Economic Growth Committee

|

Leonie

Hapeta (Chair)

|

|

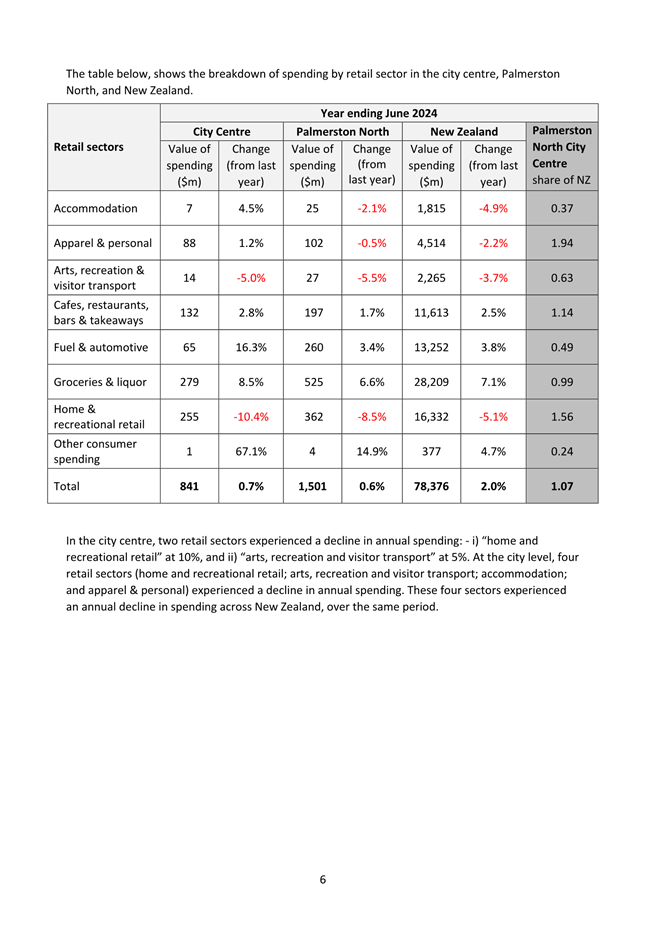

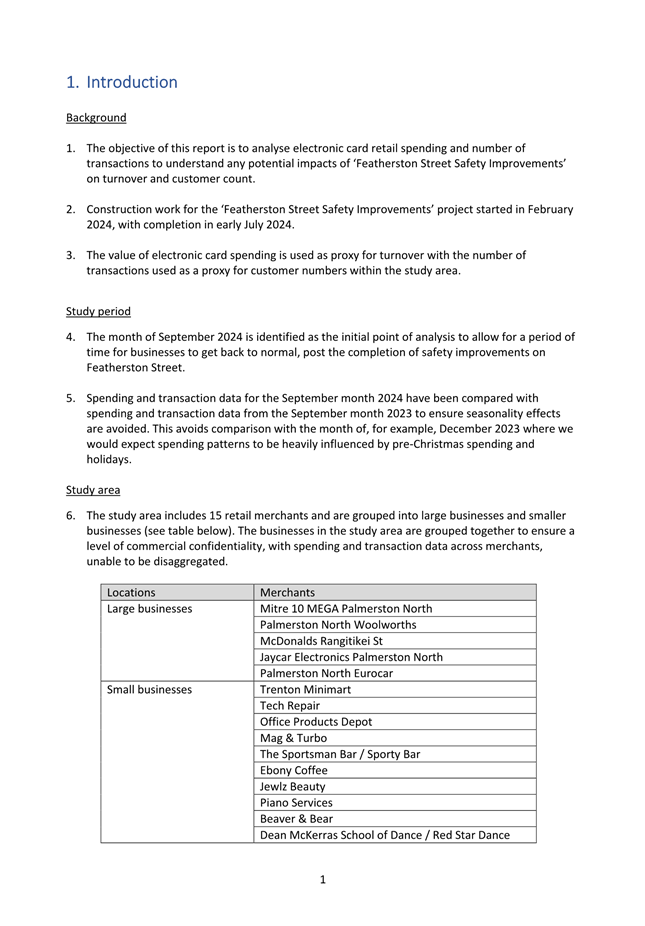

William

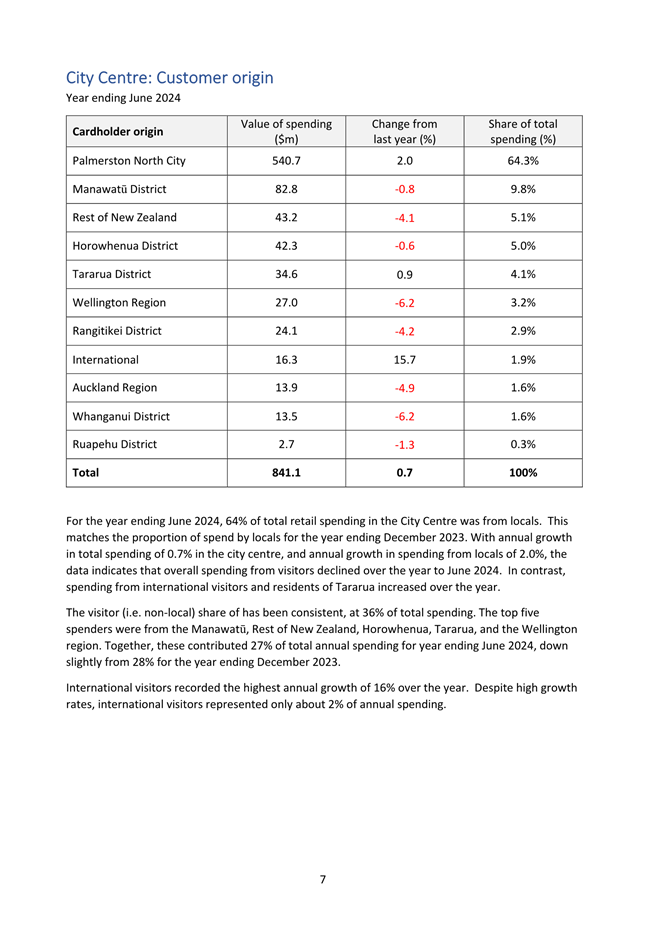

Wood (Deputy Chair)

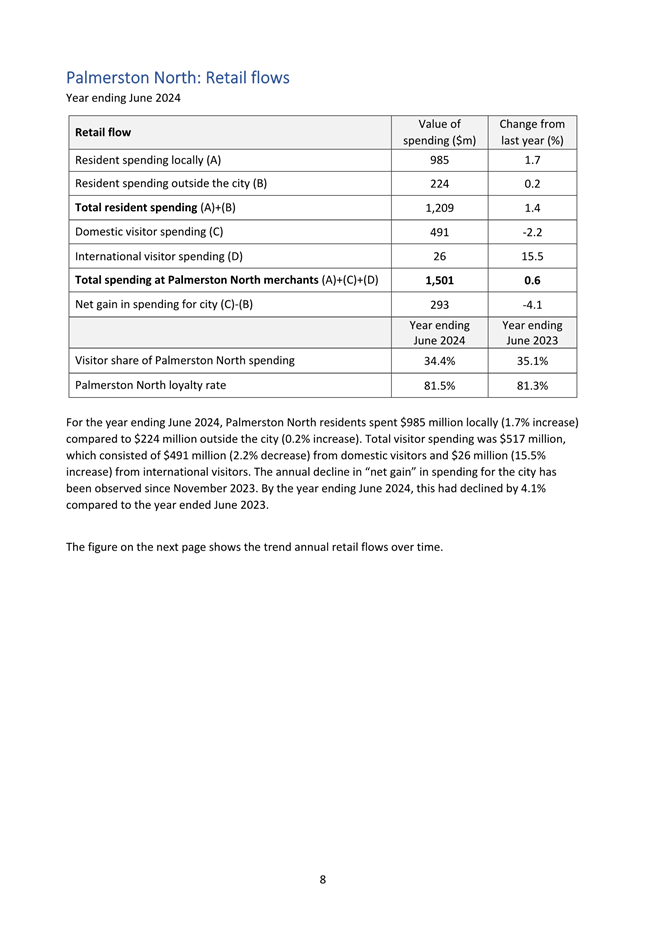

|

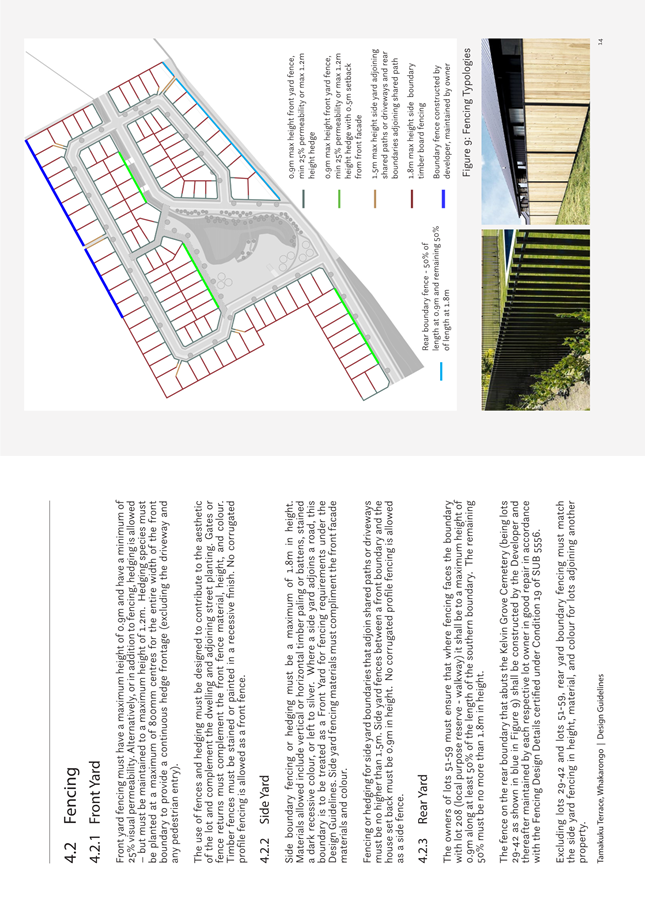

|

Grant

Smith (The Mayor)

