|

Grant

Smith (Mayor)

|

|

Debi

Marshall-Lobb (Deputy Mayor)

|

|

Mark

Arnott

|

Leonie

Hapeta

|

|

Brent

Barrett

|

Lorna

Johnson

|

|

Rachel

Bowen

|

Billy

Meehan

|

|

Vaughan

Dennison

|

Orphée

Mickalad

|

|

Lew

Findlay (QSM)

|

Karen

Naylor

|

|

Roly

Fitzgerald

|

William

Wood

|

|

Patrick

Handcock (ONZM)

|

Kaydee

Zabelin

|

Council MEETING

25 June 2025

Order of Business

1. Karakia

Timatanga

2. Apologies

3. Notification

of Additional Items

Pursuant to

Sections 46A(7) and 46A(7A) of the Local Government Official Information and

Meetings Act 1987, to receive the Chairperson’s explanation that

specified item(s), which do not appear on the Agenda of this meeting and/or the

meeting to be held with the public excluded, will be discussed.

Any

additions in accordance with Section 46A(7) must be approved by resolution with

an explanation as to why they cannot be delayed until a future meeting.

Any

additions in accordance with Section 46A(7A) may be received or referred to a

subsequent meeting for further discussion. No resolution, decision or

recommendation can be made in respect of a minor item.

4. Declarations

of Interest (if any)

Members

are reminded of their duty to give a general notice of any interest of items to

be considered on this agenda and the need to declare these interests.

5. Public

Comment

To receive

comments from members of the public on matters specified on this Agenda or, if

time permits, on other matters.

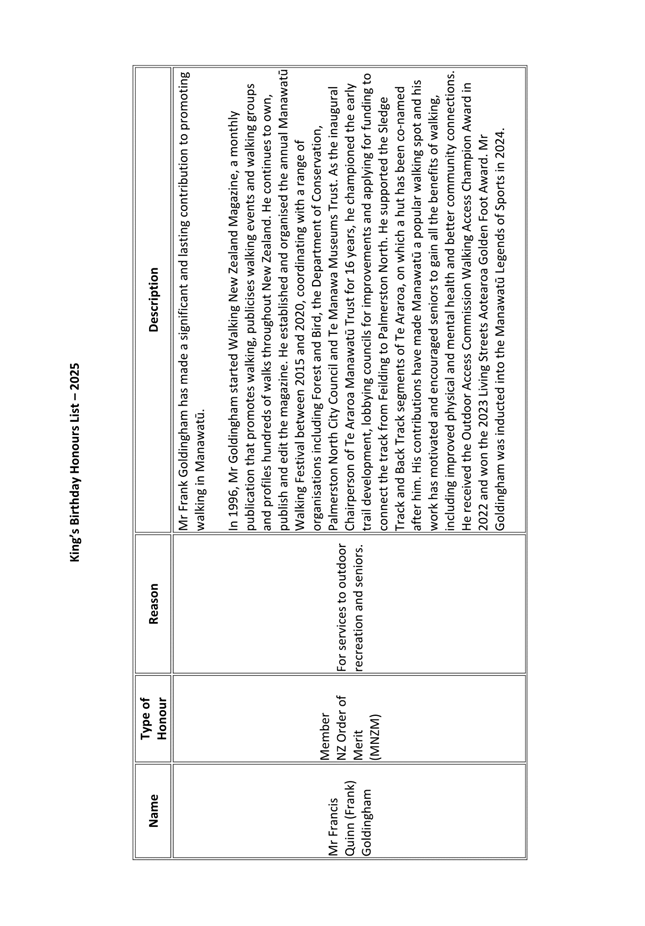

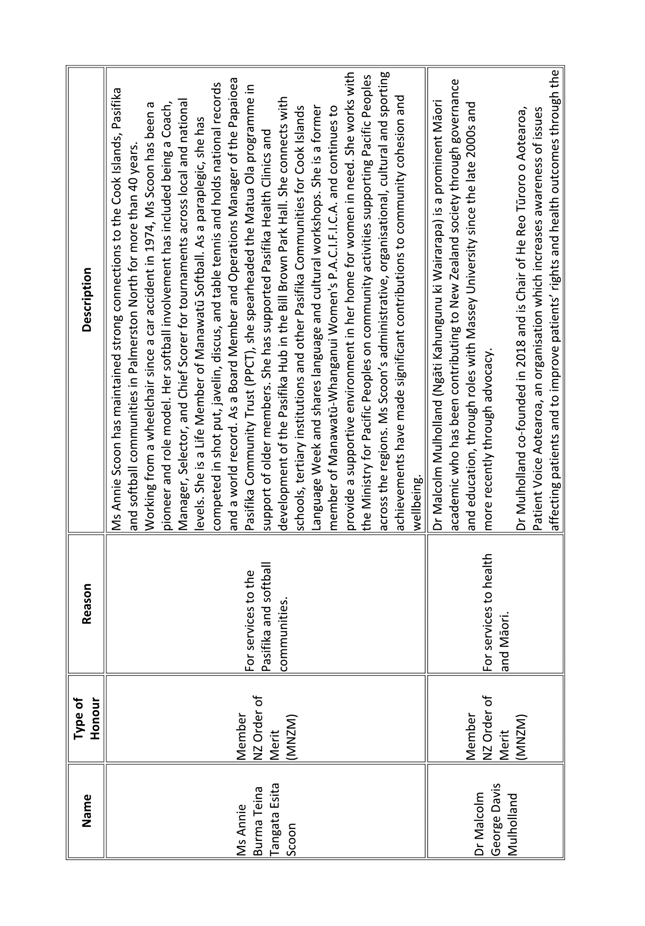

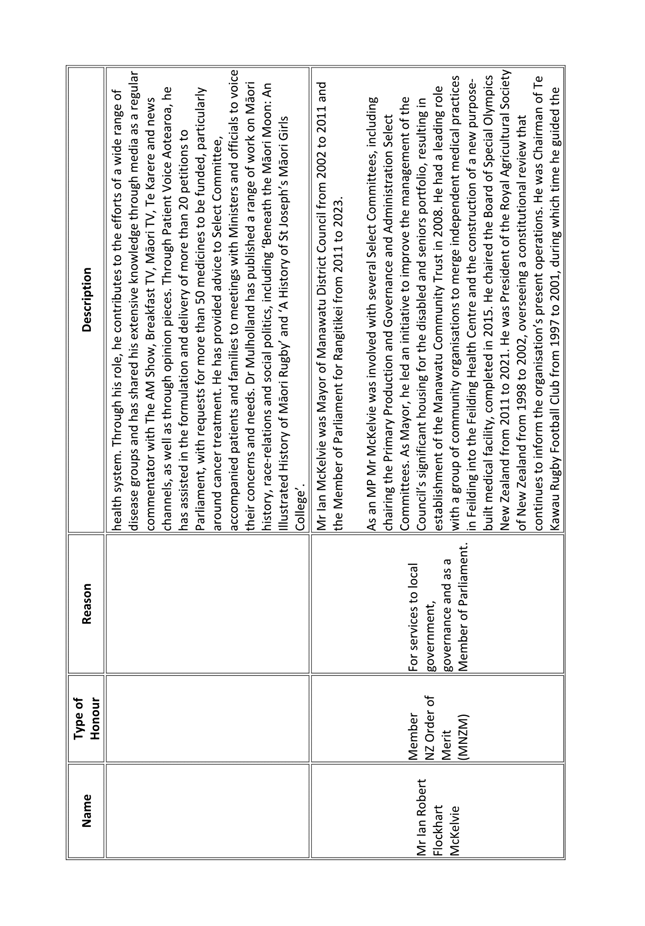

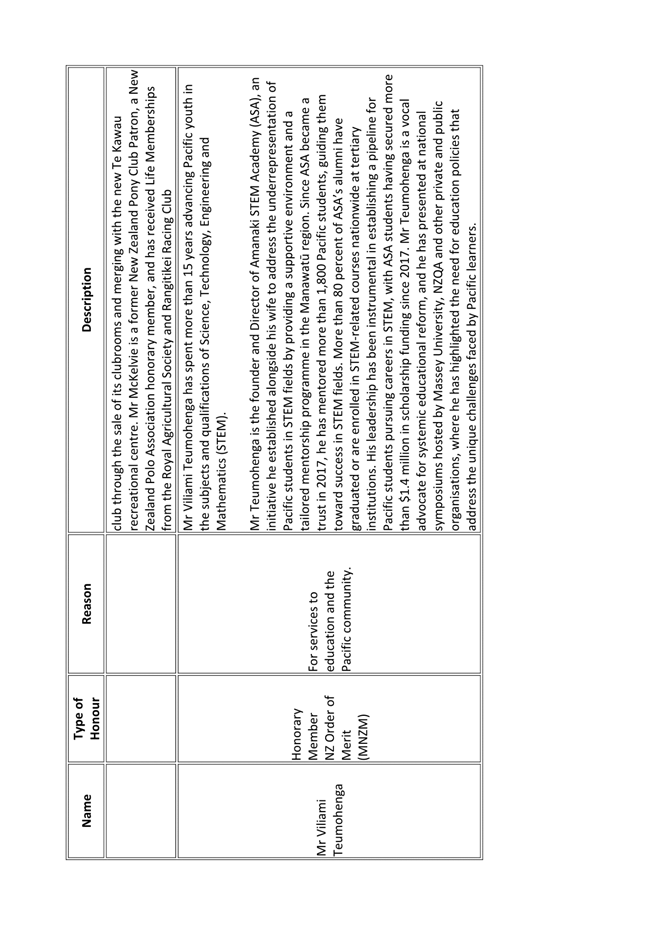

6. Tribute

- King's Birthday Honours 2025 Page 7

Presentation, by Deputy Mayor, Debi Marshall-Lobb

7. Confirmation

of Minutes Page 13

That the minutes of the ordinary Council meeting of 4 June

2025 Part I Public be confirmed as a true and correct record.

8. Notice

of Motion: Inclusion of the city centre in the scope of the draft Speed

Management Plan Page 31

Reports

9. Kākātangiata

Urban Growth Area: Update and Next Steps Page 39

Report, presented by Jono Ferguson-Pye, Manager City

Planning, Stewart McKenzie, Consultant Planning Advisor.

10. 21 Havelock Avenue,

Bill Brown Park: Proposal to grant a lease on Council land to Kia Toa Football

Club Incorporated - Deliberations Report Page 65

Memorandum, presented by Glenn Bunny, Manager Property

and Perene Green, Property Officer.

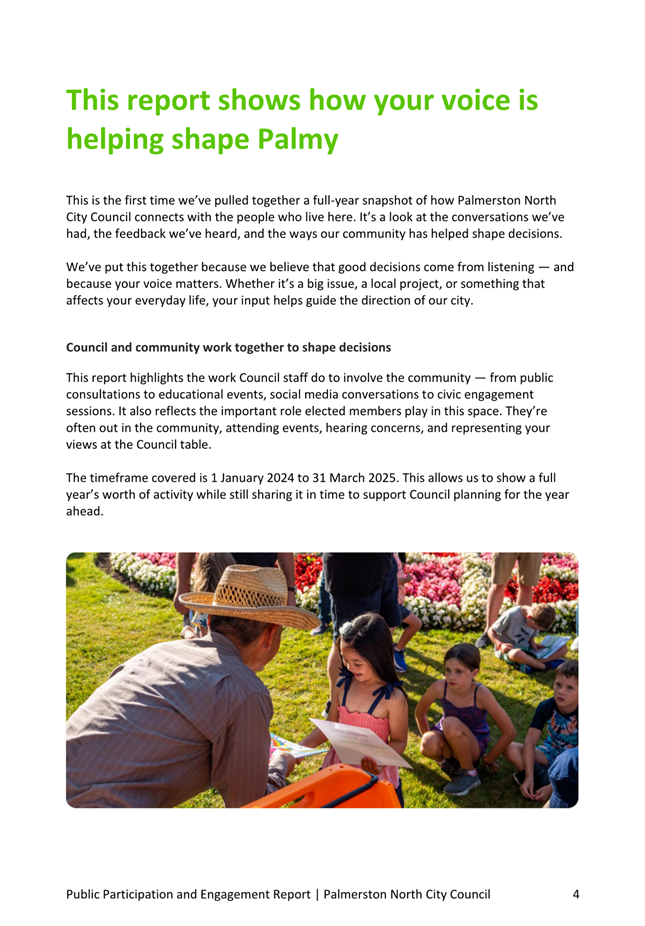

11. Public

Participation and Engagement: Annual Progress Report, and proposed indicators. Page 73

Memorandum, presented by Olivia Wix - Manager

Communications.

