|

Grant

Smith (Mayor)

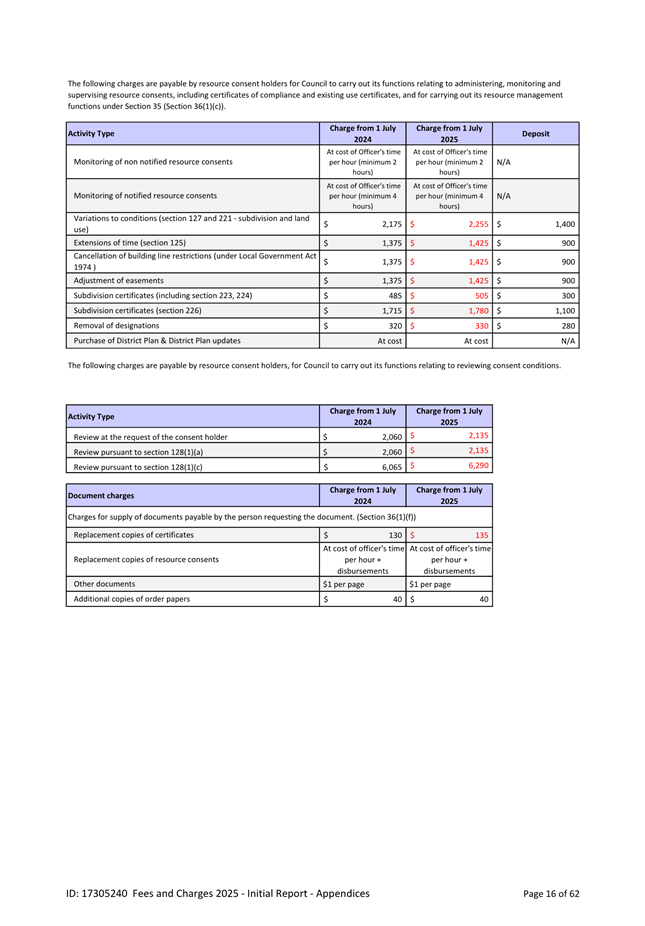

|

|

Debi

Marshall-Lobb (Deputy Mayor)

|

|

Mark

Arnott

|

Leonie

Hapeta

|

|

Brent

Barrett

|

Lorna

Johnson

|

|

Rachel

Bowen

|

Billy

Meehan

|

|

Vaughan

Dennison

|

Orphée

Mickalad

|

|

Lew

Findlay (QSM)

|

Karen

Naylor

|

|

Roly

Fitzgerald

|

William

Wood

|

|

Patrick

Handcock (ONZM)

|

Kaydee

Zabelin

|

Council MEETING

12 February 2025

Order of Business

1. Karakia

Timatanga

2. Apologies

3. Notification

of Additional Items

Pursuant to

Sections 46A(7) and 46A(7A) of the Local Government Official Information and

Meetings Act 1987, to receive the Chairperson’s explanation that

specified item(s), which do not appear on the Agenda of this meeting and/or the

meeting to be held with the public excluded, will be discussed.

Any

additions in accordance with Section 46A(7) must be approved by resolution with

an explanation as to why they cannot be delayed until a future meeting.

Any

additions in accordance with Section 46A(7A) may be received or referred to a

subsequent meeting for further discussion. No resolution, decision or

recommendation can be made in respect of a minor item.

4. Declarations

of Interest (if any)

Members

are reminded of their duty to give a general notice of any interest of items to

be considered on this agenda and the need to declare these interests.

5. Public

Comment

To receive

comments from members of the public on matters specified on this Agenda or, if

time permits, on other matters.

6. Presentation

- Massey University Foundation Page 7

7. Confirmation

of Minutes Page 9

That the minutes of the ordinary Council meeting of 5

February 2025 Part I Public be confirmed as a true and correct record.

Reports

8. Annual

Budget (Plan) 2025/26 - Update including draft Consultation Document and

Supporting Information Page 19

Memorandum, presented by Steve Paterson, Manager - Financial

Strategy and Scott Mancer, Manager - Finance.

9. Fees and

Charges Review Page 223

Report, presented by Steve Paterson, Manager -

Financial Strategy.

10. Rating System for

2025/26 Page 293

Memorandum, presented by Steve Paterson, Manager -

Financial Strategy.

11. Submission on the

Local Government (Water Services) Bill Page 317

Memorandum, presented by Mike Monaghan, Group Manager -

3 Waters and Julie Keane, Transition Manager Three Waters.

12. Submission on

Treaty of Waitangi Principles Bill Page 341

Memorandum, presented by Todd Taiepa, Manager -

Māori Advisory.

13. Arena Masterplan

Steering Group Page 347

Memorandum, presented by John Lynch, Manager Venues +

Events.

14. Order of Candidate

Names on Voting Papers 2025 Page 355

Report, presented by Hannah White, Manager - Governance.

15. Appointment to the

Heritage Reference Group Page 361

Memorandum, presented by Hannah White, Manager -

Governance.

16. Council Work

Schedule Page 363

17. Karakia

Whakamutunga

18. Exclusion

of Public

|

|

To be

moved:

“That the public be excluded from the

following parts of the proceedings of this meeting listed in the table below.

The general subject of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under Section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for

passing this resolution

|

|

19.

|

Confirmation of the minutes of the ordinary

Council meeting of 5 February 2025 Part II Confidential

|

For the reasons set out in the Council of 5 February

2025, held in public present.

|

|

|

|

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

|

Presentation

TO: Council

MEETING DATE: 12

February 2025

TITLE: Presentation

- Massey University Foundation

FROM:

RECOMMENDATION(S)

TO Council

1. That the

Council receive the presentation for information.

Mitch Murdoch, Director of the Massey University

Foundation, will update the Council on the Foundation’s projects and

plans.

Attachments

NIL

Palmerston North City Council

Minutes of

the Council Meeting Part I Public, held in the Council Chamber, First Floor,

Civic Administration Building, 32 The Square, Palmerston North on 05 February 2025,

commencing at 9.00am

|

Members

Present:

|

Grant Smith (The Mayor) (in the Chair)

and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie

Hapeta, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

|

Apologies:

|

Councillor Lorna Johnson (lateness)

|

Councillor Lorna Johnson entered the meeting at 9.23am during

consideration of clause 3-25. She was not present

for clauses 1-25 and 2-25.

Councillor Leonie Hapeta left the meeting at 12.25pm after

consideration of clause 7-25. She was not present

for clauses 8-25 to 14-25.

|

|

Karakia

Timatanga

|

|

|

Councillor

Debi Marshall-Lobb opened the meeting with karakia.

|

|

1-25

|

Apologies

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That

Council receive the apologies.

|

|

|

Clause 1-25 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark

Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay, Roly

Fitzgerald, Patrick Handcock, Leonie Hapeta, Billy Meehan, Orphée

Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

|

|

2-25

|

Public

Comment

|

|

|

Shaun

Kay spoke on the work of the Education is a right not a privilege Stationery

bank.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

That the Public Comment

be received.

|

|

|

Clause 2-25 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark

Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay, Roly

Fitzgerald, Patrick Handcock, Leonie Hapeta, Billy Meehan, Orphée

Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

|

|

3-25

|

Presentation

- The Plaza, Kiwi Property

Presentation from Andrew

Heaphy, Senior Centre Manager, The Plaza and Linda Trainer, General Manager

– Assets, Kiwi Property.

The presenters discussed the

detrimental effect of the change in the rating system on the Plaza. Whilst

they agreed with the rationale to move towards capital value; they were

concerned with the speed at which the change was happening.

They requested Council

consider the following:

· Slow

the transition (to Capital value) from the proposed 3 years to 5 years,

· Lower

the differential factor for non-residential ratepayers

· Increase

the uniform annual general charge

Councillor Lorna Johnson entered

the meeting at 9.23am.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That the Council receive the presentation for

information.

|

|

|

Clause 3-25 above was

carried 16 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta,

Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William

Wood and Kaydee Zabelin.

|

|

4-25

|

Confirmation

of Minutes

|

|

|

Moved Grant Smith, seconded Brent Barrett.

RESOLVED

1. That the

minutes of the extraordinary Council meeting of 5 December 2024 Part I Public

be confirmed as a true and correct record.

2. That the

minutes of the ordinary Council meeting of 11 December 2024 Part I Public be

confirmed as a true and correct record.

|

|

|

Clause 4-25 above was

carried 15 votes with 1 abstention, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew

Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson,

Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee

Zabelin.

Abstained:

Councillor Debi

Marshall-Lobb.

|

|

5-25

|

Tribute

- New Year's Honours 2025

The Mayor read out the

achievements of the New Year’s Honours recipients from Palmerston

North. He also acknowledged the achievements of the following former

Palmerstonians:

· Sam

Whitelock. (Now Hawkes Bay) Former resident and ex All Black Rugby

captain. Awarded ONZM for services to Rugby and Community/Mental

Health.

· Noel

Harris. (now Mt Maunganui) Former resident and premier Horse Racing

jockey. Awarded MNZM for services to Horse Racing.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council congratulate the local recipients of

the New Year’s Honours 2025.

|

|

|

Clause 5-25 above was

carried 16 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor,

William Wood and Kaydee Zabelin.

|

|

6-25

|

Local

Water Done Well- Approval for Consultation

Memorandum, presented by

Julie Keane - Transition Manager Three Waters, Mike Monaghan - Group Manager

Three Waters, Olivia Wix - Communications Manager.

Council requested several

amendments be made to the consultation document to further clarify some of

the issues and ensure continuity of how costs are presented throughout the

document.

|

|

|

Moved

Grant Smith, seconded Lorna Johnson.

RESOLVED

1. That the consultation document be edited and come

back to Council on 12 February, with the following edits:

· show

option of numbers plus inflation

· Option

2 – show which councils are possible for option 2 and effect of smaller

group on costs; range of options – best vs worst matrix.

· explain

changes to national standards and likely changes to costs due to them.

· whether

Nature Calls costs are included or not - show consistently across all

figures.

|

|

|

Clause 6-25 above was

carried 16 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta,

Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William

Wood and Kaydee Zabelin.

|

The

meeting adjourned at 11.05am.

The

meeting resumed at 11.20am.

|

7-25

|

Exemption

of Council Controlled Organisations

Memorandum, presented by

Sarah Claridge, Governance Advisor.

An amendment to

recommendation 4 was moved, which requested that the Globe and Regent

Theatres continue to present an annual Statement of Intent. An additional

recommendation was also moved ensuring that Council produce a Statement of

Expectation for the two theatre CCOs. Both resolutions were put to ensure

some continuity of current practice whilst allowing for an annual audit and

six-month report to no longer be required.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

3. That Council

decline the request from Te Manawa Museums Trust to become an exempted

organisation.

|

|

|

Clause 7-25 above was

carried 12 votes to 4, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison,

Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson,

Billy Meehan and Orphée Mickalad.

Against:

Councillors Rachel Bowen,

Karen Naylor, William Wood and Kaydee Zabelin.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council approve the

request to treat the Globe Theatre

Trust as an exempted organisation for the purpose of compliance and

external financial audit; for three years from 5 February 2025 to 5 February

2028, pursuant to Section 7 of the Local Government Act 2002.

2. That Council approve the request to treat the

Regent Theatre Trust as an exempted organisation for the purpose of

compliance and external financial audit; for three years from 5 February 2025

to 5 February 2028, pursuant to Section 7 of the Local Government Act 2002.

4. That Council request the Globe Theatre Trust and

Regent Theatre Trust present an annual Statement of Intent and Annual Report

to the relevant committee.

|

|

|

Clause 7-25 above was

carried 16 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor,

William Wood and Kaydee Zabelin.

|

|

|

Moved

Rachel Bowen, seconded Brent Barrett.

RESOLVED

5. That Council continue to

provide a three - yearly Statement of Expectation to The Globe Theatre

Trust and Regent Theatre Trust.

|

|

|

Clause 7-25 above was

carried 16 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie

Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor,

William Wood and Kaydee Zabelin.

|

|

|

Moved

Rachel Bowen, seconded Brent Barrett.

On an amendment to

recommendation 4: That Council request the Globe Theatre Trust and Regent

Theatre Trust present an annual Statement of Intent and their Annual Report to the relevant committee.

RB/BB

The amendment was carried 11 votes to 5, the voting being as followed

For:

Councillors Debi

Marshall-Lobb, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay,

Roly Fitzgerald, Patrick Handcock, Orphée Mickalad, Karen Naylor,

William Wood and Kaydee Zabelin.

Against:

The Mayor (Grant Smith) and Councillors Mark Arnott,

Leonie Hapeta, Lorna Johnson and Billy Meehan.

|

The

meeting adjourned at 12.25pm.

The

meeting resumed at 1.30pm.

Councillor Leonie Hapeta was

not present when the meeting resumed at 1:30pm.

|

8-25

|

Review

of CEDA Appointment of Director Policy - Creation of Working Group and Terms

of Reference

Memorandum, presented by

Sarah Claridge, Governance Advisor.

|

|

|

Moved Lew Findlay, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council establish a joint working group with

Manawatū District Council to review the CEDA Appointment of Directors

Policy.

2. That Council approve

the Terms of Reference of the CEDA Appointment of Directors Policy Working

Group (Attachment 1).

|

|

|

Clause 8-25 above was carried 15 votes to 0, the

voting being as follows:

For:

The Mayor (Grant Smith) and Councillors Debi

Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Billy Meehan,

Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

|

|

|

Moved

Lew Findlay, seconded Debi Marshall-Lobb.

RESOLVED

3. That Council agree

the Mayors’ recommendation to appoint Mayor Grant Smith, Councillor

Vaughan Dennison and Councillor Leonie Hapeta (as members of the Electoral

College) to the Working Group.

|

|

|

Clause 8-25 above was carried 12 votes to 1, with 2

abstentions, the voting being as follows:

For:

Councillors Debi Marshall-Lobb, Mark Arnott, Brent

Barrett, Rachel Bowen, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna

Johnson, Billy Meehan, Orphée Mickalad, William Wood and Kaydee

Zabelin.

Against:

Councillor Karen Naylor.

Abstained:

The Mayor (Grant Smith) and Councillor Vaughan

Dennison.

|

|

9-25

|

Civic

Fund Establishment - Te Awa Community Foundation

Memorandum, presented by

Richard Carr, Commercial Partnerships and Funding Manager.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council

note progress towards establishing a civic fund in conjunction with the Te

Awa Community Foundation.

|

|

|

Clause 9-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna

Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

|

10-25

|

Civic

and Cultural Precinct: 6 Month Update

Memorandum, presented by

David Murphy, General Manager Strategic Planning and Richard Carr, Commercial

Partnerships and Funding Manager.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council

receive the report titled Civic and Cultural Precinct: 6 Month Update,

presented on 5 February 2025.

|

|

|

Clause 10-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna

Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

|

11-25

|

Council

Work Schedule

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council receive its Work Schedule dated 5

February 2025

|

|

|

Clause 11-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna

Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

Exclusion

of Public

|

12-25

|

Recommendation to

Exclude Public

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

That the public be excluded from the following parts

of the proceedings of this meeting listed in the table below.

The general subject of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under Section 48(1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for passing

this resolution

|

|

18.

|

Confirmation of the minutes of the ordinary

Council meeting of 11 December 2024 Part II Confidential

|

For the reasons set out in the Council of 11

December 2024, held in public present.

|

|

|

19.

|

Sale and Purchase of Property on Ruahine Street

|

COMMERCIAL ACTIVITIES:

This information needs to be kept confidential to

allow Council to engage in commercial activities without prejudice or

disadvantage

|

s7(2)(h)

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

|

|

|

Clause 12-25 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark

Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay, Roly Fitzgerald,

Patrick Handcock, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen

Naylor, William Wood and Kaydee Zabelin.

|

Councillor Vaughan Dennison

left the meeting at 2:06pm

The public part

of the meeting finished at 2.06pm.

Confirmed 12 February 2025

Mayor

Memorandum

TO: Council

MEETING DATE: 12

February 2025

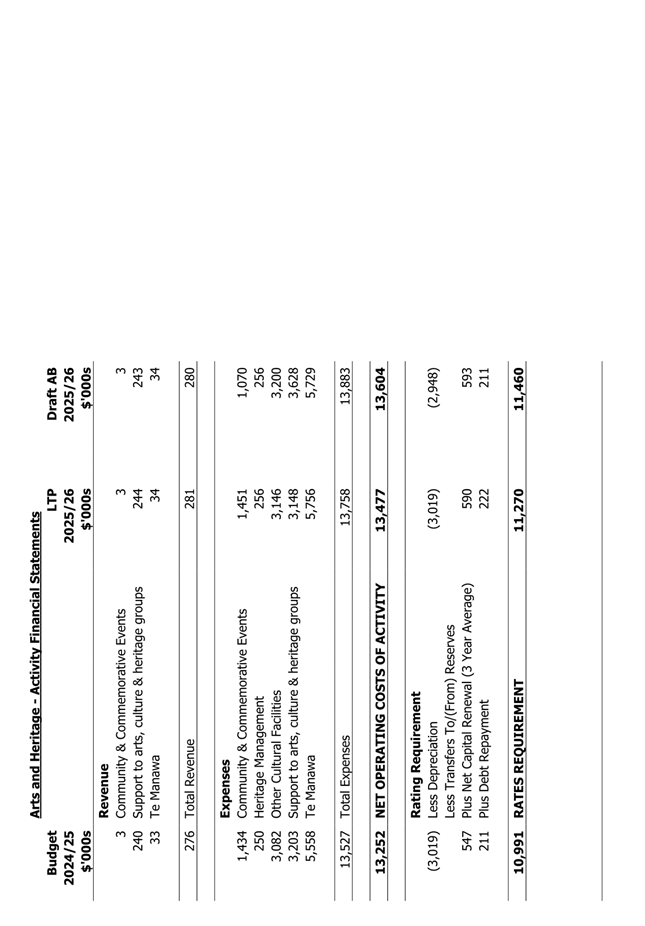

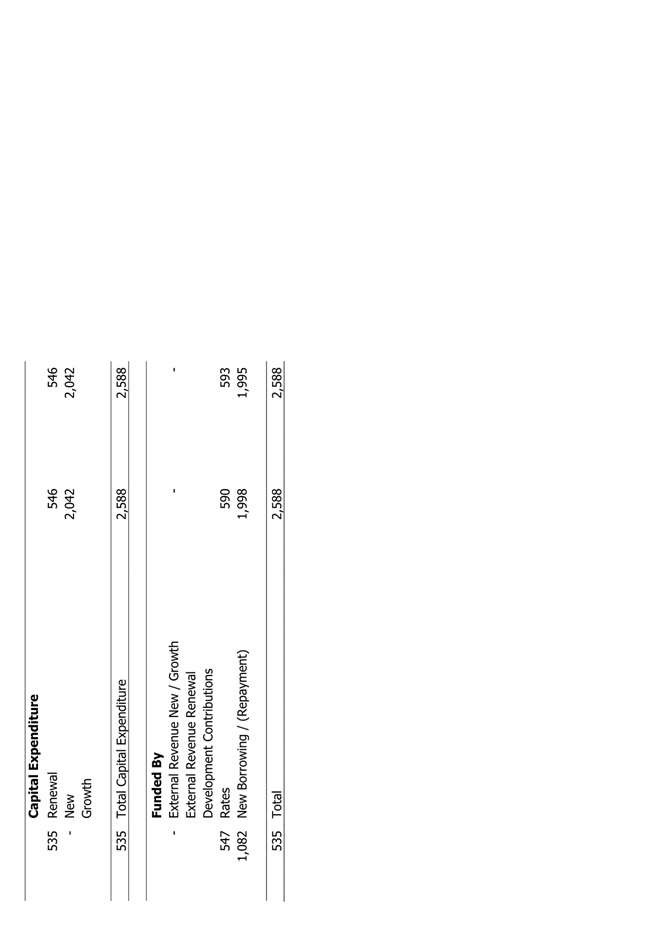

TITLE: Annual

Budget (Plan) 2025/26 - Update including draft Consultation Document and

Supporting Information

Presented

By: Steve

Paterson, Manager - Financial Strategy and Scott Mancer, Manager - Finance

APPROVED BY: Cameron

McKay, General Manager Corporate Services

RECOMMENDATIONS TO

Council

1. That the

Chief Executive incorporate the following in the draft 2025/26 Annual Budget

supporting information for adoption at the Council meeting of 5 March 2025:

a. Budgetary

assumptions that are unchanged from those agreed to at the Council meeting on

11 December 2024, except for the addition of operating expenditure budget of

$400K to fund the proposed levy from the water services regulator.

b. Financial statements

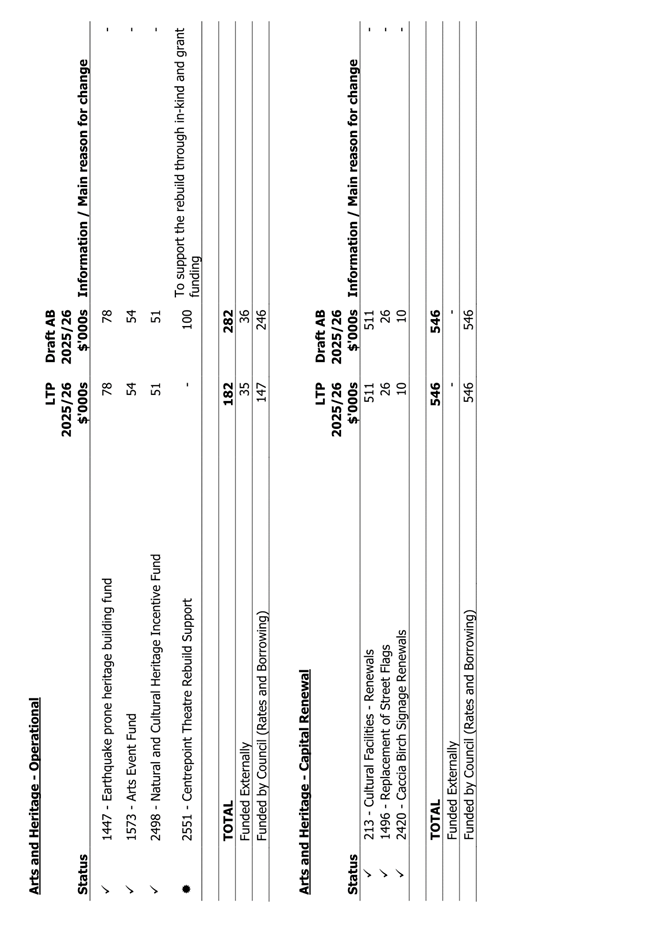

and other supporting information based on the drafts included as Attachment 2,

noting that $100,000 has been set aside in each of the financial years 2025/26

and 2026/27 to support the Centrepoint Theatre rebuild, until further

confirmation from Centrepoint as to which allocation of support (in-kind,

consent costs, grant) would be most appropriate.

2. That Council

note the Consultation Document will be presented for adoption at the Council

meeting of 5 March 2025, based on the draft in Attachment 3.

1. ISSUE

1.1 At

its meeting on 11 December 2024 Council resolved to:

“… instruct the

Chief Executive to prepare a draft of the Consultation Document and supporting

information for the Annual Budget 2025/26 for consideration by the Council at

its meeting on 12 February 2025 and that it contains:

a. key assumptions outlined in Section 4 amended by

confirming the proposed budget for remuneration as being $63m, being the $62.5m

as outlined in the Long-Term Plan 2024/34 plus $0.5m for positions which are

offset with additional revenue

b. programmes as agreed at the Council meeting on 6

November 2024

c. a budget for Local Water Done Well Transition support

in 2025/26 comprising expenditure of $1.5M funded by way of a grant subsidy of

$621,831 and the balance of $878,169 by way of loan (the grant subsidy is the

remainder of the balance of Better Off Funding, reallocated by resolution 214-24).

d. increase the resource recovery operating budget by

$65k to fund the delivery of Programme 2338 – Recycling Contamination

Monitoring Development

e. a budget of $120,000 to support a Street Lighting

survey

f. approve Option 1 and agree an additional budget of

$50K for the development and implementation of the Palmerston North Age

Friendly Implementation Plan

g. support the Centrepoint Theatre rebuild of up to $200k

over two years by:

i. In-kind support – officer time to support with

fundraising, promotion, communications etc; and

ii. Resource consent and building consent costs –

the application process for this is already underway; and

iii. Grant funding – the quantum to be determined at the 12 February

2025 Council meeting.

h. That the Chief Executive

look at reducing the professional services budgets in 2025/26 by $1M and

creating a new $1M Internal Capacity Building Budget to be used for

professional development, internal capacity support and staff remuneration; and

report back to 12 February 2025.”

1.2 This

report provides the information required in response to the resolutions above

and seeks endorsement of the content of the draft Consultation Document and

Supporting Information.

2. BACKGROUND

general

2.1 Council

has been following its agreed timetable

towards the adoption of a 2025/26 draft budget for consultation in March.

Materials presented today are based on direction received at Council meetings

of 6

November and 11

December 2024.

2.2 An

initial draft of the proposed Consultation Document is attached. Once

updated it will highlight what changes there are from Year 2 of the Long-term

Plan, primarily due to changed circumstances and updated timelines for some

programmes. It will also highlight proposed rates levels for (average)

properties.

2.3 A

strategy for public engagement has been developed. This will include provision

of the final Consultation Document and Supporting Information on

Council’s website and at the Customer Service Centre and libraries.

There will be opportunities for group meetings and for information to be

provided through social media channels. It is intended that a brief

document will be delivered to all households.

2.4 We

plan to have proposed rates for each property available to be viewed on the

Council’s website.

2.5 The

public will have the option of making a submission and being heard by Council.

2.6 Following

the consultation period and hearings, the Council will be required to adopt its

final Annual Budget (Plan) prior to 30 June 2025 (currently scheduled for 4

June following a deliberations meeting on 14 May 2025).

