TO: Council

MEETING DATE: 11 December 2024

TITLE: Presentation - Aspiring Leaders Forum

1. That the Council receive the presentation for information.

Summary

Alex Murray and Liorah Jainarain will present on the Aspiring Leaders Forum

Nil

Council

|

Grant Smith (Mayor) |

|

|

Debi Marshall-Lobb (Deputy Mayor) |

|

|

Mark Arnott |

Leonie Hapeta |

|

Brent Barrett |

Lorna Johnson |

|

Rachel Bowen |

Billy Meehan |

|

Vaughan Dennison |

Orphée Mickalad |

|

Lew Findlay (QSM) |

Karen Naylor |

|

Roly Fitzgerald |

William Wood |

|

Patrick Handcock (ONZM) |

Kaydee Zabelin |

Council MEETING

11 December 2024

Order of Business

1. Karakia Timatanga

2. Apologies

3. Notification of Additional Items

Pursuant to Sections 46A(7) and 46A(7A) of the Local Government Official Information and Meetings Act 1987, to receive the Chairperson’s explanation that specified item(s), which do not appear on the Agenda of this meeting and/or the meeting to be held with the public excluded, will be discussed.

Any additions in accordance with Section 46A(7) must be approved by resolution with an explanation as to why they cannot be delayed until a future meeting.

Any additions in accordance with Section 46A(7A) may be received or referred to a subsequent meeting for further discussion. No resolution, decision or recommendation can be made in respect of a minor item.

4. Declarations of Interest (if any)

Members are reminded of their duty to give a general notice of any interest of items to be considered on this agenda and the need to declare these interests.

5. Public Comment

To receive comments from members of the public on matters specified on this Agenda or, if time permits, on other matters.

6. Presentation - Aspiring Leaders Forum Page 7

7. Confirmation of Minutes Page 9

That the minutes of the ordinary Council meeting of 6 November 2024 Part I Public be confirmed as a true and correct record.

Reports

8. FoodHQ Annual Update Page 29

Memorandum, presented by Chris Dyhrberg, General Manager - Infrastructure.

9. 2024 Rating Valuations Page 41

Memorandum, presented by Steve Paterson, Strategy Manager - Finance.

10. 2024 Rating Valuations - Impact on Rating Incidence Page 53

Memorandum, presented by Steve Paterson, Strategy Manager - Finance.

11. Annual Budget 2025/26 Page 71

Memorandum, presented by Scott Mancer - Manager Finance, and Steve Paterson - Manager Financial Strategy.

12. Approval of International Travel for the Mayor in March 2025 Page 189

Memorandum, presented by Gabrielle Loga, Manager International Relations.

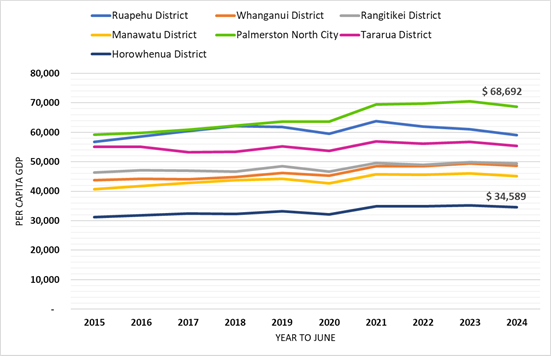

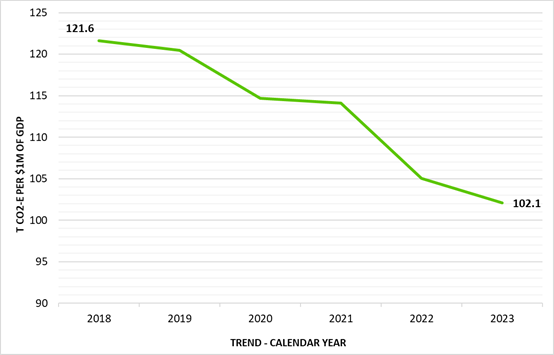

13. Palmerston North Quarterly Economic Update - December 2024 Page 229

Memorandum, presented by Stacey Andrews, City Economist.

14. Submission on the Principles of the Treaty of Waitangi Bill Page 255

Memorandum, presented by Todd Taiepa, Poutoko Aropei - Manager Māori Advisory.

15. Council Work Schedule Page 259

Recommendations from Committee Meetings

16. Presentation of the Part I Public Strategy & Finance Committee Recommendations from its 13 November 2024 Meeting Page 261

17. Presentation of the Part I Public Economic Growth Committee Recommendations from its 20 November 2024 Meeting Page 265

18. Presentation of the Part I Public Culture & Sport Committee Recommendations from its 27 November 2024 Meeting Page 267

19. Presentation of the Part I Public Sustainability Committee Recommendations from its 4 December 2024 Meeting Page 269

20. Presentation of the Part I Public Community Committee Recommendations from its 4 December 2024 Meeting Page 271

21. Karakia Whakamutunga

22. Exclusion of Public

|

|

To be moved: “That the public be excluded from the following parts of the proceedings of this meeting listed in the table below. The general subject of each matter to be considered while the public is excluded, the reason for passing this resolution in relation to each matter, and the specific grounds under Section 48(1) of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution are as follows:

This resolution is made in reliance on Section 48(1)(a) of the Local Government Official Information and Meetings Act 1987 and the particular interest or interests protected by Section 6 or Section 7 of that Act which would be prejudiced by the holding of the whole or the relevant part of the proceedings of the meeting in public as stated in the above table. Also that the persons listed below be permitted to remain after the public has been excluded for the reasons stated. [Add Third Parties], because of their knowledge and ability to assist the meeting in speaking to their report/s [or other matters as specified] and answering questions, noting that such person/s will be present at the meeting only for the items that relate to their respective report/s [or matters as specified].

|

||||||||||||||||||||

TO: Council

MEETING DATE: 11 December 2024

TITLE: Presentation - Aspiring Leaders Forum

1. That the Council receive the presentation for information.

Summary

Alex Murray and Liorah Jainarain will present on the Aspiring Leaders Forum

Nil

Palmerston North City Council

Minutes of the Council Meeting Part I Public, held in the Council Chamber, First Floor, Civic Administration Building, 32 The Square, Palmerston North on 06 November 2024, commencing at 9.02am.

|

Members Present: |

Grant Smith (The Mayor) (in the Chair) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Rachel Bowen, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin. |

|

Apologies: |

Councillors Rachel Bowen, Lorna Johnson (late arrival) and William Wood (early departure). |

Councillor Lorna Johnson entered the meeting at 9.19am during consideration of clause 188-24 She was not present for clause 187-24.

Councillor William Wood left the meeting at 12.26pm after consideration of clause 197.6-24. He entered the meeting again at 3.04pm after consideration of clause 198.5-24. He was not present for clauses 197.6-24 to 198.5-24 inclusive.

Councillor Billy Meehan left the meeting at 4.27pm during consideration of clause 199-24 He was not present for clauses 199-24 to 202-24 inclusive.

|

|

Karakia Timatanga |

|

|

Councillor Debi Marshall -Lobb opened the meeting with karakia. |

|

187-24 |

Apologies |

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council receive the apologies. |

|

|

Clause 187-24 above was carried 14 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin. |

|

|

Declarations of Interest |

|

|

The Mayor Grant Smith (Item 13 and 14) and Councillor Vaughan Dennison (Item 13) declared an interest in clause 202-24 but stated they would consider the items with an open mind. Councillor Leonie Hapeta declared a conflict of interest in Item 21 Confidential Recommendations from the Community Committee (clause 202-24) and took no further part in discussion or debate. |

|

188-24 |

Public Comment |

|

|

Nigel Fitzpatrick spoke on Item 10 Transport Funding Implications (clause 197-24). He spoke in support of separated cycleways to improve the safety of the roads for bike riders (young and old) and drivers. He thanked Council for what they had done to improve the safety of Featherston St for bike riders and encouraged Council to continue funding shared pathways. Karen Griffiths and Tom Poole, residents of Purdie Place, spoke on Item 8 Stormwater Improvements in Milson (clause 190-24). They stated that residents of Purdie Place are also vulnerable to flooding, and asked that Council officers engage with Purdie Place residents during the detailed design process. They requested that both sides of the waterway be equally protected from flooding, with a similar height wall on both sides. Evelyn Strugnell, resident of McGregor St, spoke on Item 8 Stormwater Improvements in Milson (clause 190-24), in reference to the flooding caused by the stream opposite her property. She would like to see better drainage in the area; pipes need to be made bigger, stream needs to be widened, and drainpipes cleaned regularly. Councillor Lorna Johnson entered the meeting at 9:19am.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED That Council receive the Public Comments. |

|

|

Clause 188-24 above was carried 15 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin. |

|

|

Tributes - Peter Michael Willis, Baldeep Dhillon and Roger Clausen. Mayor Grant Smith, read out tributes to Peter Michael Willis, Baldeep Dhillon and Roger Clausen. |

|

189-24 |

Petition: Flooding at Julia Wallace Retirement Village Petition presented by Elisabeth Gosse, resident of Julia Wallace Retirement Village. Elisabeth spoke, on behalf of residents, on the flooding of the Village and requested Council act to prevent the Village flooding in the future. She corrected an error; the Mangaone stream should read the Milson Stream. She requested environmental impact reports for the commercial area by the airport, the Pillars and the new health centre. |

