deficit of $542k per annum when

all houses are built and tenanted. This is the combination of an annual $272k

cashflow deficit and the opportunity cost of a net $270k in interest savings if

no rental houses are built.

2.7 The

current Long Term Plan assumes that the subdivision will go ahead with all

sections being sold, resulting in a cash surplus of approximately $10m which is

currently budgeted to repay debt. Under the scenario presented in Appendix 1

where no houses are built $10.1m is available for debt repayment or as capacity

to complete further developments.

2.8 If

40 houses are built that would result in approximately $7.9m less net revenue

in sales, and an additional cost of construction of $15.3m. The net impact on

loans is an increase in debt of $23.2m over that assumed in the current Long

Term Plan.

2.9 Consideration

should be given to the effect this could have on Council’s capacity to

borrow, as one of the key challenges we are likely to face through the Long

Term Plan will be Council’s ability to fund future infrastructure needs.

2.10 In

summary, building 40 houses will add 23.2m to debt levels and require a rates

subsidy of $272k per annum to rent out. Officers suggest that if this is an

option Council would like to pursue, that further financial advice and analysis

be sought regarding the implications of this cost in light of other priorities

through the Long Term Plan and the overall financial position of Council.

2.11 As the

cashflow analysis is based on a large number of assumptions, some scenario

analysis is presented in Appendix 3. This presents the results under different

assumed scenarios such as land sale price, construction price, rental return

and interest rate assumptions.

Partnership Opportunities

2.12 The

original concept for development of the Whakarongo subdivision is based on

Council marketing and selling the sections to individual buyers, and current

demand for sections suggests that this could be successfully achieved.

Alternatively, there could be potential partnership opportunities, and

organisations who could be approached regarding the provision of houses at

Whakarongo. This needs to be explored further as Officers have not yet had the

opportunity to engage with potential partners.

2.13 Conceptual

strategies for partnership opportunities could be split into 3 broad

categories:

1. Building Companies – retaining as

rentals.

a. Council

provides the land, the building company builds the house, we have a 50/50 split

on the rental income and expenses.

2. Building Companies – house and land

packages to ensure houses are built.

a. Council

provides the land, the building company builds the house, house and land

packages sold to market, profit split 50/50.

3. Government Organisations.

a. Sections sold to government agencies who

build the houses themselves at their cost to rent and/or sell to their tenants.

b. Examples

could be Defence, Roading alliance, etc.

2.11 Council

Officers have engaged with a group builder to gauge the interest in options 1

and 2. Whilst this is only one opinion, it does provide some insight. There was

not much interest in option 1. This was deemed to be outside of their business

model and not something they were interested in engaging on. However, there was

some interest in option 2 and this has been done with other clients.

3. NEXT

STEPS

3.1 Council

to consider its options in respect to retaining 40 sections within the

Whakarongo subdivision and the building of public rental housing on these

sections.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current Annual

Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the outcomes of the City Development Strategy

|

|

The recommendations contribute

to the achievement of action/actions in the Housing and Future Development

Plan

The action is: Progress a

Council led housing development at Whakarongo.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

|

|

|

|

Attachments

|

1.

|

Cashflow Analsis - No Houses ⇩

|

|

|

2.

|

Cashflow Analysis - 40 Houses ⇩

|

|

|

3.

|

Scenario Analysis ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 19

August 2020

TITLE: Quarterly

Performance and Financial Report - Quarter Ending 30 June 2020

Presented By: Stuart

McKinnon, Chief Financial Officer and Andrew Boyle, Head of Community Planning

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

Sheryl Bryant, General Manager -

Strategy & Planning

|

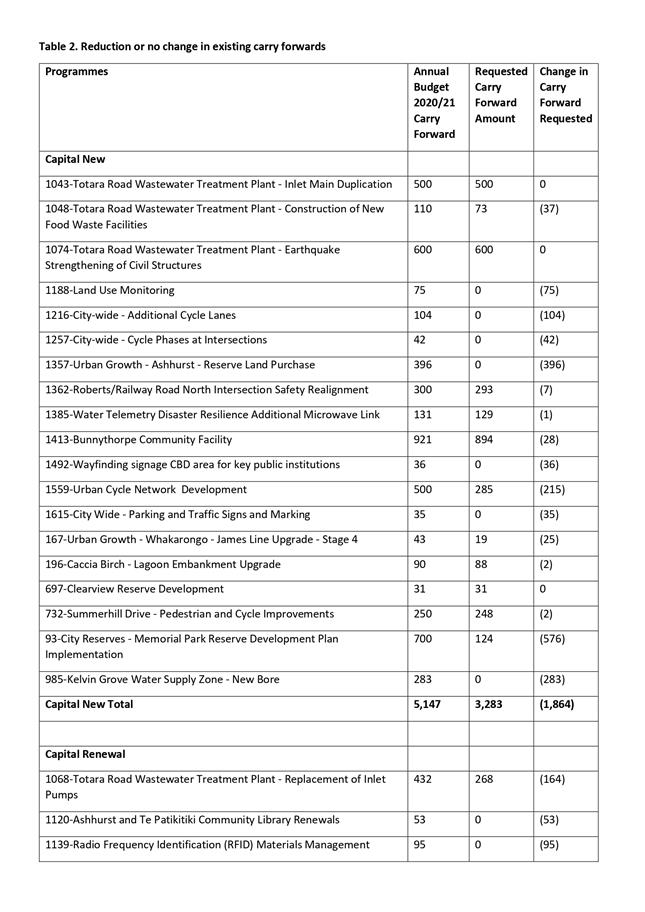

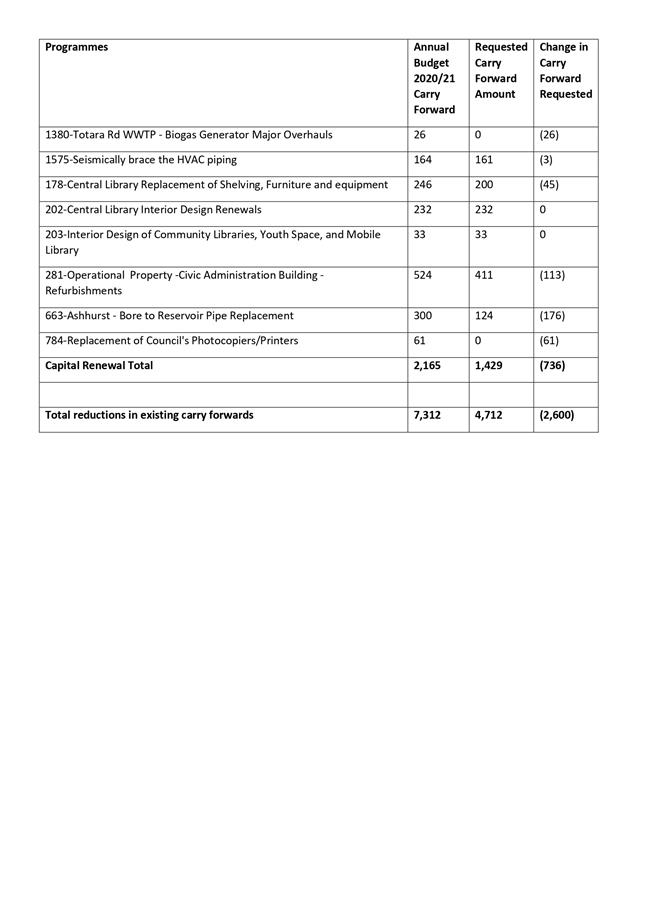

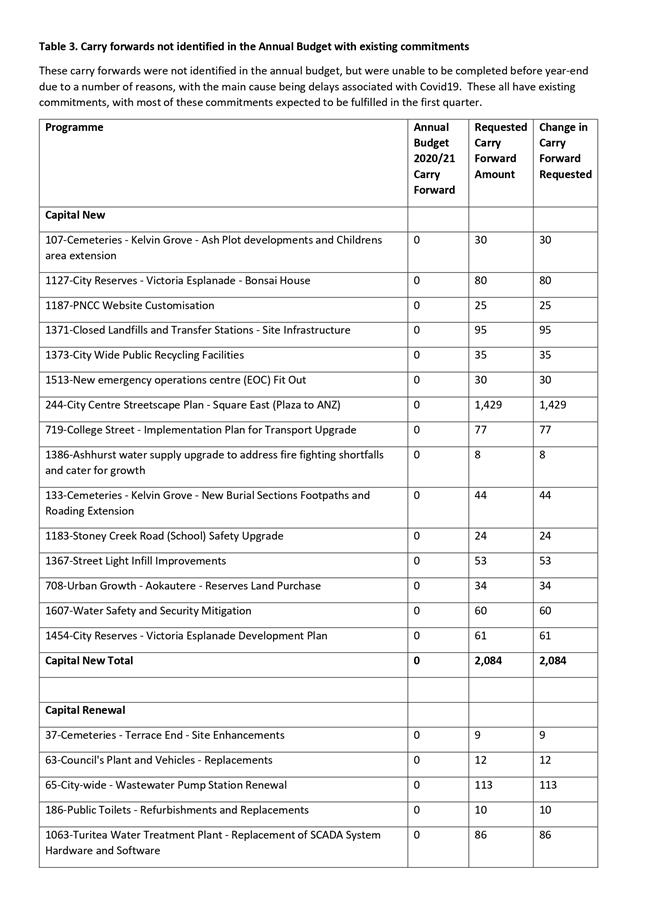

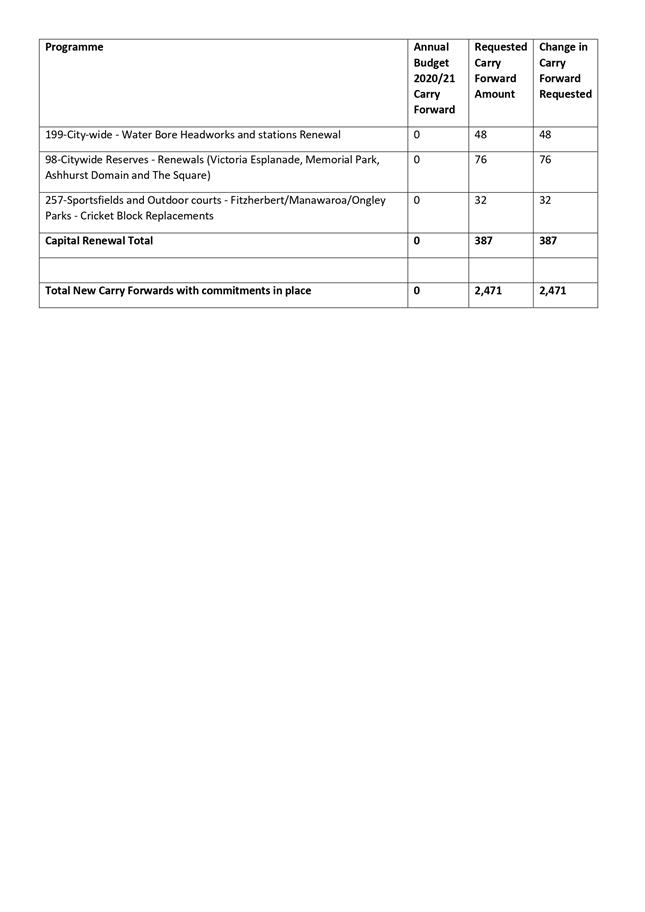

RECOMMENDATIONS TO Council

1. That the

memorandum entitled ‘Quarterly Performance and Financial Report –

Quarter Ending 30 June 2020’ presented to the Finance & Audit

Committee on 19 August 2020 be received, and that Council note the following:

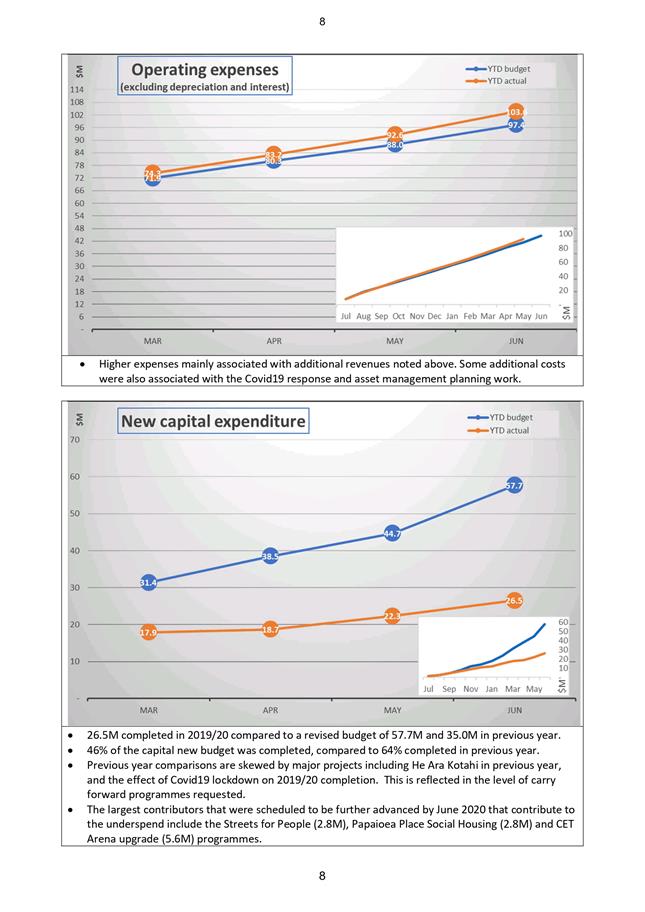

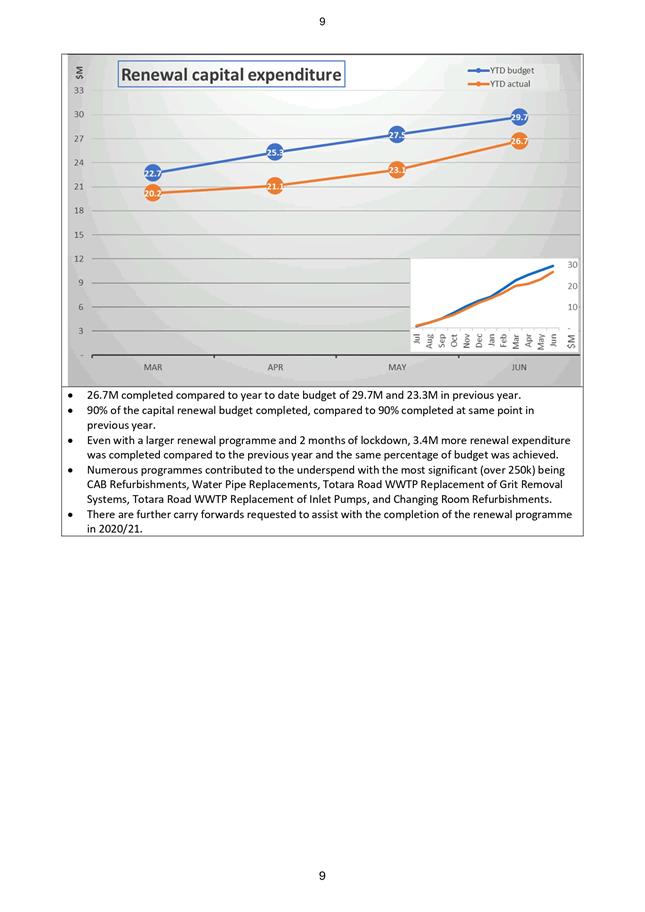

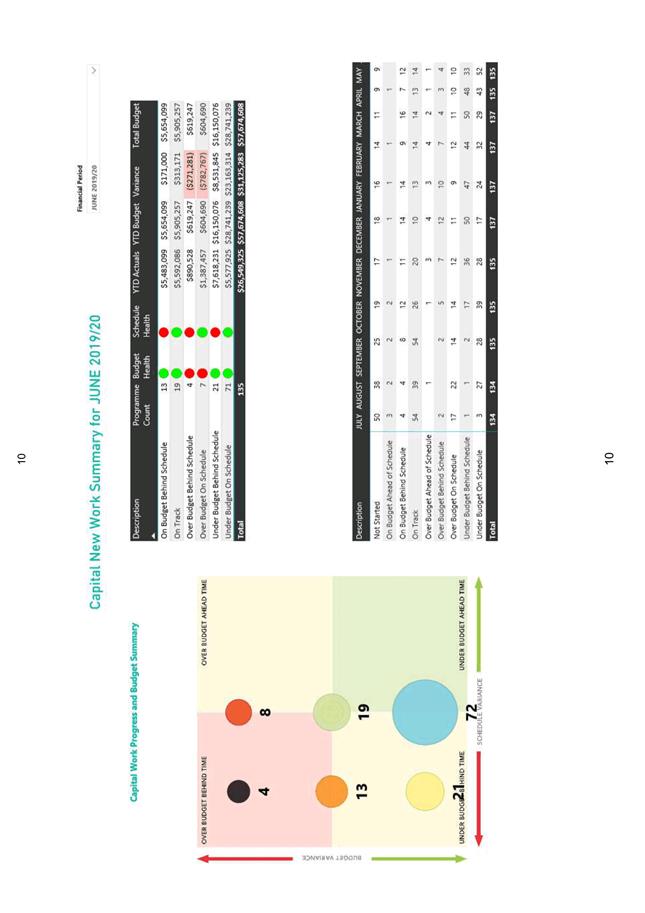

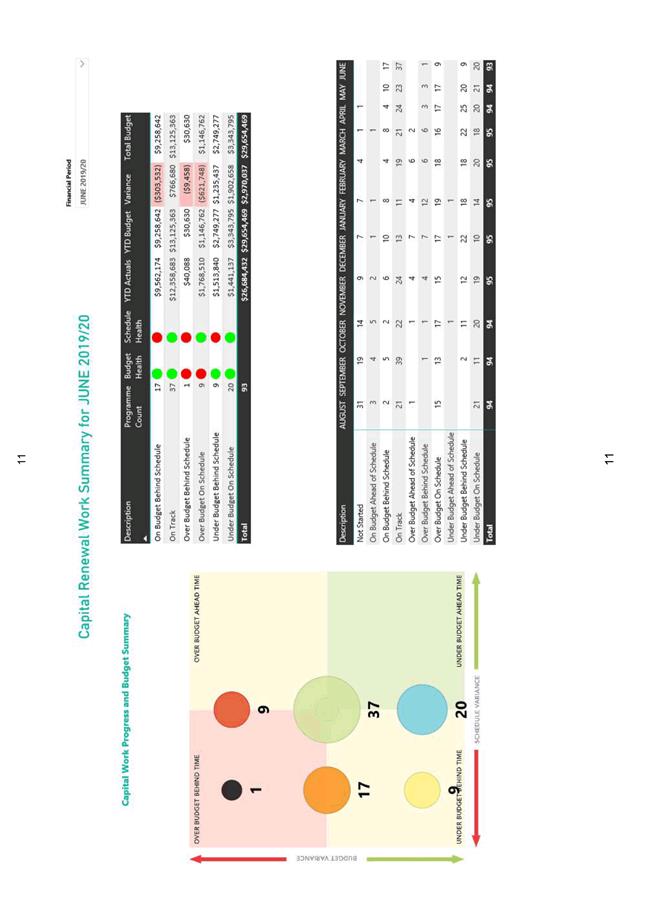

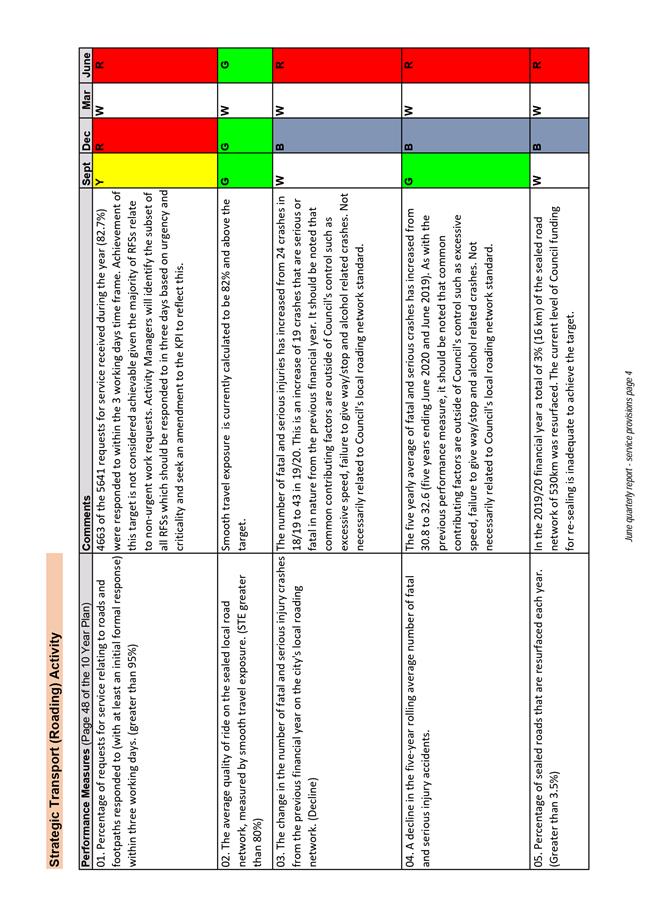

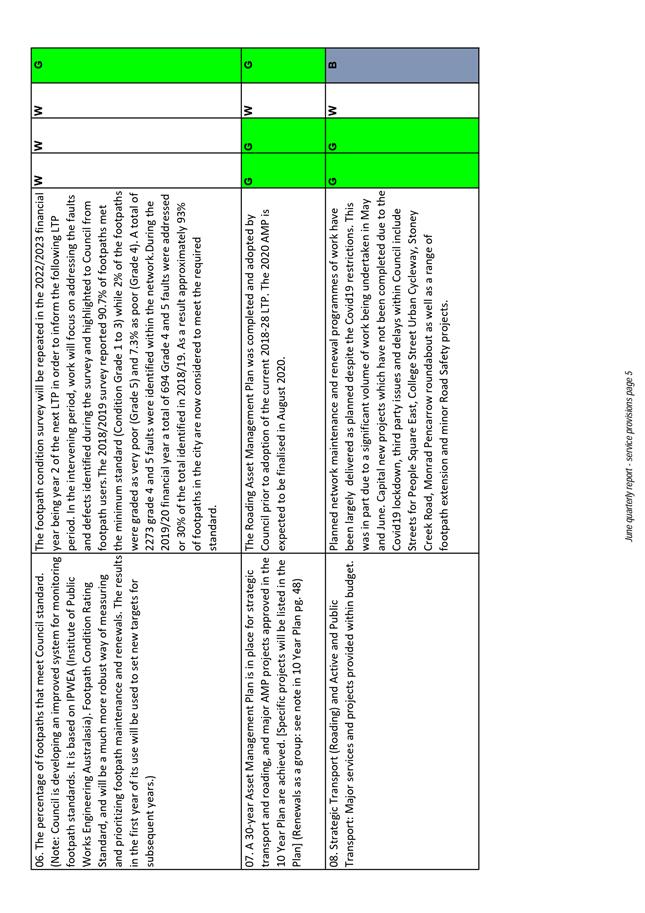

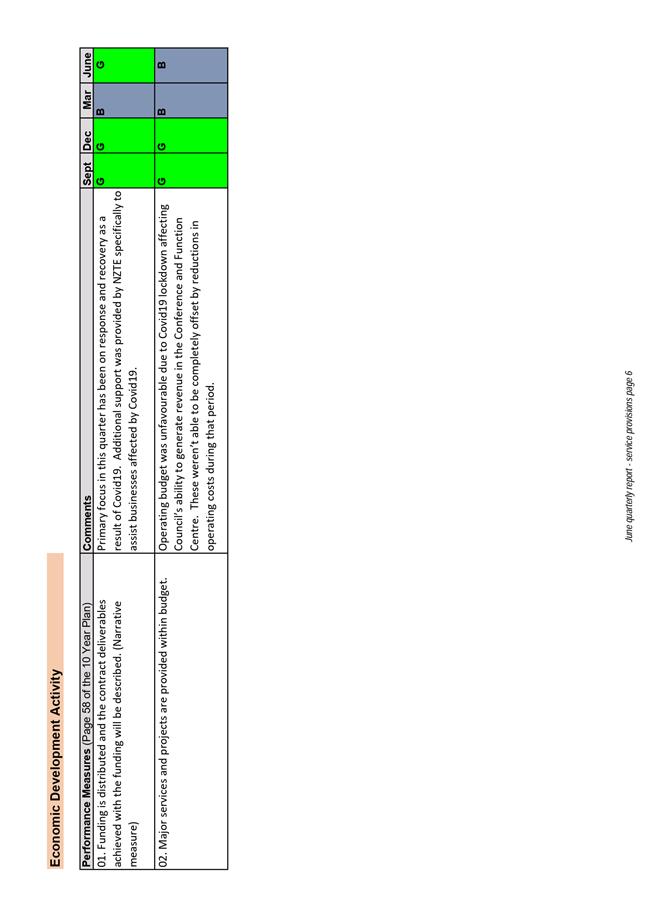

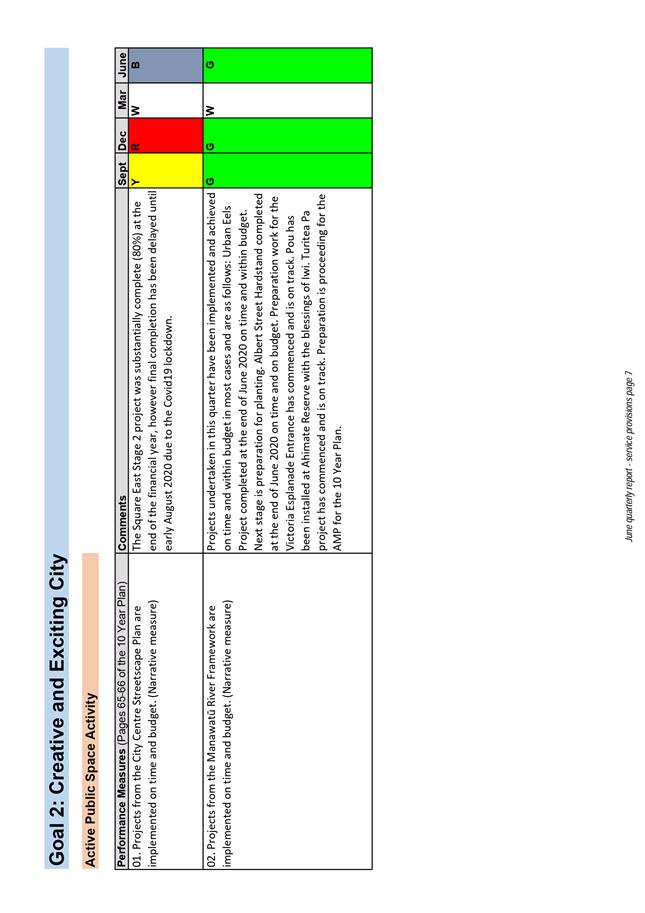

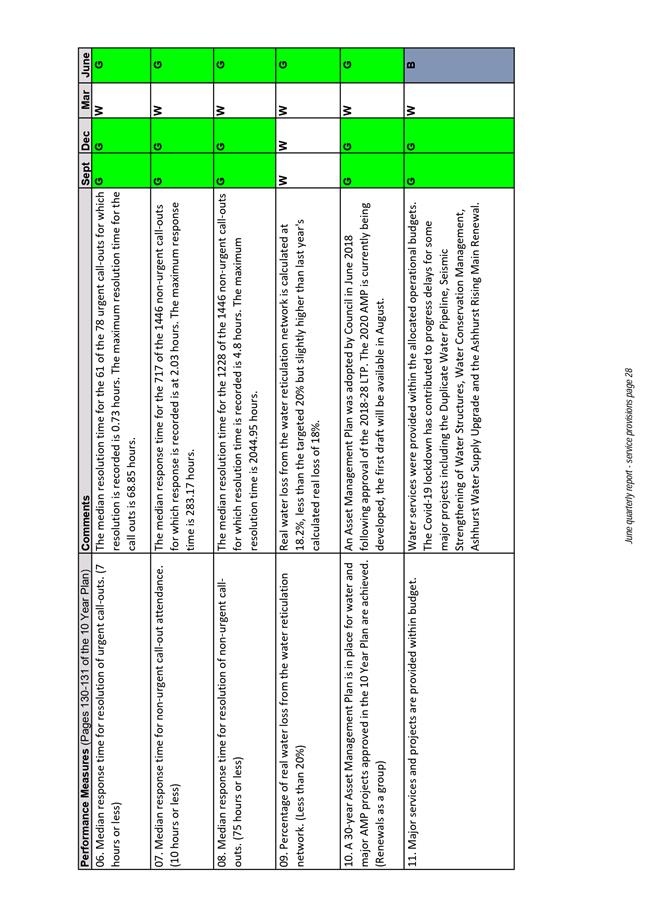

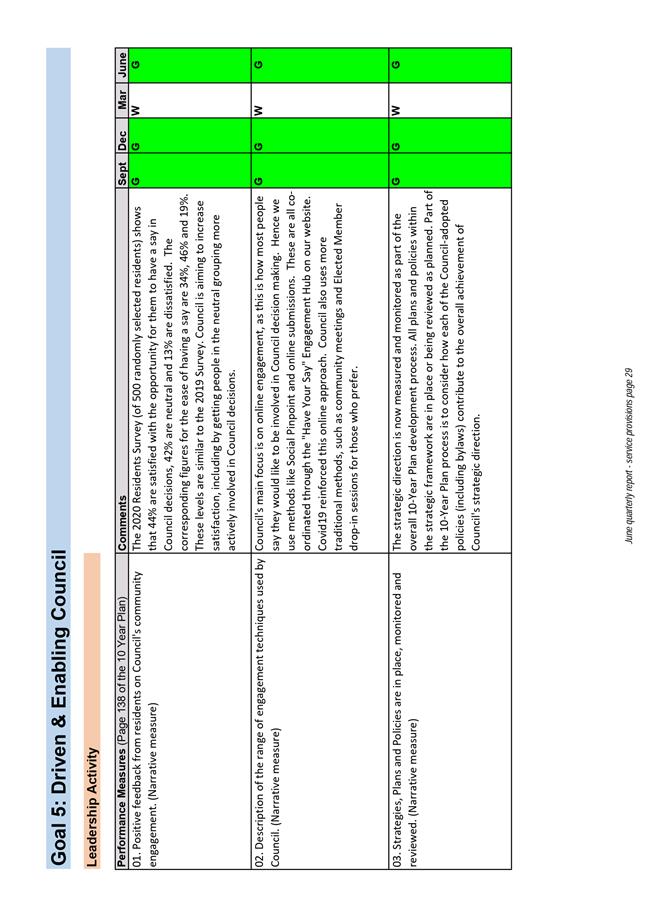

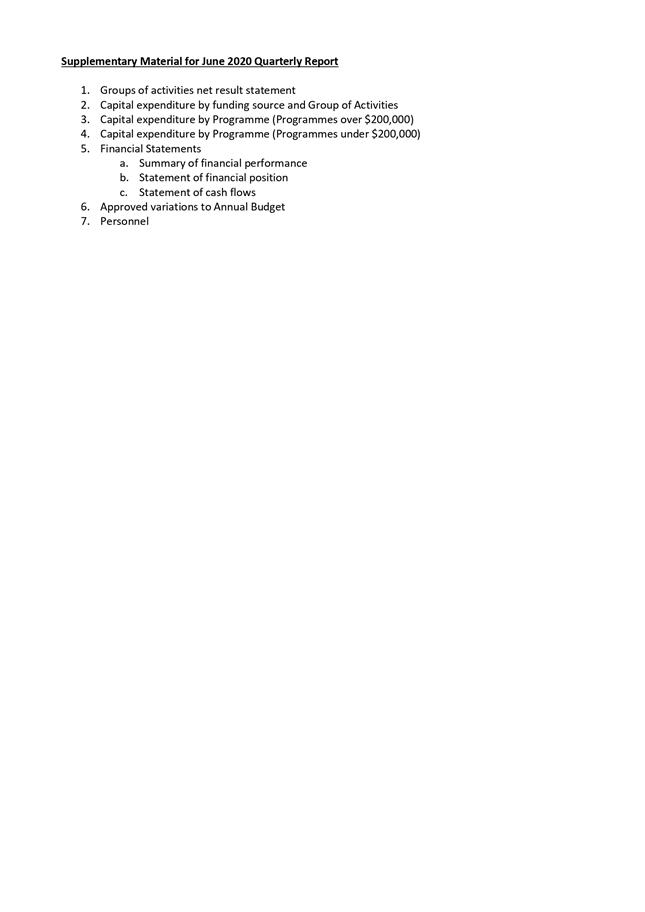