|

|

Mark

Arnott

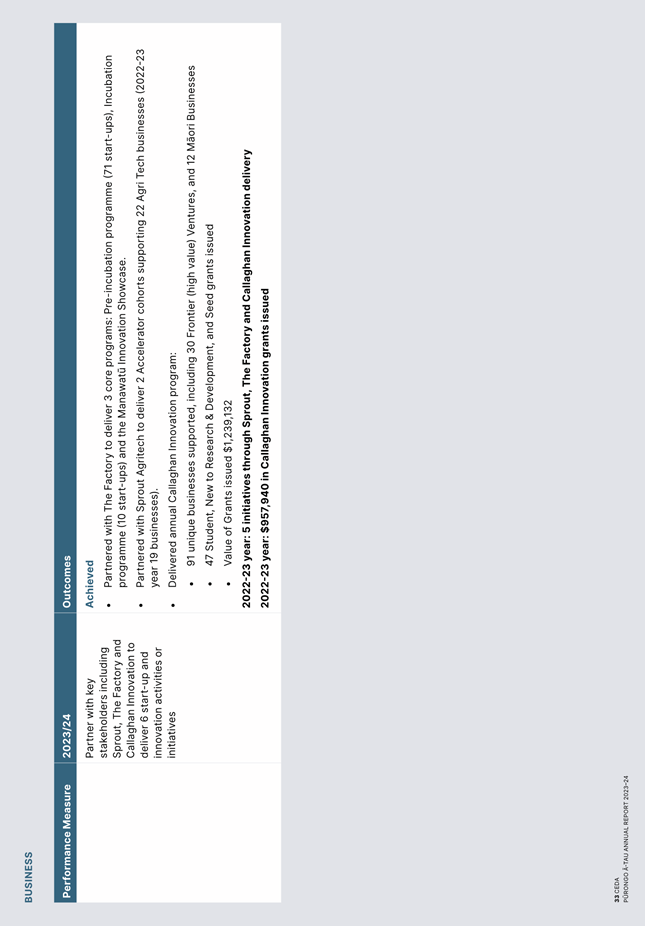

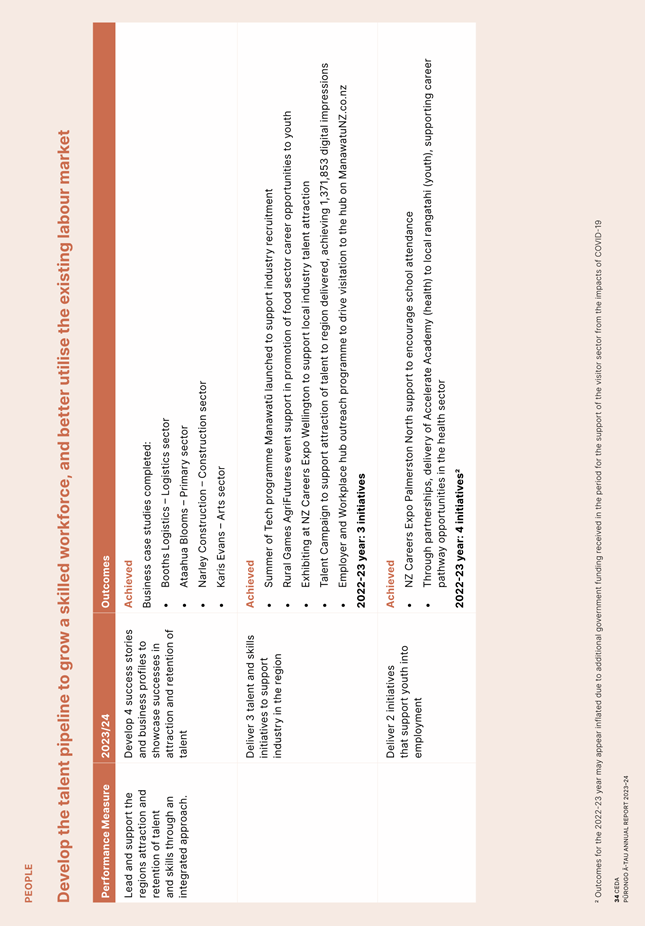

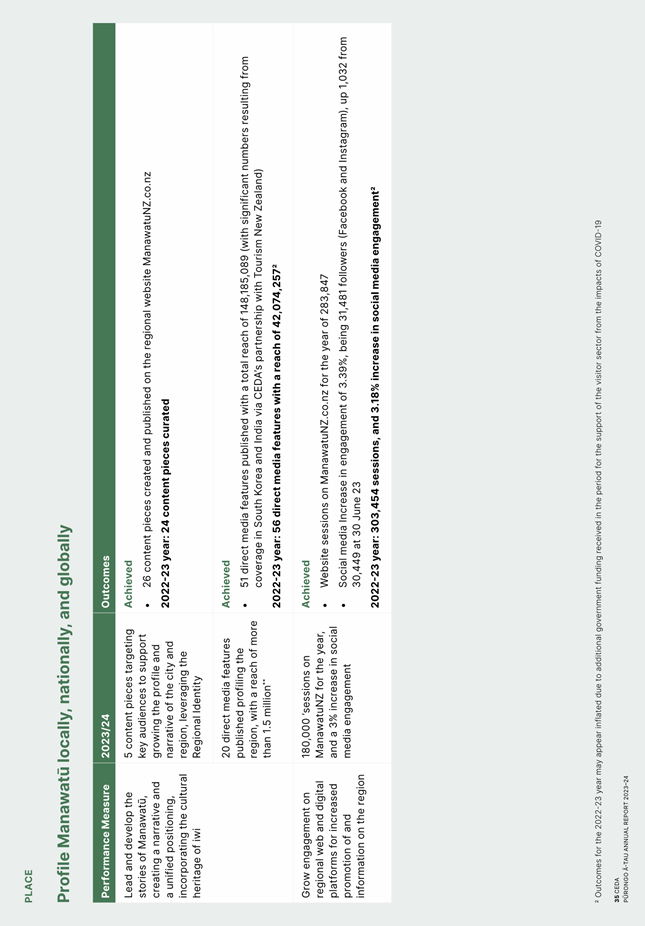

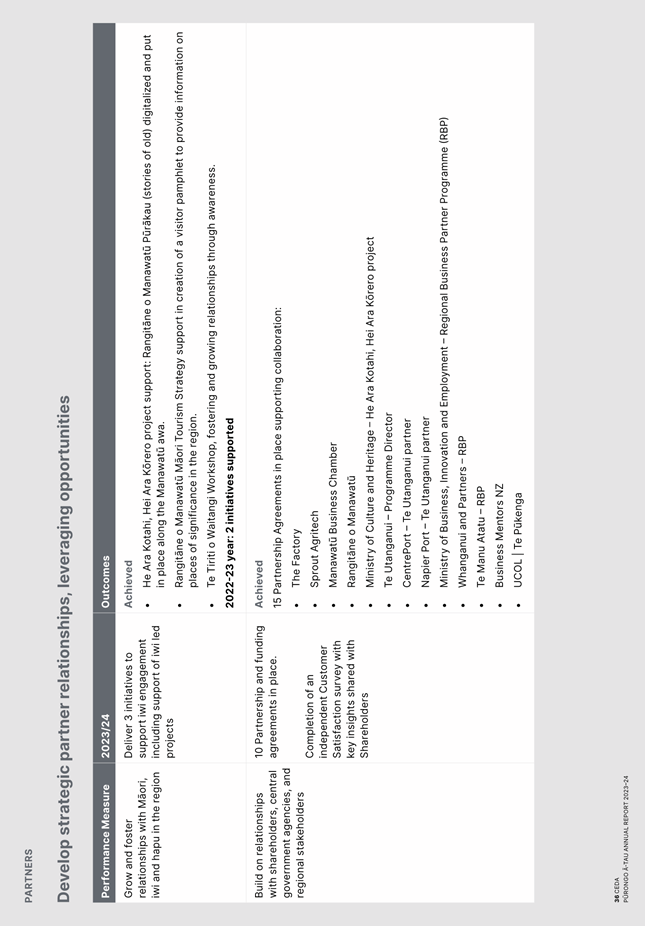

|

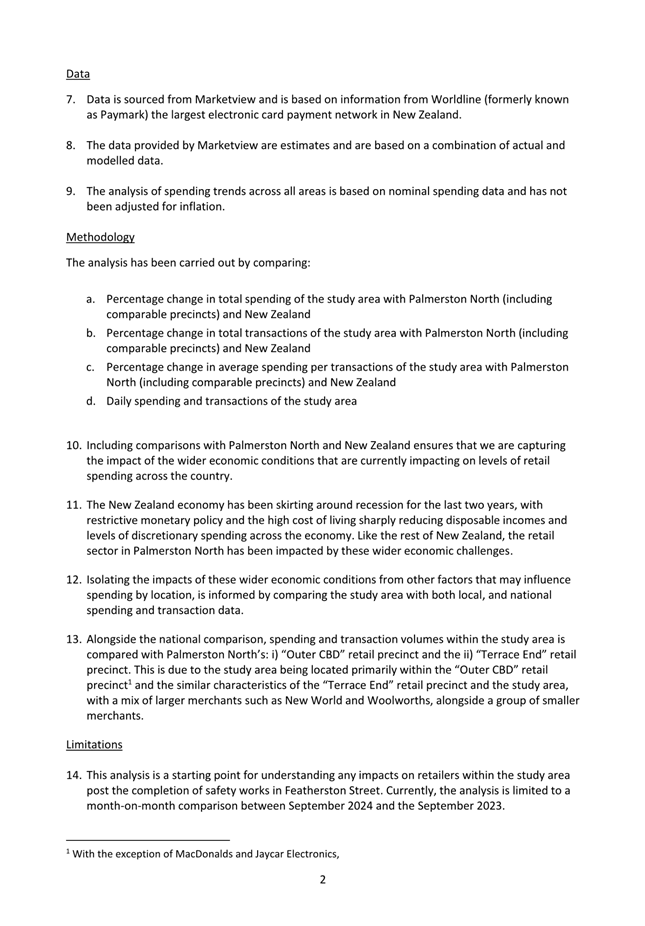

Lorna

Johnson

|

|

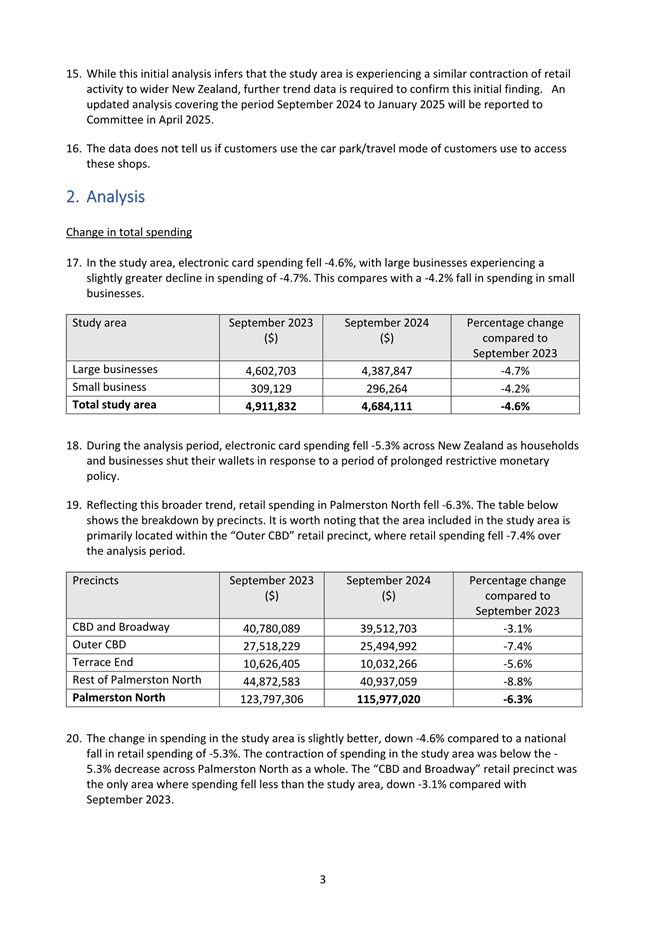

Brent

Barrett

|

Debi

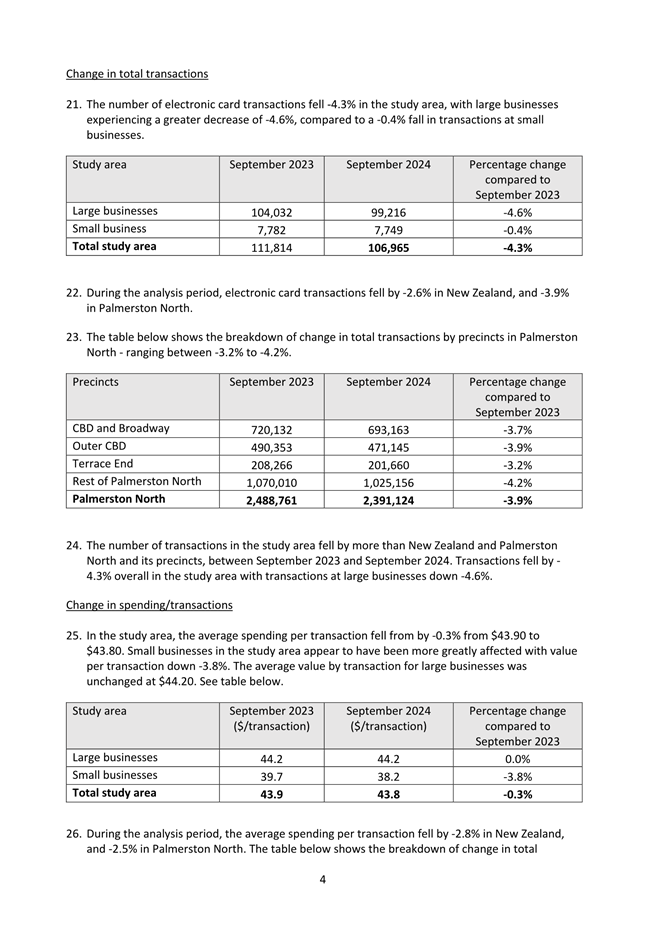

Marshall-Lobb

|

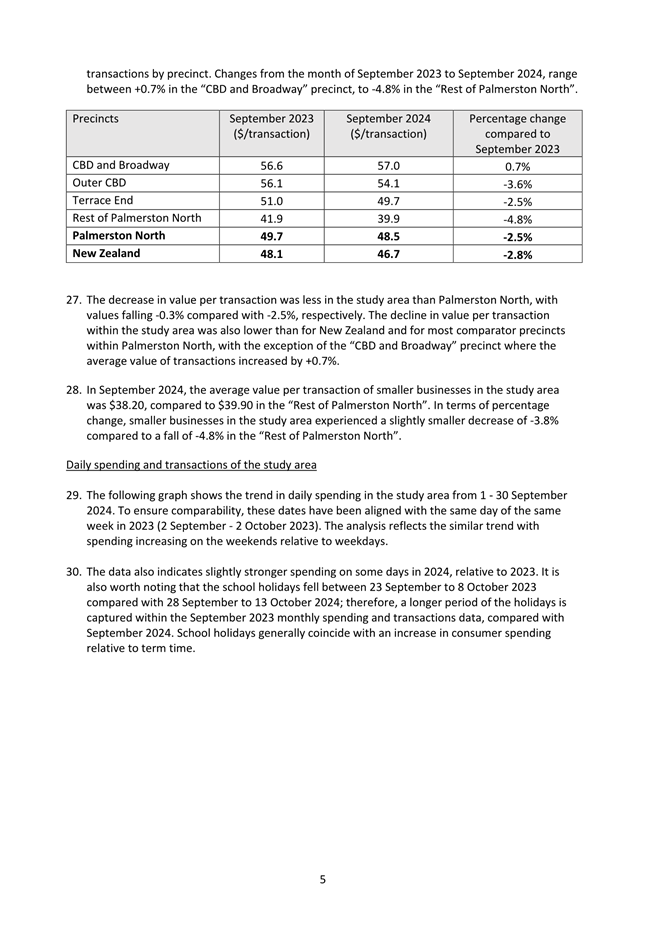

|

Rachel

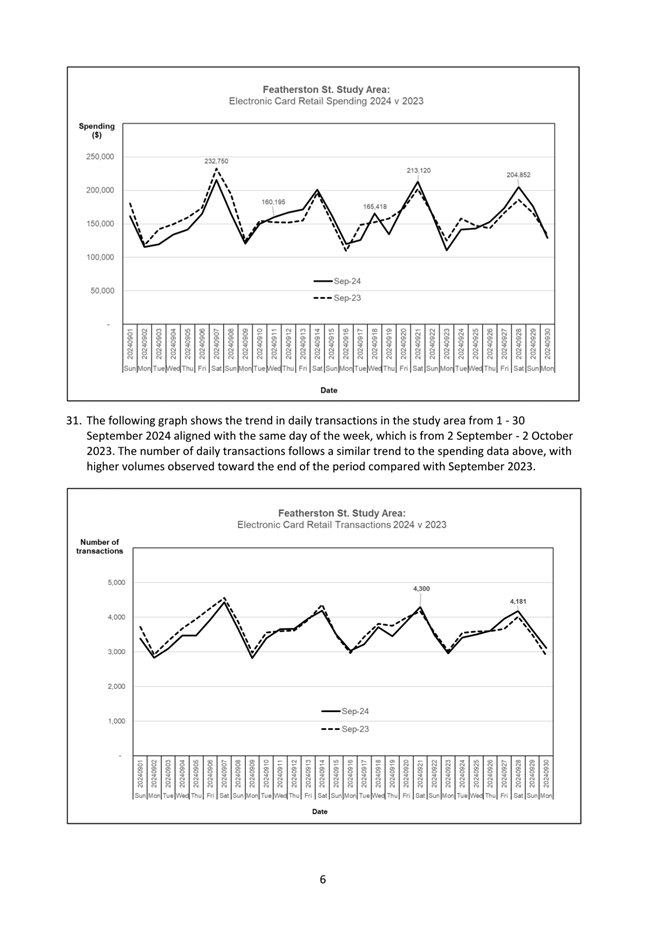

Bowen

|

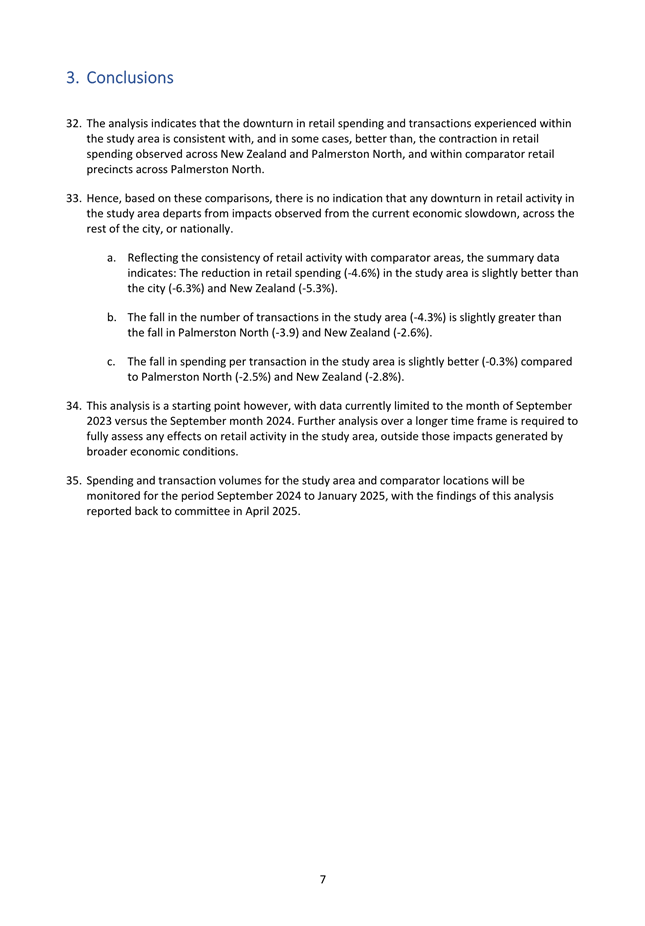

Billy

Meehan

|

|

Vaughan

Dennison

|

Orphée

Mickalad

|

|

Roly

Fitzgerald

|

|

Economic Growth Committee

MEETING

20 November 2024

Order of Business

1. Karakia Timatanga

2. Apologies

3. Notification

of Additional Items

Pursuant to

Sections 46A(7) and 46A(7A) of the Local Government Official Information and

Meetings Act 1987, to receive the Chairperson’s explanation that

specified item(s), which do not appear on the Agenda of this meeting and/or the

meeting to be held with the public excluded, will be discussed.

Any

additions in accordance with Section 46A(7) must be approved by resolution with

an explanation as to why they cannot be delayed until a future meeting.

Any

additions in accordance with Section 46A(7A) may be received or referred to a

subsequent meeting for further discussion. No resolution, decision or

recommendation can be made in respect of a minor item.

4. Declarations

of Interest (if any)

Members are

reminded of their duty to give a general notice of any interest of items to be

considered on this agenda and the need to declare these interests.

5. Public

Comment

To receive

comments from members of the public on matters specified on this Agenda or, if

time permits, on other Committee matters.

6. Petition

- Streets Ahead Palmerston North Page 7

7. Presentation

- The Factory Page 9

8. Confirmation

of Minutes Page 11

That the minutes of the Economic Growth Committee meeting

of 18 September 2024 Part I Public be confirmed as a true and correct record.

rePORTS

9. International

Trip to China, April 2024 Page 17

Memorandum, presented by Councillor Debi Marshall-Lobb.

10. International

Relations and Education - 6 Monthly Report Page 33

Memorandum, presented by Gabrielle Loga, Manager

International Relations.

11. Palmerston North

Quarterly Economic Update - September 2024 Page 91

Memorandum, presented by Stacey Andrews, City

Economist.

12. Road Maintenance

Contract - 6 Monthly Update Page 117

Memorandum, presented by Glen O'Connor, Manager -

Transport and Development.

13. Street Light Infill Page 123

Memorandum, presented by Glen O'Connor, Group Manager -

Transport and Development.