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council receive the petition for information.

|

|

|

Clause 189-24 above was carried 15 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin. |

The meeting adjourned at 10.32am

The meeting resumed at 10.55am

|

191-24 |

Confirmation of Minutes |

|

|

Moved Debi Marshall-Lobb, seconded Brent Barrett. RESOLVED That the minutes of the ordinary Council meeting of 30 October 2024 Part I Public be confirmed as a true and correct record.

|

|

|

Clause 191-24 above was carried 13 votes to 0, with 2 abstentions, the voting being as follows: For: Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Abstained: The Mayor (Grant Smith) and Councillor Leonie Hapeta.

|

|

192-24 |

Standing Orders - Option C |

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED That Council adopt Option C (SO 2.12.3) for Item 11 Annual Budget 2025-26 – Timing and Programme Budget. |

|

|

Clause 192-24 above was carried 15 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin. |

|

193-24 |

Sustainability Committee Part I Public - 16 October 2024 Councillor Barrett presented the recommendations below: |

|

|

|

Moved Brent Barrett, seconded Kaydee Zabelin. RESOLVED 1. That Council adopt the recommendations from the Sustainability Committee of 16 October 2024: Local Water Done Well Update (clause 32-24) Memorandum, presented by Mike Monaghan, Manager Three Waters and Julie Keane, Transition Manager. The COMMITTEE RECOMMENDS 1. That the Local Water Done Well report include the following options: (a) That any joint CCO proposal considers proportionality shareholding and electoral college arrangements, and (b) That an option of establishing a single-Council CCO accountable to PN City Council be also brought back.

2. That Council note the recommendations from the Sustainability Committee of 16 October 2024: Manawatū River Pathway Project (clause 41-24) Memorandum, presented by Glen O'Connor, Manager Transport and Development and Michael Bridge, Service Manager Active Transport. The COMMITTEE RECOMMENDS 1. That Council consider 1b and 1c in conjunction with the 6 November 2024 report to Council regarding Transport Funding, with a view to enabling flexible progress on the Ashhurst riverside and the Feilding shared paths. Note 1b Direct the Chief Executive to continue engagement with affected landowners and progress planning and preparations for the Notice of Requirement over the 2024-2027 Financial Years; with the Notice of Requirement to be lodged in Year 4 of the Long-Term Plan, or earlier if all directly affected landowners provide their written support prior to lodgement. ($350,000) OR 1c Direct the Chief Executive to continue engagement with affected landowners and lodge the Notice of Requirement over the 2024-2027 Financial Years; with land acquisition and construction commencing from Year 4 of the Long-Term Plan. ($800,000).

|

|

|

|

Clause 193-24 above was carried 14 votes to 0, with 1 abstention, the voting being as follows: For: Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Abstained: The Mayor (Grant Smith). |

|

194-24 |

Community Committee Part I Public - 23 October 2024 Councillor Johnson presented the recommendations below: |

|

|

|

Moved Lorna Johnson, seconded Patrick Handcock. RESOLVED 1. That Council adopt the recommendations from the Community Committee of 23 October 2024: |

|

|

|

Presentation: Disability Reference Group - Annual Report (clause 24-24) Presentation, by Hugh O’Connell, Chair, Lisa McElvoy and Denise Bethell, members of the Disability Reference Group. The COMMITTEE RECOMMENDS 1. That Council acknowledge the impact of recent changes to disability support services, and that the Mayor, on behalf of the Council, write to Hon Louise Upston asking her to amend the Purchasing Rules to restore flexible funding to the pre-18 March 2024 Levels.

|

|

|

|

Presentation: MASH Trust (clause 25-24) Presentation, by Karleen Edwards, Chief Executive and John Fawke, Chair of MASH Trust.

The COMMITTEE RECOMMENDS 1. That Council support the proposed concept of Te Whare Oranga outlined by MASH Trust.

|

|

|

|

Presentation: Manawatū Tenants Union (clause 26-24) Presentation, by Cameron Jenkins, Coordinator of Manawatū Tenants Union.

The COMMITTEE RECOMMENDS 1. That Council endorse the Healthy Homes Commitment in their role as landlord and housing provider, as presented by Manawatū Tenants Union. |

|

|

|

Palmerston North Age Friendly Action Plan (clause 29-24) Report, presented by Amy Viles, Acting Manager Community Development. The COMMITTEE RECOMMENDS 1. That Council endorse the Palmerston North Age Friendly Action Plan and accept the Options Report; and 2. That Council approve the reallocation of the existing $30K of implementation budget towards .3 FTE, for a Community Development Advisor – Age Friendly to: guide the Council’s commitment to be an Age Friendly City, develop a Palmerston North Age Friendly Implementation Plan and to coordinate the internal and external implementation of actions from that plan.

|

|

|

|

Clause 194-24 above was carried 14 votes to 0, with 1 abstention, the voting being as follows: For: Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Abstained: The Mayor (Grant Smith).

|

|

|

|

Moved Lorna Johnson, seconded Patrick Handcock. RESOLVED That Council adopt the following recommendation from the Community Committee of 23 October 2024: Palmerston North Age Friendly Action Plan (clause 29-24) 3. That Council approve Option 1 and refer an additional budget of $50K for the development and implementation of the Palmerston North Age Friendly Implementation Plan to the draft Annual Budget.

|

|

|

|

Clause 194-24 above was carried 14 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, William Wood and Kaydee Zabelin.

Against: Councillor Karen Naylor. |

|

|

195-24 |

Recommendation to Exclude Public |

||||||||||||

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED That the public be excluded from the following parts of the proceedings of this meeting listed in the table below. The general subject of each matter to be considered while the public is excluded, the reason for passing this resolution in relation to each matter, and the specific grounds under Section 48(1) of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution are as follows:

This resolution is made in reliance on Section 48(1)(a) of the Local Government Official Information and Meetings Act 1987 and the particular interest or interests protected by Section 6 or Section 7 of that Act which would be prejudiced by the holding of the whole or the relevant part of the proceedings of the meeting in public as stated in the above table.

|

||||||||||||

|

|

Clause 195-24 above was carried 15 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin. |

||||||||||||

The meeting went into Part II Confidential at 11.11am

The meeting returned to Part I Public at 11.15am

|

197-24 |

Transport Funding Implications 2024-2027 Memorandum, presented by Glen O'Connor, Manager - Transport & Development, Scott Mancer, Manager - Finance and James Miguel, Senior Transport Planner. Officers noted that recommendation 2b. should read Increase rather than Decrease Operating Expenditure. |

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council approve adjustments to the Active and Transport Activity Budgets for the 2024/25 financial year as detailed below: a. Decrease NZTA Subsidy Operating Revenue by $736k as detailed in Attachment 1. b. Decrease Operating Expenditure by $1,283k as detailed in Attachment 1. c. Decrease NZTA Subsidy Capital Revenue by $883k for Renewal Programmes as detailed in Attachment 2. e. Decrease NZTA Subsidy Capital Revenue by $1,913k for Capital New/Growth Programmes as detailed in Attachment 3.

|

|

|

Clause 197.1-24 above was carried 15 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

|

|

1D |

Moved Brent Barrett, seconded Lorna Johnson. RESOLVED Reinstate $632,000 for Active Transport Capital Renewals in Financial Year 2024/25 (Attachment 2).

|

|

|

Clause197.2-24 above was carried 9 votes to 6, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Brent Barrett, Vaughan Dennison, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Orphée Mickalad and Kaydee Zabelin.

Against: Councillors Mark Arnott, Lew Findlay, Leonie Hapeta, Billy Meehan, Karen Naylor and William Wood.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council approve adjustments to the Active and Public Transport Activity Budgets for the 2024/25 financial year as detailed below: d. Amend the Capital Renewal Programme Expenditure as detailed in Attachment 2 (as amended, including 1D above). |

|

|

Clause197.3-24 above was carried 11 votes to 4, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Orphée Mickalad and Kaydee Zabelin. Against: Councillors Mark Arnott, Billy Meehan, Karen Naylor and William Wood.

|

|

1F |

Moved Brent Barrett, seconded Lorna Johnson. RESOLVED Reinstate $150,000 for Capital New Prog 2505 City-Wide Shared Pathways - Slip Prevention in Financial Year 2024/25 (Attachment 3).

|

|

|

Clause197.4-24 above was carried 14 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Against: Councillor Leonie Hapeta.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council approve adjustments to the Active and Transport Activity Budgets for the 2024/25 financial year as detailed below: f. Amend Capital New/Growth Programme Expenditure as detailed in Attachment 3 (as amended including 1F and Part II- Sustainability resolutions).

|

|

|

Clause 197.5-24 above was carried 13 votes to 2, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Against: Councillors Leonie Hapeta and Billy Meehan.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 2. That Council approve adjustments to the Roading Activity Budgets for the 2024/25 financial year as detailed below: a. Decrease NZTA Subsidy Operating Revenue by $60k as detailed in Attachment 4. b. Increase Operating Expenditure by $2,081k as detailed in Attachment 4. c. Increase NZTA Subsidy Capital Revenue by $305k for Renewal Programmes as detailed in Attachment 5. d. Amend the Capital Renewals Programme Expenditure as detailed in Attachment 5. e. Decrease NZTA Subsidy Capital Revenue by $2,461k for Capital New/Growth Programmes as detailed in Attachment 6. f. Amend the Capital New/Growth Programme Expenditure as detailed in Attachment 6.

|

|

|

Clause197.6-24 above was carried 12 votes to 3, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Orphée Mickalad and Kaydee Zabelin.