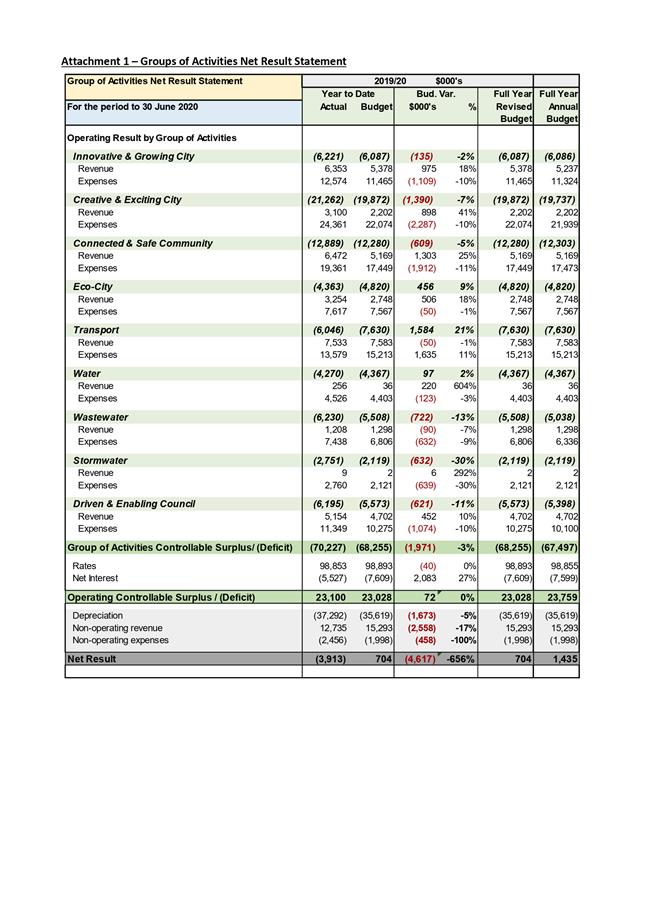

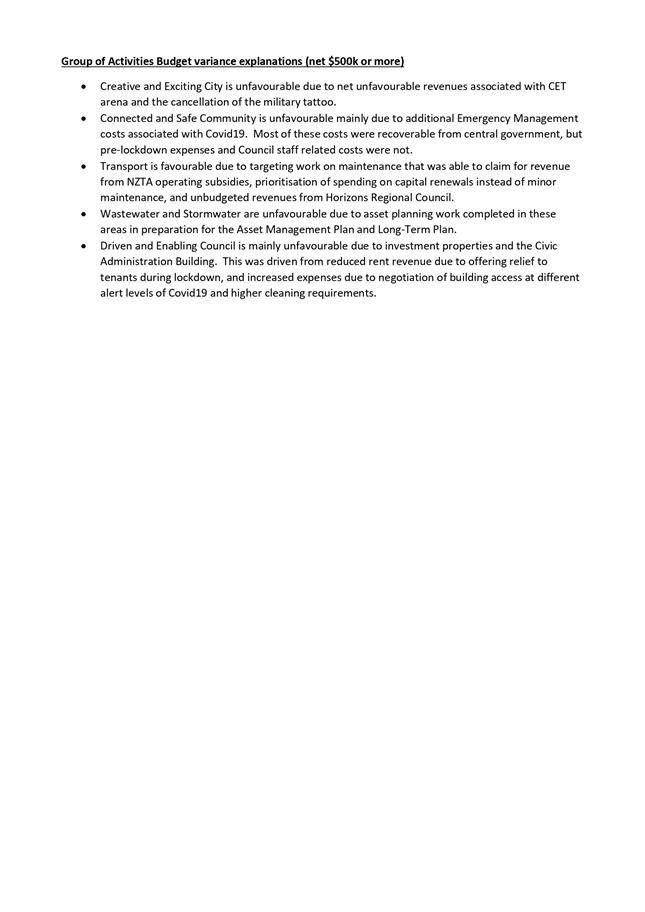

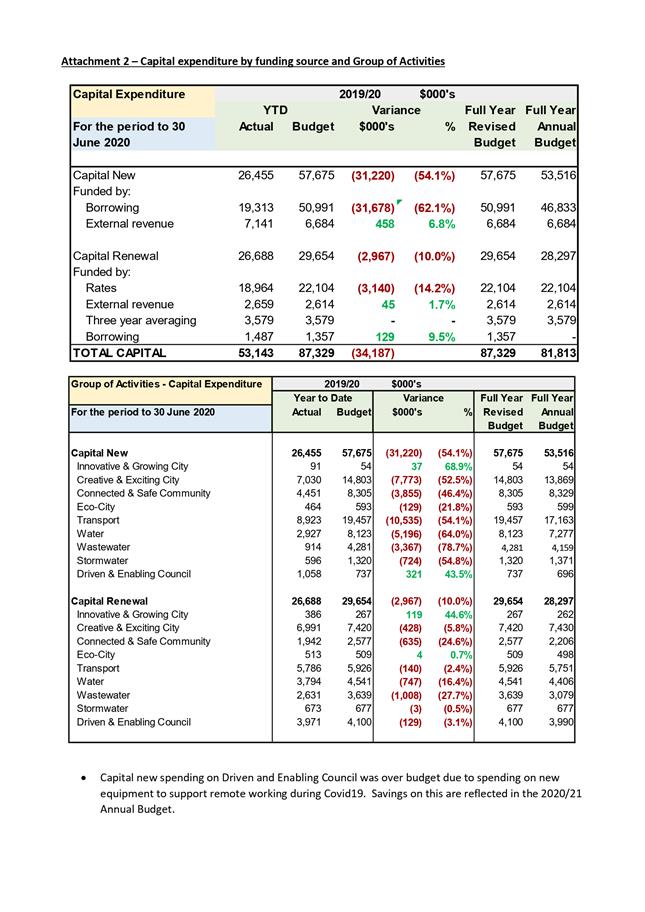

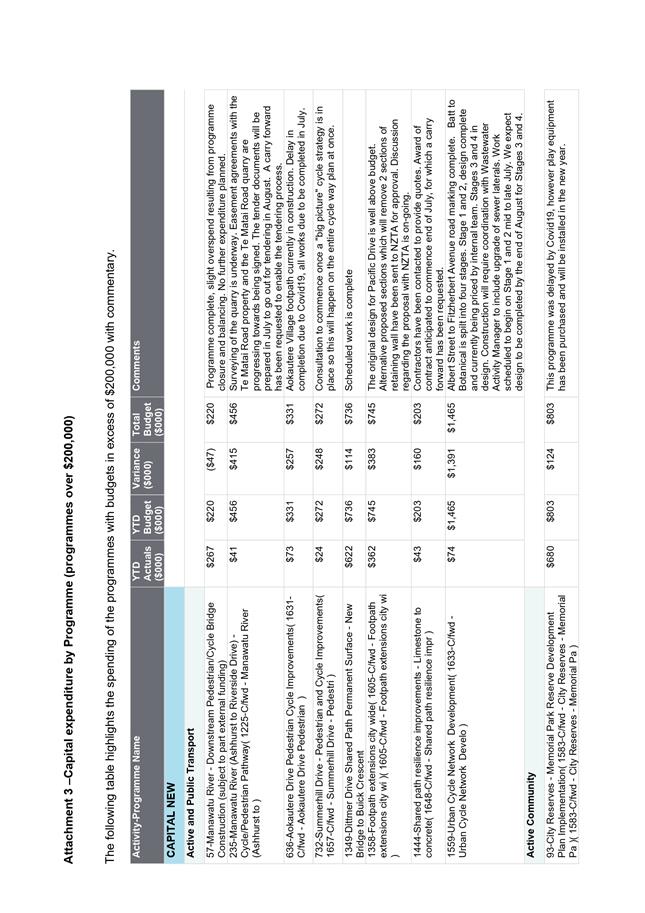

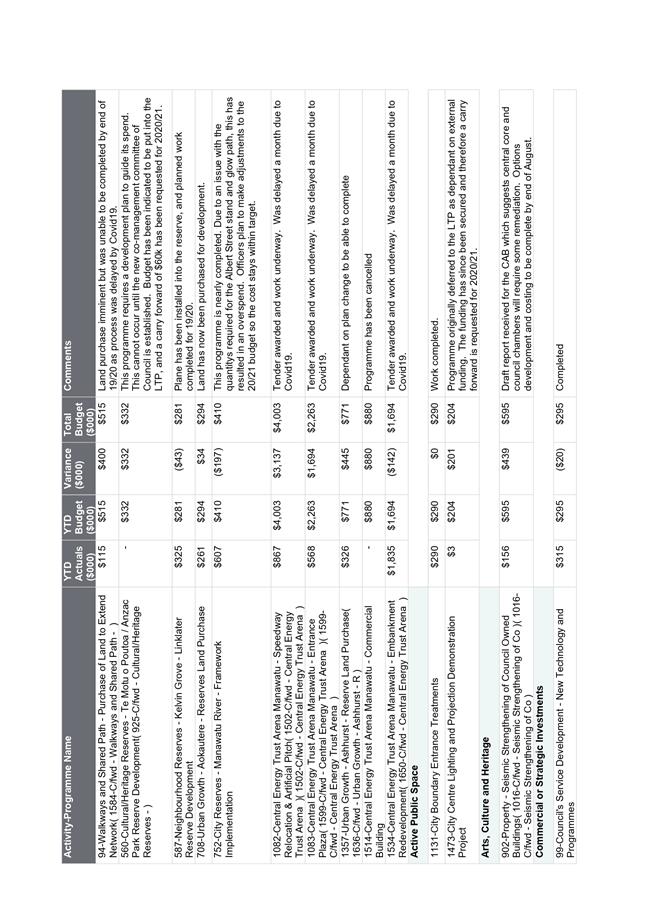

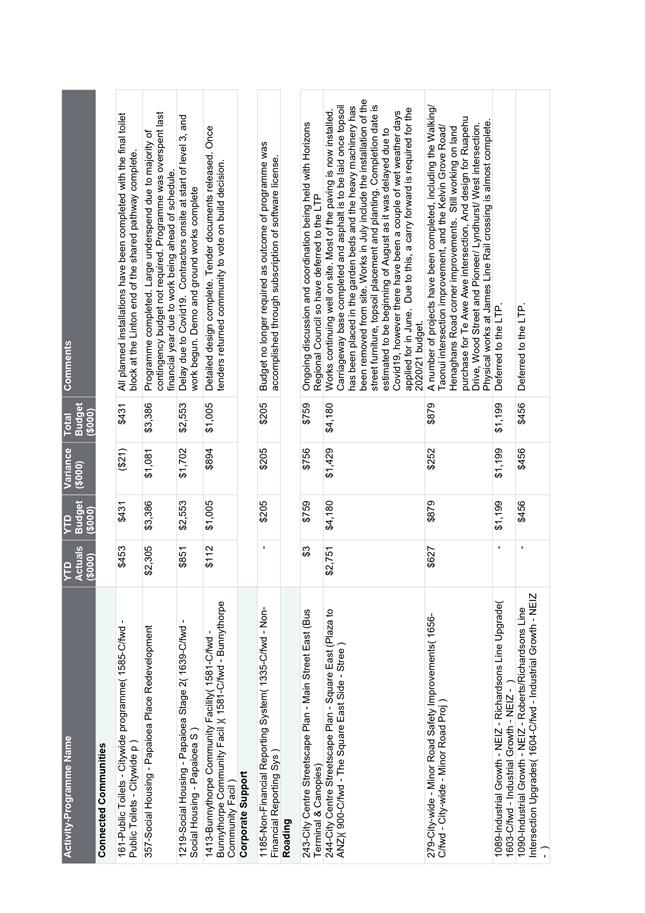

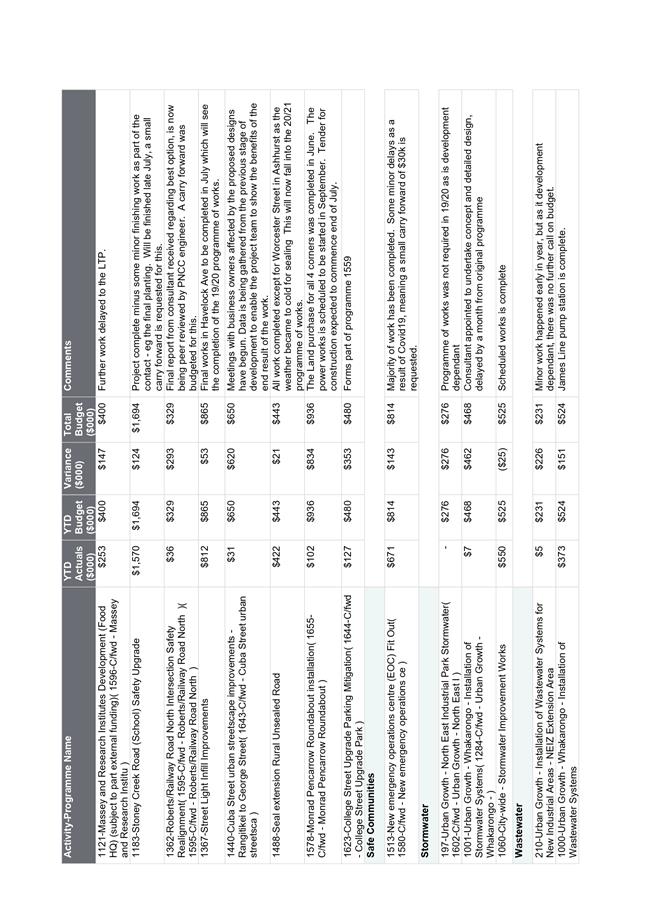

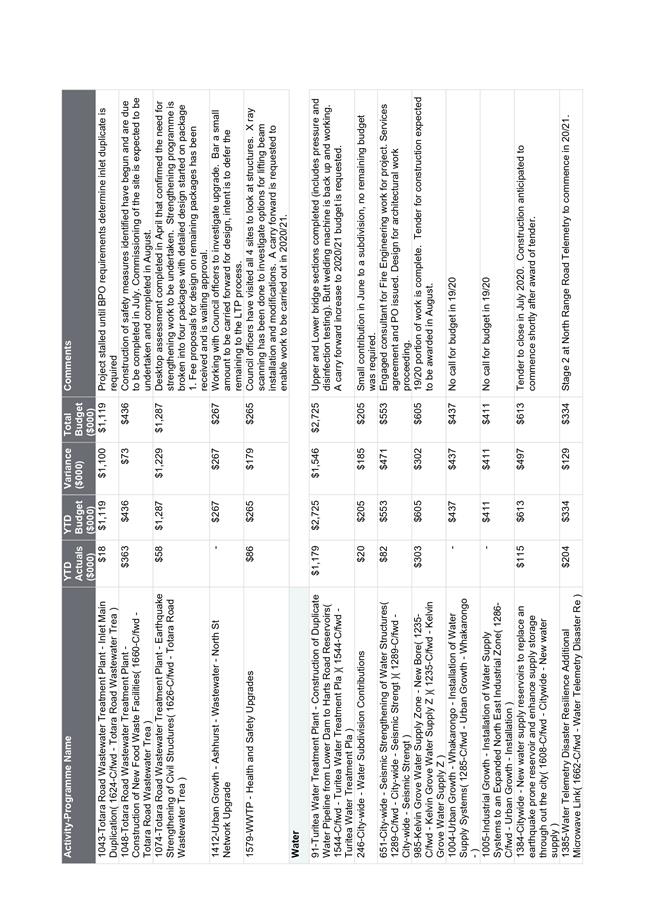

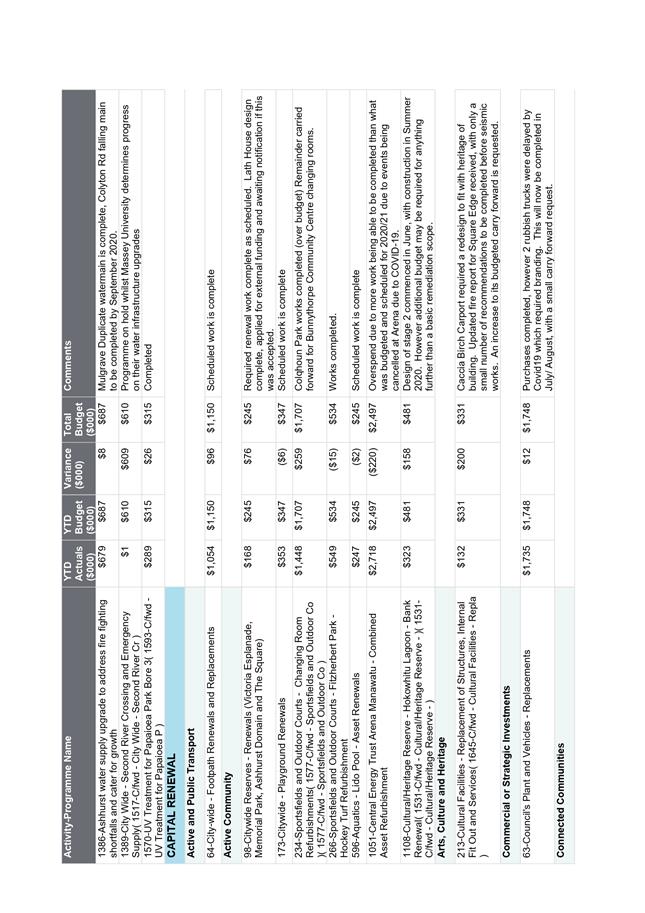

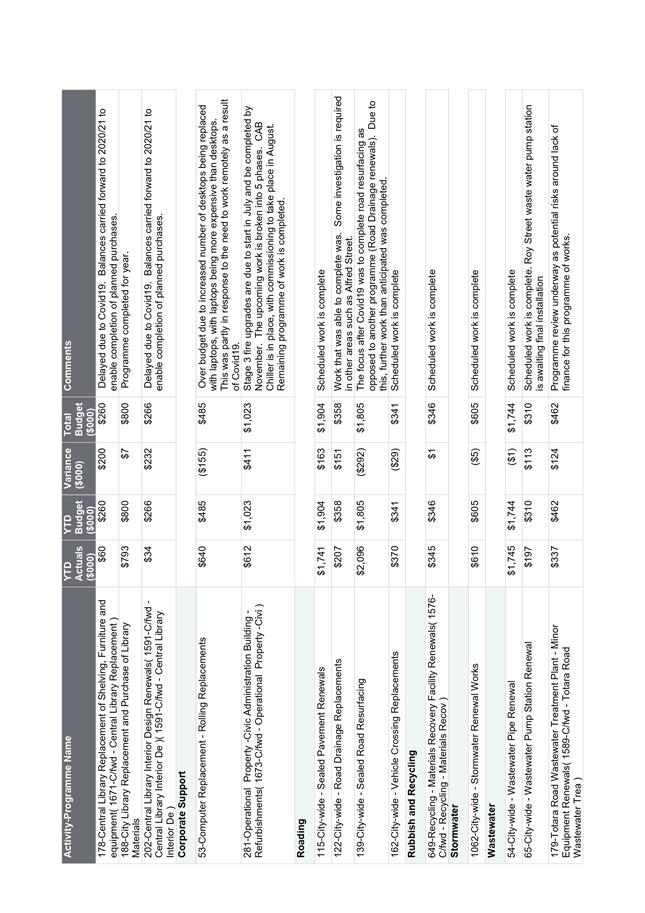

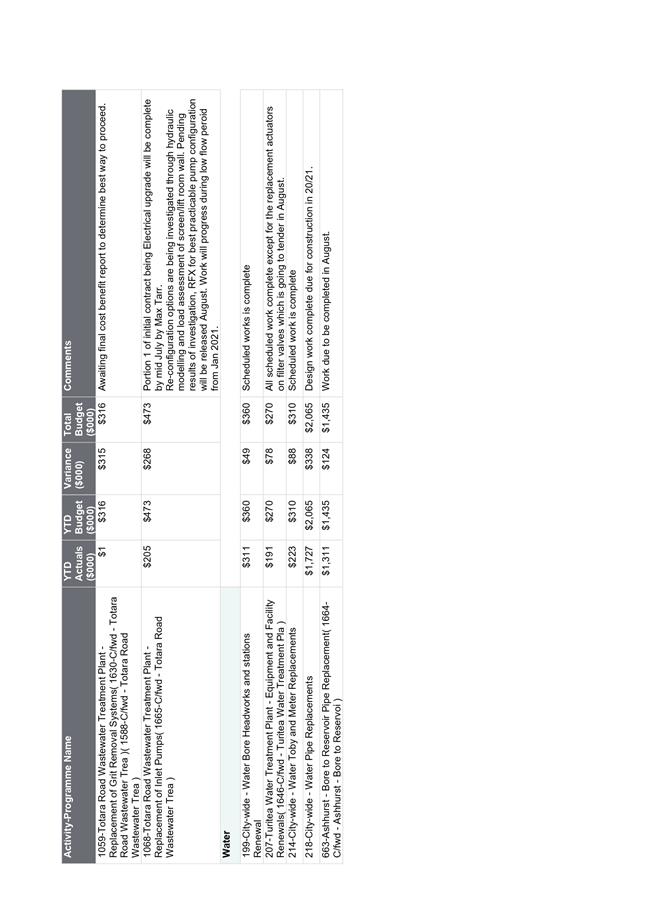

