Economic Growth Committee

|

Leonie Hapeta (Chair)

|

|

William Wood (Deputy Chair)

|

|

Grant Smith (The Mayor)

|

|

Mark Arnott

|

Lorna Johnson

|

|

Brent Barrett

|

Debi Marshall-Lobb

|

|

Rachel Bowen

|

Billy Meehan

|

|

Vaughan Dennison

|

Orphée Mickalad

|

|

Roly Fitzgerald

|

|

Economic Growth Committee

MEETING

12 April 2023

Order of Business

1. Apologies

2. Notification

of Additional Items

Pursuant to Sections 46A(7) and

46A(7A) of the Local Government Official Information and Meetings Act 1987, to

receive the Chairperson’s explanation that specified item(s), which do

not appear on the Agenda of this meeting and/or the meeting to be held with the

public excluded, will be discussed.

Any additions in accordance with

Section 46A(7) must be approved by resolution with an explanation as to why

they cannot be delayed until a future meeting.

Any additions in accordance with

Section 46A(7A) may be received or referred to a subsequent meeting for further

discussion. No resolution, decision or recommendation can be made in

respect of a minor item.

3. Declarations

of Interest (if any)

Members are reminded of their duty

to give a general notice of any interest of items to be considered on this

agenda and the need to declare these interests.

4. Public

Comment

To receive comments from members of

the public on matters specified on this Agenda or, if time permits, on other

Committee matters.

(NOTE: If

the Committee wishes to consider or discuss any issue raised that is not

specified on the Agenda, other than to receive the comment made or refer it to

the Chief Executive, then a resolution will need to be made in accordance with

clause 2 above.)

5. Confirmation

of Minutes Page 7

“That the minutes of the

Economic Growth Committee meeting of 22 February 2023 Part I Public be

confirmed as a true and correct record.”

6. Palmerston

North Airport Limited - Interim Report for 6 months to 31 December 2022 Page 13

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

7. Palmerston

North Airport Limited - Draft Statement of Intent for 2023/24 to 2025/26 Page 31

Memorandum, presented by Steve

Paterson, Strategy Manager - Finance.

8. Central

Economic Development Agency (CEDA): Six-Month Report 1 July to 31 December 2022

and Draft Statement of Intent 2023-24 Page 65

Memorandum, presented by David

Murphy, Chief Planning Officer.

9. College

Street and Botanical Road Intersection Page 163

Report, presented by Hamish

Featonby, Group Manager - Transport and Development.

10. Vogel Street Safety

Improvements Page 175

Memorandum, presented by Hamish

Featonby, Group Manager - Transport and Development.

11. Palmerston North

Quarterly Economic Update - March 2023 Page 183

Memorandum, presented by Stacey

Bell - City Economist.

12. 6-monthly report on

International Relations and Education Activities Page

205

Memorandum, presented by

Gabrielle Loga, International Relations Manager.

13. Work Schedule -

April 2023 Page 223

14. Exclusion of Public

|

|

To be moved:

“That the public

be excluded from the following parts of the proceedings of this meeting

listed in the table below.

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under Section 48(1) of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under Section 48(1) for

passing this resolution

|

|

|

|

|

|

|

|

|

|

This resolution is made in reliance on Section 48(1)(a) of the

Local Government Official Information and Meetings Act 1987 and the

particular interest or interests protected by Section 6 or Section 7 of that

Act which would be prejudiced by the holding of the whole or the relevant

part of the proceedings of the meeting in public as stated in the above

table.

Also that the

persons listed below be permitted to remain after the public has been

excluded for the reasons stated.

[Add Third

Parties], because of their knowledge and ability to assist the

meeting in speaking to their report/s [or other matters as specified] and

answering questions, noting that such person/s will be present at the meeting

only for the items that relate to their respective report/s [or matters as

specified].

|

Palmerston North City Council

Minutes of

the Economic Growth Committee Meeting Part I Public, held in the Council

Chamber, First Floor, Civic Administration Building, 32 The Square, Palmerston

North on 22 February 2023, commencing at 9.00am.

|

Members

Present:

|

Councillor William Wood (in the Chair),

The Mayor (Grant Smith) and Councillors Mark Arnott, Brent Barrett, Rachel

Bowen, Vaughan Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb,

Billy Meehan and Orphée Mickalad.

|

|

Non Members:

|

Councillors Lew Findlay, Patrick

Handcock, Karen Naylor and Kaydee Zabelin.

|

|

Apologies:

|

Councillor Leonie Hapeta.

|

Councillors Lew

Findlay and Debi Marshall-Lobb left the meeting at 12.04pm. They were not

present for clauses 7 and 8.

|

|

Karakia

Tīmatanga

|

|

|

Councillor

Fitzgerald opened the meeting with karakia.

|

|

1-23

|

Apologies

|

|

|

Moved William Wood, seconded Grant Smith.

The

COMMITTEE RESOLVED

1. That

the Committee receive the apologies.

|

|

|

Clause 1-23 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and

Councillors William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

|

2-23

|

Public

Comment

|

|

|

Rob

Campbell, Chief Executive of Palmy Bid spoke on the following items.

· Current economic

conditions, particularly the effect of inflation on small business owners.

· Urged Council to

continue to have an Investment mindset and not to shrink investment in the

city.

Regarding Transport Strategies and Plans:

· Palmy Bid is

supportive of transport strategies that encourage access to city centre for

all modes of transport.

· Supports buses

using outer ring road, and an on-demand bus system.

· Wishes to work

with Council to investigate the design and location of the Main St Bus

terminal and any review of the car parking strategy.

|

|

|

Moved William Wood, seconded Grant Smith.

The

COMMITTEE RESOLVED

1.

That the Committee receive the public comment for information.

|

|

|

Clause 2-23 above was carried 15 votes to 0, the voting being as

follows:

For:

The Mayor (Grant Smith) and

Councillors William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

|

3-23

|

Presentation - Central Economic Development Agency

Presentation, by Jerry

Shearman CEO and Bobby McFee, Chair of the Board.

Jerry outlined CEDA’s

strategic projects and updated the Committee on progress. He discussed -

Te Utanganui –

Central NZ distribution hub – wide support around the region

for this key logistics hub.

Manawatū Food

Strategy – developing sustainability practices and

innovation in food production. Focused on getting it adopted as a

regional strategy.

Manawatū Destination

Management Plan – launched the new Manawatū Version 2.0

visitor promotion. Focused on encouraging sustainable tourism practices.

Te Āpiti

Manawatū Gorge Master Plan – deciding on a catalyst

project.

Profiling the region –

ongoing work to promote the region as a great place to do business.

|

|

|

Moved

William Wood, seconded Grant Smith.

The COMMITTEE RESOLVED

1. That the Committee receive the presentation for

information.

|

|

|

Clause 3-23 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

Reports

|

4-23

|

Summary report on the Palmerston North economic structure

Memorandum, presented by

Stacey Bell - City Economist.

|

|

|

Moved

William Wood, seconded Grant Smith.

The COMMITTEE RESOLVED

1. That the

Committee receive the report titled ‘Summary report on the Palmerston

North economic structure’ of 22 February 2023 presented to the Economic

Growth Committee.

|

|

|

Clause 4-23 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

|

5-23

|

Palmerston North Strategic Transport Networks

Memorandum, presented by

Vinuka Nanayakkara, Senior Transport Planner.