Against: Councillors Billy Meehan, Karen Naylor and William Wood.

|

|

|

Councillor William Wood left the meeting at 12.26pm.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 3. That Council amend the operational programme budgets (both NZTA Subsidy Revenue and Expenditure) for business cases and transport planning, as detailed in Table 1. 4. That Council note that by approving the changes in 1 – 3 that this will result in an operating deficit for the Transport Group of Activities of $1,593M and that this will be funded by loans from a net reduction in the capital programme and a transfer of $740k from loan funded Capital Programme 628 – Totara Road Wastewater Consent Renewal Upgrade. 5. That Council note that the recommendations above relate to the 2024/25 Financial Year and implications for the Transport Programme and future years (2025/26 & 2026/27) budget implications will be referred to the appropriate Annual Plan process. |

|

|

Clause 197.7-24 above was carried 12 votes to 2, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Orphée Mickalad, Karen Naylor, and Kaydee Zabelin. Against: Councillors Leonie Hapeta and Billy Meehan.

Note: Recommendation 4 above was adjusted from the papers to reflect decisions made earlier in the meeting. |

The meeting adjourned at 12.35pm.

The meeting resumed at 1.37pm.

|

Annual Budget 2025/26 - Timing and Programme Budgets Memorandum, presented by Scott Mancer - Manager Finance and Steve Paterson - Manager Financial Strategy. |

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council note the process for, and timing of, the Annual Budget 2025/26 as outlined in Table 1 of the “Annual Budget 2025/26- timing and programme budgets” presented to Council on 6 November 2024.

|

|

|

Clause 198.1-24 above was carried 14 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor and Kaydee Zabelin.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 2. That Council recommend the following programmes for inclusion in the draft 2025/26 Annual Budget: a. Operating programmes as outlined in Attachment 1. |

|

|

Clause198.2-24 above was carried 14 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor and Kaydee Zabelin. |

|

A* |

Moved Brent Barrett, seconded Lorna Johnson. Note: On a motion: That Council reinstate Programme 2476 Bus Hub Detailed Business Case $230K in draft Annual Budget 25-26 and $235K in indicative Annual Budget 26-27. The motion was lost 6 votes to 8, the voting being as follows: For: Councillors Debi Marshall-Lobb, Brent Barrett, Roly Fitzgerald, Patrick Handcock, Lorna Johnson and Kaydee Zabelin.

Against: The Mayor (Grant Smith) and Councillors Mark Arnott, Vaughan Dennison, Lew Findlay, Leonie Hapeta, Billy Meehan, Orphée Mickalad and Karen Naylor.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 2. That Council recommend the following programmes for inclusion in the draft 2025/26 Annual Budget: b. Transport operating programmes as outlined in Attachment 2.

|

|

|

Clause198.3-24 above was carried 14 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor and Kaydee Zabelin.

|

|

AA |

Moved Brent Barrett, seconded Lorna Johnson. RESOLVED That Council provide budget of $150K in draft Annual Budget 2025-26 and $150K in indicative Annual Budget 2026-27 for shared path planning and preparation for Notice of Requirement.

|

|

|

Clause198.4-24 above was carried 12 votes to 2, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Orphée Mickalad and Kaydee Zabelin.

Against: Councillors Billy Meehan and Karen Naylor.

|

|

B |

Moved Kaydee Zabelin, seconded Brent Barrett. RESOLVED That programme #2380 - City-wide - Transport - Emergency Reinstatements – be increased to $500k in Financial Year 25/26 (Attachment 3).

|

|

|

Clause198.5-24 above was carried 8 votes to 6, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Brent Barrett, Vaughan Dennison, Roly Fitzgerald, Patrick Handcock, Lorna Johnson and Kaydee Zabelin.

Against: Councillors Mark Arnott, Lew Findlay, Leonie Hapeta, Billy Meehan, Orphée Mickalad and Karen Naylor.

|

|

|

Cr William Wood entered the meeting at 3.04pm. |

|

C |

Moved Karen Naylor, seconded Leonie Hapeta. Note: On a motion: That Programme 2456 - Cliff Road Upgrade remains as outlined in the Long Term Plan (Attachment 3). The motion was lost 6 votes to 9, the voting being as follows:

For: Councillors Mark Arnott, Leonie Hapeta, Billy Meehan, Orphée Mickalad, Karen Naylor and William Wood.

Against: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson and Kaydee Zabelin.

|

|

D |

Moved Brent Barrett, seconded Lorna Johnson. RESOLVED That Council reinstate Programme 2505 City-Wide Shared Paths Slip Prevention to $306k (capital) and $51K (operational) in draft Annual Budget 2025-26, and to $313k (capital) $52K (operational) in the indicative Annual Budget 2026-27.

|

|

|

Clause 198.6-24 above was carried 10 votes to 5, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Orphée Mickalad and Kaydee Zabelin.

Against: Councillors Mark Arnott, Leonie Hapeta, Billy Meehan, Karen Naylor and William Wood.

|

|

E |

Moved Brent Barrett, seconded Lorna Johnson. Note: On a motion: That Council partially reinstate 2390 Capital New Low Cost Low Risk at $1M in draft Annual Budget 2025-26 and $1M in indicative Annual Budget 2026-27. The motion was lost 6 votes to 9, the voting being as follows: For: Councillors Debi Marshall-Lobb, Brent Barrett, Roly Fitzgerald, Patrick Handcock, Lorna Johnson and Kaydee Zabelin.

Against: The Mayor (Grant Smith) and Councillors Mark Arnott, Vaughan Dennison, Lew Findlay, Leonie Hapeta, Billy Meehan, Orphée Mickalad, Karen Naylor and William Wood.

|

|

F |

Moved Lorna Johnson, seconded Brent Barrett. Note: On a motion: That Council include $632,000 for Active Transport Capital Renewals in the 2025/26 and 2026/27 annual budget drafts. The motion was lost 6 votes to 9, the voting being as follows: For: Councillors Debi Marshall-Lobb, Brent Barrett, Roly Fitzgerald, Patrick Handcock, Lorna Johnson and Kaydee Zabelin.

Against: The Mayor (Grant Smith) and Councillors Mark Arnott, Vaughan Dennison, Lew Findlay, Leonie Hapeta, Billy Meehan, Orphée Mickalad, Karen Naylor and William Wood.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 2. That Council recommend the following programmes for inclusion in the draft 2025/26 Annual Budget: c. Transport capital programmes as outlined in Attachment 3 (as amended including resolutions AA, B and D).

|

|

|

Clause 198.7-24 above was carried 14 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, William Wood and Kaydee Zabelin.

Against: Councillor Karen Naylor. |

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 2. That Council recommend the following programmes for inclusion in the draft 2025/26 Annual Budget: d. Non-Transport programmes as outlined in Attachment 4. |

|

|

Clause198.8-24 above was carried 14 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphee Mickalad, William Wood and Kaydee Zabelin.

Against: Councillor Karen Naylor

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 3. That Council provide direction to officers, for consideration as part of the Annual Budget 2025/26 and 2026-27 process, to support the Centrepoint Theatre rebuild of up to $200k over two years by: a. In-kind support – officer time to support with fundraising, promotion, communications etc; and b. Resource consent and building consent costs – the application process for this is already underway; and c. Grant funding – the quantum to be determined by the Council as part of the Annual Budget process.

|

|

|

Clause 198.9-24 above was carried 14 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, William Wood and Kaydee Zabelin.

Against: Councillor Karen Naylor.

|

|

G |

Moved Brent Barrett, seconded Lorna Johnson. RESOLVED That in response to the 2024 Residents Survey, Council include a budget of $24,000 for focus group research in draft Annual Budget 2025-26.

|

|

|

Clause 198.10-24 above was carried 14 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, William Wood and Kaydee Zabelin.

Against: Councillor Karen Naylor.

|

|

|

Moved William Wood, seconded Leonie Hapeta. On an amendment: That

in response to the 2024 Residents Survey, Council include a budget of $24,000 The amendment was carried 14 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Against: Councillor Lorna Johnson.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 4. That Council note directions given today will be brought back for Council consideration on 11 December 2024.

|

|

|

Clause 198.11-24 above was carried 15 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald Patrick Handcock, Leonie Hapeta, Lorna Johnson, Billy Meehan, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

|

|

200-24 |

Exemption of the Manawatū-Whanganui Regional Disaster Relief Fund, and Palmerston North Performing Arts Trust from being Council Controlled Organisations Memorandum, presented by Sarah Claridge, Governance Advisor. Palmerston North Performing Arts Trust - Annual Report and Annual Accounts 2023/24 Memorandum, presented by Hannah White, Democracy & Governance Manager. Items 13 and 14 were taken together.

|

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council exempt the Manawatū-Whanganui Regional Disaster Relief Fund from being a Council Controlled Organisation for three years to 31 August 2027. 2. That Council exempt the Palmerston North Performing Arts Trust from being a Council Controlled Organisation for three years from 30 June 2025 to 30 June 2028, pursuant to section 7 of the Local Government Act 2002.

|

|

|

RESOLVED 1. That Council receive the Palmerston North Performing Arts Trust Annual Report and financial statements for the year ended 30 June 2024 (Attachments 1-3).

|

|

|

Clause 200-24 above was carried 13 votes to 0, with 1 abstention, the voting being as follows: For: Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin.