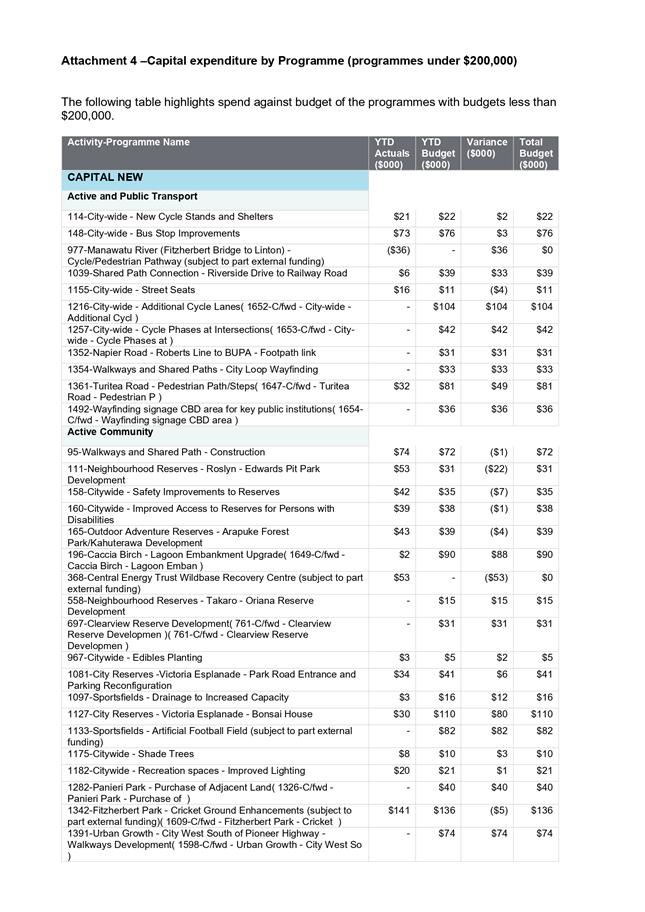

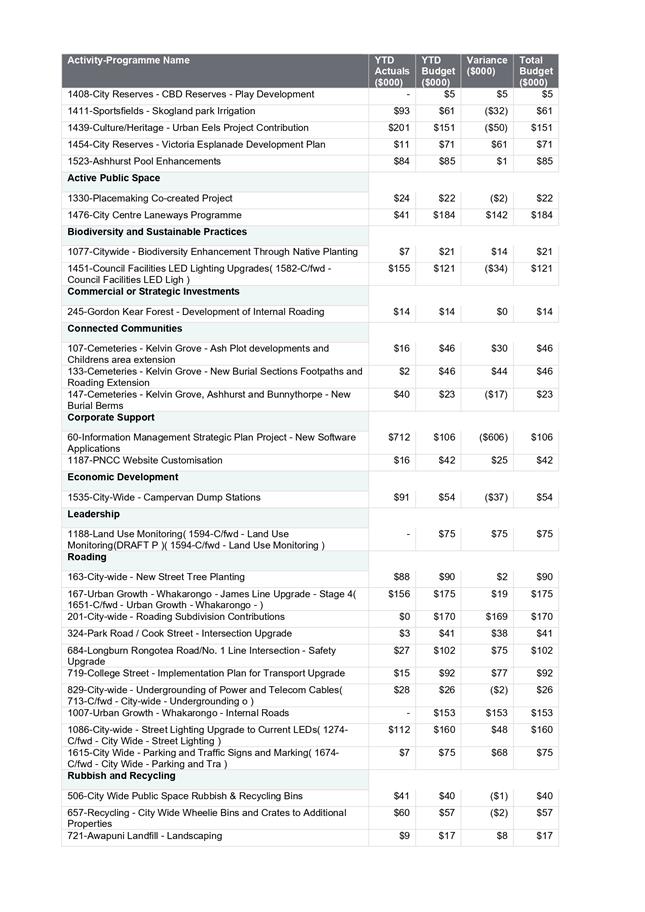

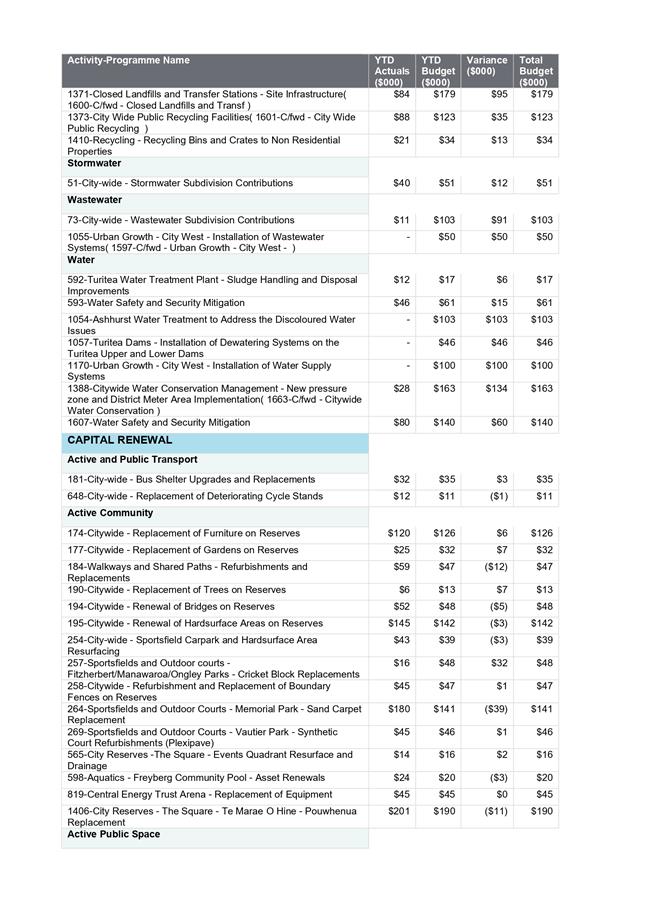

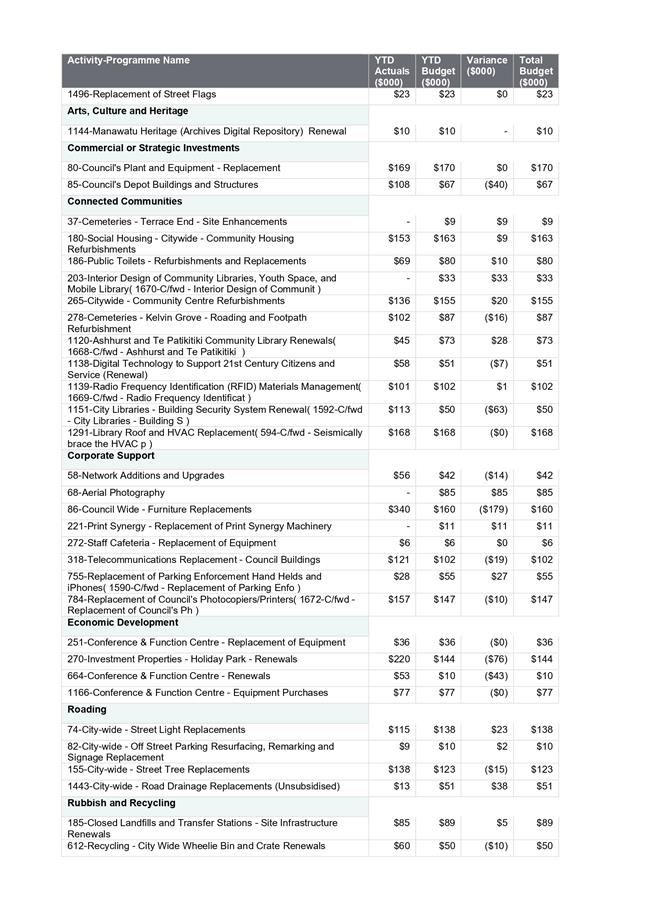

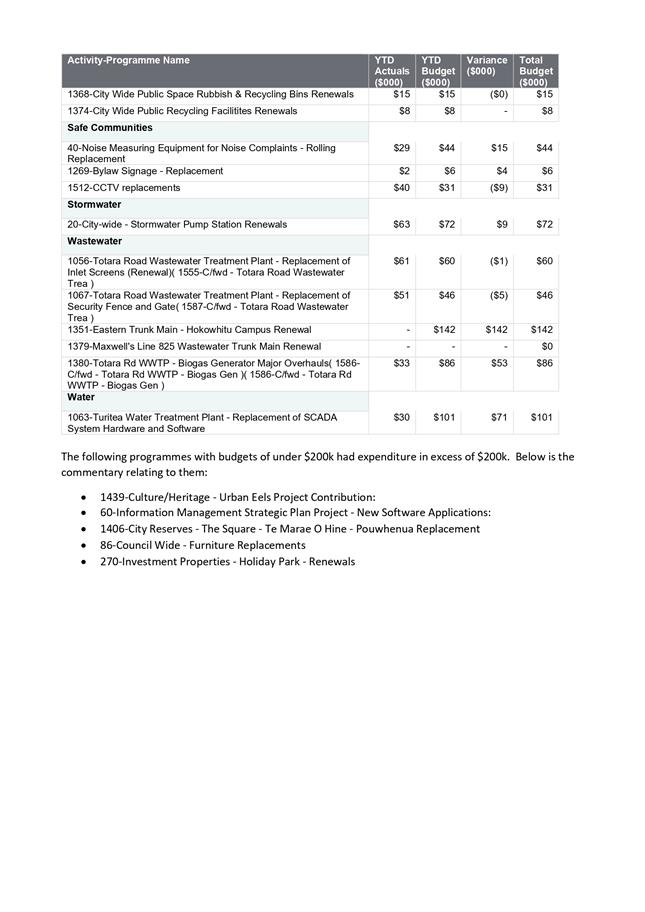

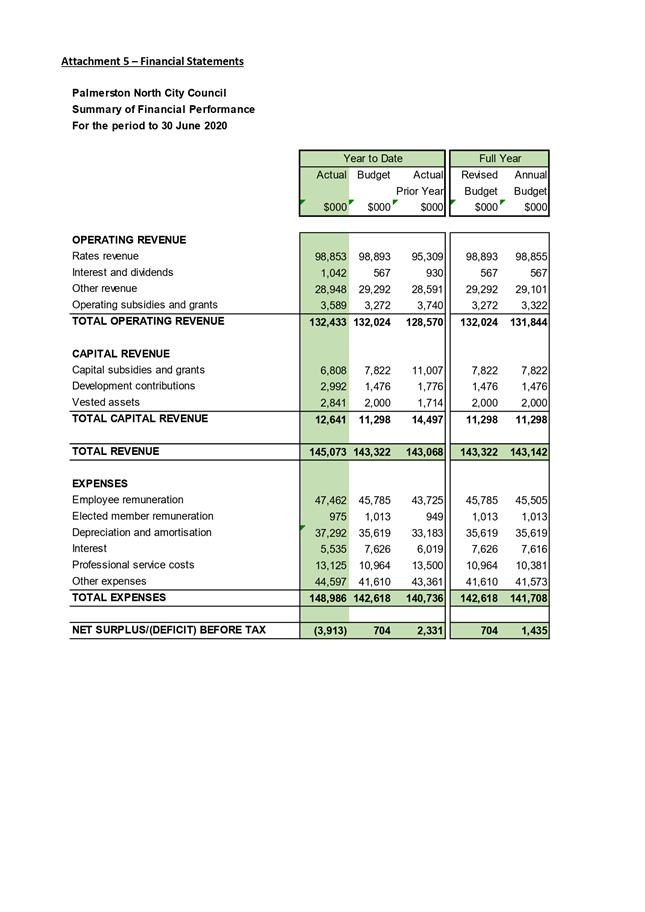

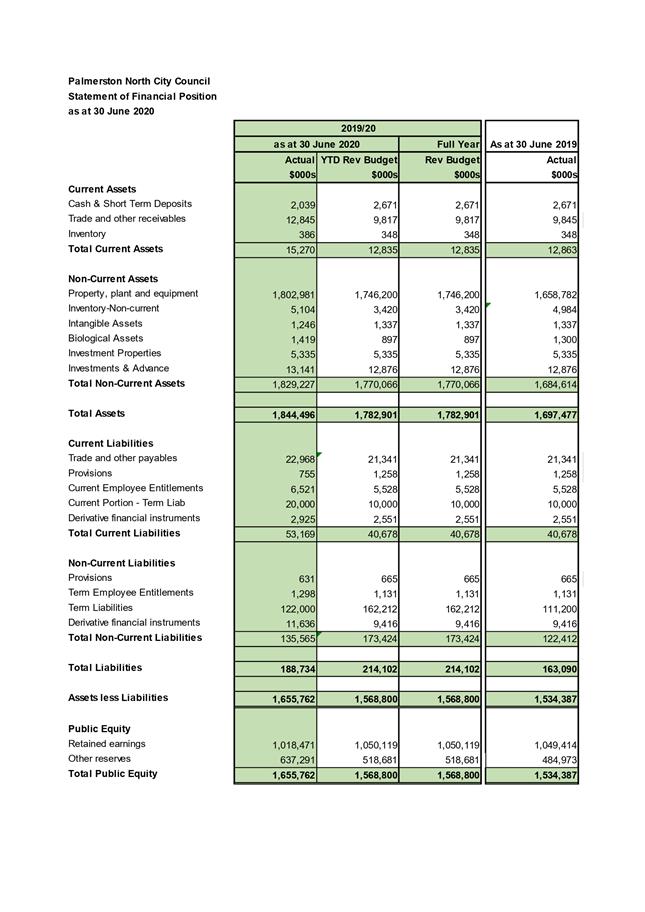

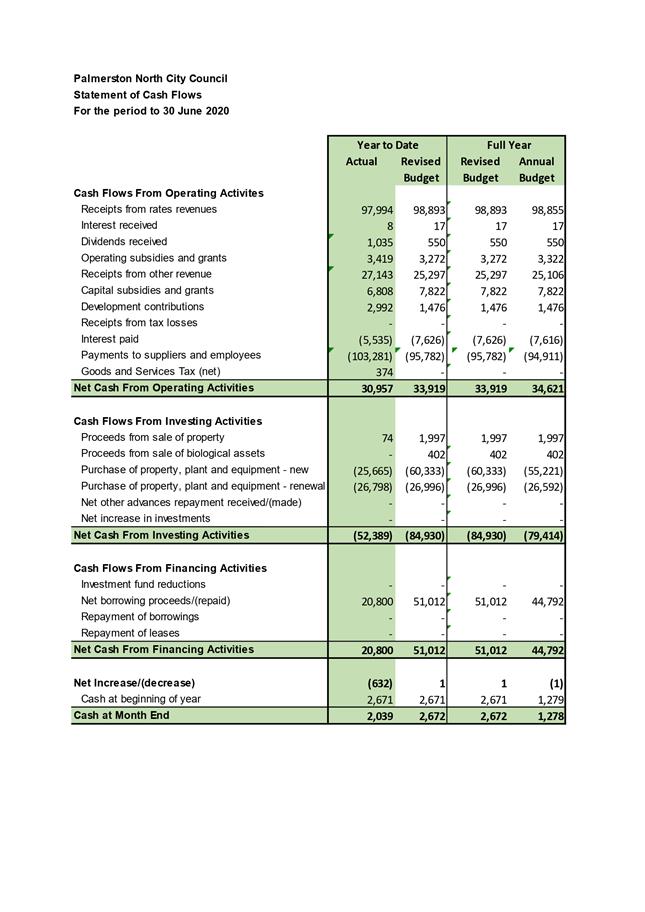

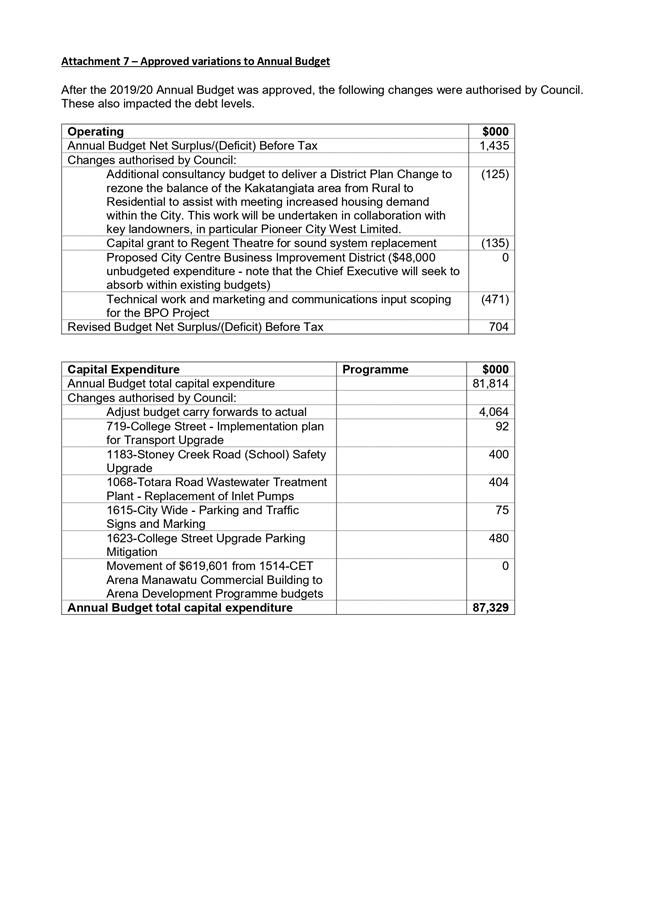

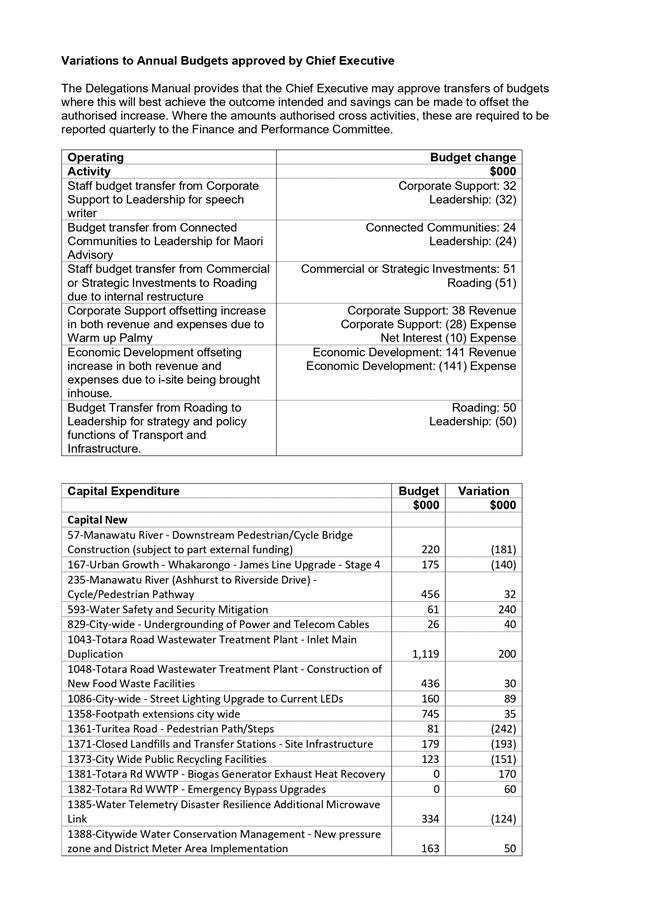

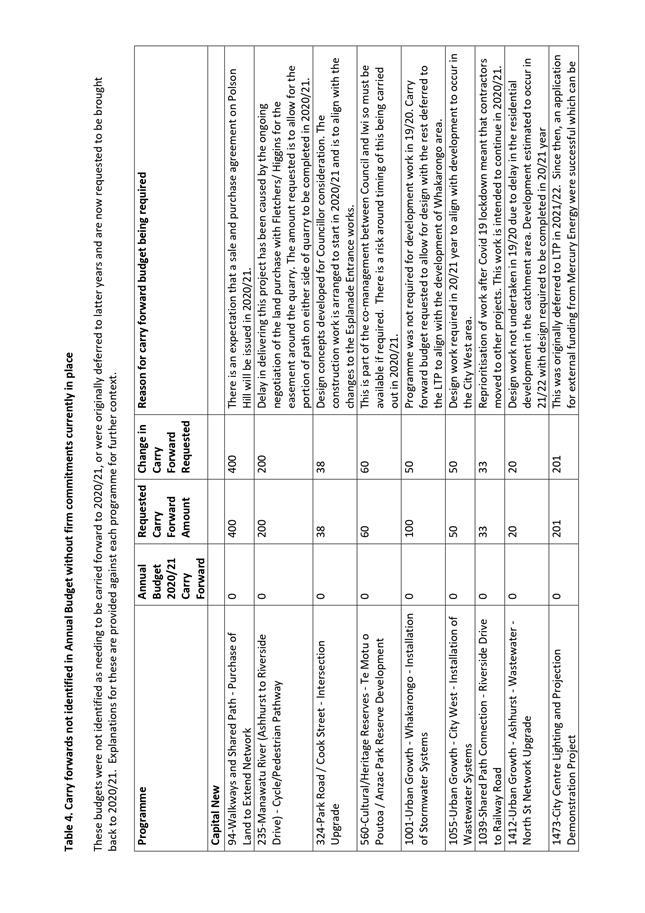

a. The June