2.7 Attached

are the following:

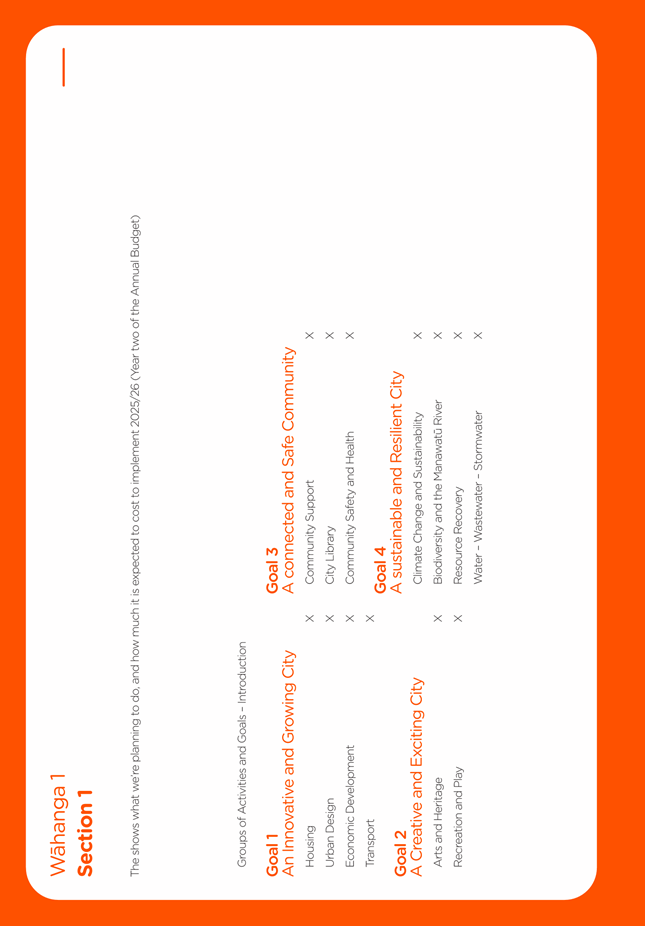

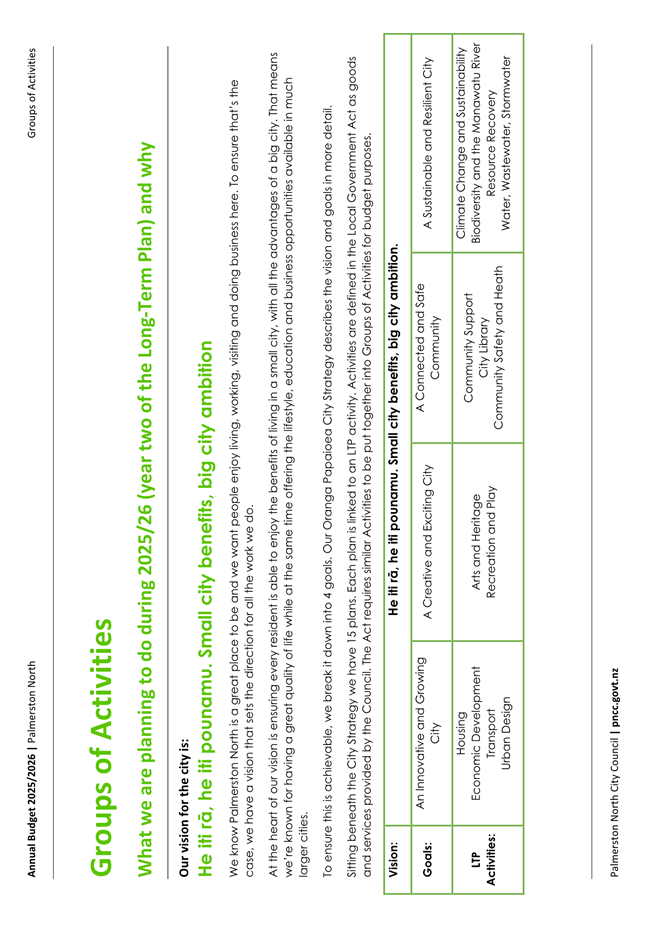

Attachment

1 – provides and overview to the resolutions that were passed at the

6 December 2024 meeting regarding professional services, providing a summary of

the uses of the professional services budget.

Attachment

2 – drafts of the supporting information, including changes to

capital and operating budgets as resolved at the 6 November and 11 December

2024 meetings:

• Financial

overview and forecast financial statements

• Annual

Budget (Plan) Disclosure Statement

• Groups

of Activities information, including financial forecasts and programme

schedules

• Significant

forecasting assumptions

• Descriptions

of the proposed rating system, rates and funding impact statements

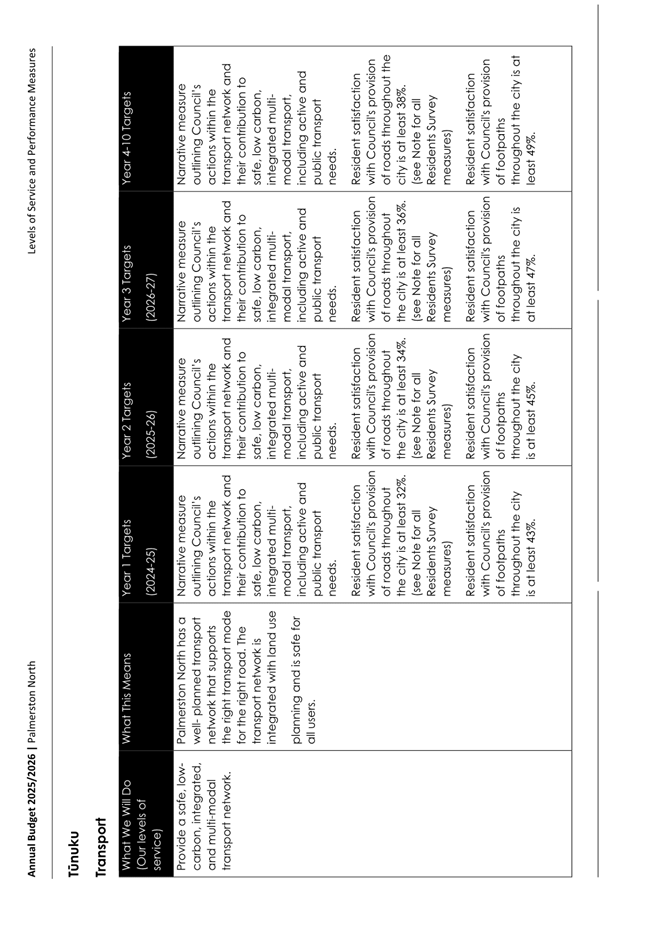

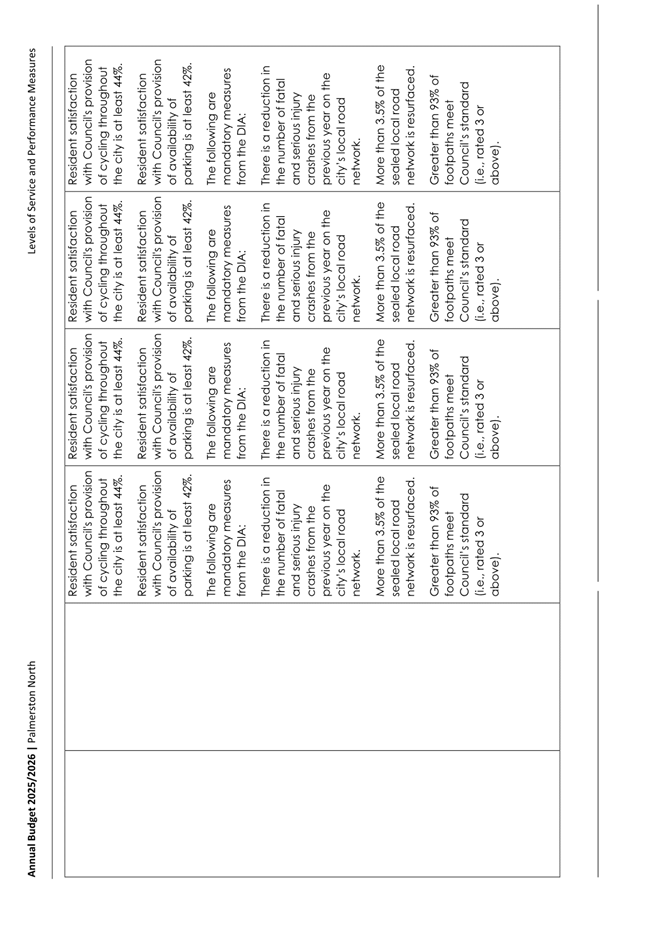

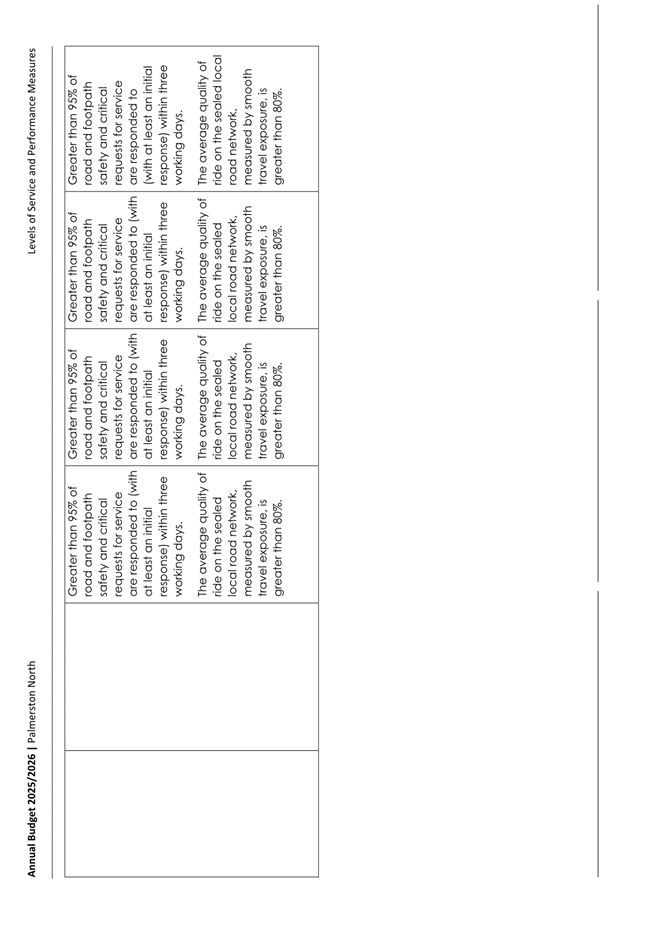

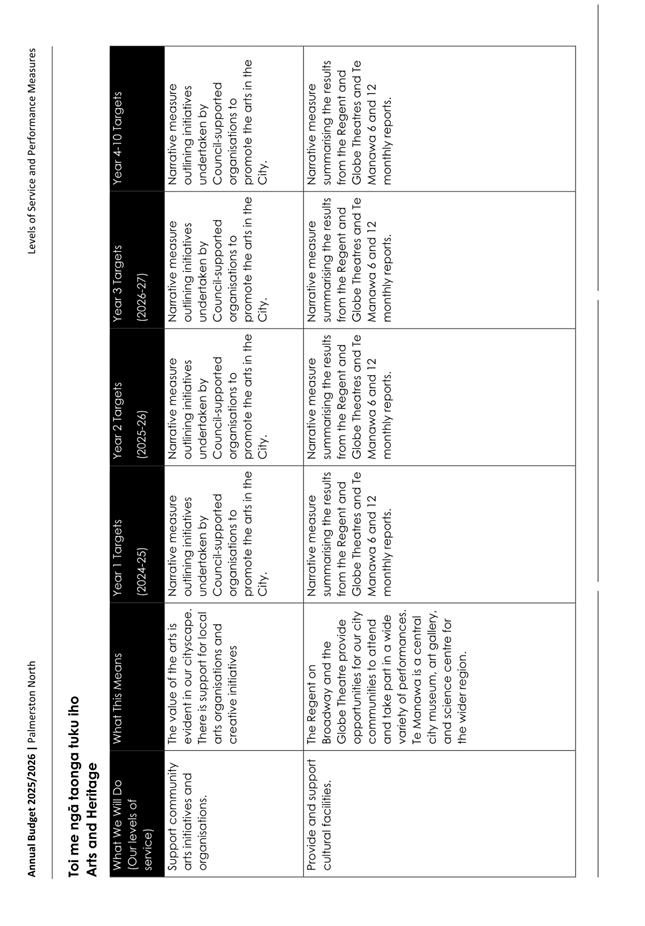

• Levels

of service and performance measures

Attachment

3 – draft of the proposed Consultation Document

BUDGET

UPDATE

2.8 The

budget is based on Year 2 of the Long-Term Plan updated to reflect subsequent

decisions of Council. Key matters influencing the preparation of the

annual budget were outlined in the reports to the meetings on 6 November and 11

December 2024. The current proposed increase for 2025/26 is lower than that

included in Year 2 of the Long-Term Plan.

2.9 In

addition to the matters resolved by the Council on 11 December 2024, an

additional budgeted operating expenditure of $400K has been included to reflect

the cost of the new levy being proposed by the Government to fund the water

regulator. As advised by the Department of Internal Affairs, the levy has

been allocated between the water activities as follows: water supply (75%),

wastewater (21%) and stormwater (4%).

2.10 Officers

have also been made aware, since the meeting on 11 December, of another

proposed levy for the Commerce Commission in relation to the economic

regulation of ringfencing water services activities. This new levy is proposed

to start from 1 July 2025 and initial calculations suggest that the levy for

Palmerston North would be circa $100K. If confirmed, officers will include this

in the papers for deliberations on 14 May 2025, however we will look to absorb

this within existing budgets, where possible.

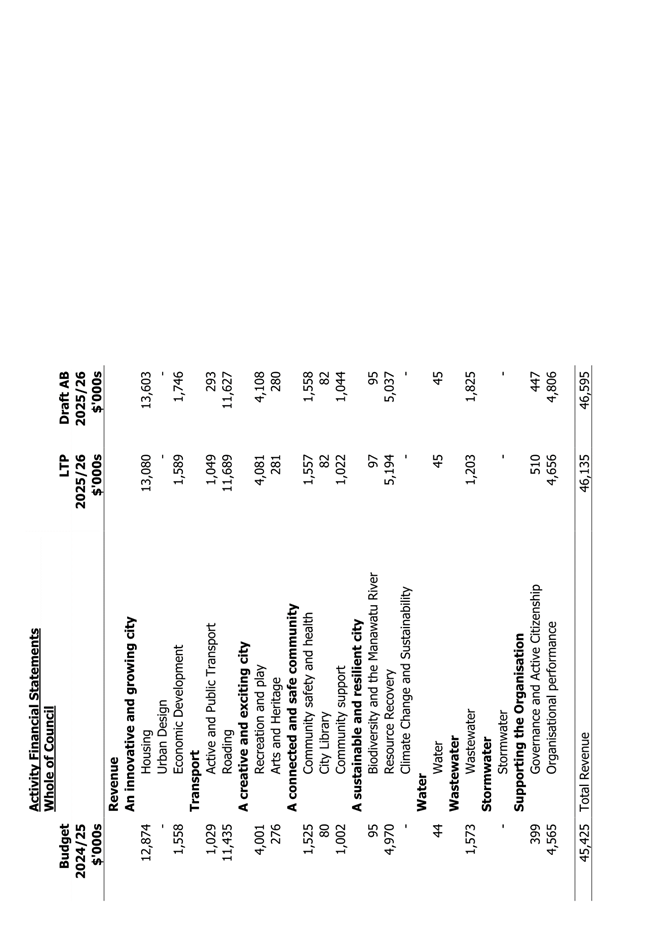

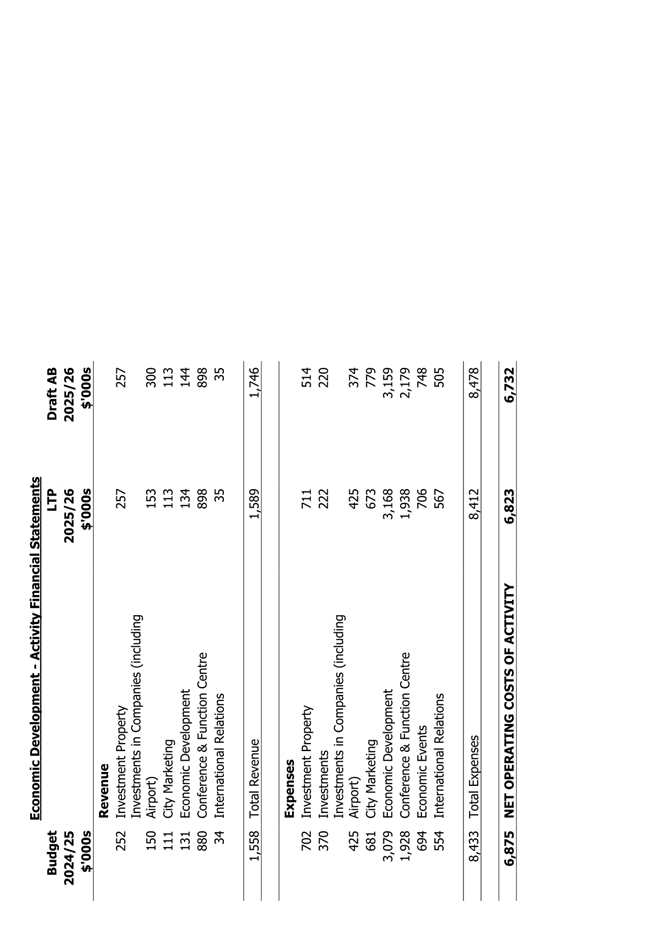

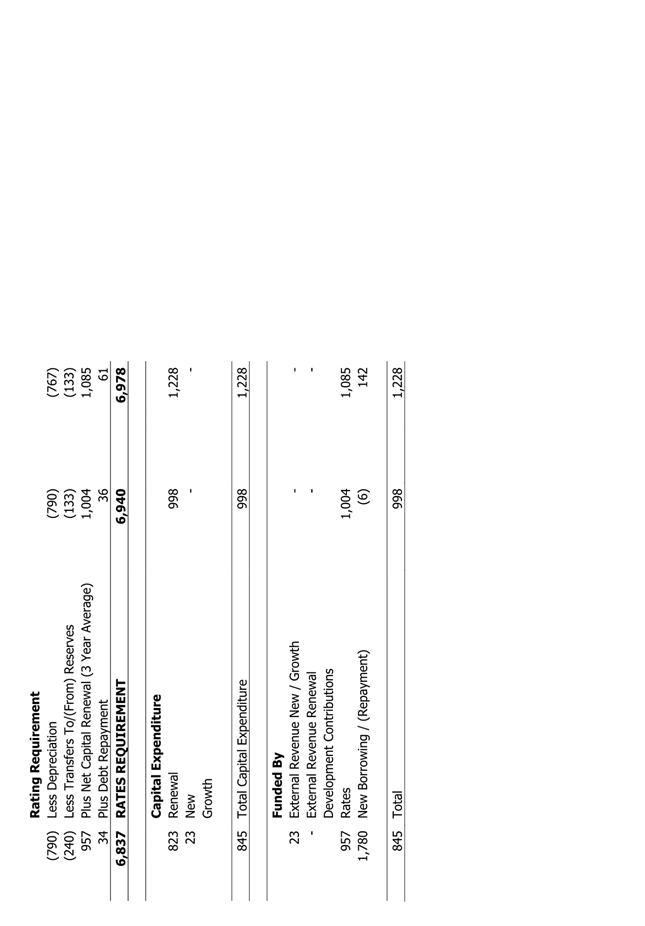

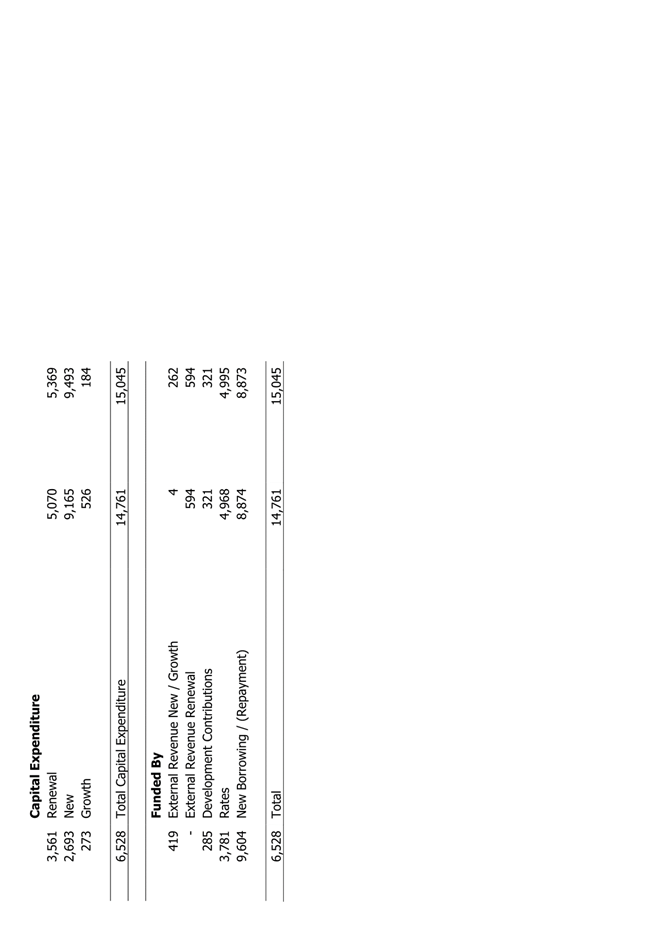

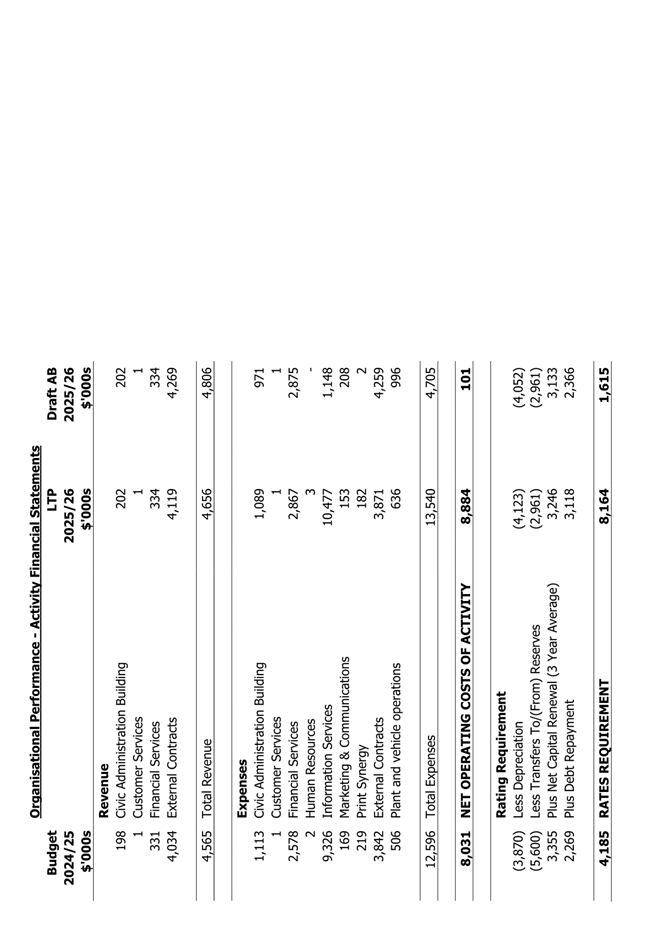

2.11 Tables

1-3 below provide the latest summary of the draft budget compared to the

Long-Term Plan.