Abstained: The Mayor (Grant Smith). |

|

201-24 |

Council Work Schedule |

|

|

Moved Grant Smith, seconded Debi Marshall-Lobb. RESOLVED 1. That Council receive its Work Schedule dated 6 November 2024. |

|

|

Clause 201-24 above was carried 14 votes to 0, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Leonie Hapeta, Lorna Johnson, Orphée Mickalad, Karen Naylor, William Wood and Kaydee Zabelin. |

|

202-24 |

Community Committee Part II Confidential - 23 October 2024 Councillor Lorna Johnson presented the recommendations below: |

|

|

Moved Lorna Johnson, seconded Patrick Handcock. RESOLVED 1. That Council adopt the recommendations from the Community Committee of 23 October 2024: |

|

|

Provisional Local Alcohol Policy - progress update (clause 34-24) Report, presented by Peter Ridge - Senior Policy Analyst. The COMMITTEE RECOMMENDS 1. That Council advise the Alcohol Regulatory and Licensing Authority that it will discontinue the development of the Provisional Local Alcohol Policy 2021 and begin development of a new draft local alcohol policy (Option 4). 2. That the Chief Executive release the decision immediately following the meeting. 3. That the Chief Executive release the report titled “Provisional Local Alcohol Policy – progress update” and the report’s attachments, with appropriate redactions (if any), immediately following the resolution of the appeals to the Alcohol Regulatory and Licensing Authority on the PNCC Provisional Local Alcohol Policy.

|

|

|

Clause 202-24 above was carried 12 votes to 1, the voting being as follows: For: The Mayor (Grant Smith) and Councillors Debi Marshall-Lobb, Mark Arnott, Brent Barrett, Vaughan Dennison, Lew Findlay, Roly Fitzgerald, Patrick Handcock, Lorna Johnson, Orphée Mickalad, Karen Naylor and Kaydee Zabelin.

Against: Councillor William Wood.

Note: Councillor Leonie Hapeta declared a conflict of interest, withdrew from the discussion and sat in the gallery. |

|

|

Karakia Whakamutunga |

|

|

Councillor Debi Marshall-Lobb closed the meeting with karakia. |

The public part of the meeting finished at 5.00pm.

Confirmed 11 December 2024

Mayor

TO: Council

MEETING DATE: 11 December 2024

TITLE: FoodHQ Annual Update

Presented By: Chris Dyhrberg, General Manager - Infrastructure

APPROVED BY: Waid Crockett, Chief Executive

1. That Council note the update on FoodHQ activities.

2. That Council appoint David Murphy, General Manager – Strategic Planning as Council’s nominated alternate director for FoodHQ Innovations Ltd, to be reviewed in March 2026, or earlier if necessary.

1. ISSUE

1.1 On 6 April 2022, Council agreed to become a founding shareholder in FoodHQ Innovation Ltd (FoodHQ).

1.2 On 6 September 2023, Council agreed that Chris Dyhrberg, Deputy Chief Executive be appointed as Council’s nominated director for FoodHQ, to be reviewed in March 2026, or earlier if necessary.

1.3 Council requested that progress of the company be regularly reported. This report, and the attached presentation (Attachment 1), provides an update on FoodHQ’s activities.

1.4 The FoodHQ board has occasionally had difficulty making a quorum for meetings due to the availability of directors. This has resulted in delays to decision making. For this reason, the board resolved that each organisation with a director appoint an alternate director to be able to attend meetings when the nominated director is unavailable.

2. BACKGROUND

2.1 Council is a founding shareholder (20% shareholding) of Food HQ. The other shareholders are Plant and Food Research (60%) and Fonterra (20%).

2.2 The background to the establishment of the company and the initial appointment of Chris Dyhrberg is set out in the Shareholding in FoodHQ Innovation Ltd report to Council 6 April 2022.

2.3 The Manawatū region research, science and innovation sector report (2021) includes the following introductory comments regarding food innovation:

The Manawatū region has significant strengths in food innovation. The university, CRI and business research and development organisations described in this profile have extensive food-related expertise. These are further complemented by a range of other food focussed collaborative organisations including FoodHQ, the Riddet Institute Centre of Research Excellence, the Hopkirk Institute, the New Zealand Food Safety Science and Research Centre and the New Zealand Leather and Shoe Research Association.

This is New Zealand’s most significant concentration of food science and innovation capability, and collectively is arguably the largest food innovation centre in the Southern Hemisphere. These strengths in food innovation are key to the future economic development potential for the region and New Zealand. Significant opportunities exist to add value to primary products produced in New Zealand, develop new primary sector opportunities, industrial processing machinery, technology, and software that supports food innovation. These could lead to the export of intellectual property, food ingredients and products, processing equipment or software

2.4 Food HQ has six directors on its board. These are: Mark Piper (Plant and Food Research and FoodHQ Chair), Pierre Venter (Fonterra), and Chris Dyhrberg (Palmerston North City Council) as shareholder representatives; plus, Sue Bidrose (AgResearch), Ray Goer (Massey University) and Nick Pyke (AGMARDT).

2.5 Further information on FoodHQ can be located at Home - Food HQ.

2.6 In the 2024-34 Long Term Plan, Council committed to a three-year funding contribution to FoodHQ of $65,000 per annum through to the 2026-27 financial year.

3. ALTERNATE DIRECTOR

3.1 The FoodHQ board meets formally every two months. In between each board meeting, it has an interim on-line meeting to deal with any business that can’t wait until the next formal meeting. This cadence is generally sufficient to allow the Chief Executive and FoodHQ team to operate effectively and without delays waiting for board decisions.

3.2 There are times, however, that due to the availability of directors, the board is unable to form a quorum and it is unable to pass resolutions. For this reason, the board resolved that each director request their organisation to appoint an alternate director to attend meeting when the nominated director is unavailable.

3.3 Because the activities of FoodHQ broadly contribute to business development and investment within the city and region, it is recommended that David Murphy, General Manager Strategic Planning would be the most appropriate officer to be appointed as the Council’s alternate director to the FoodHQ board.

3.4 Chris Dyhrberg’s appointment as the Council’s nominated director was to March 2026. It is, therefore, recommended that David Murphy’s appointment be aligned to this date so that Council can consider the future appointments of the nominated director and alternate director at the same time.

4. NEXT STEPS

4.1 Food HQ will be informed of David Murphy’s appointment on behalf of Council, should this be Councils’ decision.

5. Compliance and administration

|

Does the Council have delegated authority to decide? |

Yes |

|

|

Are the decisions significant? |

No |

|

|

If they are significant do they affect land or a body of water? |

No |

|

|

Can this decision only be made through a 10 Year Plan? |

No |

|

|

Does this decision require consultation through the Special Consultative procedure? |

No |

|

|

Is there funding in the current Annual Plan for these objectives? |

Yes |

|

|

Are the recommendations inconsistent with any of Council’s policies or plans? |

No |

|

|

The recommendations contribute to Goal 1: An Innovative and Growing City |

||

|

The recommendations contribute to the achievement of action/actions in Economic Development The action is: Support initiatives that promote the region’s strengths (in particular research/agri-food/business/land/horticulture). |

||

|

Contribution to strategic direction and to social, economic, environmental and cultural well-being |

An active shareholding in FoodHQ demonstrates Council’s commitment to its strategic positioning of the city as a food innovation capital of New Zealand and enables it to take a leadership role in realising the city’s strength in food innovation. |

|

|

1. |

FoodHQ Update Presentation ⇩ |

|

TO: Council

MEETING DATE: 11 December 2024

TITLE: 2024 Rating Valuations

Presented By: Steve Paterson, Strategy Manager - Finance

APPROVED BY: Cameron McKay, General Manager Corporate Services

1. That Council note that the 2024 City rating revaluation has been completed and new values, with an effective date of 1 September 2024, have been authorised for implementation by the Valuer-General through the issue of an unqualified audit opinion on 29 November 2024.

1. ISSUE

1.1 The 2024 city rating revaluation has recently been completed. This memo and an associated presentation will highlight the main outcomes.

2. BACKGROUND

Process

2.1 There is a legislative requirement that the Council commission a revaluation of the City (for rating purposes) at least once every three years. As the previous revaluation was completed in 2021 a new revaluation is required this year. The Council engaged Quotable Value (QV) to undertake this task and this work has now been completed.