The meeting adjourned at 10.28am

The meeting resumed at 11.00am

Following

concerns that members had not received enough time to consider the Plan, the

Mayor moved a procedural motion to lie the report on the table so that the

Strategic Transport Networks Plan could be workshopped with Elected Members.

|

|

|

Moved

Grant Smith, seconded Patrick Handcock.

The COMMITTEE RESOLVED

1. That the Palmerston North Strategic Transport

Networks Plan be laid on the table for further socialising and workshopping

with Elected Members.

|

|

|

Clause 5-23 above was

carried 9 votes to 6, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors William Wood, Mark Arnott, Roly Fitzgerald, Debi Marshall-Lobb,

Billy Meehan, Orphée Mickalad, Lew Findlay and Patrick Handcock.

Against:

Councillors Brent Barrett,

Rachel Bowen, Vaughan Dennison, Lorna Johnson, Karen Naylor and Kaydee

Zabelin.

|

|

6-23

|

Process and options to establish and enforce heavy

vehicle routes

Memorandum, presented by

Vinuka Nanayakkara, Senior Transport Planner; Peter Ridge, Senior Policy

Analyst and Chris Lai, Activity Manager – Transport.

|

|

|

Moved

William Wood, seconded Grant Smith.

The COMMITTEE RESOLVED

1. That the

Committee receive the memorandum titled ‘Process and options to

establish and enforce heavy vehicle routes’ of 22 February 2023 to

the Economic Growth Committee.

|

|

|

Clause 6-23 above was

carried 15 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Roly Fitzgerald, Lorna Johnson, Debi Marshall-Lobb, Billy Meehan,

Orphée Mickalad, Lew Findlay, Patrick Handcock, Karen Naylor and

Kaydee Zabelin.

|

The meeting adjourned 12.04pm.

The meeting resumed at 1.04pm.

Councillors Debi Marshall-Lobb and Lew Findlay were

not present when the meeting resumed.

|

7-23

|

Main Street Cycleway - Permanent Solution Decision

Report, presented by Chris

Lai - Activity Manager Transport and Bryce Hosking, Acting Chief Infrastructure

Officer.

Officers

corrected the following errors in the report; -

· the total cost

for Option 1 is $650K not $750K.

· the

Officer’s recommendation should read “retain the existing …

temporary cycleway” not “retain the existing … shared

pathway”

|

|

|

Moved

Lorna Johnson, seconded Orphée Mickalad.

The COMMITTEE RECOMMENDS

1. That

Council endorse Option 1: Retain the existing Pioneer Highway temporary

cycleway infrastructure until it reaches the end of its useful life and

replace it and progress the remaining pieces as a permanent solution to

create a complete and safe cycleway along that route.

|

|

|

Clause 7-23 above was

carried 9 votes to 4, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors Brent Barrett, Rachel Bowen, Roly Fitzgerald, Lorna Johnson,

Billy Meehan, Orphée Mickalad, Patrick Handcock and Kaydee Zabelin.

Against:

Councillors William Wood,

Mark Arnott, Vaughan Dennison and Karen Naylor.

|

|

8-23

|

Work Schedule - February 2023

|

|

|

Moved

William Wood, seconded Patrick Handcock.

The COMMITTEE RESOLVED

1. That

the Economic Growth Committee receive its work schedule dated February 2023.

|

|

|

Clause 8-23 above was

carried 13 votes to 0, the voting being as follows:

For:

The Mayor (Grant Smith) and

Councillors William Wood, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan

Dennison, Roly Fitzgerald, Lorna Johnson, Billy Meehan, Orphée

Mickalad, Patrick Handcock, Karen Naylor and Kaydee Zabelin.

|

|

|

Karakia

Whakamutunga

|

|

|

Councillor

Fitzgerald ended the meeting with karakia.

|

The meeting finished at 1.43pm.

Confirmed 12 April 2023

Chair

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 12

April 2023

TITLE: Palmerston

North Airport Limited - Interim Report for 6 months to 31 December 2022

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Cameron

McKay, Chief Financial Officer

RECOMMENDATION TO Economic Growth Committee

1. That the

Committee receive the Interim Report and Financial Statements of Palmerston

North Airport Ltd for the period ended 31 December 2022, presented to the

Committee on 12 April 2023.

1. ISSUE

Palmerston North Airport Ltd

(PNAL), as a Council-Controlled Organisation, is required to provide a

6-monthly report to Council. The report for the period ending 31 December

2022 is attached.

2. BACKGROUND

PNAL’s draft Statement of

Intent (SOI) for 2022/23 was considered by Council in March 2022 and the final

SOI was agreed to by Council in June 2022.

Performance for the six-month

period to 31 December 2022 is covered in the attached report by the Chair and

Chief Executive.

It’s pleasing to see the

recording of growth in passenger numbers and in net revenue relative to the

conservative assumptions in the SOI.

In July 2022 PNAL made first

use of the debt facility made available by the Council. $5m was raised by

the Council from the Local Government Funding Agency and on-lent to PNAL.

This arrangement was agreed to by the Council as a means of assisting PNAL (as

a 100% subsidiary of the Council) to obtain funding at the best possible

interest rates.

As earlier agreed with Council

no dividend has been paid in relation to the 2021/22 year.

PNAL has prepared its draft SOI

for the 2023/24 year and this is being considered under a separate report.

3. NEXT STEPS

PNAL will prepare and forward

an annual report after 30 June 2023.

4. Compliance and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the achievement of action/actions in Transport

The action is: Work with the

airport company to ensure the airport’s strategic intent aligns with

the City’s aspirations

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

This report outlines progress

to date.

|

|

|

|

Attachments

|

1.

|

PNAL - Interim Report to 31 December 2022 ⇩

|

|

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 12

April 2023

TITLE: Palmerston

North Airport Limited - Draft Statement of Intent for 2023/24 to 2025/26

Presented By: Steve

Paterson, Strategy Manager - Finance

APPROVED BY: Cameron

McKay, Chief Financial Officer

RECOMMENDATIONS TO

Economic Growth Committee

1. That the

Committee receive the Palmerston North Airport Ltd (PNAL) draft Statement of

Intent for 2023/24 to 2025/26, presented to the Economic Growth Committee on 12

April 2023.

2. That Palmerston

North Airport Limited be advised:

a. Council supports

the proposed direction and implementation strategy;

b. Council suggests

the target for tangible net worth be increased from $50m to $80m;

c. Council

recognises the projected requirement for loans totalling $31.7m by 30 June 2024

and that Palmerston North Airport Limited will be seeking to

utilise the loan facility provided by the Council to fund a significant portion

of this.

1. ISSUE

To present and provide comment

on the draft Statement of Intent for Palmerston North Airport Ltd (PNAL) for

2023/24 and the following two years.