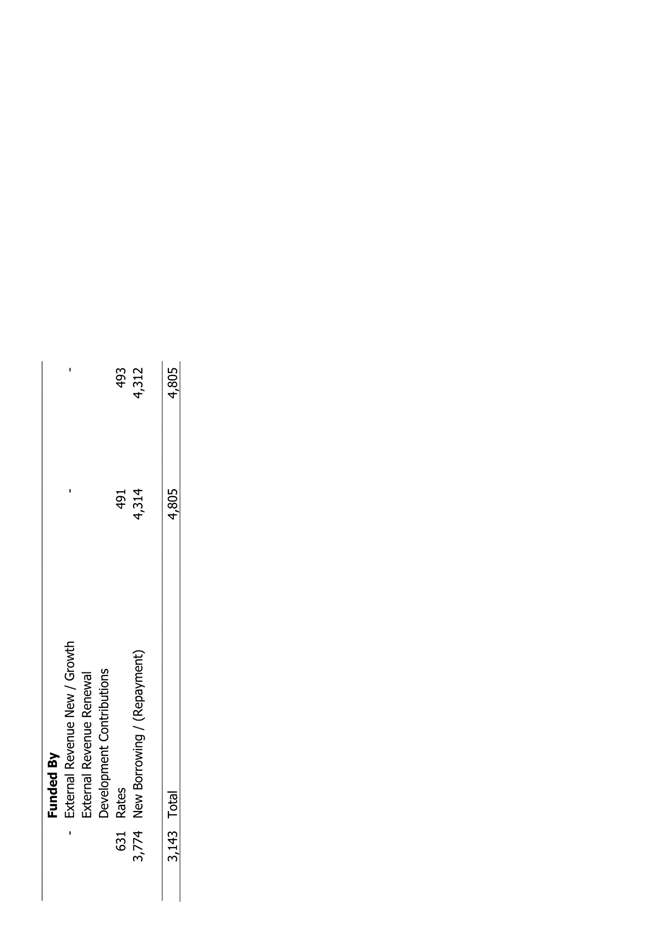

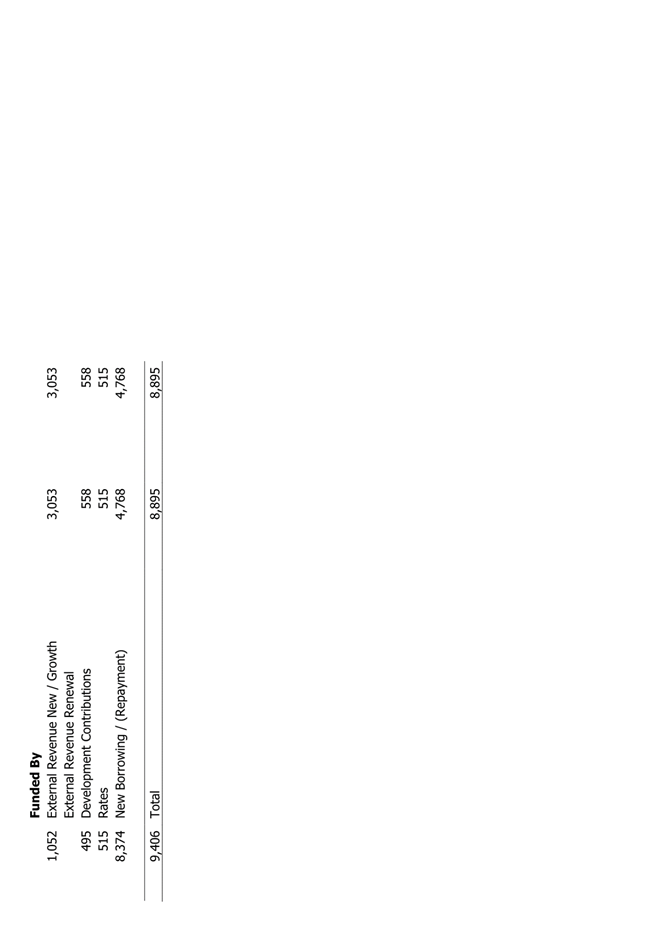

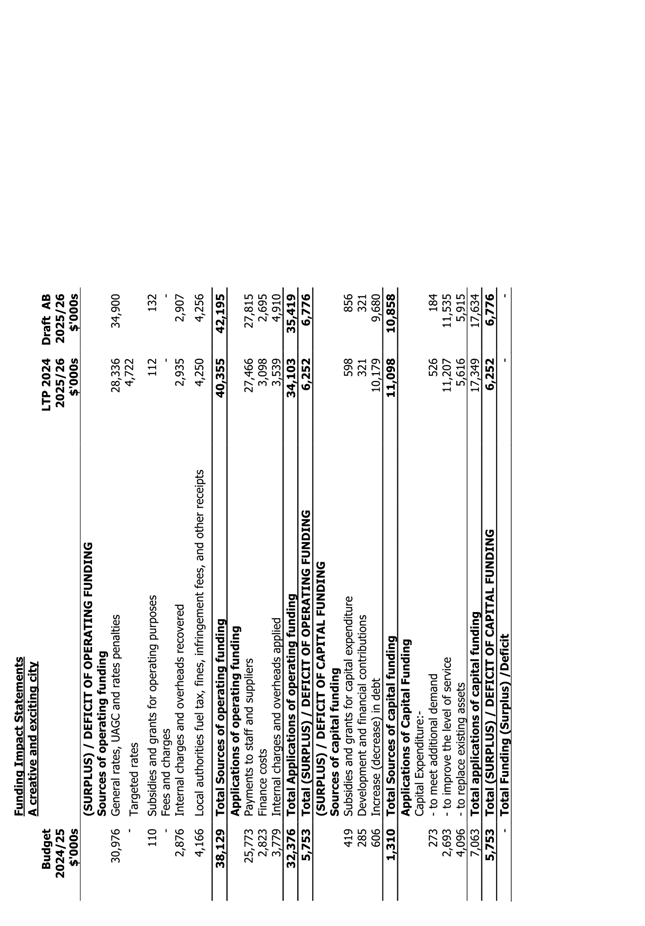

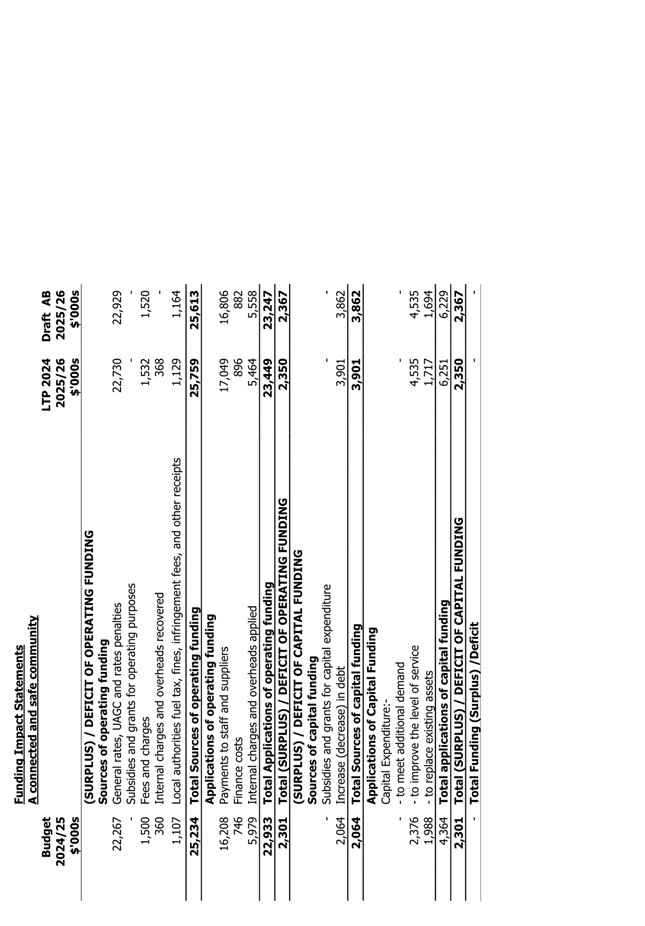

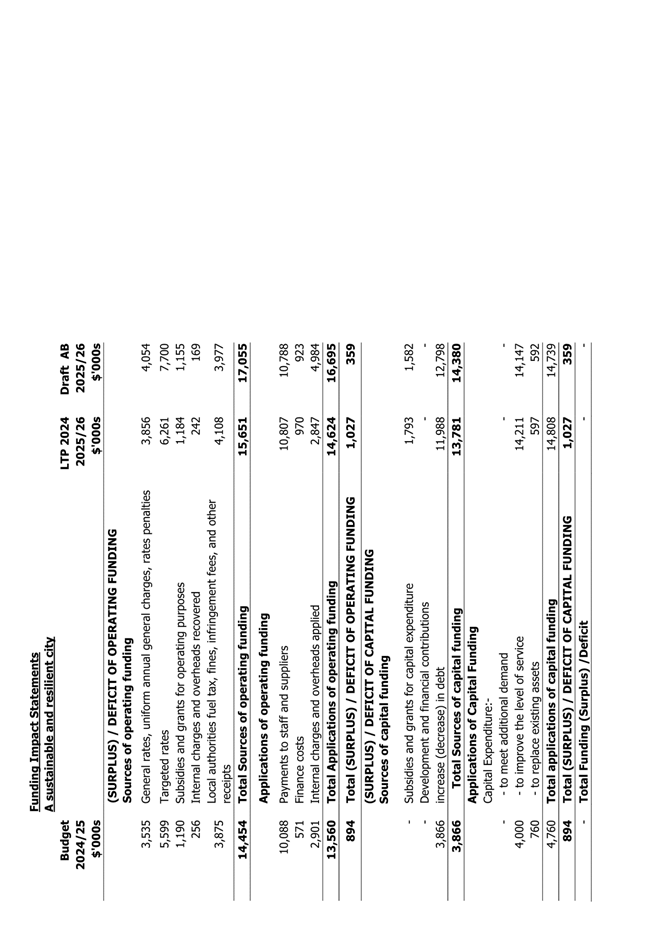

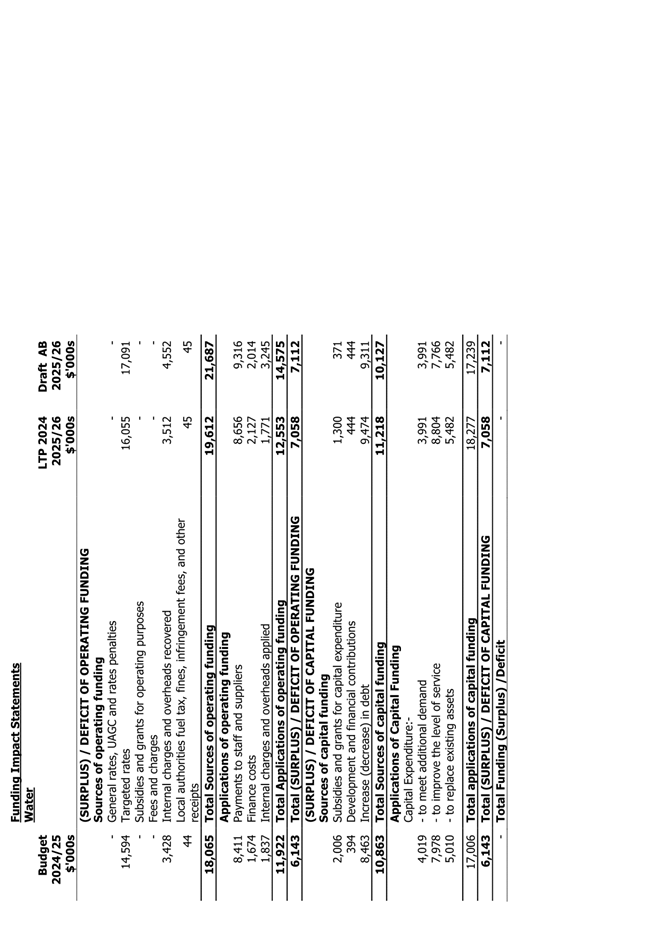

|

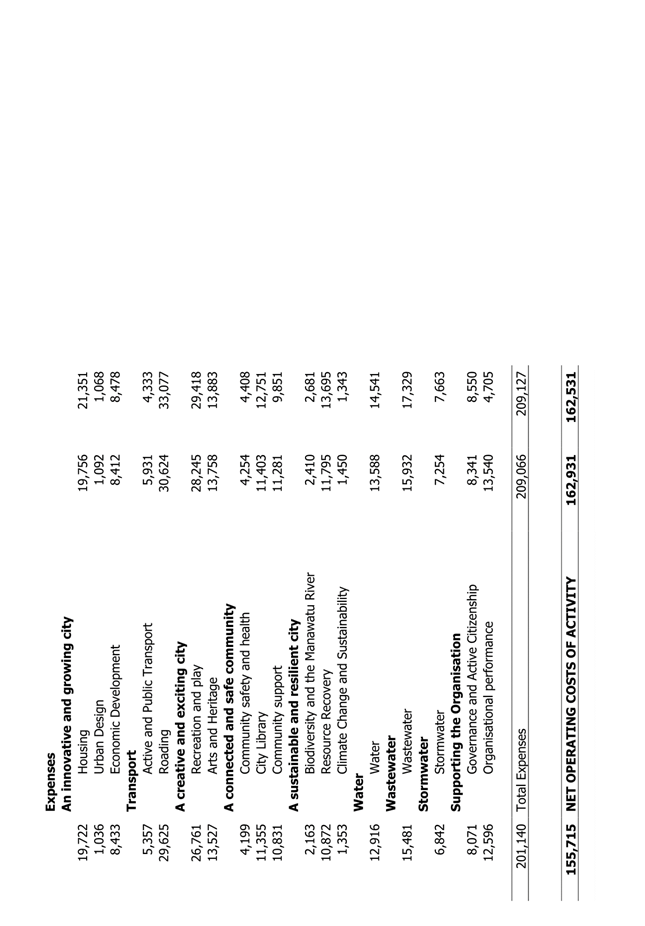

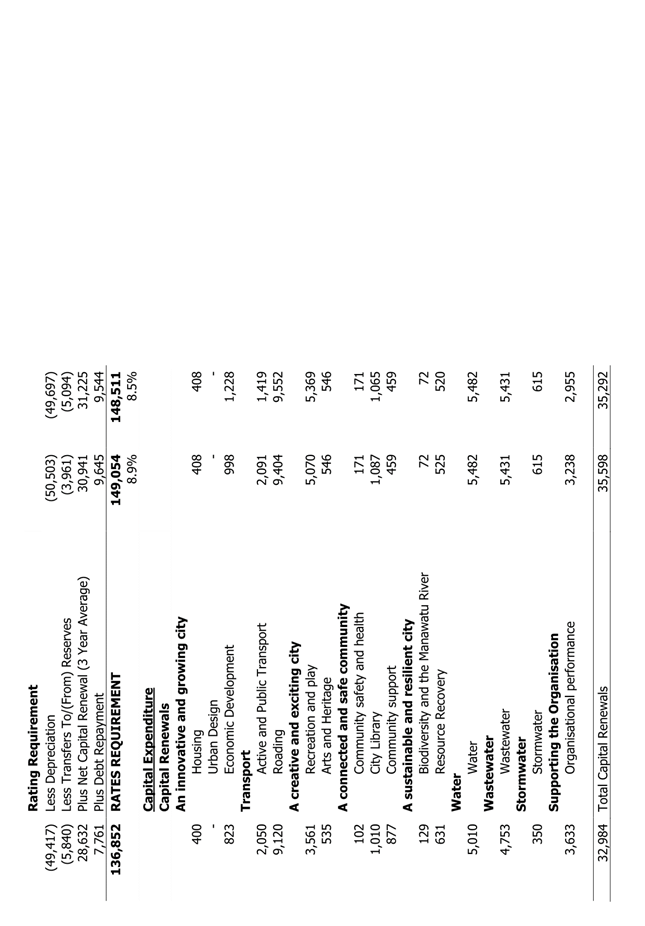

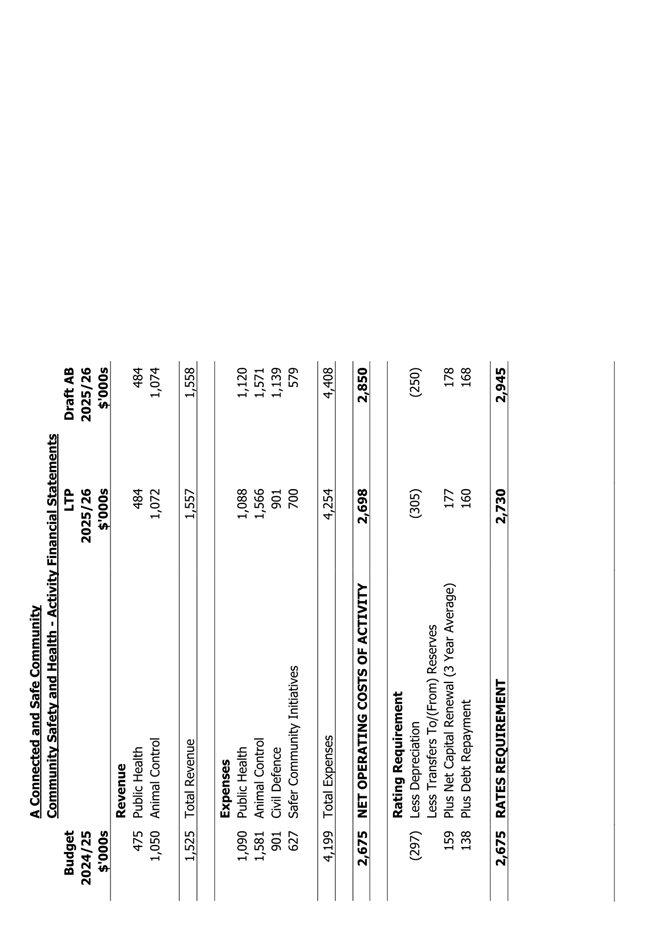

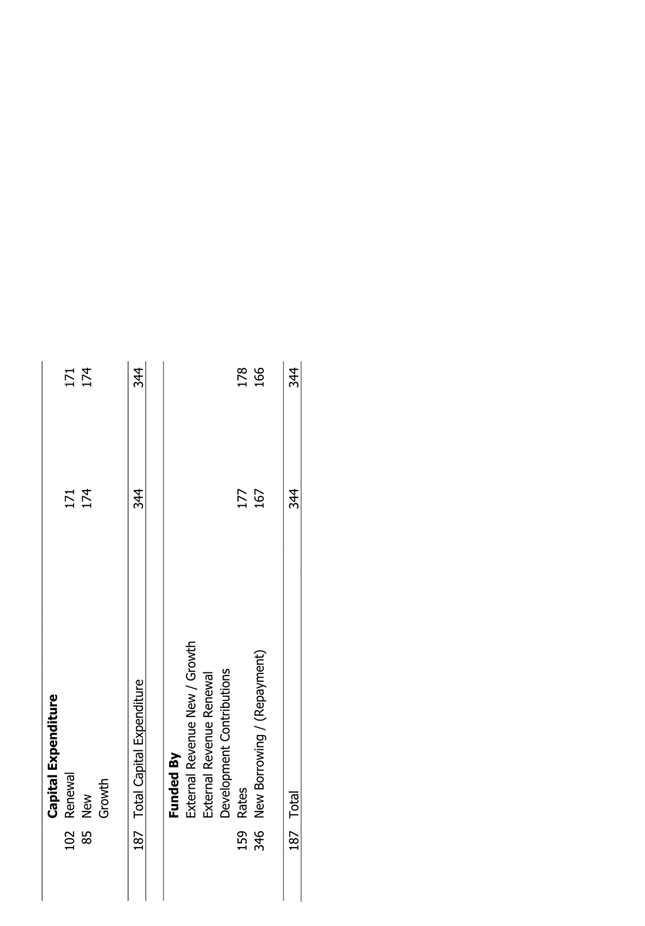

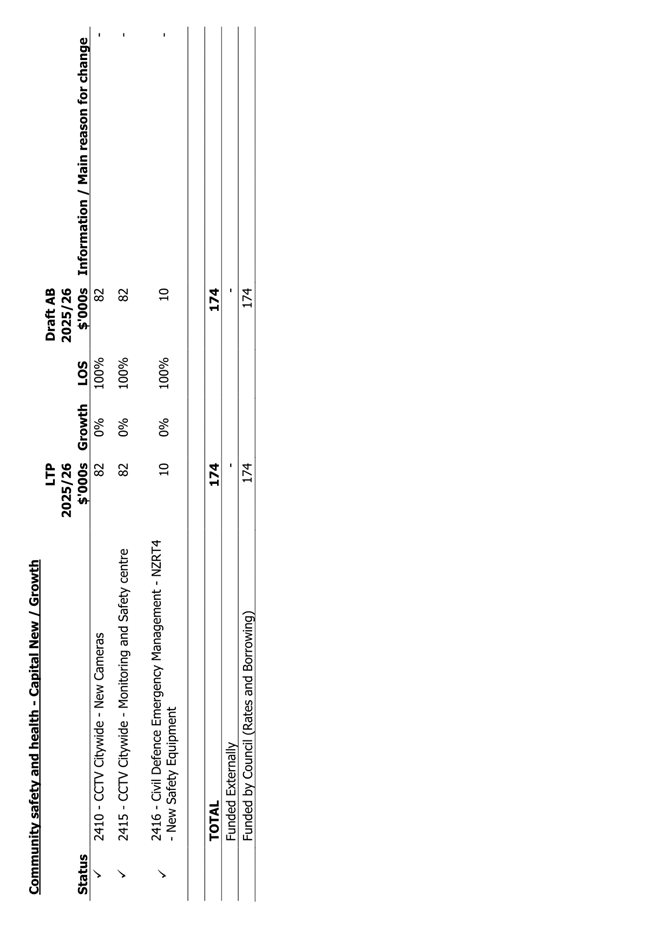

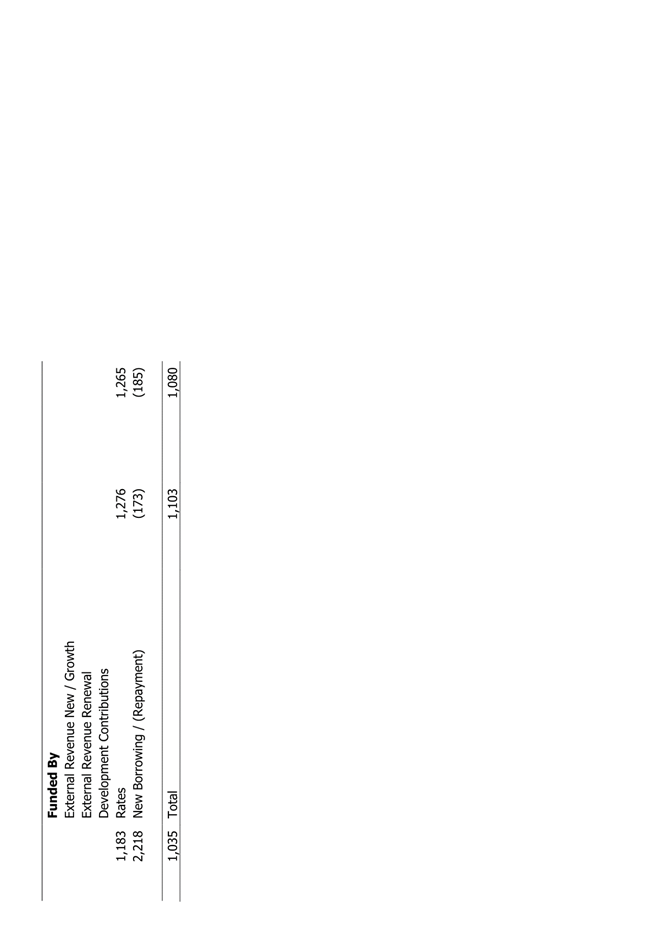

Table 1: Funding of Operating expenses

|

Long-term Plan

|

Draft Annual

budget

|

|

|

2024/25

$M

|

2025/26

$M

|

2025/26

Dec draft

$M

|

2025/26

Feb draft

$M

|

|

Personnel

Depreciation

Finance (interest)

All Other Operating Expenses

|

59.3

49.4

14.5

77.9

|

62.5

50.5

17.0

79.1

|

64.2

49.7

14.9

79.3

|

63.0

49.7

14.9

81.5

|

|

Total operating expenses

|

201.1

|

209.1

|

208.1

|

209.1

|

|

Operating subsidies & grants

Finance revenue

Other revenue

|

(6.4)

(0.4)

(38.6)

|

(6.5)

(0.4)

(39.2)

|

(5.5)

(0.5)

(40.0)

|

(6.1)

(0.5)

(40.0)

|

|

Total operating revenue

|

(45.4)

|

(46.1)

|

(46.0)

|

(46.6)

|

|

Net operating expenses

|

155.7

|

163.0

|

162.1

|

162.5

|

|

Less:

Depreciation

Operating expenses funded from

debt

Plus:

Renewals (3 year rolling average)

Debt repayment

|

(49.4)

(5.8)

28.6

7.8

|

(50.5)

(3.9)

30.9

9.6

|

(49.7)

(4.2)

31.2

9.6

|

(49.7)

(5.1)

31.2

9.6

|

|

Total rates requirement

|

136.9

|

149.1

|

149.0

|

148.5

|

|

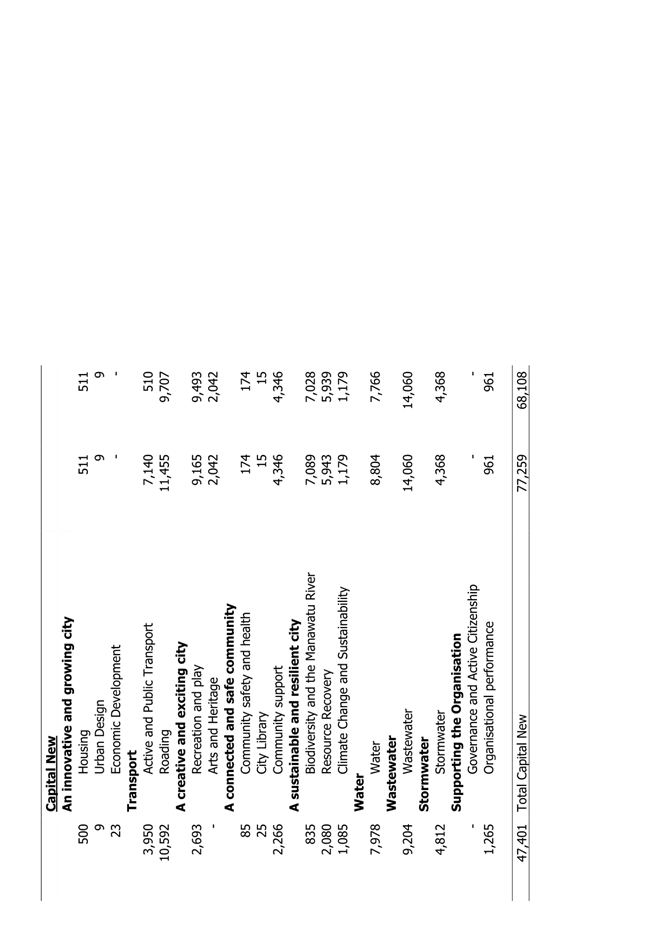

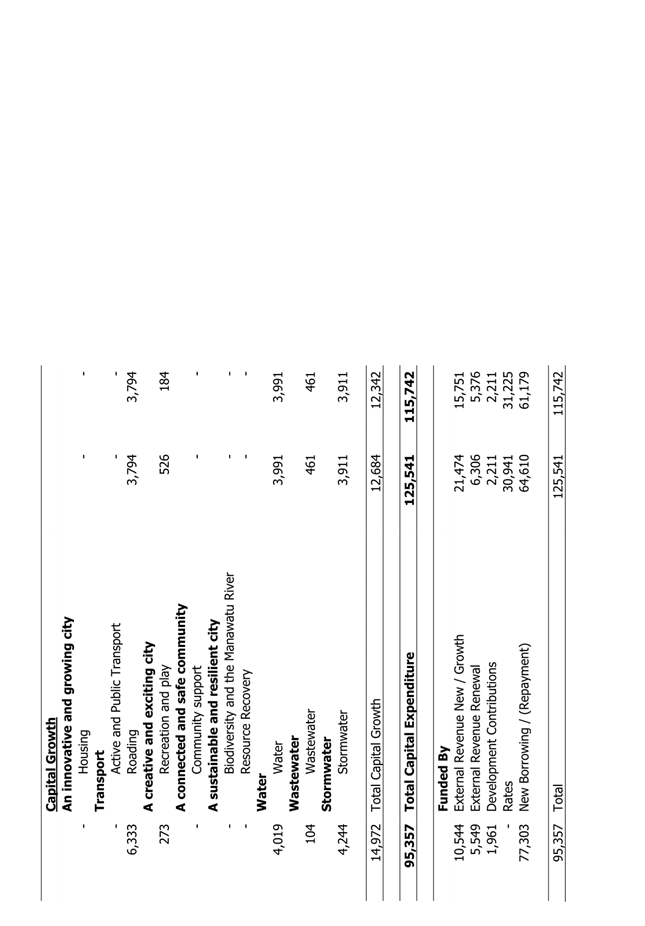

Table 2: Funding of Capital Expenditure

|

Long-term Plan

|

Draft Annual

budget

|

|

|

2024/25

$M

|

2025/26

$M

|

2025/26

Dec draft

$M

|

2025/26

Feb draft

$M

|

|

Renewals

Capital for growth

Capital new

|

33.0

15.0

47.4

|

35.6

12.7

77.2

|

35.6

12.7

77.2

|

35.3

12.3

68.1

|

|

Total capital expenditure

|

95.4

|

125.5

|

125.5

|

115.7

|

|

Funding from external sources

|

(18.1)

|

(30.0)

|

(30.0)

|

(23.3)

|

|

Funding from rates (for renewals)

|

(28.6)

|

(30.9)

|

(30.9)

|

(31.2)

|

|

Funding from additional debt

|

(48.7)

|

(64.6)

|

(64.6)

|

(61.2)

|

|

Table 3: Components of increased rates

requirement

|

Impact on Total Rates for Year 2

|

|

As per LTP

|

As per draft AB

|

|

Interest Costs on Debt

|

1.8%

|

0.3%

|

|

Debt Repayment

|

1.4%

|

1.3%

|

|

Rolling Average Renewal increase

|

1.7%

|

1.9%

|

|

Labour Costs

|

2.3%

|

2.7%

|

|

Utilities and Insurance

|

0.2%

|

0.4%

|

|

All Other (Contractors, Professional Services, Materials

etc.)

|

2.1%

|

2.6%

|

|

Revenue (excluding Rates and Grants & Subsidies)

|

(0.5%)

|

(0.9%)

|

|

Revenue – Operating Grants & Subsidies

|

(0.1%)

|

0.2%

|

|

Increase in total rates requirement

|

8.9%

|

8.5%

|

2.12 The

tables include the funding of the Transport Omissions, plus the additional

funding of the Footpath Renewal Programme as resolved by Council on 6 November

2024. This equates to circa $1.5M or 1.1% out of the 8.5% of the increase. The

additional water levy mentioned in 2.9 above is a further 0.2% out of the 8.5%

proposed increase.

2.13 Additionally,

3.5% out of the 8.5% proposed increase relates to the funding of the capital

programme for the year (interest, debt repayment and rolling average renewal).

3. RATES ISSUES

3.1 The

budget assumes total rates revenue will need to increase by 8.5%.

3.2 Noting

that the impact on individual ratepayers will vary, options for the rates

system to apply for 2025/26 are outlined in the report ‘Rating System for

2025/26’ also on this meeting agenda.

4. NEXT STEPS

4.1 Officers

will make any changes resulting from the Council’s decisions.

4.2 An

updated final Consultation Document and supporting information will be

presented to the Council for adoption at its meeting on 5 March 2025.

5. Compliance and administration

|

Does Council have delegated

authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

Yes

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The

recommendations contribute to the achievement of objective/objectives

in:

14.

Mahere mana urungi, kirirarautanga hihiri

14. Governance and Active

Citizenship Plan

The objective is: Base our

decisions on sound information and advice

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

Adopting an annual budget/plan

each year is a fundamental legislative requirement and without this in place

the Council will not be able to set rates for the year and therefore fund any

of its actions, plans or strategies.

Palmerston North City Council

consults on its annual budget to ensure public awareness of any proposed

changes since the Long-Term Plan was agreed.

|

|

|

|

Attachments

|

1.

|

Professional

Services Information ⇩

|

|

|

2.

|

Draft

Supporting Information - Annual Budget 2025/26 ⇩

|

|

|

3.

|

Initial

draft of Consultation Document - Annual Budget 2025/26 ⇩

|

|

TO: Council

MEETING DATE: 12

February 2025

TITLE: Fees

and Charges Review

PRESENTED BY: Steve

Paterson, Manager Financial Strategy

APPROVED BY: Cameron

McKay, General Manager Corporate Services

RECOMMENDATIONS TO

Council

1. That Council

receive the report titled ‘Fees and Charges Review’, presented on

12 February 2025, and note the current status of fees and charges.

Trade Waste

2. That Council

agree for consultation the proposal of updated fees and charges for Trade Waste

services effective from 1 July 2025 as attached in Appendix 2 and authorise the

Chief Executive to undertake the necessary consultative process under sections

82 and 150 of the Local Government Act 2002;

OR

That Council agree for consultation the proposal of

updated fees and charges for Trade Waste services effective from 1 July 2025 as

attached in Appendix 2 (and amended using either Option A or Option B from

Table 1 in section 3.4 of this report) and authorise the Chief Executive to

undertake the necessary consultative process under sections 82 and 150 of the

Local Government Act 2002.