2.2 The process for the revaluation is determined by the Rating Valuations Act 1998 and the Rules issued by the Valuer-General pursuant to that Act. Key dates in the revaluation timetable are:

|

Effective date of revaluation |

1 September 2024 |

|

Implementation date of new values |

30 November 2024 |

|

Approximate date of posting to new owners – ratepayers who have provided email addresses for rating communications will have these revaluation notices emailed to them. |

11 December 2024 |

|

Period for objections closes |

3 February 2025 |

2.3 The new values cannot be implemented without approval from the Valuer-General. His unqualified audit opinion was received on 29 November 2024.

2.4 The 2021 values have been used as the rating base for the 2024/25 rating year. The new values will become effective for rating purposes on 1 July 2025. At the present time the City Council uses the land value as the base for its general rate and the capital value for a new targeted rate whilst Horizons Regional Council utilises the capital value for many of its rates.

Revaluation Outcome

2.5 The previous revaluations in 2009, 2012 & 2015 saw minimal movements in property values following reasonable movements in 2003 and 2006 and a long period with little growth before that. There were significant movements in 2018 and again in 2021.

Table 1: Movements in total values at each City revaluation

|

|

2006 |

2009 |

2012 |

2015 |

2018 |

2021 |

2024 |

|

Land value |

+125% |

-0.5% |

-1.1% |

+4.7% |

+56.0% |

+83.1% |

-17.6% |

|

Capital value |

+54.7% |

+1.9% |

+0.1% |

+3.7% |

+28.7% |

+60.8% |

-8.7% |

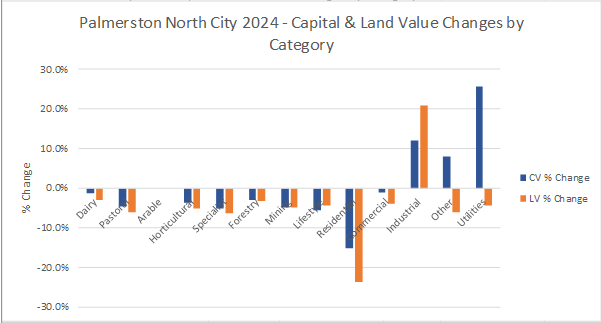

2.6 In this latest revaluation the capital value of the City has decreased by 8.7% and the land value by 17.6% and varies by category as shown in the following table:

Table 2: Summary new total values & changes by Category

|

Sector |

No. of rating units |

2024 CV ($000) |

CV % Change since 2021 |

2024 LV ($000) |

LV % Change since 2021 |

|

Dairy |

103 |

341,117,300 |

-1.3% |

284,442,500 |

-3.0% |

|

Pastoral |

186 |

307,262,000 |

-4.8% |

251,347,000 |

-6.1% |

|

Horticultural |

61 |

87,672,500 |

-3.8% |

62,750,000 |

-5.0% |

|

Specialist |

15 |

24,311,000 |

-5.2% |

15,990,000 |

-6.3% |

|

Forestry |

18 |

10,864,000 |

-3.0% |

10,050,000 |

-3.2% |

|

Mining |

2 |

2,760,000 |

-4.8% |

2,720,000 |

-4.9% |

|

Lifestyle |

1,625 |

1,838,504,000 |

-5.6% |

921,584,000 |

-4.3% |

|

Residential |

30,070 |

19,487,137,000 |

-15.2% |

10,846,595,000 |

-23.8% |

|

Commercial |

998 |

2,548,473,500 |

-1.1% |

1,101,903,500 |

-3.9% |

|

Industrial |

1,033 |

2,540,689,500 |

12.1% |

1,280,114,500 |

20.9% |

|

Other |

688 |

2,578,442,600 |

8.1% |

768,575,500 |

-6.0% |

|

Utilities |

89 |

1,191,494,500 |

25.7% |

43,314,500 |

-4.3% |

|

TOTAL |

34,888 |

$30,958,727,900 |

-8.7% |

$15,589,386,500 |

-17.6% |

2.7 As can be seen from Table 2 total values have reduced for every category except for Industrial, Utilities and other (reserves & recreation facilities, educational & health establishments)

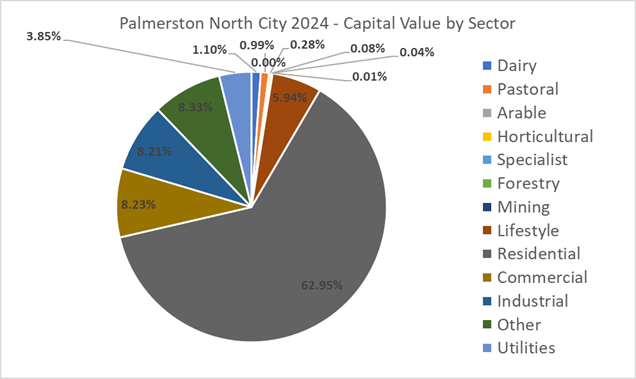

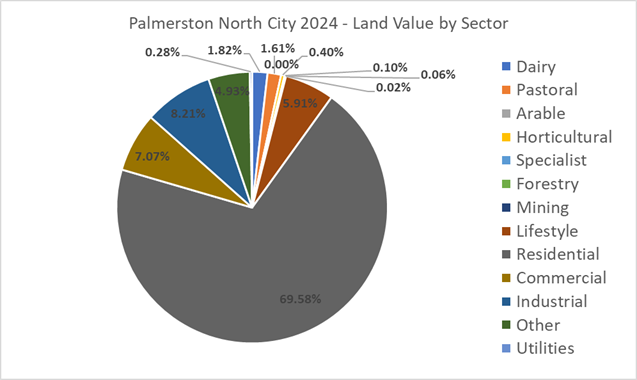

2.8 The share of the total capital and land values that relate to each sector are shown in the following graphs:

Residential

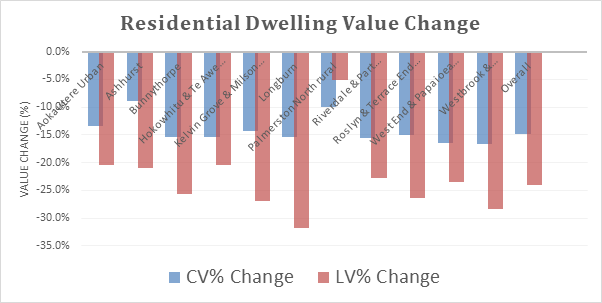

2.9 Average residential capital and land values and movements by valuation roll QV sale group are shown in following table:

Table 3: Residential – Average Rating Values & Rating Value movements since 2021:

|

QV Sale Group |

No. of Rating Units |

Average 2024 CV |

Average 2024 LV |

CV% Change since 2021 |

LV% Change since 2021 |

|

Aokautere Urban |

1,411 |

900,748 |

352,183 |

-13.4% |

-20.5% |

|

Ashhurst |

1,120 |

619,920 |

276,165 |

-8.8% |

-20.9% |

|

Bunnythorpe |

168 |

513,393 |

260,655 |

-15.4% |

-25.6% |

|

Hokowhitu & Te Awe Awe |

4,005 |

799,990 |

497,904 |

-15.3% |

-20.5% |

|

Kelvin Grove & Milson & Cloverlea |

5,345 |

668,643 |

331,197 |

-14.4% |

-26.9% |

|

Longburn |

103 |

499,854 |

238,107 |

-15.4% |

-31.8% |

|

Palmerston North rural |

668 |

944,746 |

384,259 |

-10.1% |

-5.0% |

|

Riverdale & Part Awapuni |

1,439 |

668,426 |

406,550 |

-15.5% |

-22.9% |

|

Roslyn & Terrace End & Brightwater |

3,485 |

604,225 |

351,783 |

-15.1% |

-26.5% |

|

West End & Papaioea & Central |

3,515 |

620,257 |

392,084 |

-16.5% |

-23.5% |

|

Westbrook & Highbury & Takaro |

4,288 |

544,654 |

308,772 |

-16.7% |

-28.4% |

|

Overall |

25,547 |

$669,167 |

$368,293 |

-14.9% |

-24.0% |

The values changes from Table 3 are shown graphically below:

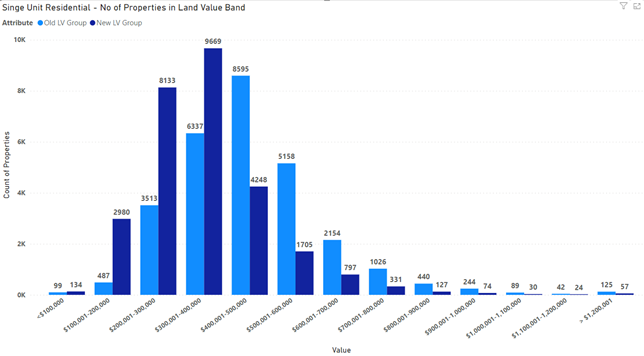

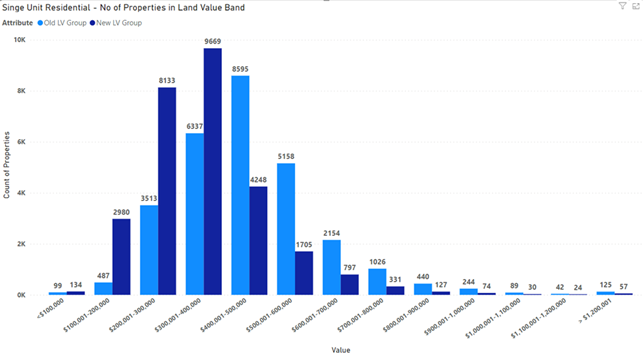

2.10 The distribution of land values over various land value bands is shown in the following graph (2024 valuation in dark blue & 2021 in light blue):