2020 financial performance and operating performance.

b. The June

2020 capital expenditure programme progress together with those programmes

identified as unable to be completed this financial year.

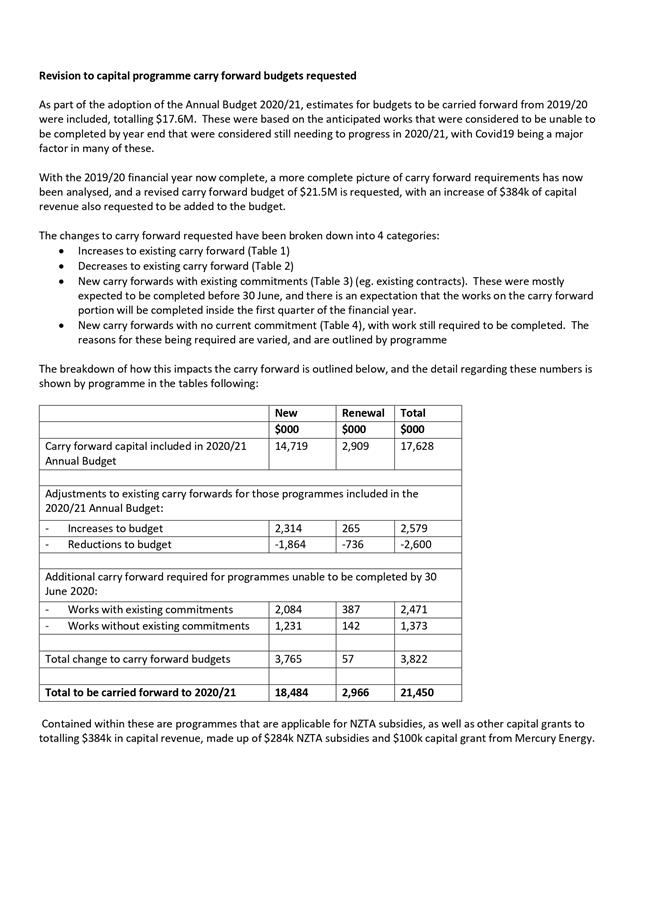

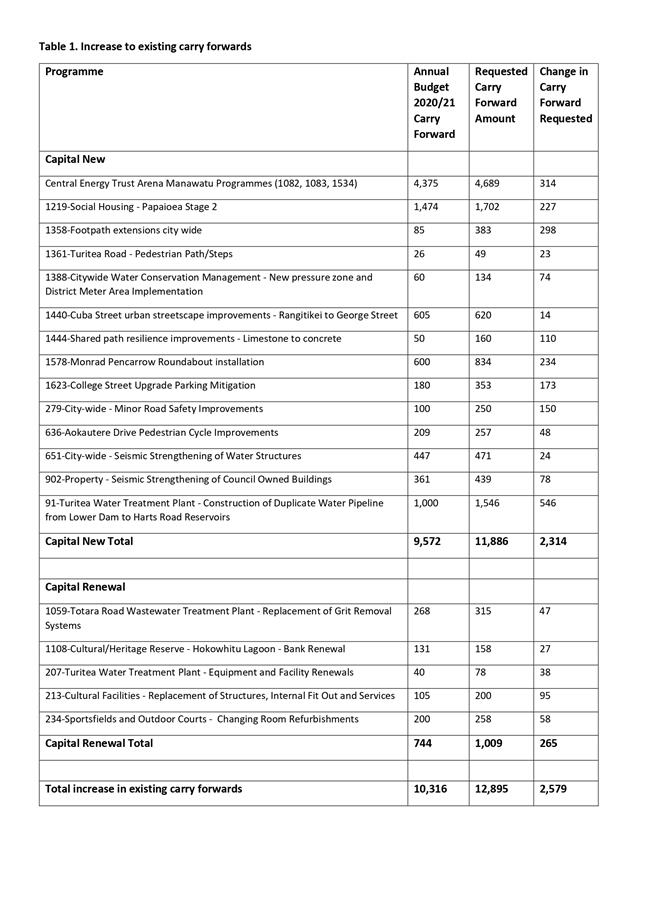

2. That

Council note that the capital expenditure carry forward values in the 2020/21

Annual Budget will be increased by a net $3,822,000 and capital revenue will

increase by $384,000.