2. BACKGROUND

2.1 Introduction

PNAL is deemed a Council-Controlled

Trading Organisation (CCTO) under the Local Government Act 2002. A CCTO

must deliver a draft Statement of Intent (SOI) to shareholders by 1 March each

year and adopt it by 30 June. The Council must, as soon as possible after

a draft SOI is delivered to it, agree to a CCTO’s SOI or, if it does not

agree, take all practicable steps under clause 6 of Schedule 8 of the Local

Government Act 2002 to require the SOI to be modified. The Board of the

CCTO must consider any shareholder feedback by 1 May.

The Council’s reason for

its shareholding in PNAL is to ensure that the capacity and image of the

City’s key transportation gateway is consistent with the Council’s

economic development objectives.

As a CCTO PNAL is required under the Local Government Act

2002 to have the following principal objective:

· Achieve the

objectives of its shareholders, both commercial and non-commercial, as

specified in the Statement of Intent; and

· Be a good

employer; and

· Exhibit a sense of

social and environmental responsibility by having regard to the interests of

the community in which it operates and by endeavouring to accommodate or

encourage these when able to do so; and

· Conduct

its affairs in accordance with sound business practice.

The Council’s

shareholding represents 100% of the issued and paid-up capital.

On 16 November 2022 the Council

adopted a Statement of Expectations for PNAL and this was provided to PNAL in

advance of its development of the draft SOI.

2.2 Draft

SOI - overview

Attached is a letter

from PNAL to shareholders explaining the enclosed draft SOI and

outlining the key assumptions.

The draft SOI retains the

vision from the current year ‘New Zealand’s leading regional

airport’ and the purpose statement ‘Launching our communities into

a promising future’ as well as the five strategic objectives.

The SOI addresses all of the

matters outlined in Council’s Statement of Expectations.

It has been assumed there will

be a gradual recovery of passenger numbers to 654,000 p.a. by 2025/26 but the

ongoing uncertainty is noted.

The key

capital-intensive focus is planned to be on:

· Continued

reinvestment in landside and airside infrastructure

· Continuous

improvement in the customer experience with the commencement of the terminal

redevelopment

The three-year budgets assume

capital development (totalling $52m; including terminal ($40m) and Ruapehu

Aeropark and Airport Drive ($5.8m) and critical infrastructure of $4.38m) will

be able to be accomplished by PNAL with additional borrowing (of $42m) but

without the need for additional share capital.

It is signalled, however, that

funding constraints may limit what is able to be achieved in the way of income

diversification. PNAL is actively working with other parties to find ways

of funding the capital investment required.

Shareholders’ funds as a

percentage of total assets are forecast to reduce to 66% in the first year and

57% through the three-year term of the SOI. This is still well above the

expectation that it will remain over 40%.

2.3 Draft

SOI – Performance targets

The following financial

performance targets are included in the Draft SOI:

|

|

Draft SOI

2023/24

Budget

|

Forecast

2022/23

|

SOI

2022/23

Budget

|

|

NPBIT:

Total assets

|

4%

|

5%

|

3%

|

|

NPAIT:

Shareholders’ funds

|

2%

|

3%

|

1%

|

|

Shareholders’

funds: Total assets (>40%)

|

66%

|

76%

|

69%

|

|

Interest

cover (>2.5)

|

4.6

|

9.1

|

4.9

|

|

Tangible

Net Worth (>$50m)

|

$87.0m

|

$85.2m

|

$69.7m

|

|

Total

debt

|

$31.7m

|

$14.3m

|

$23.2m

|

|

Debt

to Equity ratio

|

36%

|

17%

|

|

|

Net

Debt*/EBIDA (< 4.5)

|

5.5

|

2.7

|

6.9

|

|

Funds

from Operations (FFO**)/Net Debt (long term target > 11%)

|

12.1%

|

27.2%

|

10%

|

|

Dividends

- % of NPAT

|

Nil

|

Nil

|

Nil

|

*Net Debt = total

borrowings less cash on hand

**FFO = EBIDA less

interest less tax

There are non-financial

measures of performance for each of the strategic areas – compliance,

customer, community, culture and commercial.

Examples include:

· Various compliance

requirements including CAA part 139 recertification

· Maintaining a

customer satisfaction Net Promoter score of 45 or above (increased from the

previous 30)

· Serving 581,000

passengers during the 2023/24 year increasing to 637,000 for the following year

and 654,000 in the June 2026 year

· Zero lost time

injuries to those who work within the airport community

· Achieving Airport

Carbon Accreditation level 4 and implementing several specific initiatives

Completion of physical works:

· terminal

development (detailed design by June 2024 and construction by June 2026)

· carpark cover

installation and infrastructure/technology updates (June 2024)

· Zone D warehouses

complete (June 2024 assuming partner secured by June 2023)

The target that PNAL’s tangible net worth (i.e. total

tangible assets after revaluations less total liabilities) be greater than $50m

needs updating as it is meaningless as it is. The tangible net worth increases

through reinvestment of annual surpluses and from revaluation of assets. The

actual net tangible worth has increased as follows over recent years:

|

As at

|

Tangible Net

Worth $m

|

|

30 June 2016

30 June 2017

30 June 2018

30 June 2019

30 June 2020

30 June 2021

30 June 2022

|

49.8

59.6

60.7

67.5

67.1

68.3

83.0

|

The net tangible worth performance target became out of date

and was last increased from $35m to $50m in 2018.

The draft SOI estimates the

tangible net worth will be between $85m and $90m over the period from 2023 to

2026. Staff recommend the target be increased to something more like what

PNAL is currently worth (say $80m) as the expectation going forward is this

will continue to grow.

2.4 Draft

SOI – Dividend policy

Council’s Letter of

Expectation outlined the expectation that:

“PNAL is required to

have a commitment to retaining and growing long-term shareholder value. Council

recognises that shareholder value accretion occurs through PNAL’s

on-going and significant investment in critical infrastructure including the

terminal development to improve the customer experience and to facilitate

sustainable growth in passenger and airfreight volumes, and investment in the

development of Ruapehu Business Park which will provide income diversification

and value accretion benefits. This is partly reflected in the on-going

delivery of dividends to the shareholder.

Council further recognises

that given the on-going impacts of Covid-19 on the aviation industry

PNAL’s ability to preserve cash and to continue to invest in the long

term means dividend payments have been suspended in the short-term.

Council has however an expectation that dividend payments will be progressively

re-instated within the next two years and that the implications of this will be

addressed annually through the SOI.”

The draft SOI contains the

following dividend policy:

“PNAL is focused on

delivering against strategic objectives as outlined in this Statement of

Intent. The achievement of these strategies will ensure PNAL is well placed in

the medium to long term to generate enhanced financial returns and maximise

value to our Shareholder through an appropriate balance between regional social

and economic outcomes, re-investment and dividends.

In total over $52 million of

capital expenditure is projected to be undertaken over the three-year SOI

period. The level of investment is unprecedented in PNAL’s history

with the Terminal Development Project (TDP) alone anticipated to cost $40

million. The company’s financial performance is projected to improve,

however with debt at historical highs the gearing risks assumed to achieve

strategic objectives is high. Given debt levels and the Shareholder

expectations the Airport company must actively seek like-minded investment

partners who can support the commercial development priorities outlined within

Ruapehu Aeropark and Te Utanganui.