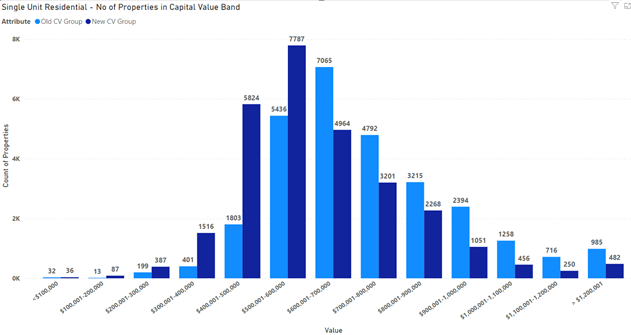

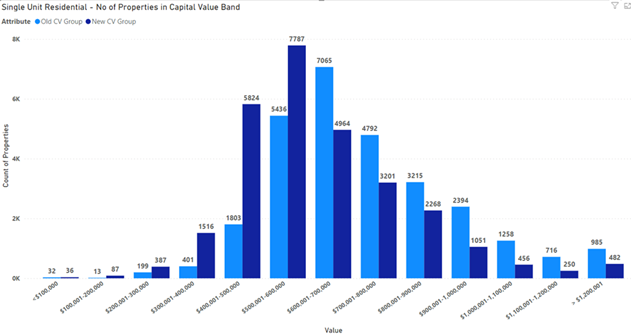

2.11 The distribution of capital values over various capital value bands is shown in the following graph (2024 valuation in dark blue & 2021 in light blue):

Commercial / Industrial

2.12 Changes to land and capital values for this group have been variable with an overall reduction in land value of 3.9% and capital value of 1.1% for commercial properties. By comparison there is an overall increase of 20.9% in the land value and 12.1% in the capital value for industrial properties.

2.13 Changes in the main areas are shown in the following table:

Table 4: Value movements for Commercial & Industrial Properties

|

Area (Valuation Roll) |

No of RUs |

Commercial CV % change since 2021 |

Commercial LV % change since 2021 |

Industrial CV % change since 2021 |

Industrial LV % change since 2021 |

|

Central Commercial (14740) |

393 |

-2.9 |

-4.0 |

11.1 |

-0.3 |

|

Northern Fringe Commercial (14610) |

214 |

-0.2 |

-11.2 |

4.8 |

-6.7 |

|

Western Fringe Commercial (14550, 14560, 14600)

|

246 |

3.0 |

5.1 |

8.4 |

9.6 |

|

Eastern Fringe Commercial (14650, 14660, 14670) |

142 |

1.6 |

-6.3 |

6.0 |

4.0 |

|

Terrace End Suburban (14570, 14620, 14680, 14690) |

78 |

-2.6 |

-7.8 |

10.3 |

12.8 |

|

Highbury/Awapuni Suburban (14520, 14530, 14540, 14630, 14640) |

41 |

-3.9 |

-10.4 |

12.6 |

-3.7 |

|

Hokowhitu/Summerhill/Riverdale (14700, 14710, 14720, 14730) |

60 |

-4.8 |

-13.1 |

1.4 |

-6.0 |

|

Northern Industrial (14460, 14470, 14580, 14590) |

431 |

-0.2 |

7.9 |

14.1 |

27.7 |

|

Western Industrial (14500, 14510) |

303 |

0.5 |

13.8 |

11.4 |

22.9 |

|

Villages (14030, 14040, 14050) |

87 |

2.1 |

-5.0 |

2.3 |

0.6 |

|

Rural (14440, 14450, 14460, 14461, 14490) |

35 |

-0.8 |

4.7 |

16.2 |

26.2 |

|

All |

|

-1.1 |

-3.9 |

12.1 |

20.9 |

Potential Impact on Rating Incidence

2.14 The new valuations do not impact on the total rates revenue for the Council – this is determined through the Annual Budget process. They do, however, impact on the allocation of rates from 1 July 2025.

2.15 The land value is the base for the general rate and for the first time in 2024/25 a targeted rate based on the capital value was introduced. A system of differential rating charges a different rate in the dollar to the each of the various differential rating categories. The portion of the total value in each category influences the rates allocated to each category.

2.16 Table 5 below shows there has been a significant movement in the share of the total land value from residential to non-residential (commercial/industrial) and rural/semi-serviced. Without making system changes this would lead to the non-residential and rural/semi-serviced sectors bearing a greater share of the general and targeted rates than previously.

Table 5: Share of total rateable values by differential rating category

|

|

% of old CV |

% of new CV |

% of old LV |

% of new LV |

|

Single Unit Residential |

66.5 |

62.1 |

72.1 |

66.6 |

|

Multi-Unit Residential |

3.5 |

3.3 |

3.6 |

3.4 |

|

Miscellaneous |

1.6 |

2.1 |

1.8 |

2.3 |

|

Non-Residential |

16.9 |

20.4 |

10.7 |

13.8 |

|

Rural/Semi-Serviced |

11.5 |

12.1 |

11.8 |

13.9 |

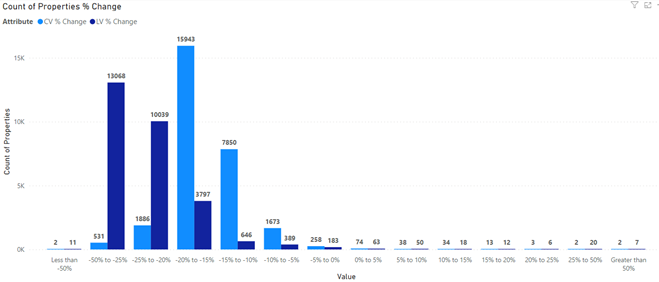

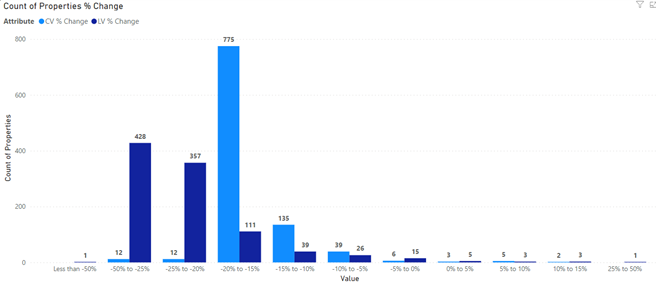

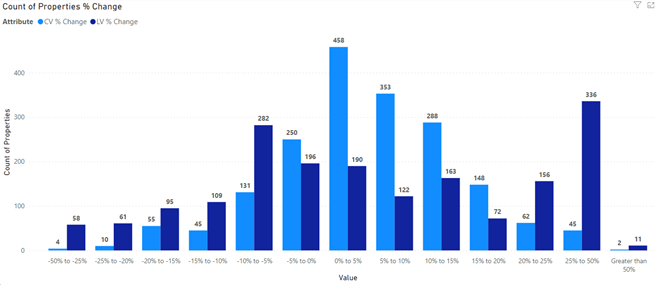

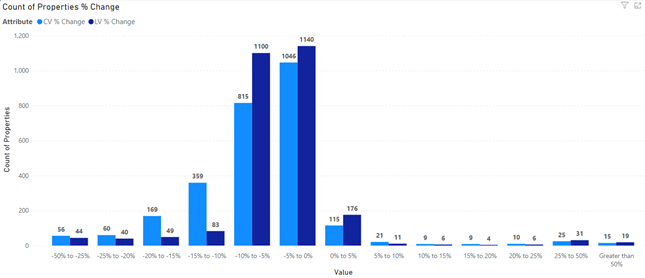

2.17 The following four graphs show the number of properties in each band of percentage movement in the land value and capital value. For example, 15,943 single unit residential properties had capital value decreases of between 15% and 20% and 3,797 had land value decreases of between 15% and 20%.

Single unit residential

Multi-unit residential

Non-residential (Commercial/industrial)

Rural/semi-serviced

2.18 A separate report addresses the potential impacts on rates incidence in more detail.

3. NEXT STEPS

3.1 Property owners will have the opportunity to consider individual property valuations and lodge objections, if they wish, provided these are lodged before 3 February 2025. All objections will be reviewed, and a decision made as to whether or not any alteration to the values is warranted. The outcome will be formally communicated to each objector.

3.2 Council staff have provisionally analysed the new values and used this analysis to prepare a separate report regarding rating incidence for Council consideration.

3.3 Feedback provided by the Council will assist staff develop more detailed options for consideration by the Council in February 2025 leading to a proposed approach to be incorporated in the Council’s annual budget for 2025/26.