|

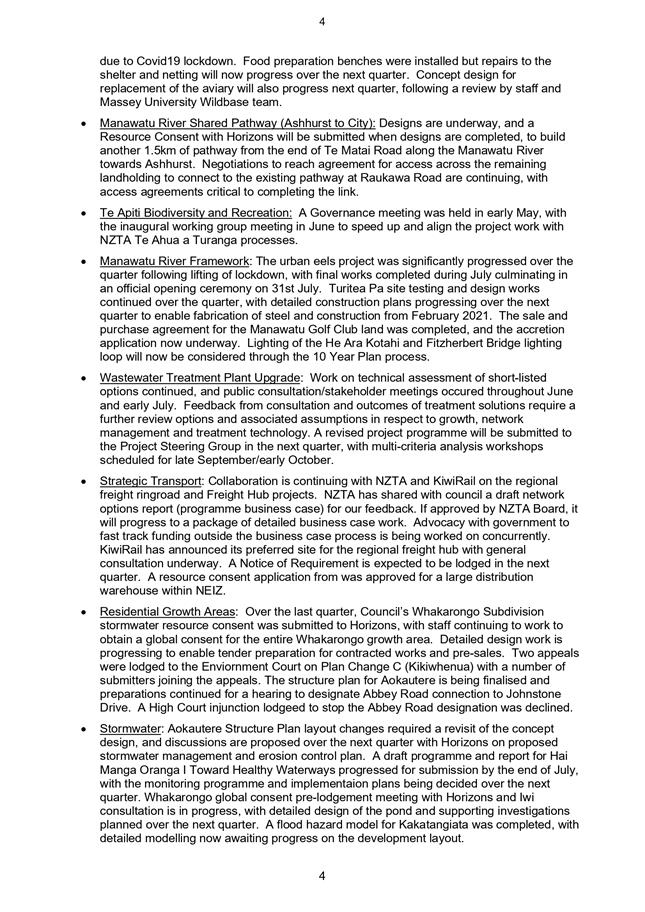

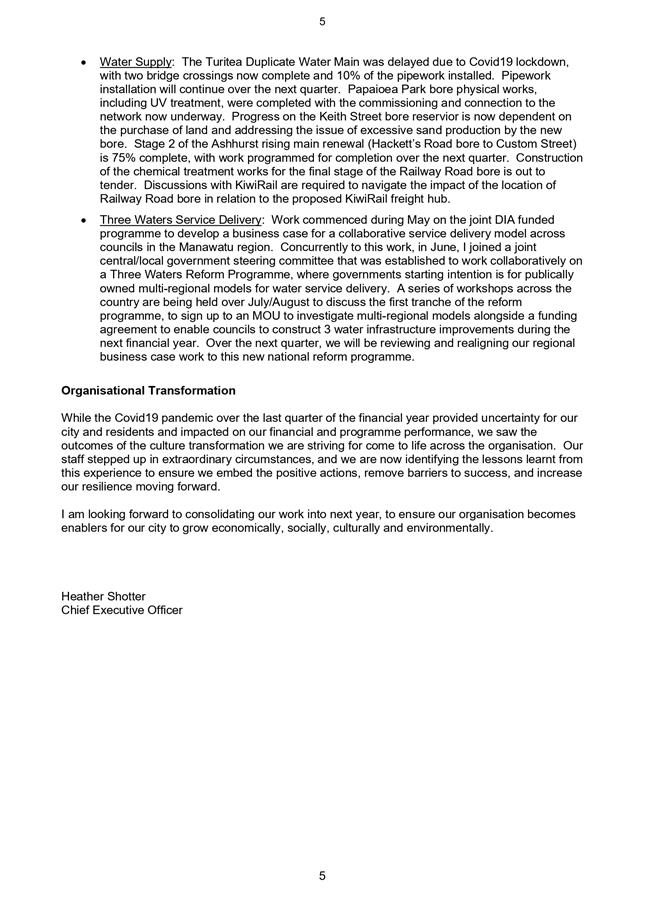

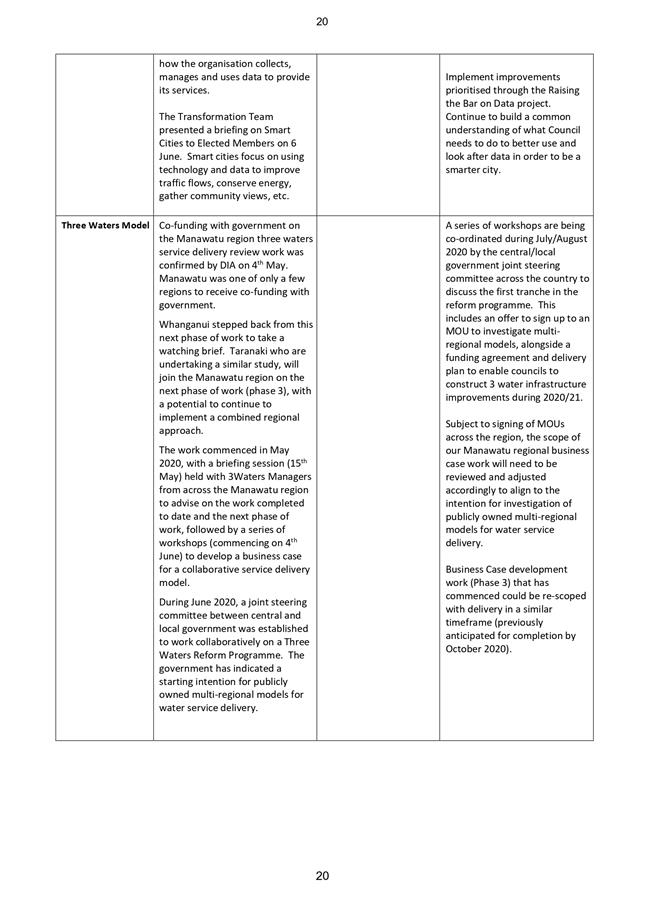

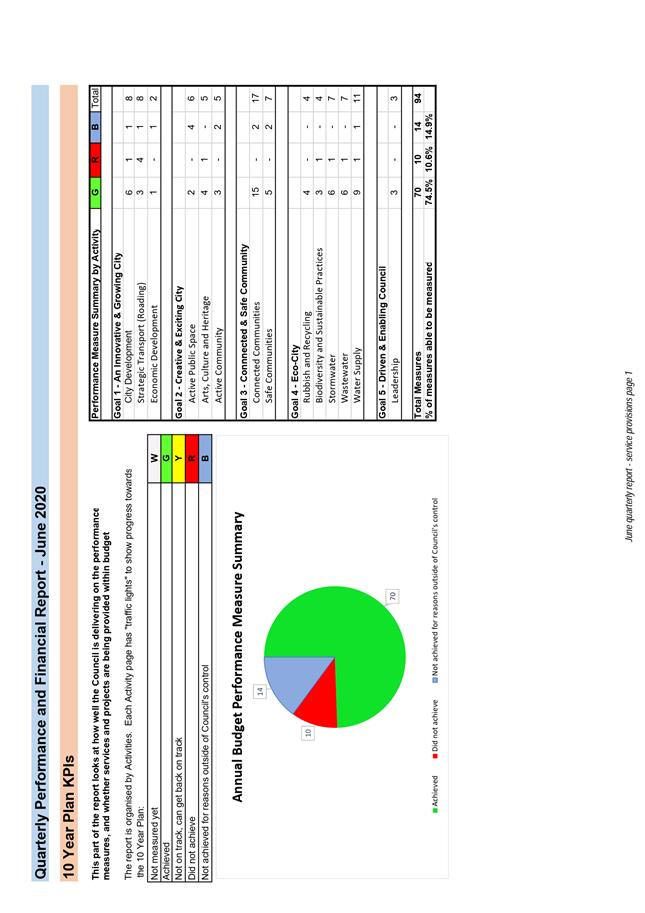

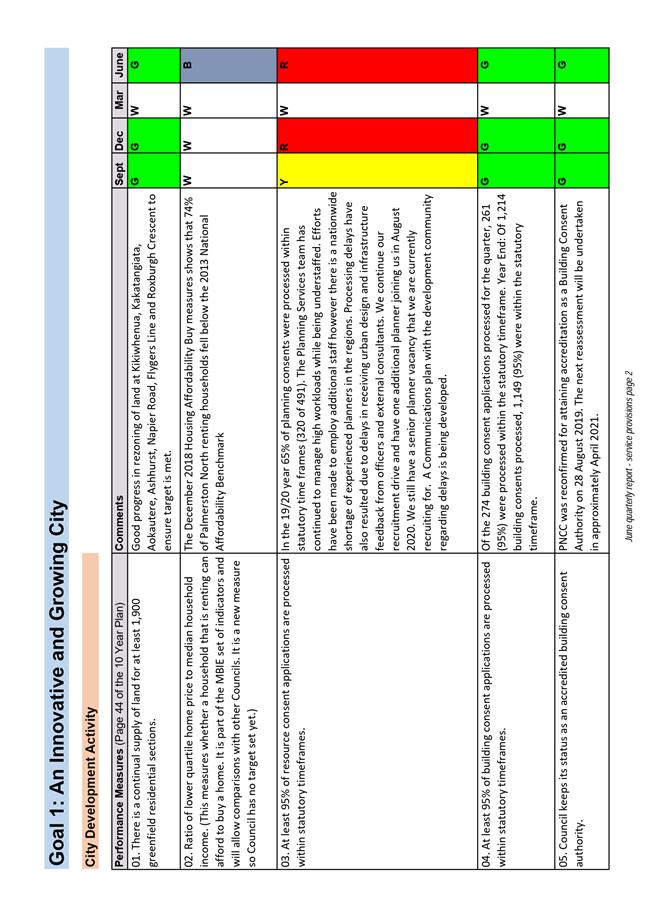

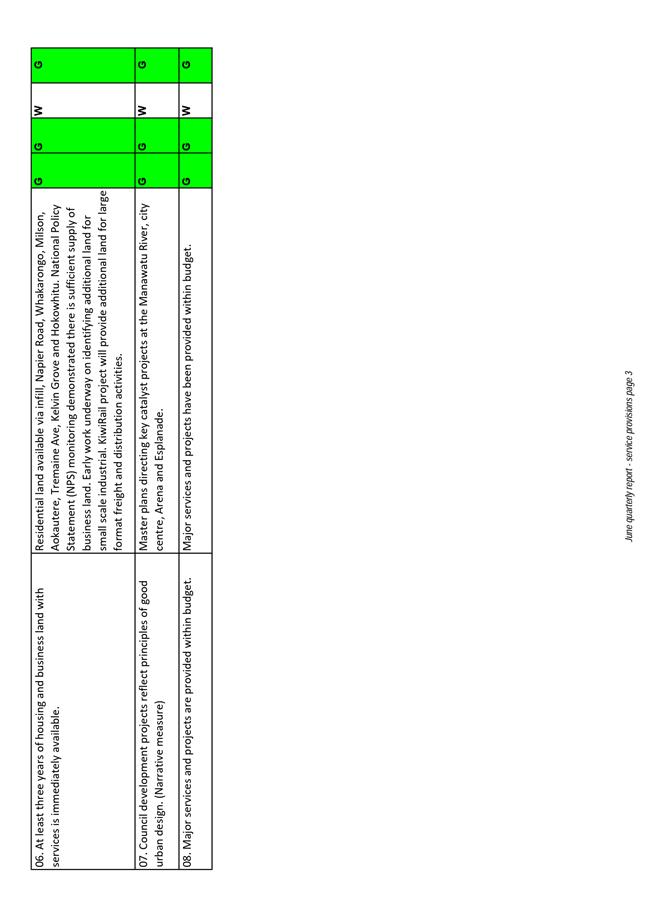

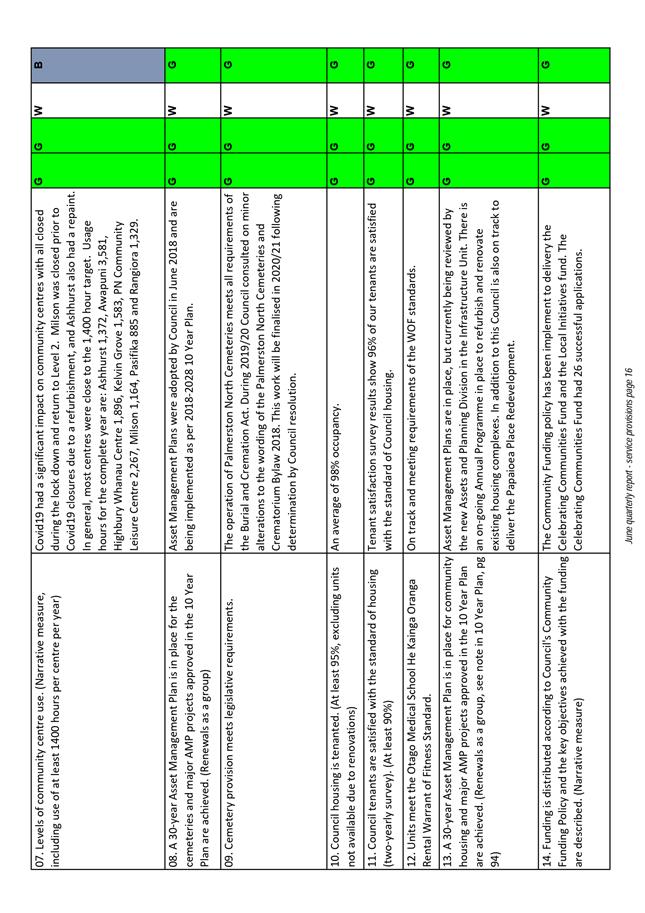

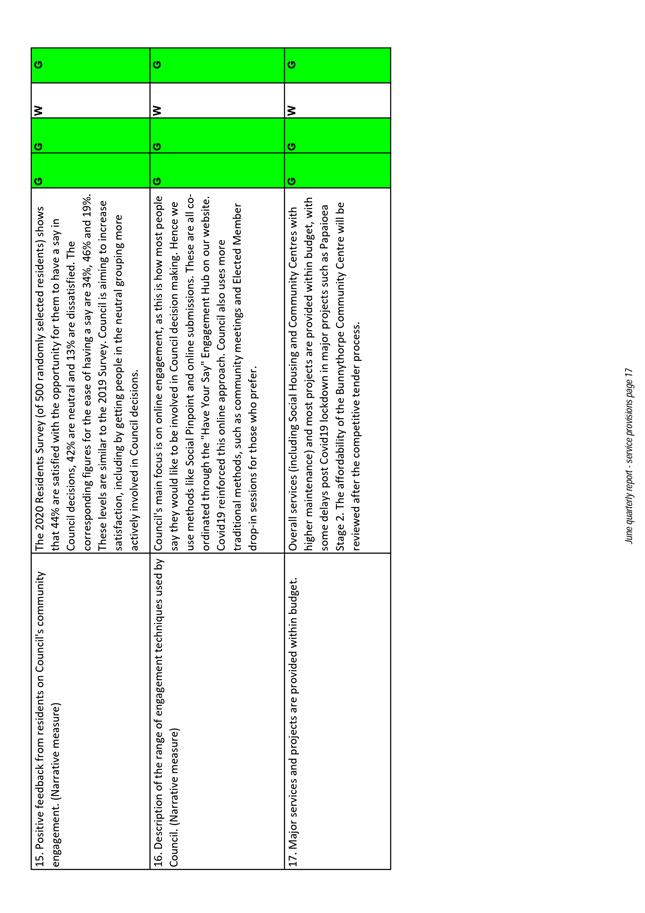

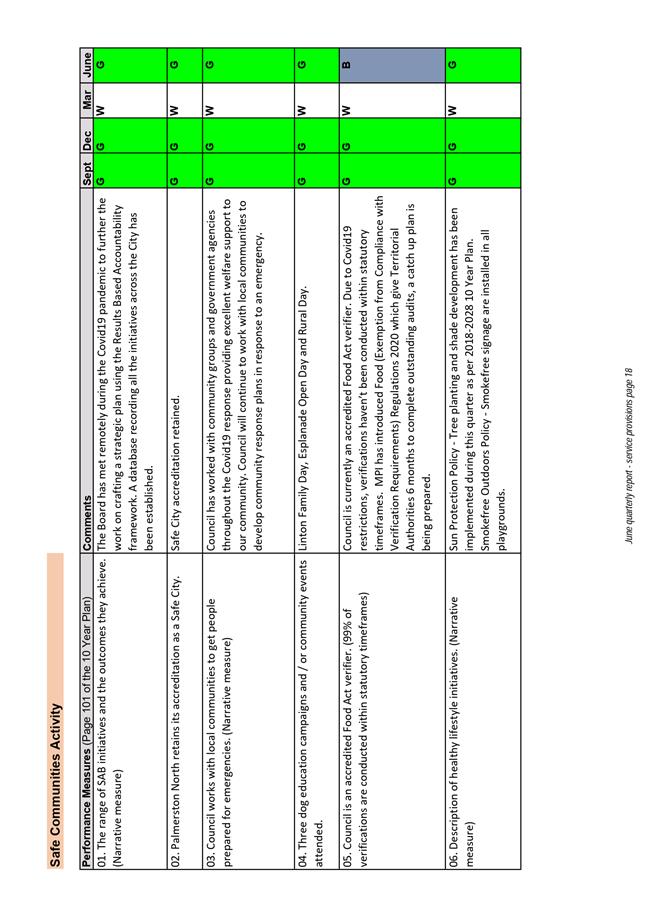

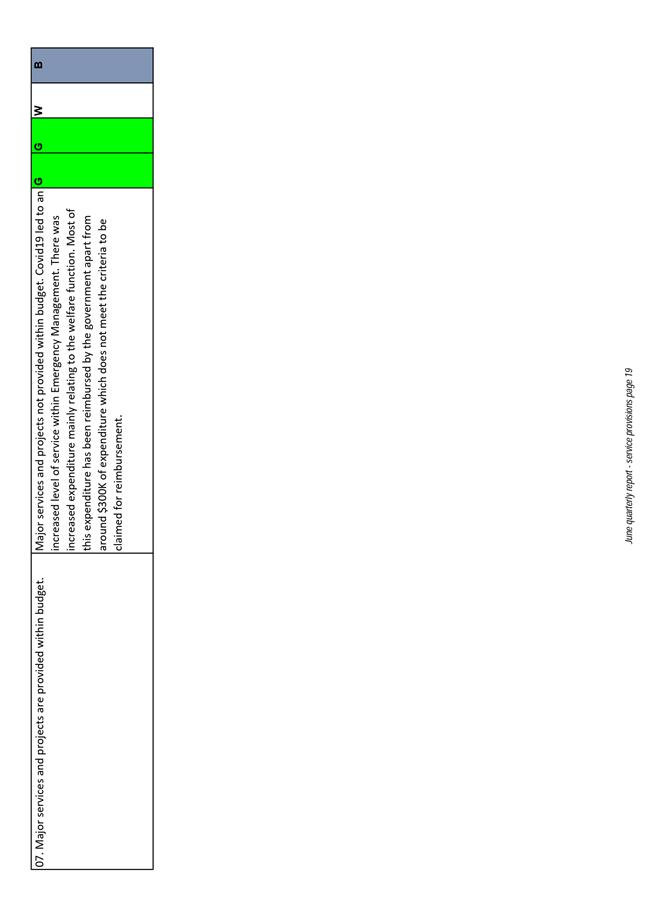

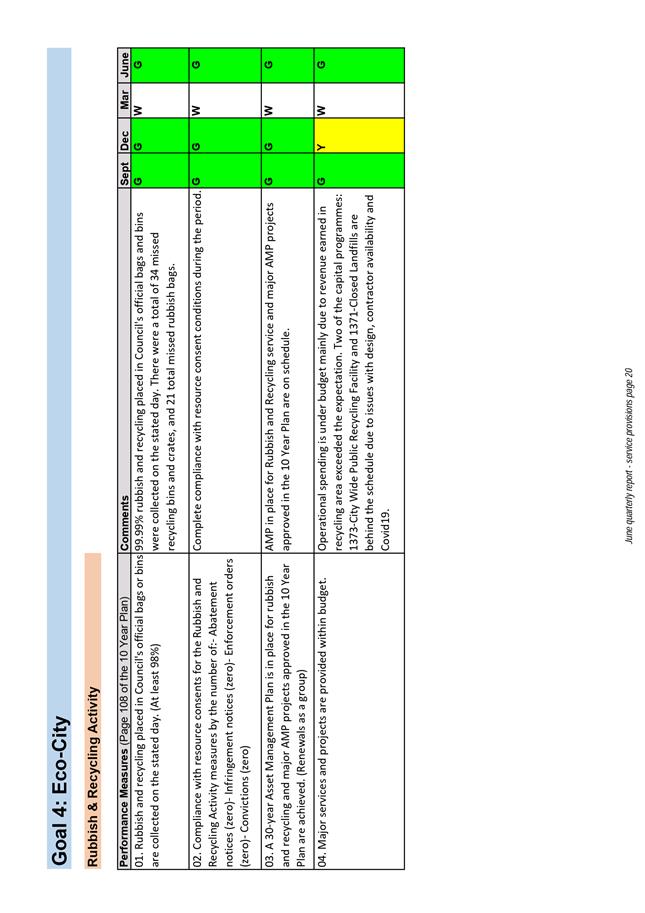

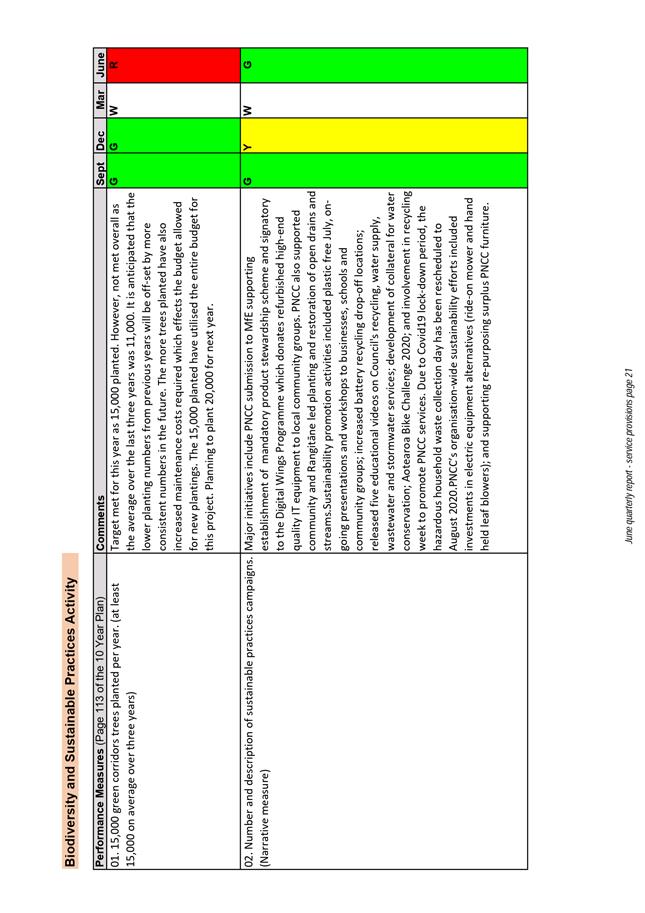

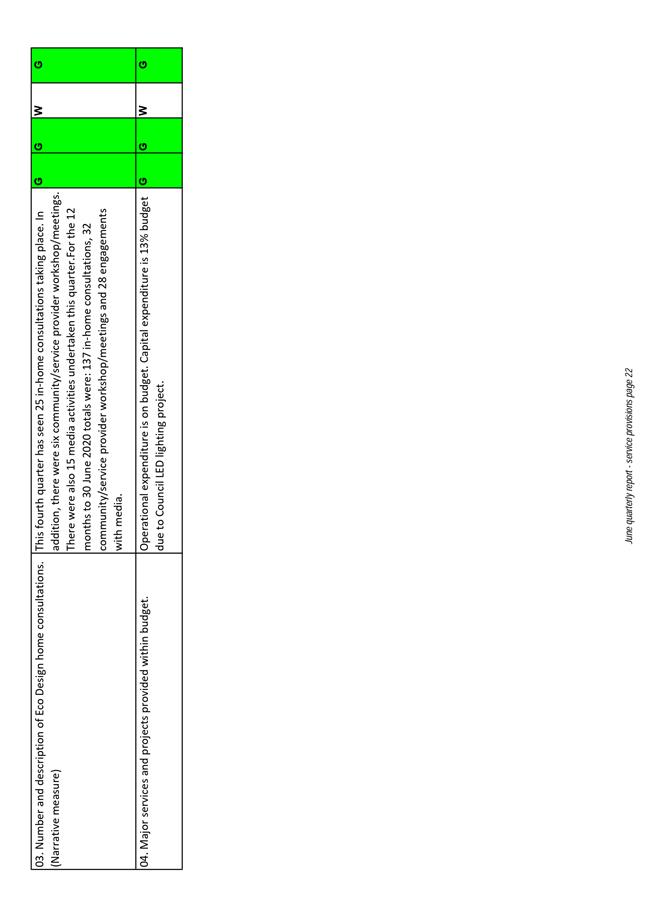

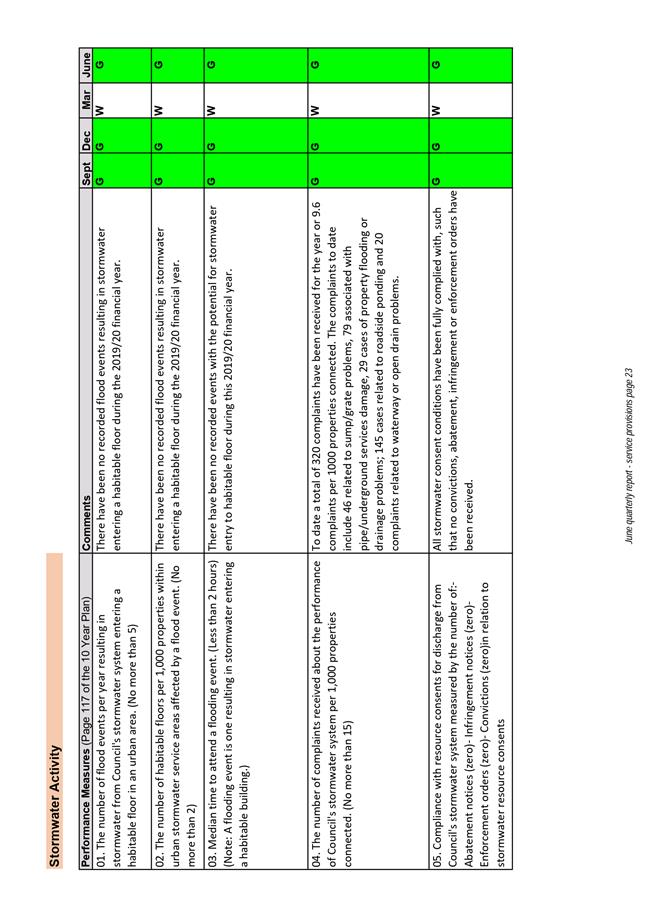

1. ISSUE

To provide an update on the

performance and financial achievements of the Council for the period ending 30

June 2020. This is the third update provided for the year, as the March

quarterly update was affected by COVID-19.

2. BACKGROUND

Details of operating and

financial performance are included in the attachments. Reports are against the

goals as detailed in the 10 Year Plan 2018-28.

3. NEXT

STEPS

The Annual Report will be

provided after clearance has been granted by Audit NZ.

4. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

No

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 5: A Driven and Enabling Council

|

|

The recommendations contribute

to the outcomes of the Driven and Enabling Council Strategy

|

|

The recommendations contribute

to the achievement of action/actions in a plan under the Driven and Enabling

Council Strategy