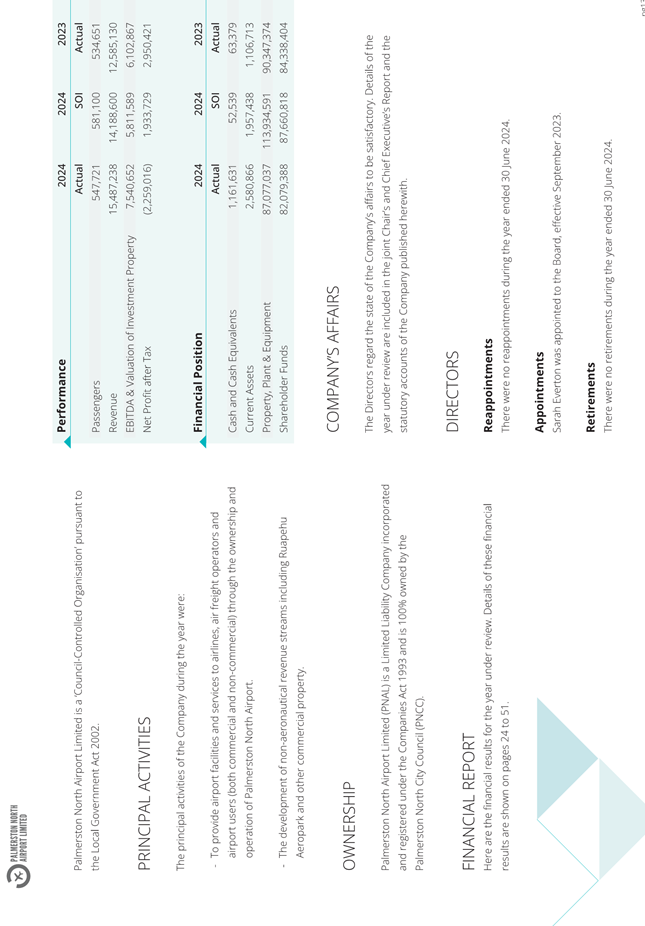

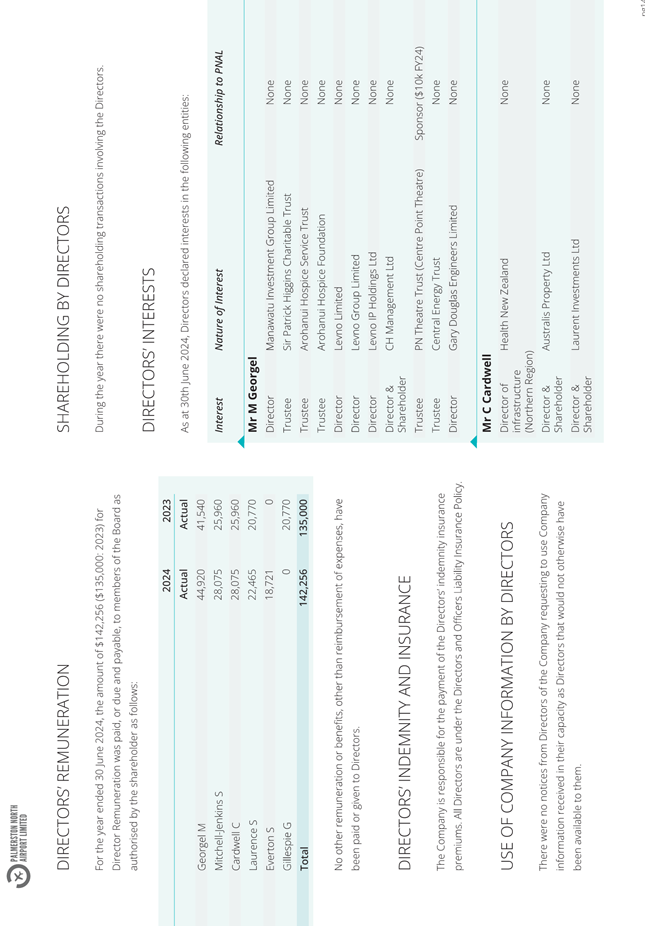

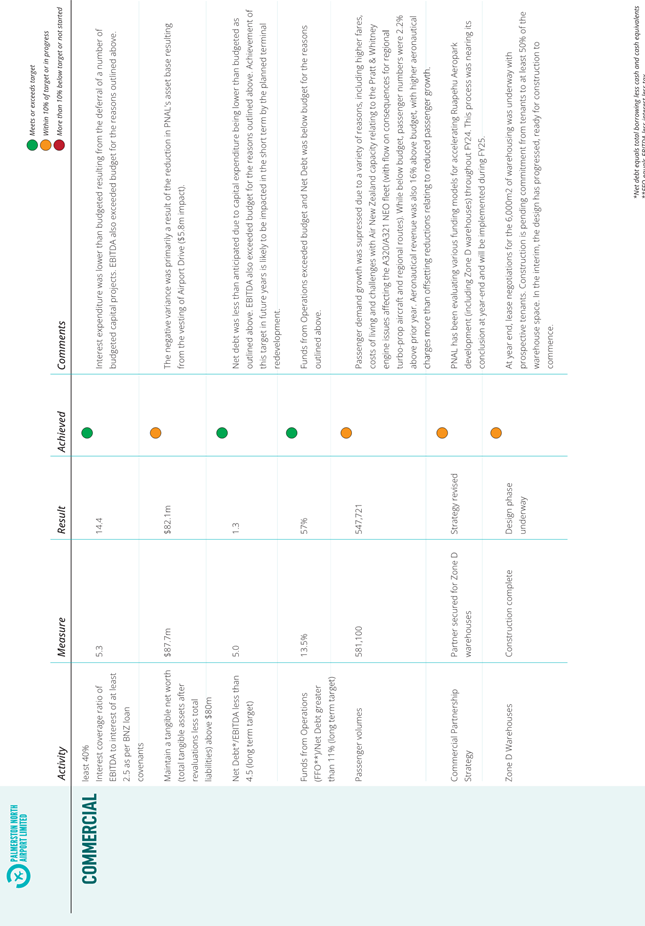

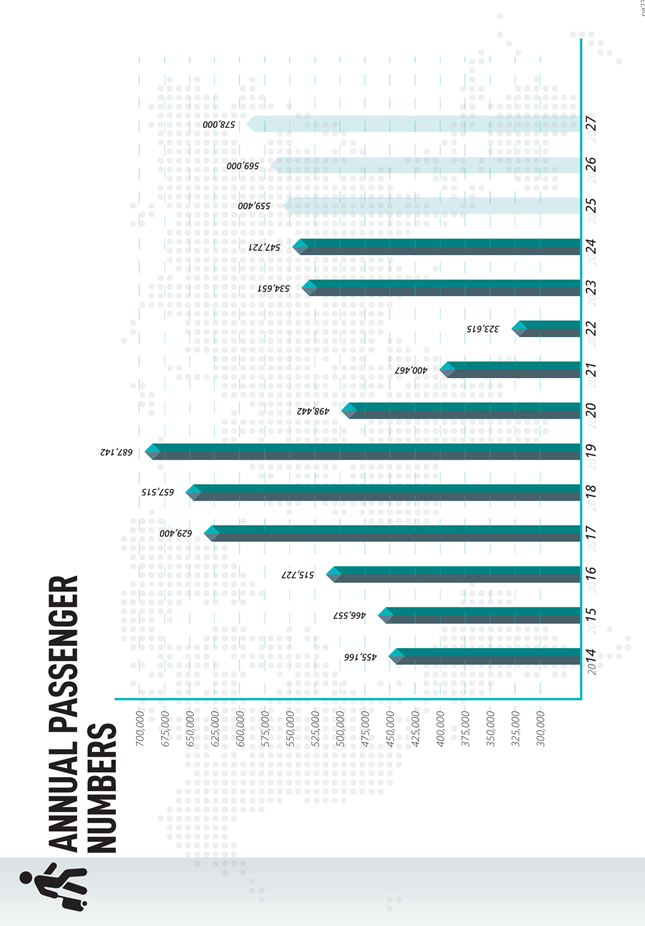

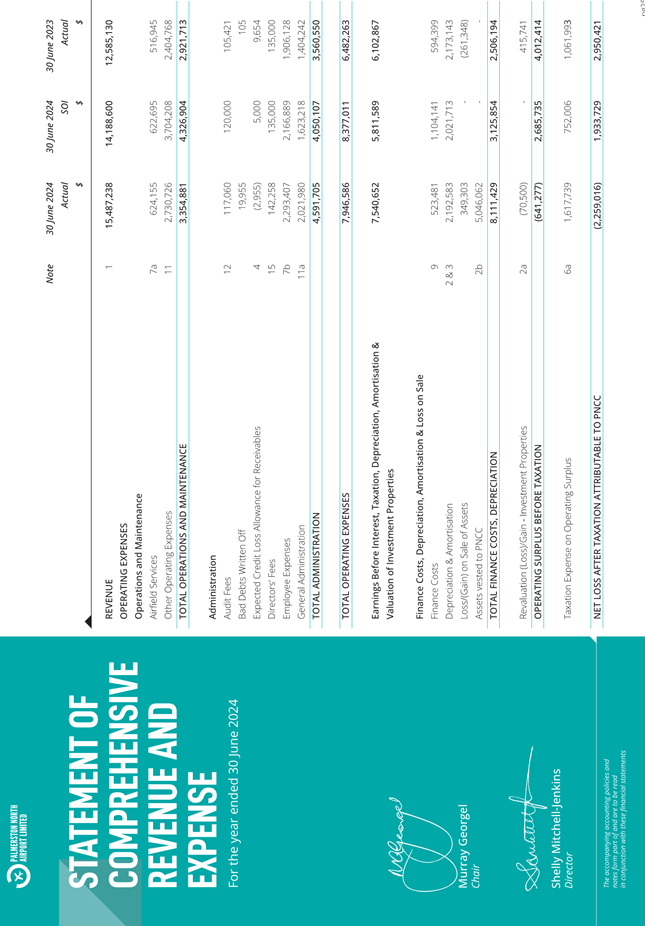

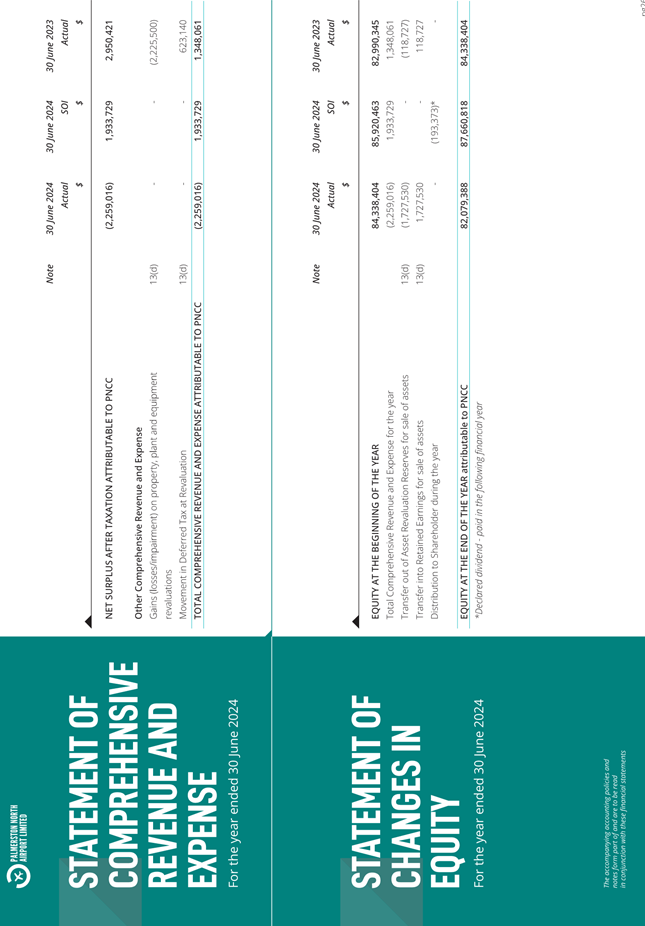

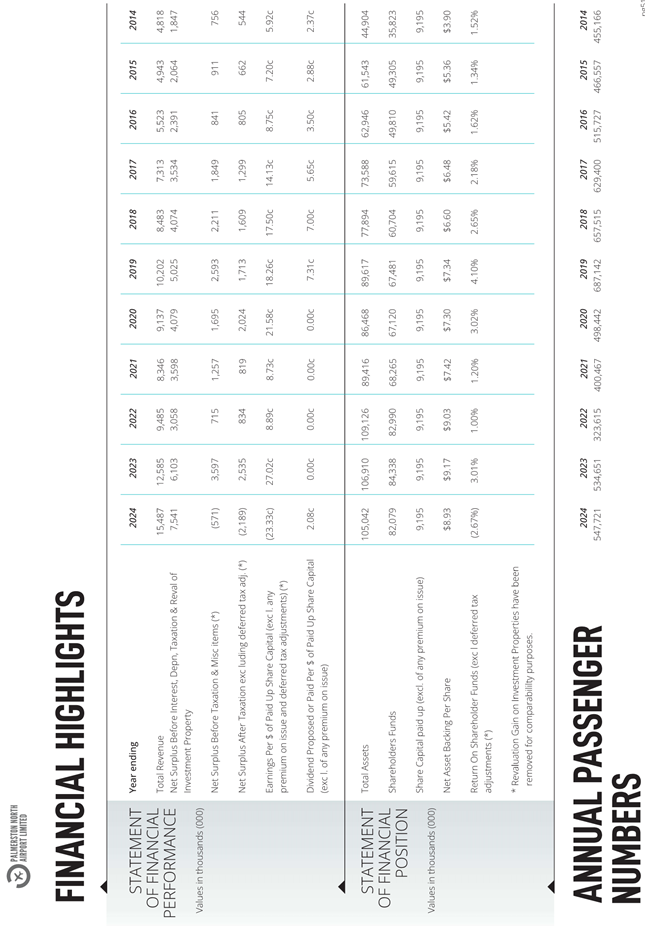

14. Palmerston North

Airport Limited - Annual report for 12 months ended 30 June 2024 &

Instructions relating to Annual Meeting Page 127

Memorandum, presented by Steve Paterson, Manager -

Financial Strategy.

15. Palmerston North

Airport Ltd - Statement of Expectations 2025/26-2027/28 Page 195

Memorandum, presented by Steve Paterson, Manager -

Financial Strategy.

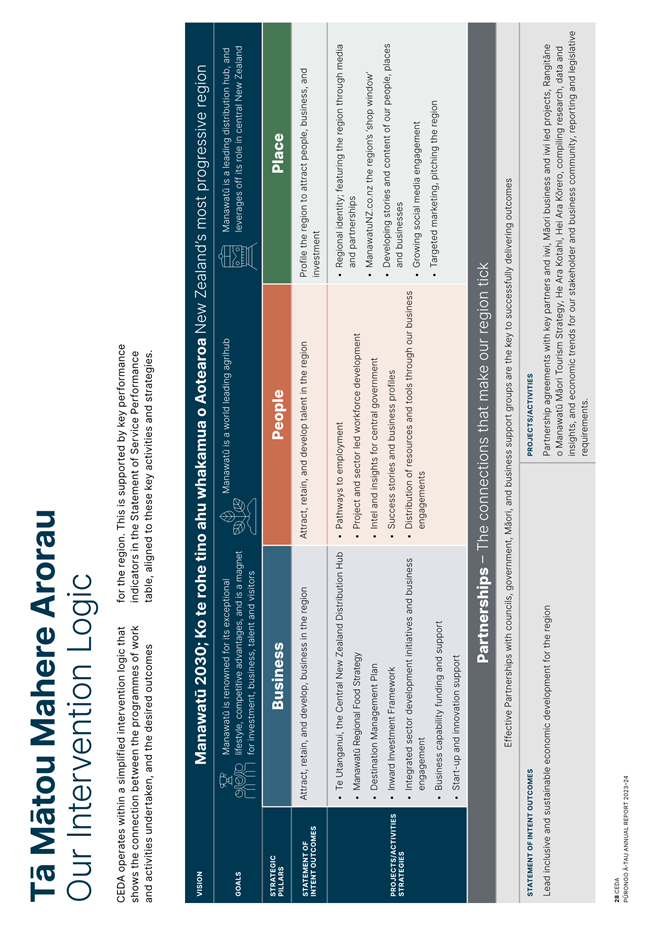

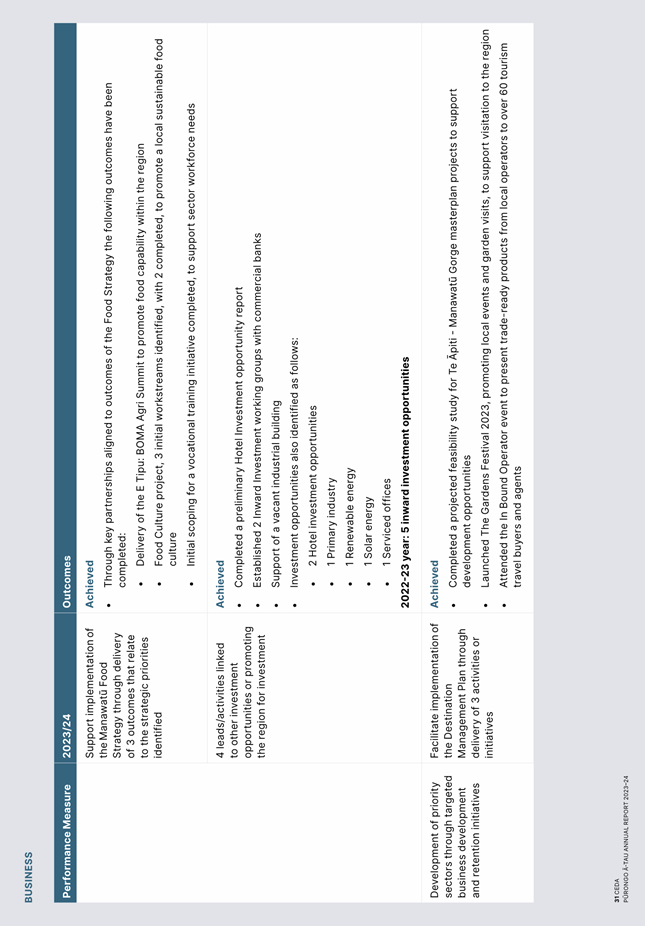

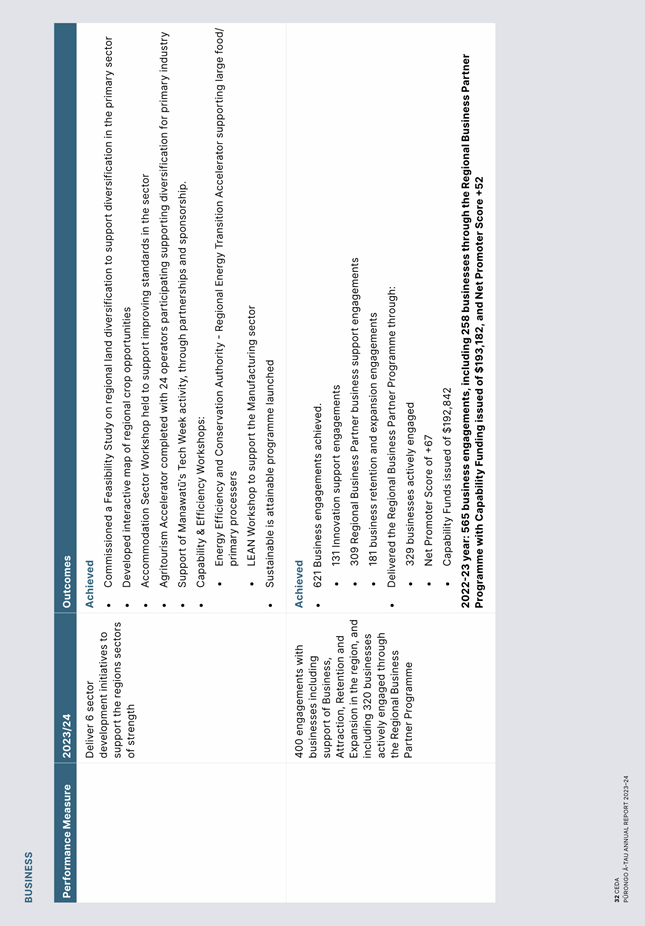

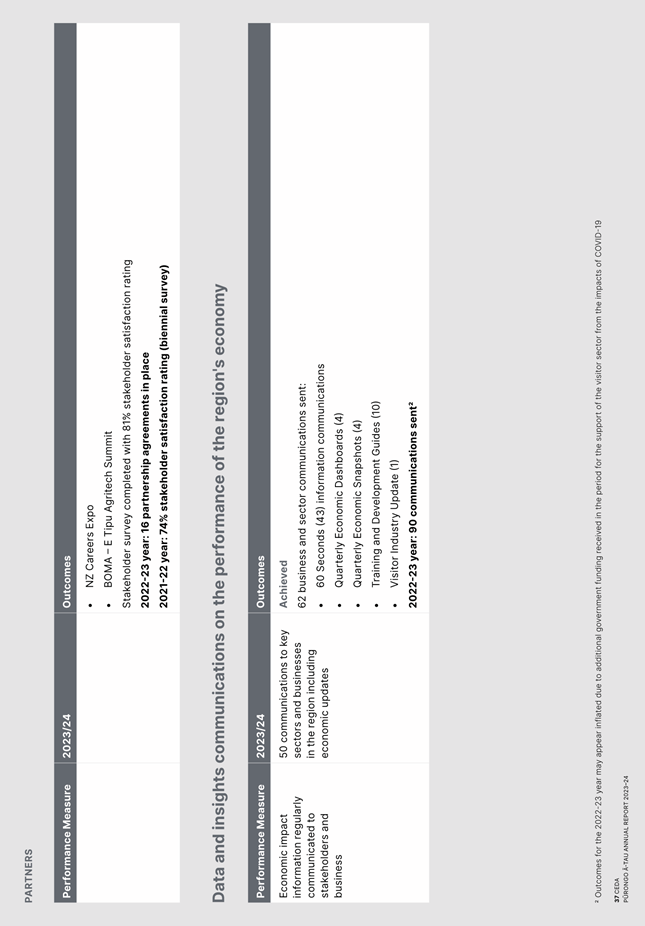

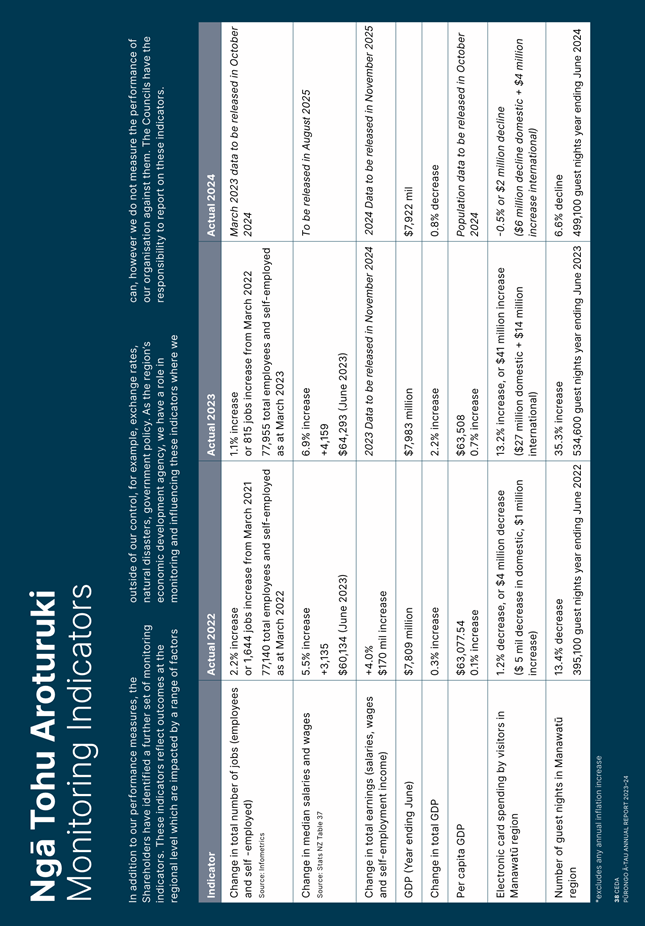

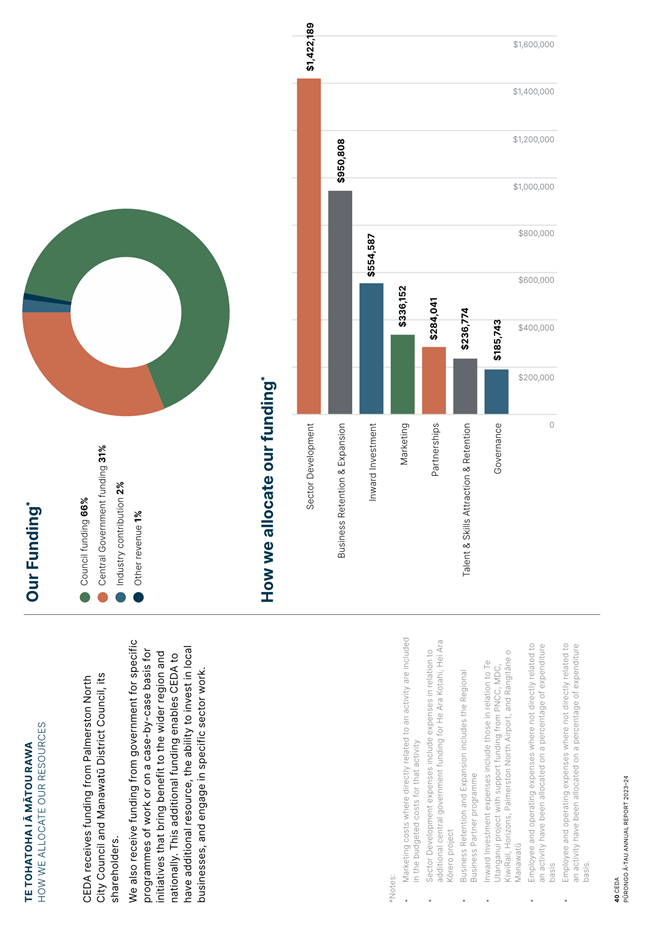

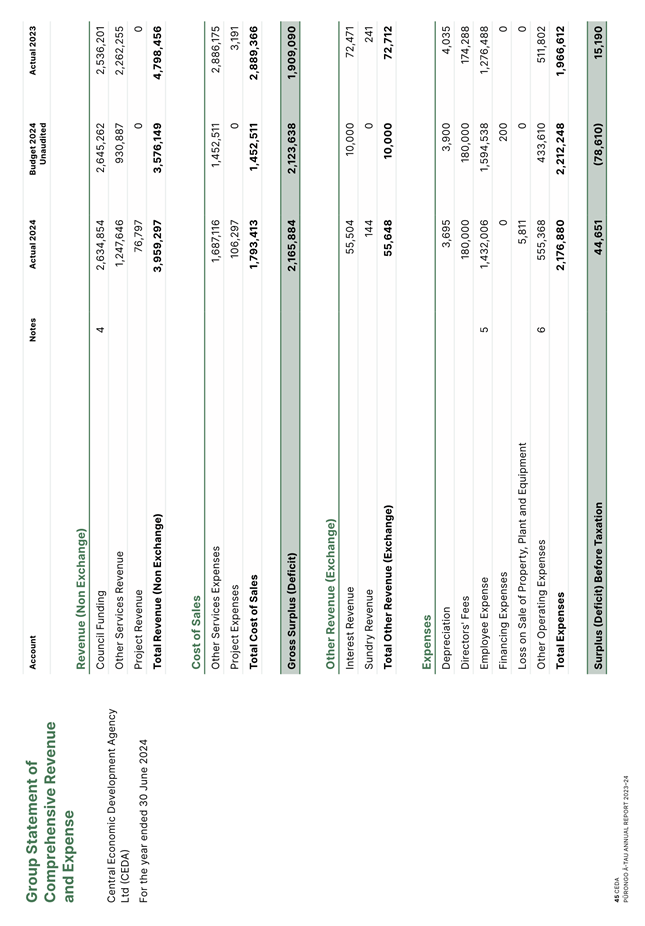

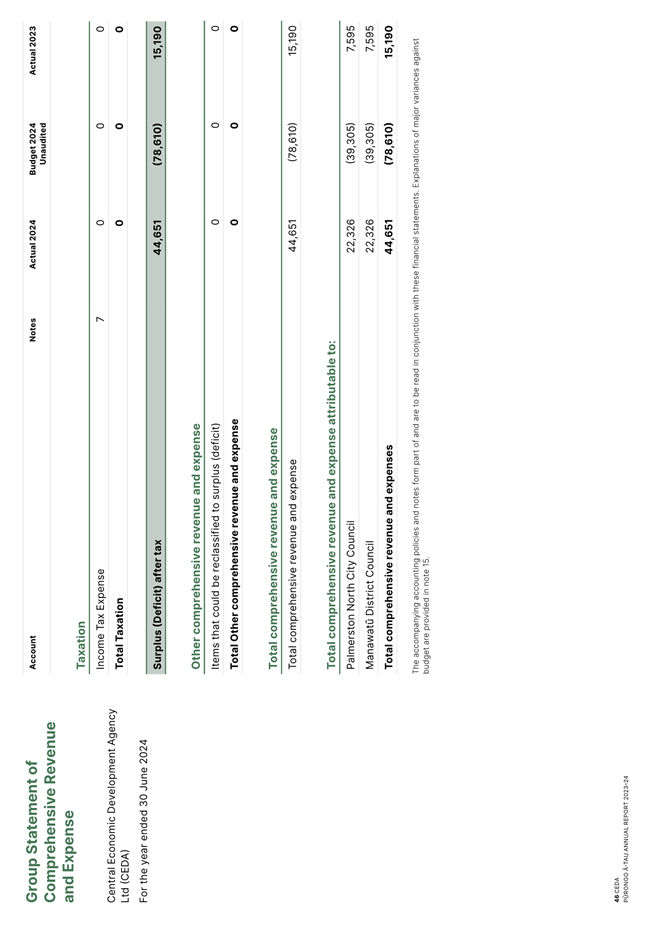

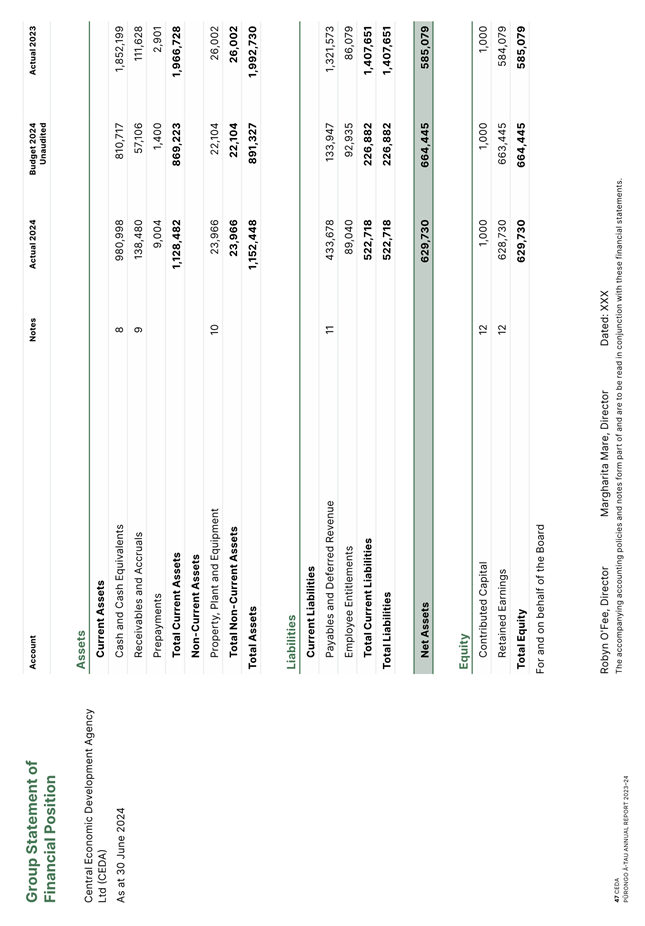

16. Central Economic

Development Agency (CEDA) Annual Report 2023-24 Page

203

Memorandum, presented by David Murphy, General Manager

Strategic Planning.