4. Compliance and administration

|

Does the Council have delegated authority to decide? |

Yes |

|

|

Are the decisions significant? |

No |

|

|

If they are significant do they affect land or a body of water? |

No |

|

|

Can this decision only be made through a 10 Year Plan? |

No |

|

|

Does this decision require consultation through the Special Consultative procedure? |

No |

|

|

Is there funding in the current Annual Plan for these actions? |

Yes |

|

|

Are the recommendations inconsistent with any of Council’s policies or plans? |

No |

|

|

The recommendations contribute to the achievement of action/actions in (Not Applicable) |

||

|

Contribution to strategic direction and to social, economic, environmental and cultural well-being |

Determining rating valuations every three years is a legislative obligation that is required to enable the Council to set rates. |

|

NIL

TO: Council

MEETING DATE: 11 December 2024

TITLE: 2024 Rating Valuations - Impact on Rating Incidence

Presented By: Steve Paterson, Strategy Manager - Finance

APPROVED BY: Cameron McKay, General Manager Corporate Services

1. That Council note:

a. the new rateable values will be used as the basis for calculating rates effective from 1 July 2025.

b. the valuation changes do not increase the total rates revenue for the Council. However, without further changes to the rating system the valuation significantly alters the incidence of rates both within and between the differential groups of property, and in particular transfer a greater share of the rates to the commercial/industrial sector.

2. That Council instruct the Chief Executive to bring options to the 12 February 2025 Council meeting in response to the change in rating incidence caused by the valuation changes and the planned stage 2 implementation of the greater share based on capital value. These options will include mechanisms such as altering the level of uniform annual general charge; or the differential surcharges applying to the general rate based on the land value; or the targeted rate based on capital value; or a combination of all three.

1. ISSUE

1.1 The 2024 city rating revaluation with an effective date of 1 September 2024 has been implemented and will become the base for value-based rates from 1 July 2025. This memo addresses potential rating implications as well as foreshadowing other changes to the rating system that will need to be considered as part of the Annual Budget process in February.

2. BACKGROUND

Recap of valuation outcomes

2.1 A separate report titled “2024 Rating Valuations” outlines the outcome of the revaluation. In summary the capital value of the City has decreased by 8.6% and the land value by 17.6%.

2.2 For rating purposes, the Council uses a differential system that categorises properties as shown in the following table.

Table 1: Proportions of total land & capital value by differential category

|

|

% of old CV |

% of new CV |

% of old LV |

% of new LV |

|

Single Unit Residential |

66.5 |

62.1 |

72.1 |

66.6 |

|

Multi-Unit Residential |

3.5 |

3.3 |

3.6 |

3.4 |

|

Miscellaneous |

1.6 |

2.1 |

1.8 |

2.3 |

|

Non-Residential |

16.9 |

20.4 |

10.7 |

13.8 |

|

Rural/Semi-Serviced |

11.5 |

12.1 |

11.8 |

13.9 |

2.3 The distribution of land values over various land value bands for single unit residential properties is shown in the following graph (new values in dark blue & old in light blue):

2.4 The distribution of capital values over various capital value bands for single unit residential properties is shown in the following graph (new values in dark blue & old in light blue):

Potential impact on rating incidence

2.5 The three-yearly revaluation process is a legislative requirement designed to bring the rates allocation base up to date to make it fairer for all.

2.6 The new valuations do not generate additional rates revenue for the Council. They do, however, impact on the allocation of rates from 1 July 2025. The land value is the base for the general rate and for the first time in 2024/25 a targeted rate based on the capital value was introduced. A system of differential rating charges a different rate in the dollar to the each of the various differential rating categories. The portion of the total value in each category influences the general rates and targeted rates allocated to each category.

2.7 The following graph shows the proportion of the total rates assessed on each differential category – showing the actual rates share for 2024/25 and what it would have been for 2024/25 had the rates been set using the new values.

2.8 With the single unit residential property share of the total land value decreasing from 72.1% to 66.6% and capital value from 66.5% to 62.1%, using the new values would see approximately $11m of rates transferred from the residential sector to the non-residential sector ($10.2m) and rural sector ($0.8m).

2.9 Such a significant movement may not be an appropriate outcome. However, there are other factors that will influence the final rates incidence for 2025/26, and these are outlined in the following section.

2.10 The following two graphs show the rates in the $ of value that would be applied for 2024/25 if the new values were used and no other changes were made to the rating system. Because the rateable values are lower higher rates in the $ need to be used to obtain the same total revenue.

Other factors impacting on rates incidence for 2025/26

2.11 In addition to the revised rating valuations rates incidence for 2025/26 will be influenced by the following:

· The proposed second stage of implementation of the targeted rate based on the capital value – in effect approximately doubling the rates to be based on the capital value

· The proposed second stage of implementing the change to the differential surcharge for the rural/semi-serviced (lifestyle) properties

· The extent of the increases required in the fixed charges to fund the proposed budgets for water, wastewater and resource recovery. Based on the first draft of the annual budget to be presented for consideration by Council on 11 December the following fixed charges would be required:

|

|

Actual for 2024/25 ($ GST incl) |

Initial draft for 2025/26 ($GST incl) |

|

Water |

415 |

486 |

|

Wastewater |

375 |

403 |

|

Kerbside recycling |

144 |

189 |

|

Rubbish & public recycling |

51 |

83 |

Metered water charges will also need to increase by approx. 10%

· Whether as a consequence of the revaluation or as a part of the progressive implementation of the capital value-based rate it is considered appropriate to change the differential surcharges for some of the differential categories

· The level of the uniform annual general charge (UAGC).

3. Discussion

Why might an intervention to moderate the impact of the revaluation be appropriate?

3.1 An intervention may be appropriate if it is considered that the rates that would be assessed based on the updated valuations are unreasonable for a significant group of ratepayers. It may also be appropriate as a holding action or temporary measure if the extent of the change in rates is considered unreasonably high.

3.2 Such an intervention was made following the 2018 and 2021 revaluations as on both occasions there was a significant increase in residential land values especially for those at the lower end of the market. The response was to lower the uniform annual general charge and increase the differential surcharge for non-residential properties.

3.3 The circumstances this year are similar again this year although on this occasion there have been reductions in values with the greatest reduction occurring for residential properties.

What type of changes might be possible?

3.4 The following three main tools for change are considered in turn:

· A change to the level of the uniform annual general charge (UAGC)

· A change to the differential surcharges for some categories of property

· Changing the proportion of the rates based on the capital value.

Changing the level of the UAGC:

3.5 The UAGC is an integral part of the Council rating system. It serves to moderate the level of rates (especially for residential properties) by making sure those with low land values pay at least a minimum contribution to fund city services and facilities and those with very high land values do not pay an unreasonably high contribution.

3.6 The UAGC for 2024/25 is $200 per rating unit. It was reduced to this level in 2022/23 from $500 per rating unit in 2021/22. It was reduced to $500 from $690 in 2018/19.

3.7 For many years it was the practice to increase the UAGC annually to keep the fixed component of the rates at similar proportions from year to year.

3.8 Given the higher total rates assessed on commercial/industrial properties the UAGC forms a much smaller part of the individual rates assessed on them compared to residential properties.

3.9 Changing the level of the UAGC would impact not only on the total rates contributed by each differential category but also the incidence of rates within each category.

3.10 One of the arguments to reduce the UAGC to $200 following the 2021 revaluation was that the spread of residential land value had been reduced through the revaluation (lower land values increased by 100% or more whilst higher land values increased by a smaller percentage).

3.11 The reverse has occurred during the 2024 revaluation. The greater reductions in land value have been in the traditionally lower valued areas. These reductions have flowed through to the capital value.

3.12 An option is therefore to increase the UAGC. A scenario is included showing what would happen to incidence if this was increased to $400.

Changing the differential surcharges:

3.13 A fundamental component of the present rating system is that property is grouped by differential category (primarily based on the nature of use) and a general rate is assessed with different rates in the dollar of land value being assessed on each property group.

3.14 The new targeted rate based on the capital value is also categorised in the same manner and surcharges are applied (although not at the same level as for the general rate). There are various reasons for this outlined in the funding impact statement in the Council’s Long-term Plan.

3.15 The Council describes the relationship between the rates charged to each differential group in terms of a factor expressed as a percentage of the rate that would apply if there were no differential rating in place. Each year the Council reviews the differential factors applied to each group.

3.16 When adopting the Long-term Plan the Council signalled its intention that the discount provided through the differential system to semi-serviced/rural properties (lifestyle blocks) of between 0.2 ha and 5 ha would be reduced over two years, 2024/25 and 2025/26. Year 2 of this change will be taken into account in modelling various scenarios for Council consideration.

3.17 If the intention is that the other differential groups should pay similar proportions of the total rates in 2025/26 as in 2024/25 then there will need to be significant changes to the differential surcharges. A number of scenarios are being tested.

The capital value based targeted rate:

3.18 When adopting the revisions to the rating system for 2024/25 Council signalled it intended that its desire was to progressively increase the portion of the value-based rates based on the capital value to 50% over three years. Rates for 2024/25 are based on 16.5% using the capital value.

3.19 At this stage it has been assumed the Council will proceed along the implementation path and base 33% of the value-based rates on the capital value in 2025/26.

3.20 This has been built into scenario testing done to date though one scenario tests what would happen to incidence if the 16.5% portion was retained.

Testing scenarios

3.21 Given the new valuations have just been released and the first draft of the annual budget has just been completed there has not been sufficient time to adequately test scenarios.