In this context the Airport

company’s focus on prudent cashflow management remains as critical as it

did during the Covid-19 pandemic. Any divided declaration must therefore

carefully consider actual and projected performance. In establishing a

dividend recommendation, the directors will consider;

1. The scale of

the company’s capital expenditure plans including shareholder

expectations,

2. The

company’s financial performance including cashflows from operations,

3. The

company’s ability to raise debt finance and the term thereof,

4. Compliance

with performance metric targets,

5. The

risks associated with airline schedule uncertainty in the short to medium term.

Reflecting the above criteria, and the Shareholder

expectation that dividends are progressively re-instated, an indicative

dividend has been included in the third year of the FY24-FY26 SOI, payable in

FY27. The Airport company will however review its ability to declare this

dividend in subsequent SOIs.”

Council’s 10 Year Plan

2021-31 assumes there will be no dividend payable for the time being and also

assumes the Council will not be required to make any further capital injections

during that time. The Council’s Annual Budget for the 2022/23 year

assumes there will be no dividend payable in relation to the 2021/22 year and

the draft of the 2023/24 Annual Budget assumes there will be no dividend

payable in relation to the 2022/23 year.

Directors of companies have an

obligation to undertake appropriate solvency tests each year before declaring a

dividend. A dividend in any year is therefore subject to successfully

completing this test.

Prior to the outbreak of

Covid-19 the Council was prepared to consider the suspension of dividend

payments for a period to support the planned capital development. The proposed

dividend policy is consistent with this and the indication given in the

Statement of Expectation.

2.5 Draft

SOI – Debt funding

The Council and PNAL have

entered a loan facility agreement that involves the Council borrowing from the

Local Government Funding Agency and on-lending to PNAL in an effort to reduce

the interest expense for PNAL. The intention of the agreement is that the

Statement of Intent is a mechanism for determining the maximum facility

agreement in any given year.

To date $5m has been raised and

on-lent under the terms of the facility. The draft SOI forecasts term

liabilities increasing to $53.9m over the coming three years (up to $31.7m in

year one) and that revenue will be adequate to service this level of debt

assuming interest payable by them at rates of up to 6.5%. Whilst some of

the term liabilities will reflect utilisation of PNAL’s facility with its

Bank it is anticipated that a significant portion of the increased debt will be

obtained through the facility provided by the Council.

The basis of the loan

arrangement is that the PNAL borrowing will not impact on the Council’s

ability to borrow for other Council funded capital expenditure. This

relies on LGFA being prepared to treat the loan advance from the Council to

PNAL as an asset that it will net off against the related borrowing. It

is important PNAL‘s assessment of its ability to service the debt is

robust and it is acknowledged there are many assumptions involved and

there are potential risks.

PNAL believe the terminal

development plan is fundamental to protecting the future of the City’s

airport business.

3. NEXT STEPS

The Council can either endorse

the SOI as presented or make suggestions for change to a greater or lesser

extent.

4. Compliance and administration

|

Does the Committee have

delegated authority to decide?

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current Annual

Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the achievement of action/actions in Transport

The action is: Work with the

airport company to ensure the airport’s strategic intent aligns with

the City’s aspirations

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The draft Statement of Intent

includes a direction and specific actions that are designed to continue to

improve the airport for customers and stimulate growth.

|

|

|

|

Attachments

|

1.

|

Draft Statement of Intent cover letter from PNAL 2023 ⇩

|

|

|

2.

|

Draft Statement of Intent 2023/24 -2025/26 ⇩

|

|

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 12

April 2023

TITLE: Central

Economic Development Agency (CEDA): Six-Month Report 1 July to 31 December 2022

and Draft Statement of Intent 2023-24

Presented By: David

Murphy, Chief Planning Officer

APPROVED BY: David

Murphy, Chief Planning Officer

RECOMMENDATIONS TO

Economic Growth Committee

1. That the

Committee receive the Central Economic Development Agency (CEDA) Six-Month

Report 1 July to 31 December 2022 (Attachment 1).

2. That the

Committee receive the Central Economic Development Agency (CEDA) draft

Statement of Intent 2023-24 (Attachment 3).

3. That the

Committee agree that the recommended comments on the draft Statement of Intent

2023–24 outlined in Table 1 be advised to the Central Economic

Development Agency (CEDA).

1. ISSUE

1.1 The

Central Economic Development Agency (CEDA) has delivered its six-month report 1

July to 31 December 2022 and draft Statement of Intent (SOI) 2023-24. This

report includes analysis of both documents, which are attached to this

memorandum.

1.2 Under

the Local Government Act 2002 (LGA), when preparing the final SOI, a Council

Controlled Organisation (CCO) must consider any comments made on the draft by

the Council prior to delivering a final SOI by 30 June 2023.

1.3 The

Economic Growth Committee has the delegation to receive the performance report

and agree the Statement of Intent for Te Manawa on Council’s behalf.

1.4 The

purpose of this report is to receive the CEDA six-month report 1 July to 31

December 2022 and provide an opportunity for Council to give feedback to the

CEDA on their draft SOI 2023-24.

1.5 As

a joint shareholder of CEDA with the Manawatu District Council (MDC), any

feedback to CEDA on their draft SOI 2023-24 should carefully consider any

implications for MDC and the views of MDC on the draft SOI 2023-24. The content

of this memorandum and comments on the draft SOI 2023-24 have been shared with

MDC.

2. BACKGROUND

2.1 CEDA

is a Council Controlled Organisation (CCO) under the LGA and is jointly owned

by PNCC and MDC. A CCO must deliver a draft SOI to PNCC and MDC each year and a

final SOI by 30 June 2023.

2.2 The

CEDA Board must consider any feedback from the shareholders before delivering a

final SOI for approval in June 2023.

2.3 The

Council is required by the LGA to regularly undertake performance monitoring of

its CCOs. Council is required to evaluate:

· The

contribution of each CCO to the Council’s objectives for the CCO;

· The

desired results set out in the SOI; and

· The

overall aims and outcomes of the Council based on the six-month reports.

3. six-month report 1 july to 31 december 2002

3.1 The

six-month report allows the Committee to track CEDA’s progress against

their SOI 2022/3.

3.2 A

copy of the six-month report is included as Attachment 1.

3.3 From

a contract-manager perspective, we have seen a renewed focus from CEDA in the

last 12-months to actively connect with partners and foster inward investment

opportunities that are aligned to the region’s strategic objectives. This

has been particularly evident with regards to the work completed on Te Utanganui,

Central New Zealand Distribution Hub, where projects of this nature require a

long-term commitment to relationships.

3.4 The

six-month report is based around the following three pillars:

· People

- Attract, retain, and develop talent in the region

· Business

- Attract, retain, and develop business and investment in the region

· Place

- Profile the region to attract people, business, and investment

3.5 Highlights

from CEDA’s six-month report include the following:

· People

- Attract, retain, and develop talent in the region:

o Workforce

development planning toolkit – 30 businesses registering

o Sustainability

toolkit for employers – launched online platform

o Freight

and Logistics Workforce planning group established

o Health

and School Transitions Workforce Plan established

o Health

Sector Accelerate Academy Programme – 50 to 90 students for each week of

the 12-week programme

· Business

- Attract, retain, and develop business and investment in the region:

o Te

Utanganui, Central New Zealand Distribution Hub – raising the profile,

regional advocacy and collateral development.

o Manawatū Food Strategy – due for completion by the end of June

o Investment opportunities supported – Soundsphere;

pharmaceutical company; commercial analysis for Safari Group; Te Āpiti

West Accomodation Hub

· Place

- Profile the region to attract people, business, and investment:

o Profiling

Manawatū’s regional identity – 12 content pieces

o 34

media features secured profiling the city and region – total reach of 33,401,364

o 29,712

social media followers – Palmy & Manawatū Facebook and

Manawatū_NZ Instagram.