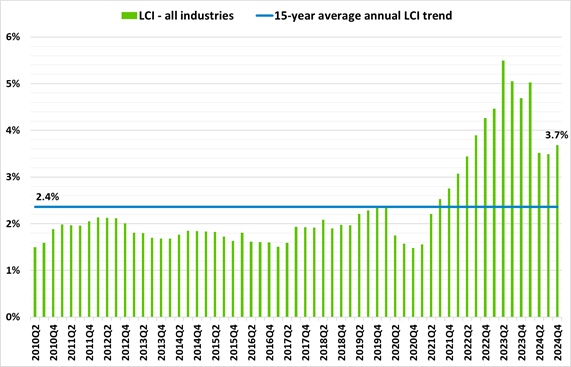

12. Palmerston North

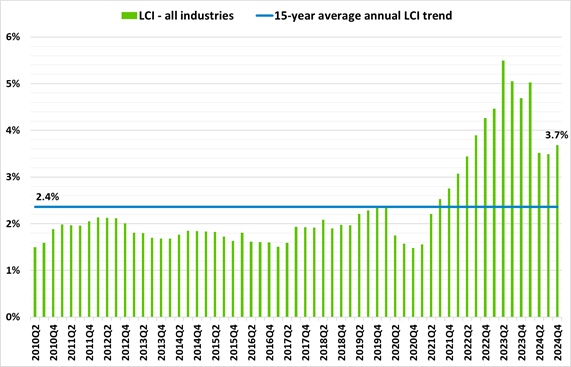

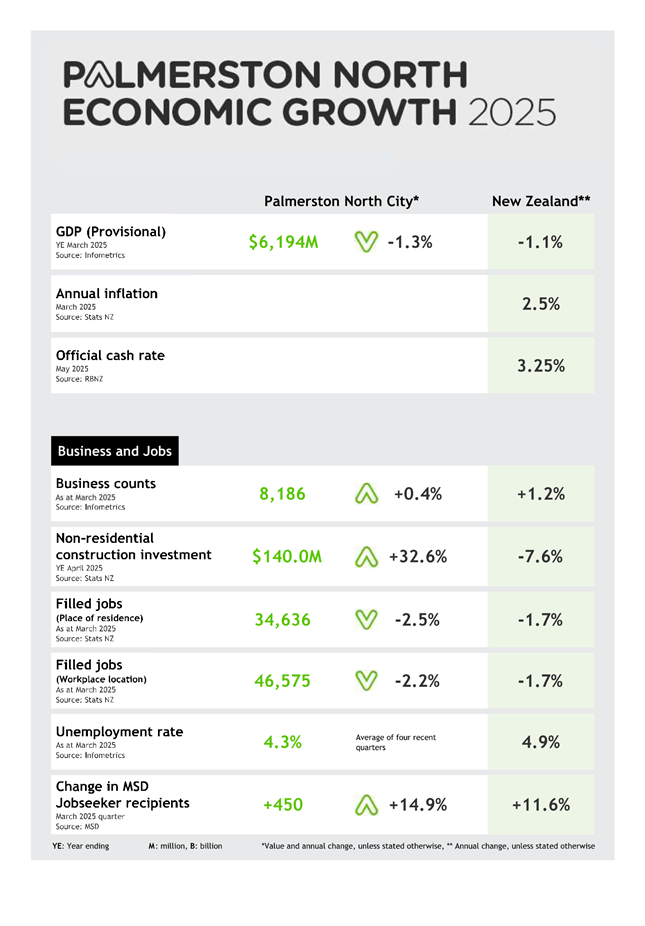

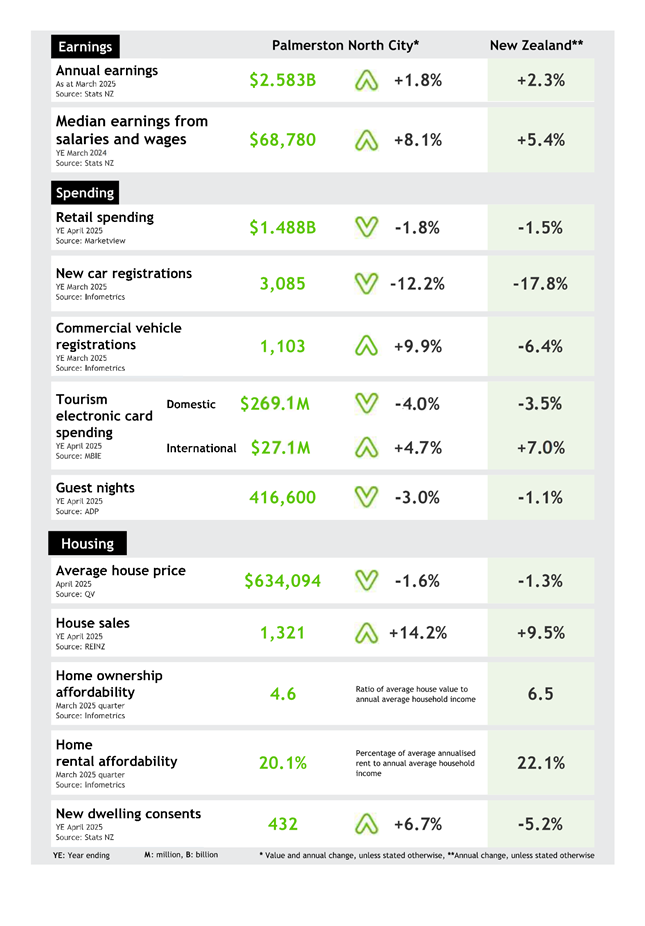

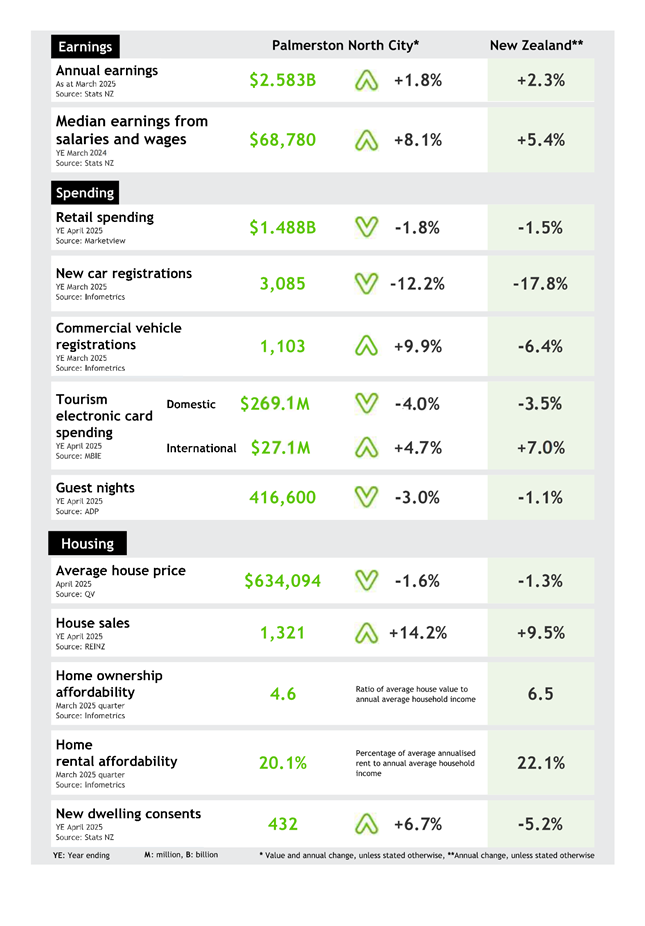

Quarterly Economic Update - June 2025 Page 127

Memorandum, presented by Stacey Andrews, City

Economist.

13. Support of Remits

to Local Government New Zealand 2025 Annual General Meeting Page 149

Memorandum, presented by Sarah Claridge, Governance

Advisor.

14. Council Work

Schedule Page 161

15. Karakia

Whakamutunga

16. Exclusion of Public

|

|

To be moved:

That the public be excluded from the following parts

of the proceedings of this meeting listed in the table below.

The general subject of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under Section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for

passing this resolution

|

|

17.

|

Confirmation of the minutes of the ordinary

Council meeting of 4 June 2025 Part II Confidential

|

For the reasons set out in the Council of 4 June

2025, held in public.

|

|

18.

|

Purchase of land for City East Bore –

alteration of purchase price.

|

COMMERCIAL ACTIVITIES: This information needs to

be kept confidential to allow Council to engage in commercial activities

without prejudice or disadvantage

|

s7(2)(h)

|

|

19.

|

Mechanical Electrical Maintenance Contract -

revision

|

NEGOTIATIONS: This information needs to be kept confidential

to ensure that Council can negotiate effectively, especially in business

dealings

|

s7(2)(i)

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

|

TRibute

TO: Council

MEETING DATE: 25

June 2025

TITLE: Tribute

- King's Birthday Honours 2025

RECOMMENDATION(S)

TO Council

1. That Council

congratulate the local recipients of the King’s Birthday Honours 2025.

Deputy Mayor, Debi Marshall-Lobb will acknowledge the

achievements of the local recipients of the King’s Birthday Honours 2025.

Attachments

|

1.

|

King's

Birthday Honours ⇩

|

|

Palmerston North City Council

Minutes of

the Council Meeting Part I Public, held in the Council Chamber, First Floor,

Civic Administration Building, 32 The Square, Palmerston North on 04 June 2025,

commencing at 9.02am

|

Members

Present:

|

Grant Smith (The Mayor) (in the Chair)

and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Leonie Hapeta, Lorna Johnson, Billy Meehan,

Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

|

|

Members Present

Online:

|

Councillor Patrick Handcock

|

|

Apologies:

|

Councillor Roly Fitzgerald

|

Councillor William Wood left the meeting at 3.57pm after

consideration of clause 94-25. He entered the

meeting again in Part II Confidential at 3.02pm.

He was not present for clause 95-25.

|

|

Karakia

Timatanga

|

|

|

Councillor

Debi Marshall-Lobb opened the meeting with karakia.

|

|

81-25

|

Apologies

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That

Council receive the apologies.

|

|

|

Clause 81-25 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark

Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay, Patrick

Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad,

Karen Naylor, William Wood and Kaydee Zabelin.

|

|

|

Declaration

of Interest

|

|

|

Councillor Debi Marshall-Lobb declared a conflict of

interest in Item 8 Notice of Motion: Palmerston North Boys High School -

Hockey Turf Project (clause 80-25) and took no further part in discussion or

debate.

|

|

82-25

|

Confirmation

of Minutes

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

That the minutes of the ordinary Council meeting of 7 May

2025 Part I Public and Part II Confidential be confirmed as a true and

correct record.

|

|

|

Clause 82-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna

Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

|

83-25

|

Confirmation

of Minutes

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

That the minutes of the ordinary Council meeting of 14 May

2025 Part I Public be confirmed as a true and correct record.

|

|

|

Clause 83-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna

Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

|

84-25

|

Notice

of Motion: Palmerston North Boys High School - Hockey Turf Project.