3.22 However, the approach taken for this report has been as follows:

· Test what the rates incidence would have been for 2024/25 had the new values been used as the base. The outcomes of this are shown earlier in this memo.

· Test scenarios for 2025/26 all of which assume the new values will be used, the overall rates increase will be 8.9% as per the Long-term Plan year 2, and the fixed charges for services will be as outlined in section 2.3.

3.23 The assumptions for the 4 scenarios are shown in the following table:

|

Scenario |

Values Used |

Total rates increase |

Differentials |

UAGC |

CV % |

|

1 |

2024 |

8.9% |

No change |

$200 |

33% |

|

2 |

2024 |

8.9% |

No change |

$200 |

16.5% |

|

3 |

2024 |

8.9% |

No change |

$400 |

33% |

|

4 |

2024 |

8.9% |

FM (lifestyle) change discount to -40% from -45% CI (non-residential) Reduce LV surcharge from 200% to 150% Reduce CV surcharge from 120% to 80% |

$200 |

33% |

3.24 The following graph demonstrates the proportion of the total rates assessed that would be borne by each differential group for each scenario, compared with the actual for 2024/25.

3.25 Some initial observations from the above graph:

· The total rates allocated to each category is not significantly influenced by the move from 16.5% on a capital value base to 33% (scenarios 1 & 2)

· Increasing the UAGC does move some rates from non-residential to residential – this is because there are many more rating units in the residential category.

· Even after making significant reductions to the non-residential differentials the total rates increase for the non-residential category would still be approx. 12.3% compared with 5.8% for single unit residential and 33% for the rural/semi-serviced (lifestyle) category.

3.26 In addition to checking the rates incidence at the differential category level it is necessary to consider the changing incidence at the individual ratepayer level.

3.27 The graphs in Attachment 1 show the number of properties within each band of movement in rates (in both %age and dollar terms). There are graphs for the single unit residential, non-residential and rural differential groups.

3.28 Some initial observations from the graphs include:

· Scenarios 1-3 show significant reductions in rates for many residential properties as the total sum to be collected from each differential category is significantly different from the current year. By comparison these scenarios show significant increases for non-residential properties and rural/semi-serviced.

· Scenario 4 produces an overall outcome by differential category that is more like the distribution for 2024/25. The majority of the rates increases for residential properties are less than 10%. 3,600 residential properties would have increases in the 10-25% band – principally those with high ratios of capital value to land value.

· In Scenario 4 most of the residential rates increases are less than $500 with one-third less than $250.

· Rates movements for non-residential properties vary widely in all scenarios. This is because of the wide variation in value movements in different parts of the City and because of the range of different capital to land value ratios for the properties in this category.

· Scenario 4 moderates the increases for non-residential properties with very high ratios of capital to land value. Even in this scenario there are over 100 such properties with increases over $10,000 with 3 having increases over $100,000, 6 with increases of between $50,000 and $80,000, 7 with increases of between $30,000 and $50,000 and 14 with increases of between $20,000 and $30,000.

4. Conclusions

4.1 As expected the combination of the application of new rating values (most of which have reduced), an increase in the overall rates requirement, increases required for fixed charges for services and the progressive implementation of the capital value based targeted rates make for a very complex story for ratepayers to understand.

4.2 Further analysis and modelling is required to enable acceptable options to be brought to the Council for consideration in February 2025.

5. NEXT STEPS

5.1 Should the Council agree to recommendation 2 to provide options that moderates the effect of the revaluation by making changes, officers will continue further modelling and report the findings to Council in February for consideration.

5.2 The modelling will consider mechanisms such as the level of the UAGC and differential surcharges for the general rate and the capital value based targeted rate and will incorporate the draft total rates requirement for 2025/26 to fund operations.

6. Compliance and administration

|

Does the Council have delegated authority to decide? |

Yes |

|

|

Are the decisions significant? |

No |

|

|

If they are significant do they affect land or a body of water? |

No |

|

|

Can this decision only be made through a 10 Year Plan? |

No |

|

|

Does this decision require consultation through the Special Consultative procedure? |

No |

|

|

Is there funding in the current Annual Plan for these actions? |

Yes |

|

|

Are the recommendations inconsistent with any of Council’s policies or plans? |

No |

|

|

The recommendations contribute to the achievement of objective/objectives in: 14. Mahere mana urungi, kirirarautanga hihiri 14. Governance and Active Citizenship Plan The objective is: Base our decisions on sound information and advice

|

||

|

Contribution to strategic direction and to social, economic, environmental and cultural well-being |

Determining rating valuations every three years is a legislative obligation that is required to enable the Council to set rates. The Council is required to prepare Funding Impact Statements that provide the detail of the proposed rating system as part of each year’s Annual Plan. |

|

|

1. |

Graphs showing rating incidence movement for scenarios 1-4 ⇩ |

|

TO: Council

MEETING DATE: 11 December 2024

TITLE: Annual Budget 2025/26

Presented By: Scott Mancer - Manager Finance, and Steve Paterson - Manager Financial Strategy

APPROVED BY: Cameron McKay, General Manager Corporate Services

1. That Council instruct the Chief Executive to prepare a draft of the Consultation Document and supporting information for the Annual Budget 2025/26 for consideration by the Council at its meeting on 12 February 2025 and that it contains:

a. Key assumptions outlined in Section 4.

b. Programmes as agreed at the Council meeting on 6 November 2024 and attached for information in Attachment 4

c. Operating budgets as outlined in Attachments 1-3, as amended below.

i. That Council agree a budget for Local Water Done Well Transition support in 2025/26 comprising expenditure of $1.5M funded by way of a grant subsidy of $621,831 and the balance of $878,169 by way of loan.

ii. EITHER:

(A) That Council increase the resource recovery operating budget by $65k to fund the delivery of Programme 2338 – Recycling Contamination Monitoring Development

OR

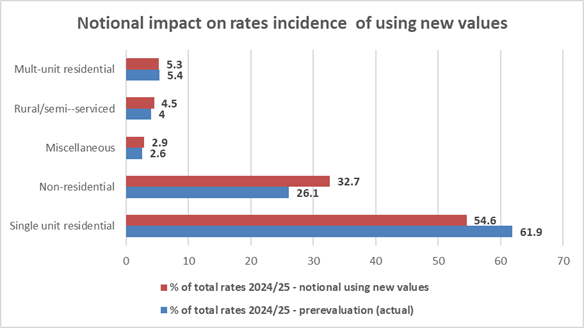

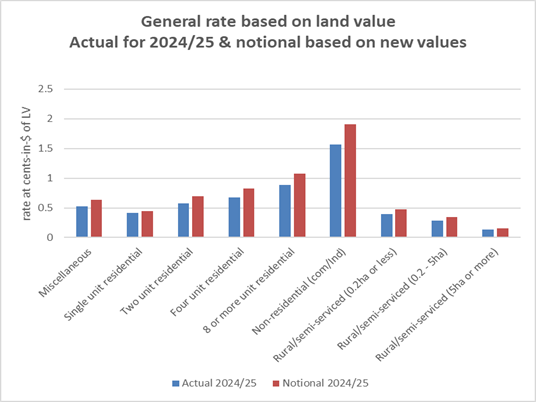

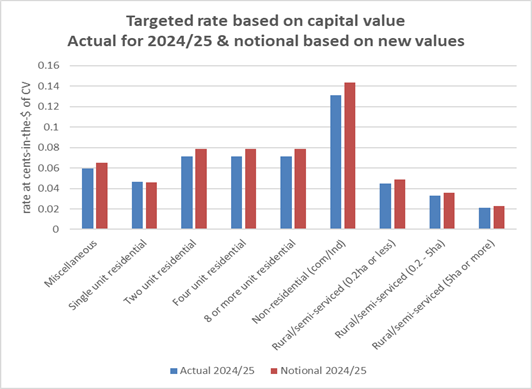

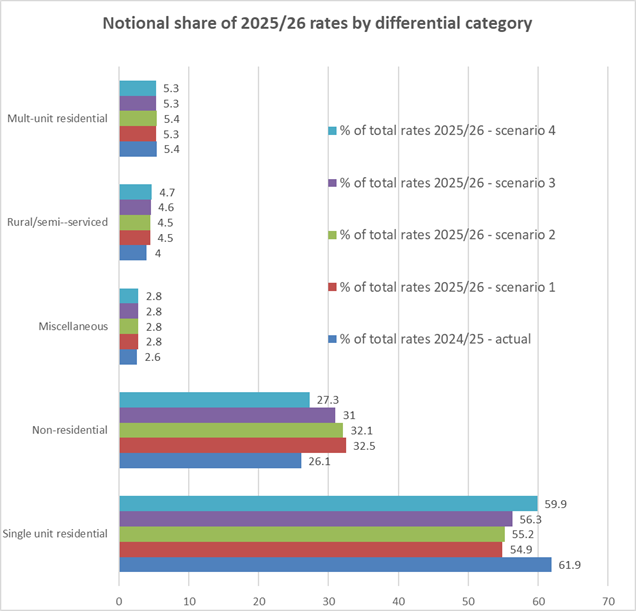

(B) That Council defer Programme 2338 – Recycling Contamination Monitoring Development by one year to 2026/27.