3.6 CEDA’s

financial performance is detailed on pages 29 to 33 of the six-month report and

includes a $194,626 surplus for the six-months to 31 December 2022 (unaudited).

4. statement of expectation 2023/24

4.1 In

September 2022, the former Palmerston North City Council/Manawatū District

Council Joint Strategic Planning Committee agreed a new Statement of

Expectation (SOE) 2023/24 for CEDA, to assist them in preparing their draft

SOI. A copy of the SOE 2023/24 is included as Attachment 2.

4.2 The

SOE 2023/24 was largely a rollover from previous years and maintained a focus

on developing a talent pipeline (people); inward investment (business); and

domestic visitation (place).

4.3 There

is an opportunity for Council to work with Manawatū District Council to

complete a more comprehensive review the next SOE alongside the review of both

shareholders’ strategic priorities as part of the 2024 Long Term Plan.

4.4 Both

shareholders have also signalled a desire to move to a three-yearly SOE and

funding agreement from 2024/25 aligned to the 2024 Long Term Plan cycle, with a

letter exchange in the intervening years.

5. draft statement of intent 2023/24

5.1 A

copy of the draft SOI 2023/24 is included as Attachment 3.

5.2 CEDA

has presented a draft SOI that aligns with the SOE, as outlined in the table

below.

Table 1: Comparison of CEDA

SOI with the SOE

|

Statement of Expectation

|

CEDA

Draft SOI 2023/24

|

Comments

|

|

Taking a leadership position

and building strategic relationships in the Manawatū region and beyond,

is fundamental for CEDA to achieve its purpose.

The shareholders have

identified the following strategic partners for CEDA: Palmerston North City

Council, Manawatū District Council, Iwi, Manawatū Chamber of

Commerce, Talent Central, The Factory, and key central government agencies.

|

CEDA

has addressed strategic partners at page 18 of the SOE.

|

While

PNCC and MDC are not listed, it is implicit they are key strategic partners.

|

|

Stimulate inward investment

(both national and international), retention and expansion of business in the

Manawatū region, along with business recovery to COVID-19.

Developing a talent pipeline

Support Domestic Visitation

and tourism recovery post COVID-19.

|

CEDA

has addressed these outcomes via the three pillars, statement of intent

outcomes, projects, activities and strategies summarised on page 8.

|

No

comment. Good progress shown in the six-month report 1 July to 31 December

2022.

|

|

Top

Priorities for PNCC

Implementation

of the Central NZ Distribution Hub Strategy.

Support

advocacy on the Palmerston North Integrated Transport Investment project.

Stimulate

inward investment in Palmerston North city.

Continue

to stimulate visitor activity in Palmerston North city, in conjunction with

the PNCC marketing unit and MDC

|

CEDA

has addressed its work to support Te Utanganui, Central NZ Distribution Hub

at page 10.

Te

Utanganui, Central NZ Distribution Hub advocacy is addressed at page 10 but

does not explicitly reference the links to PNITI.

Inward

investment is addressed via pillar one (business) and the supporting

statement of intent outcomes, projects and activities summarised on page 8.

Visitor

activity is addressed via pillar three (place) and the supporting statement

of intent outcomes, projects and activities summarised on page 8.

|

CEDA

should explicitly address the key strategic connections between Te

Utangtanui, Central NZ Distribution Hub and PNITI.

|

|

Top priorities for MDC

Promotion and development of

key tourism and visitor destinations, including The Country Road tourism

route.

Stimulate inward investment for

Manawatū district.

Promote Manfeild as a

conference and events venue option

Deliver on the Regional

Identity implementation.

Identify

activities that help resolve labour shortages in the district.

|

Promotion and development of

key tourism and visitor destinations, including The Country Road tourism

route is addressed through Pillar one (business) Destination Management Plan

Progression, detailed on page 11 and performance measure page 26

Inward investment is

addressed via pillar one (business) and the supporting statement of intent

outcomes, projects and activities summarised on page 8 and performance

measure page 26

Promotion of Manfeild as a

conference and events venue option is not explicitly mentioned

Regional Identity is

addressed via pillar three (place), detailed on page 15 and performance

measures page 27

Identification

of activities to help resolve labour shortages are addressed via pillar two

(people), detailed on page 13, and performance measure page 26

|

Promotion/development

of key tourism and visitor destination priority:

· further develop

The Country Road tourism/ visitor business

· facilitate farm

diversification workshops to develop farm business offerings and farm stay,

home hosting options

· develop

clusters/hubs in the district to create visitor destination product i.e.

recent Makoura Lodge and Awastone visitor packages

Manfeild

promotion priority: CEDA advises that Manfeild is promoted via their

relationship with the Regional Conference Bureau (that sits within PNCC).

CEDA facilitates the relationship between Manfeild and the Bureau and

provides visitor destination package options for prospective Conference

managers

5.3 Regional

Identity priority: Note: regional Manawatū signage ready to be erected

|

|

Development of a Food

Strategy that addresses the total value chain from primary production,

farmers and growers to agri-business clusters, e.g. rural banks, real estate,

insurance, vets, sale yards, stock firms, grain & seed merchants,

agri-retail and rural tourism with a Manawatu District focus, through to

agri-tech & science, including supporting the Factory and Food HQ with

its aspirations.

|

CEDA

has addressed the Food Strategy at page 10 as part of the business pillar.

|

No

comment. Good progress shown in the six-month report 1 July to 31 December

2022.

|

|

CEDA’s success will be

measured by the shareholders using the following indicators of the health of

the regional economy:

· Job

growth

· Increase

in median household income

· Number

of investment leads and deals secured

· Strength

of the relationship with strategic partners

|

Addressed

in the performance measures (pages 26 and 27) and monitoring indicators on

page 30.

|

No

comment.

|

5.4 CEDA

has for the first time included explicit quantifiable outcomes for each of its

performance measures detailed on pages 26 and 27 of the draft SOI.

5.5 The

draft SOI addresses CEDA’s financial performance at pages 33 – 36

and includes a projected $78,611 deficit and total equity of $664,445 for

2023/24.

6. next steps

6.1 Provide

comments on the draft SOI in writing to CEDA, noting that any comments on the

draft SOI agreed by Council will need to be cognisant of what they mean for

Manawatū District Council as a joint shareholder.

6.2 CEDA

will deliver its final SOI to both councils (shareholders) in June 2022.

7. Compliance and administration

|

Does the Committee have

delegated authority to decide?