17. Featherston Street

Safety Improvements Project Update Page 275

Memorandum, presented by Glen O'Connor, Manager

Transport and Development and Michael Bridge, Service Manager Active Transport.

18. Draft Parking

Framework - Approval for Public Consultation Page 353

Report, presented by James Miguel, Senior Transport

Planner.

19. Annual Summary of

Economic Impact and Benefits of Council Supported Events Page 383

Memorandum, presented by Luke McIndoe, Head of Events.

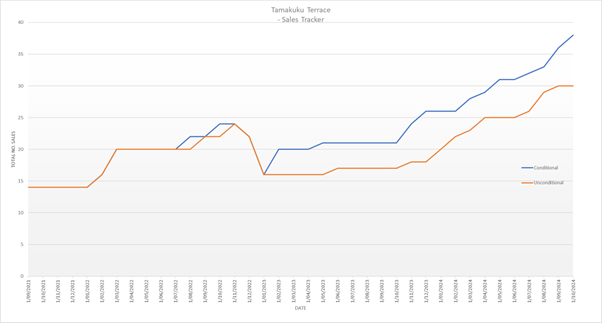

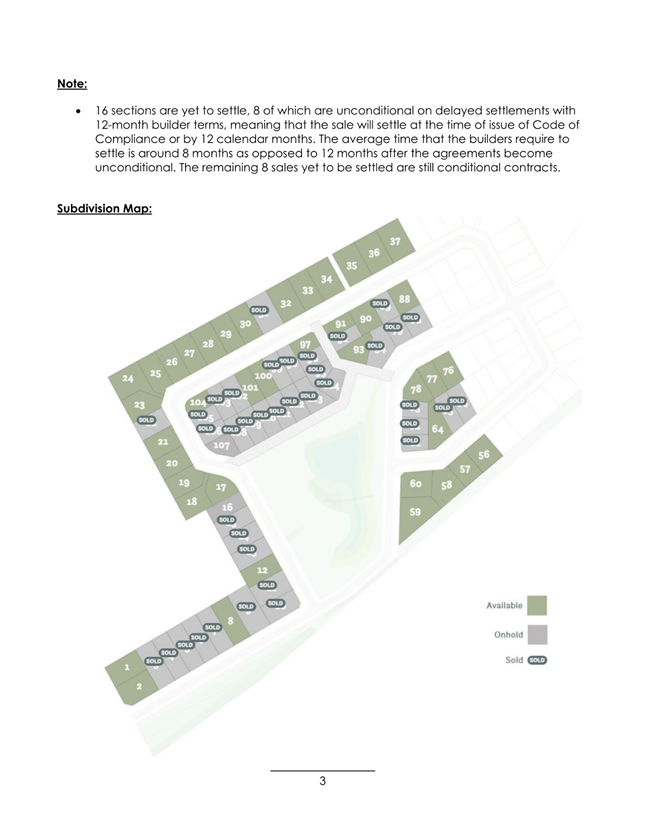

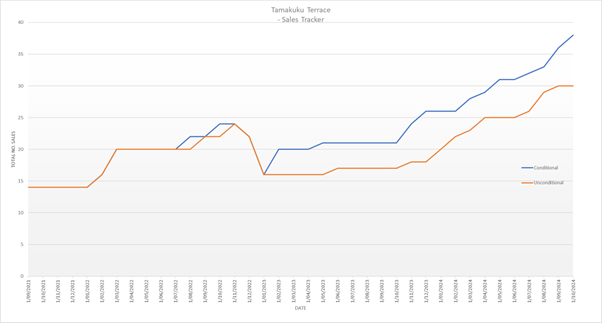

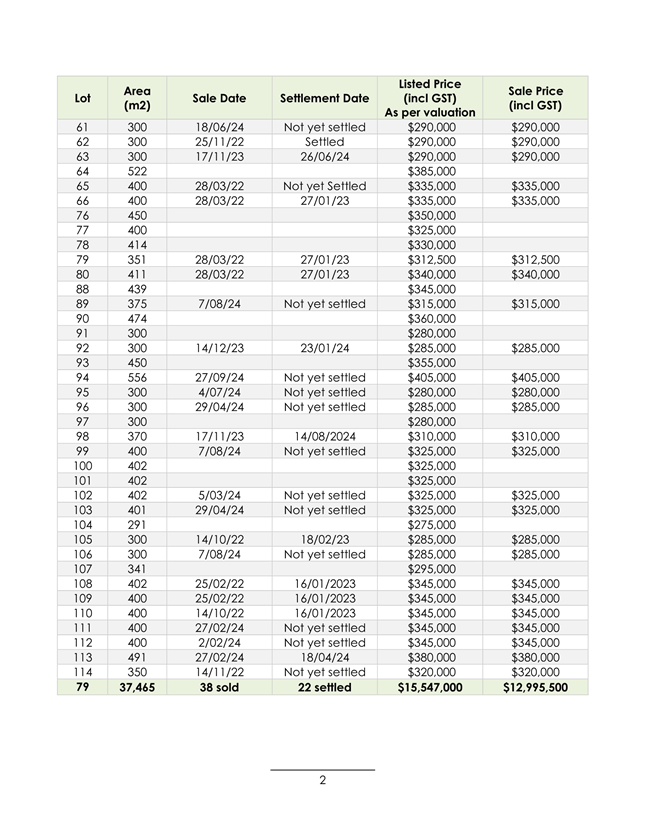

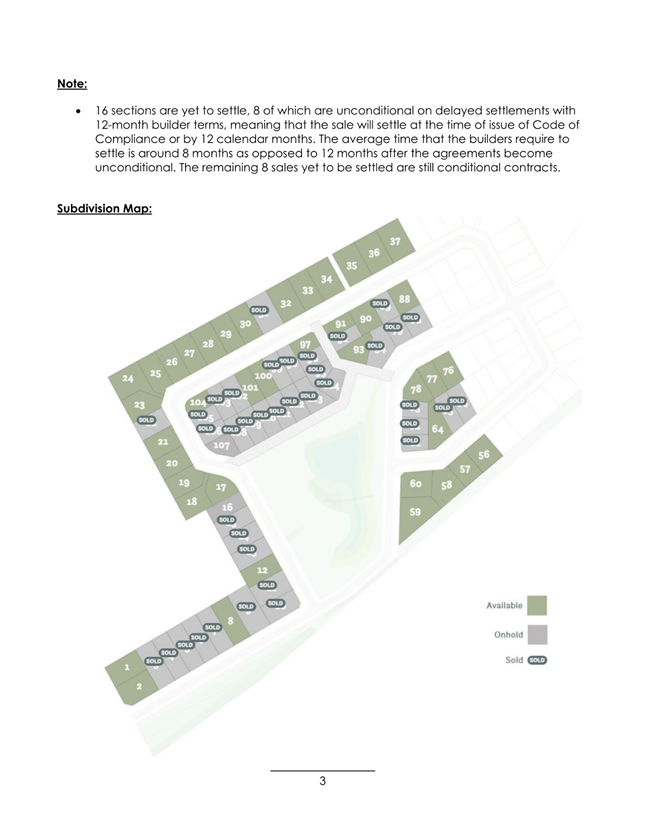

20. Tamakuku Terrace

Six Monthly Update Page 391

Memorandum, presented by Bill Carswell, Acting Manager

- Property, and Anna Saunders, Capital Projects Officer.

21. Committee Work

Schedule - November 2024 Page 421

22. Karakia

Whakamutunga

23. Exclusion

of Public

|

|

To be

moved:

“That the public be excluded from the

following parts of the proceedings of this meeting listed in the table below.

The general subject of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under Section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for

passing this resolution

|

|

24.

|

Confirmation of the minutes of the Economic Growth

Committee meeting of 18 September 2024 Part II Confidential

|

For

the reasons set out in the Economic Growth Committee of 18 September 2024,

held in public present.

|

|

|

|

|

This resolution is made in reliance on

Section 48(1)(a) of the Local Government Official Information and Meetings

Act 1987 and the particular interest or interests protected by Section 6 or

Section 7 of that Act which would be prejudiced by the holding of the whole

or the relevant part of the proceedings of the meeting in public as stated in

the above table.

|

Presentation

TO: Economic

Growth Committee

MEETING DATE: 20

November 2024

TITLE: Petition

- Streets Ahead Palmerston North

RECOMMENDATION

TO Economic Growth Committee

1. That the

Economic Growth Committee receive the petition for information.

James Irwin, on behalf of Streets Ahead Palmerston North, to

speak to Council in support of the completion of Featherston Street upgrades.

330 signatories.

121 signatories from Palmerston North and the wider

Manawatū.

PETITION TO THE ECONOMIC GROWTH COMMITTEE RE THE

COMPLETION OF FEATHERSTON STREET UPGRADES.

Streets Ahead Palmerston North is presenting a petition to

Palmerston North City Council at 9am on Wed 20th November, in support of the

completion of Featherston Street upgrades.

The changes implemented so far on Featherston street have

provided a greater feeling of safety for those residents who move about on

foot, cycle and by public bus. At the same time we’re seeing a change in

motor vehicle driver behaviour, such that following these changes this section

of the street feels safer on foot and on bicycle, and drivers of motor vehicles

are travelling slower and less aggressively. We need to keep in mind that

Featherston Street has been the most dangerous for all street users over the

last decade with 442 accidents and two fatalities. Our opinion is that

the design changes made will see a complete reversal of these staggering

statistics over the coming decade.

Palmerston North City Council has done a large amount of

work to include residents in the decision-making process for this change.

During this process there has been vocal opposition to the change from business

owners and residents on Featherston Street, and in the community at large. We

have raised this petition to demonstrate to council that there is support in

our community for these changes. Additionally, we also share in Palmerston

North City Council 's vision of a vibrant, creative and exciting city, and

consider that designing our streets to prioritise walking, scootering, and

cycling are a significant part of this vision.

The completed upgrade on Featherston street is part of

Palmerston North City Council’s original plan to upgrade the street from

Botanical Road to Vogel Street. In isolation, it provides a street that is safe

and pleasant for walking and cycling. However, it soon gives way to 'old

Featherston Street', a street that was designed to prioritise motor vehicle

transport. Pedestrians wait at intersections and roundabouts, with no

prioritised or safe crossing of the road, and cyclists must travel on a road

where there is no safe space for them to ride between parked cars and motor

vehicles travelling at speed. To enjoy the changes made so far, vulnerable road

users often must also use 'old Featherston Street' to get to the upgraded

section. This petition asks council to complete the upgrade of

Featherston Street, from Botanical Road to Vogel Street, as part of the changes

we need to move towards a vibrant, creative and exciting city.

Attachments

Nil

Presentation

TO: Economic

Growth Committee

MEETING DATE: 20

November 2024

TITLE: Presentation

- The Factory

RECOMMENDATION TO Economic Growth Committee

1. That the

Economic Growth Committee receive the presentation for information.

Nick Gain, General Manager, of The Factory will present an

update on The Factory activities to the Committee.

Attachments

NIL

Palmerston North City Council

Minutes of

the Economic Growth Committee Meeting Part I Public, held in the Council

Chamber, First Floor, Civic Administration Building, 32 The Square, Palmerston

North on 18 September 2024, commencing at 9.00am

|

Members

Present:

|

Councillor Leonie Hapeta (in the Chair),

The Mayor (Grant Smith) and Councillors William Wood, Mark Arnott, Brent

Barrett, Rachel Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna Johnson, Debi

Marshall-Lobb, Billy Meehan and Orphée Mickalad.

|

|

Non Members:

|

Councillors Lew Findlay, Councillor

Patrick Handcock and Councillor Kaydee Zabelin.

|

Councillor Lorna Johnson left the meeting at 12.35pm during

consideration of clause 52-24. She was not present for

clauses 52-24 and 53-24.

|

|

Karakia Timatanga

|

|

|

Councillor Kaydee Zabelin

opened the meeting with karakia.

|

|

47-24

|

Public Comment

Peter French recommended a design option to improve the

layout of the Vogel/Hayden/Featherston Street intersection.

Harvey Jones, Phil Stevens and Arthur Yeo made public

comment in support of the Notice of Motion to keep Te Ahu a Turanga highway

toll-free.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the Economic Growth Committee receive the public

comments.

|

|

|

Clause 47-24 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett, Rachel

Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb,

Billy Meehan, Orphée Mickalad, Lew Findlay, Patrick Handcock and Kaydee

Zabelin.

|

|

48-24

|

Presentation - Manawatū Chamber of Commerce

Amanda Linsley, Chief Executive, and Steve Davey, Chair,

Manawatū Chamber of Commerce, presented to the Committee.

They spoke on changes to the rating system, consultation

on the Te Ahu a Turanga proposed toll, local business confidence, and

business awards.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the Economic Growth Committee

receive the presentation for information.

|

|

|

Clause 48-24 above was

carried 14 votes to 1, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett, Rachel

Bowen, Vaughan Dennison, Roly Fitzgerald, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock and Kaydee Zabelin.

Against:

Councillor Lorna Johnson.

|

|

49-24

|

Presentation - Palmy BID

Rob Campbell, Chairperson, and Matthew Jeanes, General

Manager, of Palmy BID presented to the Committee.

They summarised the activities, programmes and projects

they developed during the year, along with future challenges.

They spoke on business confidence, retail crime and

homelessness and how they are working alongside the community to provide more

tools and information to be able to deal with these.

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the Economic Growth Committee

receive the presentation for information.

|

|

|

Clause 49-24 above was

carried 14 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett, Rachel

Bowen, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock and Kaydee Zabelin.

Note:

Councillor Vaughan Dennison

did not vote.

|

|

50-24

|

Confirmation of Minutes

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That

the minutes of the Economic Growth Committee meeting of 19 June 2024

Part I Public be confirmed as a true and correct record.

|

|

|

Clause 51-24 above was

carried 13 votes to 0, with 1 abstention, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett, Rachel

Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna Johnson, Billy Meehan,

Orphée Mickalad, Patrick Handcock and Kaydee Zabelin.

Abstained:

Councillor Debi

Marshall-Lobb.

Note:

Councillor Lew Findlay did

not vote.

|

The meeting adjourned at

10.30am.

The meeting resumed at

10.51am.

|

51-24

|

Notice of Motion -

Tolling Proposal for Te Ahu a Turanga

Councillor Brent

Barrett presented the notice of motion.

David Murphy, General Manager Strategic Planning and James

Miguel, Senior Transport Planner presented the officers’ advice.

The Mayor moved an additional motion to include in the

submission – that Council does support tolling future roads when the

affected community has prior knowledge (of a toll) before the project

commences.

|

|

|

Moved

Brent Barrett, seconded Lorna Johnson.

The COMMITTEE RECOMMENDS

1. That

Council lodge a submission calling for Te Ahu a Turanga to be kept free of

road tolling.

|

|

|

Clause 51.1-24 above was carried 11 votes to 4, the voting being as

follows:

For:

The Mayor (Grant Smith) and Councillors Brent Barrett, Rachel Bowen,

Vaughan Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy

Meehan, Lew Findlay, Patrick Handcock and Kaydee Zabelin.

Against:

Councillors Leonie Hapeta, William Wood, Mark Arnott and

Orphée Mickalad.

|

|

|

Moved

Grant Smith, seconded Leonie Hapeta.

The COMMITTEE RECOMMENDS

2. That in

principle, Palmerston North City Council support the option of tolls on

future new roading/highway projects where that is signalled in advance of the

project.

|

|

|

Clause 51.2-24 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and Councillors Leonie Hapeta, William Wood,

Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Roly Fitzgerald,

Lorna Johnson, Debi Marshall-Lobb, Billy Meehan, Orphée Mickalad, Lew

Findlay, Patrick Handcock and Kaydee Zabelin.

|

|

|

Moved

William Wood, seconded Vaughan Dennison.

The COMMITTEE RESOLVED

3. That

the Committee receive the officers’ advice attached to the Notice of

Motion - Tolling Proposal for Te Ahu a Turanga.

|

|

|

Clause 51.3-24 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett, Rachel

Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb,

Billy Meehan, Orphée Mickalad, Lew Findlay, Patrick Handcock and Kaydee

Zabelin.

|

The

Chair deferred the following reports to the next Economic Growth meeting on 20

November 2024:

· International Relations and Education

– 6 Monthly Report

· International Trip to China, April

2024

· Palmerston North Quarterly Economic

Update – September 2024

· Road Maintenance Contract – 6

Monthly update

|

52-24

|

Committee Work Schedule -

September 2024

|

|

|

Moved

Leonie Hapeta, seconded William Wood.

The COMMITTEE RESOLVED

1. That the

Economic Growth Committee receive its Work Schedule dated September 2024.

|

|

|

Clause 52-24 above was

carried 13 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Leonie Hapeta, William Wood, Mark Arnott, Brent Barrett, Rachel

Bowen, Vaughan Dennison, Roly Fitzgerald, Debi Marshall-Lobb, Orphée

Mickalad, Lew Findlay, Patrick Handcock and Kaydee Zabelin.

Note:

Councillors

Lorna Johnson and Billy Meehan did not vote

|

Exclusion

of Public

|

53-24

|

Recommendation to Exclude Public

|

|

|

Moved

William Wood, seconded Leonie Hapeta.

The COMMITTEE RESOLVED

That the public

be excluded from the following parts of the proceedings of this meeting

listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under Section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General

subject of each matter to be considered

|

Reason

for passing this resolution in relation to each matter

|

Ground(s)

under Section 48(1) for passing this resolution

|

|

17.

|

Tamakuku Terrace design guidelines review

|

Maintain legal privilege: and commercial

activities:

|

s7(2)(g) and s7(2)(h)

|

|

|

|

|

This resolution is made in reliance on Section 48(1)(a) of the

Local Government Official Information and Meetings Act 1987 and the

particular interest or interests protected by Section 6 or Section 7 of that

Act which would be prejudiced by the holding of the whole or the relevant part

of the proceedings of the meeting in public as stated in the above table.

Also that Stephen Cornwall, Veros, be permitted to remain after the public has been excluded for the

reason stated, for his knowledge and ability to assist the meeting in

speaking to, and answering questions for Item 17 Tamakuku Terrace design

guidelines review, noting that he will be present at the meeting only for that

report.

|

|

|

Clause 53-24 above was

carried 13 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Leonie Hapeta, William Wood, Mark Arnott, Rachel Bowen, Vaughan

Dennison, Roly Fitzgerald, Debi Marshall-Lobb, Billy Meehan, Orphée

Mickalad, Lew Findlay, Patrick Handcock and Kaydee Zabelin.

Note:

Councillors Brent Barrett

and Lorna Johnson did not vote.

|

The Chair (Leonie

Hapeta) vacated the Chair, and announced the Deputy Chair (William Wood ) would

chair the confidential part of the meeting.

The public part

of the meeting finished at 12.37pm.

Confirmed 20 November 2024

Chair

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 18

September 2024

TITLE: International

Trip to China, April 2024

Presented

By: Councillor

Debi Marshall-Lobb

APPROVED BY: Waid

Crockett, Chief Executive Officer

RECOMMENDATION TO Economic Growth Committee

1. That the

Committee receive the memorandum titled ‘International visit to China,

April 2024’ presented on 18 September 2024.

This Report was deferred

from the Committee meeting on 18 September 2024

1. ISSUE

1.1 On

6 March 2024, Council approved the Deputy Mayor to travel to China from 11 - 25

April 2024 to join the World Class Education delegation to Hefei, China and to

cover up to $400 travel costs associated with this trip.

1.2 This

memorandum reports back on outcomes of that visit.

Mā te kimi ka kite, mā te kite ka mōhio, mā te mōhio ka mārama

Seek and discover; discover and know; know and become enlightened

2. background

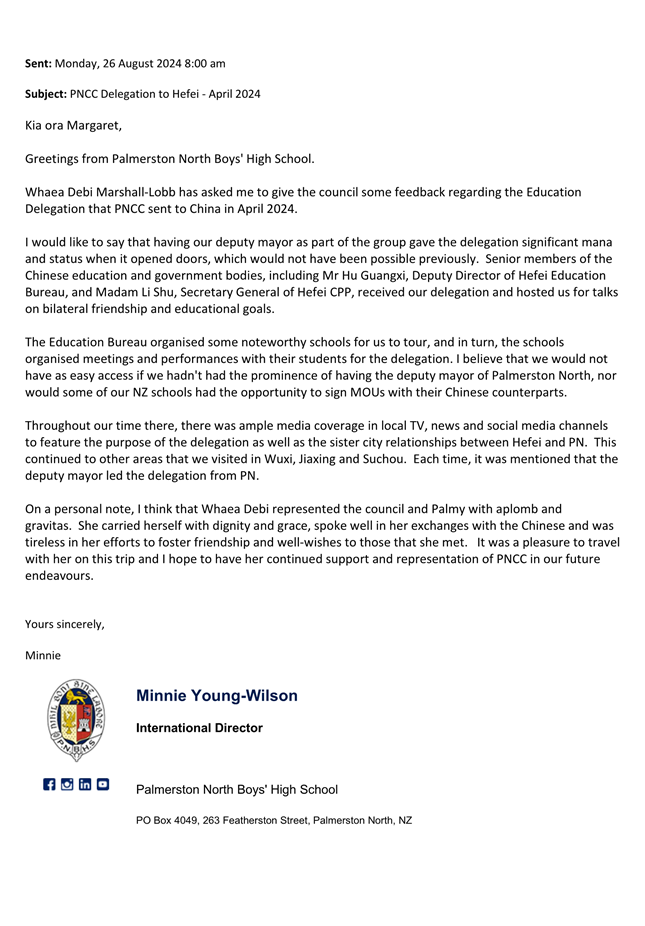

2.1 The

Director of World Class Education invited me to accompany their Education

Delegation to China in order to give prominence to the City’s support of

our schools and wider community. I was chosen because of my educational background

(Retired Primary and Secondary School Principal, former ministerial appointee

of the New Zealand Teachers’ Council and current Secondary School

educator) as well as being Deputy Mayor.