The action is: to enable Council

to exercise governance by reviewing financial performance and operating

performance and provide accountability for these to the public.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

As above.

|

|

|

|

Attachments

|

1.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2020 - CE and Catalyst Report ⇩

|

|

|

2.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2020 - Performance Measures ⇩

|

|

|

3.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2020 - Supplementary Material ⇩

|

|

|

4.

|

Quarterly Performance and Financial Report - Quarter Ending

30 June 2020 - Revision to carry forwards 2020-21 ⇩

|

|

PALMERSTON NORTH CITY COUNCIL

Memorandum

TO: Finance

& Audit Committee

MEETING DATE: 19

August 2020

TITLE: Update

of Treasury Policy (including Liability Management & Investment Policies)

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Stuart

McKinnon, Chief Financial Officer

|

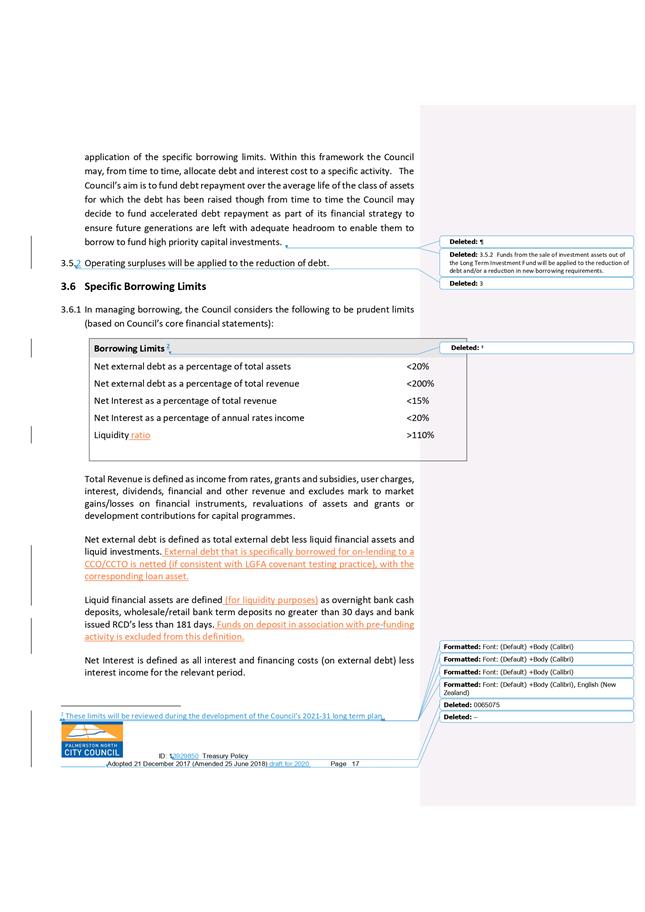

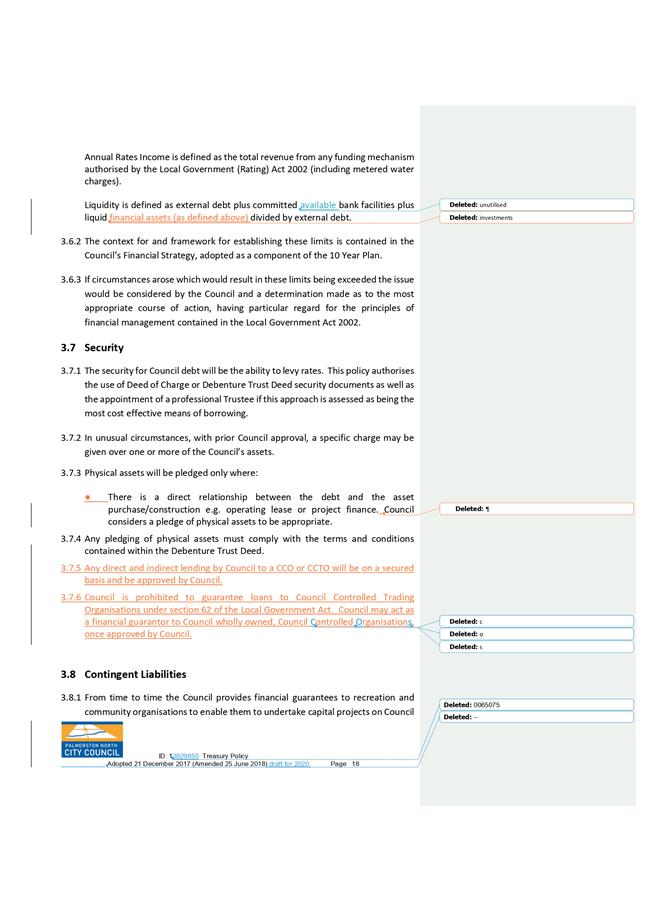

RECOMMENDATIONS TO Council

1. That the

memorandum entitled ‘Update of Treasury Policy (including Liability

Management & Investment Policies)’ presented to the Finance &

Audit Committee on 19 August 2020, be received.

2. That the

updated Treasury Policy (incorporating the Liability Management and

Investment Policy pursuant to section 102 of the Local Government Act 2002)

as attached to this report be adopted.