If Yes quote relevant clause(s)

from Delegations Manual

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

· The

recommendations contribute to the achievement of action/actions

in Economic Development

· The actions are:

· Agree a

Statement of Intent with CEDA

· Carry out

regular performance monitoring and reporting for CEDA

|

|

Contribution to strategic

direction and to social, economic, environmental and cultural well-being

|

The Innovative and Growing

Strategy includes the following:

Increasing economic wellbeing will depend on Council

working well with businesses, support agencies, central government and other

local authorities. The Central Economic Development Agency (CEDA) will

support business development and retention and will promote a diverse

economy. CEDA will focus on helping young people develop the skills they need

for the changing jobs market.

|

|

|

|

Attachments

|

1.

|

CEDA Six-Month Report 1 July to 31 December 2022 ⇩

|

|

|

2.

|

CEDA Statement of Expectation 2023/24 ⇩

|

|

|

3.

|

CEDA Draft Statement of Intent 2023/24 ⇩

|

|

TO: Economic

Growth Committee

MEETING DATE: 12

April 2023

TITLE: College

Street and Botanical Road Intersection

PRESENTED BY: Hamish

Featonby, Group Manager - Transport and Development

APPROVED BY: Bryce

Hosking, Group Manager - Property and Resource Recovery

RECOMMENDATIONS TO

Economic Growth Committee

1. That the Committee

refer an additional Capital New Programme of $120,000 to the 2023/24 Annual

Budget deliberations to enable the right turn infrastructure and phases change

work to be implemented at the College St/ Botanical Road intersection (Option

1).

2. That the

Committee refer the cycleway improvement work at the College Street/ Botanical

Road intersection for consideration to the 2024-34 Long Term Plan process

(Option 1).

Summary of options analysis

|

Problem

or Opportunity

|

In response to concerns

raised by members of the public relating to turning traffic and cyclists at

the Botanical Rd/ College St intersection, Council requested Officers

investigate safety improvement options for the intersection.

This report seeks direction

on the timing of when the work is to be implemented, if at all.

|

|

OPTION

1:

(Preferred

option)

|

Install

the right turn bays and phases in 2023/24

Defer

the cycleway work for consideration as part of the 2024-34 Long Term Plan

process.

|

|

Benefits

|

· The

right turn infrastructure and phases can be implemented in 2023/24 which will

resolve some of the safety concerns and will improve the safety of turning

traffic. Council Officers are comfortable that this can be implemented

alongside their existing workloads without impacting the delivery of other

programmes of work.

· The cycleway

infrastructure can be implemented in a coordinated way with any future

cycleway infrastructure along Botanical Road.

· The public will

feel that their submissions on the safety at this intersection were listened

to and that action is being taken to remedy these in a timely manner.

· Provides the

opportunity for Officers to apply for co-funding from Waka Kotahi for the

cycleway part of the project as part of the 3-year funding allocation

submission.

|

|

Risks

|

· Altering the

intersection will increase the delays experienced at the intersection,

especially in peak times.

· As the cycleway

infrastructure is being deferred to the LTP, no improvement to active

transport safety will be achieved in 2023/24.

|

|

Financial

|

· The

implementation of the right turn bays and phases is estimated to cost

$120,000.

· This work was

not planned for in 2023/24 and as such $120,000 capital new budget would need

to be included in the 2023/24 Annual Budget prior to its approval in June to

progress.

· The $120,000

right turn bay portion of the project is not co-funded from Waka Kotahi.

· The cycleway

infrastructure at the intersection is estimated to cost $500,000 and would be

considered as part of the 2024-34 LTP.

|

|

OPTION

2:

|

Make

no changes to the intersection.

|

|

Benefits

|

· No additional

financial commitment will be required in the 2023/24 Financial Year.

· There will be no

impact on the current wait times experienced at the intersection, maintaining

the current level of service in this respect.

|

|

Risks

|

· The public may

feel their submissions on the safety at this intersection were ignored.

· The safety

concerns raised for turning traffic and active transport users remains as it

is currently.

|

|

Financial

|

· None.

|

|

OPTION

3:

|

Refer

both the right turn and separated cycleway work for consideration as part of

the 2024-34 Long Term Plan.

|

|

Benefits

|

· The public may

feel disappointed any work to remedy their concerns raised in submissions

will be delayed from their initial expectations.

· The intersection

improvements can be considered in a coordinated way with any future cycleway

infrastructure along Botanical Road.

· No additional

financial commitment will be required in the 2023/24 Financial Year.

· There will be no

immediate impact on the current wait times experienced at the intersection,

maintaining the current level of service in this respect.

· Provides the

opportunity for Officers to apply for co-funding from Waka Kotahi for the

project as part of the 3-year funding allocation submission.

|

|

Risks

|

· The public may

feel that Council is not prioritising their safety concerns as these would

not be attended to for several years as they would be considered in the LTP.

· The safety

concerns raised for turning traffic and active transport users remains as it

is currently.

|

|

Financial

|

· No additional

financial commitment will be required in the 2023/24 Financial Year.

· The

implementation of the right turn bays and phases is estimated to cost

$120,000.

· The separated

cycleway is estimated to cost $500,000.

· Both expenses

would be considered as part of the 2024-34 Long Term Plan.

· Provides the

opportunity for Officers to apply for co-funding from Waka Kotahi for the

project as part of the 3-year funding allocation submission.

|

1. Overview of the problem or opportunity

1.1 Council

received several requests from the public as part of the 2022/23 Annual Plan

consultation which raised concerns about the safety of the intersection at

Botanical Road and College Street. Specific concerns were raised regarding

right turning of vehicles and active transport navigation through the

intersection.

1.2 Council

requested Officers investigate safety improvement options for the intersection

to address the concerns raised relating to turning traffic and cyclists.

1.3 Officers

have investigated safety improvements. This report updates Elected Members on

this work and seeks direction on the timing of when the work is to be

implemented, if at all.

2. Background- botanical Rd/ college St

intersection

2.1 Under

the PNCC Urban Cycle Network Master Plan 2019, both College Street and

Botanical Road are indicated as cycle routes. College Street currently has

buffered cycle lanes along its length, but the lanes terminate leading up to

the intersection as cyclists are expected to merge with traffic on approach.

Botanical Road currently has minimal markings along its length but is currently

not fit for purpose as a cycle route. Work is planned in future LTPs for a

separated cycleway on Botanical Road.

2.2 In

the 5-year period between 2018-2022, there have been eight recorded crashes at

the intersection. This involved one serious, one minor, and six non-injury

crashes. The one serious crash involved a pedestrian, and two of the crashes

involved vehicles turning right. This intersection has not registered as a high

priority under Road to Zero due to there being other intersections within our

road network that have ranked higher (this conclusion is based on road safety

reviews/planning between Council and Waka Kotahi Officers).

2.3 Near

to the intersection is a dairy and neighbouring shops on the North East

corners, West End School and Hilton Brown swimming pool on the South East

corner, as well as a childcare centre and Awatapu College nearby.

2.4 The

current layout of the intersection has right hand turning bays, straight

through and left turning combined bays and painted sections providing provision

for cyclists as per the image below. The intersection itself includes

painted turning bays but not the traffic light infrastructure to create a

prioritised right hand turning for cycles.

2.5 Whilst

Officers acknowledge that some members of the public may feel unsafe, it is

important to note that the incident data for the intersection is relatively low

compared to other intersections.