2.2 The

trip resulted in several Memoranda of Understanding (MoUs) between the

participating Palmerston North schools and the partner schools. These

agreements outline plans for student exchange programmes, aiming to enhance

educational outcomes for both parties.

2.3 The

trip was funded collectively by Awatapu College, Palmerston North Boys’ High

School, Palmerston North Girls’ High

School, Queen Elizabeth College, Whakarongo Primary School and World Class

Education.

2.4 As stated on Palmerston North City Council’s

(Council) website:

“Palmy is a growing hub of international

activity and networks. We are home to world-class education and research

institutes, international firms and businesses in trade. We welcome students

from all over the world …Palmerston North City Council has an important

role in helping our city become more internationally connected, competitive,

and vibrant.”

2.5 Hence,

this position corresponds with the objectives of the trip and also the

Council’s goal to be an innovative and growing city: a

globally connected city that fosters opportunities for local people, businesses

and organisations.

3. trip report

Purpose of

the Trip:

• To establish and consolidate

strategic cooperative partnerships with schools in Changchun City, Wuxi City,

Jiaxing City, and Hefei City.

• To foster friendly and sister

inter-school relations between primary and secondary schools.

• To promote study trips,

winter and summer camp activities for Chinese and New Zealand students.

• To encourage educational

exchanges and visits, including teacher and school student exchange programmes,

and to organise high-level forums on educational topics.

Palmerston

North Participants and Schools:

• Mary Cherian, International

Director - Awatapu College

• Minnie Young-Wilson,

International Director - Palmerston North Boys’

High School

• Lina Hong, Director - International,

Palmerston North Girls’ High School

• Sarah Lassen, Deputy

Principal - Queen Elizabeth College

• Jaco Broodryk, Principal -

Whakarongo Primary School

• Shirley Urquhart,

Administration Manager - World Class Education

• Wendy Jochem, Director - World

Class Education

Other

Participants and Schools:

• Antoinette Walters,

International Director - Waiuku College

• Stuart Kelly, Principal -

Waiuku College

• Robert Gilbert, Principal -

Papanui High School, Christchurch

• Jo Hunnikin, Principal -

Waimate High School

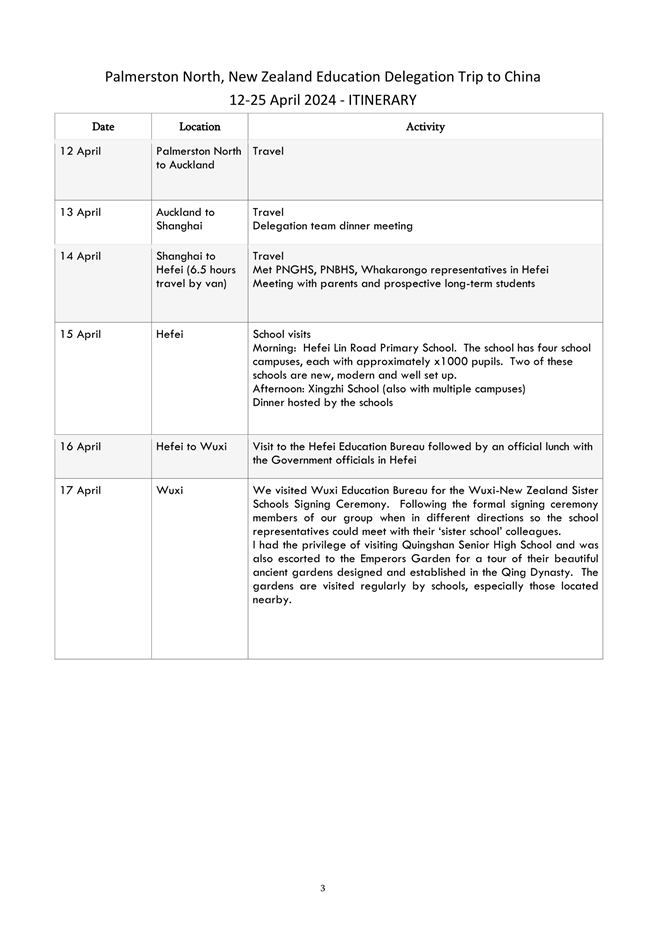

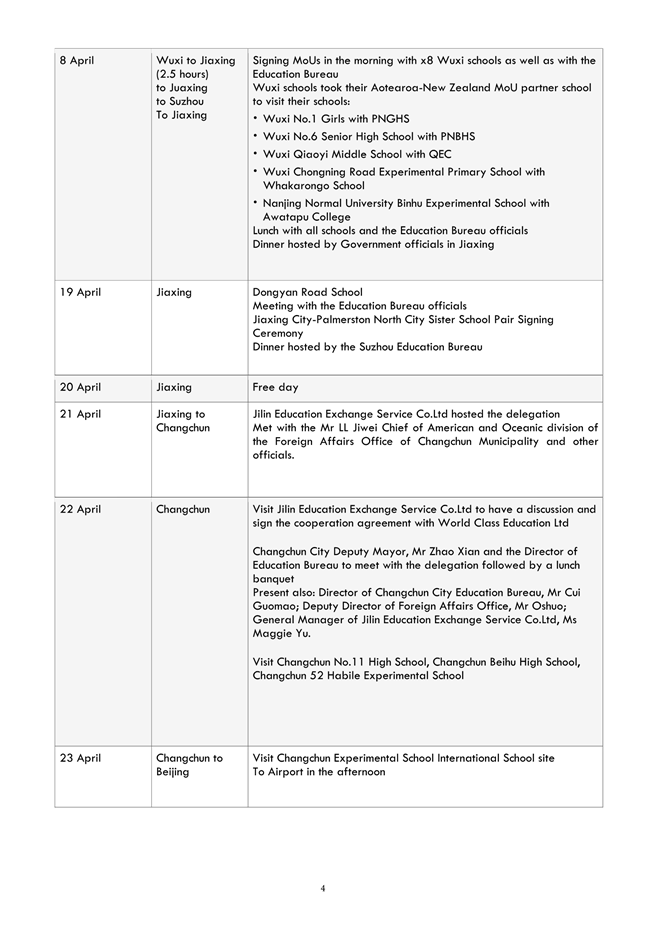

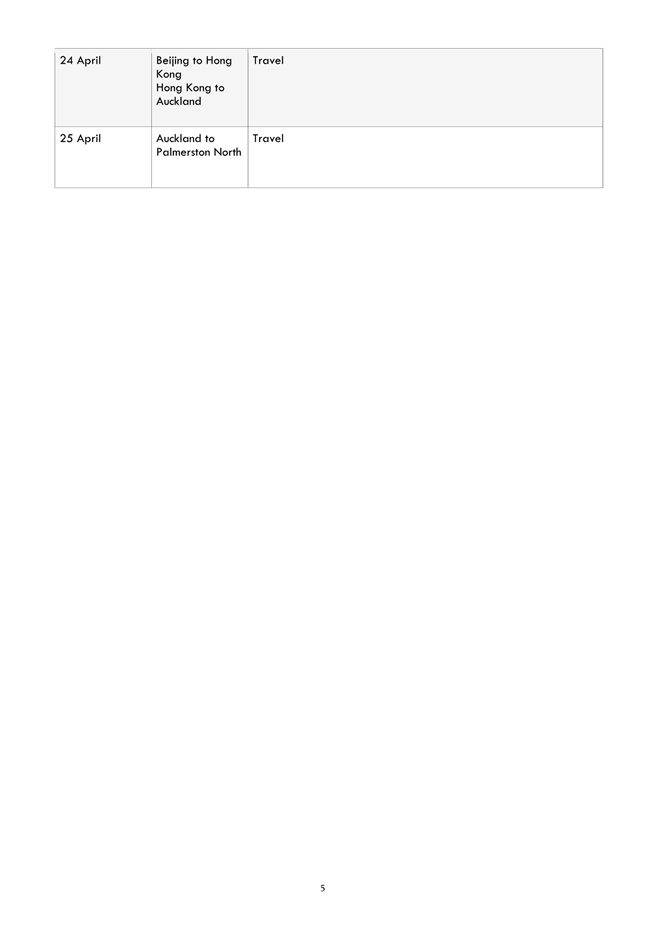

Itinerary, Feedback

and Photos

3.1 Attached

is the travel itinerary (Attachment 1), feedback from school representative

(Attachment 2) and photos (Attachment 3).

4. KEY FINDINGS

4.1 Cultural

Exchange and Mutual Learning:

4.2 Both the local schools and partner schools gained valuable insights

into each other’s

educational systems and cultural contexts. This exchange fostered mutual

respect and understanding, paving the way for future collaborations.

Benefits of

Educational Delegation Trips:

4.3 Educational delegation trips offer multifaceted benefits, including

improved teaching practices, the fostering of international partnerships, and

enhanced student learning outcomes and experiences.

Insights:

4.4 World

Class Education Limited have a well-established network and relationships with

schools in China and provided a well-planned trip with multiple opportunities

to meet school officials, parents and students.

4.5 Our

school representatives were all experienced, diligent and professional

educators who superbly promoted their schools and community; they also

supported each other in a manner that was cooperative and collaborative.

4.6 The

schools we visited were welcoming and genuinely interested in Palmerston North

schools and our city.

5. RECOMMENDATIONS

Promoting Local

Schools to Overseas Schools and their Students:

5.1 Promoting local schools to overseas schools and their students can strategically enhance educational opportunities,

cultural diversity, and boost the local economy.

Suggest Palmerston

North City Council considers:

1. Continuing to support and promote our local schools to

cities with which they/we have formal relationships.

2. Look to develop

a dedicated International section with a

Education sub-set on our council’s website with information about our schools,

highlighting their strengths and successes.

3. Where possible consider sending representatives to accompany local educational

delegations to showcase the schools and interact directly with potential

schools, students, families, civic leaders, and related organisations.

4. Collaborate on joint projects or initiatives

that can raise the profile of our city and local schools internationally.

5. Take opportunities domestically within the City/region to welcome

and host visiting schools,

educators, and associated guests.

6. ACKNOWLEDGMENTS

6.1 I

would like to thank the following people and schools:

• Wendy Jochem, Director of World Class

Education for the Invitation to accompany the Delegation and for the

opportunity to have such a positive experience to promote our city and schools.

• Mary Cherian of Awatapu College.

• Minnie Young-Wilson of Palmerston North

Boys’ High School.

• Lina Hong, Palmerston North Girls’

High School.

• Sarah Lassen of Queen Elizabeth College.

• Jaco Broodryk of Whakarongo Primary

School.

• and Shirley Urquhart, of World Class

Education.

• Stuart Kelly and Antoinette Walters of

Waiuku College; Robert Gilbert of Papanui High School, and Jo Hunnikin of

Waimate High School.

• David Bovey, Rector-Palmerston North

Boys’ High School.

• Tracey Walker, Principal-Palmerston

North Girls’ High School.

• Gary Yeatman, Principal-Awatapu College.

• Chris Moller, Principal-Queen Elizabeth

College.

• Jaco Broodryk, Principal-Whakarongo

Primary School.

• Mayor Grant Smith, Elected Members of

Council, Council Staff- especially Margaret Hunt, Kunal Chonkar and Sheila

Monaghan.

7. NEXT STEPS

7.1 The

on-going partnership between Palmerston North and China should continue to

support the initiatives that further develop our relationship.

7.2 No

further actions are required from this visit.

8. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these objectives?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to:

Whāinga 1: He tāone

auaha, he tāone tiputipu

Goal 1: An innovative and

growing city

|

|

The

recommendations contribute to the achievement of objective/objectives

in:

14.

Mahere mana urungi, kirirarautanga hihiri

14. Governance and Active

Citizenship Plan

Facilitate international economic and educational

partnerships for the city.

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The delegation visit helped to

promote the city’s positive international reputation, demonstrated

Palmerston North’s commitment to international collaboration and friendship,

exchanged best practices and explored opportunities to enhance economic,

educational, cultural and community cooperation.

|

|

|

|

Attachments

|

1.

|

Delegation

Trip to China - Itinerary ⇩

|

|

|

2.

|

Delegation

Trip to China - School Feedback ⇩

|

|

|

3.

|

Delegation

Trip to China - Photos ⇩

|

|

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 20

November 2024

TITLE: International

Relations and Education - 6 Monthly Report

Presented

By: Gabrielle

Loga, Manager International Relations

APPROVED BY: David

Murphy, General Manager Strategic Planning

RECOMMENDATION TO Economic Growth Committee

1. That the

Committee receive the report titled ‘International Relations and

Education – 6 Monthly Report’ presented on 18 September 2024.

This Report was deferred

from the Committee meeting on 18 September 2024

1. ISSUE

1.1 The

purpose of this memorandum is to update the Economic Growth Committee on the

key international relations and education activities over the past six months

and their contribution to the relevant goal, strategy and plan.

2. BACKGROUND

2.1 This

report outlines the key international relations and education activities since

April 2024 and provides an updated activity schedule from the International

Relations and Education Annual Plan 2024-2025.

3. International

city partnership updates

Mihara, Japan (2019 – 2024)

3.1 In

commemoration of the 5th anniversary of the sister city

relationship, Palmerston North city and Mihara city signed a Memorandum

of Understanding with the Hiroshima Global Academy, providing an opportunity

for Palmerston North high school students to study an International

Baccalaureate (IB) programme at Hiroshima Global Academy at no tuition cost for

2-3 years. Mihara will assign an adopted local family to look after the

selected student as their own, providing an authentic Japanese cultural

experience and extra family support in Hiroshima during the study.

3.2 Officers

have worked with Hiroshima Global Academy on a campaign to promote the

programme to Palmerston North local high schools. Two international webinars

were organised for interested students, parents, and teachers on 7 June and 5

July 2024 in Palmerston North to learn about Hiroshima Global Academy, the IB

programme offered as well as the application process.

Figure 1- Mayor of Palmerston North,

Mayor of Mihara, and Principal of Hiroshima Global Academy signed the MOU in

January 2024

3.3 Two

teachers from Hiroshima Global Academy travelled to Palmerston North in person

from 19 – 23 August 2024. They visited Palmerston North Boys’ High

School, Awatapu College, Freyberg High School, and Palmerston North

Girls’ High School to present directly to the students about the

programme. They also took the opportunity to visit Massey University, UCOL, IPU

New Zealand, and the English Teaching College (ETC)while they were here.

3.4 There

is potentially an opportunity to set up an annual study program from Hiroshima

Global Academy to Palmerston North schools in the future, if capacity allows.

Kunshan, China (1994 – 2024)

3.5 In

line with the celebration of 30 years of friendship between Palmerston North

and Kunshan, Kunshan Municipal People’s Government sent a delegation to

Palmerston North from 17 June to 19 June 2024 to attend E Tipu Boma Agri Summit

and explore business opportunities with the city. The delegation was led by Mr

Feng Renxin, Chairman of the Standing Committee of Kunshan Municipal People’s

Congress.

3.6 Mayor

Grant Smith and a small delegation went to Kunshan in January 2024 to progress

discussions regarding cooperation in the AgriTech and food science sectors

between FoodHQ, Palmerston North and the East China Agricultural Science and Technology

Centre, Kunshan – Suzhou.

3.7 On

17 June 2024, with the presence of the Kunshan delegation, Palmerston North

City Council held a formal signing ceremony where the two cities’ leading

research and development centres agreed to work together on food innovation and

technology. A copy of the memorandum of understanding is included as attachment

one.

3.8 The

Memorandum of Understanding between FoodHQ in Palmerston North and the East

China Agricultural Science and Technology Centre in Kunshan (as attached in

Attachment 1) will open doors for bilateral cooperation in modern agriculture,

smart farming, and talent cultivation for companies, entrepreneurs, and

research institutes in both countries.

Figure 2- MOU Signing Ceremony between

FoodHQ and ECS-CAAS witnessed by PNCC and Kunshan delegation 2024

3.9 In

addition to attending the E Tipu Boma Agri Summit, the Kunshan delegation

visited Massey University, New Zealand Plant and Food Research, The Factory and

Goodman Fielder factory in Longburn. These visits provided the delegation with

insights into Palmerston North’s advanced achievements and offers in

education, research, innovation and agricultural technology.

3.10 Upon

return, Mr Feng Renxin sent a thank you letter to Palmerston North, signalling further

collaborative opportunities in trade and agribusiness. A copy of the letter is

included as attachment two.

3.11 The

Kunshan delegation visit to Palmerston North and the formal signing ceremony in

June 2024 was well reported by The NZ Herald, Manawatū Standard, and

Chinese media, boosting the publicity and profile of both cities.

3.12 Conversations

about subsequent visits from Kunshan – Suzhou to Palmerston North

later in 2024 are happening as a direct result of the signed Memorandum of

Understanding between FoodHQ and the East China Agricultural Science and

Technology Centre.

Figure 3- Kunshan delegation visited NZ

Plant & Food in June 2024

Guiyang, China (1992 – 2024)

3.13 Guiyang

continues to express its desire to enhance educational collaboration with

Palmerston North at all levels.

3.14 At

elementary school level, Council’s International Relations and Education

Advisor is exploring the partnership opportunity between the Central Primary

School of Dula Buyi Village and Whakarongo School as well as other interested

primary schools in the Manawatū.

3.15 At high

school level, Guiyang is proposing a “Youth Ambassadors Summer

Camp” for July 2025 in order to nurture international youth connections

and consolidate the 32-year sister city relationship with Palmerston

North. The programme offers to invite up to 20 Palmerston North high

school students to participate in a 10-day and 9-night visit to Guiyang during

the term 2 holiday in New Zealand. During their time in Guiyang, the students

will get to visit scenic spots in Guiyang and colourful Guizhou, explore 23

different ethnic minority cultures and attend Chinese school activities.

Council’s International Relations and Education Advisor will continue to

further plan and action this programme in 2025.

3.16 At

tertiary level, Council is offering support for Massey University School of

Agriculture and Environment to revitalise their partnership with Guizhou

University and Guizhou Vocational College of Agriculture.

Missoula, the USA (1982 – 2024)

3.17 Council’s

International Relations division was awarded with the US Public Diplomacy Grant

to bring Aspen Decker, a Salish representative from Missoula, to Palmerston

North from 14-19 June 2024 to co-present with Rangitāne at E Tipu Boma

Agri Summit on indigenous practices of food harvesting, consuming and

sustainable traditions. Due to logistical issues, Aspen was unable to travel in

person and had to send in a short video presentation instead.

3.18 The

funding is now earmarked for Missoula Day in November 2024. The proposal is to

bring a small indigenous delegation from the Salish Kootenai College, the

Native American Centre of University of Montana, and Aspen Decker to Palmerston

North to participate in Missoula Day 2024.

3.19 Missoula

Children’s Theatre is also looking to take part in the event, working

with Aspen Decker to create short plays telling indigenous stories to perform

at Missoula Day in Palmerston North.

3.20 In addition,

Missoula Children’s Theatre has been in discussions with Kane Parsons

about the possibility of bringing their Little Red Truck programme to the

children of Palmerston North in a near future. The discussion is supported by

Arts Missoula, the Central Economic Development Agency and Palmerston North

City Council. Further details on the Little Red Truck programme are available

at: https://www.youtube.com/watch?v=N6ZU0H8aQh0

Wageningen,

The Netherlands

3.21 An online

meeting was held on 7 December 2023 attended by:

· Mayor

Grant Smith – Palmerston North City Council

· Mayor

Floor Vermeulen – Gemeete Wageningen

· Professor

Chris Anderson – Massey University

· Mr

Marco Otte – Wageningen University and Research

· Mrs

Gabrielle Loga – Palmerston North City Council

· Mr

Kunal Chonkar – Palmerston North City Council

· Ms

Tjitske Zwerver – Gemeete Wageningen

3.22 During the

7 December 2023 meeting it was agreed that a ‘University Cities

Network’ would be beneficial, providing cities with Agritech focused

universities a platform to exchange ideas and address common issues.

Universities will gain from student mobility agreements, supported by

comprehensive, ongoing exchange programmes and commitments of financial or

in-kind support from each member city. Cities will benefit from the influx of

international students, researchers and visitors. Cities will also be able to

attract talent from a larger pool and retain skilled workers to meet short,

medium and long-term labour market needs as well as able to promote the

city’s sustainable development objectives and bolster its competitiveness

on the world stage.