Councillor

Wood introduced the Notice of Motion.

|

|

|

Moved

William Wood, seconded Grant Smith.

RESOLVED

1. That

Council create a new operating programme to provide civic support for the

PNBHS Hockey Turf project of $33.5K in 2025/26 and refer $33.5K per year to

2026/27 and 2027/28 annual budget processes.

|

|

|

Clause 84-25 above was

carried 11 votes to 3, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Mark Arnott, Rachel Bowen, Vaughan Dennison, Lew Findlay, Patrick

Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad

and William Wood.

Against:

Councillors Brent Barrett,

Karen Naylor and Kaydee Zabelin.

Note

Councillor Debi

Marshall-Lobb declared a conflict of interest, withdrew from the

discussion and sat in the gallery.

|

|

85-25

|

Community

Committee Part I Public - 21 May 2025

Councillor Johnson presented the

recommendations below. She moved an additional motion, to agree Niuvaka Trust

as a Sector lead from 2025-2028. This was the recommendation that was laid on

the table from the Community Committee on 21 May 2025. The motion was lifted

and moved as the engagement required with the Pasifika community had

occurred.

|

|

|

Moved Lorna Johnson, seconded Patrick Handcock.

RESOLVED

1. That

Council adopt the recommendations from the Community Committee of 21 May

2025:

Potential locations for a public toilet

at Albert St (clause 12-25)

Memorandum, presented by Bill Carswell, Activities

Manager, Property Services.

1. That Council proceed with applying for a planning and building

consent for the installation of a single pan toilet at the end of Albert Street

(option 2 residential pump station).

|

|

|

Clause 85-25 above was

carried 12 votes to 1, with 2 abstentions, the voting being as follows:

For:

Councillors Debi

Marshall-Lobb, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay,

Patrick Handcock, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen

Naylor, William Wood and Kaydee Zabelin.

Against:

Councillor Mark Arnott.

Abstained:

The Mayor (Grant Smith) and Councillor Leonie

Hapeta.

|

|

|

|

Moved

Lorna Johnson, seconded Patrick Handcock.

RESOLVED

2. That

Council adopt the recommendations from the Community Committee of 21 May

2025:

Recommendation to engage Sector Lead Organisations (clause

11-25)

Memorandum, presented by Ahmed Obaid, Community

Development Advisor and Stephanie Velvin, Manager Community Development.

1. That Council

engage the following organisation through Sector Lead Partnership Agreement

for the period 1 July 2025 to 30 June 2028:

a. MASH Trust

|

|

|

|

Clause 85-25 above was

carried 14 votes to 0, with 1 abstention, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Lorna Johnson, Billy Meehan,

Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Abstained:

Councillor Leonie Hapeta.

|

|

|

|

Moved

Lorna Johnson, seconded Patrick Handcock.

On a procedural motion:

That Council lift 1.b (make the Niuvaka Trust a sector lead for the period 1

July 2025- 30 June 2028) off the table.

The procedural motion was

carried 13 votes to 1, with 1 abstention, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Lorna Johnson, Billy Meehan,

Orphée Mickalad, William Wood and Kaydee Zabelin.

Against:

Councillor Karen Naylor.

Abstained:

Councillor Leonie Hapeta.

|

|

|

|

Moved

Lorna Johnson, seconded Patrick Handcock.

RESOLVED

2. That Council engage the

following organisation through Sector Lead Partnership Agreement for the

period 1 July 2025 to 30 June 2028:

b. Niuvaka Trust

|

|

|

|

Clause 85-25 above was

carried 13 votes to 1, with 1 abstention, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Lorna Johnson, Billy Meehan,

Orphée Mickalad, William Wood and Kaydee Zabelin.

Against:

Councillor Karen Naylor.

Abstained:

Councillor Leonie Hapeta.

|

|

|

86-25

|

Fees

and Charges - Confirmation following consultation

Memorandum, presented by

Steve Paterson, Manager - Financial Strategy.

Councillor Wood moved an

additional motion seeking information on how fees and charges for Planning

Services are set.

|

|

|

Moved Grant Smith, seconded Vaughan Dennison.

RESOLVED

2. That Council approve the fees and charges for Planning

& Miscellaneous Services, as scheduled in Attachments 2 and 3, effective

from 1 July 2025.

|

|

|

Clause 86-25 above was

carried 11 votes to 4, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Brent Barrett, Rachel Bowen, Lew Findlay,

Patrick Handcock, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen

Naylor and Kaydee Zabelin.

Against:

Councillors Mark Arnott,

Vaughan Dennison, Leonie Hapeta and William Wood.

|

|

|

Moved

Grant Smith, seconded Vaughan Dennison.

RESOLVED

1. That Council receive the submissions for fees and

charges (Attachment 1).

3. That Council approve the fees and charges for

Trade Waste Services, as scheduled in Attachment 4, effective from 1 July

2025.

|

|

|

Clause 86-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna

Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

|

|

Moved

William Wood, seconded Karen Naylor.

RESOLVED

4. That the Chief Executive

provide a breakdown for how we set our fees and charges for Planning

Services.

|

|

|

Clause 86-25 above was

carried 9 votes to 6, the voting being as follows:

For:

Councillors Mark Arnott,

Brent Barrett, Vaughan Dennison, Leonie Hapeta, Billy Meehan, Orphée

Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Against:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Rachel Bowen, Lew Findlay, Patrick Handcock

and Lorna Johnson.

|

Meeting adjourned at 10.35am

Meeting resumed at 10.56am

|

87-25

|

2025/26

Annual Budget - Adoption

Memorandum, presented by Cameron

McKay, Chief Financial Officer, Steve Paterson, Manager - Financial Strategy

and Scott Mancer, Manager - Finance.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council adopt the Annual Budget (Plan) for

2025/26 (as amended to incorporate item 8 (clause 84-25)) as attached.

2. That Council confirm the adoption of the Annual

Budget (Plan) 2025/26 is a significant decision within the parameters of the

Local Government Act 2002 and that Council is satisfied that all submissions

have been considered and that there has been compliance with the

decision-making and consultation requirements of the Act.

3. That Council delegate authority to the Chief

Executive to authorise payments to council-controlled organisations and other

external organisations in accordance with their respective service level

agreements.

|

|

|

Clause 87-25 above was

carried 11 votes to 4, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna Johnson,

Orphée Mickalad and Kaydee Zabelin.

Against:

Councillors Mark Arnott,

Billy Meehan, Karen Naylor and William Wood.

|

|

88-25

|

Setting

Rates for 2025/26

Memorandum, presented by

Steve Paterson, Manager - Financial Strategy.

The agreed Rates resolution

2025-26 is attached.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council

adopt the resolution to set the rates for the 2025/26 year (Attachment 1).

2. That Council

note that the setting of rates is a significant decision within the

parameters of the Local Government Act 2002 and that it is satisfied there

has been compliance with the decision-making and consultation requirements of

the Act.

|

|

|

Clause 88-25 above was

carried 12 votes to 3, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan,

Orphée Mickalad and Kaydee Zabelin.

Against:

Councillors Mark Arnott,

Karen Naylor and William Wood.

|

|

89-25

|

Resolutions

to Authorise Borrowing

Memorandum, presented by

Steve Paterson, Manager - Financial Strategy.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council

authorise the Chief Executive to borrow, in accordance with delegated

authority, up to $49 million (“the Borrowing”) of additional term

debt by way of bank loan or loans or credit facilities or other facilities or

the issue of stock for the Borrowing secured by the Debenture Trust Deed.

2. That Council

note that the purpose of the Borrowing is the carrying out or continuing of

programmes identified in the 2025/26 Annual Budget.

3. That Council

note that any sums raised and subsequently on-lent to Palmerston North

Airport Limited pursuant to the loan agreement between the Council and the

Company will be in addition to the sums to be raised for the Council’s

own funding purposes as authorised above.

4. That Council

note that the security for the Borrowing may be the charge over rates under

the Debenture Trust Deed if the Chief Executive considers appropriate.

5. That Council

approve that having regard to the Council’s financial strategy, it is

prudent and reasonable to enter into the proposed borrowing for the reasons

set out in this report.

6. That Council

note that the raising of the Borrowing will comply with the Council's

Liability Management Policy.

7. That Council

note that the decision to borrow up to $49 million is a significant decision

within the parameters of the Local Government Act 2002 and is satisfied that

there has been compliance with the decision-making and consultation

requirements of the Act.

|

|

|

Clause 89-25 above was

carried 11 votes to 0, with 4 abstentions, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Brent Barrett, Rachel Bowen, Vaughan Dennison,

Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Orphée

Mickalad and Kaydee Zabelin.

Abstained:

Councillors Mark Arnott,

Billy Meehan, Karen Naylor and William Wood.

|

Meeting adjourned at 12.16pm

Meeting resumed at 1.18pm

|

90-25

|

Local Water Done Well Decision

Report, presented by Mike

Monaghan, Manager Three Waters, Julie Keane, Transition Manager, Olivia Wix,

Manager Communications and Scott Mancer, Manager Finance.

Officers made a presentation

(as attached). They explained that there was an error in workshop material

from last week where the inflated figures for the Palmerston North City

Council base case had been shown. This has been corrected in the report to

show the uninflated figures over the 10 year period.

Officers corrected the

following additional errors in the report:

In section 11.9 of the report

(page 96), the additional debt repayment provisions of $75M

should read $150M in the Long-Term Plan.

Figures in the Palmerston

North City Council base case throughout the report include the cost of

the IFF levy (for Nature Calls).

Page 83 –

Financial Section for Option 3 (for a standalone Council-Controlled

Organisation) - The figure for 10 years should read $2790 per year not 3,800

per year.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That

this matter or decision is recognised as of high significance in accordance

with the Council’s Significance and Engagement Policy.

|

|

|

Clause 90-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna

Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and

Kaydee Zabelin.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

2. That

Council confirm a Joint Water Services Council-Controlled Organisation as its

preferred future Water Services Delivery Model.

3. That

Council agree to partner with Horowhenua District Council and Rangitīkei

District Council in a Joint Water Services Council-Controlled Organisation

(WSCCO).

4. That

Council agree to continue to work with Ruapehu District Council and Whanganui

District Council with a view to including them in a Joint WSCCO upon

confirmation from those councils.

5. That

Council instruct the Chief Executive to prepare a Joint Water Services

Delivery Plan to be brought back to Council in August 2025 for approval prior

to submission to the Department of Internal Affairs before the 3 September

deadline, which includes further information relating to the management of

stormwater.

|

|

|

Clause 90-25 above was

carried 12 votes to 3, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Rachel Bowen, Vaughan Dennison,

Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan,

Orphée Mickalad and William Wood.

Against:

Councillors Brent Barrett,

Karen Naylor and Kaydee Zabelin.

|

|

91-25

|

Te

Motu o Poutoa Governance and Management Structure Options: Summary of

submissions, including hearings

Report, presented by Kathy

Dever-Tod, Manager Parks and Reserves

Cameron McKay, General Manager, Corporate Services.

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council agree to the establishment of a

Jointly Governed Council-Controlled Organisation, governed by Council and

Rangitāne o Manawatū for the Te Motu o Poutoa civic marae and

cultural centre, subject to Council confirming ongoing funding in the 2025/26

Annual Plan.