Current Intersection-

Botanical Rd/ College St

3. safety improvementS proposed

3.1 In

October 2022, Officers commissioned WSP to assess the current performance of

the intersection and model the impact on traffic wait times should certain

safety improvement works be implemented.

3.2 Several

scenarios were considered. Analysis included assessment of the potential

impacts on traffic flows.

3.3 A

summary of the WSP Report and the scenario investigations are attached as

Appendix 1.

3.4 After

considering the findings of the WSP report, Officers consider the best solution

to address the safety concerns is:

· Adding a right

turn bay and phases for all approaches to the intersection.

· Cycle

lanes extending to the intersection on all approaches including a phase for

cycling.

This is Scenario 5 in the WSP report.

4. timing of improvements

4.1 Given

the above, Council now has options around the timing of when the work is to be

implemented, if at all. Officers suggest there are three options to consider:

1. Add

the right turn infrastructure and phases in 2023/24 and defer the cycleway work

for consideration as part of the 2024-34 Long Term Plan process.

2. Make

no changes to the current situation.

3. Refer both the right

turn and separated cycleway work for consideration as part of the 2024-34 Long

Term Plan.

Option 1 - Install the right

turn infrastructure and phases in FY 2023/24 and defer the cycleway work for

consideration as part of the 2024-34 Long Term Plan process.

4.2 This

option allows the right turn bay and phases to be implemented in 2023/24,

resolving some of the safety concerns and will improve the safety of turning

traffic.

4.3 The

cycleway infrastructure can then be implemented in a coordinated way with any

future cycleway infrastructure along Botanical Road as it will be considered as

part of the 2024-34 Long Term Plan.

4.4 This

also provides the opportunity for Officers to apply for co-funding from Waka

Kotahi for the cycleway part of the project as part of the 3-year funding

allocation submission.

4.5 As

this work was not planned for in 2023/24 this work is currently not included in

the draft 2023/24 budget. As such, an additional $120,000 capital new budget

would need to be included in the 2023/24 Annual Budget for this to proceed next

year and this would be unsubsidised from Waka Kotahi.

Option 2 – Make no

changes

4.6 This

is option would keep the Level of Service at under 35 seconds throughout the

peak times, ensuring reasonable traffic flows. However, it does not address the

safety concerns at that intersection or prepare it for future cycleways along

the route.

Option

3 – Defer both the right turn and separated cycleway work for

consideration as part of the 2024-34 Long Term Plan.

4.7 This

option reflects the desire to proceed with the right turn bay and cycleway with

phases, but instead defers all works for prioritisation as part of the 2024-34

Long Term Plan.

4.8 This

option allows for the all the work to be planned and timed to coordinate with

any future cycleway along Botanical Road.

5. Next actions

5.1 If

Recommendation 1 is agreed by the Committee, it will be included as part of the

2023/24 Annual Budget deliberations.

5.2 Should

the 2023/24 budget be confirmed, Officers will commission the work to have the

right turning phase added to the traffic lights at College / Botanical

intersection during the 2023/24 Financial Year.

5.3 If

Recommendation 2 is agreed by the Committee, Officers will apply for co-funding

from Waka Kotahi for future Long-Term Plans for the cycleway along Botanical

Road as part of the 3-year funding allocation submission.

5.4 Following

approval of the 2024-34 Long Term Plan, work would begin on engagement,

consultation, and designs for cycling for Botanical Rd including this

intersection and its improvements in the considerations.

Compliance and administration

|

Does the Committee have delegated

authority to decide?

If Yes quote relevant clause(s)

from Delegations Manual

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do, they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

No

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the achievement of action/actions in Transport

The action is: Deliver the Urban

Cycle Network Masterplan.

|

|

Contribution to strategic

direction and to social, economic, environmental, and cultural well-being

|

The implementation of the

safety improvements and the cycleway improvements at the intersection will

contribute towards the Urban Cycle Network Masterplan and make the

intersection safer for its users.

|

|

|

|

Attachment

|

1.

|

Appendix 1 - Summary of WSP Report - Botanical and College

Intersection ⇩

|

|

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 12

April 2023

TITLE: Vogel

Street Safety Improvements

Presented By: Hamish

Featonby, Group Manager - Transport and Development

APPROVED BY: Bryce

Hosking, Acting Chief Infrastructure Officer

RECOMMENDATION TO Economic Growth Committee

1. That

the Committee note that public engagement will be undertaken to

seek community feedback on Vogel St safety improvement packages.

1. ISSUE

1.1 This

report:

· Provides the

Committee with more detail on potential packages of work that can address

safety concerns for walking and cycling on Vogel St.

· Notifies

the Committee that Council Officers will be undertaking community engagement on

these packages to understand public preference(s).

2. BACKGROUND

Previous Decisions

2.1 In

response to public submission and accompanying petition to the Annual Budget

2022/23, Council resolved,

“That the Chief Executive report to Council with a

staged plan to address the road safety concerns in Vogel Street as raised by

petitioners in Submission 174, including information on community engagement,

budget and timing.”

2.2 Following

this, Officers investigated options to resolve the safety concerns. The Vogel

Street Safety Investigation Plan was presented at the Council meeting on 5

October 2022. The memorandum of 5

October 2022 should be read in conjunction with this report. It focuses on

the strategic and implementation considerations for developing safety

improvements for Vogel St.

Vogel Street Context

2.3 In

the five-year period 2018-2022, there were 50 crashes on Vogel Street (not

including Tremaine Avenue intersection). This comprised of two serious

injuries, 13 minor and 35 non-injury crashes:

· 25 crashes

involved vehicles rear ending with a combination of speed and distracted

driving being the main causes.

· nine lost control

on bend.

· five lost control

on straight.

· 21 intersections

at intersections (only five involved turning).

· 2

pedestrian crashes (1 serious, 1 minor).

2.4 The

road reserve is approximately 20.2m wide and has a carriageway (kerb to kerb)

width of approximately 10.5m-11.5m. The width between the kerb to the property

boundary varies between 4m and 5m.

2.5 Current

street configuration:

2.6 On

approach to the intersection of Tremaine Avenue, the street cross section

changes as there are three lanes on approach. Due to the change in cross

section the carriageway widens to 15m and the width between properties and the

kerbs is reduced to 2.7m.

2.7 Each

side of Vogel Street has 37 trees where the estimated value is $800,000 for

each side based on the “Tree valuations in the city of Melbourne”

methodology. The methodology provides a dollar figure to represent a

combination of replacement cost, amenity, species, age, condition and locality

for protection bonds and removal fees and can be used towards understanding the

true cost of a project. While this metric is useful for comparison purposes it

does not necessarily reflect the public sentiment or views on tree value.

3. proposed vogel street safety improvementS

3.1 In

the urban environment there are multiple different users and requirements of

the road reserve (from fence to fence) competing for limited space.

Accommodation of pedestrians, cyclists, buses, cars, freight vehicles, parking,

and trees are currently sharing the space and so the options will require

reallocating that space.

3.2 Officers

have undertaken a detailed assessment and derived feasible opportunities that

address the following areas:

· Pedestrian improvements

· Right Turn Bay

considerations

· Cycling

improvements

These opportunities have then been aligned into two

potential work packages which could be implemented should Council wish to

proceed with the work.