3.23 A subsequent

meeting on 13 August 2024 was attended by:

· Professor

Chris Anderson – Massey University

· Mr

Marco Otte – Wageningen University and Research

· Mrs

Gabrielle Loga – Palmerston North City Council

· Ms

Tjitske Zwerver – Gemeete Wageningen.

3.24 During

this meeting, it was agreed that the 2025 Aotearoa New Zealand Sustainable

Development Goals Summit would be an appropriate opportunity to launch the

‘University Cities Network’.

3.25 A draft

proposal paper has been developed between PNCC, Wageningen, Massey University

and Wageningen University and Research to identify the unique opportunities for

the two cities and two world-class universities to be founding members of an

AgriFutures Cities Network (ACN). The name of the network is subject to discussion

and change if needed.

3.26 The draft

proposal includes a clear statement of purpose, membership criteria, resources

required, an implementation plan with expected outcomes and a risk analysis.

The tentative plan is to:

· Submit

the final version of the proposal paper to Council by December 2024.

· Send

out invitation to potential members – cities and universities by January

2025

· Hold

a launch ceremony at the Aotearoa New Zealand Sustainable Development Goals

Summit in April 2025.

3.27 It is

proposed that by endorsing this initiative, Palmerston North and Wageningen

will be investing in a collaborative network that leverages cutting-edge

Agritech innovations to foster sustainable development, create new economic

opportunities and enhance resilience and quality of life for our community.

3.28 The next

planning meeting and discussion is set to be on 17 September 2024.

4. kEY

international relations events

Visit from the Embassy of the Republic of Cuba 15 April

2024

4.1 His

Excellency Mr Luis Morejón Rodríguez arrived as Ambassador of the

Republic of Cuba to New Zealand in February 2024. Coinciding with the 25th

anniversary of diplomatic relations between New Zealand and Cuba, he paid an

official visit to Palmerston North on 15 April 2024.

4.2 During

his visit, the Cuban Ambassador met with Mayor Grant Smith to discuss

collaborative opportunities in the healthcare sector, dairy sector, and in the

art sector.

4.3 He

was also given a facility tour of the Fonterra Research and Development Centre

and discussed the Cuban dairy sector and the possibility of bringing New

Zealand technology to build capability in Cuba.

Figure 4- HE Ambassador Mr Rodgriguez

visited Fonterra R&D Centre in April 2024

The Australian High Commission – Prima Facie 10

May 2024

4.4 The

Australian High Commission organised a pre-show reception and performance of

Suzie Miller’s Prima Facie at Centre Point Theatre on Friday 10 May

2024.

4.5 On

behalf of Her Excellency Harinder Sidhu, the Deputy High Commissioner Ms Amy

Guihot recognised the efforts of Council for showcasing the city to the

diplomatic corps during the 2023 Festival of Cultures and promoting the

economic potentials of the city’s key sectors. In her opening remarks, Ms

Guihot acknowledged that bringing Prima Facie to showcase a facet of Australian

culture to Palmerston North was the High Commission’s response to the

city’s international relations efforts.

Figure 5- Mayor Grant Smith, Director

Lyndee-Jane Rutherford,

and Deputy

High Commissioner Ms Amy Guihot at the Prima Facie pre-show reception (left to right)

4.6 Prior

to the reception, Mayor Grant Smith had a discussion with Ms Guihot about the

longstanding relationship between New Zealand and Australia and the

opportunities of collaboration and exchanges at a city level to deepen the

bilateral partnership between the two countries. Ms Guihot believed that with

strengths in distribution/logistics, Palmerston North should explore

connections with Penrith city and Liverpool city in New South Wales in addition

to Launceston, ‘City of Gastronomy’ in Tasmania.

4.7 As

a result, Council has made initial contact with Penrith, Liverpool and

Launceston. The International Relations division has assisted Te Utanganui

Programme Director to organise visits to both Penrith and Liverpool as part of

a knowledge acquisition trip to Australia in October 2024 to learn about their

intermodal distribution hubs, logistics planning, new technology and

implementation of sustainability.

4.8 The

October trip to Australia was instigated by KiwiRail and has been organised by

the Te Utanganui Programme Director. The primary purpose of the trip is to

visit Moorebank intermodal freight hub, where KiwiRail have existing

relationships. The trip will also involve discussions with potential investors

in Te Utanganui.

Hefei Delegation 21 May 2024

4.9 Following

Deputy Mayor Debi Marshall-Lobb’s education delegation visit to China in

April 2024, she extended an invitation to a delegation from Hefei city, China

to visit Palmerston North in May 2024. The purpose of the visit was to discuss

potential collaborative opportunities between the two cities.

4.10 On 21 May

2024, the city welcomed 19 delegates from Hefei, accompanied by World Class

Education Limited to Palmerston North City Council. Manawatū District

Council’s Mayor Helen Worboys and other representatives from local

education providers attended the pōwhiri. Jerry Shearman, Chief

Executive of Central Economic Development Agency, gave a presentation on

economic overview and opportunities in the Manawatū region.

4.11 It was

encouraging to have Mayor Helen Worboys and Manawatū District Council join

international relations activities and promoting the economy.

Figure 6- Deputy Mayor D. Marshall-Lobb

and councillors welcomed Hefei delegation at Pōwhiri

Yantai Delegation 29 August 2024

4.12 On 25

August 2022, Palmerston North organised a panel discussion on

“Positioning your company for growth in China” in collaboration

with CEDA and Manawatū Business Chamber. The panellists included:

· Mr

Alistair Crozier - Executive Director of New Zealand China Council

· Mr

Richard Dunsheath Trade Commissioner from New Zealand Trade & Enterprise

· Mr

Kim Scott – Founder of Idea Developments

· Professor

Stephen Kelly – Massey University

· Mr

Brian Zheng – Founder & CEO of Livall Smart Helmet and Helmetphone, a

Massey alumnus from China.

4.13 The event

was attended by officials from the Embassy of the People’s Republic of

China and a representative from Yantai Municipal People’s Government.

Afterwards, with support by the Embassy of the People’s Republic of

China, the Yantai Foreign Affairs Office contacted Palmerston North and made a

proposal to explore collaborative opportunities for the two cities.

4.14 After

considering Yantai’s city profile (included as attachment 3) and further

communication with the Embassy of the People’s Republic of China,

Palmerston North is open to consider partnership opportunities for the two

cities, starting with the education sector.

4.15 On 29

August 2024, Yantai Municipal People’s Government sent a delegation to

Palmerston North for the first time. The delegation was led by Mr Gao Jianguang,

Head of the Organisation Department of the Communist Party of China Yantai

Municipal Committee.

4.16 The

delegation was welcomed by:

· Ms

Debi Marshall-Lobb - Deputy Mayor of Palmerston North

· Ms

Gabrielle Loga – Manager International Relations, Palmerston North City

Council

· Ms

Ping Peng – Senior Global Partnerships Advisor, Massey University.

4.17 Both

cities presented an overview of each city and the respective international

relations programme. Deputy Mayor and Mr Gao made remarks on behalf of each

city, followed by the signing of a Letter of Intent (included as attachment 4)

to explore a cooperative relationship for the purpose of facilitating

educational exchanges and promoting collaborative opportunities in the

education sector as well as opportunities in other fields such as economic,

trade, culture, sports and tourism.

5. other

development opportunities

Fuzhou, China

5.1 Fuzhou

city approached Palmerston North through the Embassy of People’s Republic

of China for a city partnership after former Prime Minister Chris

Hipkins’ visit to China in June 2023.

5.2 Massey

University has had partnerships with several institutions in Fuzhou and UCOL

expressed interest in the Fuzhou market for their international education

programmes. After consulting with the Palmerston North International Education

Leadership Group, Palmerston North is open to consider educational partnership

opportunities for the two cities, similar to the arrangement with Yantai and

Shijiazhuang city.

5.3 Fuzhou

has invited Mayor Grant Smith to attend the Fuzhou Tourism & Culture

Festival and 2024 Friendship Cities Festival from 21 – 24 November 2024.

Further detail of the invitation is included in a separate report to Council

meeting on 4 September 2024 titled “International travel proposed for

Mayor – November 2024”.

Kurihara, Japan

5.4 Ms

Natsumi Kobayashi, an officer from Kurihara city, Miyagi prefecture was

seconded to New Zealand on a three-month study tour. While attending English

courses, Ms Kobayashi also connected with various councils for knowledge

acquisition in the area of supporting migrants and international workers in the

city.

5.5 Ms

Kobayashi visited Palmerston North in July 2024 and met with Council’s

Community Development and International Relations divisions.

5.6 Both

Palmerston North and Kurihara have a blend of city and rural living with

strengths in agricultural and livestock industry. Ms Kobayashi was impressed

with the cutting-edge agricultural technology created and available in

Palmerston North.

6. international

education updates

Waseda programme

6.1 As

a result of our successful proposal to Education New Zealand and the Waseda

teacher familiarisation visit in November 2022, Manawatū and Hawkes Bay

were selected as the two regions to host a group study programme for students

from Waseda University’s network of affiliated schools in 2023 and beyond.

6.2 A

fourth cohort of 15 students undertook a three-week programme in Palmerston

North from 4 - 24 August 2024. The participating schools were Awatapu College,

Palmerston North Boys High School, and Palmerston North Girls High School. The

students study English, attend regular classes, participate in extracurricular

activities and live with homestay families.

6.3 The

tertiary providers are also showcased. The cohort spent an afternoon at Massey

University touring various facilities such as lecture theatres, the library and

recreation centre. They met with international staff who introduced them

to the tertiary education system in New Zealand and the study options available

in the region. The students also took part in an ‘Amazing Race’

challenge around campus and a Kahoot quiz for Massey-themed prizes. They had an

afternoon excursion to UCOL Te Pūkenga and were welcomed with a Mihi

Whakatau. This was followed by an introduction to the Student Connect Hub, a

comprehensive campus tour and participation in an interactive, hands-on cooking

class with the Chef and Hospitality lecturers.

6.4 A

fifth cohort of 15 students will undertake a two-week programme in Palmerston

North from 23 March to 5 April 2025.

Vietnamese Master Agent Visit and Sector Update event 14

June 2024

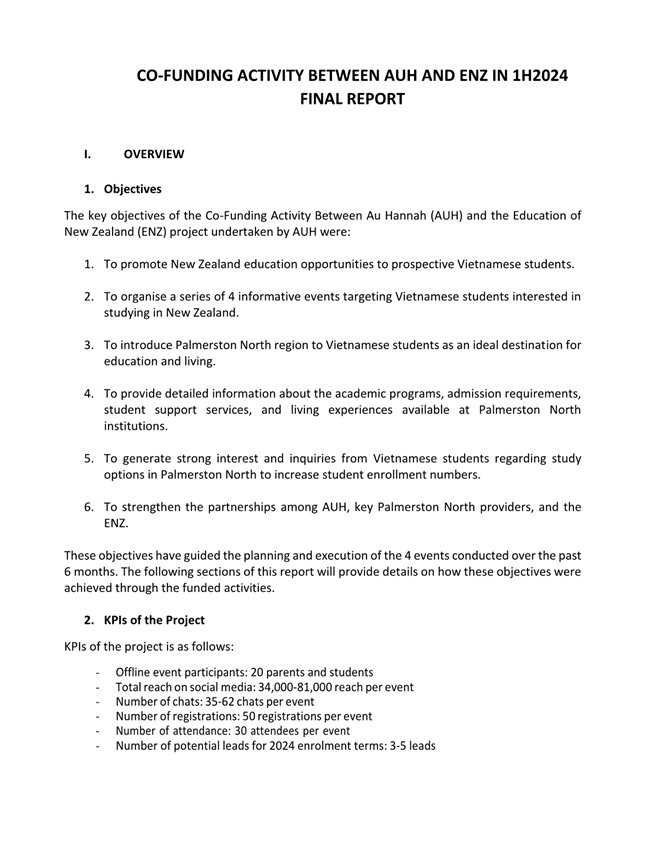

6.5 AU

Hannah Co. Limited is Palmerston North’s master agent in Vietnam. In

December 2023, with the support from Council, the company secured funding from

Education New Zealand for a marketing campaign focused on promoting Palmerston

North, Manawatū, and the local education providers to the Vietnamese

market.

6.6 The

funded campaign included the following offline and online events:

· Studying

High School in New Zealand – Offline event on 6 January 2024

· The

Differences and Advantages of Single-sex Education – Online event on 24

February 2024

· Discover

Life and Study Experience in Palmerston North – Online event on 16 March

2024

· Popular

Courses at Massey University – Online event on 13 April 2024.

6.7 In

June 2024, Mr Allan Mai, Director, accompanied students and their families to

visit Palmerston North in order to promote the city as a preferred study

destination for them. Mr Mai also met and visited individual schools including

Awatapu College, Palmerston North Girls’ High School and Palmerston North

Boys’ High School.

6.8 During

his visit to the city, Mr Mai presented the final report on the successful

marketing campaign to the International Education Manawatū (IEM) group and

the International Education Leadership Group (IELG). The campaign provided

Vietnamese students and parents accurate, valuable and practical insights on

studying opportunities in the Manawatū. The outcome of the campaign was

very encouraging with a total market reach of over 200,000, including 127 event

attendees and 3 long-term enrolments in 2024. More detail is included in the

written report in attachment 5.

SIEBA Conference 25-26 June 2024

6.9 SIEBA

(Schools International Education Business Association of New Zealand) is the

recognised peak body for the international education school sector in Aotearoa

New Zealand. Its purpose is to provide leadership and support for a high

quality and sustainable international education sector for New Zealand schools.

Currently SIEBA has over 400 member schools across the country.

6.10 Council’s

Manager International Relations was invited to participate in a panel

discussion at the SIEBA hui, a two-day biennial gathering of over 250

institutions specialising in international education. The panel

discussion’s topic was on regional collaboration and international

education.

6.11 Council’s

International Relations division holds the function of coordinating, supporting

and advising the local international education sector in enhancing the study

experience in Palmerston North and promoting the city as a preferred study

destination. The city works collaboratively with various regional/city partners

in:

· Organising

community events to welcome and integrate international students into the fibre

network of the local community.

· Responding

to marketing opportunities for the region and following up with potential leads

as well as connecting suitable opportunities with education providers.

· Applying

for regional funding for collaborative projects.

Figure 7- Ms Gabrielle Loga, Manager

International Relations presented at 2024 SIEBA Hui

6.12 Presented

alongside Christchurch Educated, the support for international education of

Council was also recognised as robust, inclusive and innovative. The outcomes

of the concerted effort include the success of various funded regional projects

with Education New Zealand to promote Palmerston North, Manawatū and

coordinating educational delegation visits to the city over the last two years.

6.13 The panel

acknowledged some key challenges in fostering regional collaboration in the

coming years are:

· to

bring together diverse stakeholders with varying priorities and agendas.

· to

enhance capacity of education providers and quality homestay network to meet

increasing demands while ensuring sustainability for New Zealand education.

· to

organise direct feedback loops with international students to understand their

needs and improve on their study experience.

· to

handle resource constraints and ensure effective resource allocation.

Global Ambassador Programme

6.14 Applications

for the 2024/25 Global Ambassador Programme opened on 19 August and closed

on 13 September 2024. Shortlisted applicants will be interviewed and up to five

Global Ambassadors will be appointed by the end of September 2024.

6.15 The Global

Ambassadors will:

· Take

an active role in showcasing Palmerston North to important visitors and

diplomats.

· Learn

about our international partnerships and the role of the Welcoming Communities

programme through public events and festivals.

· Receive

Council support to plan and manage their own student event.

· Share

our city’s story with the world.

6.16 The

programme aims to empower local talent and support local initiatives with links

to our international relations goals and community development goals in the

Oranga Papaioea City Strategy and plans.

6.17 This

programme is jointly managed by Council’s International Relations and

Education Advisor and Community Development Advisor (Welcoming Communities).

7. Next

steps: Updated annual plan 2024 – 2025

|

Proposed timeline

|

Planned

activities

|

Partners to

work with

|

|

August 2024

|

Waseda Study Group

– 2nd intake for 2024

HiGA visit

Global Ambassadors

Programme 2025

Yantai Delegation

Visit

|

Awatapu College

Palmerston North

Girls’ High School

Palmerston North

Boys’ High School

Massey University

UCOL

Waseda affiliated

schools

Hiroshima Global

Academy

PNGHS - PNBHS

Awatapu College

Freyberg High

School

Marcomms team

Welcoming

Communities

Embassy of

People’s Republic of China

Yantai

People’s Municipal Government

|

|

September 2024

|

Event ‘Pōwhiri – Welcoming

newcomers’ 14 Sept 2024

Event ‘EU NZ FTA and Horizon

Fund’

16 Sept 2024 (tentative)

To replace Event ‘The Effects of

EU-NZ FTA’

Event ‘ASEAN – Open Doors for

AgriTech’ – a market information session and networking

opportunity for local businesses interested in one of the key strategic

partners for New Zealand.

19 Sept 2024

|

Welcoming Communities

Rangitāne iwi

EU Delegation Ambassador

CEDA

Manawatū Business Chamber

FoodHQ

Massey University

ASEAN Business Council NZIIA Palmerston North

ASEAN Committee in Wellington

Ministry of Foreign Affairs and Trade

CEDA

Manawatū Business Chamber

|

|

October 2024

|

Engage with

Penrith, Liverpool, and Bradfield Development Authority to assist with Te

Utanganui Sydney Knowledge Acquisition Trip 3-4 Oct

Latin American and

Spanish Film Festival – showcasing Latin cultures

Diwali Mela –

Festival of Light

2 Nov 2024

|

CEDA

Australian High

Commission

Penrith

Mayor’s Office

Liverpool

Mayor’s Office

Bradfield

Development Authority

Shaun Kay,

Palmerston North Arts Ambassador

Manawatū

Multicultural Council

Embassy of Cuba

Embassy of Peru

Embassy of

Argentina

Other Latin

American embassies

PNCC Events Team

High Commission of

India

High Commission of

Republic of Fiji

High Commission for

Malaysia

Singaporean High

Commission

Embassy of Republic

of Indonesia Manawatū Multicultural Council

Local communities:

Indian, Nepalese, Sri Lanka, Fijian, Bangladeshi, Indonesian

|

|

November 2024

|

Event ‘Pōwhiri – Welcoming

newcomers’ 16 Nov 2024

Missoula Day 23 November

Hosting Missoula Indigenous delegation to

Palmerston North

Support the 17th International

Hydrocolloids Conference

|

Welcoming Communities

Rangitāne

Palmy BID

Arts Missoula

Destination Missoula

Embassy of the USA

Missoula Children’s Theatre

Salish Kootenai College

University of Montana

Riddet Institute

Massey University

|

|

December 2024

|

Event ‘Building

Youth Engagement in sister city relationships, international policy and

global citizenship’

|

NZIIA Palmerston

North

UCOL

Massey University

IPU NZ

|

|

January 2025

|

Lunar New Year Celebration

|

PNCC Events Team Manawatū Multicultural

Council

Chinese Community

Vietnamese Community

Korean Community

Embassy of People’s Republic of China

Embassy of Socialist Republic of Vietnam

Embassy of Republic of Korea

Singapore High Commission

High Commission for Malaysia

|

|

February 2025

|

2025 Festival of

Cultures:

Day 1 – City

tour themed ‘Sustainability’ TBC

Day 2 – World

Food, Craft and Music Fair

|

Members of the

diplomatic corps

CEDA

Manawatū

Multicultural Council

PNCC Events Team

|

|

March 2025

|

Holi – Festival of Light

Waseda Study Group – 1st

intake for 2025

Taipei Smart Cities Summit & Expo 2025

|

Manawatū Multicultural Council

PNCC Events Team

High Commission of India

Awatapu College

Nga Tawa Diocesan School

Palmerston North Girls’ High School

Palmerston North Boys’ High School

Massey University

UCOL

Waseda affiliated schools

TCA

Taipei Economic & Cultural Office in

Wellington

Palmerston North start-ups and tech companies

|

|

April 2025

|

Application for

Prime Minister Scholarships – Cultural Competence Development Tour

Application for

Prime Minister Scholarships – Emergency Management Tour

|

Education New Zealand

Education New

Zealand

Manawatū-Whanganui

Civil Defence Emergency Management Group

|

|

May 2025

June 2025

|

NZ-China

Mayoral Forum TBC

|

Global Cities NZ

The Chinese People's Association for

Friendship with Foreign Countries (CPAFFC)

Embassy of People’s Republic of China

Ministry of Foreign Affairs and Trade

|

8. Compliance

and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to:

Whāinga 1: He tāone

auaha, he tāone tiputipu

Goal 1: An innovative and

growing city

|

|

The

recommendations contribute to the achievement of objectives

in:

2.

Mahere whakawhanake ohaoha

2. Economic Development

Plan

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The 6-monthly report on

International Relations and Education Activities outlines the progress of

actions in the International Relations Chapter, which contributes to the

Economic Development Plan and Innovative and Growing City Strategy.

|

|

|

|

Attachments

|

1.

|

MOU

FoodHQ - ECS-CAAS, Kunshan Suzhou ⇩

|

|

|

2.

|

Thank

You Letter from Mr Feng Renxin - Kunshan Delegation 2024 ⇩

|

|

|

3.

|

Yantai

City Profile ⇩

|

|

|

4.

|

Letter

of Intent with Yantai City ⇩

|

|

|

5.

|

AUH

Marketing Campaign Final Report - Manawatū ⇩

|

|

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 20

November 2024

TITLE: Palmerston

North Quarterly Economic Update - September 2024

Presented

By: Stacey

Andrews, City Economist

APPROVED BY: David

Murphy, General Manager Strategic Planning

RECOMMENDATION TO ECONOMIC

GROWTH COMMITTEE

1. That the

Committee receive the Palmerston North Quarterly Economic Update –

September 2024, including:

a. Palmerston North

Economic Growth Indicators - September 2024 (Attachment 1), and

b. Palmerston North

Quarterly Economic Card Spending Report - June 2024 (Attachment 2),

presented to

the Economic Growth Committee on 20 November 2024.