Planning & Miscellaneous

3. That Council

agree for consultation the Statement of Proposal (and the associated summary)

of updated fees and charges for Planning Services and Miscellaneous Services

effective from 1 July 2025 as attached in Appendix 3, and authorise the Chief

Executive to undertake the necessary consultative process under sections 83 and

150 of the Local Government Act 2002.

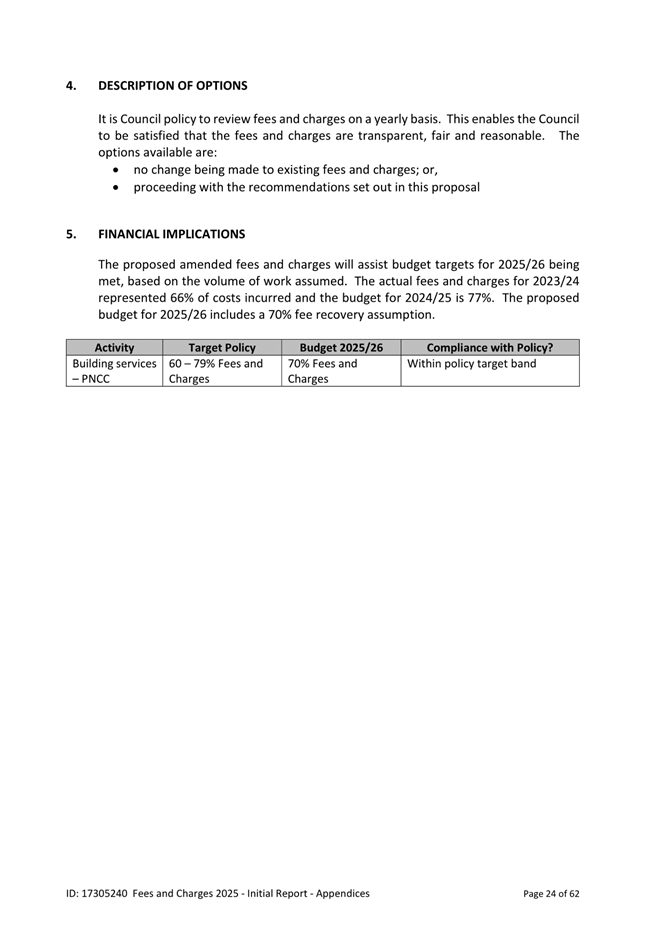

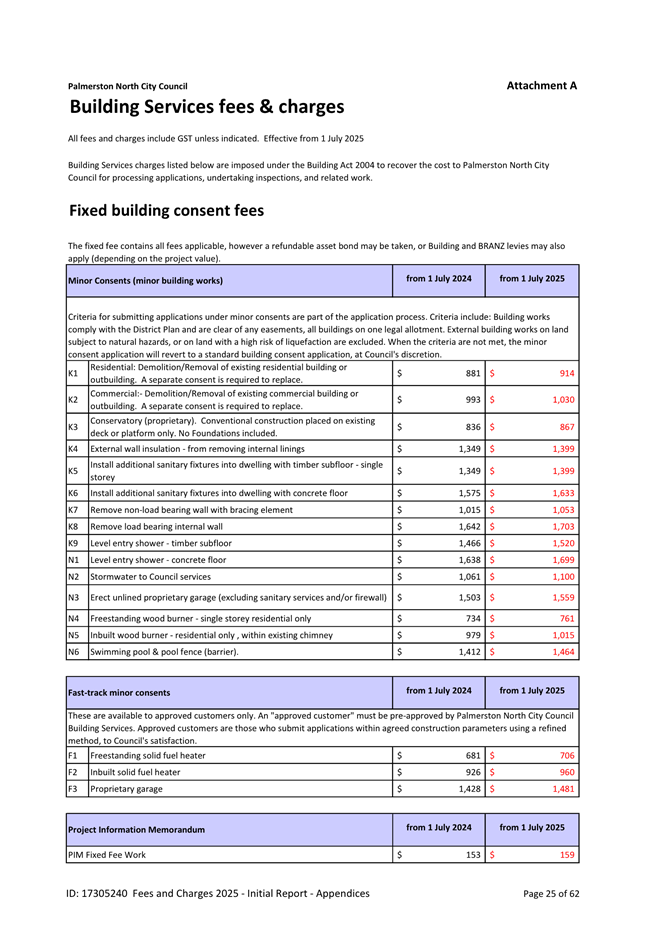

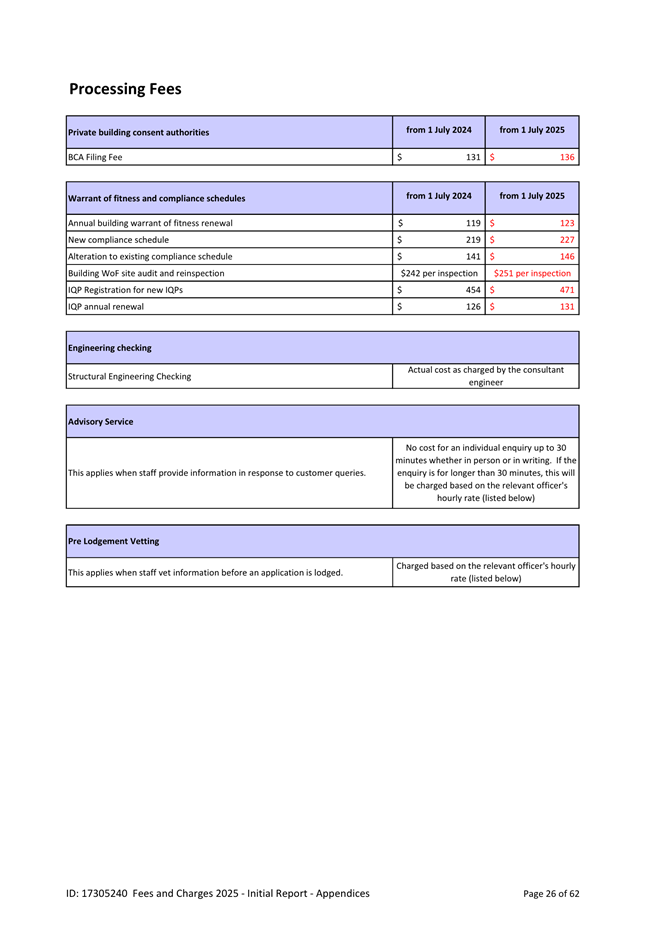

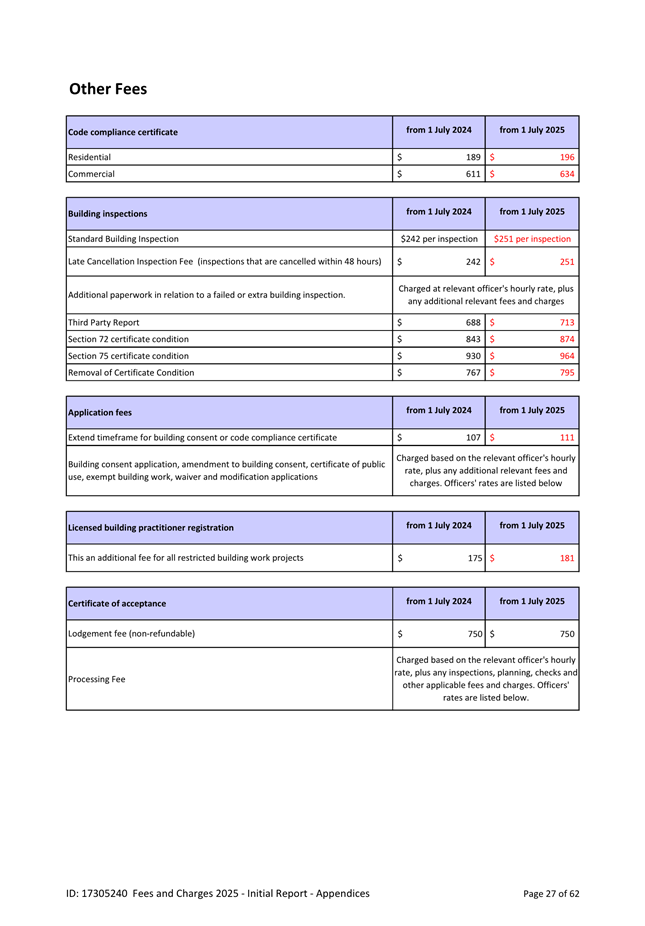

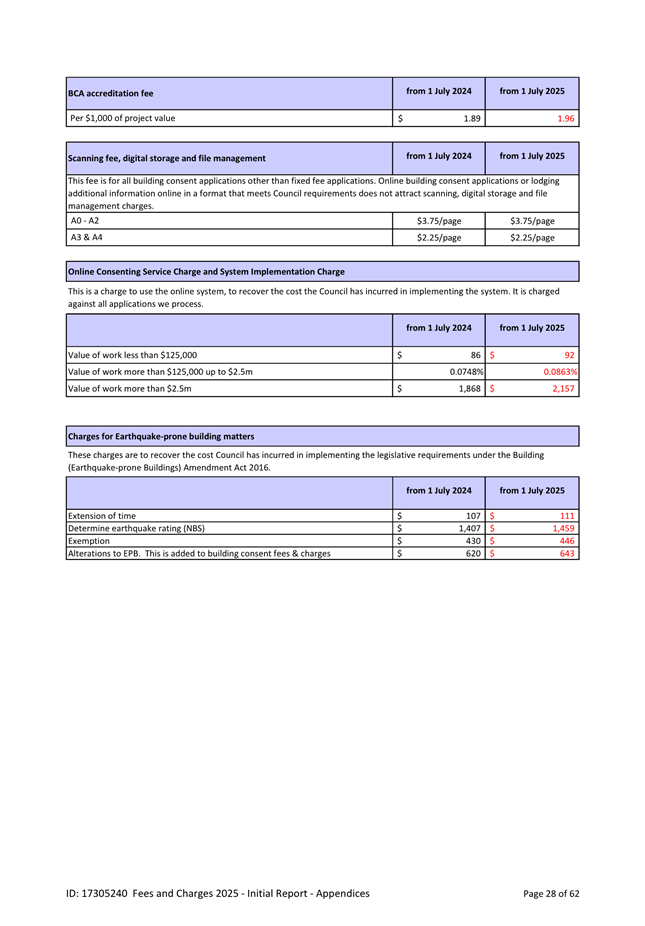

Building

4. That Council

agree the fees and charges for Building Services, as proposed in Appendix 4 for

public notification to take effect from 1 July 2025.

Environmental Health

5. That Council

agree the fees and charges for Environmental Health Services (in terms of

regulation 7 of the Health (Registration of Premises) Regulations 1966) as

proposed in Appendix 5 for public notification to take effect from 1 July 2025.

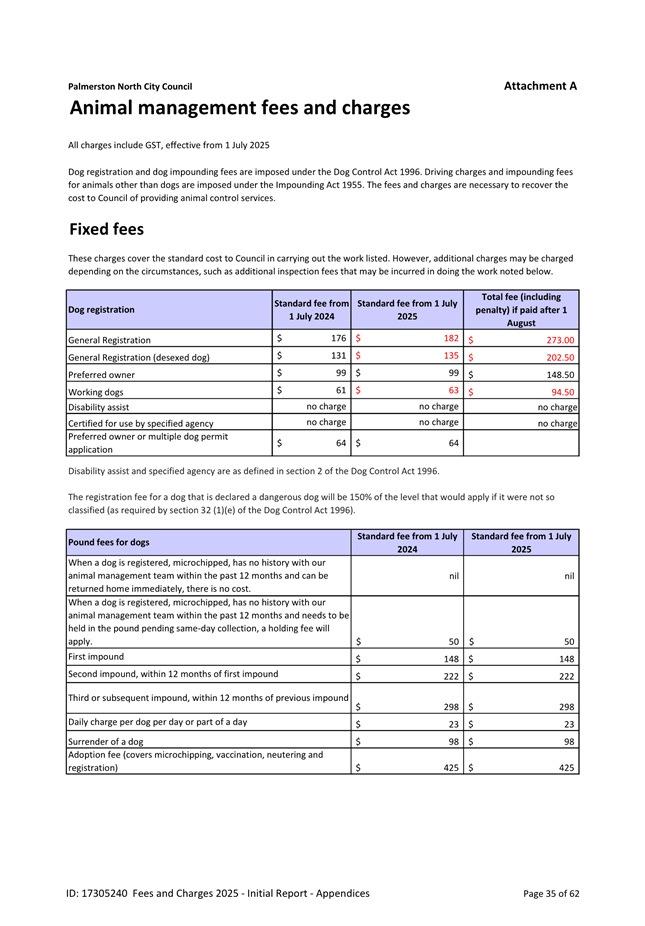

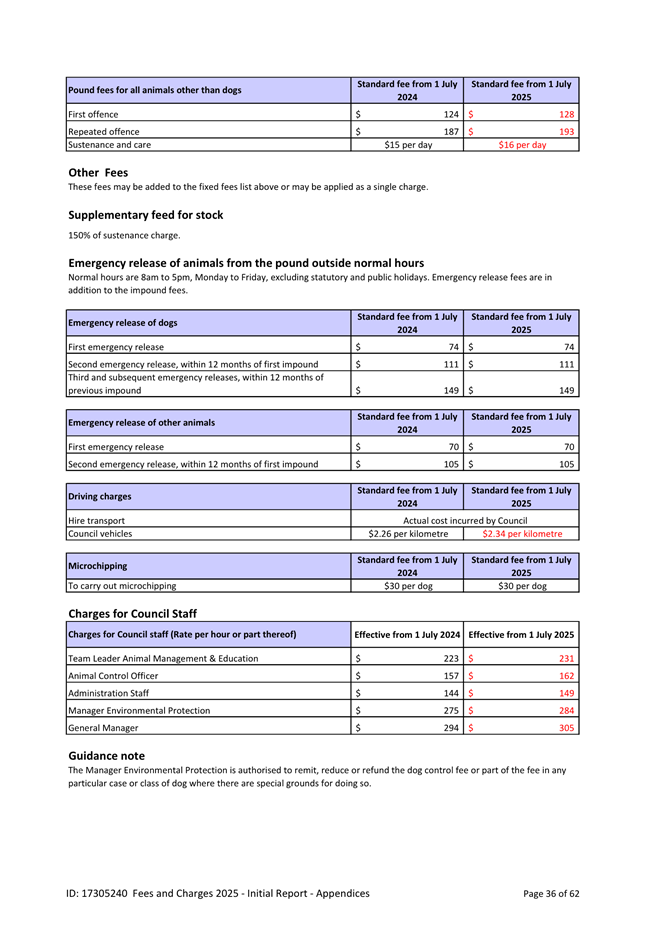

Animal Management

6. That Council

agree the fees and charges for the Impounding of Animals (in terms of section

14 of the Impounding Act 1955) and for Dog Registration and Dog Impounding (in

terms of sections 37 and 68 of the Dog Control Act 1996) as proposed in

Appendix 6 for public notification to take effect from 1 July 2025.

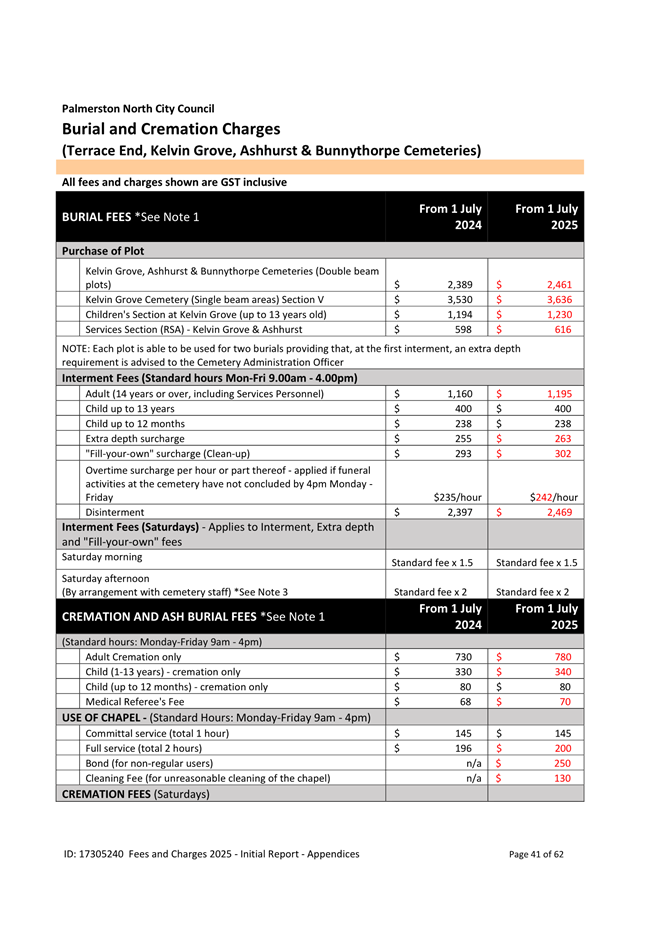

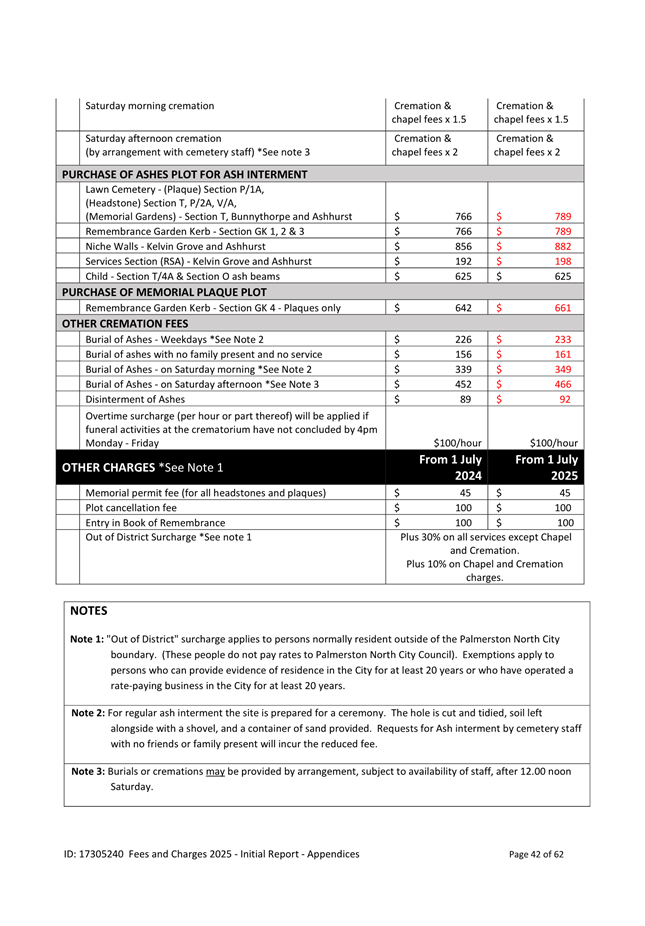

Burial & Cremation

7. That Council

agree the fees and charges for Burial and Cremation, as proposed in Appendix 7

for public notification to take effect from 1 July 2025.

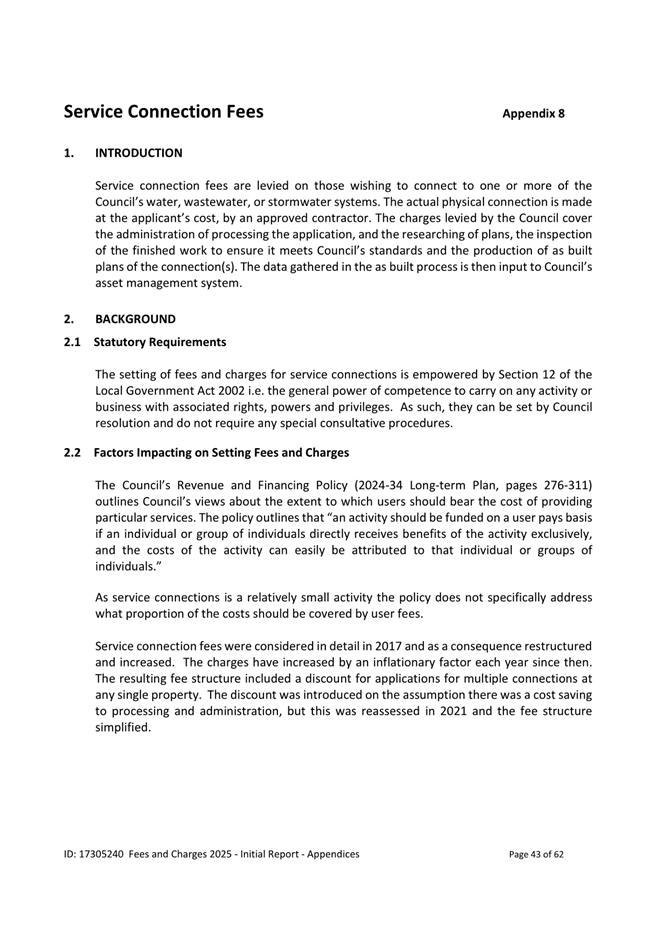

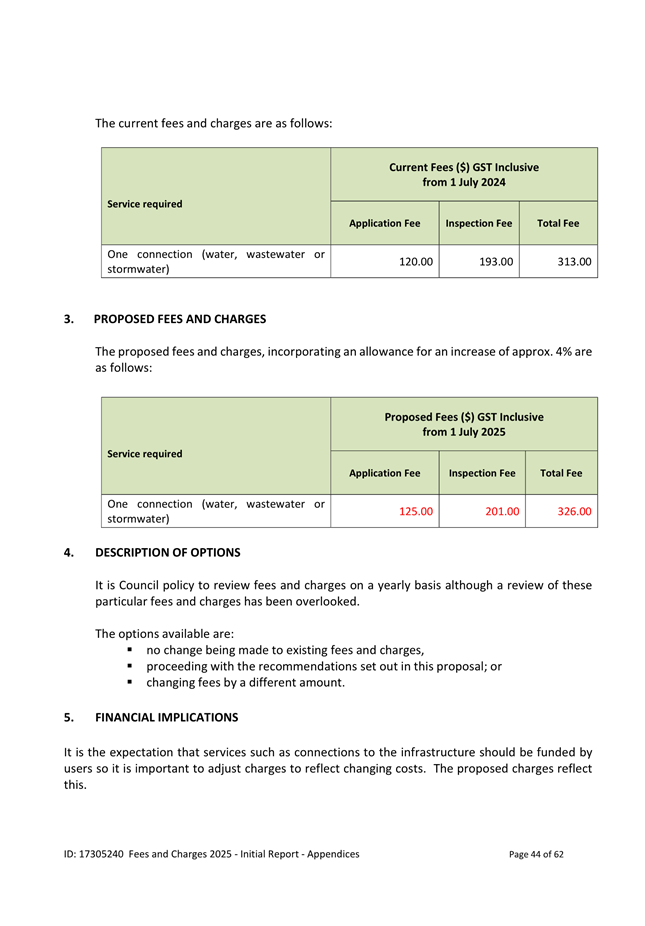

Service Connections

8. That Council

agree the fees and charges for Service Connections, as proposed in Appendix 8

to take effect from 1 July 2025.

Resource Recovery

9. That Council

agree there be no changes to fees and charges for Resource Recovery, as

proposed in Appendix 9.

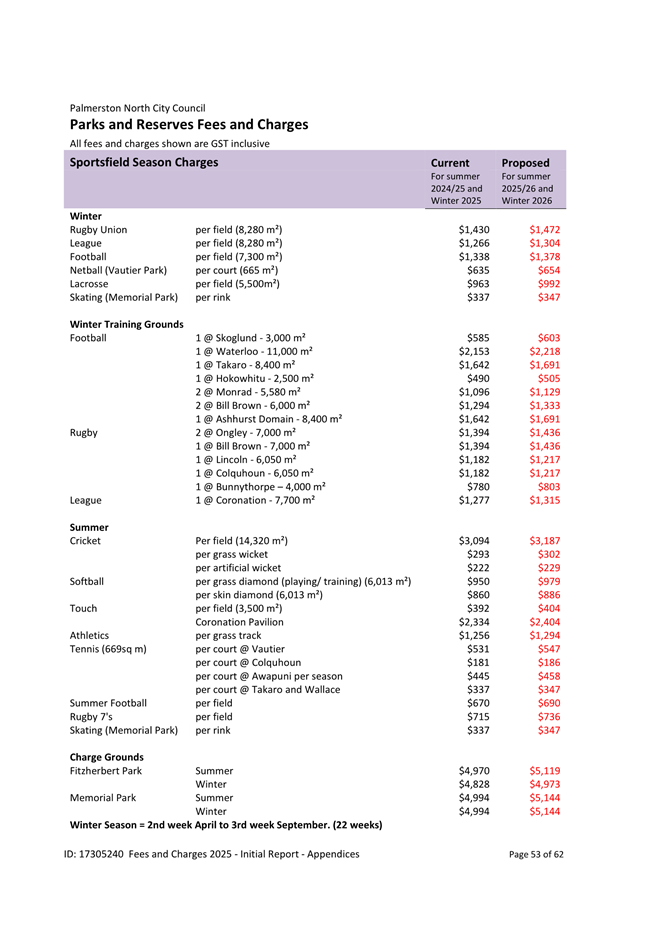

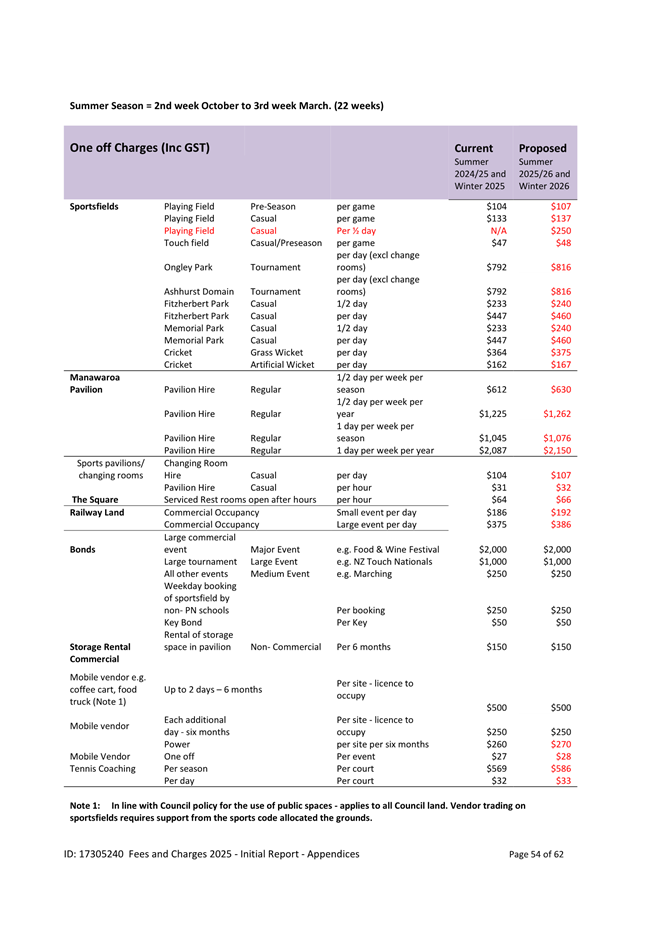

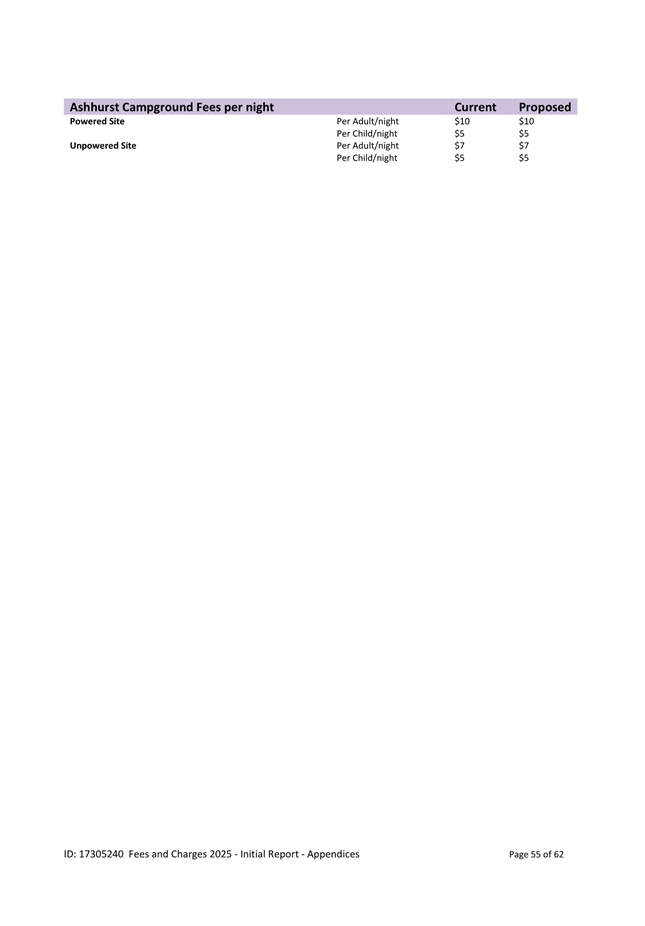

Parks and Reserves

10. That Council agree the

fees and charges for Parks and Reserves as proposed in Appendix 10 to take

effect from 1 July 2025.