3.3 The

recommended approach to make improvements for pedestrians crossing the

road is to install raised pedestrian crossings near key intersections along the

corridor. The rationale behind this approach is to facilitate key walking

routes within the neighbourhood which improves neighbourhood connectivity and

targets locations pedestrians are more likely to cross.

3.4 Officers

recommend three raised crossings at a cost of circa $80,000 each. The advantage

of starting with a small number of crossings is that additional crossings

and/or traffic calming can be considered as future options should the community

feel more is needed.

3.5 The

use of right turn bays should be undertaken where the intersection is

experiencing a high volume of right turning traffic and is supported by

crashes.

3.6 Along

the corridor there are 15 intersections. Based on the crash data, turning type

crashes at most intersections along Vogel Street is low (21 crashes over 14

intersections). Featherston Street has the worst record on along Vogel Street

at with two minor crashes and one non-injury.

3.7 Officers

recommend one right turn bay at a cost of circa $20,000. Due to the high volume

of Featherston Street and crash data, a right turn bay (or painted median) is

only recommended to be considered at this intersection.

3.8 Officers

will continue to investigate a possible conflict between the right turn bay and

pedestrian crossing and whether it may be appropriate to use a painted median

instead which would operate similarly.

3.9 Cycleway

options in both the safety improvement packages below have been costed out

for the West side of Vogel Street (City side) as it has fewer intersections to

deal with and makes the connection to Featherston Street and its future

cycleway easier. That said, the options would still work and be of similar

expense on the other side and so this would be a consideration included when

talking to the community to determine whether there is a strong preference for

one side over another.

Example of a raised

pedestrian crossing

Safety Improvement Package options

|

|

Package

1

|

Package

2

|

|

Raised

pedestrian crossings[1]

|

3

locations:

· Rata St

· Featherston

St/Haydon St

· Rangiora Ave

|

3

locations:

· Rata St

· Featherston

St/Haydon St

· Rangiora Ave

|

|

Right

turn bay

|

1

location:

· Featherston St

|

1

location:

· Featherston St

|

|

Cycles

|

Shared

pathway

|

Separated

cycleway

|

|

Cost

estimate[2]

|

$3,560,000

|

$2,360,000

|

Package 1

This work package includes a Shared pathway, Raised

Pedestrian Crossings, and a Right Turn Bay.

3.10 The main benefit

of a shared path is that the function of Vogel Street will remain like it is

today with the availability of on street parking.

3.11 The

disadvantage of a shared path is:

· Pedestrians will

be at a higher safety risk.

· There is an

increased likelihood of cyclists being struck by vehicle emerging from

driveways, particularly where there are tall fences and vegetation. Driveways

will also affect the quality of the ride due to level changes with the vehicle

crossings.

· Unfortunately,

the only way to feasibly construct a shared pathway on Vogel Street, would

require the removal of the 37 street trees and relocation of 14 streetlights to

enable the 3m-wide path required.

3.12 Like the

bi-directional cycleway, intersections pose a safety risk. As such it is

recommended that intersections are treated with raised platforms and kerb

extensions to slow down vehicles entering the intersection.

3.13 The Shared

Pathway Street Configuration could look like the following:

3.14 A shared

pathway is estimated at $3,300,000.

Package 2

This work package includes a Separated Cycleway, Raised

Pedestrian Crossings, and a Right Turn Bay.

3.15 To

undertake a separated cycleway within the existing carriage way, the cycleway

would need to be bi-directional due to the narrow width. The change will

require the removal of on-street parking and require bus and collection

services to operate within the traffic lane which will slow down traffic.

3.16 The main

advantage of this option is the retention of street trees.

3.17 The

disadvantage of a bi-directional cycleways is the complex interactions at

intersections. To alleviate the risk associated, the cycleway would need safety

improvements by using raised platforms at intersections to slow down traffic.

The platforms would be supported with kerb extensions to narrow down the road

carriage way. This would also include raised platforms/kerb extensions, lighting

relocation, cycling separators, and line marking.

3.18 Separated

Cycleway Street Configuration could look like the following:

3.19 A

separated bi-directional cycleway is estimated at $2,100,000.

4. NEXT STEPS

4.1 Undertake

public engagement on the Vogel Street safety improvement packages detailed in

Section 3 of this report.

4.2 Report

community feedback to the Economic Growth Committee alongside officer analysis

of the strengths and weaknesses of options for a decision on how to proceed.

4.3 A

preferred improvement package could then be considered as part of the 2024-34

Long Term Plan process.

5. Compliance and administration

|

Does the Committee have

delegated authority to decide?

If Yes quote relevant clause(s)

from Delegations Manual

|

Yes

|

|

Are the decisions significant?

|

No

|

|

If they are significant do, they

affect land or a body of water?

|

No

|

|

Can this decision only be made

through a 10 Year Plan?

|

No

|

|

Does this decision require

consultation through the Special Consultative procedure?

|

No

|

|

Is there funding in the current

Annual Plan for these actions?

|

Yes

|

|

Are the recommendations

inconsistent with any of Council’s policies or plans?

|

No

|

|

|

|

The recommendations contribute

to Goal 1: An Innovative and Growing City

|

|

The recommendations contribute

to the achievement of action/actions in Transport

The action is: Prioritise active

transport programmes that deliver on Council goals, the purpose of this plan,

and the Government Policy Statement on Transport.

|

|

Contribution to strategic

direction and to social, economic, environmental, and cultural well-being

|

Road safety improvements will

encourage active transport and in turn improve the social and environmental

wellbeing of the Vogel St residents; noting that the strategic nature of the

route is not defined and therefore does not prioritise modes of travel.

|

|

|

|

Attachments

NIL

Memorandum

TO: Economic

Growth Committee

MEETING DATE: 12

April 2023

TITLE: Palmerston

North Quarterly Economic Update - March 2023

Presented By: Stacey

Bell - City Economist

APPROVED BY: David

Murphy, Chief Planning Officer

RECOMMENDATION TO Committee

1. That Committee

receives the following reports for information:

a. Palmerston North

Quarterly Economic Update – March 2023; and the,

b. Palmerston North

electronic card spending report – December quarter 2022

1. ISSUE

1.1 This

memorandum presents a summary of the key themes in the Palmerston North

Quarterly Economic Update to March 2023, and the Palmerston North City Centre

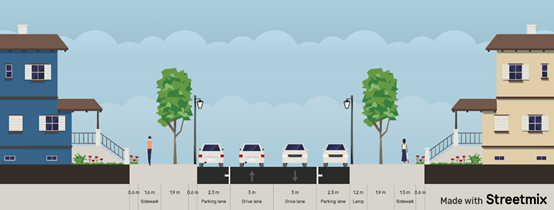

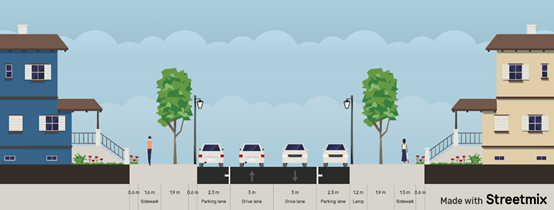

Quarterly electronic card spending (retail and selected tourism sectors) for