This Report was deferred from the Committee meeting on 18

September 2024

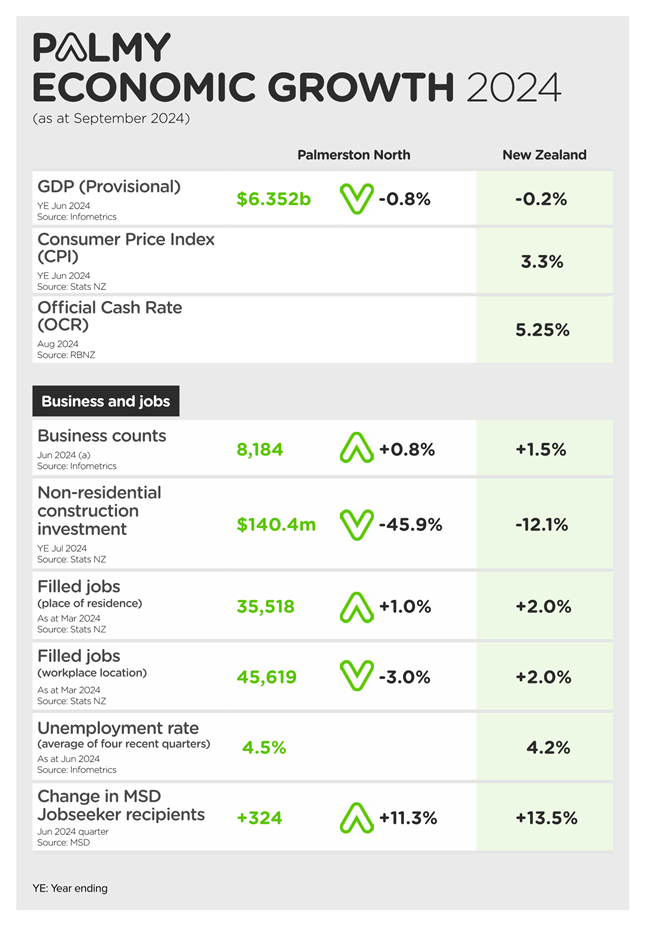

1. introduction

and purpose

1.1 This

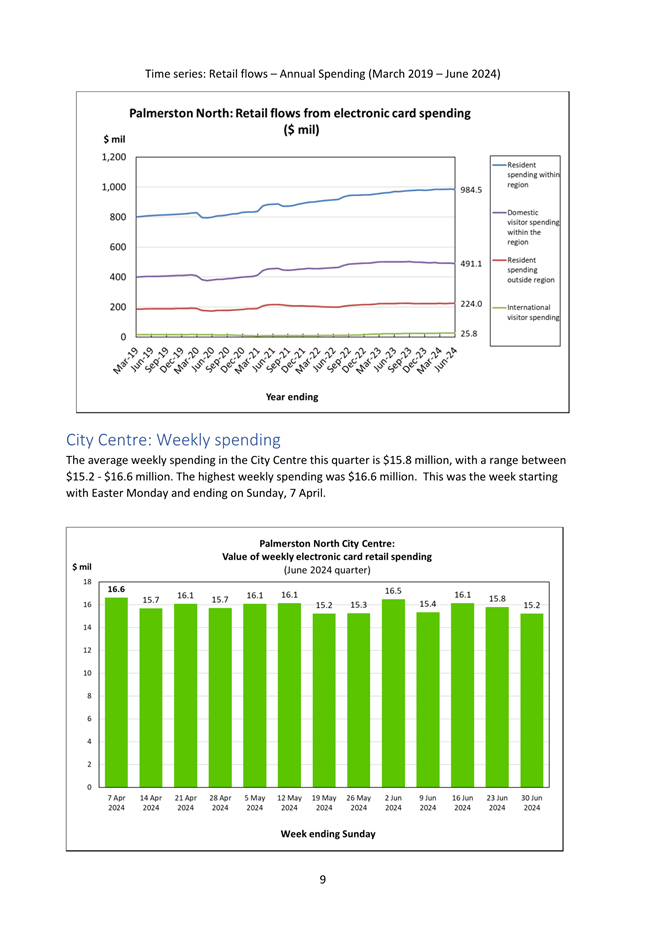

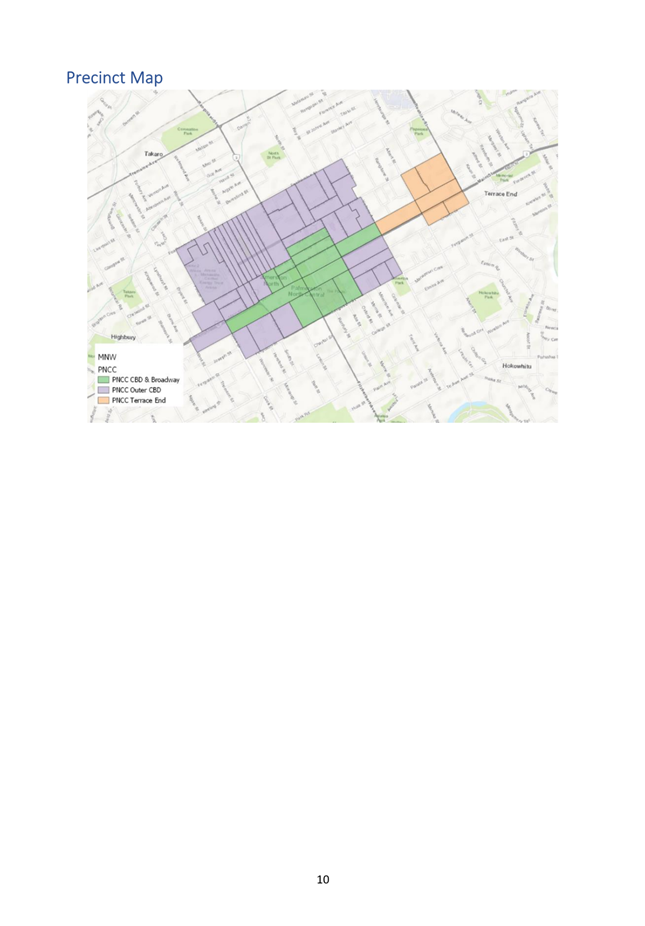

memorandum presents a summary of the key themes in the Palmerston North

Quarterly Economic Update to September 2024, and the Palmerston North City

Centre Quarterly electronic card spending (retail and selected tourism sectors)

for the June quarter 2024.

1.2 The

quarterly economic update is prepared in-house, utilising data from a range of

sources to provide the most up-to-date information available on the city

economy. This includes national and global data where appropriate, to

inform us of broader conditions that are impacting on local economic

conditions.

1.3 The

quarterly economic update is organised under the categories of Gross Domestic

Product (GDP), ‘business and jobs’, ‘earnings and

income’, ‘spending’, and ‘housing’.

National data that influences the city economy, such as the Consumer Price Index

(CPI) and the Official Cash Rate (OCR), are also included in the quarterly

economic update. This update is attached as Appendix 1.

1.4 The

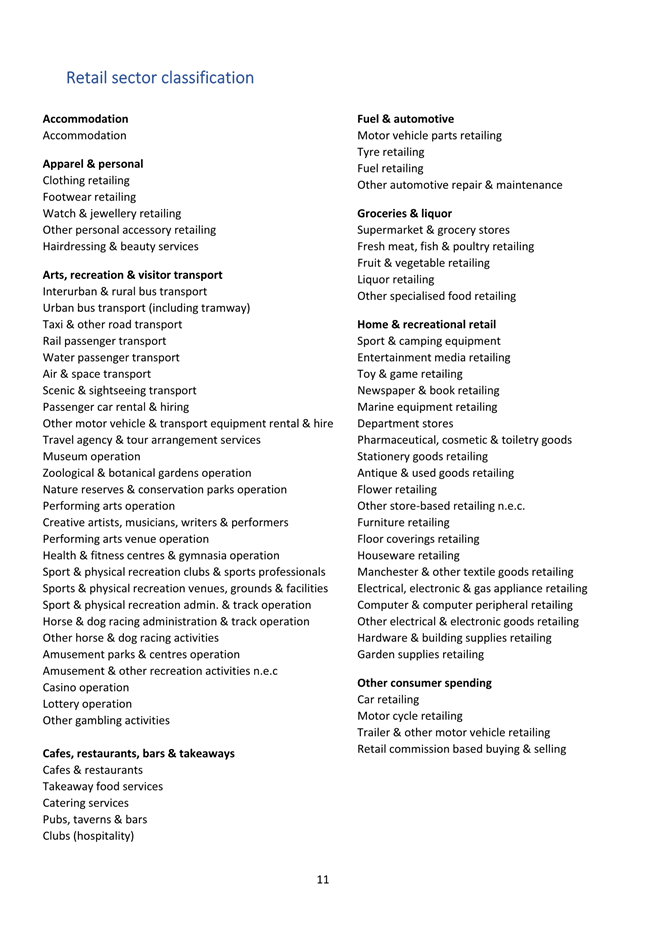

Palmerston North City Centre Quarterly electronic card spending report is

prepared in-house and provided as a resource to the city retail sector. This

report includes information on retail spending across the city and by precinct,

as well as data on retail flows, customer loyalty, and the origin of customers

who are spending in Palmerston North. The electronic card spending report

for the city is included as Appendix 2.

1.5 The

memorandum concludes with a summary of the economic outlook for the city and

the wider New Zealand economy.

2. Quarterly

economic Update

2.1 Infometrics

reports that Palmerston North GDP fell by -0.8% over the year to June 2024 as

the New Zealand economy hit the bottom of the economic cycle. This

compares with a -0.2% contraction in GDP nationally. Statistics New

Zealand GDP data for the June quarter 2024 is not released until 19

September.

2.2 Annual

inflation (as measured by the Consumer Price Index) eased to 3.3% in the June

quarter as the economy continued to contract in response to higher interest

rates and a further pullback in spending across the economy. Inflation is

heading in the right direction, with the Reserve Bank of New Zealand (RBNZ)

stating that inflation is likely to have fallen back within range in the

September quarter. This is positive, as banks move to reduce interest

rates to households and businesses. Six-month mortgage rates have fallen

to 6.85% at the time of writing, with two-year rates falling below 6.0%.

2.3 In

response to falling inflationary pressures and weaker economic activity than

anticipated, the RBNZ dropped the Official Cash Rate (OCR) by 25 basis points

to 5.25% in the August 24 Monetary Policy review. This follows a policy

rate of 5.5% in place since May 2023. The OCR is now forecast to fall

sooner than indicated at the release of the May Monetary Policy Statement

(MPS). Figure 1 illustrates the difference in the OCR track between the

RBNZ’s May and August Monetary Policy Statements.

2.4 Figure

1: RBNZ OCR projections – Aug MPS vs May MPS

2.5 While

headline inflation is forecast to have fallen back into the RBNZ 1%-3% range in

the September quarter, electricity costs have risen sharply due to low lake

levels and disrupted gas supplies. To date, commercial consumers have

taken the brunt of these higher costs with electricity prices rising 9.7% overall

over the year. Limited gas supplies have been a dominant driver of these

higher energy costs with gas prices to the commercial sector increasing 22.4%

over the year, curtailing production in some cases due to elevated production

costs.

2.6 Household

energy costs have been less affected but have still increased by +4.0% over the

year to June 2024. To put this in context, household electricity costs

increased by 3.5% while household gas prices increased by 8.5% over the

year. While the RBNZ is likely to look through any increases in costs

driven by the current energy supply shortage, price stability in energy markets

is central to the competitiveness of the productive sector. Stable prices will

also reduce pressure on household budgets to support recovery of the New

Zealand economy.

2.7 The

New Zealand population is estimated by Statistics NZ to have grown by 1.8% over

the year to June 2024, with growth slowing to just 0.1% in the June quarter

2024. While annual population growth remains elevated, the more recent slowdown

in population growth is explained by a decline in net international migration

to 73,300 over the June 2024 year. This is down from the record high of

136,600 posted over the year to October 2023. While easing relative to

recent highs, current net international migration remains well above the

long-term trend.

2.8 The

first set of Estimated Resident Population figures for the city based on the

2023 Census have not yet been released, however secondary data implies that the

population of the city continues to grow. Primary health enrolments in

Palmerston North increased by +1,625 over the year to August 2024

(+2.1%).

2.9 This

implied population growth, alongside the current contraction in annual GDP,

indicates falling GDP per capita in Palmerston North and across much of New

Zealand. GDP per capita figures will be updated post the release of the

Estimated Resident Population data series due in October 2024.

Business and jobs

2.10 There were

8,184 businesses in Palmerston North in June 2024; an increase of 121

businesses from the previous year. This is an increase of +1.5% over the

year, compared with +1.9% growth in business counts, nationally.

2.11 Non-residential

consents totalled $104.4m in the city over the year to July 2024. This is

a decrease in value of -45.9% compared with the July year 2023 and compared with

a decrease of -12.1% nationally. This negative growth follows a record

breaking level of non-residential construction investment in 2023.

Specifically, non-residential consents totalled $192.0m in the July year 2023,

with construction of health and education buildings hitting record values of

$40.6m and $81.7m respectively. More positively, construction of

factories, and industrial and storage buildings increased by 55.4% over the

year to July 2024, reaching a total of $51.8m.

2.12 The

findings of the Seek Employment report for July 2024 are mixed. The

Manawatū

Region continues to see an annual decrease in jobs advertised, down -29%

compared with the year ended July 2023. In contrast, job advertisements

in the Region increased +10% from June to July, implying some strengthening in

employment intentions. Nationally, advertised jobs fell -29% over the

year, with a monthly increase of +3% between June and July 2024. More broadly,

the employment report indicates an increase in advertised jobs for construction

workers (+14%) and consumer service workers (+10%) in regional areas in July

2024, compared with June 2024. Indicators that reflect changing

employment intentions will be monitored and reported on through the quarterly

reporting series.

2.13 At the

time of writing, filled jobs and earnings data for the June quarter are not

available. The latest data to the year ended March 2024 indicates that

filled jobs by workplace address decreased by -3.0% to a total of 45,619 over

the year with jobs by place of residence up by 1.0% to 35,518. This

compares with +2.0% growth, nationally. The impacts of the economic

slowdown on employment and earnings levels in the city is an important

indication of economic wellbeing.

2.14 The annual

average unemployment rate published by Infometrics remained at 4.5% in the city

in the June quarter 2024. This compares with an annual average

unemployment rate of 4.2% nationally. In contrast, quarterly unemployment

rate figures from Infometrics cite an unemployment rate of 4.4% in Palmerston

North in the June quarter, compared to 4.5% unemployment nationally. The

national unemployment rate for the June quarter compares with the Statistics NZ

national unemployment rate of 4.6%.

2.15 The number

of MSD jobseeker beneficiaries in Palmerston North increased by 321 over the

year to June, to a total of 3,180. This is an +11.3% increase on the

previous year, compared with a +13.5% increase, nationally. Of this increase,

192 people were receiving the benefit due to health conditions and

disability.

2.16 The number

of people receiving the Jobseeker benefit increased across all age groups in

Palmerston North and nationally over the year to June 2024. Jobseeker

beneficiaries aged between 18-24 years increased by 93 in the city (+13.7%),

compared with an increase of 12.8% nationally. The number of Jobseekers

beneficiaries aged 25-39 increased by 87 (+8.8%) compared with a +9.6% increase

nationally, while recipients aged 40-54 years and 55-64 years each increased by

69 in the city over the June 2024 year (+9.2% 40-54 years; +15.8% 55-64

years). This compares with an annual increase of +9.6% in Jobseeker

recipients aged 40-55 years and an +8.0% increase in Jobseeker benefit

recipients aged 55-64 years, nationally.

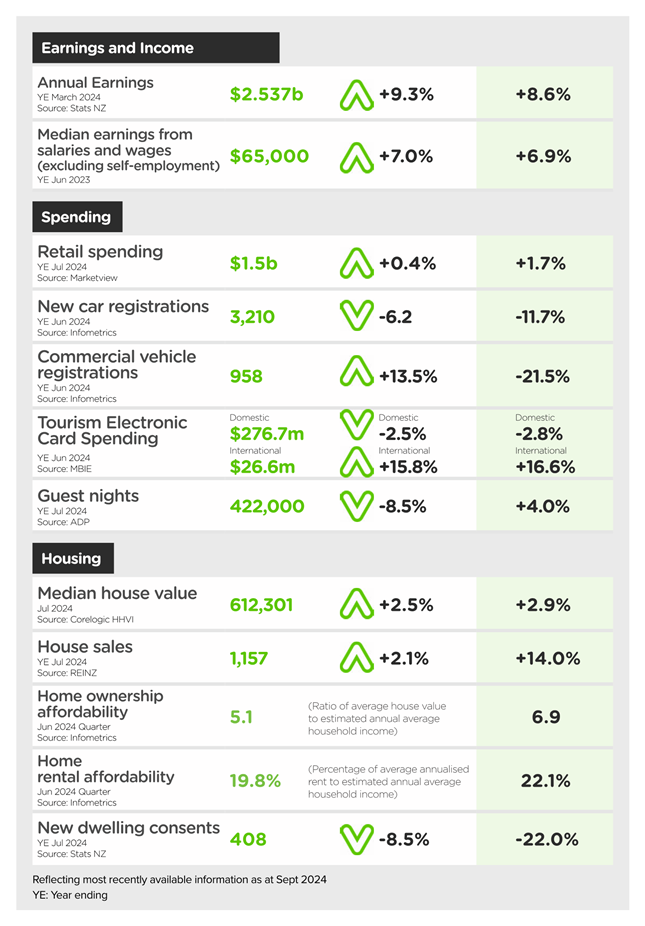

Earnings and income

2.17 Earnings

data for the city for the June 2024 quarter will be released 10 September.

Latest earnings data for the city for the March quarter indicated strong

earnings growth with annual earnings up +9.3% over the March 2024 year.