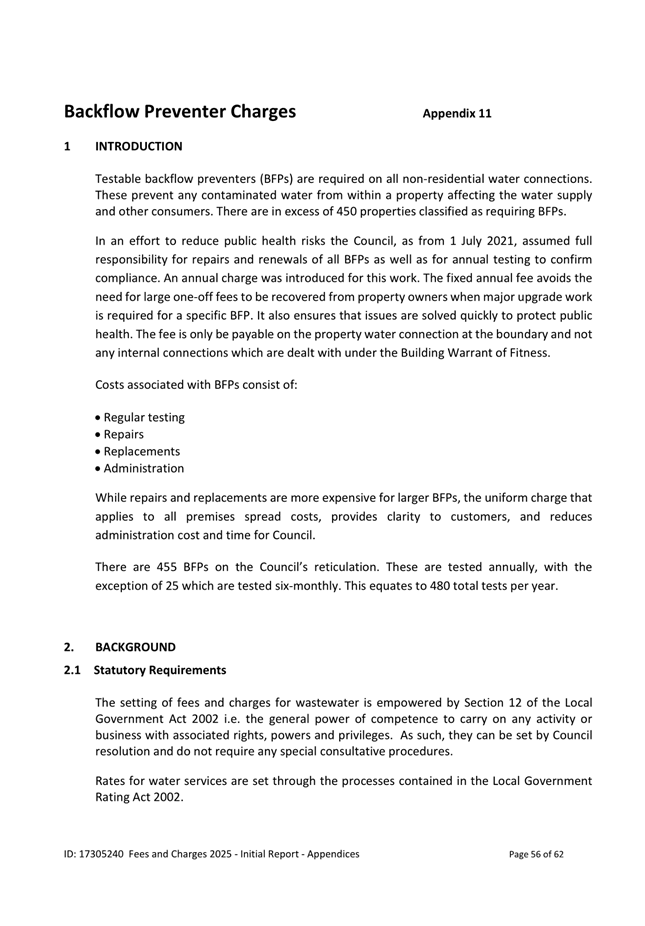

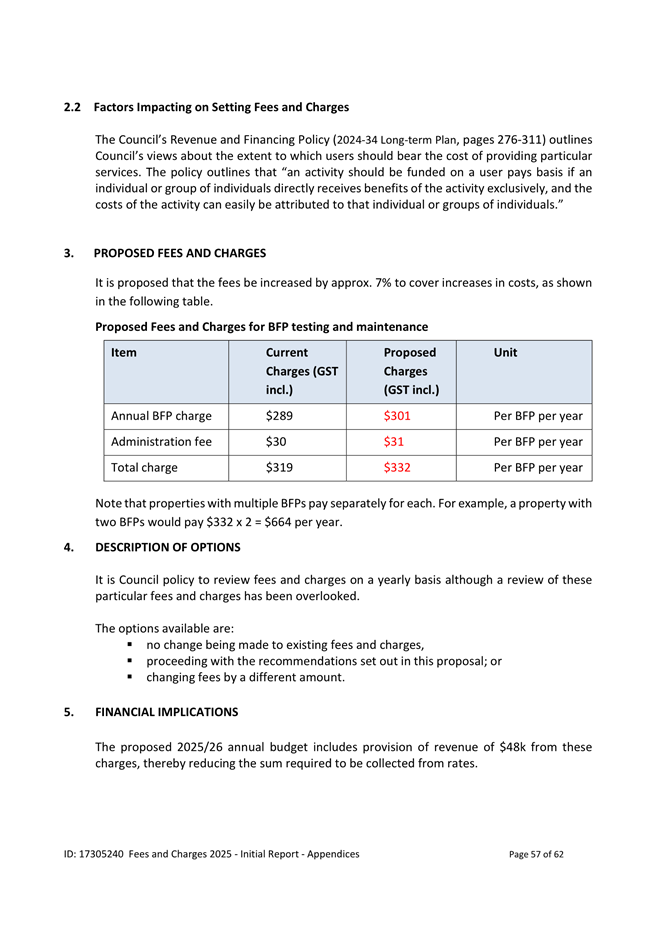

Backflow Prevention

11. That Council agree the

fees and charges for Backflow Prevention testing and maintenance as proposed in

Appendix 11 to take effect from 1 July 2025.

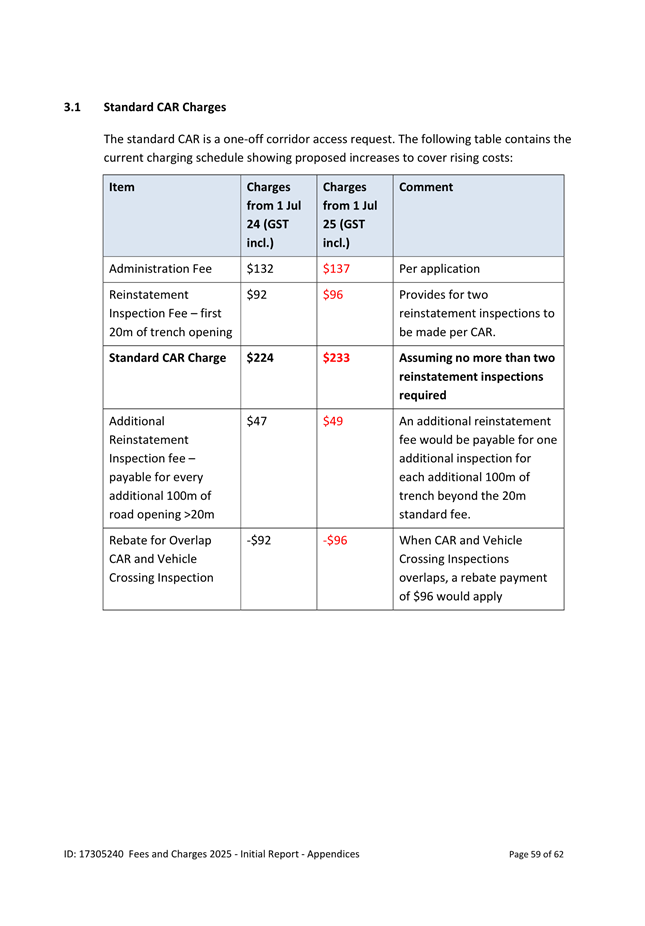

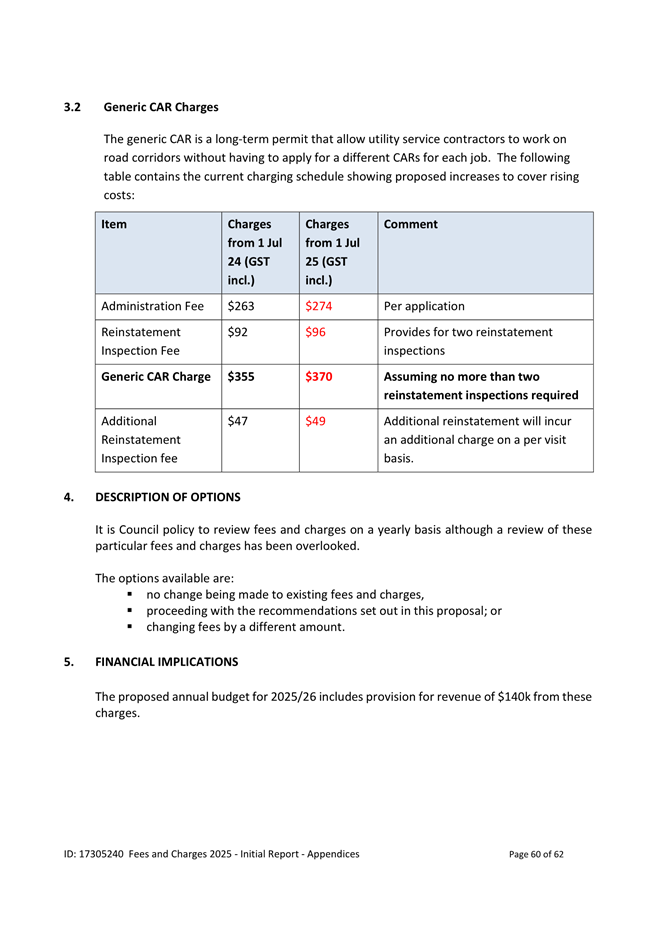

Corridor Access Request

12. That Council agree the

fees and charges for Corridor Access Requests as proposed in Appendix 12 to

take effect from 1 July 2025.

Parking

13. That Council agree

there be no change to fees and charges for Parking, as proposed in Appendix 13.

Summary of options analysis for

|

Problem or

Opportunity

|

Fees and charges need to be reviewed annually to ensure

they adequately meet the Revenue & Financing policy, budgetary and other

objectives

|

|

OPTION 1:

|

Approve fee increases as proposed

|

|

Community Views

|

Each of the different types of fees requires a

different process for community engagement. Where this is legislatively

controlled it is identified in the report

|

|

Benefits

|

More likely to comply with funding proportions

contained in Revenue & Financing Policy

|

|

Risks

|

· Public

criticism of increases

· Increased

charges for some activities may discourage compliance or reduce volumes

|

|

Financial

|

Budgeted revenue targets more likely to be achieved

|

|

OPTION 2:

|

Approve fee amendments for some of those proposed

at greater or lesser levels

|

|

Community Views

|

As above

|

|

Benefits

|

· Lower

fees than recommended likely to mean policy targets will not be achieved

· Higher

fees than recommended in some instances will increase likelihood of policy

user fee target being achieved

|

|

Risks

|

Higher fees than recommended may increase the risk of

public criticism

|

|

Financial

|

If lower increases are approved for some fees likely

that budgeted revenue will not be achievable

|

|

OPTION 3:

|

Do not approve any fee increases

|

|

Community Views

|

As above

|

|

Benefits

|

Lower fees than recommended likely to mean policy targets

will not be achieved

|

|

Risks

|

When increases eventually are made (to reduce the

pressure on rates increases) the extent of the increase required will be

publicly and politically unacceptable

The budget assumptions for fees and charges in the

Long-term Plan or Annual Budget would need to be revisited which would result

in an increase in rates requirement

|

|

Financial

|

If no increases are approved likely that budgeted

revenue will not be achievable

|

Rationale for the recommendations

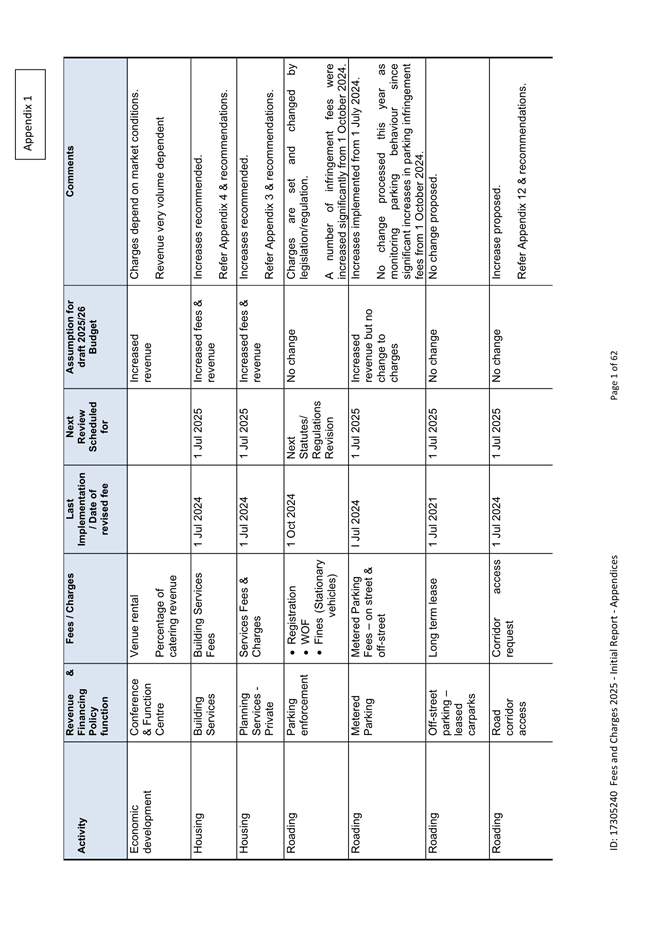

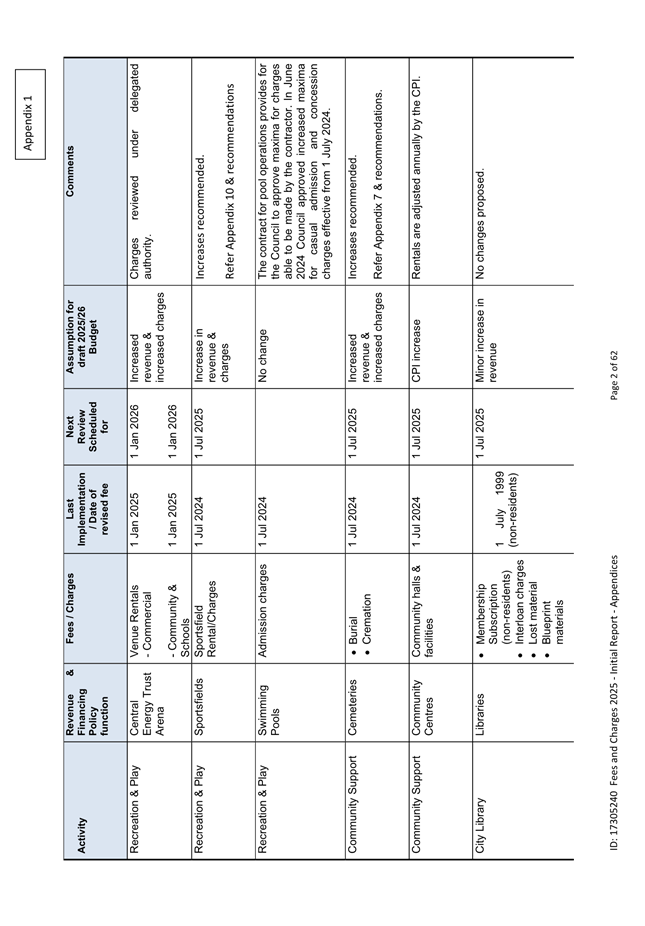

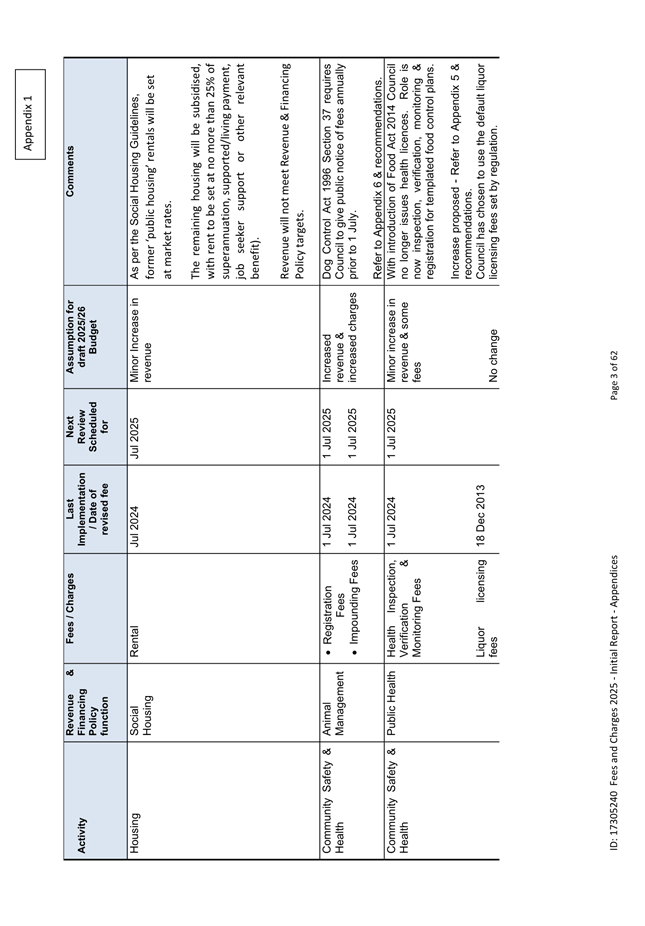

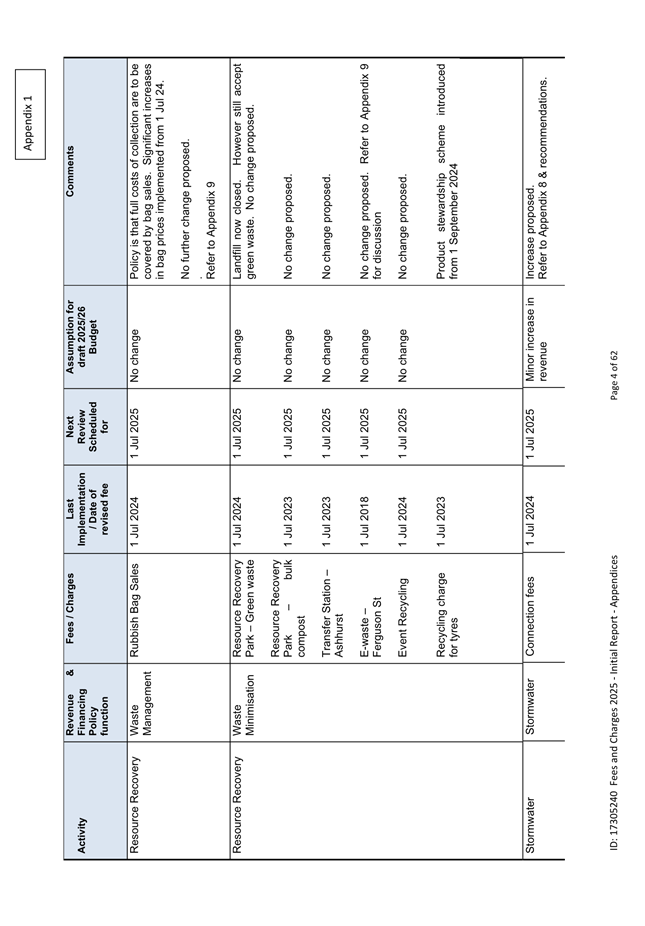

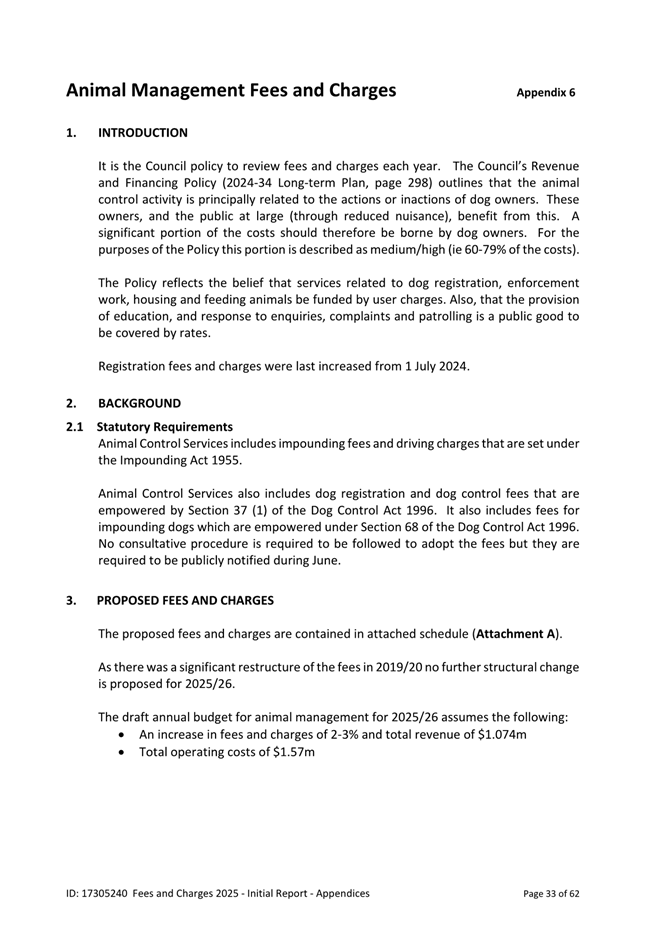

1. Overview of the problem or opportunity

1.1 The

purpose of this report is to provide an overview of the current status of fees

and charges made by the Council and to recommend the adoption of updated fees

for some of them.

1.2 At

its meeting on 11 December 2024 Council considered the first draft of the

2025/26 Annual Budget and endorsed the revenue assumptions outlined in the

covering report.

1.3 It

is important that fees and charges be regularly reviewed. There are a

variety of reasons for this including:

· Compliance

with legislative requirements – many fees and charges made by the Council

are governed by specific legislation

· Consistency

with Council’s Revenue and Financing policy – for each activity the

Council has adopted targets for the funding mix, i.e. the proportion of costs

to be funded from fees and charges

· Transparency

– in some instances it is important to be able to demonstrate that the

charge being made represents a fair and reasonable recovery of the costs of

providing a particular service

· Market

comparability – for some services the Council operates in a contestable

market and it is important that fees and charges are responsive to market

changes.

1.4 However,

as a review process is sometimes very time-consuming the depth of the review

for each type of fee or charge may vary depending on the circumstances.

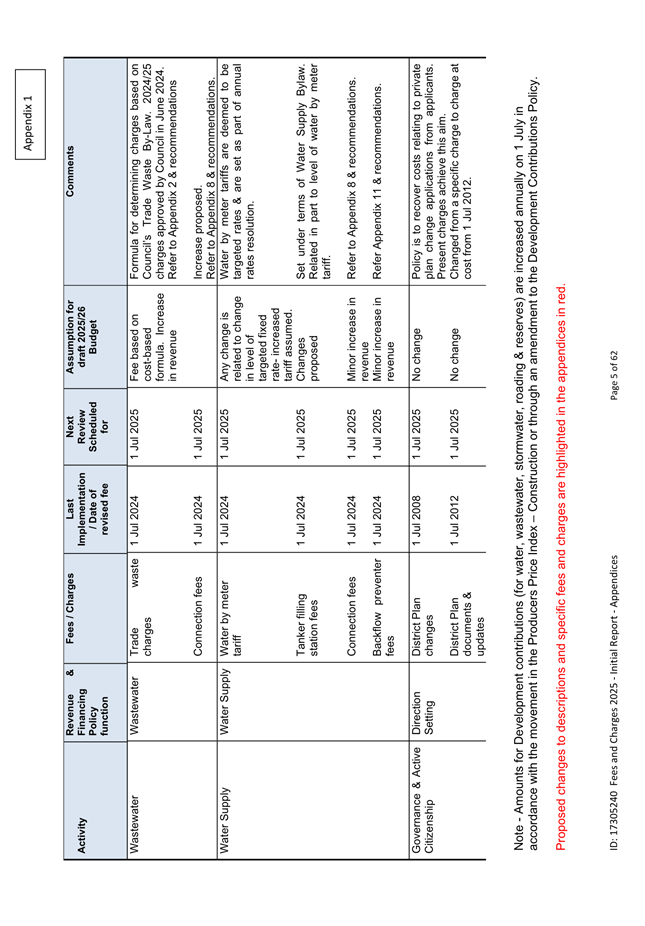

1.5 Attached

as Appendix 1 is a schedule listing, in broad terms, the various types of fees

and charges made by the Council. The schedule is ordered by activity

(consistent with the 2024-34 Long-term Plan (LTP)) and within that by function

(consistent with the Revenue & Financing Policy). Comments are made

within the schedule outlining the reasons for there being no change recommended

to a particular fee or charge. In cases where changes are recommended

more detail is provided in the appendices.

2. Background and previous council decisions

2.1 Council

has previously indicated that as a matter of policy it wishes all fee and

charge revisions to be encapsulated in a single report to the Council early

each year.

2.2 Council’s

current Revenue & Financing Policy (Long-term Plan 2024-34 pages 276-311)

describes how the Council goes about deciding who should pay for the provision

of each activity and in what proportions. The policy should be the

foundation for decisions about the levels of fees and charges.

2.3 For

some activities (such as swimming pools) only a portion of the operating costs

is borne by the Council and none of the revenue is received directly by the

Council. The Council does have the right under the agreement with CLM to

set the maximum fees charged for the services. The Revenue &

Financing Policy addresses only that portion of the net operating costs funded

by the Council and therefore makes no reference to user charges for swimming

pools.

2.4 In

some of the activities shown above it is not practical to charge users through

a separate charge specifically related to use. An example of this is

water where large consumers are metered but the majority of users are charged

through the rating system by way of a fixed targeted rate as the best proxy for

direct user charge.

2.5 In

some activities a combination of charging mechanisms is used. Resource

recovery is an example. Users are responsible for their own rubbish

disposal. The Council does provide a collection and disposal service

which is funded from the sale of rubbish bags. Recycling activity is

funded from the sale of recyclables and the balance through the rating system

by way of fixed targeted rates.

3. Description of options

3.1 With

a few exceptions (being cemeteries, social housing, Conference and Function

Centre), draft revenue budgets for 2025/26 have been set at levels which aim to

meet the Revenue & Financing Policy proportion targets. Achieving

these revenue levels is dependent not only on the level of fee or charge set

but also the actual volumes of activity by comparison with budget

assumptions.

3.2 The

timing of this review is scheduled to fit into the annual planning timetable in

a way which ensures appropriate revenue assumptions are made in the proposed

Annual Budget and changes to fees and charges can be implemented as soon as

practicable.