2. That Council note the following steps are required

before the new Jointly Governed Council Controlled Organisation commences

operations:

· Proposed establishment costs and

processes, including relevant entity agreements such as a shareholders

agreement or trust deed.

· A Statement of Expectation agreed by

Council

· A Statement of Intent agreed upon between the

Board and the Shareholders, outlining the specific objectives, clear roles

and responsibilities for the Council-Controlled Organisation, including

Council and Rangitāne o Manawatū roles in monitoring and

accountability

· Appointment of Board members

|

|

|

Clause 91-25 above was

carried 14 votes to 1, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy

Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee

Zabelin.

Against:

Councillor Mark Arnott.

|

|

92-25

|

Council

Work Schedule

|

|

|

Moved

Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

1. That Council receive its Work Schedule dated 4

June 2025.

|

|

|

Clause 92-25 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Leonie Hapeta, Lorna Johnson,

Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee

Zabelin.

|

Recommendations from Committee Meetings

|

93-25

|

Strategy

& Finance Committee Part I Public - 28 May 2025

Councillor Vaughan Dennison presented the

recommendations below:

|

|

|

Moved

Vaughan Dennison, seconded Karen Naylor.

RESOLVED

1. That Council adopt the

recommendations from the Strategy & Finance Committee of 28 May 2025:

Variable Speed Limits for schools - confirmation of

scope for draft Speed Management Plan (clause 17-25)

Memorandum, presented by

Peter Ridge, Senior Policy Analyst and James Miguel, Senior Transport

Planner.

1. That Council

confirm that the scope of the draft Speed Management Plan 2025 (stage 1) will

include:

· variable speed limits for all schools within

Palmerston North; and

· Te Wanaka Road/SH56 intersection; and

· An intersection speed zone (ISZ) for Longburn- Rongotea Road/No. 1

Line.

|

|

|

|

Clause 93-25 above was

carried 14 votes to 1, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen,

Vaughan Dennison, Lew Findlay, Patrick Handcock, Lorna Johnson, Billy Meehan,

Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Against:

Councillor Leonie Hapeta.

|

|

|

|

|

|

Exclusion

of Public

|

94-25

|

Recommendation to

Exclude Public

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb.

RESOLVED

That the public be excluded from the following parts

of the proceedings of this meeting listed in the table below.

The general subject of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under Section 48(1) of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for

passing this resolution

|

|

21.

|

Presentation of the Part II Confidential Strategy

& Finance Committee Recommendations from its 28 May 2025 Meeting

|

NEGOTIATIONS: This information needs to be kept confidential

to ensure that Council can negotiate effectively, especially in business

dealings

|

s7(2)(i)

|

|

|

|

|

This resolution is made in reliance on Section

48(1)(a) of the Local Government Official Information and Meetings Act 1987

and the particular interest or interests protected by Section 6 or Section 7

of that Act which would be prejudiced by the holding of the whole or the

relevant part of the proceedings of the meeting in public as stated in the

above table.

|

|

|

Clause 94-25 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark

Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay, Patrick

Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad,

Karen Naylor, William Wood and Kaydee Zabelin.

|

The public part

of the meeting finished at 2.57pm

Confirmed 25 June 2025

Mayor

Attachment One

Palmerston

North City Council

Resolution

to Set Rates for the 2025/2026 year

The Palmerston North City Council

resolves to set rates for the financial year commencing on 1 July 2025 and

ending on 30 June 2026 in accordance with the Rating Policies and Funding

Impact Statement contained in its Annual Budget (Plan) 2025/26 as follows:

1 Details

of rates to be set

Notes

· All

rates and charges shown are inclusive of Goods and Services Tax.

· References

to the ‘Act’ relate to the Local Government (Rating) Act 2002.

1.1 Uniform

Annual General Charge

A

Uniform Annual General Charge of $300 on each rating unit pursuant to section

15 of the Act.

1.2 General

Rate (based on land value)

A

general rate pursuant to section 13 of the Act set on all rateable land on the

basis of land value and assessed differentially (based on land use) against

each property group code at the rate of cents in the dollar set down in the

following schedule:

|

Differential Group

|

Differential

Factor

(expressed

as % of Group Code MS)

|

Rate

(cents in $

of LV)

|

|

Code

|

Brief Description

|

|

R1

|

Single

unit residential

|

Balance

(approx.80)

|

0.4134

|

|

R2

|

Two unit

residential

|

110

|

0.5697

|

|

R3

|

Three

unit residential

|

120

|

0.6215

|

|

R4

|

Four

unit residential

|

130

|

0.6733

|

|

R5

|

Five

unit residential

|

140

|

0.7251

|

|

R6

|

Six unit

residential

|

150

|

0.7769

|

|

R7

|

Seven

unit residential

|

160

|

0.8286

|

|

R8

|

Eight or

more unit residential

|

170

|

0.8804

|

|

MS

|

Miscellaneous

|

100

|

0.5179

|

|

CI

|

Non-residential

(Commercial/Industrial)

|

250

|

1.2948

|

|

FL

|

Rural

& Semi-serviced

(5

hectares or more)

|

25

|

0.1295

|

|

FS

|

Rural

& Semi-serviced

(0.2

hectares or less)

|

75

|

0.3884

|

|

FM

|

Rural

& Semi-serviced (between 0.2 & 5 hectares)

|

55

|

0.2848

|

1.3 Capital

Value targeted rate

A targeted rate to fund the costs of the

goal one (innovative and growing city) activities including transport, economic

development, housing and urban design, set under section 16 of the Act on all

rateable land on the basis of the capital value, and assessed differentially

(based on land use [1])

against each property group code at the rate of cents in the dollar set down in

the following schedule:

|

Differential Group

|

Differential Factor

(expressed as % of

Group Code MS)

|

Rate

(cents in $ of CV)

|

|

Code

|

Brief Description

|

|

R1

|

Single unit

residential

|

Balance (approx.

76)

|

0.1009

|

|

R2

|

Two unit

residential

|

120

|

0.1589

|

|

R3

|

Three unit

residential

|

120

|

0.1589

|

|

R4

|

Four unit

residential

|

120

|

0.1589

|

|

R5

|

Five unit

residential

|

120

|

0.1589

|

|

R6

|

Six unit residential

|

120

|

0.1589

|

|

R7

|

Seven unit

residential

|

120

|

0.1589

|

|

R8

|

Eight or more unit

residential

|

120

|

0.1589

|

|

MS

|

Miscellaneous

|

100

|

0.1324

|

|

CI

|

Non-residential

(Commercial/Industrial)

|

200

|

0.2648

|

|

FL

|

Rural/Semi-serviced

|

35

|

0.0463

|

|

(5 hectares or

more)

|

|

FS

|

Rural/Semi-serviced

|

75

|

0.0993

|

|

(0.2 hectares or

less)

|

|

FM

|

Rural/Semi-serviced

(between 0.2 & 5 hectares)

|

55

|

0.0728

|

1.4 Water Supply Rates

A

targeted rate for water supply, set under section 16 of the Act, of:

· $487

per separately used or inhabited part of a residential rating unit which is

connected to a Council operated waterworks system. This charge is not

made where water supply is invoiced on the basis of water consumed.

· $487

per rating unit for all other rating units which are connected to a Council

operated waterworks system. This charge is not made where water supply is

invoiced on the basis of water consumed.

· $243.50

per rating unit which is not connected to a Council operated waterworks system

but which is serviceable (i.e. within 100 metres of such waterworks system) and

the Council would allow a connection.

Instead of the above

targeted rates for metered water supply, targeted rates set under sections 16

and 19 of the Act, of $1.96305 per cubic metre of water supplied to any rating

unit that is invoiced on the basis of water supplied plus a fixed amount of

$253 per metered connection for connections of 25mm or less and $540 for

connections greater than 25mm.

1.5 Wastewater

Disposal Rates

A

targeted rate for wastewater disposal, set under section 16 of the Act, of:

· $397

per separately used or inhabited part of a residential rating unit which is

connected to a public wastewater drain.

· $397

per rating unit for all other rating units which are connected to a public

wastewater drain.

· $397

per pan (i.e. water closet or urinal) for all pans in excess of three for

non-residential rating units connected to a public wastewater drain.

· $198.50

per separately used or inhabited part of a residential rating unit which is not

connected to a public wastewater drain but which is serviceable (i.e. within 30

metres of such a drain) and the Council would allow the connection.

· $198.50

per rating unit for all other rating units which are not connected to a public

wastewater drain but which is serviceable (i.e. within 30 metres of such a

drain) and the Council would allow the connection.

1.6 Rubbish

and Recycling Rates

1.6.1 Kerbside Recycling

A

targeted rate for kerbside recycling set under section 16 of the Act of:

· $188 per separately

used or inhabited part of a rating unit for residential properties receiving

the Council’s kerbside collection service.

· $188 per rating unit

for non-residential and rural/semi-serviced properties receiving the

Council’s kerbside collection service.

Where

ratepayers elect, and the Council agrees, additional levels of service may be

provided. These additional services could be by way of provision of more

recycling bins or more frequent service. Each additional level of service

will be charged a rate of $188. This may include charges to non-rateable

rating units where the service is provided.

1.6.2 Rubbish and Public Recycling

A

targeted rate for rubbish and public recycling set under section 16 of the Act

of $69 per separately used or inhabited part of each residential rating unit

and $69 per rating unit for all other rating units. Rating units which

are vacant land will not be liable for these rates.

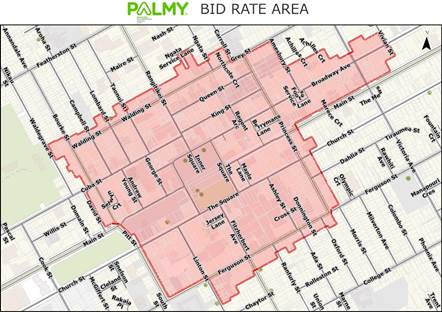

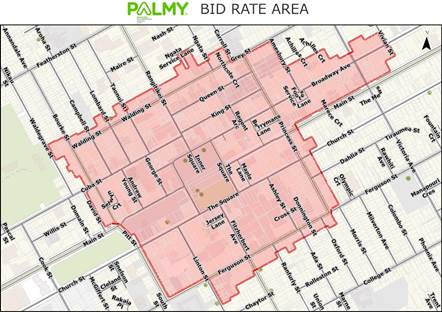

1.7 Palmy BID

Targeted

rates set under section 16 of the Act on all properties within the central city

Palmy BID area as shown on the following map that are categorised as

non-residential for the Council’s general rate calculated as follows:

· A fixed amount of

$345 per rating unit; and

· A variable amount of 0.0137 cents in

the dollar of capital value of the rating unit.

2. Due

Dates for Payment of Rates

Rates (other than metered water

targeted rates) will be payable at the offices or agencies of the Council in

four quarterly instalments on 1 August 2025, 1 November 2025, 1 February 2026

and 1 May 2026.

The due dates (i.e. final day for

payment without incurring penalty) shall be:

Instalment

One 29 August 2025

Instalment

Two 28 November

2025

Instalment

Three 27 February 2026

Instalment Four 29

May 2026

3. Due

Dates for Payment of Metered Water Targeted Rates

Properties which have water provided

through a metered supply will be invoiced either monthly or two monthly at the

discretion of the Council.