This compares with an +8.6% increase nationally. As explained in section

2.19, we expect the rate of earnings growth to have started to ease over the

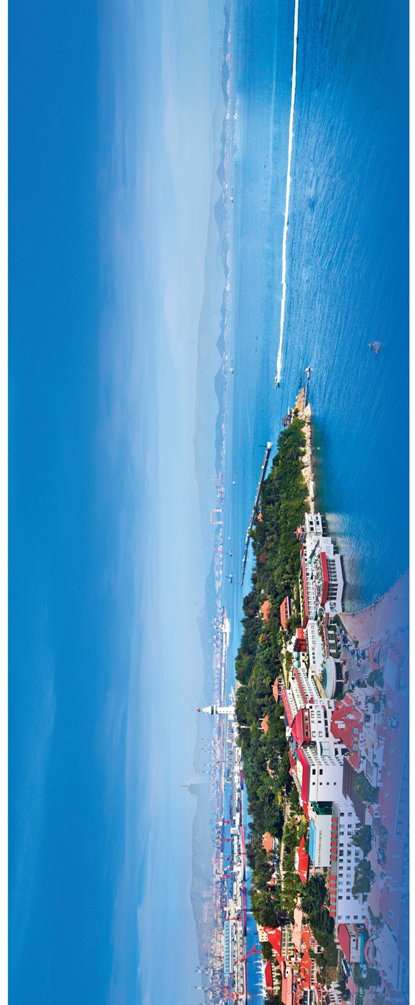

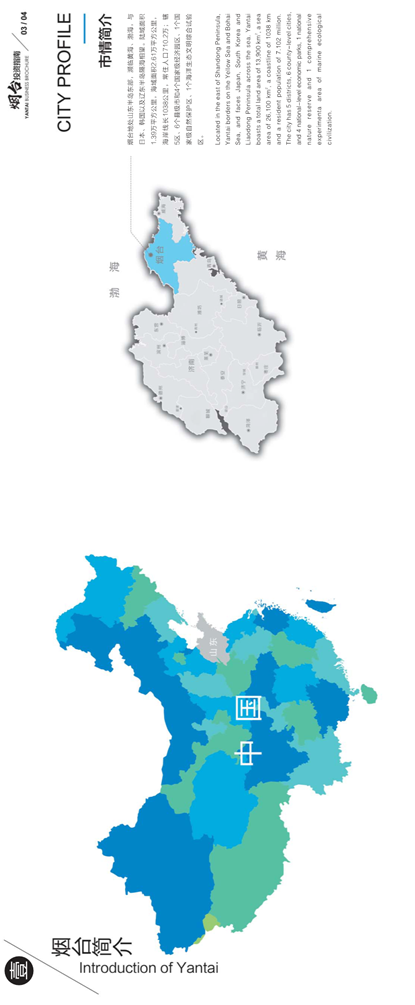

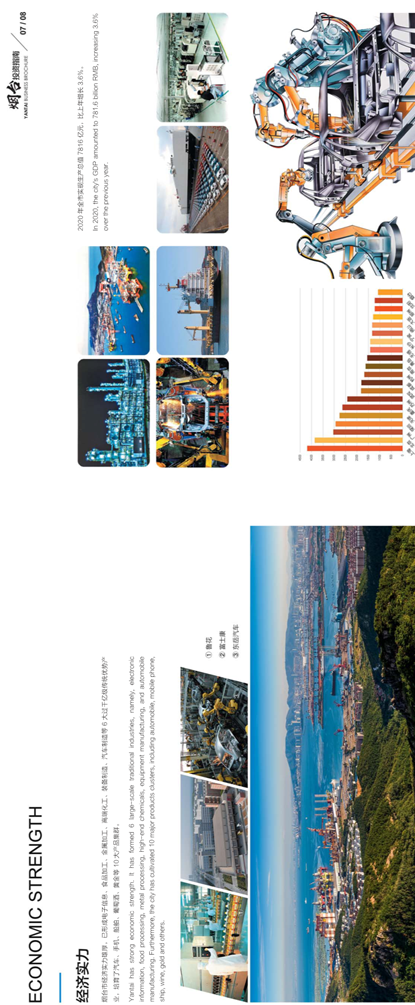

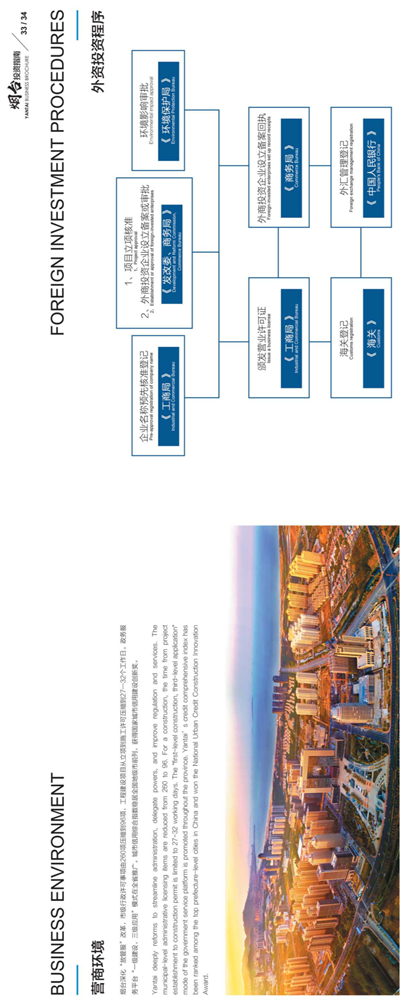

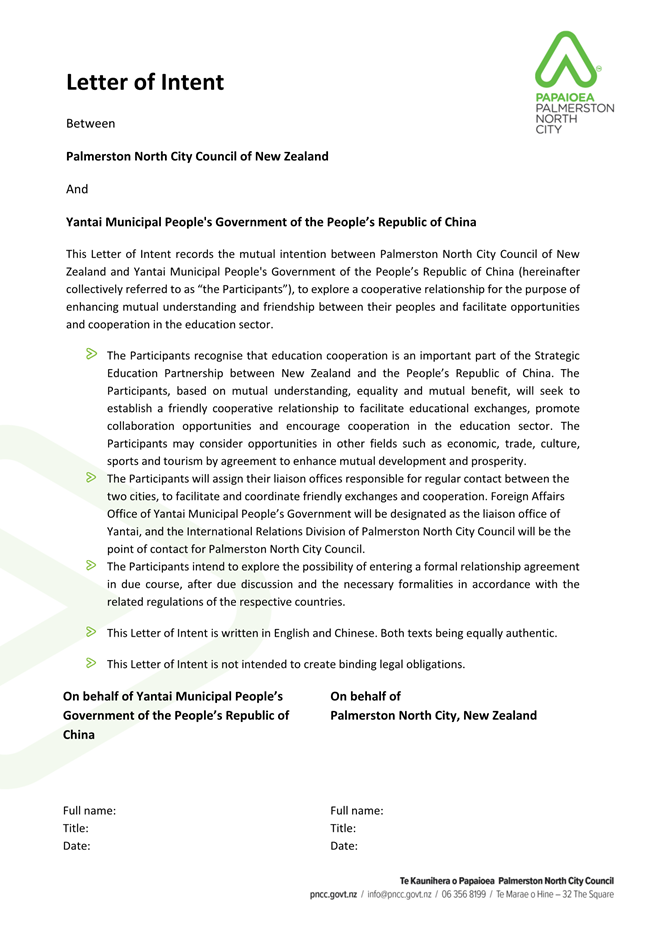

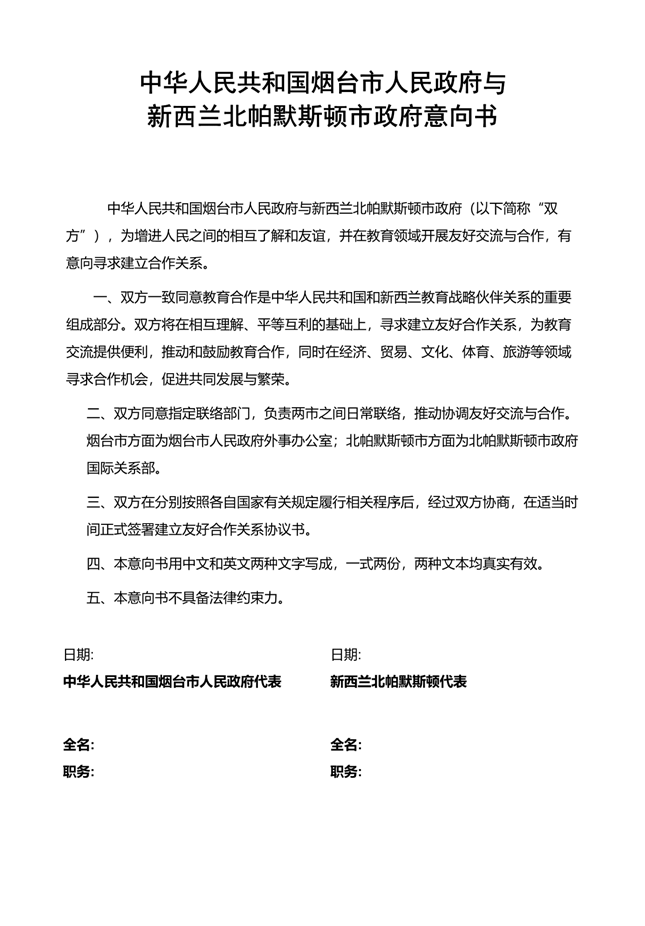

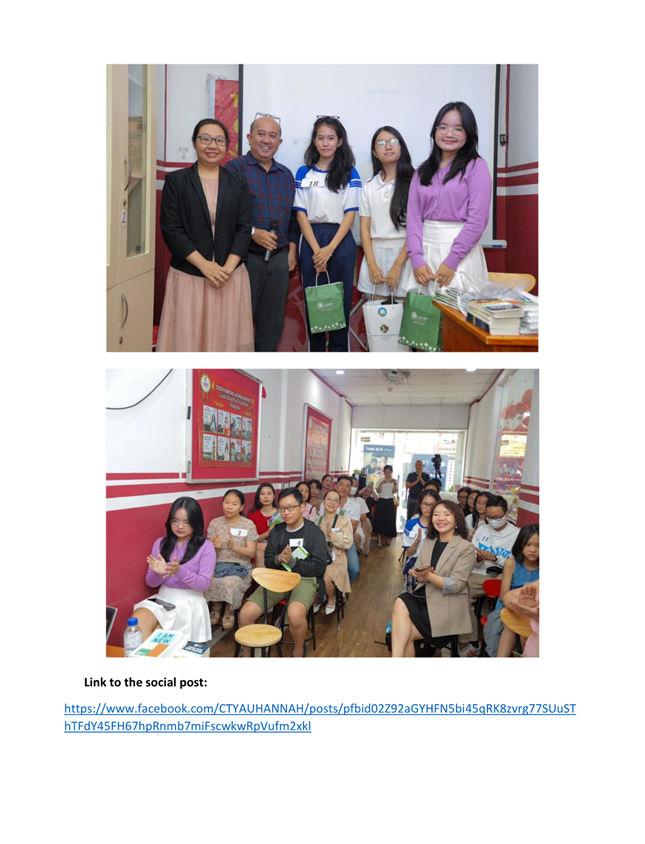

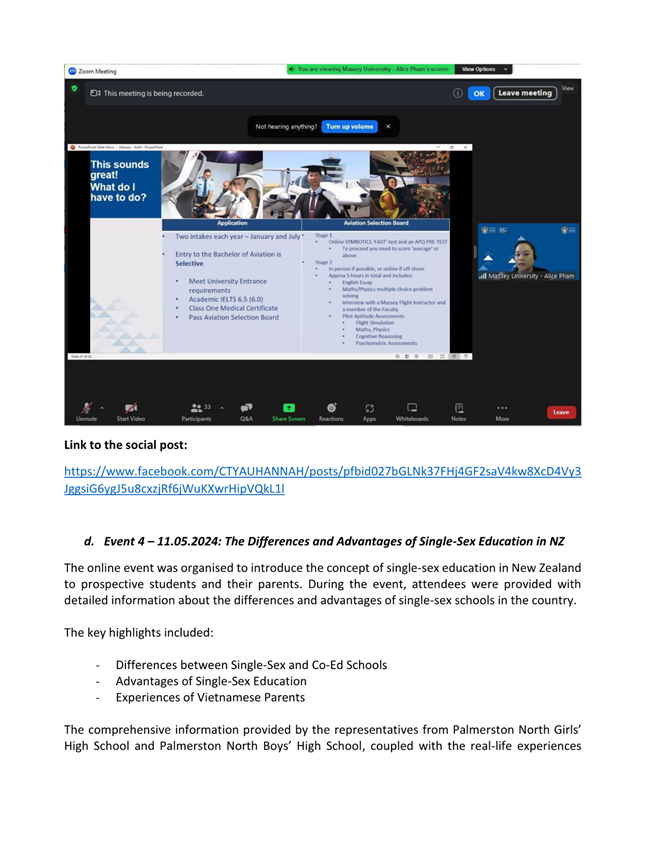

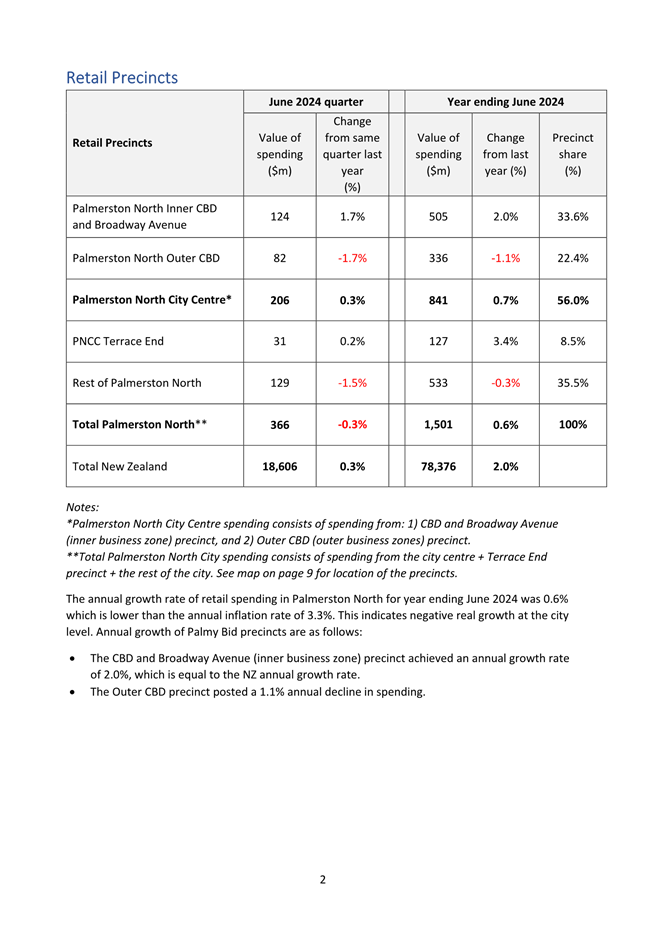

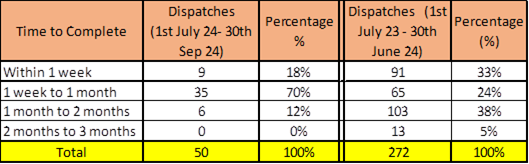

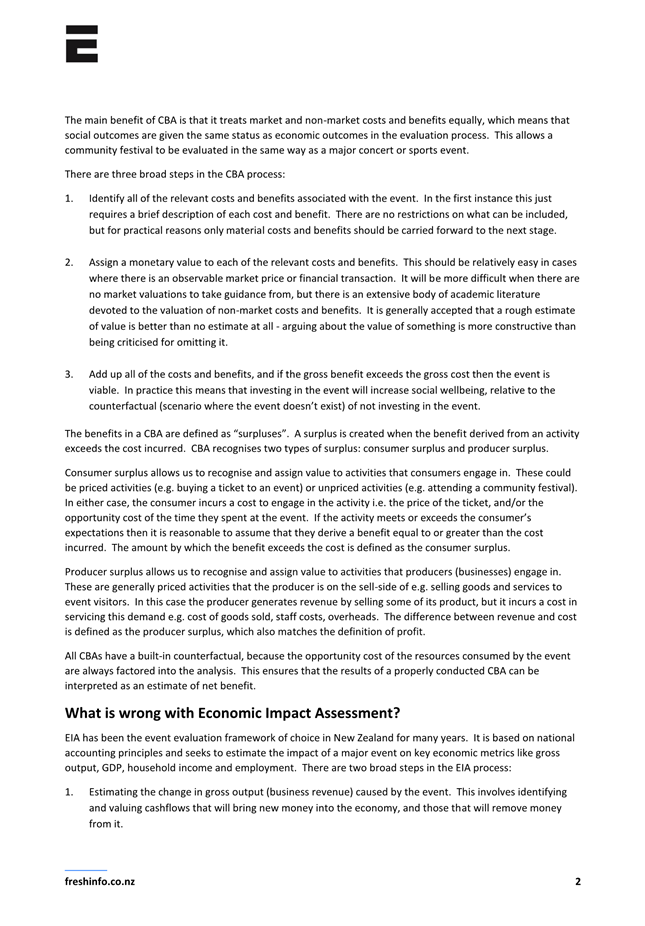

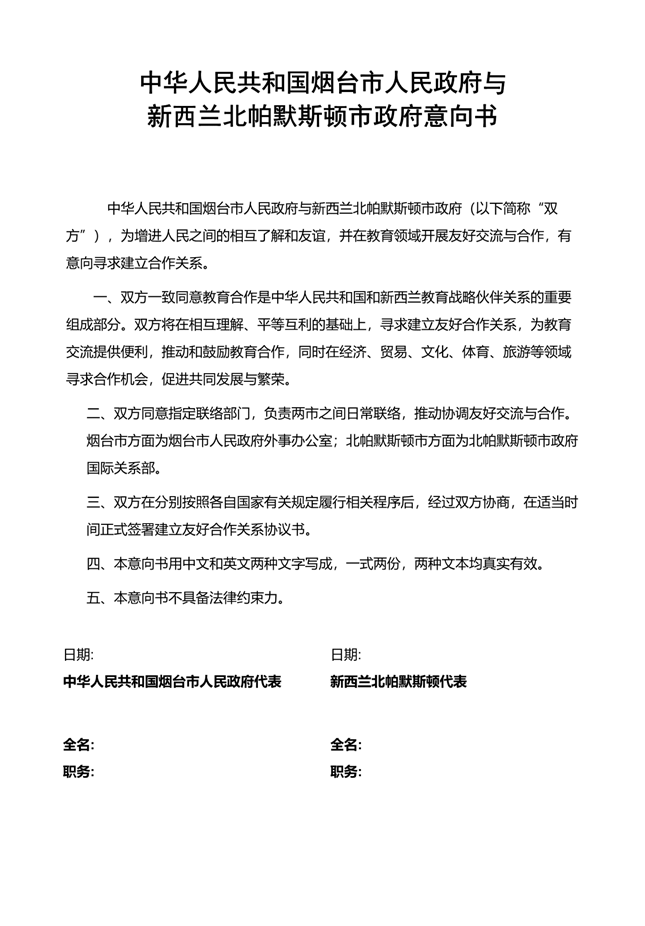

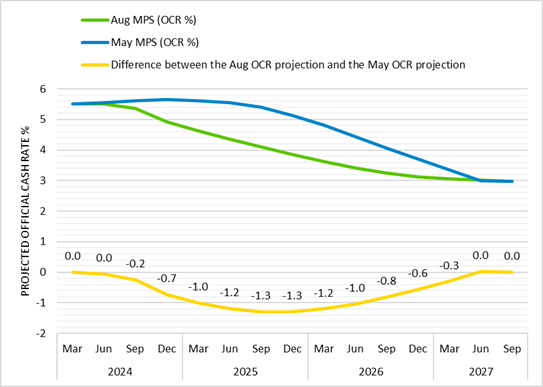

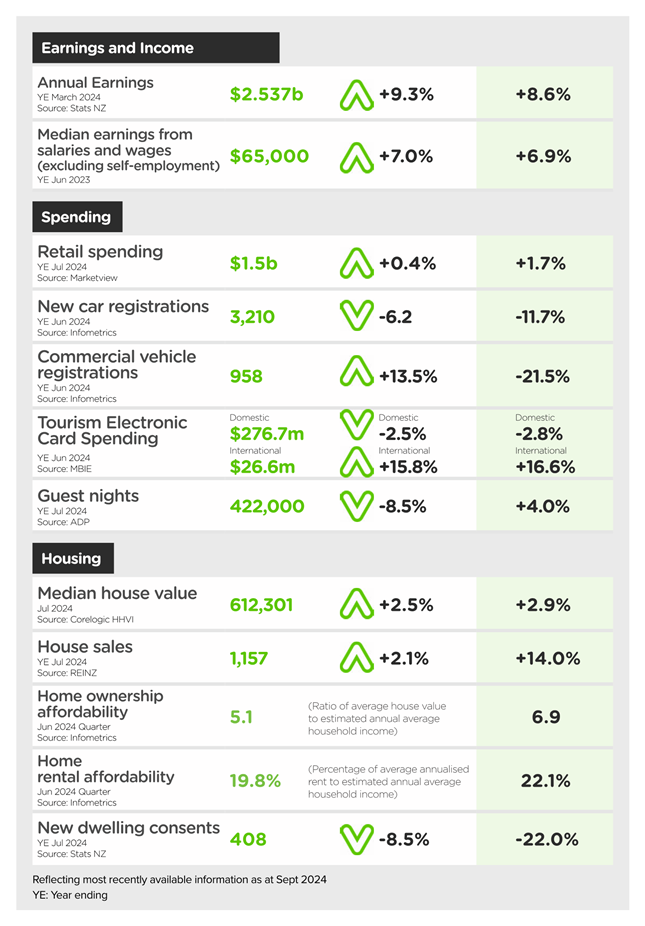

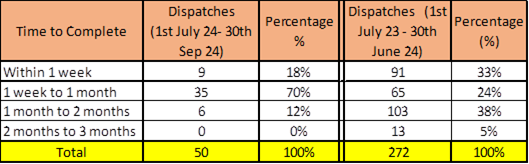

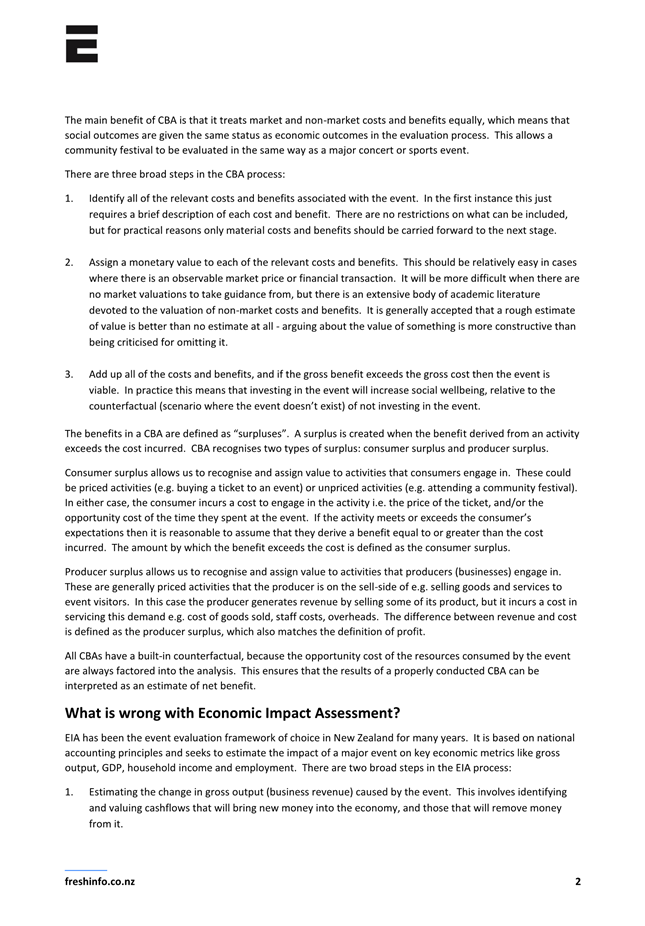

later part of the June 2024 year. However, the flow through of wage