3.3 Much

of this report is focused on providing an overview of Council’s fees and

charges. However, the report does include specific proposals for change

for a number of fees and charges as explained in more detail in the following

appendices:

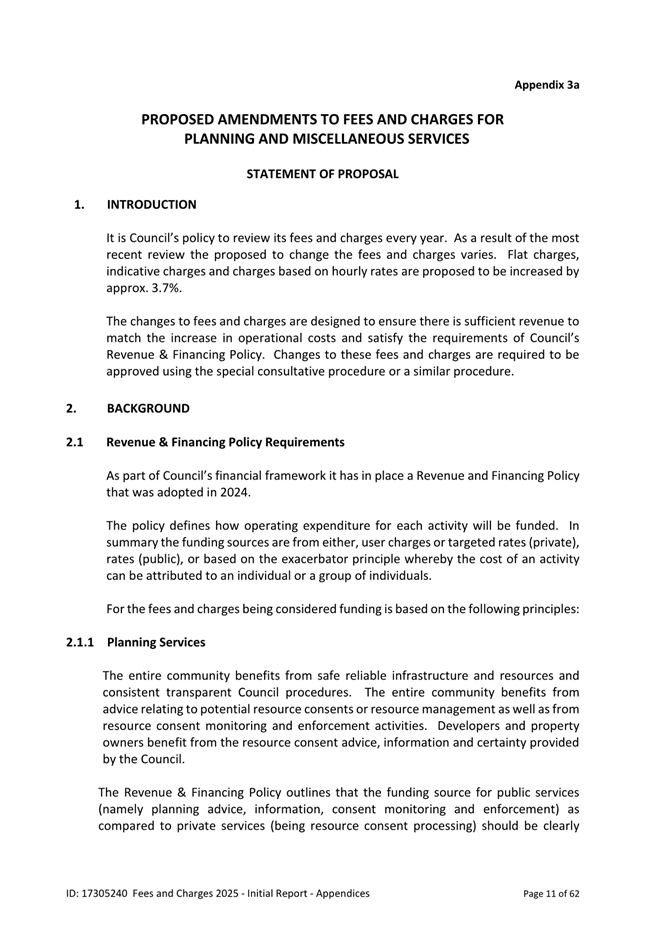

|

Appendix

|

Activity

|

Proposed action

|

|

2

|

Trade Waste

|

Proposal for public

consultation

|

|

3

|

Planning &

Miscellaneous

|

Proposal for public

consultation

|

|

4

|

Building

|

Proposed increases

|

|

5

|

Environmental Health

|

Proposed increases

|

|

6

|

Animal Management

|

Proposed increases

|

|

7

|

Burial & Cremation

|

Proposed increases

|

|

8

|

Service Connections

|

Proposed increases

|

|

9

|

Resource Recovery

|

No change

|

|

10

|

Parks and Reserves

|

Proposed increases

|

|

11

|

Backflow Prevention

|

Proposed increases

|

|

12

|

Corridor Access Requests

|

Proposed increases

|

|

13

|

Parking

|

No change

|

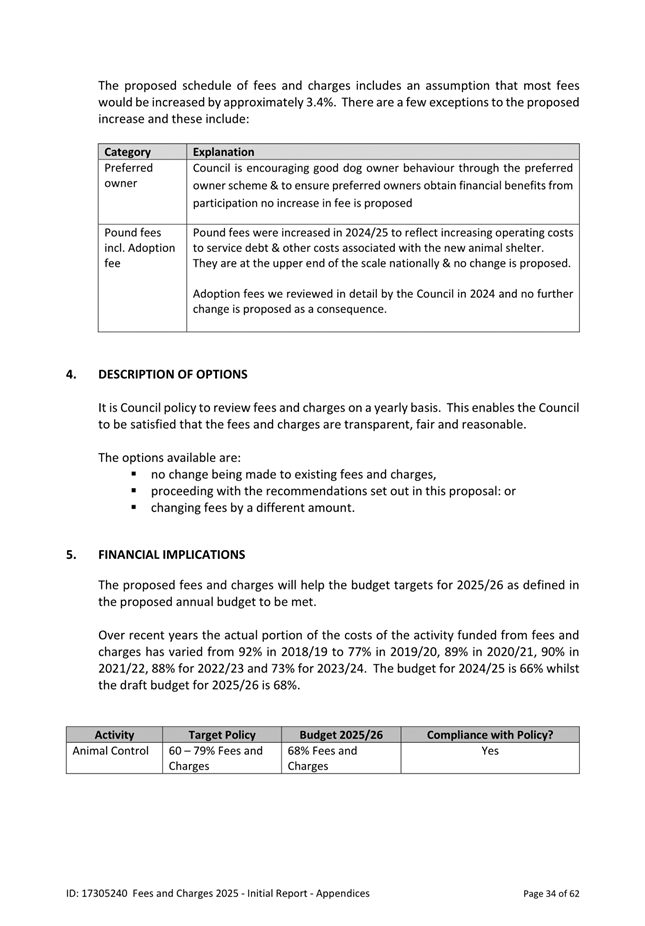

3.4 Whilst

the background to, and rationale for, the recommendations is made in each of

the appendices, attention is drawn to the following:

· Many

of the charges are being proposed to be increased by 3.4-3.7% (rounded) to

reflect the level of operational cost increase being experienced and thereby

ensure an appropriate proportion of the increase is incurred by the user rather

than the general ratepayer.

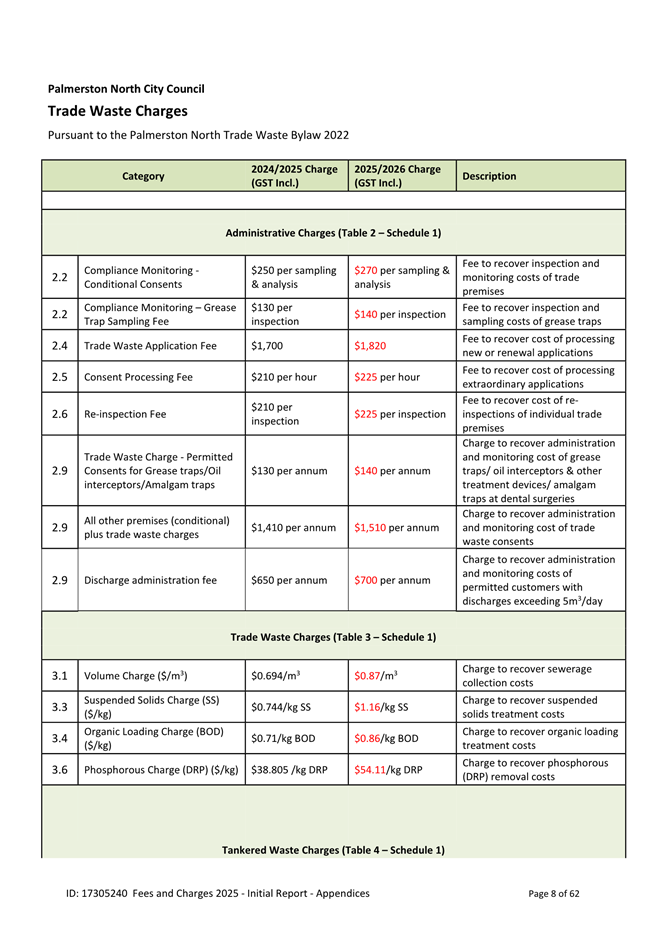

· Proposed

increases in the volume-based charges for trade waste vary but will lead to

increases in overall charges of approx. 25% for some tradewaste users.

These charges are based on a long-standing formula associated with the

Council’s tradewaste bylaw. They reflect the increasing costs of

tradewaste disposal over the last two years. It is recognised that such

an increase is significant. An option is to increase the charges by a smaller

percentage and review the position again next year. Table 1 below shows

two options for charges that would apply if the increase was to be less than

what is recommended:

o Option

A – represents rates with an increase at 50% of what has been recommended

o Option

B – represents rates with an increase at 60% of what has been

recommended. This option recognises that costs of delivering the services

will increase again in the following year and that unless charges are increased

by more than 50% of what is recommended we will not reach the policy

expectation that users should pay the full cost of processing their tradewaste

and will face the same issue again next year when considering charge levels.

Based on assumed trade waste volumes and

composition adopting these charges would reduce the tradewaste revenue

expectation by approx. $62k (GST excl.) for Option a and $52k (GST excl.) for

Option B.

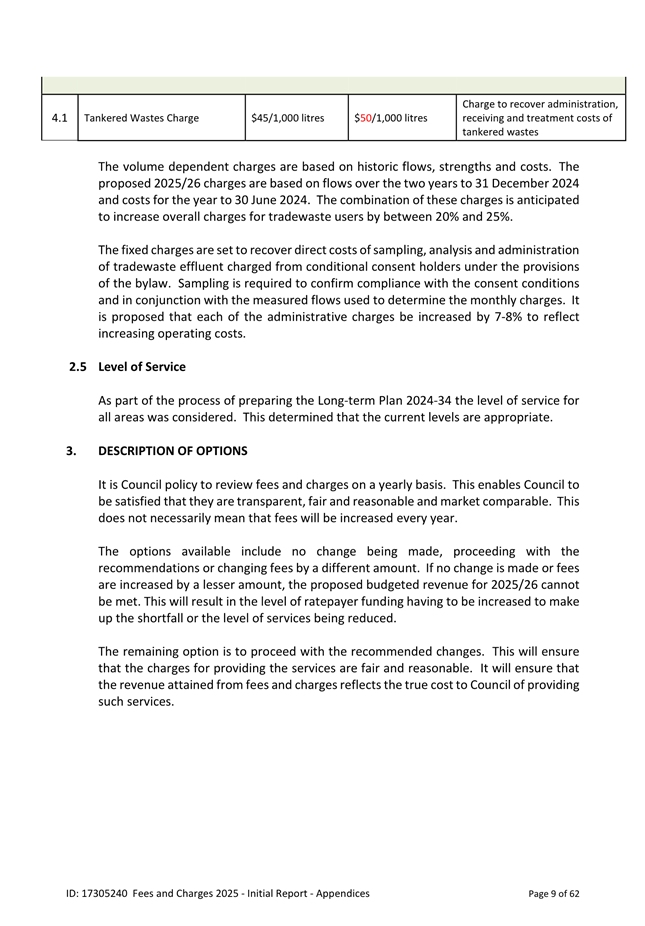

|

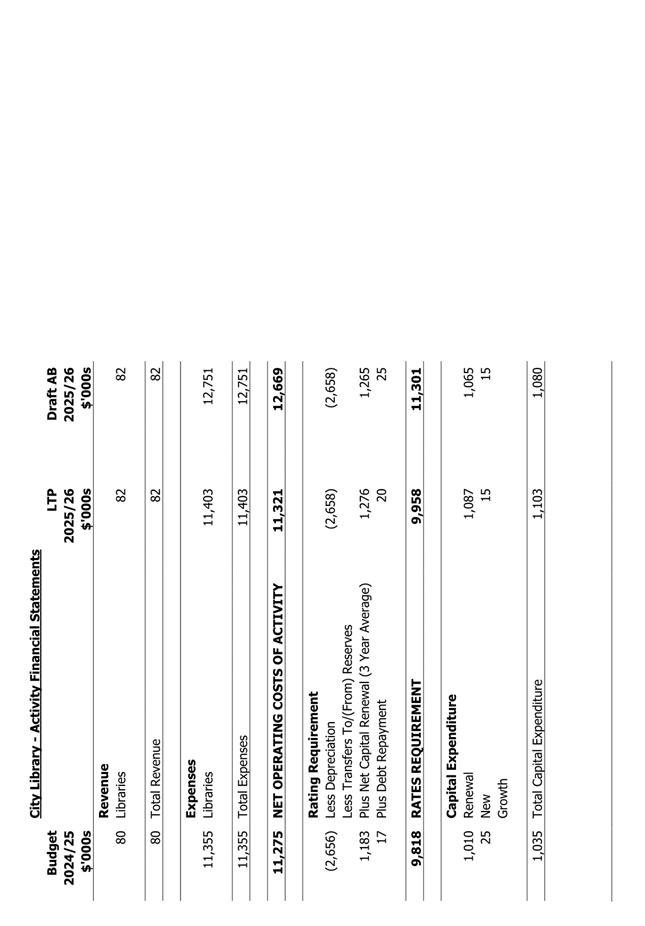

Table 1: Optional

increase for trade waste charges – refer Appendix 2 for recommended

charges

|

|

|

|

Actual Charge 2024/25 (GST incl.)

|

Option A

Charge for 2025/26 (GST incl.)

|

Option B

Charge for 2025/26 (GST incl.)

|

|

3.1

|

Volume Charge ($/m3)

|

$0.694/m3

|

$0.78/m3

|

$0.80/m3

|

|

3.3

|

Suspended Solids Charge (SS) ($/kg)

|

$0.744/kg SS

|

$0.95/kg SS

|

$1.00/kg SS

|

|

3.4

|

Organic Loading Charge (BOD)

($/kg)

|

$0.71/kg BOD

|

$0.79/kg BOD

|

$0.80/kg BOD

|

|

3.6

|

Phosphorous Charge (DRP) ($/kg)

|

$38.805 /kg DRP

|

$46.45/kg DRP

|

$48.00/kg DRP

|

· The

possibility of increasing cremation charges more than is proposed is discussed

in Appendix 7.

· As

outlined in the report to the Council meeting on 11 December 2024 no change is

proposed to fees and charges for resource recovery and parking – both

were increased from 1 July 2024 see Appendices 9 & 13 of this report.

4. Analysis OF PROPOSALS

4.1 Analysis

of each of the fee types for individual activities is contained in the

appendices.

5. SUMMARY OF CONSIDERATIONS

5.1 A

broad review of fees and charges has been undertaken. Revenue from these

is an important part of the funding mix. There are two elements to

achieving revenue budgets. The first is the actual level of the fee or

charge. The second is the volume of sales or use. A change to the

level of fee or charge can influence demand. Achieving revenue targets is

sometimes more about volumes than the level of the charge. There is a

fine balance between the two. This report recommends increases in charges

for a number of services and many of these are reflective of revenue assumptions

made in the proposed Annual Budget for 2025/26.

6. Next actions

6.1 There is a series of procedural steps to be followed

to enable some of the revised fees and charges to be implemented. In some

cases (as specifically identified in the recommendations) this involves a

period of public consultation and a report back to the Council for final

confirmation (taking into account any public submissions).

6.2 Staff will action messaging appropriate to the rates

and fee changes not otherwise formally notified.

7. Outline of community engagement process

7.1 The

Revenue & Financing Policy incorporates the Council’s current views

on what portion of each activity should be directly funded from users.

This policy forms part of the 2024-34 Long-term Plan which was the subject of

public consultation in 2024.

7.2 There

are varying types of public consultation required to enable changes to be made

to fees and charges. For some the special consultative process or a

process consistent with the principles of section 82 of the Local Government

Act is to be used. More detail about each is provided in the detailed

appendices.

Compliance and administration

|

Does the Council have delegated

authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

Yes

|

|

Is there funding in the current Annual

Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

There

are some activities as mentioned in this report that do not meet the Revenue

and Financing Policy funding band targets for Fees and Charges. The Council

has previously acknowledged these and for the time being proposes to operate

outside the policy expectations.

|

Yes

|

|

The

recommendations contribute to the achievement of objective/objectives

in:

14.

Mahere mana urungi, kirirarautanga hihiri

14. Governance and Active

Citizenship Plan

The objective is: Base our

decisions on sound information and advice

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The process for setting fees

and charges depends on the nature of the activity and the particular

requirements of the relevant bylaw, legislation or Council policy.

The recommendations take

account of Council’s Revenue & Financing Policy that in turn

reflects Council’s strategic direction.

|

|

|

|

Attachments

|

1.

|

Appendices

1 to 13 ⇩

|

|

Memorandum

TO: Council

MEETING DATE: 12

February 2025

TITLE: Rating

System for 2025/26

Presented

By: Steve

Paterson, Manager - Financial Strategy

APPROVED BY: Cameron

McKay, General Manager Corporate Services

RECOMMENDATIONS TO

Council

1. That the

Chief Executive incorporate the following rating system assumptions in the

draft of the 2025/26 Annual Budget supporting information and consultation

document to be presented for adoption at the Council meeting on 5 March 2025

(subject to any amendment):

i. continuing

the second stage of the implementation of the capital value based targeted rate

ii. a

uniform annual general charge of:

· $200; or

· $300; or

· $400

iii. differentials

for the rural/semi-serviced (0.2ha to 5ha) differential category with a surcharge

of -40% for the general rate and for the targeted capital value-based rate

iv. differentials

for the non-residential differential category with a surcharge of 150% for the

general rate and 100% for the targeted capital value-based rate.

1. ISSUE

1.1 The

2024 city rating revaluation with an effective date of 1 September 2024 has

been implemented and will become the base for value-based rates from 1 July

2025. As outlined in a report to Council’s meeting on 11 December

2024 using the new values will have a significant impact on the incidence of

rates.

1.2 On

11 December Council resolved:

“That Council instruct the Chief Executive to

bring options to the 12 February 2025 Council meeting in response to the change

in rating incidence caused by the valuation changes. These options will include

mechanisms such as altering the level of uniform annual general charge; or the

differential surcharges applying to the general rate based on the land value;

or the targeted rate based on capital value; or a combination of all

three.”

2. BACKGROUND

Recap of valuation outcomes

& impact on rating incidence

2.1 The

capital value of the City has decreased by 8.6% and the land value by

17.6%. The distribution of the values between the differential categories

used by the Council for rating purposes has changed as shown in the following

table.

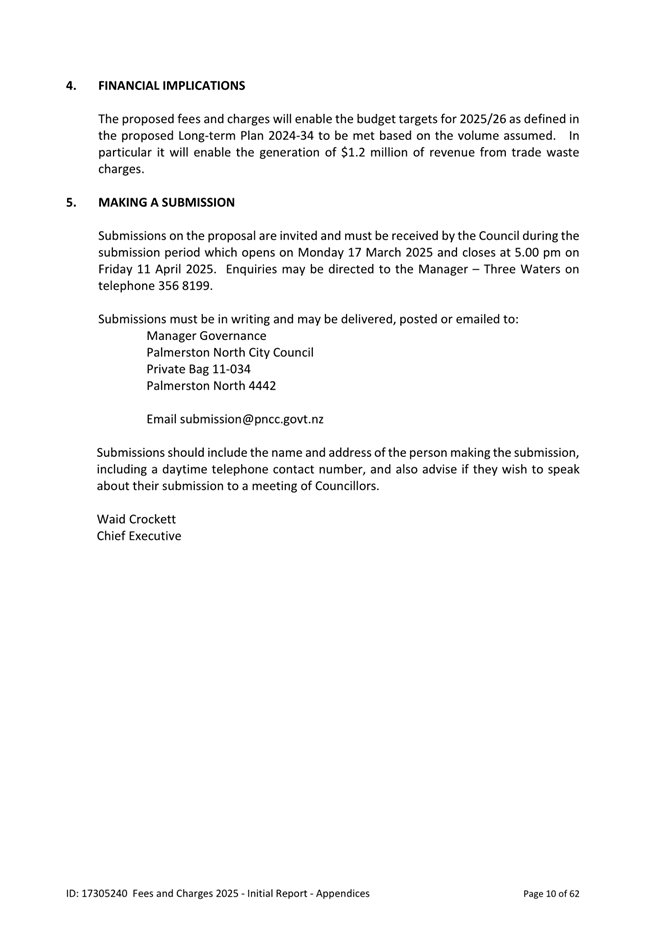

Table 1: Proportions

of total land & capital value by differential category

|

|

% of old CV

|

% of new CV

|

% of old LV

|

% of new LV

|

|

Single Unit Residential

|

66.5

|

62.1

|

72.1

|

66.6

|

|

Multi-Unit Residential

|

3.5

|

3.3

|

3.6

|

3.4

|

|

Miscellaneous

|

1.6

|

2.1

|

1.8

|

2.3

|

|

Non-Residential

|

16.9

|

20.4

|

10.7

|

13.8

|

|

Rural/Semi-Serviced

|

11.5

|

12.1

|

11.8

|

13.9

|

2.2 The

non-residential category includes utilities in the road network. The rateable

capital value for these rating units increased by 39% meaning they now

represent 3.2% of the total city rateable capital value (previously

2.1%). The extent of this change (especially when considered on

conjunction with the doubling of the portion of the rates based on the capital

value) clouds the assessment of the total rates payable by the non-residential

sector. This will be referred to again later in the report.

2.3 The

new valuations do not generate additional rates revenue for the Council.

They do, however, impact on the allocation of rates from 1 July 2025. The

land value is the base for the general rate and for the first time in 2024/25 a

targeted rate based on the capital value was introduced. A system of differential

rating charges a different rate in the dollar to the each of the various

differential rating categories. The portion of the total value in each

category influences the general rates and targeted rates allocated to each

category.

2.4 The

following graph shows the proportion of the total rates assessed on each

differential category – showing the actual rates share for 2024/25 and

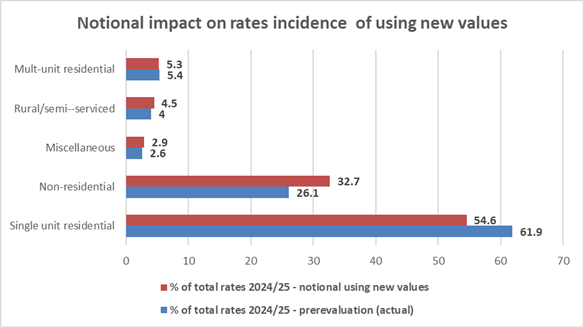

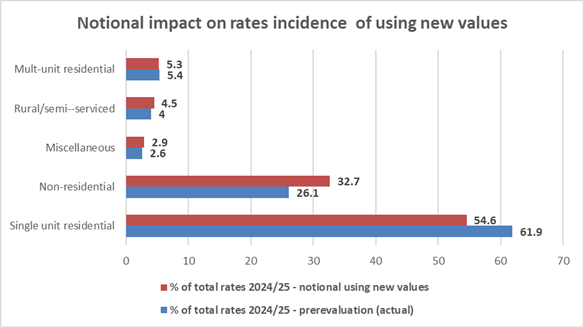

what it would have been for 2024/25 had the rates been set using the new

values.

2.5 With

the single unit residential property share of the total land value decreasing

from 72.1% to 66.6% and capital value from 66.5% to 62.1%, using the new values

would see approximately $11m of rates transferred from the residential sector

to the non-residential sector ($10.2m) and rural sector ($0.8m) if no further

changes were made to the rating system.

2.6 Such

a significant movement may not be an appropriate outcome and scenarios have

been modelled to understand how this may be moderated. However, there are

other factors that will influence the final rates incidence for 2025/26, and

these are outlined in the following section.

Other factors impacting on rates

incidence for 2025/26

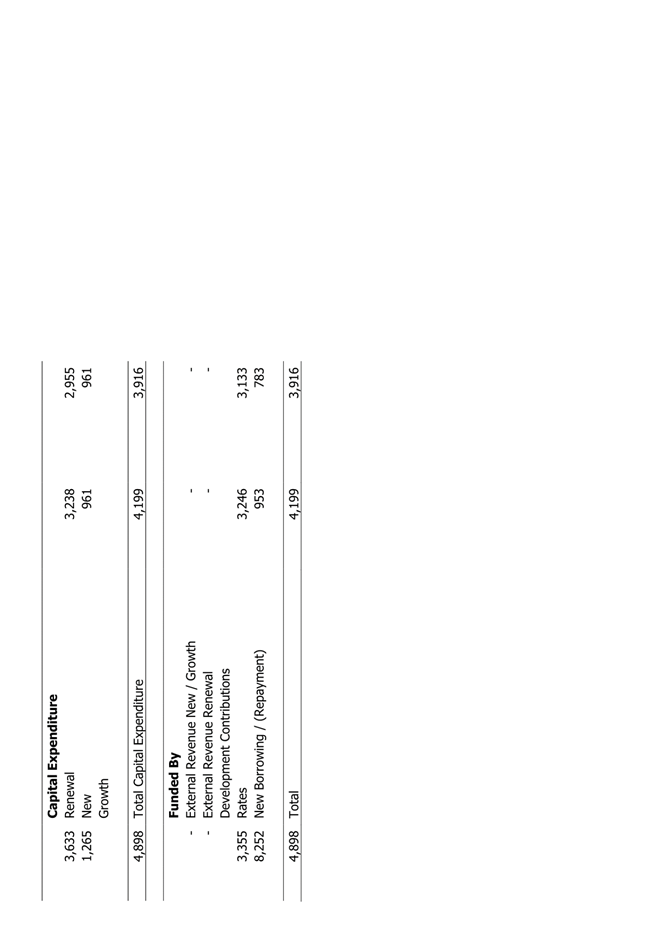

2.7 In

addition to the revised rating valuations, rates incidence for 2025/26 will be

influenced by the following:

· The

second stage of implementation of the targeted rate based on the capital value

– in effect approximately doubling the rates to be based on the capital

value

· The

proposed second stage of implementing the change to the differential surcharge

for the rural/semi-serviced (lifestyle) properties

· The

extent of the increases required in the fixed charges to fund the proposed

budgets for water, wastewater and resource recovery. Based on the draft of the

annual budget to be presented for consideration by Council on 12 February the

following fixed charges would be required:

|

|

Actual

for 2024/25 ($ GST incl.)

|

Draft

for 2025/26 ($GST incl.)

|

|

Water

|

415

|

500

|

|

Wastewater

|

375

|

410

|

|

Kerbside recycling

|

144

|

189

|

|

Rubbish & public

recycling

|

51

|

77

|

Metered water charges will also need to increase by approx.

10% - these are ultimately adopted as part of the rates setting resolution.

· Whether

as a consequence of the revaluation or as a part of the progressive

implementation of the capital value-based rate it is considered appropriate to

change the differential surcharges for some of the differential categories

· The

level of the uniform annual general charge (UAGC).

3. Discussion

Why might an intervention to

moderate the impact of the revaluation be appropriate?

3.1 An

intervention may be appropriate if it is considered that the rates that would

be assessed based on the updated valuations are unreasonable for a significant

group of ratepayers. It may also be appropriate as a holding action or

temporary measure if the extent of the change in rates is considered

unreasonably high.

3.2 Such

an intervention was made following the 2018 and 2021 revaluations as on both

occasions there was a significant increase in residential land values

especially for those at the lower end of the market. The response was to

lower the uniform annual general charge and increase the differential surcharge

for non-residential properties meaning the non-residential properties then paid

a greater share of the total than before.

3.3 The

circumstances are similar again this year although on this occasion there have

been reductions in values with the greatest reduction (in percentage terms)

occurring for residential properties at the lower end of property values.

What type of changes might

be possible?

3.4 The

following three main tools for change are considered in turn:

· A change to the level of

the uniform annual general charge (UAGC)

· A change to the

differential surcharges for some categories of property

· Changing

the proportion of the rates based on the capital value.

Changing the level of the UAGC:

3.5 The

UAGC is an integral part of the Council rating system. It serves to

moderate the level of rates (especially for residential properties) by making

sure those with low land values pay at least a minimum contribution to fund

city services and facilities and those with very high land values do not pay an

unreasonably high contribution.

3.6 The

UAGC for 2024/25 is $200 per rating unit. It was reduced to this level in

2022/23 from $500 per rating unit in 2021/22. It was reduced to $500 from $690

in 2018/19.

3.7 For

many years it was the practice to increase the UAGC annually to keep the fixed

component of the rates at similar proportions from year to year at levels just

below the statutory maxima of 30% (which by legislative definition excludes any

fixed targeted rates for water and wastewater). For the 2024/25 year

fixed charges, calculated in the same way as prescribed in the legislation, are

approx. 8%.