The due date for metered water

targeted rates shall be the 20th of the month following invoice date

as follows:

|

Monthly invoicing

|

|

Instalment

|

Date meter read &

invoice issued

|

Due date

|

Instalment

|

Date meter read &

invoice issued

|

Due date

|

|

1

2

3

4

5

6

|

June 2025

July 2025

August 2025

September 2025

October 2025

November 2025

|

20 July 2025

20 August 2025

20 September 2025

20 October 2025

20 November 2025

20 December 2025

|

7

8

9

10

11

12

|

December 2025

January 2026

February 2026

March 2026

April 2026

May 2026

|

20 January 2026

20 February 2026

20 March 2026

20 April 2026

20 May 2026

20 June 2026

|

|

Two monthly invoicing

|

|

Linton, East & North

Rounds

|

Ashhurst, South West,

PNCC & Central Rounds

|

|

Instalment

|

Date meter read &

invoice issued

|

Due date

|

Instalment

|

Date meter read &

invoice issued

|

Due date

|

|

1

2

3

4

5

6

|

June 2025

August 2025

October 2025

December 2025

February 2026

April 2026

|

20 July 2025

20 September 2025

20 November 2025

20 January 2026

20 March 2026

20 May 2026

|

1

2

3

4

5

6

|

July 2025

September 2025

November 2025

January 2026

March 2026

May 2026

|

20 August 2025

20 October 2025

20 December 2025

20 February 2026

20 April 2026

20 June 2026

|

4. Penalties

on Unpaid Rates (excluding metered water)

A penalty charge of 10% will be added

on the following dates to any portion of an instalment remaining unpaid after

the due dates:

Instalment

One 3 September

2025

Instalment

Two 3 December 2025

Instalment

Three 4 March 2026

Instalment Four 3

June 2026

Any penalty charge imposed on the

outstanding first instalment will be automatically remitted provided payment of

the full year’s rates is made by 28 November 2025.

A penalty charge of 10% will be added

to any outstanding rates (including penalties) assessed in previous years and

remaining outstanding at 3 July 2025 (penalty applied on 4 July 2025) and again

on 5 January 2026 (penalty applied on 6 January 2026).

Penalties will not be applied to the

metered water targeted rate.

4 June 2025

Notice of Motion

TO: Council

MEETING DATE: 25

June 2025

TITLE: Notice

of Motion: Inclusion of the city centre in the scope of the draft Speed

Management Plan

FROM: Councillor

Brent Barrett

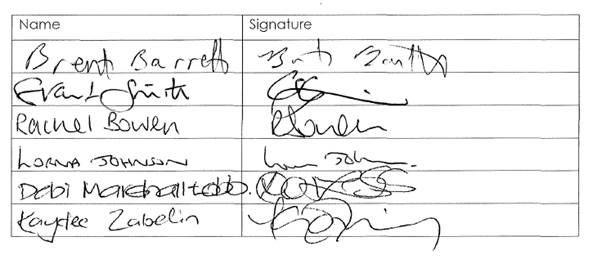

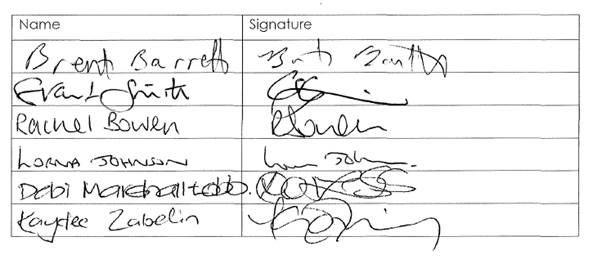

THAT THE Council Resolves:

1. That Council

confirm that the scope of the draft Speed Management Plan 2025 (stage 1)

will include the city centre.

I, Brent Barrett, in accordance

with Standing Order 2.7.1. hereby GIVE NOTICE OF

MOTION that I will move at the

next Council meeting on 25 June 2025 the following

motion:

That Council confirm that the

scope of the draft Speed Management Plan 2025 (stage 1) will include the city

centre.

AND I further give notice that in

compliance with Standing Order 2.7.2 the reasons for the Notice of Motion

include:

Reviewing city centre speed limits

will deliver substantial benefits for the city centre as a desired destination,

enhance its live-work-play attractiveness, make it more pedestrian and bike

friendly, support city centre businesses, increase road safety, improve traffic

flow, and deliver cost-efficiencies; contributing directly to the performance

and potential of our city centre.

Only 12 elected members

participated in the initial decision on the member's recommendation at the

Strategy & Finance Committee meeting of 28 May 2025. The meeting was

divided with a 6 - 6 vote. Bringing this motion to full Council gives all

elected members the opportunity to

participate in the decision.

Noting that under Standing Order

2.25.1, "when a motion has been considered and rejected by the Council or

a committee, no similar notice of motion which, in the opinion of the

Chairperson, may be accepted within the next six months, unless signed by not

less than one third of all members, including vacancies. "

More than one third of elected

members have signed below to request that Council

reconsider the motion, which

failed for lack of majority at the Strategy and Finance

Committee meeting of 28 May 2025.

Moved Cr Brent Barrett

Seconded Mayor Grant Smith.

Attachments

|

1.

|

Officer's

Advice on Notice of Motion - Scope of Speed Management Plan ⇩

|

|

TO: Council

MEETING DATE: 25

June 2025

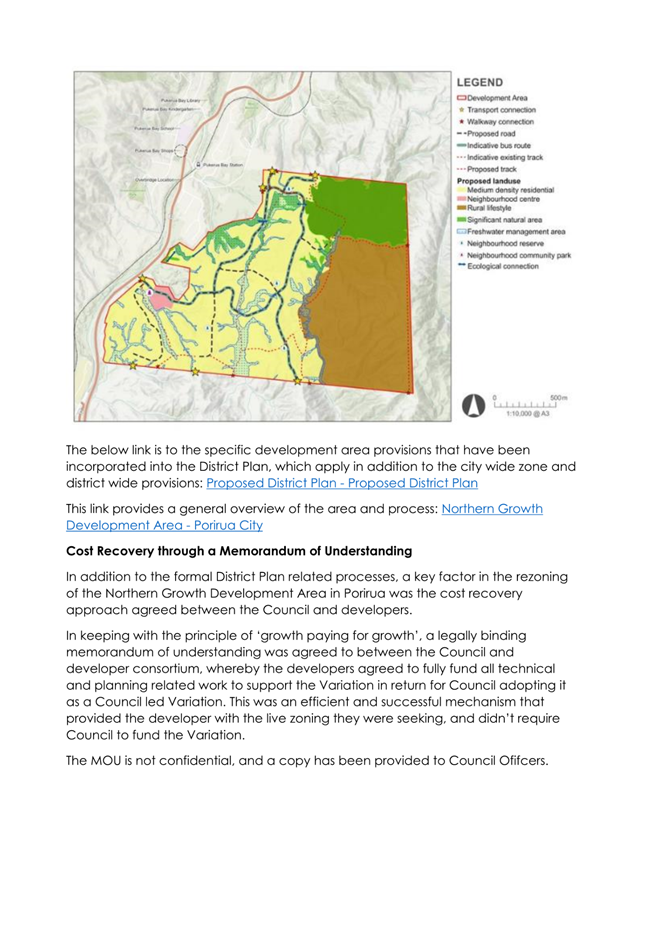

TITLE: Kākātangiata

Urban Growth Area: Update and Next Steps

PRESENTED BY: Jono

Ferguson-Pye, Manager City Planning, Stewart McKenzie, Consultant Planning

Advisor

APPROVED BY: David

Murphy, General Manager Strategic Planning

RECOMMENDATION(S)

TO Council

1. That the

Chief Executive prepare a District Plan change to zone the

Kākātangiata Residential Growth Area identified in Map 9.2 of the

Palmerston North City District Plan to Future Urban Zone (Option 4).

Summary of options analysis

|

Problem

or Opportunity

|

Kākātangiata

rezoning options

|

|

OPTION 1:

|

Rezone Kākātangiata to Residential using

existing resources and budget allocated in 2024/34 LTP (current approach).

|

|

Community Views

|

Will be heard through

the plan change submission and hearing process.

|

|

Benefits

|

Conventional and well

understood, uses existing technical inputs, is consistent with landowner and

developer expectations.

|

|

Risks

|

Complex process,

programme delay, landowner and developer frustration at not advancing land

supply in the medium term.

|

|

Financial

|

High costs borne by

ratepayers to date, existing budget not sufficient to fund process.

|

|

OPTION 2:

|

Rezone Kākātangiata to Residential with

increased budget 2025/26 -2026/27

|

|

Community Views

|

Will be heard through

the plan change submission and hearing process.

|

|

Benefits

|

Conventional and well

understood, uses existing technical inputs, consistent with landowner and

developer expectations, may deliver land supply in the medium term.

|

|

Risks

|

Complex process,

unlikely to resolve programme delay, landowner and developer frustration at

not advancing land supply over the medium term.

|

|

Financial

|

Higher costs borne by

ratepayers. Additional budget not provided in 2025/26 Annual Budget. Would

require reprioritizing existing work programme in 2025/26 and additional

budget in 2026/27. Reassess progress and budgets as part of 2027 LTP. This

option will require more budget in years 2 and 3 of the 2024 LTP than option

3.

|

|

OPTION 3:

|

Rezone

Kākātangiata to Residential with increased budget 2025/26 -2029/30

|

|

Community Views

|

Will be heard through

the plan change submission and hearing process.

|

|

Benefits

|

Conventional and well

understood, uses existing technical inputs, consistent with landowner and

developer expectations, delivers land supply in the medium term but over a

longer timeframe.

|

|

Risks

|

Complex process,

unlikely to resolve programme delay, landowner and developer frustration at

not advancing land supply over the medium term.

|

|

Financial

|

Higher costs borne by

ratepayers, but spread over longer timeframe. Additional budget not provided

in 2025/26 Annual Budget. Would require reprioritizing existing work

programme in 2025/26 and additional budget in 2026/27. Reassess progress and

budget as part of 2027 LTP. This option spreads the costs of a longer time

period than option 2.

|

|

OPTION 4:

|

Rezone

Kākātangiata to Future Urban Zone using existing budget allocations

for 2025/26 and 2026/27

|

|

Community Views

|

Will be heard through

the plan change submission and hearing process.

|

|

Benefits

|

Nationally standardised

best practice, a realistic and manageable two-step pathway for rezoning,

protects land from inappropriate development, an integrated and flexible

planning approach, and enables cost sharing.

|

|

Risks

|

Untested approach to

greenfield planning for the city, not fully understood or accepted by

landowners / developers, resistance to cost sharing, an additional step to

‘live’ zoning, may not deliver all the urban form and function

outcomes of Options 1, 2 and 3.

|

|

Financial

|

Uses existing 2024-34

LTP budgets (Y1: $204k and Y2: $261) to progress step 1. Developers fund step

2 ‘live’ zoning via private or Council led plan changes. Reassess

progress and budgets as part of 2027 LTP.

|

|

OPTION 5:

|

Rely on Private Plan

Changes to rezone Kākātangiata to Residential

|

|

Community Views

|

Will be heard through

the plan change submission and hearing process.

|

|

Benefits

|

Conventional and well

understood, flexibility for landowners / developers to progress when they are

ready.

|

|

Risks

|

Complex / inefficient

process, poorly coordinated and fragmented land development, less Council

control, difficult to co-ordinate infrastructure funding and delivery when

needed.

|

|

Financial

|

Costs covered by

landowners / developers. Growth paying for growth.

|

Rationale for the recommendations

1. Overview of the problem or opportunity

1.1 The

rezoning of the Kākātangiata Urban Growth Area

(Kākātangiata) from Rural to a range of urban zones (Residential,

Local Business and Recreation) to enable development has been difficult to

progress since 2010. The rezoning process to date has relied on conventional

planning methods which have proven complex, costly and inefficient resulting in

significant delays. Apart from the Kikiwhenua Residential Area, the bulk of the

land identified in Map 9.2 of the District Plan has yet to be rezoned. These

issues have been exacerbated by:

- The 2010-11

Christchurch earthquakes and the need to more fully understand liquefaction

risk and cost-effective mitigation responses;

- The number of

landowners and stakeholders involved and their competing interests;

- The

increasing scale of the land area over time;

- The adoption

of PNITI by the NZTA Waka Kotahi board in 2021 and subsequent discussion

regarding the alignment of the Manawatu Regional Freight Ring Road (MRFRR); and

- The decision

of the 2024/34 LTP not to fund supporting infrastructure for

Kākātangiata.