3. That it be

noted Council will be reviewing the specific borrowing limits contained in

clause 3.6.1 of the Policy as part of the process of developing its Financial

Strategy for the 2021-31 10 Year Plan, and that if the outcome of this is

that there are changes to these limits, the Policy will be updated to include

them.

|

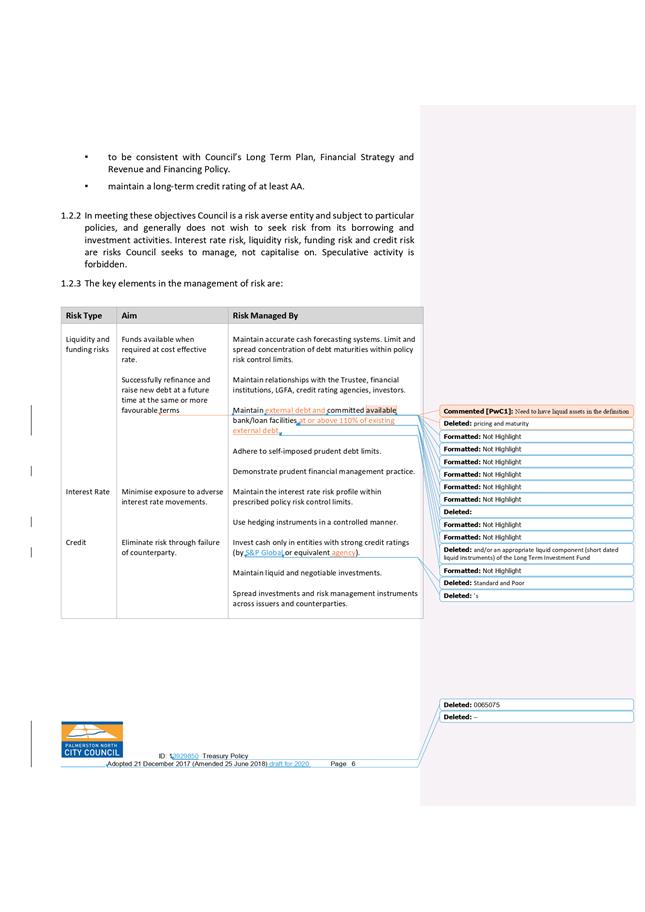

1. ISSUE

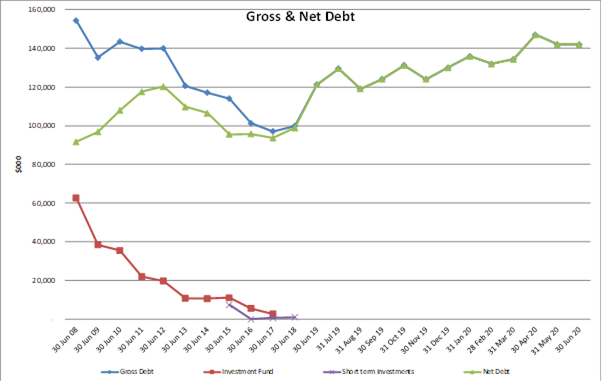

Council adopted its current

Treasury Policy on 21 December 2017 and adopted amendments to specific

borrowing limits on 25 June 2018. One of the terms of the Policy is that

it will be reviewed every three years. This report recommends the adoption

of an updated policy (marked up version attached) containing a number of

changes to reflect changed circumstances, although in practical terms they will

not impact materially on the way the treasury activity is managed.

2. BACKGROUND

The Council is required under

section 102 of the Local Government Act 2002 to adopt a Liability Management

Policy and an Investment Policy. As they are operational in nature these

policies can be adopted by ordinary resolution of the Council.

Our Council chooses to combine

the two policies into one document called a Treasury Policy and the latest

version of this Policy was adopted by Council on 25 June 2018.

The Policy itself states it

will be reviewed three-yearly.

The present policy has been

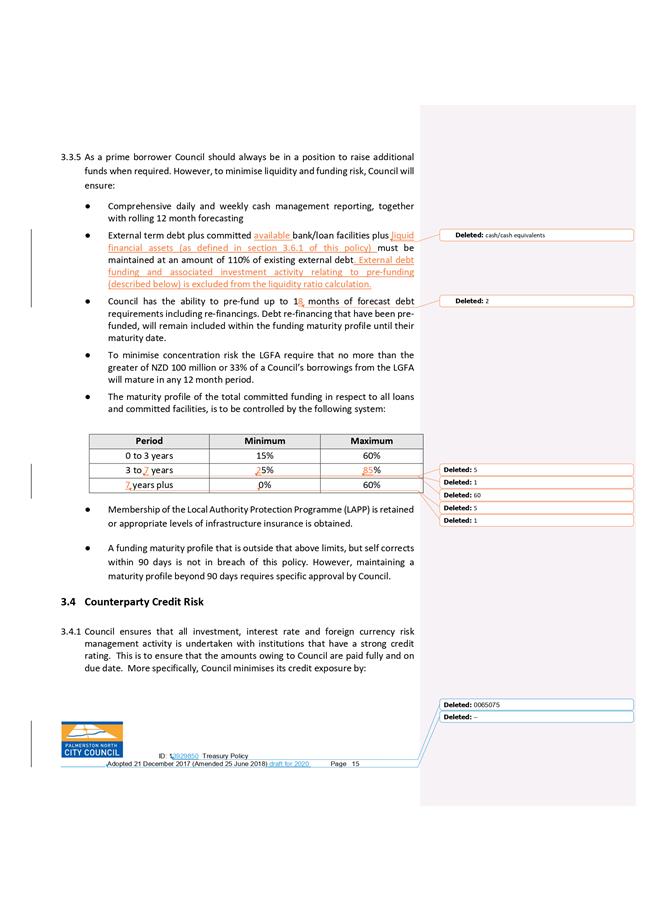

operating effectively. However changes are being proposed to:

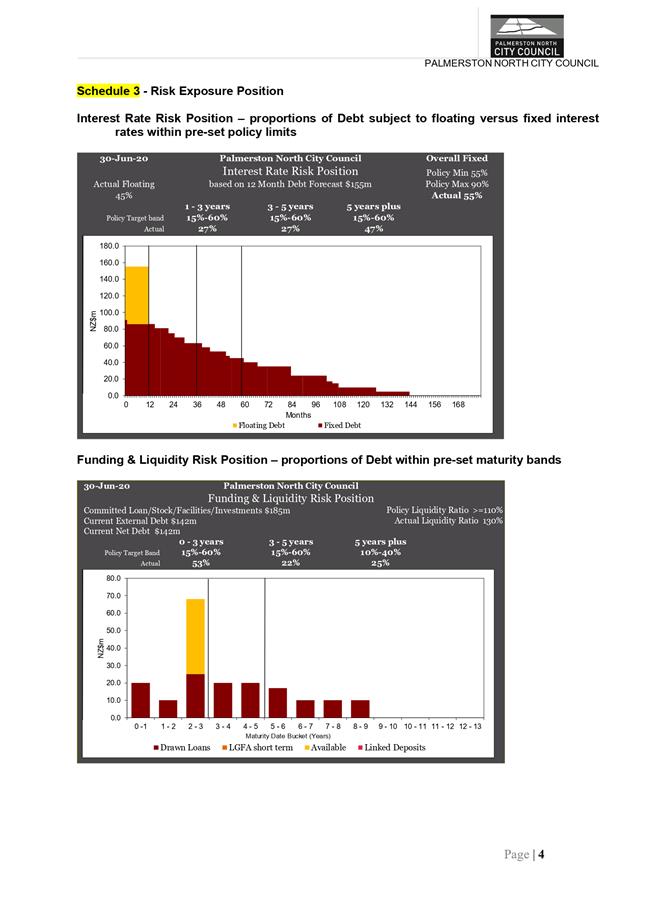

· Align

the policy with changes made by the Local Government Funding Agency (LGFA) as

well as changes to the credit rating methodology by S&P Global. These

impacts are flowing through the local government sector particularly in the

area of liquidity management.

· Change

the interest rate risk management framework in a manner consistent with other

similar sized Councils, to provide greater flexibility in the medium term

management of interest rates whilst continuing to meet a prudent risk

management approach.

· Update

the policy by removing reference to matters that are out of date such as the

long term investment fund.

Key changes proposed include:

· A

policy framework around on-lending activity to CCOs (including CCTOs).

This is to allow for any potential on-lending activity that may be required

along with allowing for the possibility of direct lending from the LGFA to

these entities.

· A

new policy framework for interest rate risk control limits (section 3.2).

· Updated

funding control limits to provide greater flexibility in Council’s

funding arrangements (clause 3.3.5).

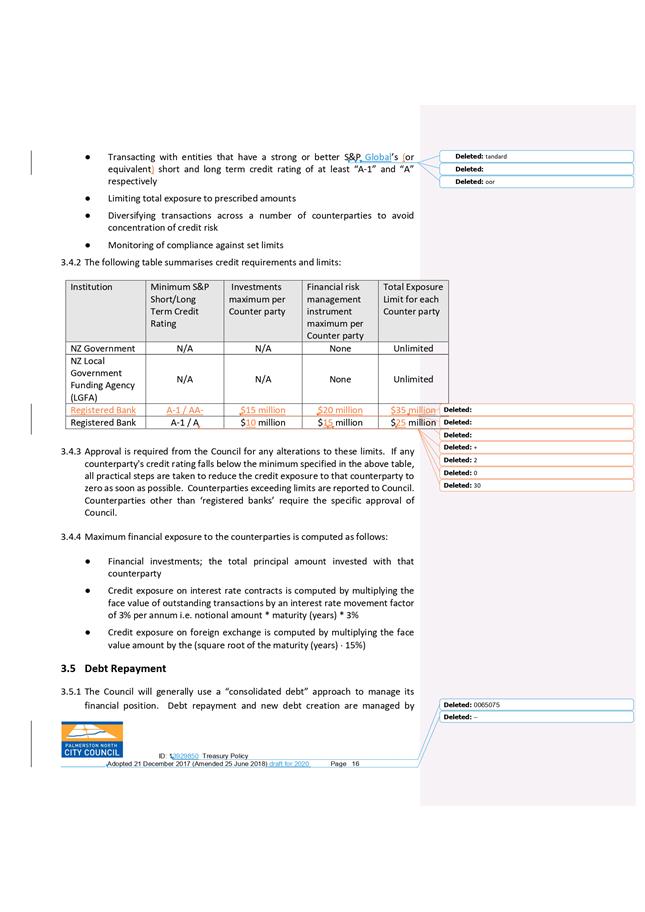

· Adjustments

to counterparty credit limits along with a tiered approach to counterparty risk

management. This will allow a greater exposure to ‘very

strong’ credit rated entities and a reduced exposure to

‘strong’ credit rated counterparties. The minimum credit

rating policy of long-term A has not been altered (clause 3.4.2).

Borrowing mechanisms to CCOs

& CCTOs (section 3.14)

Shareholders have approved changes

to foundation documents for the LGFA that enable LGFA to lend to CCO/CCTOs

either directly or through shareholder Councils. These changes are

expected to be operative shortly. Such lending is expected to be provided

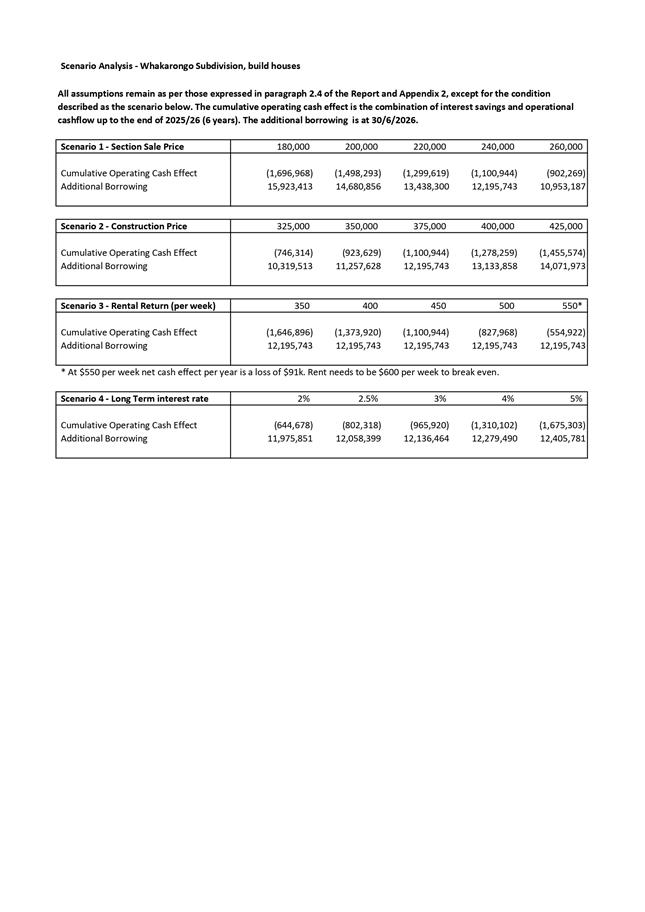

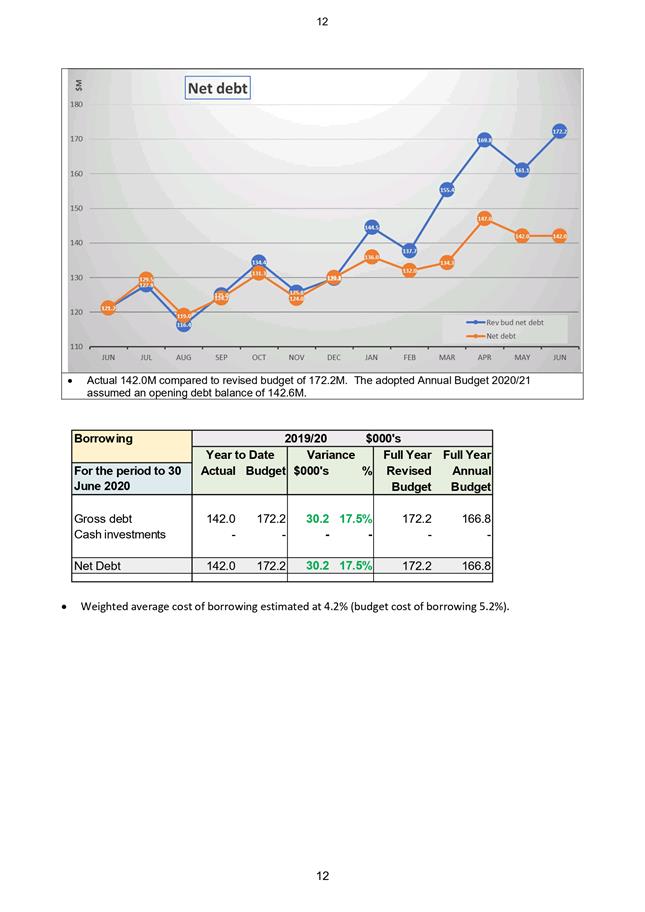

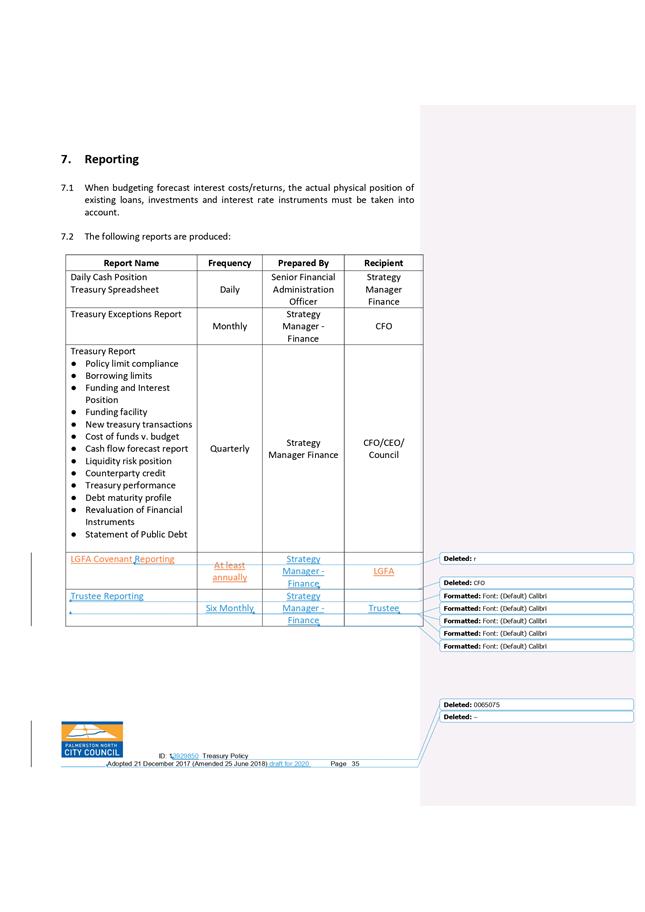

on a case by case basis, approved by the LGFA Board and will depend on the