3.8 Given

the average rates assessed on commercial/industrial properties is much higher

than for residential properties the UAGC forms a much smaller part of the

individual rates assessed on them compared to residential properties.

3.9 Changing

the level of the UAGC would impact not only the total rates contributed by each

differential category but also the incidence of rates within each category.

3.10 One of the

arguments to reduce the UAGC to $200 following the 2021 revaluation was that

the spread of residential land value had been reduced through the revaluation

(lower land values increased by 100% or more whilst higher land values

increased by a smaller percentage).

3.11 The

reverse has occurred during the 2024 revaluation. The greater reductions

in land value have been in the traditionally lower valued areas. These

reductions have flowed through to the capital value.

3.12 An option

is therefore to increase the UAGC. Scenarios have been tested with a UAGC

of $200, $300 and $400.

Changing the differential surcharges:

3.13 A

fundamental component of the present rating system is that property is grouped

by differential category (primarily based on the nature of use) and a general

rate is assessed with different rates in the dollar of land value being assessed

on each property group.

3.14 The

targeted rate based on the capital value is also categorised in the same manner

and surcharges are applied (although not at the same level as for the general

rate). There are various reasons for this outlined in the funding impact

statement in the Council’s Long-term Plan.

3.15 The

Council describes the relationship between the rates charged to each

differential group in terms of a factor expressed as a percentage of the rate

that would apply if there were no differential rating in place. Each year

the Council reviews the differential factors applied to each group.

3.16 When

adopting the Long-term Plan the Council signalled its intention that the

discount provided through the differential system to semi-serviced/rural properties

(lifestyle blocks) of between 0.2 ha and 5 ha would be reduced over two years,

2024/25 and 2025/26. Year 2 of this change has been taken into account

when modelling scenarios for Council consideration.

3.17 If the

intention is that the other differential groups should pay similar proportions

of the total rates in 2025/26 as in 2024/25 then there will need to be

significant changes to the differential surcharges. A number of scenarios

have been tested.

The capital value based

targeted rate:

3.18 When

adopting the revisions to the rating system for 2024/25 Council signalled it

intended that its desire was to progressively increase the portion of the

value-based rates based on the capital value to 50% over three years.

Rates for 2024/25 were calculated to achieve 16.5% being based on the capital

value.

3.19 All

testing of scenarios has included an assumption 33% of the value-based rates

will be based on the capital value in 2025/26 as the second year of the

transition to a 50% capital value based rating system.

Testing scenarios

3.20 The

approach taken for this report has been as follows:

· All

scenarios assume an increase in total rates required of 8.5% and fixed charges

for services being as outlined in clause 2.7 above.

· UAGC

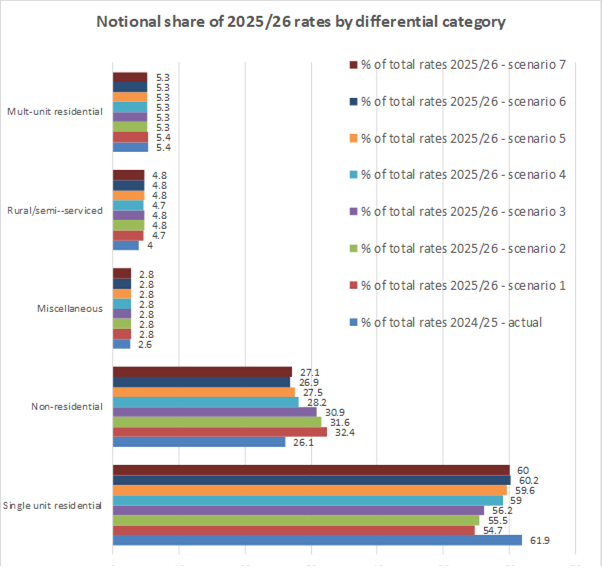

levels and differential surcharges as shown in the following table:

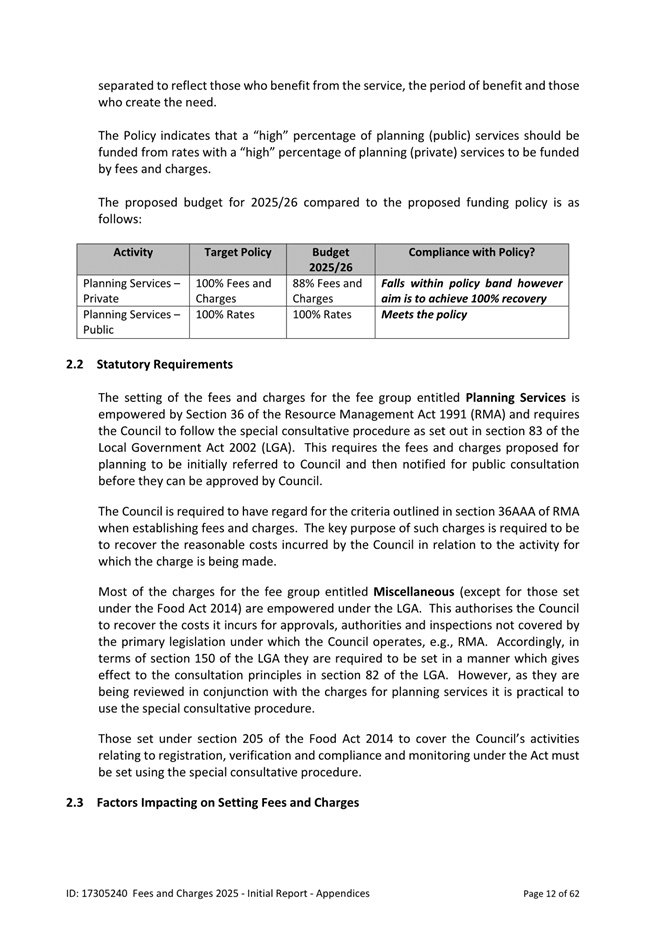

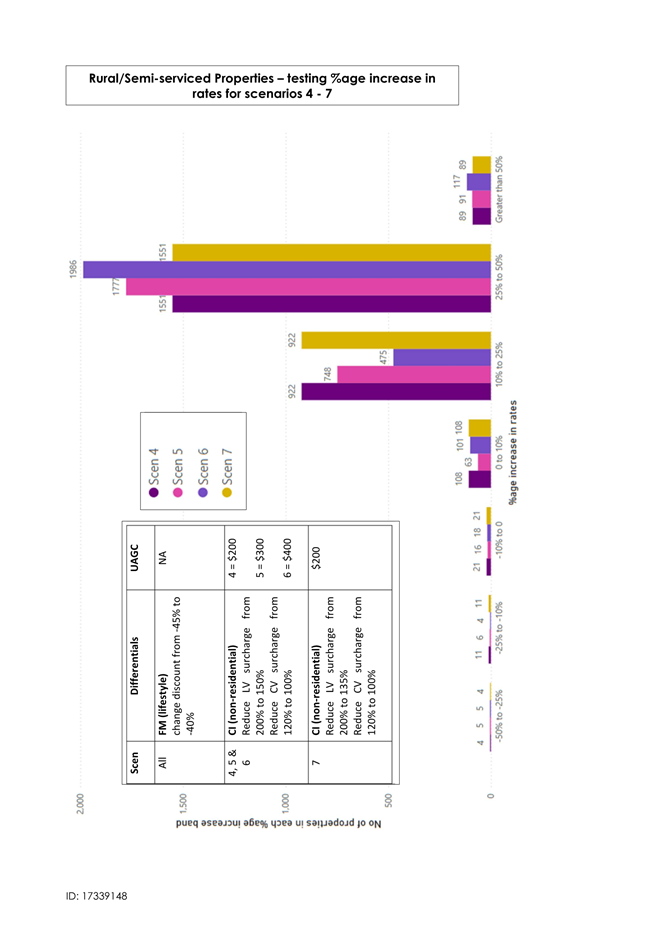

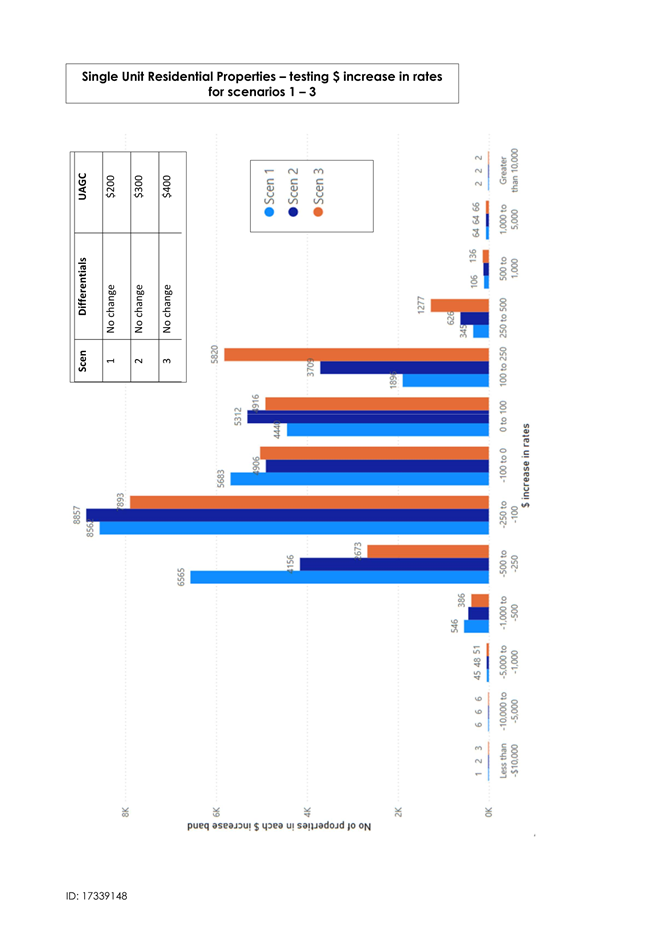

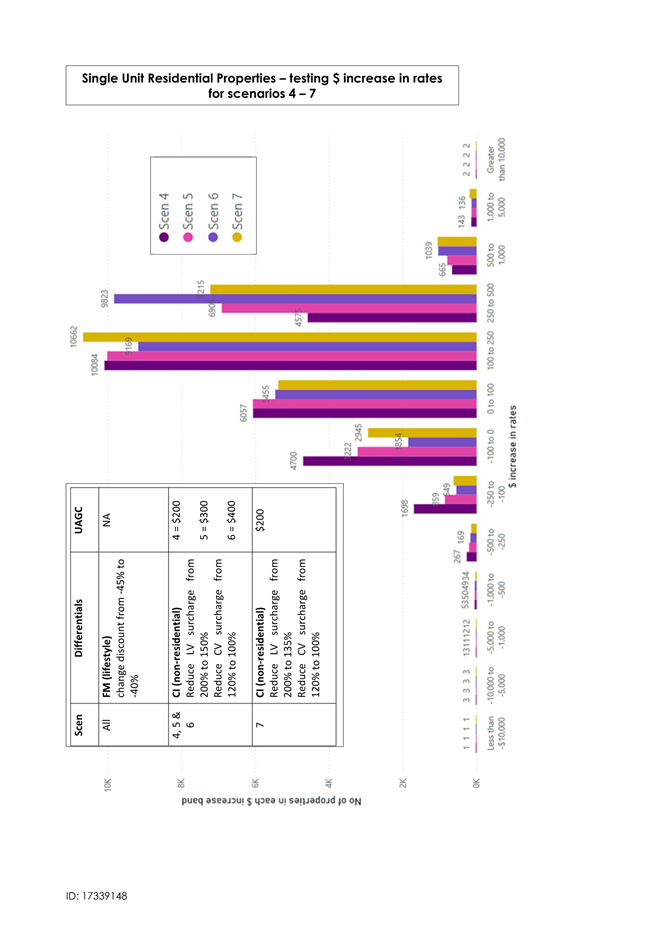

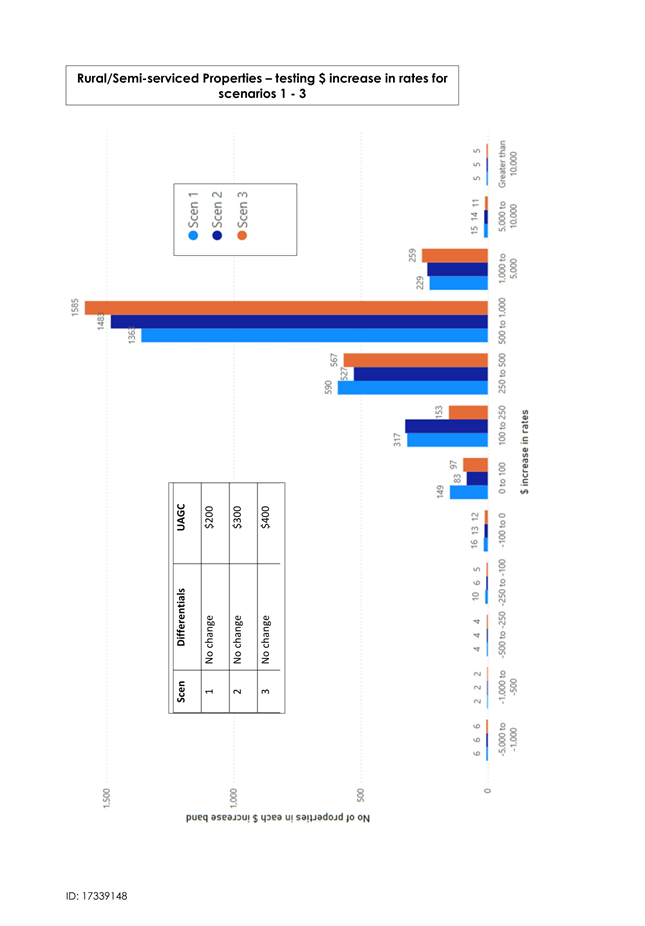

|

Scenario

|

Differentials

|

UAGC

|

|

1

|

FM (lifestyle)

change discount from -45% to

-40%

|

$200

|

|

2

|

FM (lifestyle)

change discount from -45% to

-40%

|

$300

|

|

3

|

FM (lifestyle)

change discount from -45% to

-40%

|

$400

|

|

4

|

FM (lifestyle)

change discount from -45% to

-40%

CI (non-residential)

Reduce LV surcharge from 200% to

150%

Reduce CV surcharge from 120% to

100%

|

$200

|

|

5

|

FM (lifestyle)

change discount from -45% to

-40%

CI (non-residential)

Reduce LV surcharge from 200% to

150%

Reduce CV surcharge from 120% to

100%

|

$300

|

|

6

|

FM (lifestyle)

change discount from -45% to

-40%

CI (non-residential)

Reduce LV surcharge from 200% to

150%

Reduce CV surcharge from 120% to

100%

|

$400

|

|

7

|

FM (lifestyle)

change discount from -45% to -40%

CI (non-residential)

Reduce LV surcharge from 200% to

135%

Reduce CV surcharge from 120% to

100%

|

$200

|

3.21 The first

three scenarios were chosen to demonstrate what would happen to rates incidence

if no change was made to differential surcharges (except for FM) but if instead

changes were made to the level of the UAGC.

3.22 Scenario 7

was chosen as a means of determining how much reduction there would need to be

in the differential surcharge for non-residential property in order to have the

various differential property groupings bearing a similar proportion of the

total rates as they have for 2024/25.

3.23 Scenarios

4 to 6 demonstrate how it is possible to moderate the impact on the

non-residential sector by reducing the differential surcharge but not by as

much as in scenario 7. Scenarios 5 and 6 have the same differential

surcharges as scenario 4 but the UAGC has been increased to $300 and $400

respectively. Officers have recommended the differentials that are used

in these scenarios.

3.24 The

following graph demonstrates the proportion of the total rates assessed that

would be borne by each differential group for each scenario, compared with the

actual for 2024/25.

3.25 Interpreting

what the graph shows:

· Due

to a significant increase in the capital value of the utilities in the streets

(which form part of the non-residential category) along with stage 2 of the CV

system change, approx. 1% of the total rates relates to the additional rates

assessed on these previously non-rated assessments.

· Without

changing the differential surcharges (as in scenarios 1 to 3) increasing the

level of the UAGC does marginally reduce the total rates payable by the

non-residential sector and transfer it to the residential sector – this

is because there are many more rating units in the residential category.

· There

is a slight increase in the proportion of the rates payable by the

rural/semi-serviced sector and this relates in part to the second stage of the

implementation of the reduced discount for the FM (‘lifestyle’)

properties as agreed by the Council when adopting the changes for

2024/25. Although the change in the discount has been assumed in the

modelling, the outcome for each scenario is that the FM properties would still

receive a significant discount when compared with single unit residential

properties. For example, the rate-in-the dollar for FM for the general rate for

scenarios 4-6 is 75% of the single unit residential rate and 79% of the

capital-value based targeted rate. In each of the scenarios rates for

most individual ratepayers in the FM category will increase by approx. 30%.

3.26 In

addition to checking the rates incidence at the differential category level it

is necessary to consider the changing incidence at the individual ratepayer

level.

3.27 The graphs

in Attachment 1 show the number of properties within each band of

movement in rates (in both %age and dollar terms). There are graphs for

the single unit residential, non-residential and rural differential groups.

3.28 Some

initial observations from the graphs include:

· Scenarios

1-3 show significant reductions in rates for many residential properties as the

total sum to be collected from each differential category is significantly

different from the current year. By comparison these scenarios show

significant increases for non-residential properties and rural/semi-serviced.

· Scenarios

4-7 produce an overall outcome by differential category that is more like the

distribution for 2024/25. The majority of the rates increases for

residential properties are less than 10%. Between 2,900 and 6,900

residential properties would have increases in the 10-25% band –

principally those with high ratios of capital value to land value though the

number in this band increases as the UAGC is increased.

· In

Scenarios 4-7 most of the residential rates increases are less than $500.

In Scenario 4 80% of single unit residential rates increases would be less than

$250.

· Rates

movements for non-residential properties vary widely in all scenarios.

This is because of the wide variation in value movements in different parts of

the City and because of the range of different capital to land value ratios for

the properties in this category.

· Scenario

4 moderates the increases for non-residential properties with very high ratios

of capital to land value. Even in this scenario there are over 130 such

properties with increases over $10,000 with 3 having increases over $100,000, 9

with increases of between $50,000 and $90,000, 8 with increases of between

$30,000 and $50,000 and 20 with increases of between $20,000 and $30,000.