1.2 The

issues experienced with rezoning Kākātangiata are not unusual for

greenfield development of this scale, and they are commonly experienced by many

councils across the country.

1.3 The

time, costs and complexity associated with rezoning land is one of the drivers

of the Government’s plan to replace the RMA 1991. Regardless of what

planning and resource management legislation is in place, the rezoning of land

at this scale will be a complex process.

2. Background and previous council decisions

Residential Growth Strategy

2.1 In

2010 Council adopted the Residential Growth Strategy which identified City West

(later named Kākātangiata) and Whakarongo as preferred areas for

future residential development.

2.2 In

response to the 2010-11 Christchurch earthquakes, the Residential Growth

Strategy was amended in 2012. The amendment prioritised the zoning of

Whakarongo and delayed the rezoning of Kākātangiata until further

information was known about how best to address liquefaction risk in

Kākātangiata.

2.3 The

2018 LTP process also identified the need to provide greater guidance and

additional residential land at Aokautere. District Plan Change G was developed

in response to this direction and is nearing completion. The outstanding appeal

on Plan Change G is scheduled for an Environment Court hearing in August 2025.

District Plan Work Programme

2011-2020

2.4 While

the implications of liquefaction risk to urban development were being

investigated across the country post the 2010-11 Christchurch earthquakes, Council

commenced its Sectional District Plan Review (SDPR). Preparation of the SDPR

commenced in 2011 and was completed in December 2018. SDPR Plan Change 15A

reviewed the Rural Zone in 2014-15 and inserted Map 9.2, City West –

Potential Residential Growth Area (see Attachment 1).

2.5 Post

the Whakarongo Residential Area becoming operative in the District Plan in 2015

and the completion of the SDPR in 2018, work began understanding the resource

management challenges associated with Kākātangiata. The Kikiwhenua

Residential Area was rezoned in 2020 as stage 1 of Kākātangiata. This

plan change area was identified as the extent or urban growth that could be

delivered without significant investment in water and wastewater

infrastructure.

Scaling up of Land Area and

Yield

2.6 The

original extent of Kākātangiata (see Attachment 1 and Area 1

in Attachment 2) was initially bounded by:

- State Highway

56 (Pioneer Highway) (SH56), Longburn-Rongotea Road and No 1 Line (Tremaine

Avenue); and

- Land south of

SH56 between the Mangaone Stream and Te Wanaka Road and land between Te Wanaka

Road and Sheriffs Road.

2.7 The

2019 HBA identified a shortage of greenfield land to meet projected demand for

housing in the medium to long term and noted additional land needed to be

identified for long-term housing growth.[2]

In response, the extent of Kākātangiata has changed over time to

respond to a projected shortfall of greenfield land over the long-term as

follows (see Attachment 2):

1. November

2015: 306 ha

2. March

2020: 693

ha

3. March

2021: 797

ha

4. May

2021: 842

ha

2.8 The

scale of Kākātangiata has increased significantly since 2015, growing

from 306ha to 842ha (see Attachment 3). However, the conventional

planning response has struggled to grapple with the increased complexity

associated with the increased scale of Kākātangiata.

Previous Work

2.9 Significant

work has been undertaken to support rezoning Kākātangiata for urban

development in recent years, including:

· High-level

support in the Housing and Business Needs Assessment (HBA) and Future

Development Strategy (2019-2024);

· A

detailed master planning exercise to determine the potential spatial extent,

scale, and form of urban development and other features (2022) (see Attachment

4);

· Comprehensive

technical studies and reports covering transport, ecology, flood risk,

liquefaction, contamination, economics and other key matters (2019-2025);

· Development

of a Cultural Values Assessment with Rangitāne (2020-2021);

· Council

led consultation processes (2020-2021); and

· Strong

developer and landowner interest in urban development.

As a result of this work the urban development potential of

Kākātangiata is well understood.

Resetting the Key Assumptions for

Kākātangiata

2.10 As

discussed in the City Planning Priorities and 3-Year Work Programme report

presented to the 14 August 2024 Strategy and Finance Committee, staff have been

in the process of resetting some of the key assumptions sitting behind

Kākātangiata. The reset looked at:

- The

funding and financing options available to support growth at

Kākātangiata in light of changes to LTP funding assumptions for

greenfield growth.

- Understanding

how available funding and financing options will shape the planning framework

needed to enable development.

- Reviewing

the extent of the proposed zone considering increased scale between 2015-2021

and the future alignment of the Manawatu Regional Freight Ring Road (MRFRR).

- Reviewing

the extent of the proposed area that Council may want to rezone, and what

portion could be left to the market to advance private plan change

applications.

- Reviewing

the extent of control exerted through the District Plan via master planning and

associated design controls.

- Assessing

what procurement model is best placed to deliver the plan change in a timely

manner given the size and scale of the zoning proposal.

Reset Planning Response: Future

Urban Zone

2.11 The

Future Urban Zone (FUZ) is a planning tool established by the National Planning

Standards that can be applied to rural land that has been identified as being

suitable for urban development. It has three purposes:

1. It formally acknowledges

the future urban development potential of greenfield areas in the District

Plan, both spatially and through legally binding planning provisions;

2. It protects greenfield

areas identified for urban development from inappropriate and ad hoc

development such as rural residential subdivision and other incompatible land

uses that may compromise the future development potential of the land; and

3. It establishes a clear

process and framework for rezoning based on prescribed structure plan

requirements and development area provisions, which also provide flexibility in

the timing, location and scale of urban development.

2.12 The FUZ

can be more generally described as a ‘holding zone’ where land can

continue to be used for a range of rural activities, and subdivision and urban

development is discouraged until a structure plan is prepared and the land

rezoned. Structure planning helps achieve an optimal type, form and extent of

urban development, and demonstrates how future development can be adequately

serviced by infrastructure.

2.13 This

approach introduces a three-step process for rezoning:

Step 1: The FUZ – introduces a

high-level structure plan and planning provisions that articulate the broad

resource management outcomes being sought for the whole of the growth area (the

extent being that shown in Map 9.2 of the District Plan).

Step 2: Private Plan Changes:

involves private plan change requests that use the FUZ to inform a more

detailed and fleshed out structure plan and planning provisions. Private plan

changes respond to and enable the site-specific needs of development while ensuring

the broad growth area outcomes articulated in the FUZ for the whole growth area

are achieved.

Step 3: Council initiated Plan Changes

for any residual land not rezoned via Private Plan Changes: The

final stage of rezoning that is likely to address smaller land holdings and /

or areas with multiple owners that are not addressed via Step 2.

2.14 The FUZ

proposal leverages off all previous work meaning existing Council and developer

investment in enabling the future development of Kākātangiata will not

be lost.

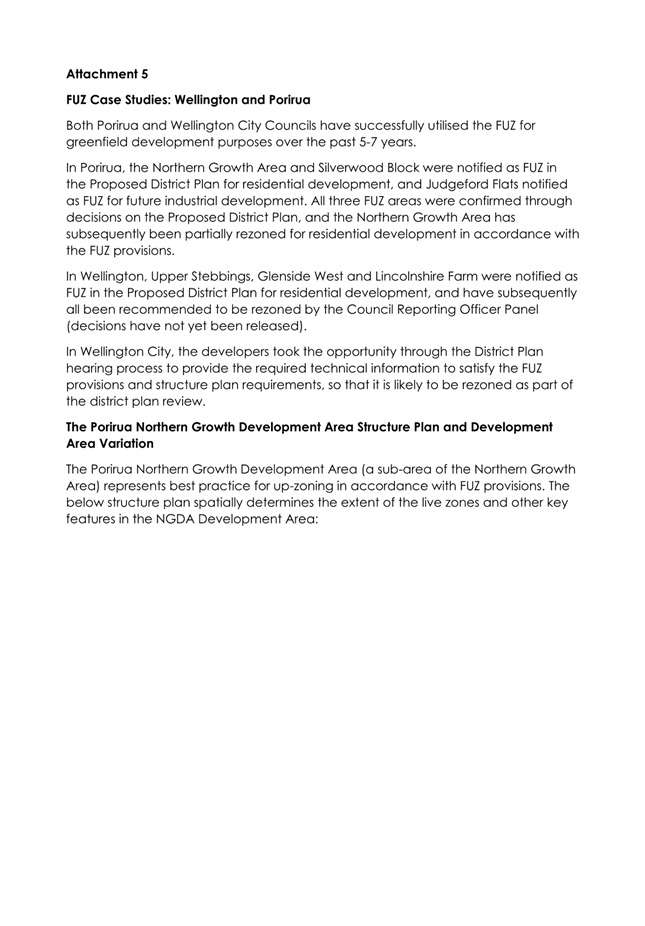

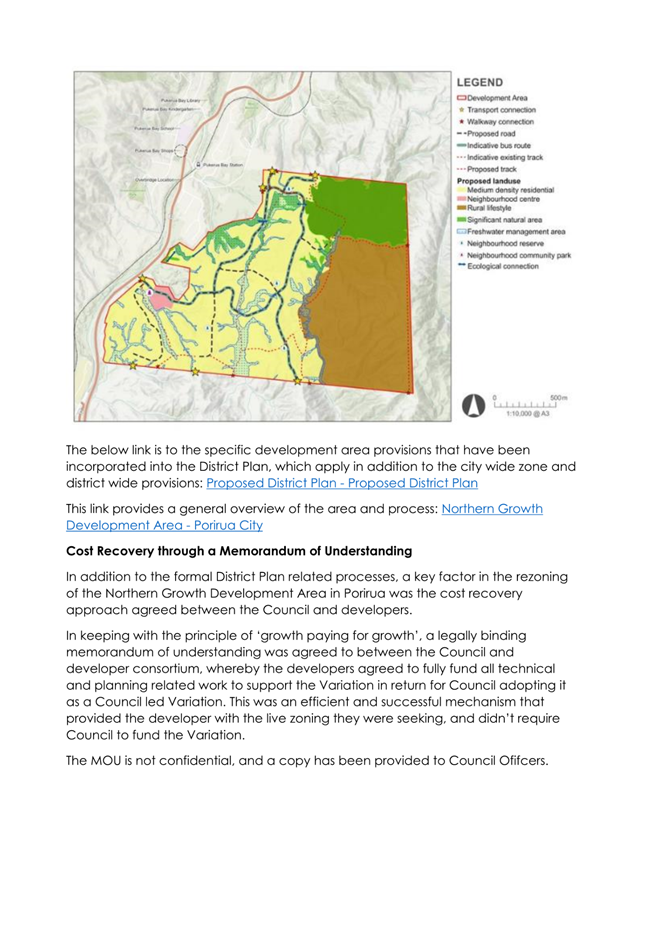

2.15 Case

studies of how the FUZ has been successfully used to enable urban development

in the Wellington Region are provided in Attachment 5.

2.16 Scaling

Down Kākātangiata: the proposed reset of Kākātangiata

includes reducing the extent of the land area proposed for rezoning to FUZ to

make the process more manageable and enable timely land supply. It is proposed

the extent of the FUZ will cover the area shown as Area 1 in Attachment 2.

Area 1 aligns with Map 9.2, City West – Potential Residential Growth Area

shown in Attachment 1.

2.17 Areas 2-4,

shown in Attachment 2, will sit outside the proposed FUZ and are

proposed to be treated as follows:

Area 2b (located north west of the Main Trunk

Railway Line (MTRL), including the Manderson Block):

o Will

remain identified in the FDS for residential development via private plan

change requests (700 lots).

Areas 2, 3 and 4 (located to the west of Longburn

Rongotea Road and Shirriffs Road, and south of Area 1):

o The

land’s suitability for future residential development will be

re-evaluated in the next review of the FDS in late 2025/26. If the indicative

business case for the MRFRR identifies Longburn Rongotea Road and or Shirriffs

Road as part of the preferred future alignment, residential development on both

sides of the road alignment may undermine the suitability and operational

efficiency of this planned strategic freight route.

2.18 Limited

Resource, Reliance on Private Plan Changes and Shifting Cost: the cost of

developing a coordinated planning framework to support development of a further

1000 lots at Aokautere cost approximately $2.2m over the period 2018-2024.

While $2.2M is a significant cost, it equates to $2,200 per lot to establish a

robust planning framework for the entire neighbourhood. To date, Council has

spent $214,000 in 2025/26 responding to an appeal on the Aokautere plan change.

These costs have been borne solely by Council.

2.19 The cost

of the Aokautere Plan Change G (PC G) was driven in-part by the level of

control and certainty over the planning outcomes sought by Council. The

planning approach for PC G reflected the long history of compliance issues in

this part of the city, poor urban form outcomes under the previous District

Plan and the desire of Council to ‘complete’ the establishment of a

neighbourhood at Aokautere.

2.20 While

Council have commissioned a suite of technical reports since 2019 to support

the rezoning of Kākātangiata, a significant amount of additional

spend is required to fully develop a plan change ready for public notification

under the RMA. The LTP has budgeted $204k and $261K in years 2 and 3 to develop

the Kākātangiata District Plan Change. When looking at the scale of

Kākātangiata and then considering the cost of developing the smaller

Aokautere plan change, the year 2 and 3 budget will not be sufficient to

progress a plan change to rezone the area to residential.

2.21 The FUZ

will not provide the same level of Council control over urban form and function

outcomes as PC G. However, the cost, complexity, and time associated with

delivering a plan change similar in nature to PC G, of the scale proposed in

Kākātangiata, will be costly and time consuming.

2.22 Private

plan changes will have to respond to and deliver on the key urban form and

function outcomes articulated in the FUZ but will not provide Council with as

much control over planning outcomes as current zoning approaches at Aokautere

and Roxburgh Crescent.

2.23 Given the

current restrained fiscal environment, the FUZ provides a level of control that

balances the maximization of planning outcomes while minimising cost. Given

current LTP settings, the City Planning Team does not have the level of

resource to manage Kākātangiata in the same manner as Aokautere.

2.24 Balancing

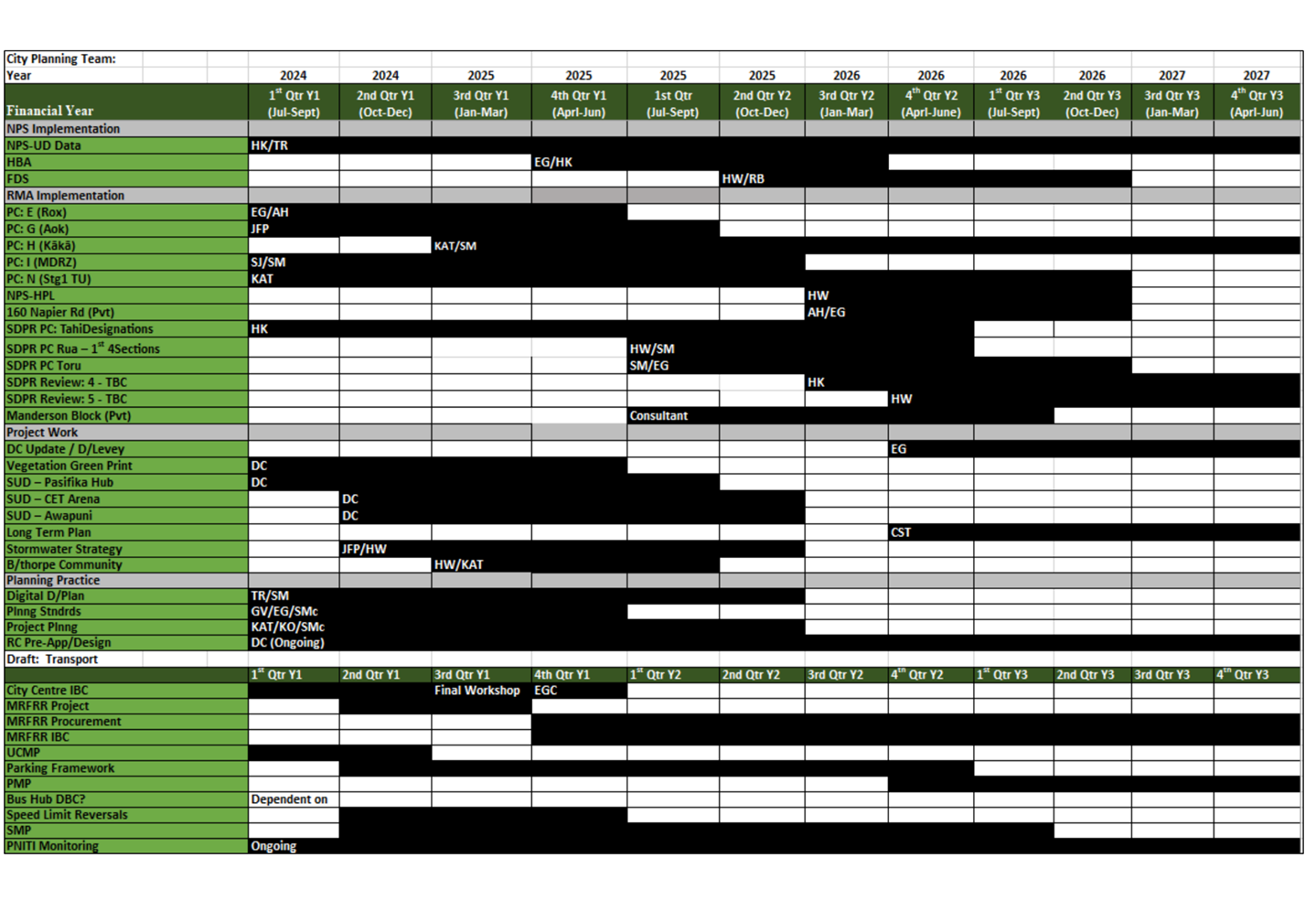

3 Year Work Programme Priorities – the City Planning Team’s 3

-year work programme is extensive. Alongside zoning land to provide for growth

(Aokautere, Roxburgh Crescent, Plan Change I and Kākātangiata), the

team has reinitiated the Sectional District Plan Review (SDPR). It is now well

over 10 years since key parts of the District Plan were reviewed and parts of

the Plan are no longer fit for purpose (see Attachment 6, 3 Year Work

Programme).

2.25 The

proposed approach to the FUZ will free up resource to assist the City Planning

Team to meet Council’s statutory obligation to review the District Plan

while meeting obligations to plan for residential growth under the National

Policy Statement for Urban Development (NPS-UD).

2.26 Relationship

of FUZ Process with Pending Private Plan Change Requests – staff are

working with and advising several developers in the wider

Kākātangiata Urban Growth Area who are at various stages of

developing private plan change requests. A proposed private plan change in Area

2b, (see Attachment 2), for approximately 700 homes, is expected to be

lodged in the second half of this year. This private plan change request will

not affect the rezoning of the scaled down Kākātangiata area to FUZ.

2.27 A number

of developers are exploring the potential to lodge private plan change requests

within the proposed FUZ area. Staff are considering options to progress the FUZ

in parallel with these private plan change proposals in a way that aligns

outcomes. Discussions are under way with the relevant developers to assess

whether the FUZ and private plan changes can be developed concurrently and

possibly notified together as a coordinated package.

2.28 Relationship

of FUZ Process with the pending replacement of the Resource Management Act 1991

– The exact nature, timing and implications of the replacement of the RMA

1991 remains uncertain. Whatever happens, the new legislation is likely to

involve a long transition period. The existing provisions of the District Plan,

including the FUZ, will have a significant influence on any new regional or

sub-regional planning document produced under the new legislation. It is also

anticipated that the existing National Planning Standards will continue to have

a role under the new legislation, including the FUZ.

3. Description of options

3.1 The

recommendation to proceed with a FUZ for Kākātangiata has been based

on an assessment of 5 options. These are described below:

Option 1: Rezone Kākātangiata to Residential

using existing resources and budget allocated in 2024/34 LTP (current approach)

– continuing with the current approach to rezoning

Kākātangiata using existing resources and budget allocated in the

2024 – 34 LTP.

Option 2: Rezone Kākātangiata to Residential

with increased budget 2025/26 - 2026/27 – continuing with the current

approach to rezoning Kākātangiata, but with reprioritised budget in

year 2 and additional budget in year 3 of the 2024-34 LTP. Reassess

progress and budget as part of the 2027 LTP. This option will require larger

budgets in years 2 and 3 of the 2024 LTP than option 3.

Option 3: Rezone Kākātangiata to Residential

with increased budget 2025/26 - 2029/30 – continuing with the current

approach to rezoning Kākātangiata, but with reprioritized budget in

year 2 and additional budget in year 3 of the 2024-34 LTP. Reassess progress

and budget as part of the 2027 LTP. This option spreads the costs of a longer

time period than option 2.

Option 4: Rezone Kākātangiata to Future Urban

Zone using existing budget allocations for 2025/26 and 2026/27 –

establishes a clear process and framework for rezoning based on prescribed

structure plan requirements and development area provisions.

Option 5: Rely on Private Plan Changes to rezone Kākātangiata

to Residential – relies on landowners and developers coming forward

individually with private plan changes to facilitate development.

3.2 The

benefits and risks associated with these five options have been assessed and

summarised in Section.

4. options Analysis for rezoning of

kākātangiata

|

|

Kākātangiata

rezoning analysis

|

|

OPTION 1:

|

Rezone

Kākātangiata to Residential using existing resources and budget

allocated in 2024/34 LTP (current approach)

|

|

Community Views

|

- Previous

plan changes have been notified with limited community opposition.

- General

acceptance of the need for greenfield urban growth through the FDS.

|

|

Benefits

|

- Conventional

and well understood planning process.

- Significant

existing investment by Council in this approach.

- Expectation

of developers and landowners that is approach will continue.

- High

level of Council control over planning outcomes.

|

|

Risks

|

- Complex,

unwieldy and inefficient process (cost and time).

- Significant

programme delays experienced with no land yet rezoned.

- Landowner

and developer frustration at delays.

- Private

plan changes initiated ahead of Council zoning process.

- Not

helping to meet the City’s housing and business needs in the short to

medium term.

- Private

plan change requests progressing ahead of Council process.

- National

Policy Statement – Highly Productive Land

|

|

Financial

|

- High

costs borne by ratepayers to date.

- Budget

allocated in LTP not sufficient to cover the cost of a full plan change.

|

|

OPTION 2:

|

Rezone

Kākātangiata to Residential with increased budget 2025/26 - 2026/27

|

|

Community Views

|

- As

per option 1.

|

|

Benefits

|

- As

per Option 1.

- Additional

budget allocated could assist with delivery.

|

|

Risks

|

- Unlikely

to resolve the programme delays currently being experienced.

- Landowner

and developer frustration at delays likely to continue.