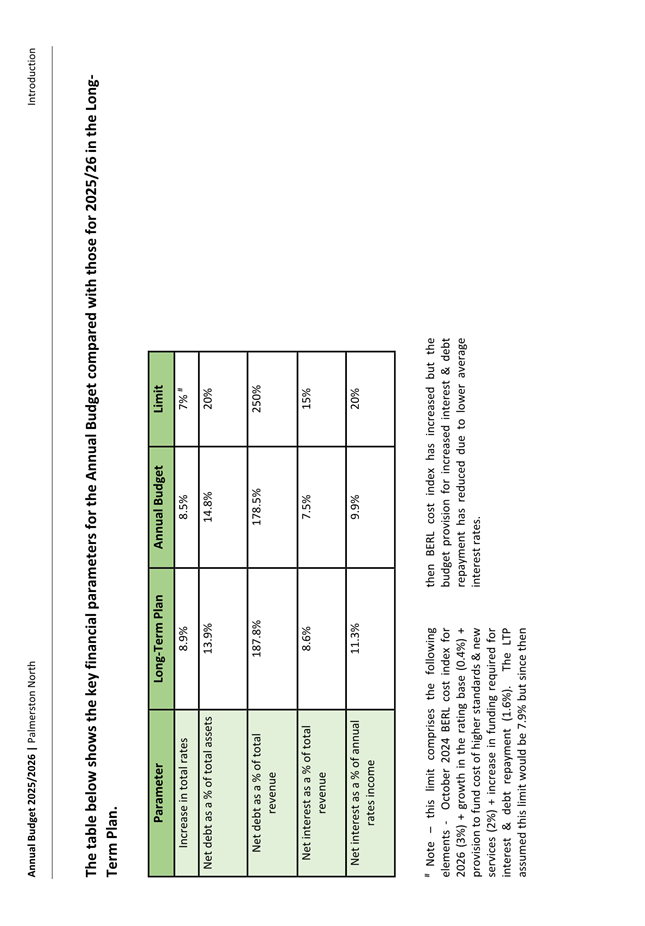

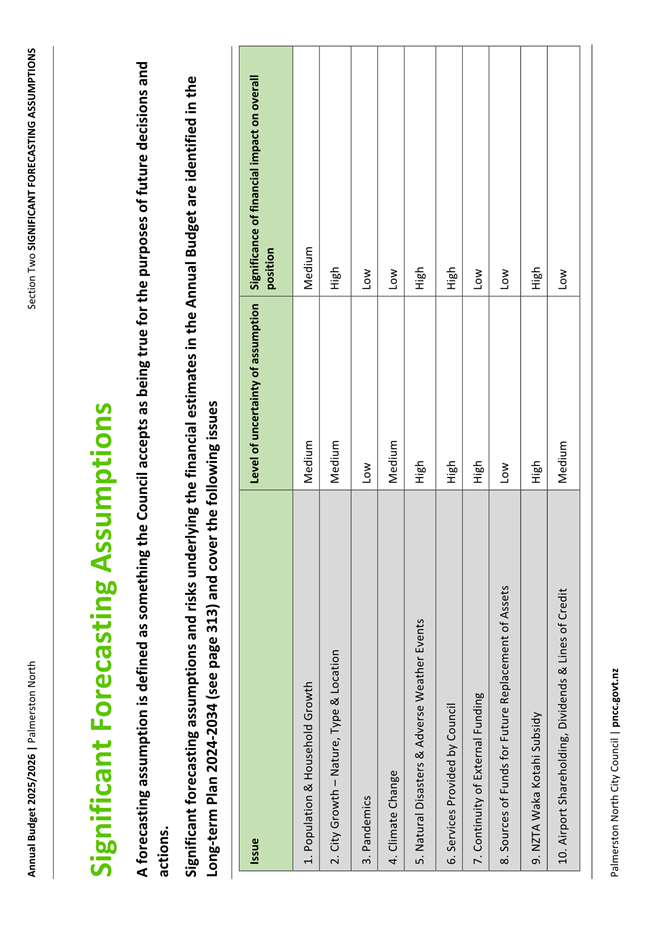

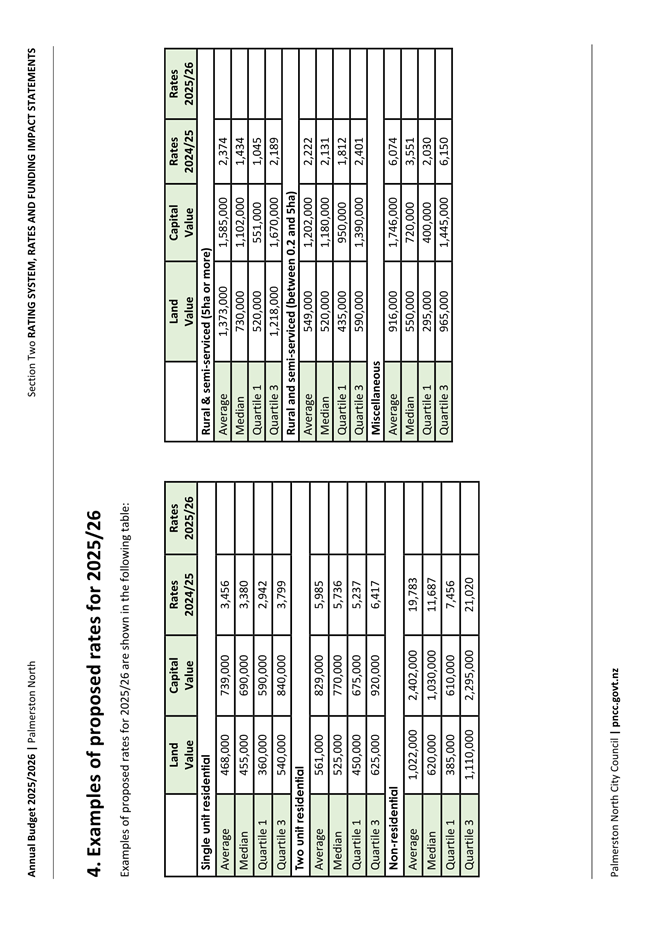

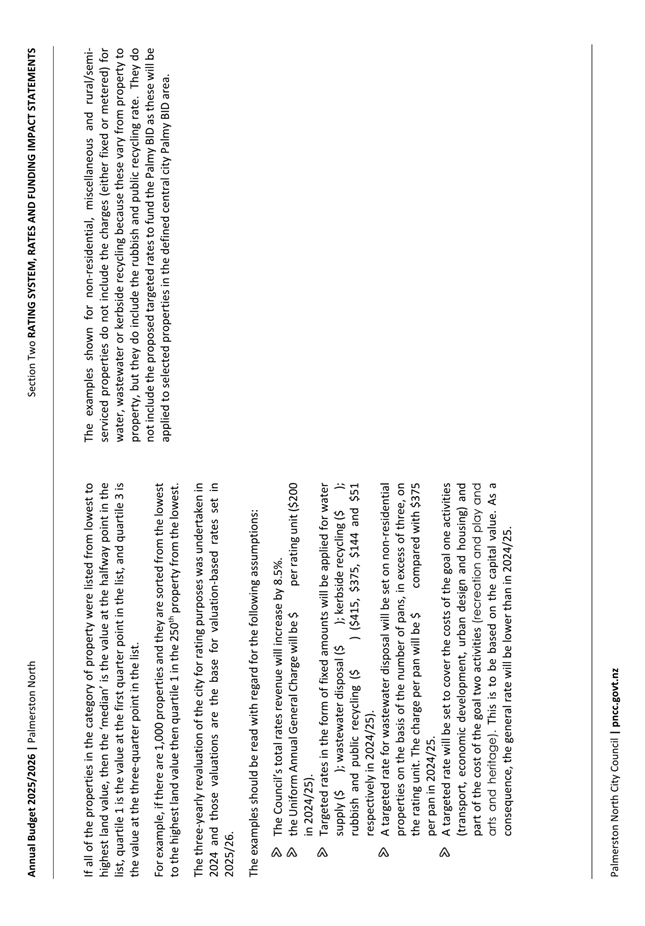

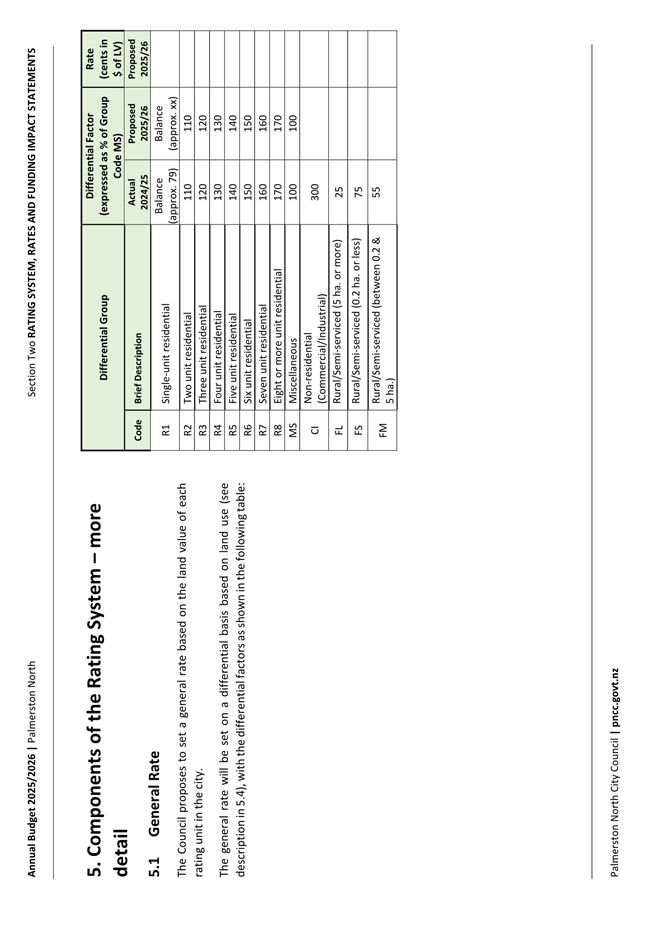

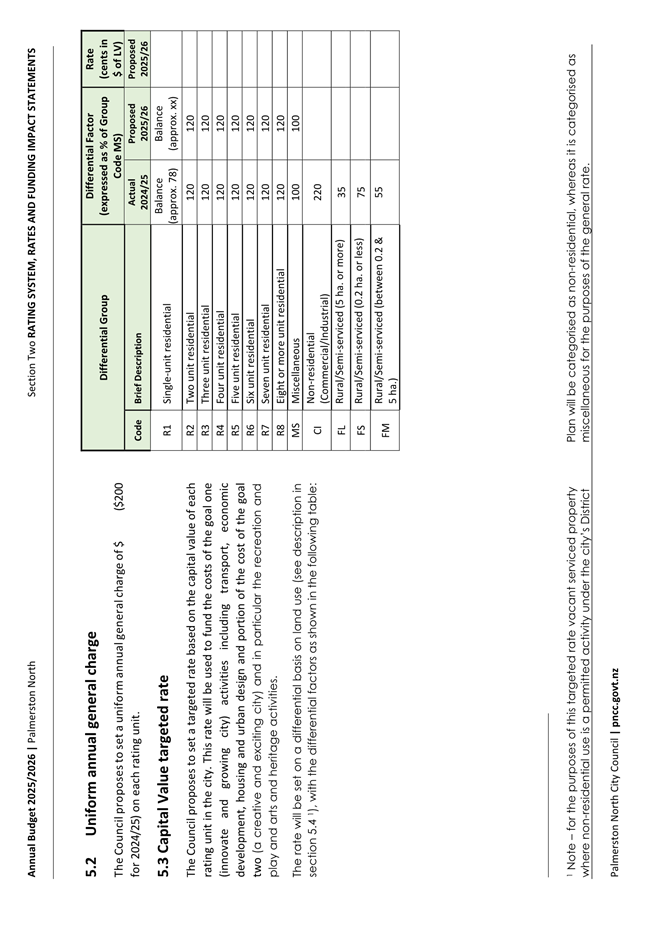

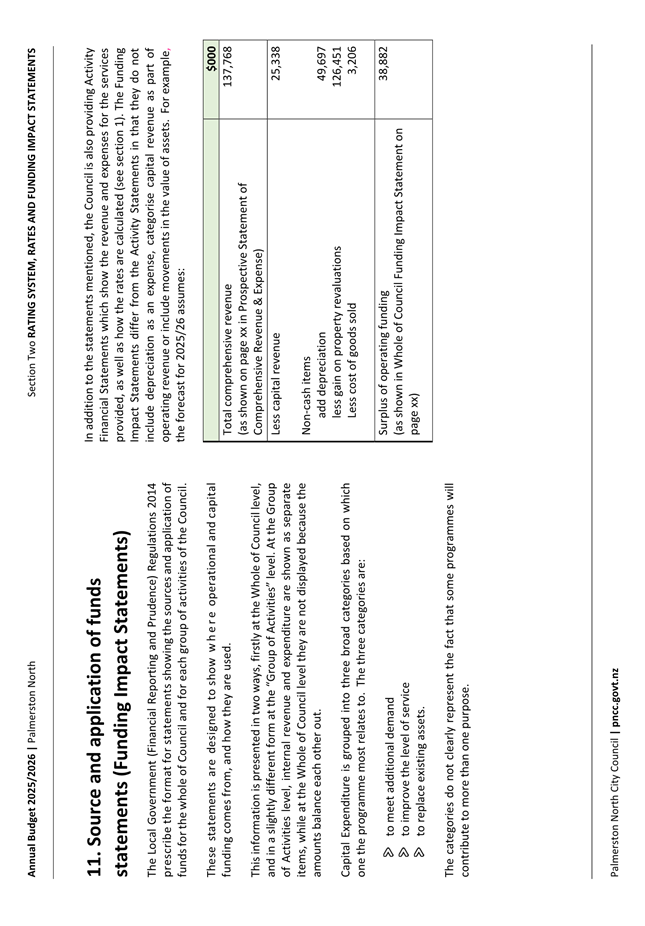

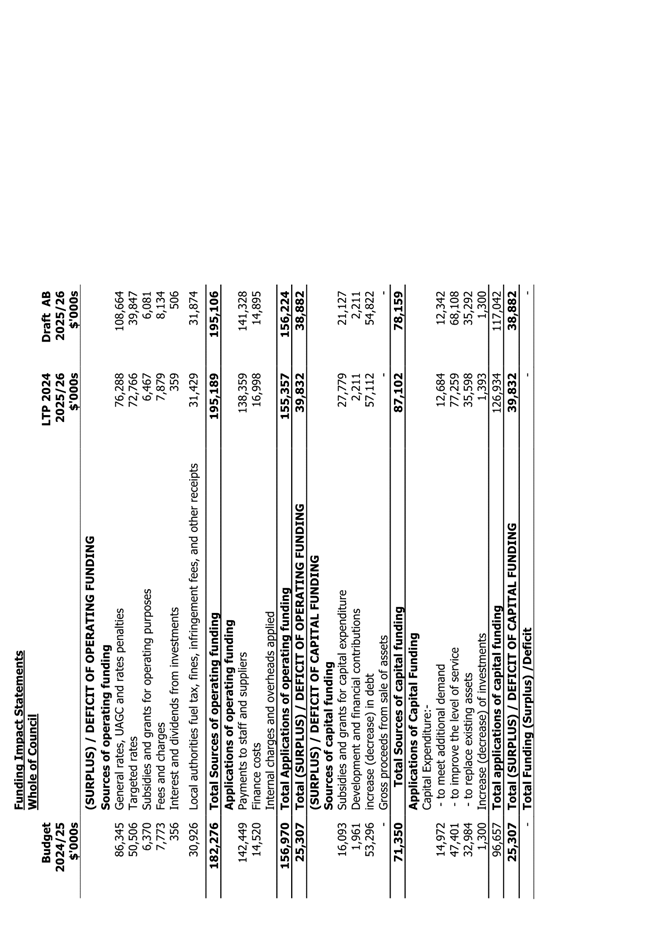

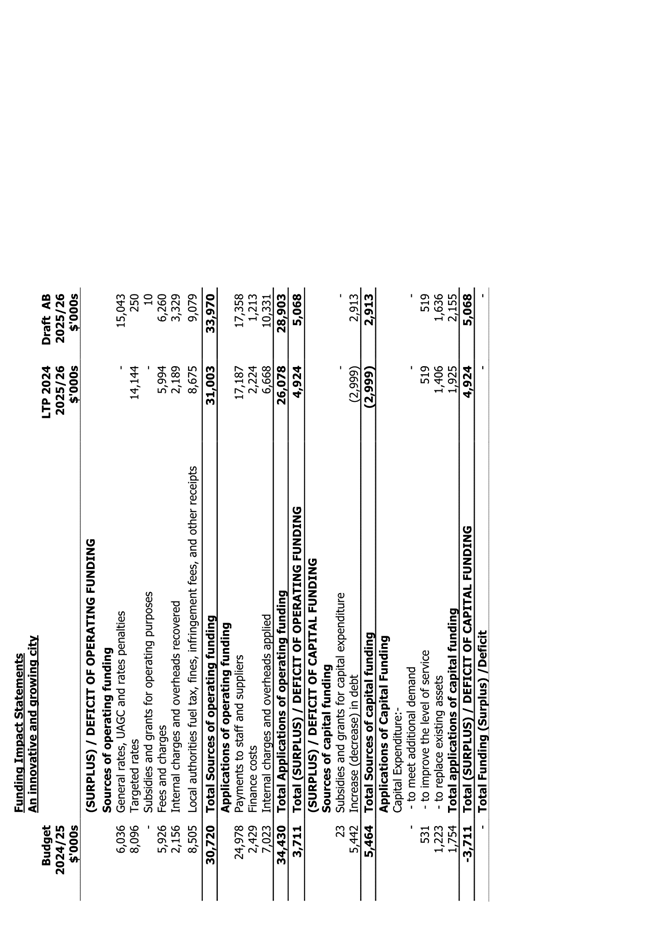

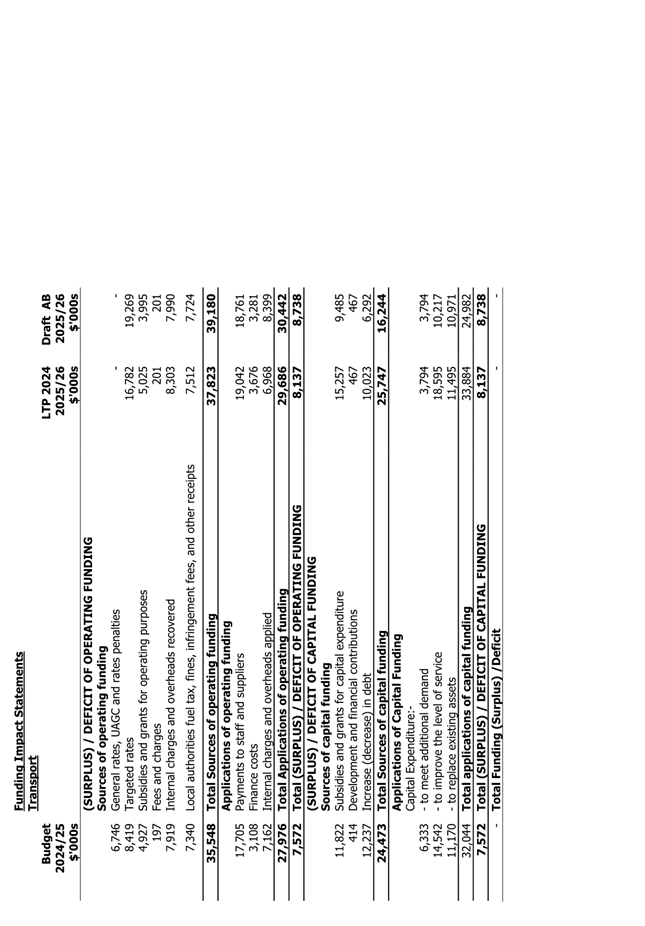

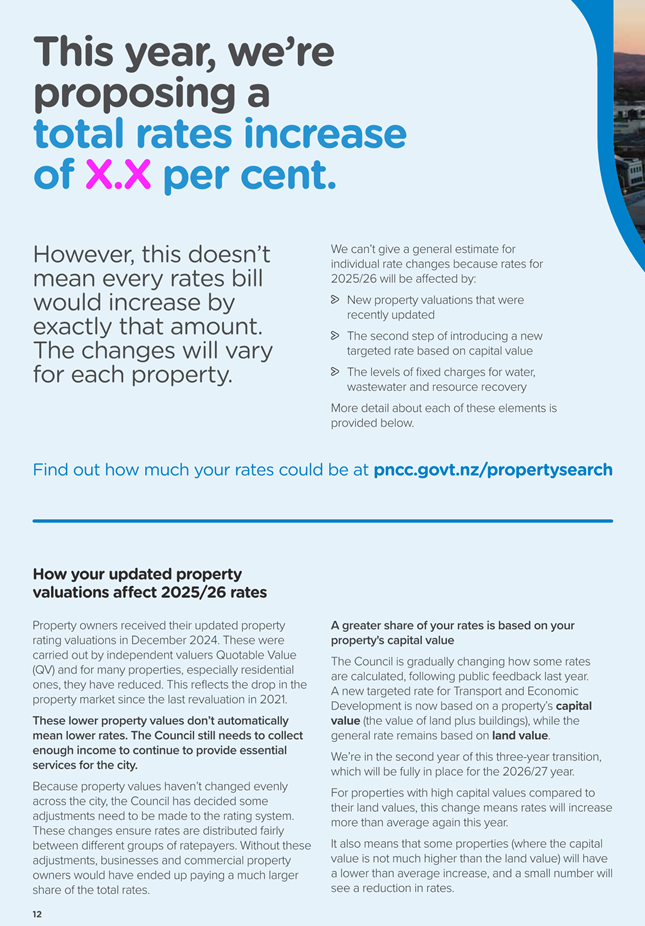

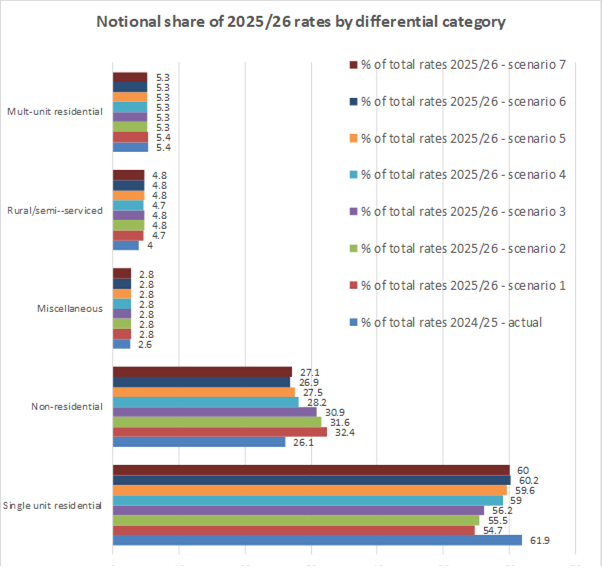

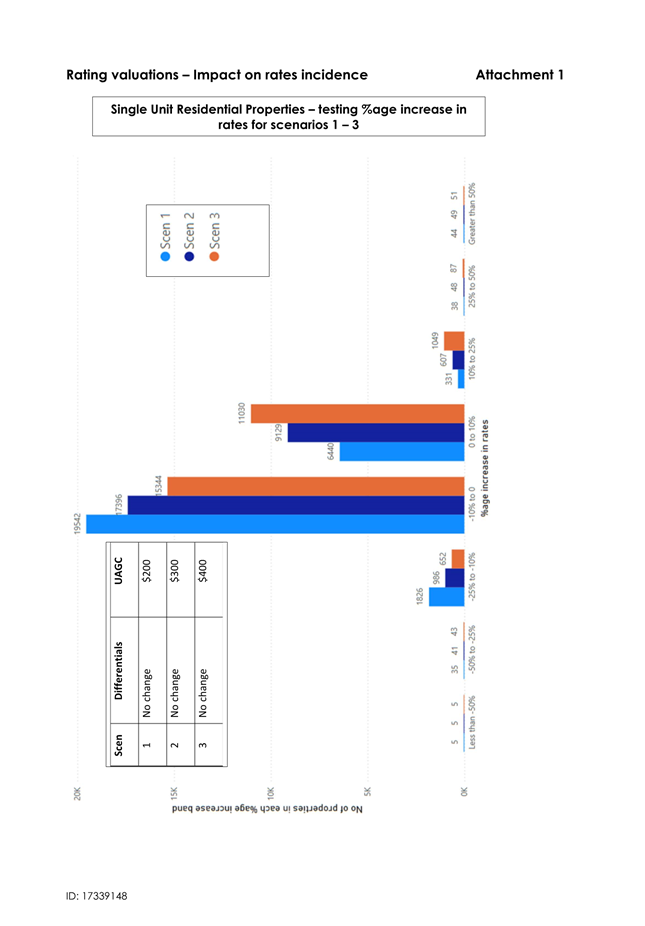

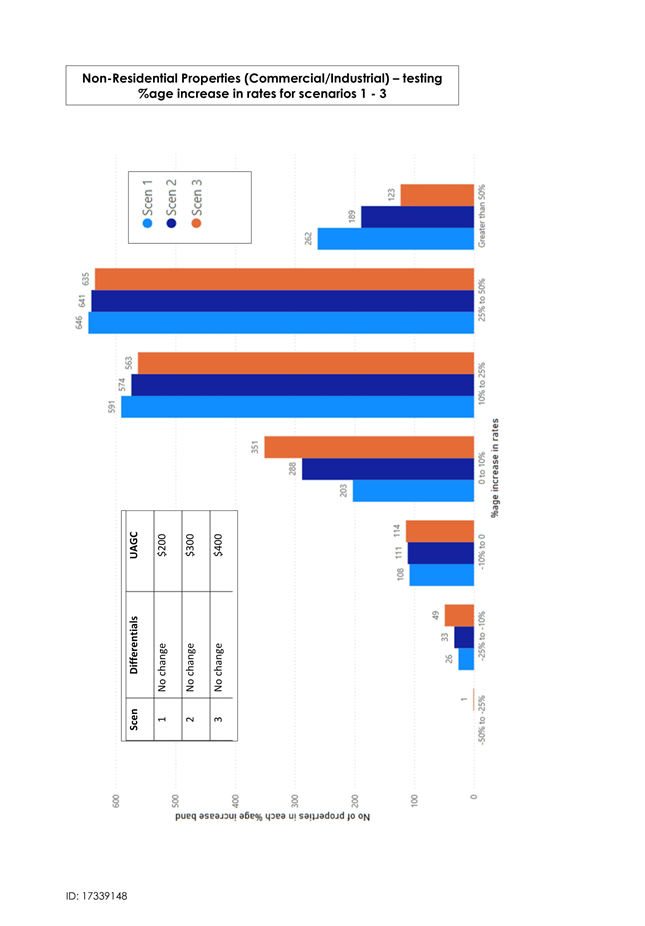

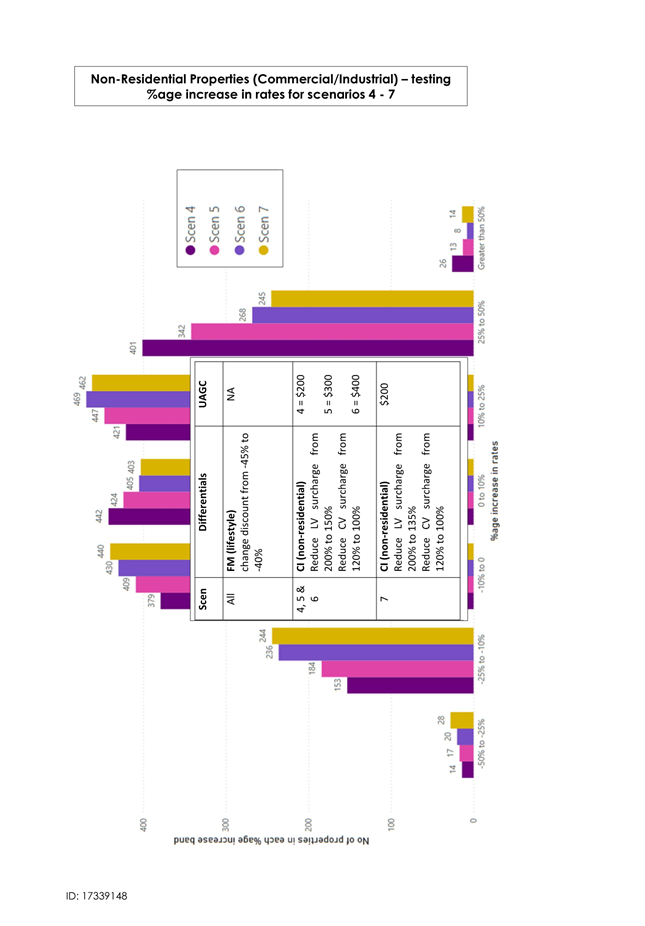

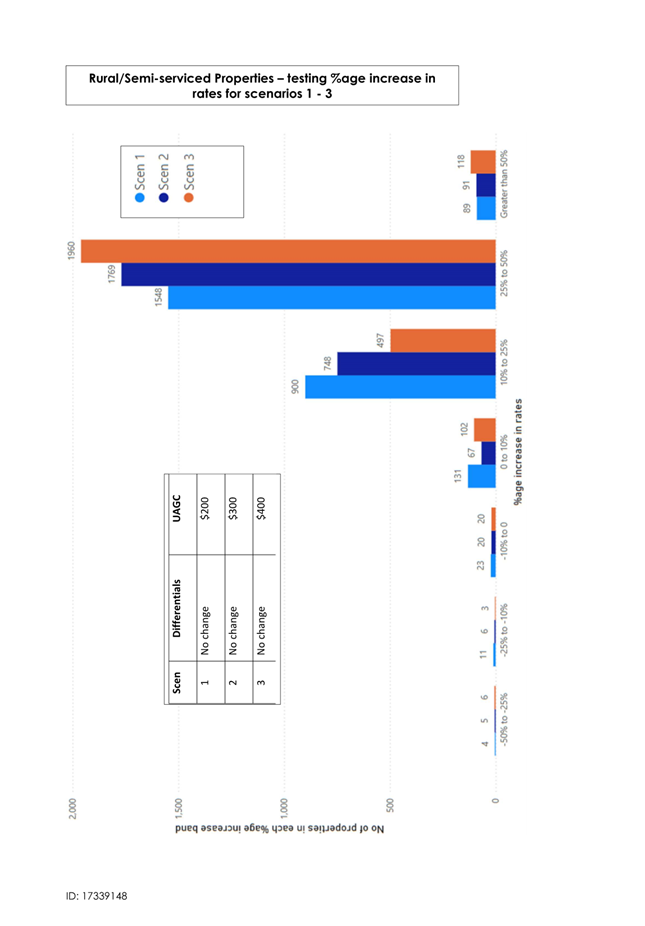

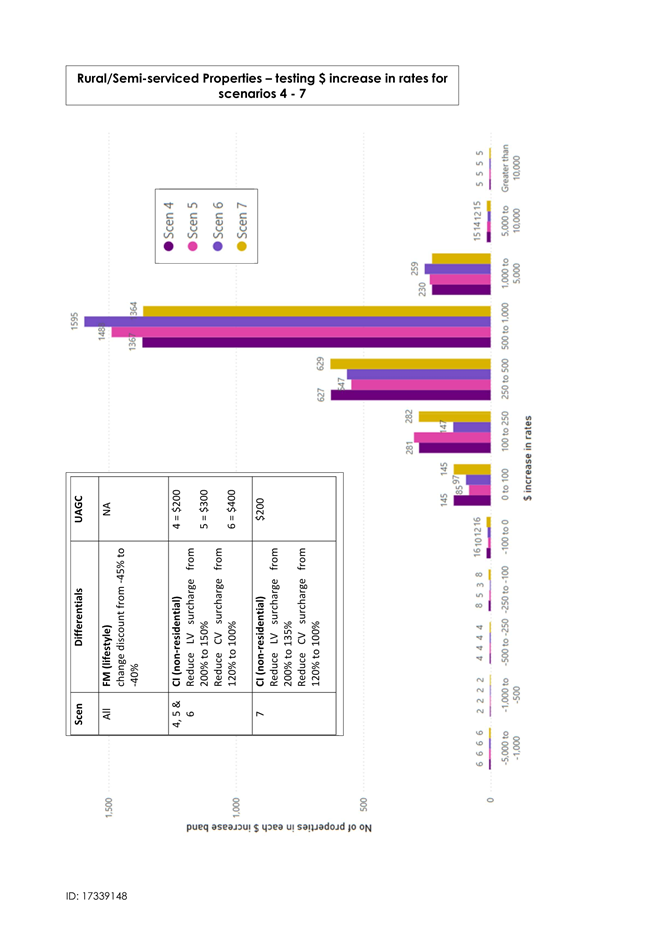

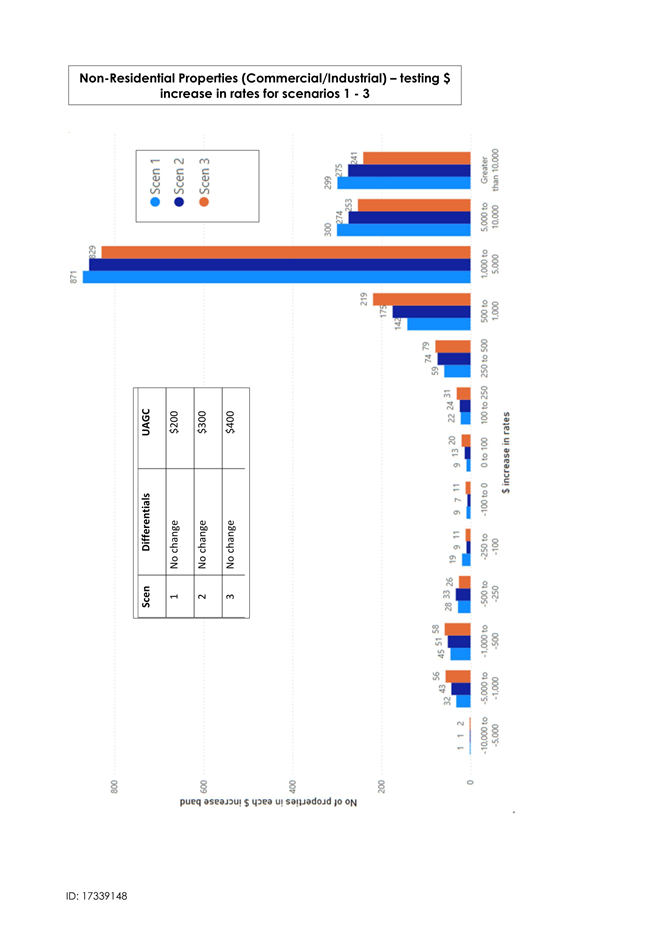

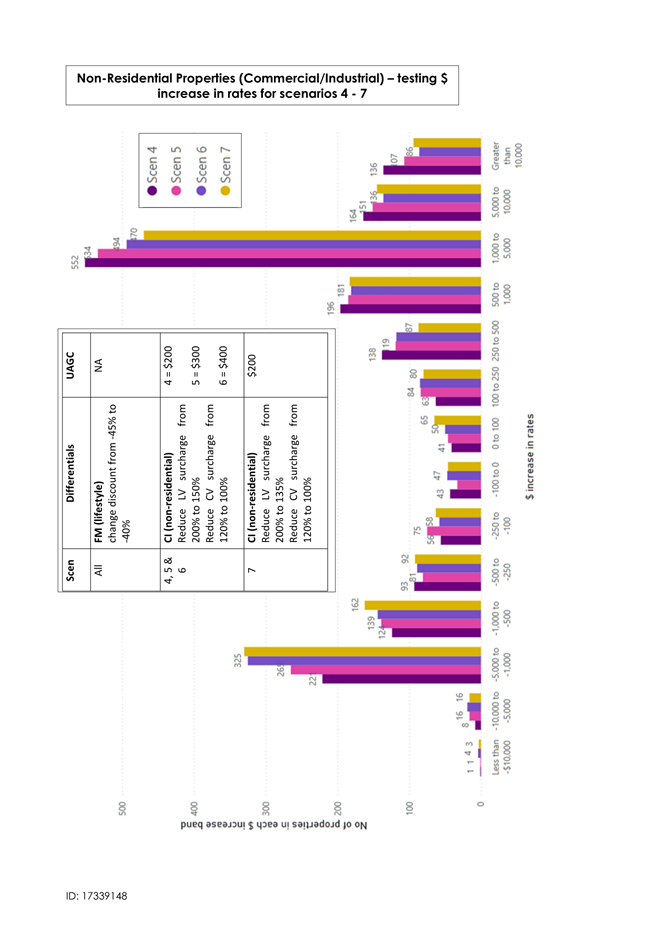

4. Conclusions