- Unlikely

to help meet the City’s housing and business needs in the short to

medium term.

- Private

plan change requests progressing ahead of Council process.

- National

Policy Statement – Highly Productive Land

|

|

Financial

|

- Higher

costs to be borne by ratepayers than the current approach.

- Current

budget allocated in the LTP insufficient to cover the cost of a full plan

change. Approximate cost $2m.

- Will

require reprioritization of year 2 budget and additional budget in year 3.

- Will

require larger budget in years 2 and 3 than option 3

- Progress

and budgets reassessed as part of 2027 LTP.

|

|

OPTION 3:

|

Option

3: Rezone Kākātangiata to Residential with increased budget 2025/26

- 2029/30

|

|

Community Views

|

- As

per Option 1.

|

|

Benefits

|

- As

per Options 1 and 2.

|

|

Risks

|

- As

per Option 2.

|

|

Financial

|

- As

per Option 2 but costs spread over longer time period.

- Will

require reprioritization of year 2 budget and additional budget in year 3

- Progress

and budget reassessed as part of 2027 LTP.

|

|

OPTION 4:

|

Rezone Kākātangiata

to Future Urban Zone using existing budget allocations for 2025/26 and

2026/27

|

|

Community Views

|

- General

acceptance of the need for greenfield urban growth through the FDS.

|

|

Benefits

|

- A

nationally standardised best practice approach to greenfield urban

development.

- Provides

a realistic and manageable two-step pathway for rezoning.

- Protects

land from inappropriate subdivision and land use which may compromise future

development potential.

- Structure

plan guidance and development area planning provisions provide integration

and flexibility in the spatial extent, timing and form of urban development.

- Provides

statutory weight to national, regional and city-wide strategic development

objectives.

- Ability

to enter in cost-sharing arrangements in accordance with the principle of

‘growth paying for growth’.

|

|

Risks

|

- An

untested approach to greenfield urban planning in Palmerston North.

- May

not be fully understood or accepted by landowners and developers.

- Resistance

to cost-share agreements by landowners and developers.

- Additional

steps required for rezoning.

- Private

plan change requests progressing ahead of Council process.

- Less

Council control over planning outcomes than Options 1, 2 and 3, but more

control than Option 5.

- National

Policy Statement – Highly Productive Land

|

|

Financial

|

- Lower

cost compared to residential plan change (Options 1, 2 and 3), and within

existing LTP budget.

- Cost

recovery or cost-share agreements for full rezoning can be entered into.

|

|

Option 5:

|

Rely on Private Plan

Changes to rezone Kākātangiata to Residential

|

|

Community Views

|

- Previous

plan changes have been notified with limited community opposition.

- General

acceptance of the need for greenfield urban growth through the FDS.

|

|

Benefits

|

- Conventional

and well understood planning process.

- Provides

flexibility to landowners and developers to progress with rezoning when they

are ready.

- Costs

covered by landowners and developers.

|

|

Risks

|

- Complex

and inefficient process (cost and time).

- Likely

to result in poorly co-ordinated and fragmented land development.

- Less

Council control and direction leading to greater risk of sub-optimal

development outcomes.

- Difficult

to predict and co-ordinate private plan changes with infrastructure funding

and delivery.

- National

Policy Statement – Highly Productive Land

- Lack

of leadership on core Council function

|

|

Financial

|

- Costs

predominately borne by landowners and developers.

- Agreements

for cost recovery or coast share agreements for Council can be entered into.

|

5. Rationale for recommending a future urban zone

5.1 The

FUZ is considered the best option for rezoning the Kākātangiata Urban

Growth Area because it provides a manageable, structured and nationally

standardised approach to urban development.

5.2 Unlike

previous methods, which have proven complex, inefficient and resulted in

significant delays, the FUZ enables a more streamlined and predictable planning

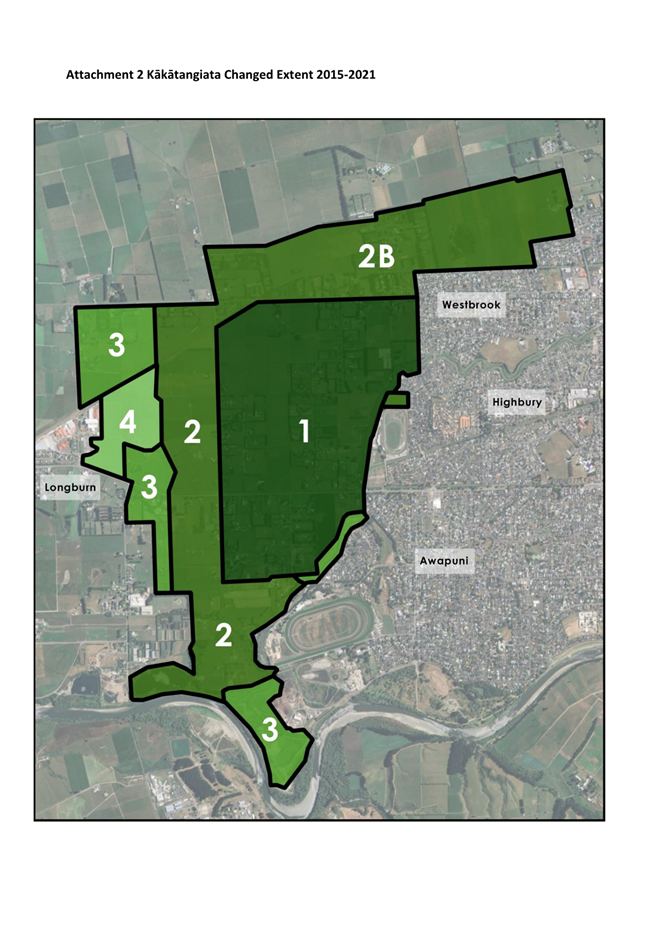

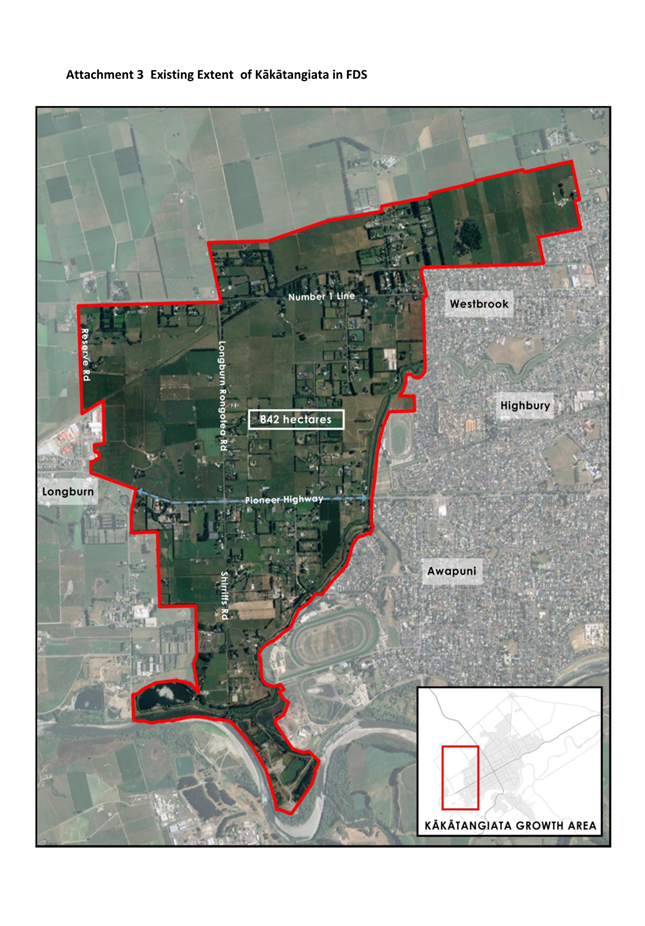

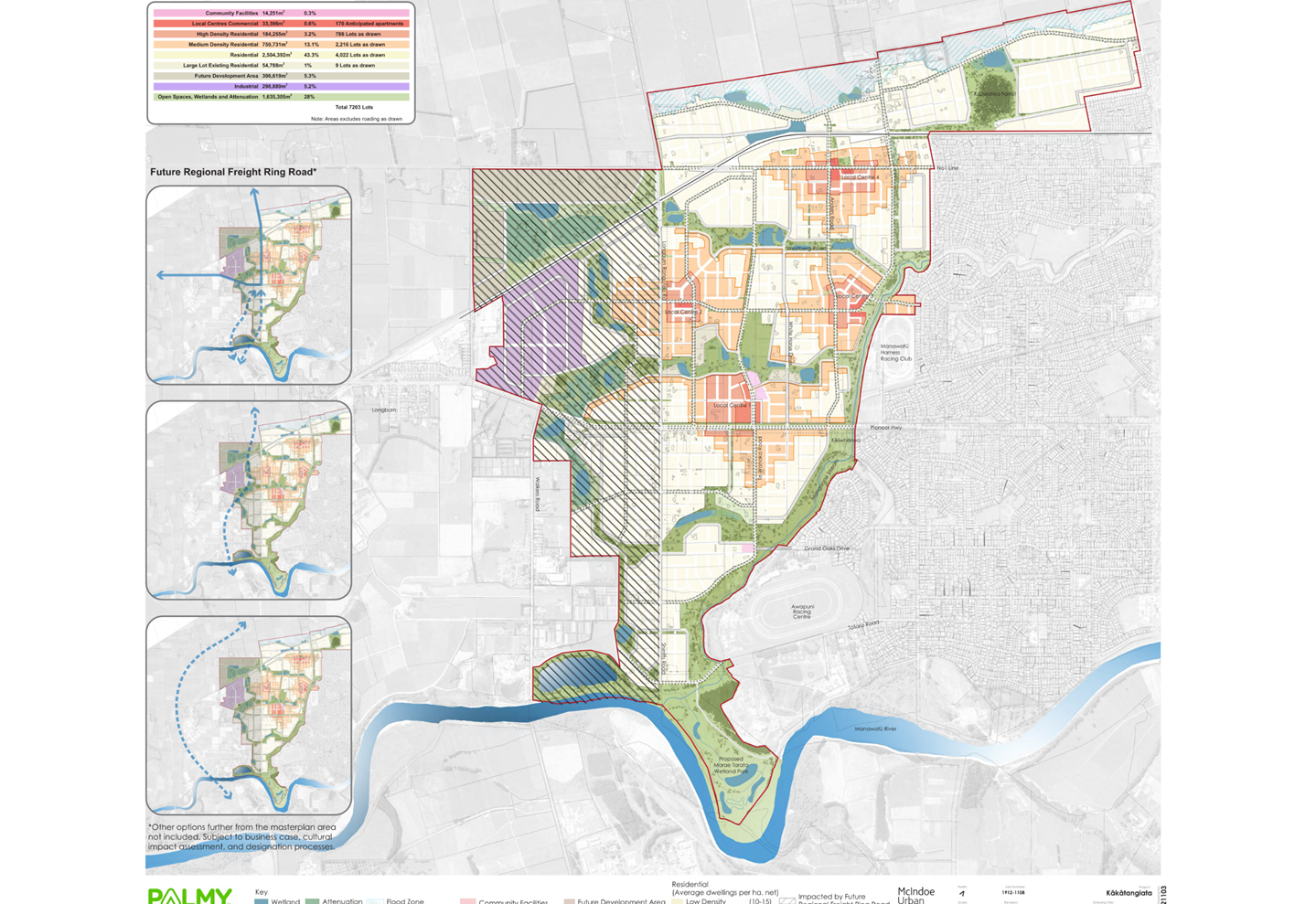

pathway. It protects the area from inappropriate rural subdivision and other